Situations with overpayments of obligations of business entities to the budget can be resolved by submitting an application to the Federal Tax Service for a refund of funds to the current account or by offsetting obligations. In the latter case, it is necessary to take into account that tax surpluses can only be directed to taxes with a similar level of budget ownership. For example, offset of funds for federal taxes (VAT, mineral extraction tax, water, etc.) is allowed in favor of other federal taxes, for regional taxes (on property of legal entities, transport, etc.) - only against regional ones. For insurance premiums, offsets are made within the limits of the same type of contributions. At the same time, the law does not provide for restrictions on the offset of funds at the interregional level (for example, when re-registering a business entity with another territorial Federal Tax Service).

Possible options

The return and offset procedure is regulated by Article 78 of the Tax Code of the Russian Federation. For convenience, we present it in the form of a diagram.

The whole procedure can be represented step by step as follows:

- We establish the fact of excessive payment to the budget.

- We check whether there is arrears on any of the taxes, penalties or fines, against which the inspectorate can offset the overpaid amounts.

- We check whether the declaration needs to be clarified at the same time.

- We determine our preferences, two options are available: refund or credit.

- We reconcile payments to the budget.

- We are preparing the necessary applications.

- We send the necessary package of documents to the inspection.

If the circumstances of tax calculation have changed

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

Actual circumstances related to the calculation of tax may change: price, shipment volume, etc. This often happens in construction: the volumes and prices of work specified in the acts may change even after several years.

The reason for this may be either the settlement of disputes between the customer and the contractor, or the completion of construction if it has been delayed.

How to identify

Before you begin filling out an application for a refund or tax credit, you need to determine whether this treasured amount exists or is it just an accounting error in the records. So, how to identify the overpaid amount in taxes.

Step No. 1. Check your accounting.

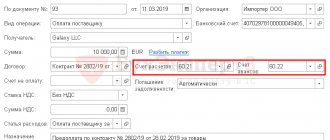

Of course, first of all it is necessary to check the correctness of registration of transactions in the organization’s accounting records. It is quite possible that the error crept not in the payment order, but in the way the accountant compiled the posting. Particular attention should be paid to the procedure for registering transactions in specialized accounting programs.

Check what? Accounting accounts and analytics on them (KBK, subaccount, KOSGU, type of payment, etc.). Re-grading by BCC or type of transaction (fine, tax, fine) are the most common errors in accounting programs.

After checking, be sure to create a balance sheet and an account card for the period you are interested in. This is necessary to check whether the errors are fixed or not.

Step No. 2. Check with the bank.

If no accounting errors are found, check your bank statements. Are the transactions posted correctly in accounting, and did the bank execute payment orders correctly?

In the bank statement, you can verify the tax recipient, KBK and other payment details; it is against these indicators that you can verify the accounting data. Correct any errors found in your accounting. If the bank makes a mistake, contact your local branch to resolve the problem. It is worth noting that banking errors are isolated cases.

Step No. 3. Reconciliation with the Federal Tax Service on taxes and contributions.

So, if internal control and reconciliation with the banking organization did not produce results, then you should contact the Federal Tax Service. To do this, just contact the nearest territorial inspection office. If the institution exchanges documentation with the Federal Tax Service via secure Internet channels, then you can request an extract in electronic format. You can also obtain information in your personal account on the official website of the Federal Tax Service. For more details, see the material “Instructions: how to check tax arrears.”

Based on the results of reconciliation with the Federal Tax Service, we determine the overpaid amount for taxes. Now we decide what to choose: offset or issue a tax refund.

Procedure for correcting detected errors

In the case under consideration, the principle of making corrections differs significantly from that established in accounting and, in accordance with paragraph 1 of Art. 54 of the Tax Code of the Russian Federation is as follows.

If distortions are detected in the calculation of the tax base relating to previous tax (reporting) periods, tax liabilities are recalculated in the period in which the error was committed.

Tax liabilities of the reporting period in which misstatements are identified are adjusted only if it is impossible to determine the specific period to which these misstatements relate.

Distortions in submitted declarations can be of two types and lead to either underpayment or overpayment of tax.

