Most recently, the legislator allowed us to submit a simplified balance sheet. The Ministry of Finance has developed simplified forms and in 2013 firms could use them when submitting reports for 2012.

Not all companies can submit a balance sheet in a simplified form for 2021, but only those that are classified as small businesses. This is very convenient because the 2021 small business balance sheet may contain far fewer forms than a traditional long form financial statement. A small company can decide for itself what is more convenient for it – a full-fledged report or a simplified version. The chosen method must be reflected in the current accounting policy.

Who submits a simplified balance sheet

The balance sheet of a small enterprise for 2021 can be submitted using a simplified form. Companies participating in the implementation of the Skolkovo innovation project and non-profit enterprises can also take advantage of this right.

Small enterprises include legal entities:

- with an average number of employees of no more than 100 people. Let us remind you that the average number differs from the payroll number. The calculation procedure is enshrined in the legislative act of state statistics (order dated October 28, 2013 No. 428);

- whose income from their commercial activities does not exceed 800 million rubles.

- on other grounds contained in clause 1.1. Article 4 of Law No. 209-FZ.

Balance sheets in a simplified form cannot be submitted by companies that have a mandatory audit of their statements (any joint stock company falls into this category, since an audit report is required for them), construction and housing cooperatives, microfinance enterprises, government agencies, notary offices, lawyers, parties and a number of others .

Specifics of filling out asset lines

How to prepare a balance sheet? An example of an algorithm for filling its asset may look like this.

Line 1110 involves reflecting information about the company’s intangible assets. They can be defined as the balance on the debit of account 04, from which the indicators on the credit of account 05 are subtracted.

Line 1120 suggests the inclusion of data relating to the results of research as well as development. In order to calculate this parameter, you need to determine the balance on the debit of account 04 in the part of the subaccount, which is called “R&D expenses”.

Line 1130 includes information about assets that are classified as intangible exploration assets. They can be determined on the basis of the balance on the debit of account 08 in the subaccount called “Intangible Exploration Assets”, reduced by the balance on the credit of account 05 in the subaccount “Depreciation and Impairment of Assets”.

Line 1140 records assets that fall into the category of material exploration assets. In order to obtain the corresponding figures, you need to subtract from the balance on the debit of account 08 in the subaccount called “Tangible Exploration Assets” the indicator on the credit of account 02 (under the subaccount called “Depreciation and Impairment”).

Line 1150 contains data reflecting fixed assets. They can be easily determined as the difference between the balance on the debit of account 01 and the corresponding indicator on the credit of account 02.

Line 1160 records information reflecting profitable investments. In order to determine them, you need to subtract from the balance on the debit of account 01 the corresponding indicator on the credit of account 02, but this time - from the subaccount “Depreciation of Income Investments”.

Line 1170 contains information about the company's financial investments. Determining the relevant indicators is somewhat more difficult. First you need to add up two balances - on the debit of accounts 58 and 55 (sub-account “Deposit accounts”). From the resulting amount, you need to subtract the credit balance on account 59, to which should be added the indicators on the debit of account 73 (sub-account “Settlements with personnel”).

Line 1180 records deferred tax assets. They are very easy to determine - like the balance under the debit of account 09.

Line 1190 reflects other non-current assets. Here you should enter numbers that belong to the corresponding category, but were not indicated in the document.

In line 1100 it is necessary to summarize the indicators of lines from 1110 to 1190. This will allow you to summarize the numbers in section 1 of the document.

Line 1210 records inventories. They can be determined on the basis of information reflecting the debit balance of such accounts as, for example, 10, 11, 41, and 43.

Line 1220 includes data reflecting VAT on purchased assets. The corresponding figures are easy to find based on the balance indicators on the debit of account 19.

Line 1230 records accounts receivable. It is calculated as the difference between the balance on the debits of such accounts as, for example, 60 and 76 and the corresponding indicator on the credit of account 63.

Line 1240 reflects data regarding financial investments. The formula for determining the corresponding numbers is quite complex. First you need to add up the balances of the debits of accounts 55 and 58, then subtract from them the figures resulting from adding the balances of the credit of account 59 and the debit of account 73

It is important to consider indicators only for short-term investments and loans

Line 1250 reflects data on cash and equivalents. They can be found out based on the balance indicators of the debits of such accounts as, for example, 50, 51, 52, and also 57.

