When calculating taxes on property rental and leasing, there are similarities and differences. For example, in terms of VAT, “input” tax is deducted. Regarding income tax, there are a number of features for leasing operations that need to be taken into account.

Tax and accounting accounting for leasing transactions is certainly more complex than accounting for leases. Often companies have to argue with tax authorities on certain issues of calculating income taxes. In addition, it is necessary to take into account who has the leased property on their balance sheet. This factor influences the tax burden.

VAT on leasing and rental

Amounts of VAT on leasing (rent) payments are accepted for deduction if the following conditions are met (Articles 171, 172 of the Tax Code of the Russian Federation):

- a leasing (rent) agreement is concluded for property that will be used by the lessee (tenant) in activities subject to VAT;

— the lessor (lessor) actually provided leasing (rent) services to the lessee (tenant) during the tax period;

— the lessee (tenant) reflected the specified services (i.e. leasing or rental payment) in accounting;

— the lessor (lessor) provided the lessee (tenant) with an invoice for the lease payment (rent) (Article 169 of the Tax Code of the Russian Federation).

Tax on leased property after redemption

After the end of the contract, the leased asset can be returned to the owner or purchased by the lessee. The procedure for calculating the property tax in both cases is similar, and the only difference is who will pay it from the moment of redemption until full depreciation.

Buy-out during a commercial lease is possible if no more than 75% of the initial cost of the leased asset remains on the balance sheet. When it is returned, nothing changes for the lessor - he continues monthly depreciation.

The transfer of the item into the ownership of the lessee changes the situation. The owner (user) becomes the owner. If he did not register the property, now in any case he will have to do this by making the following entries:

| Correspondence | Operation description | |

| Dt | CT | |

| 02 (subaccount “depreciation of leased property”) | 01 | Write-off of depreciation accrued over the term of the leasing agreement |

| 76 | 01 | Write-off of the residual value of leased property |

| 08 | 60 | Purchasing an item |

| 60 | 51 | Reflection of payment for the object to the lessor |

| 01 | 08 | Placing an item on balance sheet |

Depreciation will be calculated on the residual (redemption) value from the 1st day of the month following the registration of the purchased fixed asset.

Property tax is charged in the general manner - once a year based on the average annual value of the asset, by multiplying it by the interest rate prevailing in the region. As it is used and over time, its amount will decrease according to a pattern corresponding to the depreciation method adopted by the enterprise.

Income tax on leasing and rental

The leased asset transferred to the lessee under a leasing agreement is recorded on the balance sheet of the lessor or lessee by mutual agreement (Clause 1, Article 31 of Federal Law No. 164-FZ of October 29, 1998 (hereinafter referred to as Law No. 164-FZ)).

Based on paragraph 10 of Article 258 of the Tax Code, property received (transferred) for financial lease under a financial lease agreement (leasing agreement) is included in the appropriate depreciation group by the party for which this property should be accounted for in accordance with the terms of the financial lease agreement (leasing agreement ). The procedure for accounting for leasing payments for profit tax purposes depends on which party to the agreement takes into account the leased asset. When concluding a lease agreement, the property is always taken into account on the balance sheet of the lessor. Accounting for transactions under a lease agreement with a lessee for profit tax purposes fully corresponds to accounting for leasing operations with a lessee when concluding a leasing agreement with the condition that the leased asset be recorded on the lessor’s balance sheet.

The property is recorded on the lessor's balance sheet

In this situation, the lessee includes as expenses for income tax purposes the entire amount of the accrued lease payment (subclause 10, clause 1, article 264 of the Tax Code of the Russian Federation). Similarly, the tenant includes the amount of rent as tax expenses.

Example

The leasing agreement was concluded for 30 months. The total amount of leasing payments excluding VAT is RUB 375,000. The monthly lease payment amount is:

375,000 rub. : 30 months = 12,500 rub.

The lessee monthly includes the specified amount in the expenses of the current period as other expenses associated with production and sales (subclause 10, clause 1, article 264 of the Tax Code of the Russian Federation).

The property is recorded on the lessee's balance sheet

In this situation, tax accounting for the lessee is more complicated. First of all, the lessee must include the leased property in the appropriate depreciation group at a cost equal to the lessor’s costs for its acquisition and bringing it to a condition suitable for use (clause 1 of Article 257 of the Tax Code of the Russian Federation). The lessee has the right to include in tax expenses depreciation on such property, accrued by the linear or non-linear method using an increasing factor, but not higher than 3. The increasing factor does not apply to leased property belonging to the first, second and third depreciation groups (subclause 1, paragraph. 2 Article 259.3 of the Tax Code of the Russian Federation).

