The Unified Agricultural Tax (USAT) is a special tax regime to which all agricultural producers can switch. Such products include agricultural or forestry crop products, as well as livestock products (including fisheries). The legislative framework for the Unified Agricultural Tax is the Tax Code of the Russian Federation, Chapter 26.1. In fact, the Unified Agricultural Tax replaces VAT, income tax and some other taxes. Unified agricultural tax payers are organizations and individual entrepreneurs who are engaged in the production of agricultural goods and voluntarily refused to pay taxes under the standard scheme in favor of the unified agricultural tax. Manufacturers include:

- Organizations, individual entrepreneurs and consumer agricultural cooperatives that are engaged in the production, primary processing and sale of agricultural products. In other words, organizations that are only involved in purchasing and resale cannot become a payer of this tax. The law also requires that the profit from the sale of agricultural products was at least 70% of the total profit of the organization or individual entrepreneur for the last year.

- Village- and city-forming fishery organizations, if the number of employees of these organizations, taking into account their families, is at least 50% of the population of the locality. Also, profit from the sale of agricultural products must be at least 70% of the organization’s total profit, and fishing is carried out on vessels that belong to organizations or their employees as property or on the basis of charter agreements.

The legislation also puts forward the following requirements for entrepreneurs who want to switch to the Unified Agricultural Tax:

- The average number of employees for the tax period (calendar year) before filing an application should not be more than 300 people.

- Agricultural products must not be excisable goods.

- State-owned, budgetary and autonomous organizations, as well as organizations associated with gambling, do not have the right to switch to the Unified Agricultural Tax regime.

- There are no benefits for paying the Unified Agricultural Tax.

How to switch to Unified Agricultural Tax

If the individual entrepreneur is already working, you can switch to this mode only from the next calendar year. Before the end of the year, a notification is submitted to the tax office indicating the share of income from the sale of agricultural products or fish catch.

Newly registered individual entrepreneurs, in order to immediately begin working for the Unified Agricultural Tax, submit a notification within 30 days after registration.

Keep in mind that if at the end of the year the requirements for the use of the Unified Agricultural Tax are violated, you need to report this to the tax office. The tax will be recalculated as for OSNO and the arrears will have to be paid to the budget.

It is also possible to voluntarily abandon the Unified Agricultural Tax, but only from the new year. To do this, from January 1 to January 15, an application is submitted to the Federal Tax Service.

Unified agricultural tax: what kind of taxation system is it?

The unified agricultural tax is a system that involves its use by business entities subject to compliance with the criteria established by law. The tax itself replaces the income tax for organizations for companies and personal income tax for entrepreneurs.

In 2021, entities using this system are also exempt from VAT. However, starting in 2021, this rule is changing - payers will be required to determine and pay VAT, and will also be able to deduct input tax.

The Tax Code establishes that it will be possible to obtain tax exemption, but for this, income will have to fall within the established limit.

For 2021 it is set at 100 million rubles, for 2021 - 90 million rubles and then in descending order. Attention: starting from 2021, entities using the Unified Agricultural Tax system must pay property tax.

Property that is used directly in the production of agricultural products will not be included in the base. In connection with the introduction of sanctions and a significant increase in agricultural production, a further increase in the tax burden on this system is possible.

This system can only be used by those entities that carry out primary processing of their own agricultural products, and is not available to those involved in secondary processing. The transition to agricultural tax is voluntary.

Attention: when using Unified Agricultural Tax, a business entity has the right to use UTII for other types of activities. However, it is imperative to control the share of revenue from core activities.

Using this system, it is possible to obtain benefits for paying social contributions on the earnings of registered employees from companies and entrepreneurs.

Reporting of individual entrepreneur - head of KFK

The Unified Agricultural Tax declaration is submitted once a year until March 31. It can be submitted in paper form or electronically. The declaration on paper is taken to the tax office in person or sent by mail.

The tax is paid in two stages - the first advance payment for the six months before July 25, the second final payment for the year - until March 31.

Current declaration forms for the Unified Agricultural Tax, as well as notifications about the transition to this regime or refusal from it, can be downloaded from the “My Business” service. Or you can get rid of the headache of filling out and sending reports and entrust this to experienced specialists “My Business. Accountant” who will do everything quickly and in the best possible way.

If the individual entrepreneur, the head of the KFK , has hired employees, then several more forms are added to the reports, which are mandatory for employers. This:

To the Federal Tax Service, personal income tax declarations for their employees:

2-NDFL for each employee until March 1;

6-NDFL for everyone quarterly within 30 days after the end of the quarter and annual form until March 1.

