When applying for tax deductions, a citizen needs to send a whole package of documents to the Federal Tax Service. As a rule, the main difficulties arise when filling out the 3rd personal income tax return. Strict standards have been developed for this procedure that must be followed. When it comes to receiving a large deduction, you can entrust the procedure to a professional by paying for the services. But in the case of a tuition deduction, this is simply not profitable. Therefore, it is worth trying to fill out the document yourself. Moreover, now all kinds of specialized programs have been developed to help.

Refund of personal income tax for training: Tax Code of the Russian Federation

In 2021, the Tax Code of the Russian Federation did not change the requirements for persons applying for a deduction for training. The conditions for refunding part of the tax from the budget for the education received are as follows (clause 2, clause 1, article 219 of the Tax Code of the Russian Federation):

- the payer must have income subject to personal income tax in the year of payment for studies;

- The taxpayer himself or his child, incl. adopted or guardian/ward, as well as brother or sister of the taxpayer (full and half-blood);

- the age of a student relative, child, former ward/ward should not exceed 24 years, and wards/wards should not exceed 18 years, and the form of education is only full-time (for the taxpayer himself there are no restrictions on age and form of education);

- The individual entrepreneur or organization that received the payment must have a license to provide educational services; for an individual entrepreneur who independently organizes the entire process (without involving third-party teachers), it is enough that this type of activity is declared by him in the Unified State Register of Individual Entrepreneurs (letter of the Ministry of Finance No. 03-04-05/574 dated January 11, 2018);

- Returns are allowed only for the previous 3 years i.e. in 2021, you can claim a deduction and return taxes for 2021, 2021 and 2018.

It does not matter what kind of education was paid for (institute, academy, college, gymnasium, general education clubs, courses, including advanced training, preparation for school, tutoring, etc.), if all the conditions meet the above.

In order to receive a one-time refund of part of the tax, the taxpayer must independently apply to the Federal Tax Service for a refund by submitting a completed 3-NDFL declaration for education.

If the declaration is submitted only to receive a deduction, it can be submitted throughout the year, but if it also reflects income required to be declared (for example, from the sale of real estate), the deadline for submission is April 30 of the following reporting year.

New declaration form 2019

In order to successfully apply for a deduction and return income tax on a citizen’s expenses for studying, it is necessary to draw up a proper application, collect all the necessary documentation and fill out the current 3-NDFL form.

In this case, you should use the current reporting declaration form, regulated by the order of the tax department (FTS) under the number ММВ-7-11 / [email protected] dated 10/03/2018.

Outdated 3-NDFL templates will definitely be rejected by the fiscal authority.

About the new form of declaration 3-NDFL.

Download the new 3-NDFL form to fill out in 2021 for 2018 - excel.

How to fill out an income tax refund - instructions

In this case, you should not fill out everything, but only certain pages of the 3-NDFL declaration. The required data is entered in the following sequence:

- the first application (the amounts/sources of income of an individual are recorded);

- fifth appendix (the deduction for an individual’s expenses for studying is calculated);

- the second section (the tax base and the amount of income tax are calculated);

- the first section (the tax to be refunded is fixed);

- title part (general information about the individual taxpayer is provided).

Below are instructions for completing the specified return pages for your education tax refund.

First application

You need to fill out the following lines in 3-NDFL for each source of income (employer):

- 010 – the tax rate is given (value – 13%);

- 020 – the type of income reflected is coded (value – 01);

- 030,040,050 – TIN, KPP, OKTMO are provided, respectively, for the employer;

- 060 – enter the name/full name of the organization/entrepreneur;

- 070 – the amount of income (receipt) of the individual applicant is entered;

- 080 – the amount of withheld tax (NDFL) is entered.

An example of filling out the first application 3-NDFL:

Fifth Appendix

You need to fill out the following fields in this section of the declaration:

- from 010 to 060 - should be filled out if standard deductions of the corresponding types are requested (the amounts are written down);

- 070.080 – sums up the amounts specified in 010-060 (if filled out);

- 100 – here is written the amount of money actually spent by the individual applicant on the education of children, wards, former wards;

- 120 – total for the second sub-item (if only the 100th field is filled in, its value is transferred here);

- 130 – here the amount of money actually paid by the individual applicant for his own studies, education of his sister/brother is filled in;

- 180 – total for the third sub-item (if only the 130th field is filled in, its value is transferred here);

- 181 – reflects the total amount of social deductions received through tax agents of the individual applicant during the reporting period;

- 190 – reflects the total amount of social deductions (which is declared by the individual);

- 200 – the total declared amount of standard deductions and social benefits.