It is desirable that the possibility of applying the coefficient and its size be provided for both in the leasing agreement itself (clause 1 of Article 31 of Law No. 164-FZ) and in the accounting policy of the lessee for tax purposes (letter from the Federal Tax Service of Russia for Moscow dated December 14. 2005 No. 20-12/92338).

In addition to depreciation of the leased asset, the lessee includes in income tax expenses the lease payment accrued for the corresponding period minus the amount of depreciation of the leased asset in this period.

Example

The leasing agreement was concluded for 30 months. The total amount of leasing payments excluding VAT is RUB 375,000. The amount of the monthly accrued lease payment is equal to:

375,000 rub. : 30 months = 12,500 rub.

The cost of the leased item (CNC machine), according to the tax accounting data of the lessor (brought to the lessee by a certificate with copies of primary documents confirming the declared value), is 200,000 rubles. The CNC machine, according to the lessee, belongs to the 5th depreciation group (OKOF code 14 0001010). In accordance with the accounting tax policy of the lessee for depreciable property, the minimum useful life for the corresponding group is established, that is, 85 months, and the straight-line depreciation method is used. In accordance with the leasing agreement and the accounting policy of the lessee, for tax purposes on leased property, a depreciation acceleration factor of 3 is applied. The monthly amount of depreciation of the leased asset accrued by the lessee is equal to:

200,000 rub. : 85 months × 3 = 7059 rub.

Thus, the lessee includes RUB 7,059 as expenses for the current period. as depreciation under Article 259 of the Tax Code and the amount of the lease payment (subclause 10, clause 1, article 264 of the Tax Code of the Russian Federation) in the amount of:

12,500 – 7059 = 5441 rub.

Based on paragraph 9 of Article 258 of the Tax Code, the company has the right to include in the expenses of the reporting (tax) period expenses for capital investments in the amount of no more than 10 percent (no more than 30% in relation to fixed assets belonging to the third - seventh depreciation groups) of the original the cost of fixed assets (except for fixed assets received free of charge), as well as no more than 10 percent (no more than 30% in relation to fixed assets belonging to the third to seventh depreciation groups) of expenses incurred in cases of completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation of fixed assets and the amounts of which are determined in accordance with Article 257 of the Tax Code.

According to the tax department (letter of the Federal Tax Service of Russia dated 04/08/2009 No. ShS-22-3/267), which found support from the judges of the Moscow District (registered by the Federal Antimonopoly Service of the Moscow Region dated 04/11/2012 No. A40-23166/11-116-67), this The provision does not apply to lessees who record the leased asset on their balance sheet. In my opinion, the position of the tax authorities does not correspond to the Tax Code, since the commented paragraph of the Code does not establish such a restriction in relation to lessees. This conclusion is confirmed by the court (decision of the Federal Antimonopoly Service of the Central Election Commission dated November 11, 2011 No. A64-5786/2010).

Subtleties of calculating depreciation on a leasing object

According to the Tax Code of the Russian Federation, the balance holder of the subject of financial lease, which can be either one or the other party, is required to pay property tax under a leasing agreement.

Article navigation

- Briefly about property tax

- Who pays property tax in leasing

- Property tax using the example of car leasing

- Taxation of a car on the lessee's balance sheet

- Calculation of tax on property on the lessor's balance sheet

- Payment of property tax on a leaseback object

- Tax on leased property after redemption

- conclusions

Property owned by individuals and businesses is subject to taxation. The article highlights the situation in which the owner is one person, and the owner is another. This happens if the item is rented out on a financial lease (also called leasing). Who pays property tax in this case, and how to calculate it?

“Redemption value” of leased property

Claims from tax authorities regarding the accounting procedure for tax purposes by lessees of the redemption value of leased property are of a long-standing nature. Currently, tax authorities have agreed on the legality of lessees deducting VAT from lease payments during the period of provision of relevant services and receipt of an invoice, regardless of whether the redemption value is included in the lease payment or not, whether the redemption value is allocated or not (letter from the Ministry of Finance of Russia dated 07.07.2006 No. 03-04-15/131). However, claims continue to be made about the impossibility of including the redemption value (especially if it is not allocated as part of lease payments) as part of income tax expenses (letter of the Ministry of Finance of Russia dated 02/06/2012 No. 03-03-06/1/71) and simplified tax system. Without going into details, we can say that there is extensive arbitration practice on this issue. The judges fully support taxpayers in their right not to allocate the redemption value of the leased asset and at the same time include the entire amount of the lease payment as expenses. Thus, the Supreme Arbitration Court of the Russian Federation in its determination (Definition of the Supreme Arbitration Court of the Russian Federation dated October 10, 2007 No. 12038/07) indicated that “the inspection’s conclusion that the cost of the redemption price of the property should be separated from the amount of the lease payment and excluded from expenses that reduce taxable profit, is not based on the provisions of Chapter 25 of the Tax Code of the Russian Federation.”