Line 1260 records other non-current assets - those that were not included in the section.

Line 1200 indicates the figure that needs to be obtained by adding the indicators in lines 1210 to 1260.

After this, in line 1600 it is necessary to sum up lines from 1100 to 1200, resulting in a balance indicator.

Now let's study how the liability side of the balance sheet is filled out.

How to draw up a balance sheet for a small business

The balance sheet of a small enterprise is formed in accordance with the appendix to Order No. 66n, approved by the Ministry of Finance on July 2, 2010. In addition to the indicators for the reporting year, it indicates indicators for the two previous years; for this purpose, special columns are provided where data at the end of the year is entered.

The OKUD form 0710001 (the balance sheet for small enterprises now has exactly this number) is used for reporting for the current year 2021, as well as for 2015. Before this, another form was used, which was used from 2012 to 2014.

The balance sheet for small businesses 2021 includes two forms: the balance sheet itself (Form 1) and the statement of financial results (Form 2). If the company considers it necessary to provide more forms to disclose missing information, then this is permitted.

Companies using the OKUD 0710001 form indicate the data in large quantities without detailing the items, since this form reflects more general indicators and the number of lines in the form is much smaller.

It doesn’t matter which taxation system the company has chosen, possibly the simplified tax system, everyone, without exception, needs to report to government agencies and prepare annual financial statements.

Regardless of whether the volume of reporting provided is chosen - complete or simplified, compliance with the legal deadlines for its submission is required. For 2021, due until March 31, 2021 (Thursday). Missing the legal deadline will result in significant fines. Since we submit reports without fail to two government agencies - the tax inspectorate and the statistical authorities, the fines are different. In the first case, you will have to pay 200 rubles for each document not submitted on time; in the second case, a liability of 3,000 to 5,000 rubles is provided.

When there is no activity, firms must still submit zero reports, otherwise they will face the same fines.

Balance sheet for 2021: what has changed

Key changes affected the header part of the document. Now it is necessary to indicate data on the type of activity from the OKVED2 classifier, and not OKVED, as was previously practiced. From now on, only thousands of rubles are recognized as units of measurement in the report (millions of rubles are no longer used). And companies for which a mandatory condition for accepting annual reports is a preliminary audit are required to indicate in specially designated lines of the new balance sheet form for 2021 information (name, INN, OGRN/OGRNIP) about the auditing firm or individual auditor interacting with it.

The tabular part in the 2021 balance sheet form remains the same. On the left side of it, assets are concentrated, and on the right side - the sources that formed this property (liability). Both parts of the table must be equal, which is how their balance is achieved, emphasizing the essence of the concept of balance.

The basic requirements for the formation of information in the balance sheet remain the same (PBU 4/99) - the company:

- independently establishes the procedure for detailing indicators, i.e., has the right to supplement the report with the lines necessary for entering data;

- indicates information about assets and liabilities as of three reporting dates - based on the results of the reporting year and the two previous years;

- in a special column records links to line-by-line explanations if necessary;

- does not reflect off-balance sheet accounting data.

the balance of 2021 will not be difficult; this opportunity is provided to users by a variety of resources, both regulatory and informational, tracking emerging legislative changes. We provide the 2020 balance sheet form at the end of this article.

How to fill out a simplified balance sheet 2021?

For each line of the balance sheet, indicators for 3 years are given; if some indicator is missing, then a dash is placed. The code in the line is entered depending on whose share in this aggregated indicator is the largest. For example, if a company has the most accounts receivable at the end of the reporting period, then code 1230 is entered in the line “Financial and other current assets” in the balance sheet (see example of filling out a balance sheet for a small enterprise below).

Simplified balance sheet for small businesses: instructions for filling out

Let's start with Balance Sheet Asset . It consists of five sections and the balance sheet currency for the Asset section (line 1600). The Asset reflects all the company’s property, which is divided into current and non-current assets.