Sample of filling out the fifth application of the declaration:

Second section

The following fields (lines) of the declaration are filled in:

- 001 – the tax rate is specified (value – 13 percent);

- 002 – type of income (select code value – 3);

- 010 – the total amount of income (receipts) is entered;

- 040 – the amount of tax deduction is entered;

- 060 – calculation of the tax base value;

- 070 – income tax payable is reflected here;

- 080 – the amount of tax withheld is reflected here;

- 160 – the amount of tax reasonably claimed by an individual for refund is recorded here.

An example of filling out the second section of 3-NDFL:

First section

The data is entered by the individual applicant in the following fields:

- 010 – 2 is written here (the value corresponding to the tax refund);

- 020 – KBK is given (required code);

- 030 – OKTMO is given (required code);

- 050 – the amount of tax (income) returned to the individual is fixed.

Sample of filling out the first section of 3-NDFL:

Title part

The first page of the tax return contains the usual information about the reporting period, the taxpayer, as well as other data provided by the cover page template.

Example of filling out a title page:

Tuition deduction amount

Before you start filling out the 3-NDFL for education, a sample of which will be given below, we will tell you about the rules in force in 2021.

What to consider when drawing up a document:

- not the entire amount spent on studies is returned, but only 13% of it - the taxpayer is provided with a deduction from taxable income in the amount of payments made (but not more than the established limit), resulting in an overpayment of withheld tax;

- the deduction for your own education, as well as that of your sister and brother, cannot exceed 120,000 rubles. per year, but this is the limit for all social deductions of the current year taken together (education, treatment, contributions to the Pension Fund, etc.); Accordingly, the maximum amount of tax to be refunded will be 15,600 rubles. (120,000 x 13%);

- The maximum deduction amount that can be declared in 3-NDFL for the education of a child (both your own and a ward) is 50,000 rubles. for each student per year, and this deduction cannot be combined with the above amount of 120,000 rubles. The maximum amount of tax to be refunded is 6,500 rubles. for each child.

Unused deduction amounts are not carried over to another year.

Example

In 2021, Smirnov studied a foreign language, transferring 60,000 rubles to the educational organization for the courses. In addition, he paid for the education of his 18-year-old son in a driving school in the amount of 55,000 rubles. Smirnov’s earnings for 2021 are 640,000 rubles, the tax withheld by the employer is 83,200 rubles.

Considering that the maximum deduction amount for a child’s education is 50,000 rubles, Smirnov declared (60,000 + 50,000) x 13% = 14,300 rubles for the return to 3-NDFL for education.

The amount exceeding the limit (5,000 rubles out of 55,000 paid for my son’s education) cannot be transferred to the next year; it is not included in the calculations.

The amount of all social deductions declared in the declaration, incl. for study, in any case there cannot be more than the taxable income, and the refunded amount will not exceed the tax withheld from the applicant’s income in the reporting year.

Verification and Printing

After all the lines have been filled out, all that remains is to check the correctness of the entire document. Click the corresponding button. If the program finds any inconsistencies, it will offer to correct the errors. If everything is fine, it will report a successful check.

By clicking the “View” button, in the new window that appears, you can see how the document will look when printed. It is noteworthy that the program itself generates the required number of declaration sheets and calculates the amount of tax to be refunded from the budget.

Thus, in the example considered, the applicant’s total expenses claimed for deduction amounted to 108,500 rubles. The amount of tax that will be returned to him from the budget is 14,105 rubles. (108,500 × 13%).

What documents will be required?

One declaration will not be enough for tax authorities. It is necessary to attach documents confirming payment of tax and expenses of the taxpayer to the 3-NDFL for training:

- certificates of 2-NDFL income from the place of work (they can be downloaded from the “Taxpayer’s Personal Account” on the Federal Tax Service website);

- agreement with an organization (IP) providing educational services;

- a license for educational services, if its details are not specified in the contract;

- payment documents - receipts, checks, etc.;

- if your own child is studying - a birth certificate, a ward - a guardianship/trusteeship agreement, a sister or brother - documents on kinship (birth certificates of the taxpayer himself and the studying relative);

- a certificate from the place of study of a relative or ward, if the contract does not indicate full-time study.

The original 2-NDFL certificate and copies of other documents are attached to the paper copy of the declaration. Scans of all documents are attached to the electronic version. Inspectors may require original attached documents to be presented for verification.

How to fill out the 3-NDFL declaration for training

The declaration can be submitted to the Federal Tax Service both on paper and electronically via the Internet (for example, through the “Taxpayer Personal Account” on the Federal Tax Service website).

In 2021, the declaration form has changed. 3-NDFL for education for 2020 is filled out on the form and according to the formats approved. By Order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected] When filing returns for previous years, you must use the forms that were in force in the corresponding tax period.

The following general requirements apply to the registration of 3-NDFL for studies:

- for the handwritten version, pens with black or blue ink are used; all unfilled cells are crossed out;

- when generating a declaration on a computer, the sheets are printed on only one side;

- the tax is indicated in whole rubles, in the application for a refund (appendix to section 1 of the declaration) it can be in kopecks (if the taxpayer had arrears/overpayments on personal income tax); other cost indicators are indicated in rubles and kopecks;

- for text fields (for example, full name of the applicant), capital block letters are used;

- all sheets of completed reporting must be numbered, starting with “001” on the title page.

Before submitting, the taxpayer signs each page of the declaration and marks it with the date of completion.

Methods for filling out reports

You can involve third parties in filling out the declaration to obtain a tax deduction. Many accounting firms provide this service. If the applicant decides to do it on his own, he can draw up the document in the following ways:

- Enter all information by hand.

- Print data using a printing device.

- Use a special electronic program.

A citizen can choose the most convenient method for him.

By hand

If the applicant decides to fill out the declaration by hand, he should adhere to a number of rules:

- all information is entered in printed capital letters;

- each speech sign fits into a separate cell in order;

- if there are empty cells, you need to put a dash in them;

- numbers need to be aligned to the right;

- write only with blue or black ink;

- start line from left edge;

- do not indicate the amount in kopecks. If present, the number must be rounded according to the rules of mathematics.

When filling out, no blots, corrections, or cross-outs are allowed. There is no need to staple the sheets to avoid damaging the barcode. When printing the form, you must ensure that the entire form is printed.

Using a computer

If it is more convenient for a citizen to fill out a declaration using a computer, you must first download a specific program to choose from:

- Acrobat Reader;

- Microsoft Excel.

If forms will be downloaded from the Federal Tax Service website, you should opt for Acrobat Reader, because The document is provided in pdf format.

If information is entered using a computer, you must adhere to the following rules:

- Only capital letters are used;

- printed using Courier New font size 16 - 18.

There are no such serious requirements as when filling out by hand.

Using special programs

There are several electronic programs that help you fill out your personal income tax return. They are contained both on the official websites of government agencies and third-party financial organizations. Anyone can use the following programs:

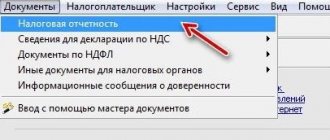

- Taxpayer Legal Entity.

- Declaration.

They are available on the website of the Federal Tax Service and on the website of the State Scientific Research Center of the Federal Tax Service of Russia.

3-NDFL for training: sample filling

You do not need to fill out all the sheets in the declaration. If an individual (not an individual entrepreneur) claims only a deduction for education, then the tax authorities only need to submit:

- title page;

- Section 1 with Appendix 1 (application for tax refund);

- section 2;

- appendices 1 and 5.

For some data, a special encoding has been introduced. The declaration shall indicate:

- number of the Federal Tax Service, OKTMO (determined by the applicant’s place of residence, they can be found on the Internet or found out in your inspection);

- codes on the title page: tax period – “34;

- countries (RF) – “643”;

- categories (if the taxpayer is not an individual entrepreneur) – 760;

- status 1 (residents - persons who stayed in the Russian Federation for more than 183 days within 12 consecutive months);

The remaining information is indicated in accordance with the documents available to the taxpayer.

Here is a completed sample of 3-NDFL for training in 2021.

Example

Alexander Petrovich Sergeev’s 19-year-old daughter is studying at a university. In 2021, the educational institution received payment from him under the contract - 123,000 rubles. Sergeev’s salary according to the 2-NDFL certificate in 2021 is 732,410.20 rubles, withheld tax is 93,029 rubles. Also, at his place of work, in 2021, Alexander Petrovich was provided with a standard deduction for two minor children in the amount of 16,800 rubles.

Since only 50,000 rubles can be claimed as a deduction for your daughter’s education, taxable income for 2021 will be:

(732,410.20 – 16,800 – 50,000) = 665,610.20 rubles.

Accrued tax:

656,610.20 x 13% = 86,529 rub.

The difference between accrued and withheld tax, i.e. the overpayment (93,029 – 86,529 = 6,500 rubles) will be returned to him within a month after the end of the desk audit of the submitted declaration. The maximum period of “camera chamber” is 3 months.

Sample 3-NDFL for child education

How to calculate deductions and tax for refund

The deduction amount reduces the so-called tax base, that is, the amount of income on which tax was withheld from you. You will be able to receive from the state in the form of tax refunds not the amount of the deduction, but 13% of the amount of the deduction, that is, what was paid in taxes. At the same time, you will not be able to receive more than you paid in taxes. For example, 13% of 100 rubles is 13 rubles. You can receive 13 rubles only if you paid 13 rubles in taxes for the year. If you paid less in taxes, you can only get back what you paid. Also, when calculating, you need to take into account the deduction limit established by law. If the deduction limit is 120,000 rubles, your deduction cannot be greater, and the tax refund cannot be more than 13% of the deduction limit, that is, 15,600 rubles. Only taxes paid at a rate of 13% can be refunded (excluding the amount of tax paid on dividends).