Features of inventory accounting

Materials (materials and materials) can be delivered to the enterprise's warehouse by purchase, gratuitous transfer, in the form of a contribution to the authorized capital, or in another way. To account for purchased materials, account 10 “Materials” is used.

The cost of inventories upon receipt at the warehouse can be taken into account as follows:

- at actual cost on account 10;

- at discounted prices. To form the cost of inventories, an additional 15th account is applied.

The selected option for accounting for inventories must be specified in the accounting policy.

Inventory structure

In order to guarantee the uninterrupted production process and satisfy managerial needs, companies form certain reserves, to control which the position outlined in today’s topic is used.

The latter refers to assets used as raw materials or materials during the production of goods for sale, as well as to meet the management needs of enterprises.

As for the tasks pursued from the point of view of inventory accounting, the following should be highlighted:

- control over the safety of inventory items in warehouses, as well as during their processing;

- ensuring the adequacy and timeliness of document flow for the movement of inventory items, determining and indicating the costs associated with their production, assessing the actual cost of used inventory items and their balances in warehouses, as well as on balance sheet items;

- constant monitoring of compliance with established inventory standards, as well as detection of surplus and unused inventory and their sale;

- ensuring the timeliness and completeness of settlements with contractors for supplied materials, as well as control over inventory items in transit.

Taking into account the role performed by certain PMZ in the production cycle, they should be divided into groups such as:

- base and raw materials;

- auxiliary raw materials;

- purchased semi-finished products;

- generated waste and fuel materials;

- components, containers and materials for its manufacture;

- household supplies and equipment.

As for the applied unit of measurement of PMZ, here, in addition to the nomenclature number, a batch, a homogeneous composition, etc. can be accepted.

Account 15 in accounting

The main aspect of using account 15 is that this account summarizes information on the procurement and acquisition of inventories, which relate to funds in circulation:

The difference between the actual cost and the accounting price is called a deviation. To reflect deviations in accounting, account 16 “Deviation in the cost of material assets” is used.

Typical transactions for account 15 are presented in the table below:

| Dt | CT | Contents of operation |

| 60 | 51 (50) | The paid cost of the supplier's inventory is taken into account |

| 15 | 60 | The cost (excluding VAT) of inventories according to the supplier’s accompanying documents is taken into account |

| 19 | 60 | VAT paid included |

| 10 | 15 | The purchased goods and materials were credited to the warehouse at the discount price |

| 15 | 16 | The excess of the book price over the actual cost is written off |

| 16 | 15 | The excess of the actual price over the accounting cost is written off |

Purchase of materials and equipment at a price higher than the discounted price

ClinkerTrade LLC purchased raw materials for production from the supplier in the amount of 135,000 rubles excluding VAT, VAT is equal to 24,300 rubles. The book value of this raw material is 130,000 rubles.

Delivery services amounted to 14,000, plus VAT 2,520 rubles.

| Dt | CT | Operation description | Sum | Document |

| 15 | 60 | Reflection of receipt of raw materials | 135000 | Invoice |

| 19 | 60 | Reflection of incoming VAT | 24300 | Supplier invoice |

| 15 | 60 | Reflection of transportation and procurement costs | 14000 | Invoice |

| 19 | 60 | VAT on TZR | 2520 | Supplier invoice |

| 16 | 15 | Reflection of the amount of the difference between the book price and the actual price. cost (135000+14000-130000) | 19000 | Accounting information |

| 60 | Transfer of payment to the supplier for raw materials (135000+24300) | 159300 | Payment order | |

| 60 | Transfer of payment to the transport company for delivery (14000+2520) | 16520 | Payment order | |

| 68 | 19 | Submitted for deduction of VAT from the supplier of raw materials | 24300 | Book of purchases |

| 68 | 19 | Submitted for VAT deduction to the transport company | 2520 | Book of purchases |

If the purchase price exceeds the accounting price, the deviation is reflected in Dt 16 and Kt 15 of the account. At the end of the month, this amount is written off to production costs in proportion to the amount of materials written off.

The balance of Dt in the cost variance account (16) must be written off to the cost account at the end of the month in proportion to the amount written off from account 10.