The line “Tangible non-current assets” reflects data on fixed assets. These can be buildings, structures, transport, etc. The balance of accounts 01 and 03 is entered here minus the balance of account 02, and expenses for construction in progress (account 08) are also added.

In the line “Intangible, financial and other non-current assets” the value of intangible assets is formed (these include: scientific works, works of art, computer programs, inventions, etc.), deposit balances are reflected (account 55), long-term investments ( account 58), as well as the debit balance of accounts 60, 62, 68, 69, 70, 71, 73, 75 and 76.

Filling out the “Inventories” line of the simplified balance sheet does not differ from the generally accepted filling out of financial statements. Inventories take into account the cost of raw materials and materials not transferred to production, but recorded in the debit of accounts 10, 15, 16, the cost of finished products reflected in the debit of accounts 43 and 45, the amount of costs for work in progress recorded in accounts 20,23,29 and so on.

The line “Cash and cash equivalents” indicates the presence of the company’s funds in Russian rubles and foreign currency, which are available in the accounts or at the cash desk of the enterprise, as well as cash equivalents. The account balance is reflected: 50, 51, 52, 55 (except for the amounts reflected on lines 1170 and 1240), 57.

The line “Financial and other current assets” displays information about short-term financial investments (account 58), accounts receivable claimed for VAT, but not accepted for deduction, the amount of excise taxes and other current assets of the organization.

In the currency of the asset, this is line 1600, indicating the sum of all the indicators discussed above. It reflects all the company's assets.

The liability side of the simplified balance sheet consists of 6 sections and reflects the sources of the company’s funds. Sources come in the form of own funds, they are reflected in the line “Capital and reserves” and include information about the authorized and additional capital, the reserve fund and retained earnings. Data for accounts 80 (minus the debit balance of account 81), 82, 83 and 84 is entered here.

Companies also attract borrowed funds, which are recorded in the line “Long-term borrowed funds.” Here is the debt on long-term loans and borrowings (account 67). Long-term are understood as liabilities with a maturity period of more than 1 year. This line reflects the balance of accounts 60, 62, 68, 69, 70, 71, 73, 75 and 76. And there is also “Short-term borrowed funds”, it reflects the balance of account 66.

The title of the line “Accounts payable” fully reveals its essence. This contains the credit balances of accounts 60, 62, 68, 69, 70, 71, 73, 75 and 76.

The line “Other short-term liabilities” may well not be filled in if all the information has already been indicated.

The line indicator 1700 reflects the total amount of the organization's liabilities. The results of the Asset and Liability must be equal.

Sample of filling out the balance sheet 2021 for small businesses

General requirements

In most cases , filling out the balance sheet for a small enterprise is done on a simplified form, which is approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

Also see “Which accounting forms to use for small businesses in 2017.”

If a small company has been operating for more than a year and is not submitting an annual report for the first time, then any example of filling out a balance sheet for small enterprises involves indicating the amount for each line:

- as of the reporting date of the reporting period (i.e. as of 12/31/2016);

- as of December 31, 2015;

- as of December 31, 2014.

Thus, information and amounts for the period 2015 must be taken from last year’s reports. And to fill out a simplified balance sheet form for small businesses with indicators for 2016, you need:

- balance sheet for all accounts for 2016;

- statement of interest accrued for 2016 on loans and borrowings received by the company (Account 66 “Short-term loans and borrowings” and account 91 “Other income and expenses”).

You can often find an example of filling out a balance sheet for a small enterprise , where there are empty lines with dashes. Is this acceptable? Quite. After all, the balance sheet does not always contain the appropriate data for filling out individual lines of the balance sheet. And in this case, accounting rules allow adding dashes. The basis is clause 11 of PBU 4/99.

Then how to fill out a balance sheet for small businesses that have developed their own form? The answer is simple: if you do not work with a standard balance sheet form, then do not provide missing indicators.

Also see “What is a small business balance sheet for 2016.”

Codes are assigned to the balance sheet lines of a small enterprise according to the table from Appendix No. 4 of Order No. 66n of the Ministry of Finance. In this case, you need to follow the principle: for aggregated indicators, take the code based on the indicator that has the greatest share in it.

