Classification of borrowed funds by lines

When forming accounting records, all debts of an enterprise can be classified according to two criteria - the type and period of payment of credit debt. The first category includes:

- Loans issued by banking organizations on the terms of payment and repayment.

This is due to a certain risk for the lender, who transfers funds for temporary use to the borrower. Relationships formalized by a loan agreement are considered external, as are acquired obligations.

- Loans received by an enterprise from third-party individuals and legal entities.

Such receipts may not be subject to additional interest. This occurs when financial support is provided by other enterprises within the same group, holding or corporation. Based on this, funds received in the form of a loan can be both external and internal.

Important! If a company uses borrowed funds obtained from different sources to achieve its goals, then they are displayed in separate lines. For each type of debt, its own sub-account is opened.

Based on the length of time during which the organization must pay off its debts, there are:

- Short-term liabilities, the reporting date for which is a period of no more than 12 months (line 1510);

- Long-term loans issued for a period of several years (line 1410).

Definition

Borrowed funds 1410 are long-term (for a period of more than 12 months) loans and borrowings received by an organization.

An organization can transfer its reporting to short-term reporting when the period for using the funds becomes less than a year, or not transfer it, leaving it long-term. Therefore, when analyzing the indicator, it is advisable to compare its changes with changes in line 1510.

Borrowed funds are an expensive source of financing; their use is justified only if the profitability of using them is higher than without them.

Decoding the amount in lines 1410 and 1510

It is not difficult to decipher balance sheet lines 1410 and 1510. They include short-term and long-term borrowed funds, which are reflected in the balance sheet along with interest accrued on them. The enterprise's reporting must display the following information:

- Amounts and terms of repayment of newly acquired liabilities.

- Balances of outstanding debt on existing loans.

- Data on interest due to creditors.

- Information about additional expenses associated with servicing loan agreements.

- Information about securities issued and acquired by the company.

- Data on the effectiveness of investments made with borrowed funds in the formation of an enterprise asset.

Attention! Payment of remuneration to the lender for the use of borrowed funds can be taken into account as part of the investment asset, if such exists on the balance sheet.

Composition of the enterprise's liabilities.

To carry out production and economic activities, an organization operating separately from others must have its own and borrowed (attracted) financial resources.

OWN CAPITAL consists of authorized, additional and reserve capital, retained earnings and other financial reserves.

Authorized capital is the monetary value of the founders’ contributions.

Reserve capital - created through annual deductions from net profit, intended mainly to cover losses. The amount of reserve capital and the amount of mandatory contributions to it are determined by the charter or constituent documents.

Additional capital is formed due to the increase in the value of non-current assets - when revaluing fixed assets upward, at the expense of share premium and a number of other sources.

Retained earnings are the part of net profit remaining after distribution and directed to the needs of the enterprise.

Targeted financing and revenues are funds received from other enterprises, state and municipal bodies and intended for the implementation of targeted activities.

Other financial reserves are created in organizations in order to evenly include upcoming expenses in production or distribution costs.

Displaying borrowed funds in reports

The formation of data on short-term loans, borrowings and long-term liabilities in the balance sheet occurs on lines 1410 and 1510. Such external receipts are displayed in sections 4 and 5 of the liability side of the balance sheet:

- The fourth section and line 1410 are intended to reflect loans with a long repayment period.

- Fifth and line 1510 – short-term loans.

Attention! The structure of these columns may vary depending on the decoding of subaccounts used. New lines may appear, numbered 14101 or 15101.

For borrowed funds received for a period of less than a year, account 66 is intended, for longer-term loans - 67. In accordance with accounting recommendations, interest and principal debt accounted for on these accounts should be divided:

- 66/01 or 67/01 – amounts of debt on loans.

- 66/02 or 67/02 – interest due to the creditor, which can be accrued monthly or once per reporting year.

Important! Interest paid under contracts should be accounted for as short-term liabilities, regardless of the method of calculation.

Calculation of the total amount of debts on line 1510 for accounting purposes will be calculated using the formula:

How to take into account other people's funds

Funds received, regardless of the type and source of financing, are accounted for by enterprises in accordance with the Chart of Accounts approved by the legislator:

Sharing of debt capital

As the name suggests, loans can be divided according to repayment periods:

- for long-term, that is, over 12 months;

- and short-term, that is, up to 12 months.

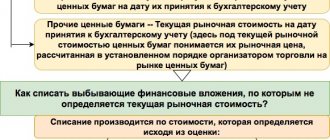

Loans, in addition to cash, can be received as debt securities:

In this case, the company pays the lender not interest, but a discount, that is, the difference between the nominal and real value of the security.

The liability on accounts 66 and 67 is accounted for in two ways:

- Based on actual loan amount plus interest.

- At par value of debt securities.

In this case, the valid entry is the one generated at the time the borrowed funds are received into the organization’s current account:

- Debit 51 of the “Current account” account Credit 66, 67 – a loan or credit was received.