Once a year, before January 20, information on the average number of employees is submitted to the Federal Tax Service;

Payment of insurance premiums is made within 30 days after the reporting quarter, also to the Federal Tax Service.

To the Pension Fund:

SZV-M until the 15th of every month;

SZV-experience, EDV-1 – once a year until March 1.

SZV-TD in 2021 is taken only based on the results of those months in which there were personnel changes for the employee or he submitted an application to choose the method of maintaining a work record.

4-FSS for contributions for injuries, submitted to the Social Insurance Fund by the 20th day after the reporting quarter (for electronic reporting, the deadline is until the 25th day).

Tax rate and reporting

The object of taxation is income minus expenses. Tax is paid in rubles. Income or expenses in foreign currency are converted into rubles at the current exchange rate of the Central Bank of the Russian Federation. Income or expenses in kind are also converted into rubles based on the market value of the products. Organizations are required to maintain accounting records to calculate the tax base; Individual entrepreneurs are not required to keep accounting records, but they must keep some other records of income and expenses to determine the tax base. The tax base can be reduced by the amount of losses that an organization or entrepreneur received over the previous year.

The tax rate is as follows:

- The standard rate of 6% is for all organizations and individual entrepreneurs, except those located in Crimea and the city of Sevastopol.

- A reduced rate of 4% is for all organizations and individual entrepreneurs located in the Crimea and in the city of Sevastopol.

The tax period for paying the Unified Agricultural Tax is 1 year, and the reporting period is 6 months. The payer must calculate the tax independently. You must submit your tax return and pay the tax at your place of residence (for individual entrepreneurs) or at your location (for organizations) no later than March 31. If an organization or individual entrepreneur ceases its activities as a producer of agricultural products, a declaration must be filed and tax paid no later than the 25th of the following month.

Changes to the Unified Agricultural Tax in 2021

Legislative changes in 2021 also affected the Unified Agricultural Tax:

- If an individual entrepreneur or organization wants to switch to the unified agricultural tax, it should notify the relevant tax authorities no later than February 15 of the current year.

- Organizations or individual entrepreneurs that provide services to producers of agricultural products have the right to pay the Unified Agricultural Tax. The services themselves must be directly related to crop and livestock production (spraying plants, harvesting crops, driving livestock, etc.).

- An independent assessment of the quality of employee training can be considered a cost.

- In 2021, the Unified Agricultural Tax rate for residents of Crimea and the city of Sevastopol was 0%; from 2021 to 2021 the unified agricultural tax rate will be 4%.

Can the reporting of individual entrepreneur KFC be zero?

Article 346.3 states that a newly registered individual entrepreneur retains the right to apply the Unified Agricultural Tax regime if he had no income in the first tax period. In simple words, you can take the zero grade only once. Next time you need to either show income or switch to a different regime. It will be possible to return to the Unified Agricultural Tax only in a year.

All that remains to talk about is penalties. If you do not report on time, the fine will be from 5 to 30% of the tax amount in the declaration, but a minimum of 1000 rubles. Failure to submit a declaration may also result in your current account being blocked. Failure to pay tax on time or not in full means forking out 20 to 40% of the unpaid tax. It is not profitable to break the law; it is better to do everything on time.

What budget are payments made to?

The unified agricultural tax is distributed in a precisely defined manner.

30 percent of the entire amount transferred by the enterprise goes to the federal budget. The Social Security Fund receives 6.4%. 0.2% goes to the Federal Compulsory Medical Insurance Fund. Another 3.4% goes to territorial compulsory medical insurance funds. 30% of these funds are provided to the regional budget, and the remaining 30% goes to the municipal treasury.

In the case where the enterprise is located on the territory of the city of Moscow or St. Petersburg, which is also a subject of the Federation, a total of 60% of the tax paid is sent to its treasury.

The single agricultural tax rate is 6% for all categories of payers. The tax base is the income of an enterprise entitled to the Unified Agricultural Tax less expenses.

Procedure and deadline for payment under Unified Agricultural Tax

To have an idea of what expenses are taken into account, in what volume and how their price is determined, if we are talking about physical measurement (barter), accounting should be regulated by Article 346.5 of the Tax Code of the Russian Federation. In-kind income will be assessed based on the terms of the contract under which it was received, taking into account market prices. If settlements occur in foreign currency, then they are recorded in chronological order with ruble settlements, at the exchange rate on the day of settlements in the Central Bank of the Russian Federation.