How to count

As a general rule, any federal tax, including income tax, can be offset against future payments for any other federal payment or fines and penalties to the federal budget. In this case, the existing arrears are repaid by the inspection itself and do not require the participation of the organization. However, the latter retains the right to submit an application for offset of overpayments on taxes; an application for this is submitted to the inspectorate at the place of registration of the organization in paper or electronic form.

To reflect the offset operation, according to the chart of accounts approved by Order 94n, analogous accounts are used for budgetary institutions.

| The amount of profit was offset against VAT payment | 68-VAT | 68-pr | 20,000 rub. | Decision, accounting certificate |

Within what period can the inspectorate itself offset the overpayment of taxes to pay off the arrears?

The inspection may carry out offsets within the time limits for forced collection of arrears, penalties, and fines. If these deadlines are missed, the tax authority does not have the right to independently offset the arrears (Determination of the Constitutional Court of the Russian Federation dated 02/08/2007 N 381-O-P, Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated 07/30/2013 N 57 (clause 32), Presidium of the Supreme Arbitration Court of the Russian Federation dated 15.09. 2009 N 6544/09).

If the inspection has missed the deadline for the undisputed collection of arrears, penalties, fines, then it has the right to carry out such an offset only if there is a court decision on this (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 9, 2008 N 8689/08).

How to fill

First of all, we note that applying for a credit is required separately for each type of tax, fee or contribution. It is not possible to combine fiscal payments in one document.

If an organization is registered with several Federal Tax Service Inspectors at once, for example, it has several branches or separate divisions, then the document should be submitted exactly to the inspection department where the overpayment of taxes occurred.

Instructions for filling:

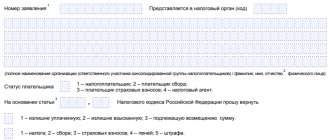

- In the header of the document we indicate the TIN and KPP of the taxpayer-applicant.

- The application number is a serial number for the current year.

- Payer status: for an organization it is either “1” - taxpayer, or “4” - tax agent.

- Enter the article of the Tax Code of the Russian Federation, in accordance with which we carry out the offset. Indicate the article number in the field: “176” - for VAT credit, “203” - for excise tax and “78” - for other fiscal payments (taxes, fees, contributions).

- Select the type of payment from the list provided. For example, to offset income tax, select “1”, to offset VAT penalties, select “4”.

- Then we determine the period or specific date for which the overpaid amount was generated. For example, for January 2021 - MS.01.2019, for the 1st quarter of 2021 - KV.01.2019, for the 1st half of the year - PL.01.2019, for the year - GD.00.2019. We indicate a specific date if the law establishes the exact date for filing a declaration or paying a tax. For example, 03/28/2019 to pay income tax.

- OKTMO - the code corresponds to the code of the place where the taxpayer is registered.

- Indicate the BCC corresponding to the tax, fee, contribution for which the overpayment was detected.

- On the second sheet of the document, indicate the overpaid amount in rubles and kopecks. Then determine what the payment should be redirected to: “1” - for arrears, “2” - for future periods. Specify the tax period to be offset against future payments.

- Enter OKTMO at the place where the payment was made.

- BCC of the tax, fee, contribution against which the offset is made.

- The last page (section “Information about an individual who is not an individual entrepreneur”) is not filled out by institutions.

How to return

It makes sense to return funds when you are sure that the organization has no debts to pay taxes, penalties and fines. Ideally, you need to obtain a reconciliation report from the tax office. Please keep in mind that the refund will be made only after the existing arrears have been repaid. Otherwise, the return application will be rejected.

If the head of the organization has decided that the overpaid amount needs to be returned, it is necessary to fill out an application for a refund of the overpayment of taxes; the terms of transfer to the organization's current account are calculated from the date of filing the application and amount to no more than one calendar month.

The return of the overpaid amount must be reflected in standard posting.

| Wiring | Operation |

| Dt 51 Kt 68 | Overpaid income tax refunded |

Please note that applying for a refund from the budget should take into account the current circumstances. For example, for monthly payments, such as insurance premiums or personal income tax, it makes no sense to return overpaid amounts, because next month the organization will again calculate wages and calculate payments towards insurance coverage. However, if we are talking about a company being reorganized or liquidated, then the return is justified.