What to do with interest on loans

In addition to the main body of the loan, interest on the loan, which is the income of the lender, is taken into account in separate subaccounts 66 and 67 of the account. Accrued interest is reflected on account 91 “Other income and expenses” as expenses, or on account 08 “Investments in non-current assets” as an increase in the cost of fixed assets:

- Debit 91.02 Credit 66, 67 – monthly interest accrued.

- Debit 08 Credit 66, 67 – the cost of the object under construction has been increased by the amount of interest.

Note from the author! Before putting an object into operation, all costs during construction are accumulated on capital investments, that is, on account 08. After completion of construction or additional equipment, the objects are entered into account 01 “Fixed Assets”.

For example, a company took out a loan for the construction of a bridge in the amount of 1,000,000 rubles for one year. The bank's annual interest rate is 18%. You need to calculate how much deductions to take into account each month:

- 1,000,000 * 18% = 180,000 rubles per annum;

- 180,000 / 12 months = 15,000 rubles – monthly interest accrual.

Since the loan term is one year, it is considered short-term, which means it will be displayed on account 66:

- Debit 51 Credit 66.01 – a loan was received in the amount of 1,000,000 rubles.

- Debit 08 Credit 66.02 – interest was accrued on the increase in the cost of the bridge in the amount of 15,000 rubles.

- Credit 66.02 Debit 51 – monthly payment to the bank of 15,000 rubles is transferred.

Credit balance of account 66 + Account balance 67

Redistribution of debt obligations

Each enterprise has the opportunity to transfer obligations that have a long maturity period to a short-term basis. This is acceptable when there are no more than 12 monthly payments remaining on the loan.

Important! Debt with a payment term exceeding 12 months cannot be included in accounts intended to reflect short-term loans and credits.

Overdue debt

When the borrower fails to repay the next payment on time, the accountant needs to transfer the remaining loan obligations to the status of overdue debt. In this case, the company may incur additional expenses:

- Paid consultations with credit experts.

- Verification of the loan agreement by third party specialists.

- Fines and penalties provided by the lender for late payments.

- Other expenses not covered by banking services.

Line 1510 is

Credit balance on account 66 “Settlements for short-term loans and borrowings”

plus

Credit balance on account 67 “Settlements on long-term loans and borrowings” (if the repayment period of debts as of the reporting date does not exceed 12 months).

Long-term debt can be converted into short-term debt if there are 365 days left until the principal amount is repaid. Upon expiration of the payment period, urgent debt is transferred to overdue.

How to avoid getting into bondage

Whether there is a need for additional investments obtained through a loan is decided at the management level.

Such income can solve the problem of purchasing expensive equipment or the necessary expansion of production. But with a new loan, the company also receives certain obligations. In this situation, the main thing to consider is whether the company will be able to pay for them. As the saying goes, “you take someone else’s, but give back your own,” and that is why you should conduct a detailed analysis of the balance sheet lines on which credit obligations are displayed. Assess the current need for new investments. Taking out a loan is not difficult, the main thing is not to use this channel if there is any slight lack of funding. Otherwise, you can fall into banking bondage.

One of the methods for analyzing the creditworthiness of an enterprise is to calculate the financial dependence ratio. To do this, divide your total equity by your total debt obligations. The result of the calculation will indicate the following:

- If the result is a number that is a multiple or greater than “1,” then the company is steadily afloat, and it is possible to attract additional investments by concluding a loan agreement.

- If the calculated value is significantly less than “1”, then there is a high probability that the enterprise will fall into debt. In this case, the company will work only to repay loan obligations and interest on them, without generating income to its founders.

Conclusions about what a change in indicator means

If the indicator is higher than normal

Not standardized

If the indicator is below normal

Not standardized

If the indicator increases

Usually a negative factor

If the indicator decreases

Usually a positive factor

Notes

The indicator in the article is considered from the point of view not of accounting, but of financial management. Therefore, sometimes it can be defined differently. It depends on the author's approach.

In most cases, universities accept any definition option, since deviations according to different approaches and formulas are usually within a maximum of a few percent.

The indicator is considered in the main free online financial analysis service and some other services

If you need conclusions after calculating the indicators, please look at this article: conclusions from financial analysis

If you see any inaccuracy or typo, please also indicate this in the comment. I try to write as simply as possible, but if something is still not clear, questions and clarifications can be written in the comments to any article on the site.

Best regards, Alexander Krylov,

The financial analysis:

- IV. LONG-TERM LIABILITIES Section IV. Long-term liabilities are the fourth section of the balance sheet. At the same time, it is also the second section of the liability side of the balance sheet, which shows the sources of financing for the property. AND…

- V. CURRENT LIABILITIES Section V. Current liabilities is the fifth section of the balance sheet. At the same time, it is also the third section of the liability side of the balance sheet, which shows the sources of financing for the property. AND…

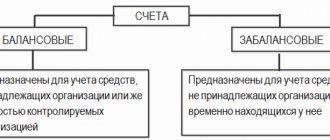

- Balance sheet liability The balance sheet liability is the second part of the balance sheet. It contains a list of those financial resources that were used to acquire property, that is, assets that...