From a detailed reflection of operations, a general picture of the company’s activities is created, its actual income, which is subject to the tariff rate under the Unified Agricultural Tax.

So, if it is determined that the agricultural producer’s reporting is submitted annually, then payment of the tax consists of two parts. The first payment is an advance payment, which is determined by calculation and payment must be made before July 25, so as not to accrue penalties and sanctions for late payments. The second part is the final payment, which is calculated from the actual results of economic activity. In case of income received, this tax contribution must be paid to the budget by March 31.

How to calculate tax?

As an example, we can take a company engaged in the production and supply of honey.

The table below provides information about the profits and expenses of this company for the year.

| Period | Income.rub. | Expenses, rub. |

| January | 200 000 | 100 000 |

| February | 220 000 | 90 000 |

| March | 175 000 | 70 000 |

| April | 180 000 | 65 000 |

| May | 200 000 | 90 000 |

| June | 210 000 | 100 000 |

| Total for 1st half of the year | 1 185 000 | 515 000 |

| July | 210 000 | 80 000 |

| August | 170 000 | 120 000 |

| September | 150 000 | 95 000 |

| October | 210 000 | 90 000 |

| November | 220 000 | 100 000 |

| December | 180 000 | 95 000 |

| Total for the 2nd half of the year | 1 140 000 | 580 000 |

| Total for the year | 2 325 000 | 1 095 000 |

Tax base for the first 6 months: RUB 1,185,000. -515,000 rub. = 670,000

Tax amount for the first 6 months: RUB 670,000. *6% = 40,200 rub.

Tax base amount per year: 2,325,000 rubles - 1,095,000 rubles. = 1,230,000 rub.

Tax for the year: RUB 1,230,000*6% = RUB 73,800.

Final annual tax amount: 73,800 rubles - 40,200 rubles. = 33,600 rub.

Tags: Financial statements of organizations, Accounting, Accounting, Declaration on Unified Agricultural Tax, Unified Agricultural Tax, Unified Agricultural Tax, Individual Entrepreneur on Unified Agricultural Tax, LLC on Unified Agricultural Tax

Peasant farm - payer of Unified Agricultural Tax

You can become a payer of the Unified Agricultural Tax if you operate as a peasant farm (peasant farm), namely:

- Your organization is engaged in the production, processing and sale of agricultural products;

- Your activity is related to fishing (fish production, its processing). A fishing organization can be created in the form of an artel or a cooperative.

Both legal entities formed in the form of peasant farms and registered individual entrepreneurs acting as the head of the enterprise can pay the tax.

On the other hand, a peasant farm cannot be a payer of the single agricultural tax if:

- the organization produces and sells excisable goods (for example, tobacco);

- companies whose activities are related to gambling;

- various budget organizations.

PSN

If an organization provides catering services through facilities that do not have a hall for serving visitors, such services will be subject to all tax definitions applied for PSN purposes. Also, regions will have the right to establish the amount of annual income potential for individual entrepreneurs to receive, depending on the number of separate facilities (areas) for such activities (clause 3 and subclause 3 of clause 8 of Article 346.43 of the Tax Code of the Russian Federation). This approach is still used in practice (letter of the Ministry of Finance of Russia dated July 20, 2016 No. 03-11-12/42505).

Conditions for applying the Unified Agricultural Tax in 2018

To use the Unified Agricultural Tax in 2021, several criteria have been defined that all organizations and entrepreneurs must meet:

- Activities take place in animal husbandry, crop production, fisheries;

- All entities using the system must be engaged in the production of agricultural products, and not just their processing. The share of income from production must be at least 70% of the total size;

- The subject is engaged in fishing, belongs to the city-forming enterprises, the number of registered employees does not exceed 300 people. Also, the vessels that are used in this activity can be either their own or hired under a charter agreement. The share of basic income must also be above 70% of the total.

- The business entity provides services for field preparation, sowing and harvesting, grazing and moving livestock, etc. For the main revenue, it must be more than 70% of the total revenue.

- The entity is an agricultural cooperative that sells its own agricultural products. The share of revenue from core activities must exceed 70% of the total amount.

Important: agricultural tax cannot be used by those who produce excisable products, organize gambling, or are state-owned, autonomous or budgetary institutions.

The procedure for transition to a single agricultural tax

There are several ways to start using this system:

- From January 1 of the new year. In this case, the notification must be sent before December 31 of the year preceding the year of intended use of this system;

- By submitting an application to switch to the system when registering a new business entity.