Briefly about property tax

This tax is also called property tax. Property tax is levied on real estate and other objects equated to fixed assets. The assessment of a property when calculating a property tax is carried out not at its residual value, but at its cadastral value.

The tax rate limit is 2.2% established by federal legislation. Regional values may be slightly lower.

Taxation applies to real estate, the ownership of which is legally justified in the following forms:

- trust management;

- temporary possession;

- part of the founding capital.

Property tax refers to direct regional taxes. Tax is calculated on the basis of Chapter 30 of the Tax Code of the Russian Federation. Its main characteristics are summarized in the table for convenience:

| Characteristic | Description |

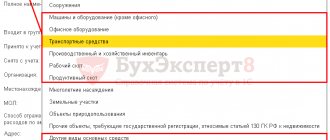

| Object of taxation | Assets of an enterprise that are fixed assets or equivalent to them |

| Tax base | Average annual value of the asset (based on Article 375 of the Tax Code of the Russian Federation) |

| Tax rate, maximum | 2,2% |

| Subjects of taxation | Russian and foreign enterprises operating in the Russian Federation |

| Tax period | 1 year, until March 30 |

Property leased is classified as fixed assets and is therefore subject to taxation. Another question is who pays it. A finance lease is similar to a purchase on credit:

- the user (owner) receives the item immediately and can use it.

- the cost is paid gradually;

- most often, the lessee, like the credit debtor, pays an initial payment (advance);

- the item is provided to the one indicated by the recipient - in contrast to rent, which involves choosing from the available assortment;

- most often, after the expiration of the financial lease agreement (as well as lending), the leased item belongs to the user;

- As a rule, the object is a completely new thing.

The presence of these similarities determines special rules for taxation of leased items.

The concept of penalties and fines for leasing

A leasing agreement is a type of rental agreement, according to which the lessor purchases equipment from the seller and provides it for temporary use to the lessee for a specified fee.

Often, for late payments in accordance with the leasing agreement, a penalty is provided in the form of a penalty. According to Art. 330 of the Civil Code of the Russian Federation, a penalty is an amount of money fixed at the legislative or contractual level that must be paid by the debtor to the creditor in the event of non-fulfillment or improper fulfillment of obligations, including in case of delay in the next payment.

In accordance with current legislation, the lessor is not obliged to confirm the fact of the loss, nor to specify the amount. This is due to the fact that the concept of a penalty means the accrual of a certain percentage of the amount of the overdue payment under the agreement.

It should be borne in mind that the amount of penalties is determined individually in each specific case. But in most situations, the formula for their calculation is the same, regardless of the type of violated obligation of the lessee: the amount of penalties is equal to 1/300 of the refinancing rate of the Central Bank of the Russian Federation of the amount of debt for each overdue day.

If the amount of the penalty fixed by the agreement is too high, then this amount can be reduced in court.

If neither the agreement nor the law stipulate sanctions for the defaulter, then penalties are collected for the use of third-party funds as a result of their illegal retention.

Accounting

As for accounting itself, the leased property remains, as a rule, on the balance sheet of the lessor. The object purchased under the contract will be reflected by the buyer in off-balance sheet account 001 “Leased fixed assets” in the total amount of the leasing contract, including VAT. In this case, payments under the agreement are reflected monthly in account 76 “Settlements with various debtors and creditors”, subaccount 76-5 “Settlements with the lessor” in correspondence with cost accounts. Depending on the use of the car in the organization’s activities, leasing payments can be recorded both as a debit to accounts 20 “Main production”, 26 “General business expenses”, and 44 “Sale expenses”.

note

If the contract contains a clause on the purchase of the object by the lessee, then the final amount includes not only the fee for the right to own and use the leased object, but also the costs of purchasing the object at the end of the contract.

Example

A KamAZ truck was purchased under a leasing agreement.

The object is recorded on the lessee's balance sheet. The total amount of the contract is RUB 10,877,674.90. (including VAT 20% - 1,812,945.82 rubles). The advance payment amounted to 1,790,000.00 rubles. (including VAT 20% – RUB 298,333.33). The total amount of leasing payments is RUB 8,998,174.90. (including VAT 20% – RUB 1,499,695.82). Number of leasing payments – 22. Purchase price – 89,500 rubles. (including VAT 20% - 14,916,67 rubles). The companies signed a purchase and sale contract (at the end of the leasing agreement). The cost of the goods is 89,500 rubles. (including VAT 20% – RUB 14,916.67). This price is a redemption payment under the leasing agreement and was paid by the buyer in a separate payment. The accountant of the enterprise, immediately after signing the leasing agreement, must make the following accounting operations: Debit 08 Credit 76.ARB

9,064,729.08 rubles.