You should also take into account the company's planned performance indicators. For example, if a budget institution previously provided paid services. Based on the results of the reporting provided to the Federal Tax Service, an overpaid amount of VAT was identified. However, business activity was terminated by the decision of the founder. Let us remind you that public sector employees are exempt from paying VAT on activities financed by subsidies. Consequently, the institution has no obligation to calculate and pay VAT in the current period. And it will not be possible to offset the overpayment against future VAT charges (paid services have been discontinued). It is in this case that you need to fill out an application for a refund of the overpaid tax.

But even in such a situation, the institution has the right to transfer the overpaid money to other payments. For example, to pay off debts on transport, land tax or property tax. Therefore, the decision must comply with the provisions of the law and satisfy the needs of the taxpayer.

How to fill out a tax refund application

The tax refund application is filled out according to similar rules. Please note that the updated KND form 1150058 itself already contains detailed instructions and tips for filling out.

The document can only be issued in relation to a specific fiscal payment. You cannot combine several types of overpayments in one refund application. Even if the taxpayer returns overpaid penalties and fines for one fee, he will have to prepare two refund applications. One is for a tax penalty, the second application is for a refund of the fine. Since for each payment the corresponding budget classification code is determined - KBK.

Submit an application for a tax refund to the exact branch of the Federal Tax Service where the taxpayer is registered. If the overpaid amount is identified in a separate division, report it to the Federal Tax Service at the place where the OP is registered.

Instructions for filling out a tax refund application, key aspects:

- The checkpoint should indicate the code assigned to the organization or separate division in the tax authority to which you are submitting an application for a tax refund.

- Correctly indicate the reason for the overpayment. There are several options available to choose from. For example, if you overpaid, indicate code “1” in your tax refund application. If the taxpayer is claiming a refund of VAT or excise taxes from the budget, then enter “3”.

- Detail the type of payment for which you are processing a refund from the budget. If you are returning the amount for the main obligation, write “1” in the return application, “4” for compensation of overpaid penalties, “5” for fines.

- In the “Account Information” section of the tax refund application, enter the necessary information about the banking organization in which the corresponding current account is opened. Then indicate the type of account, according to the decoding indicated in paragraph 6 of the filling rules (see the KND 1150058 form itself). The recipient is the applicant organization.

Please note that there are exceptional filling rules for public sector institutions. So, for example, a budgetary institution in the “Name of the bank” paragraph must indicate the name of the Federal Treasury body in which the personal account is opened. The account number is the standard 20 characters. But the recipient of the payment for public sector employees is not the name of the organization, as, for example, NPOs or commercial firms must register. In this paragraph, you must indicate code “3” and enter the name of the body that opens and maintains personal accounts. In most cases, this is a territorial branch of the Federal Treasury.

NPOs and commercial firms do not indicate the personal account number and BCC for enrollment. But public sector institutions are required to fill out the fields. The personal account number is a unique number (can contain not only numbers, but also Latin letters). But the BCC is determined for each type of institution individually:

- autonomous ones enter zeros in the budget classification code;

- budgetary - indicate KBK 000000000000000000130;

- government - fill out the KBK in accordance with Order of the Ministry of Finance No. 132n.

The last section of the tax refund application does not need to be completed. It is intended for individuals.

Special cases

Sometimes there is an overpayment of federal taxes and an underpayment of those regulated by the subject, that is, payments are made to different levels of the budget system. This is called a violation of interbudgetary regulation, and such cases are regulated not by Article 78 of the Tax Code of the Russian Federation, but by Order of the Ministry of Finance dated November 12, 2013 No. 107n and the Budget Code.

First of all, in such a situation, it is necessary to clarify the tax payment that caused the problem. And then, to correct the situation, write and send a letter to the tax office to clarify the details of the payment order regarding the budget classification code. It is compiled in free form and submitted in written or electronic form.

What to do if the inspection refused the test or carried it out late

You can appeal the refusal to offset to a higher tax authority, and then to the court (Article 137, clauses 1, 2 of Article 138 of the Tax Code of the Russian Federation).

As a general rule, the period for appeal is one year from the moment you learned or should have learned about a violation of your rights (Clause 2 of Article 139 of the Tax Code of the Russian Federation).

The period for going to court is three years from the day when you learned or should have learned about a violation of your right to offset (clause 79 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 N 57). If the inspection does not carry out the offset in a timely manner, then no interest is accrued on the offset amount. You can only appeal the inaction of the inspectorate in the manner indicated above.