To calculate the write-off amount, the formula is used:

(Balance Kt at the beginning of the month + Turnover Dt for the month) *(Turnover Kt account 10) / (Balance Dt account 10 at the beginning of the month + Turnover Dt for the month)

Postings using accounts 15 and 16 as an example

Example 1

TD "Zima" purchased MPZ in the amount of 2,500 pieces, the total cost of materials was 354,000 rubles, incl. VAT 54,000 rub. Materials were entered into the warehouse at a book price of 160 rubles. for one piece. 500 units were written off for the production of finished products.

Accounting entries using account 15 for inventory accounting:

| Dt | CT | Amount, rub. | Contents of operation | Document |

| 60 | 51 | 354 000 | Reflects payment to supplier for materials | Bank statement |

| 15 | 60 | 300 000 | Purchased materials are taken into account at actual cost, excluding VAT | Consignment note (TORG 12) |

| 19 | 60 | 54 000 | The amount of VAT on purchased materials is taken into account | Invoice received |

| 10 | 15 | 400 000 | Purchased materials are posted to the warehouse at the discount price | Invoice |

| 15 | 16 | 100 000 | The write-off of the excess of the book price over the actual cost is reflected. | Accounting information |

| 20 | 10 | 80 000 | Materials written off for production are taken into account (500 * 160) | Invoice for transfer of materials to production |

| 20 | 16 | 20 000 | At the end of the month we write off the amount of 20,000 rubles. ((0 + 100,000) * 80,000 / (0 + 400,000)) | Accounting information |

Reflection of the actual cost of purchasing materials and writing off the difference.

- Debit 10 Credit 15 - Materials received at accounting prices.

- Debit 15 Credit 60 - Reflection of the actual cost of materials and goods according to supplier documents.

- Debit 15 Credit 60-Transportation costs for the purchase of goods and materials are reflected

- Debit 15 Credit 76-Consulting costs for the purchase of materials.

- Debit 16 Credit 15-Write-off of overexpenditure (if the actual cost turned out to be higher than the book value).

- Debit 15 Credit 16-Write-off excess of book value over actual cost of materials (savings)

Let's look at example 1 (when there is overrun):

JSC "Tredax" bought bricks at a price of 100 rubles in the amount of 10 pieces (registering price 90 rubles per unit). The delivery cost was 1500 rubles. Consulting services amounted to 5,000 rubles. Bricks are written off for production 5 pcs.

Solution:

- Debit 10 Credit 15-900 rubles (90*10) - Materials have been received at discount prices.

- Debit 15 Credit 60-1000 rubles (10*100) - Actual cost of purchased materials.

- Debit 15 Credit 60-1500 rubles - Delivery cost reflected.

- Debit 15 Credit 76-5000 rubles - Consulting services for the purchase of materials are reflected.

- Debit 20 Credit 10-450 rubles (5*90) - Brick is written off for production. (Writes off at the book price since the brick is reflected in account 10 at the book price)

- Debit 16 Credit 15-6600 rubles (1000+1500+5000-900) - At the end of the month the difference is written off to account 16 (more about account 16 below).

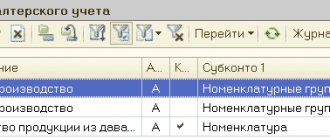

See Figure 1 (charts of accounts, “airplane”)

Let's look at example 2 (when there are savings):

JSC "Tredax" bought bricks at a price of 100 rubles in the amount of 10 pieces (registering price 1000 rubles per unit). The delivery cost was 1500 rubles. Consulting services amounted to 5,000 rubles. Bricks are written off for production 5 pcs.

Solution:

- Debit 10 Credit 15-10,000 rubles (1000*10) - Materials received at discount prices.

- Debit 15 Credit 60-1000 rubles (10*100) - Actual cost of purchased materials.

- Debit 15 Credit 60-1500 rubles - Delivery cost reflected.

- Debit 15 Credit 76-5000 rubles - Consulting services for the purchase of materials are reflected.

- Debit 20 Credit 10-5000 rubles (5*1000) - The brick is written off for production. (Writes off at the book price since the brick is reflected in account 10 at the book price)

- Debit 15 Credit 16 –2500 rubles (10000-1000-1500-5000) - Savings are written off; the accounting price exceeds the actual cost (more about account 16 below).