(10,877,674.90 – 1,812,954.82) – debt has been generated under the loan agreement; Debit 19 Credit 76.AR

1,812,954.82 rub.

– VAT allocated; Debit 01 Credit 08

9,064,729.08 rub.

– the vehicle is put into operation; Debit 76.ZL Credit 51

1,790,000 rub.

– the advance payment has been transferred. Then, on a monthly basis, the accounting specialist will make the following entries: Debit 76.ZL Credit 51,409,007.95

rubles.

– the current lease payment is transferred according to the payment schedule; Debit 76.AR Credit 76.ZL

409,007.95 rub.

– the lease payment has been credited; Debit 76.AR Credit 76.ZL

81,363.56 rub.

– advance payment credited (1,790,000 / 22 – according to the payment schedule); Debit 68 Credit 19

RUB 1,812,954.82

– VAT is accepted for deduction; Debit 20 Credit 02,108,451.39

rub.

– 5th depreciation group SPI 85 months. After the expiration of the contract, the accountant will make the following entries: Debit 76.ZL Credit 51,89,500

rubles.

– the redemption price is listed; Debit 76.AR Credit 76.ZL

89,500 rub.

– the redemption value is taken into account; Debit 01.01 Credit 01.02

RUB 9,064,729.08

– the purchased car is transferred to its own fixed assets; Debit 02.02 Credit 02.01

RUB 2,385,930.58 (108,451.39 × 22 months) - depreciation of property leased in used accounting for another 63 months.

An example is the Resolution of the Federal Arbitration Court of the Far Eastern District dated April 3, 2001 No. F03-A37/01-1/442. The leasing agreement was recognized by the court as not concluded as inconsistent with Article 422 of the Civil Code of the Russian Federation, and in particular Article 665 of the Civil Code of the Russian Federation, which, in the opinion of the court, establishes the essential conditions for a financial lease (leasing) agreement, since the agreement does not contain essential conditions, namely: the obligation of the lessor to purchase the leased item from the seller specified by the lessee and the absence of the right to choose the seller by the lessor himself. Also, as indicated in the said Resolution, the concluded agreement is not recognized as a leasing agreement by virtue of Article 667 of the Civil Code of the Russian Federation, since the lessor, when purchasing the property, did not warn the seller that the property he was purchasing was intended to be leased. The arbitration court of cassation recognized the agreement as not meeting the characteristics of a financial lease agreement, but noted the actions of the parties in the actual execution of the transaction, indicating the existence of rental relations between them with the right to purchase the leased property, which are regulated by paragraph 1 of Chapter 34 of the Civil Code of the Russian Federation.

note

A contract signed by counterparties cannot be considered a leasing agreement in accordance with Article 667 of the Civil Code of the Russian Federation if the lessor, when purchasing the property, did not warn the seller that the property he was purchasing was intended to be leased.

Accounting and tax accounting of the payer of fines

In an organization that pays fines for violated contract terms, these costs are reflected in accounting as other expenses.

The fine is charged by posting: Dt 91.2 Kt 76.

Payment of the fine from a bank account is reflected as follows: Dt 76 Kt 51.

In tax accounting, according to the Tax Code of the Russian Federation, fines are recognized as non-operating expenses, which reduce taxable profit. This applies to enterprises subject to the general taxation system. For organizations using the simplified tax system, the object of taxation is the result of subtracting expenses from income.

Penalties for violated obligations under the agreement cannot be taken into account as expenses. They are not included in the closed list of costs when allocating an object for the tax paid in connection with the use of the simplified tax system.

The legislative framework

The most popular tool for protecting the interests of lessors is a penalty. The interests of the leasing organization in the event of failure by the lessee to comply with the terms of the lease are protected by a number of legislative acts:

- Sections of Part I of the Civil Code of the Russian Federation (Chapter 2 on the exercise and protection of citizens’ rights, including Article 15 on compensation for losses; Chapters 22, 23, 25 on issues of fulfillment of obligations and liability for non-fulfillment; Chapter 29 on amendment and termination of an agreement ).

- Separate parts of Chapter 34, Part II of the Civil Code of the Russian Federation on the general provisions of rent and leasing.

- Law “On financial lease (leasing)” dated October 29, 1998 No. 164-FZ.

- Order of the Ministry of Finance of the Russian Federation on accounting for leasing operations dated February 17, 1997 No. 15.

- PBU 6/01 on accounting for fixed assets.