If at the time of registration of the subject the tax system was not selected, then the transition can be made within thirty days from the date of receipt of registration documents. Moreover, the day on which the business entity was registered will be considered the day when the use of the agricultural regime began. It is indicated in the extract from the unified register of the Unified State Register of Legal Entities or the Unified State Register of Legal Entities.

The application for transfer must be submitted for companies - at their location, and for entrepreneurs - at their registration address.

Business entities make the decision to use the Unified Agricultural Tax regime independently. To do this, they need to compare the pros and cons of all other tax systems.

If the Unified Agricultural Tax is applied through a transition from a different tax system, then the application must indicate the share of proceeds from the sale of agricultural products in total revenues. This indicator is determined based on data from the previous year of work.

Attention: before starting to use the unified agricultural tax, a business entity must notify the tax authority about this. If this is not done, then the right to use this system will not be established, and the tax authority will consider that the company or individual entrepreneur is on the previous system.

When switching to the Unified Agricultural Tax, it must be applied before the end of the current year. It is prohibited to refuse to apply it if all criteria meet those established by law.

Results

Entrepreneurs who produce agricultural goods report on agricultural taxes once a year, and it is better not to forget about this obligation, since such delay threatens with a fine.

If an individual entrepreneur decides to stop agricultural activities during the year, it is necessary to notify the tax authorities about this and submit a declaration under the Unified Agricultural Tax on time. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

System elements

Unified agricultural tax is not such a complex tax regime, especially in comparison with OSNO or UTII. You need to know the following about this tax system:

- The calendar year is the tax period for the Unified Agricultural Tax.

- Reports must be submitted every six months. At the same time, physical and legal persons are not required to submit a declaration at the end of the reporting period, however, they are obliged to pay an advance payment based on the income received until July 25th.

- The object of taxation for this regime is income minus expenses.

- The tax base for the Unified Agricultural Tax is the monetary equivalent of income minus expenses.

- The rules for recognizing expenses and income are very similar to those for the Simplified System.

- The tax rate is 6% and does not depend on the region of business.

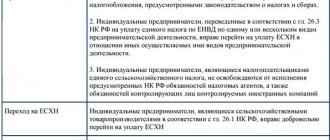

What taxes does the Unified Agricultural Tax replace?

Organizations and individual entrepreneurs who are subject to the taxation system in the form of a single agricultural tax continue to perform their duties as tax agents. But this program replaces the following payments.

For entrepreneurs:

- Personal income tax paid on income from business activities;

- Tax on property that is involved in the company’s work;

- VAT (except for cases when goods are imported into the customs territory of the Russian Federation and VAT must be paid on it; this tax is also paid when concluding a joint activity agreement or a property trust management agreement);

- Unified social tax.

For legal entities:

- Income tax (except for income on shares or from transactions with elements of debt obligations);

- Property tax;

- VAT (except for a number of cases mentioned above);

- Unified agricultural tax.

For legal entities, the unified agricultural tax can only be paid by bank transfer. According to clause 3 of Article 45 of the Tax Code of the Russian Federation, cash payment is provided only for individuals.

For non-cash payments, it is recommended to open an organization current account. Law No. 137-FZ, adopted on July 27, 2006, brings additional clarity to the provisions of the Tax Code.

back to menu ↑

The main advantages of the Unified Agricultural Tax

The first obvious advantage of the Unified Agricultural Tax is that this system has the most lenient tax burden. In order to evaluate this feature of the regime, one should compare the tax base and rate of the OSNO and the Simplified system. The agricultural tax is not compared with the Unified Imputed Value Tax, since it does not take into account expenses and income.

| System element | USN “Income minus expenses” | STS "Income" | BASIC | Unified agricultural tax |

| Tax rate | From 5 to 15% (depending on the specific area) | 6% | 20% | 6% |

| The tax base | Cash equivalent of income minus expenses incurred | Cash equivalent of income | Cash equivalent of the profit received (income minus expenses) | Cash equivalent of income minus expenses |

Thus, the tax rate on the “simplified” format “Income” is equal to the rate on the Unified Agricultural Tax, but the simplified tax system has a larger tax base, since it does not take into account expenses incurred. Of course, this increases the amount of tax compared to the agricultural tax. Thus, only the simplified tax system “Income minus expenses” can be as profitable as the Unified Agricultural Tax, provided that in the region in which the activity is carried out there will be the lowest rate of 5%, which is not so common. A comparison of the Basic System and the Unified Agricultural Tax is not worth making at all, since it is obvious that the preferential tax regime is much simpler and more profitable than the OSNO.

Thus, this regime is the most profitable option for manufacturers who are not subject to its restrictions.