Also, do not forget to put dashes in the remaining empty cells of the lines. This approach to the example of filling out a balance sheet for small businesses for 2016 will allow you to avoid making mistakes or unnecessary additions, which will inevitably affect the outcome of the report.

Below is a sample of filling out a balance sheet for small businesses , which should be followed when entering amounts for each line:

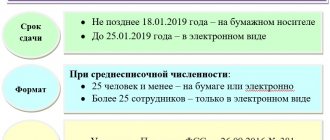

Rules for submitting financial statements for 2021

All organizations must submit their financial statements by April 1 inclusive. In 2021, there were changes to reporting forms and accounting rules. Below, the review provides recommendations. What new things to consider when you prepare reports.

Submit reports using new forms

Submit your reports for 2021 using the forms from the Order of the Ministry of Finance dated July 2, 2010 No. 66n. The Ministry of Finance made changes to the forms in 2021 (Order of the Ministry of Finance dated March 6, 2018 No. 41n). The amendments were minor. But check that the reporting form is in the current edition.

There are also new forms with a line about mandatory audit and indicators. Which take into account amendments to PBU 18/02. But they cannot be used when submitting reports for 2021. The Ministry of Finance has not yet approved the forms. It will be necessary to report on them for 2021.

- Balance sheet for 2021 Download... example (.xls 75Kb) + blank form (.xls 54Kb)

- Financial results report for 2021 Download... example (.xls 60Kb) + blank form (.doc 70Kb)

- Cash flow statementDownload... example + blank form

- Report on the intended use of fundsDownload... example + blank form

Submit reports in the same format

The composition of the financial statements for 2021 has not changed. It depends on how and with whom you keep records. In a general manner, in a simplified form or in a non-profit organization.

| Type of organization | Composition of accounting reports |

| Organizations that conduct accounting in a general manner | Balance sheetIncome statementStatement of cash flowsStatement of changes in equityExplanations |

| Organizations that have the right to conduct accounting in a simplified form | Balance sheet in a simplified form (.doc 60Kb) Statement of financial results in a simplified form (.doc 47Kb) An organization that maintains accounting in a simplified form has the right to choose which forms to submit accounting reports in: general or simplified |

| Non-profit organizations | Balance sheet Report on the intended use of funds Report on financial results. If the NPO received profit from commercial activities. And the income from this activity is significant. ExplanationsNPOs can submit a balance sheet. And a report on the intended use of funds using simplified forms. And do not provide an explanation. If accounting is carried out in a simplified manner |

Submit reports to statistics

Submit your financial statements for 2021 to both the Federal Tax Service and Rosstat. If the organization is required to pass. You still need to submit an audit report to the statistics department. When an organization is not subject to mandatory audit. But in statistics they require an audit report, please send an explanation. That you don't have to represent him. There is no need to send the audit report for 2021 to the Federal Tax Service.

Reporting can be submitted on paper

You can submit your financial statements for 2021 as if on paper. Same in electronic form. The size of the organization does not matter: even large enterprises have the right to draw up balance sheets and other forms on paper. If the organization reports in electronic form. Use the format recommended by the Federal Tax Service (letter of the Federal Tax Service dated July 16, 2018 No. PA-4-6/13687).

Explanations for reporting are required

Explanations to financial statements are required. If you conduct accounting according to general rules. It is not necessary to provide explanations. Only when you keep records according to simplified rules.

The organization has the right to determine the form and content of the explanations independently. Explanations can be provided in text or tabular form. If you fill out the explanations in tabular form, consider the example. Given in Appendix 3 to the order of the Ministry of Finance dated 07/02/2010 No. 66n.

The explanations reflect additional information to other reporting forms. Most often this is a decoding of individual balance sheet indicators. And the financial results report.

Ready-made examples of explanations that will help decipher accounts receivable and payable data

- Explanations on accounts receivableRequired: if the organization has accounts receivable in its accounting, including those covered by the reserve for doubtful debts. Download… (.doc 65Kb)

- Explanations on accounts payableRequired: if the organization reflects accounts payable in its accounting, including overdue ones. Download… (.doc 66Kb)