- II. CURRENT ASSETS Current assets are property used in the activities of an enterprise for less than a year or used in one production cycle, which also does not exceed one year. Its entire cost...

- I. NON-CURRENT ASSETS Non-current assets are property used in the activities of an enterprise for more than a year. Its value is transferred in parts to the cost of finished products. A sign of assets is the ability to generate income for the organization.…

- III. CAPITAL AND RESERVES Section III Capital and Reserves is the third section of the balance sheet. But what is more important is the first section of financial sources, that is, the liability side of the balance sheet. By this he...

- Horizontal and vertical analysis of the balance sheet and income statement (profit and loss) Good afternoon, my dear reader. In this article we will consider such a topic as horizontal and vertical analysis of the balance sheet and financial results statement (income and...

- Price of work Hello, my dear reader. On this page you can estimate the value of your work using popular exchanges.

- Analysis of the financial condition of the enterprise Hello. This page contains an updated service for free analysis of the financial condition of an enterprise online. In 2019-2020, some lines in the income statement changed, so...

- Analysis of the financial condition and performance of the bank online for free Hello, dear visitor. This service is the next update of the service for analyzing bank financial indicators for 2021 and later - until new changes appear. On the…

Balance line 1510 what contains

< 6 months for strategic enterprises and natural monopolies, for credit organizations - < 14 days.

The absolute liquidity ratio is the ratio of the value of quick assets to current liabilities:

As you already know, short-term financial investments and cash in the company’s accounts are considered quick-liquid assets.

$$К_\text{abs. liquidity} = \frac{\text{Highly liquid assets}}{\text{Current liabilities}}=\frac{ \text{form No. 1 line 1240+1250}}{\text {f№1 pp. 1500-1530}}$$

This indicator characterizes what part of short-term liabilities can be repaid almost immediately (within a few days). As a rule, at domestic large and medium-sized industrial enterprises it amounts to a few percent.

The intermediate liquidity ratio is the ratio of the sum of quick assets and short-term receivables to current liabilities:

$$К_\text{industrial liquidity} = \frac{\text{Highly liquid assets+Accounts receivable}}{\text{Current liabilities}}=\frac{ \text{form No. 1 line 1240+1250+1230 +1260}}{\text{f№1 pp. 1500-1530}}$$

This indicator characterizes what part of short-term liabilities can be repaid using current assets not involved in production, i.e. what part of the obligations can be repaid quickly enough (within a few months). It follows that in order to be able to repay the debt without any complications for current activities, all short-term liabilities must be covered by the specified assets. The recommended value of the indicator is .

The current ratio is calculated as the ratio of current assets to current liabilities:

$$К_\text{current liquidity} = \frac{\text{Current assets}}{\text{Current liabilities}}=\frac{ \text{form No. 1 page 1200}}{\text{form №1 pp. 1500-1530}}$$

It shows the portion of current assets covered by current liabilities. Indicator value > 2 (for countries with developed market economies).

In Russia in the late 1990s. the average value of the indicator was about 1. If it is > 1.5, then the enterprise is considered solvent.

The group of solvency and liquidity indicators allows you to assess the organization’s ability to pay its obligations through income from its activities (the first two indicators) and through the sale of existing property (the last 3 indicators).

Solvency and liquidity indicators

Indicators of this group characterize the possibility of making debt payments.

The overall degree of solvency is calculated as the ratio of the sum of long-term and current liabilities (i.e., the amount of borrowed funds) to average monthly revenue:

$$\text{Total solvency} = \frac{\text{Dorrowed capital}}{\text{Average monthly revenue}}=\frac{ \text{form No. 1 page 1400+1500-1530}}{\text{ f#2 page 2110/12 months}}$$

Revenue may not necessarily be calculated for a year; the calculation period can be 3, 6, 9 months; it all depends on how often the analyst plans to calculate this indicator and what reporting forms (annual or quarterly) are used for analysis.

This indicator has the dimension “months” and characterizes how many months the company needs to pay off all long-term and short-term obligations while maintaining the current level of revenue in a hypothetical case, if no other payments are made.

The degree of solvency for current liabilities is determined as the ratio of only current liabilities to average monthly revenue:

$$\text{Current solvency liabilities} = \frac{\text{Current liabilities}}{\text{Average monthly revenue}}=\frac{ \text{form No. 1 line 1500-1530}}{\text{form No. 2 line 2110/12 months}}$$

This indicator, like the previous one, has the dimension “months” and characterizes how many months the company needs to pay off short-term obligations while maintaining the current level of revenue without making other payments.

The recommended value for this indicator is . If this condition is met, the enterprise is considered solvent, otherwise it is insolvent. The three-month period is justified by the fact that for most enterprises, a sign of bankruptcy is the presence of debt, the repayment period of which expired exactly three months ago.

For enterprises that are subjects of natural monopolies (fuel and energy enterprises, etc.), strategic enterprises, the list of which is approved by the Government of the Russian Federation, and for credit institutions (banks), the signs of bankruptcy differ in the timing of delayed payments. Therefore, the recommended values of the indicator change accordingly, which are: