Purchasing a vehicle on lease allows an individual or organization to lease a car with the right to gradually buy it out during its operation on the basis of a concluded leasing agreement.

Within this type of commercial relationship, it is always necessary to clearly state in the contract: who should pay the transport tax? The conditions for its payment are regulated by the Tax Code of the Russian Federation, and the car owner should understand the intricacies of its provisions so as not to overpay.

Who pays

Many people want to buy a car, but not everyone believes that such a purchase will be profitable and a good investment of money. Potential car owners are coming up with various options for buying a car - a loan, a one-time purchase, a lease. Now leasing is also relevant.

This option for updating the vehicle fleet can be used by legal entities and individuals. Leasing is the acquisition of property for long-term use with the right to repurchase it. This is a type of long-term lease, at the end of which you can take the leased property for yourself.

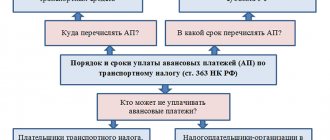

Many leasing recipients are interested in the question: who pays the tax when leasing? When leasing, the tax payer is appointed in the same way as usual - in accordance with Article 357 of the Tax Code of Russia, according to which the obligation to pay the tax payment on this property is imposed on the owner of the vehicle.

In turn, the owner is a legal entity. person or physical the person to whom the vehicle is registered.

When signing a leasing agreement, the owner of the vehicle can be both the lessor and the leasing recipient. The decision to fix assets in the name of the parties to the transaction is made by agreement of the two parties in accordance with Art. 20 Federal Law No. 164 of October 29, 1998

A written agreement with the appointment of a party to the transaction, to whom the car is registered, is submitted to the state automobile inspection, where the vehicle is registered.

There is an option available to temporarily fix the property at the location of the lease recipient for the duration of the financial lease agreement, but the lessor remains the owner, and he pays the tax at the state location. registration of transport, at the place of permanent registration of the car.

A few important points

When calculating the transport fee, there are some features that are taken into account even if the vehicles are purchased on lease.

All regions have different rates , which differ greatly from each other. Sometimes the terms of the deal allow the car to be used in another region. If the tax payer in this case is a company, then the amount of the monthly payment is increased or decreased by the local tax rate. This rule must be specified in the contract or recorded in an additional agreement.

The second feature can be considered regional benefits applied to business entities. For example, in some areas, leasing companies associated with special economic zones have a discount on transport tax. Enterprises engaged in agricultural activities receive the same discount in a number of regions.

Some types of vehicles are not subject to tax. These include:

- passenger cars equipped for use by a disabled person;

- agricultural special equipment used in accordance with its intended purpose;

- vehicles belonging to certain executive authorities.

The correct choice of the person in whose name the car will be registered after the transaction will help optimize taxation. It is known that tax rates are different in different regions. So, you can save on fees by choosing a leasing company from a neighboring region with lower tax rates. This is especially important for large carriers or other companies that lease vehicles.

If the leasing company registers the vehicle in its name, it is obliged to issue the client a power of attorney to drive it . The client must make sure that it applies for the entire duration of the leasing transaction, and not for 2 or 3 months.

Registration of a car upon purchase or sale under leasing

In the end, only the content of the agreements of the parties when signing a lease is important - they are the ones who determine who pays the transport tax under the leasing agreement, the lessor or the recipient of the lease, and to whom the transport will be registered:

- Lessor is an organization that provides transport under the terms of a material lease, on whose account the property will remain until absolute redemption.

- The recipient of the lease, whose ownership of the vehicle is registered after the signing of a material lease agreement.

- The lessor, despite the temporary registration of the vehicle in the name of the lease recipient.

If the leasing agreement does not clearly specify the condition for registering the vehicle and its ownership, then double taxation or failure to pay transport tax on both sides is possible, which can result in fines.

In such a situation, it is necessary to draw up another agreement along with the main financial lease agreement, where the owner of the property and the tax payer will be accurately registered.

There are other costs that the owner of the car bears, in addition to the costs of its service and use, so only a detailed calculation will help make the right decision. The preference for which party to the agreement to register the car during leasing should be based on an assessment of all the circumstances of the agreement.

After all, the lessor often includes the costs of paying taxes on him in the amount of leasing payments and in the end transfers this to the leasing recipient.

Briefly about car leasing

If your company requires a car for its activities, but there are not enough funds to purchase it, you can use car leasing - a long-term rental of a vehicle with its subsequent purchase (or without purchase).

A financial lease (leasing) agreement is concluded between you and the owner of the car, according to which:

- the leasing company will purchase the car (the one you need) using its own or borrowed funds;

- you will use this car for a fixed fee.

The contract will name you as the lessee and the owner as the lessor. They will draw up a schedule for you according to which you must promptly pay lease payments and the redemption price of the car (if at the end of the leasing agreement you become its owner).

Whether you need to depreciate the leased property, we will tell you here.

However, your receipt of the car under this agreement does not mean the automatic transfer of ownership of it to you. You will only be able to use the car, but you will not be able to control its fate (for example, sell it to another person).

The lessor retains the right (if such a possibility is provided for by law and the leasing agreement):

- seize your car (Clause 3, Article 11 of the Law “On Financial Lease (Leasing)” dated No. 164-FZ);

- demand its return (clause 2 of article 13 of law No. 164-FZ).

Such events do not threaten you if you transfer money to the lessor on time, without deviating from the lease payment schedule.

What is the transport tax for leasing?

When leasing, its object is accounted for in the account of the lessor or the recipient of the lease by agreement of the parties. Based on clause 10 of Art. 258 of the Tax Code, property leased under a lease agreement is included in the depreciation group by the person who accounts for this property in accordance with the terms of the financial lease agreement.

The procedure for calculating leasing payments for income tax purposes depends on which party to the agreement has the leased asset.

When a lease agreement is signed, the property is always in the landlord's account. Accounting for actions under a lease agreement with the lessor for tax purposes is absolutely consistent with accounting for leasing actions with the lessee when signing a leasing agreement with the circumstance of accounting for the leased asset in the lessor's account.

Transport tax for leasing is determined by the expenses of the current period. Each month, the leasing recipient contributes a certain amount to current costs as other expenses associated with production and sales.

If the leased asset is listed on the lessor’s account, then the price of the leased property that was received by the lease recipient is considered on the off-balance sheet account 001 Leased fixed assets.”

The accrual of leasing payments for the reporting period is reflected in the credit of account 76 “Settlements with other debtors and creditors” with the accounts of production costs. When purchasing leased property, its price at the time of transfer of ownership is removed from off-balance sheet account 02 “Depreciation of fixed assets.”

If the vehicle is on the balance sheet of the lessee, during the period of operation of the agreement, the leasing recipient generates every month the difference in taxation on the principal amount and on the deferred tax liability, the posting that the accounting displays: DEBIT 68 subaccount “Calculations for income tax” CREDIT 77.

What to Consider When Choosing a Title Type

Before concluding a leasing agreement, you need to carefully weigh all the factors that could affect the value of the property being transferred and decide which agreement to transfer ownership of the car should be concluded. The following points are important:

- Differences in transport tax rates in different regions of the Russian Federation. The Tax Code of the Russian Federation states that regional authorities can increase or decrease tariff rates up to tenfold. The tax on a car leased will be calculated according to the region of the property owner, because it will fall into the budget of this region. If the difference is significant, it is better to prefer a form of agreement in which the owner will be considered a person registered in a region with a more lenient rate.

- Possibility to apply the benefit. The situation is similar to the situation with the tax rate - all other things being equal, the region of registration with tax benefits should be preferred.

- Economic expediency . If you enter into a leasing agreement without taking into account all the key factors, this can significantly increase the cost of the property, while taking them into account will benefit both parties to the transaction.

IMPORTANT! Calculation and payment of TN is carried out in accordance with regional laws at the place of registration of the vehicle.

Why is car leasing popular?

Car leasing is the process of long-term rental of a vehicle with the possibility of buying it after the end of the leasing agreement. According to the agreement, one party provides funds for the purchase of transport, and the second accepts services and acquires transport for use.

Leasing is most often practiced in America and Europe. In Russia, leasing is not so famous, but it is already gaining popularity. Car leasing is one of the most famous areas of leasing financing, which is offered by many financial organizations.

This popularity of this type of financing is associated with the following reasons:

- Vehicles are used by many companies, regardless of the nature of their work and size.

- Car leasing is a minimally risky area of leasing, because a car is a highly liquid asset.

- The secondary car purchase and sale market is well developed.

- All transport must be registered with government agencies, so it is easy to detect it when needed and control its transportation and location.

- Low probability of non-payment and default under the leasing transaction.

- The presence of special leasing offers (small requests, urgent processing, a small number of required papers).

Kinds

There are two types of leasing:

- Financial. The client pays the price of the car in installments and becomes its full owner, buying the car at the residual price.

- Operational. The client acquires a vehicle for use for a designated time and at the end of this time returns it to the leasing organization, which is why the organization can update its vehicle fleet constantly, without being involved in the sales-purchase process.

When choosing the financial type of leasing, the vehicle is included in the account of the leasing recipient, and when choosing the operational type, the car is listed on the lessor’s account and does not burden the account of the leasing recipient.

The residual price of the car is the amount that the leasing recipient is obliged to pay after the end of the leasing agreement. Only after paying the remaining price will the leasing recipient take possession of the car.

Are you interested in what commission, mandatory payment and payments for additional services are charged when making transfers using the MIGOM system? Read the article, tariffs for money transfers “Migom”. About MTS money transfers, read more here.

Advantages and disadvantages

Advantages of leasing vehicles:

- Good conditions. There is no down payment, a corporate discount on a car for leasing organizations makes it possible to reduce the costs of the leasing recipient.

- Daily payments are an order of magnitude lower than with lending, and the payment schedule is flexible.

- Leasing payments can include any costs for the car: insurance, scheduled maintenance, additional supplies, tire fitting, etc.

- Quick consideration of the application and conclusion of an agreement.

- The lessor's risks are greatly reduced compared to a car loan, in which the car is immediately registered as a physical loan. face.

- When purchasing leased property, purchase discounts.

- As part of the leasing agreement, the possibility of acquiring additional services.

- A minimum number of papers are required for registration.

- The leasing process is much easier than the car loan process.

- You should not waste resources on finding a seller and arranging transport.

- Every few years the vehicle can be updated.