If you find it difficult to write the posting of account 15 and account 16 in debit or credit, then it’s very simple to look at the turnover on account 15, if the debit turnover is higher than the credit turnover, then we find the difference and write down the posting Debit 16 credit 15. If, on the contrary, Credit is greater than debit, then write it down the difference in debit 15 Credit 16. Or in simple words, account 15 needs to be closed, if to close you need to enter the difference in debit, then the posting will be Debit 15 Credit 16, if to close you need to write down the difference amount as credit, then the posting will be Debit 16 Credit 15

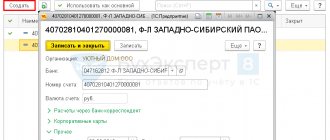

Figure 2 (charts of accounts).

How to keep track of fuel using waybills in 1C:Accounting 8?

In the 1C:Accounting 8 program, starting with release 3.0.74, the accounting of waybills and fuel costs for non-transport organizations using cars for business trips is automated:

- added a new document Waybill;

- a new type of operation Fuel has been added to the document Receipt (act, invoice);

- new subaccounts have been added to the Chart of Accounts to subaccount 10.03: 10.03.1 Fuel in warehouse - all movements previously reflected in account 10.03 Fuel have been transferred to this account (you can continue to keep track of fuel in account 10.03.1 without using the Waybills document);

- 10.03.2 Fuel in the tank of the car - intended for accounting for fuel according to waybills; on this account you can keep track of fuel for each car under the subconto Vehicles. To start accounting for fuel using waybills, the program needs to reflect the remaining fuel in the tank for each vehicle using entries Dt 10.03.02 and Kt 10.03.01 (document Operation).

Initial settings (Fig. 1):

- Section: Main - Functionality

. - On the Inventory tab, select the Waybills checkbox.

Rice. 1

Document Waybill (Fig. 2 - 4):

- Section: Shopping - Waybills.

- Create button (Fig. 2).

Rice. 2

- Using the Cost account link, you can change the cost account for consumed fuel (Fig. 3).

- The Fuel tab indicates the number of liters of fuel filled into the vehicle tank. In the Document column, select the fuel purchase option - Fuel Card or Cash Receipt and fill in the required data (Fig. 3).

Rice. 3

- On the Route tab, click the Add button to fill out the table section - indicate the departure and arrival points along the vehicle route, the date, time, and odometer readings. The distance and fuel consumption are calculated automatically based on the odometer readings and the fuel consumption rate in the field of the same name (Fig. 4).

- By clicking the Print button, you can print a waybill in form No. 3 for a passenger car or a simplified form of a waybill, as well as an advance report if fuel was purchased in cash or by bank card (note that in this case the continuous numbering of advance reports will be disrupted; you will need to manually correct the document number in printed form and the number of the next newly created document Advance report).

- Button Post and close.

Rice. 4

Click the button to see the result of the document.

When paying for fuel with a fuel card, the document generates debit entries on account 10.03.2 only for the amount of fuel filled into the tank. When paying for fuel using accountable means (cash or bank card), entries are generated to debit account 10.03.2 for the amount of fuel filled into the tank and the amount. For the amount of fuel consumed, a credit entry to account 10.03.2 is generated (for quantity without amount).

Upon receipt from the fuel supplier of primary documents (waybill and invoice) for the fuel selected for the period, a Receipt document (act, invoice) is created with the type of operation Fuel, which generates debit entries on account 10.03.02 for the total amount without quantity.

Account 76.15 Purchases using fuel cards are used as an auxiliary account.

When performing the routine operation Adjustment of the cost of an item as part of the Closing of the month processing, a posting is generated to the debit of the cost account and the credit of account 10.03.2 for the amount of fuel consumed, calculated at the average cost for the month.

Rice. 5

Application of 15 accounts in transactions

When using item 15 to record transactions, its debit part reflects the purchase price of the company's inventory according to the settlement documents received from the supplier.

Taking into account the source of origin of goods and materials and the nature of the costs of their production and delivery, account 15 is debited in correspondence with 60, 76, 71, 20, 23 and other accounts.

At the time of actual receipt and capitalization of inventories, they are written off as credit 15 of the balance sheet position and debit of 10 or 41 accounts.

In a situation where the book price of inventory exceeds its actual cost, the difference in the indicated entry must be reversed. In this case, the entry will look like this:

Dt 16

Kt 15 reversible.

The debit balance of account 15 at the end of the reporting period indicates the existence of PMZ in transit. As for Form No. 1 of financial statements, the balance of account 15 at the end of the reporting period is transferred to line 1210. If we are talking about the purchase of equipment for installation, which is subsequently reflected in account 07, then the balance of item 15 should be reflected in line 1190 balance sheet.