What formula is used to calculate

In addition to the above schemes, lenders can use simple and compound interest.

Simple interest

The simple interest formula is used if the accrued amount is paid by the borrower at certain periods (monthly, quarterly, yearly) or transferred to the lender at the end of the loan term.

To calculate simple interest, use the following formula:

Where Sp is the amount of calculated interest; P – loan amount; I – the amount of the annual interest rate specified in the agreement; t – number of days during which interest accrues; K – number of days in a year (used equal to 365 or 366).

For example, the borrower received 50,000 rubles from the lender for 2 years (not leap years). Interest rate – 20% per year.

Sp= (50000*20*730)/(365*100)=20,000 rubles

Thus, the amount of simple interest will be 20,000 rubles.

This calculation is mainly used for short-term and medium-term lending or if the loan is issued for a certain number of years.

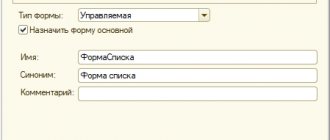

Photo: scheme for applying simple interest

Compound Interest

Calculating compound interest is the most difficult. For this, the formula is used:

Where Sp , I and K are parameters similar to those used to calculate simple interest; j – number of days in the period based on the results of which interest is capitalized; n – number of times calculations are carried out.

For example, the borrower received a loan in the amount of 100,000 rubles for a period of 180 days. The interest rate is 24% per annum, with interest compounded monthly, as is capitalization. Based on the proposed conditions, the number of recalculations is 6.

Sp=100000*(1+(24*180)/(100*365))-100000=11835.61 rubles

Thus, the amount of compound interest when carrying out capitalization once a month will be 11835.61 rubles .

Compound interest is used primarily for long-term loans. This allows the lender to receive additional profit, since with this calculation scheme, interest for a certain period is included in the loan amount.

In subsequent calculations, the included (or increased) amount is again subject to interest.

What the law says

Interest on a loan is covered by Article 809 of the Civil Code.

Paragraph one of the specified document states that any lender, when issuing a loan, has the right to charge interest from the borrower, the amount of which depends on the terms of the agreement or the refinancing rate.

If the agreement does not provide for the procedure for paying accrued interest, then it is paid once a month (clause 2).

The third paragraph describes the situation when the contract can be considered interest-free. This requires that this condition be clearly stated in the document. If there is no reference to interest-free, then the loan is considered interest-bearing.

The fourth paragraph of the article states that early repayment of a loan may be accompanied by a recalculation of interest for the actual time of use of the provided funds or not.

This aspect must also be taken into account in the contract. If the document does not refer to the possibility of recalculating interest, then the borrower is obliged to pay the entire calculated amount, regardless of the loan repayment period.

Results

In most cases, there should be no discrepancies between tax and accounting registers for credit debt.

But when registering controlled transactions, the company may experience permanent and temporary differences. You can take them into account using PBU 18/02 - read more about this here. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Tax accounting of interest on controlled debt

In general, according to Art. 269 of the Tax Code of the Russian Federation, accrued interest is taken into account in tax registers upon the fact. But if the lender is recognized as interdependent with a foreign person, then the debt may be recognized as a controlled debt. Exceptions to this rule are the cases described in paragraphs. 7–10, 12, 13 art. 269 of the Tax Code of the Russian Federation.

Find out more about the standardization of loan costs from the article “Loan interest accepted for taxation - 2016.”

To calculate debt accruals accepted as expenses in a controlled transaction, the taxpayer must:

- Divide the remaining debt by the amount of equity increased by the debt to the budget.

- If the result of the division is less than 3, the interest is written off as expenses in full.

- If the division returned a result greater than 3 (more than 12.5 for lessors and banks), then the amount of interest accepted as expenses is calculated by dividing their actual amount by the capitalization factor.

- The ratio is calculated as dividing the debt balance by the amount of equity in the foreign entity's share of participation and by the number 3 (or 12.5 for lessors and banks).

- The difference between the estimated and actual amount of interest must be reflected as dividends paid to the foreigner.

Reflection of interest on loans in tax accounting

For the purpose of calculating income tax, according to subparagraph. 2 p. 1 art. 265 of the Tax Code of the Russian Federation, interest on debt obligations is taken into account as non-operating expenses, with the exception of targeted loans for the acquisition of investment assets - interest on them increases the cost of the latter.

The moment of recognition of such expenses falls on the last date of the month for which the accrual is made (clause 8 of Article 272 of the Tax Code of the Russian Federation), regardless of the date of payment. At the same time, for simplifiers, expenses are recognized only on the date of payment (subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation). Therefore, if it turns out that a simplified company pays amounts for last year in January, they must be displayed in KUDiR as an expense of the current year.

How interest is paid

The procedure for paying interest on the loan occurs according to the agreement. It can be produced:

- once a month;

- quarterly;

- once a year;

- upon expiration of the loan term.

If this aspect is not specified in the contract, then the borrower must make payments monthly.

When using simple interest, the order of payment does not matter.

If the compound interest formula is used, then it is more expedient to assign payments and carry out capitalization in a short period of time.

For reviews of loans for maternity capital, see the comments to the article: reviews of loans for maternity capital. The procedure for receiving a mini loan to your account is described here.