Collection of funds consists of the movement by employees of a special service of money and documentary values, such as bills of exchange, payment and settlement documents, from the cash desk of clients of a banking structure to transfer to the bank for subsequent posting of money and valuables to the accounts of organizations.

Collection services are in demand in the work of an enterprise or individual entrepreneur whose activities require the periodic delivery of cash or the movement of valuables.

How to deposit cash at the bank through collection ?

Opportunities provided by the collection service

Collection, as well as all procedures related to cash transactions, including the movement/transportation of cash, are carried out in accordance with Federal Law No. 86 (07/10/2002), Regulations of the Central Bank of the Russian Federation No. 318p (04/24/2008).

Question: How are the costs of paying for services for collection of revenue by the bank's collection service reflected in accounting? The bank's remuneration for revenue collection services for the current month is 48,000 rubles. (including VAT 8,000 rubles), which is confirmed by the corresponding acceptance certificate for services provided. For profit tax purposes, the accrual method is used. View answer

The right to work with cash resources by moving/transporting and collecting, performing cash transactions is available only to organizations and enterprises accepted into the system of the Central Bank of the Russian Federation.

A credit company can use the services of enterprises engaged in the specialized transportation of valuable cargo if it needs to move cash, since a Central Bank license is not required to transport money.

Question: Can a bank take into account as expenses for income tax purposes contributions (premiums) paid on the basis of an insurance contract for the collected (delivered) valuables (money) of its clients (clauses 2, 7, clause 1, Article 263 of the Tax Code of the Russian Federation)? View answer

Among the valuables for transportation the following may be present:

- cash;

- currencies;

- valuable papers;

- financial and payment documentation that is of some value to the company being collected.

Maintaining an enterprise's own cash collection structure involves significant expenses for its maintenance and is not always profitable. Therefore, it is more advisable to use the services of third-party specialized organizations.

The transfer of authority to transport valuables to third-party companies is formalized by a special agreement, including terms of payment for the service:

- with a special division of a banking or other financial institution;

- with a private security structure operating on the basis of a license from the Central Bank of the Russian Federation.

How to take into account collection costs in accounting and for tax purposes ?

In the text of the agreement, the parties indicate the specifics of transporting money, the responsibility of each of the parties to the agreement in the event of force majeure, as well as:

- Clearly agreed schedules and conditions for the removal of valuables, their subsequent transportation and transfer.

- Conditions for the customer company to provide guaranteed access to the premises for transferring money.

- Mandatory transportation of money in special sealed bags on a vehicle intended for the specified purposes.

How to register and reflect in accounting the surplus or shortage of cash discovered during collection ?

The collection procedure involves not only the exclusive transportation of cash resources and securities for placement and storage, but also some other services:

- crediting accepted resources to company accounts;

- movement of funds/valuables between branches of the organization;

- Exchanging banknotes (increasing the denomination).

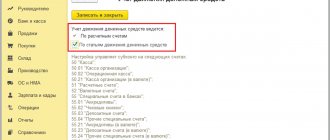

Accounting entries for the cash register

Example 1. Postings for issuance from the cash register to the reporting

Lichi LLC has a cash limit of 60,000 rubles. The cash balance at the beginning of the working day is 21,450 rubles. Operations for the working day: payment received from customers in the amount of RUB 36,240. and 15,625 rubles, funds were issued to the accountable person for the purchase of stationery for the office - 9,000 rubles. The total receipts to the cash desk amounted to 51,865 rubles.

The accountant of Lichi LLC compiled the following accounting entries for the cash register:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 71 | 50 | 9 000 | From the cash register of Lichi LLC, funds were issued to the accountable person | KO-2, statement from the accountable person |

| 50 | 62 | 36 240 | Payment from the buyer | KO-1, cash receipt |

| 50 | 62 | 15 625 | Payment from the buyer | KO-1, cash receipt |

The balance of cash in the cash register at the end of the day is 64,315 rubles. The cash surplus must be handed over to the bank in accordance with cash discipline.

Example 2. Postings for cash collection

Lichi LLC transferred the retail proceeds to the collector for transportation to the bank and subsequent crediting of funds to the bank account in the amount of 915,000 rubles. According to the agreement, the cost of collection services is 0.14% of the collected amount.

The accountant of Lichi LLC reflected the cash collection with the following entries:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 57 | 50-1 | 915 000 | The proceeds are transferred to the collector | KO-2, transmittal sheet |

| 51 | 57 | 915 000 | Funds are credited to the account | Account statement |

| 91.02.1 | 51 | 1 281 | Write-off of bank commission for receiving and recalculating funds | Account statement |

Example 3. Postings for payment of dividends from the cash register

It was decided to distribute the profit at the end of 2015 of Lichi LLC among its participants - the founder of Piktiv A.N. (not an employee of the organization) and director Amok K.A. The founder's share is 457,000 rubles, and the director's share is 121,000 rubles.

The accountant of Lichi LLC generated the following entries for the payment of dividends to the founder and director:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 84 | 75-2 | 457 000 | Accrual of profit Piktiv A.N. | The decision of the general meeting on the payment of dividends |

| 75-2 | 68 personal income tax | 59 410 | Personal income tax withheld | Help-calculation |

| 84 | 70 | 121 000 | Accrual of profit Amok K.A. | The decision of the general meeting on the payment of dividends |

| 70 | 68 personal income tax | 15 730 | Retained by NFL | Help-calculation |

| 75-2 | 50-1 | 397 590 | Payment of income Piktiv A.N. | General meeting decision on payment of dividends, KO-1 |

| 70 | 50-1 | 105 270 | Payment of income to Amok K.A. | General meeting decision on payment of dividends, KO-1 |

Organization of collection procedure

The process of moving cash includes a number of sequential actions, including:

- preparing sums of money for transportation;

- Exchanging banknotes if necessary and processing papers;

- transferring valuables to responsible collectors, placing them in special bags, sealing the latter;

- transportation of prepared and registered cargo by special armored transport, accompanied by professionally trained workers;

- transfer of property to the bank (temporary placement in the office of the collecting structure, if collection was carried out after the end of working hours at the receiving bank);

- counting and checking cash;

- receipt of money to the bank account of the client (collectee).

For each of the structures involved in collection, the bank prepares and issues special cards indicating the number of allocated and numbered bags for collection, the names of the serviced enterprises with codes and addresses, and the time of arrival of collectors.

For your information! The number of bags allocated to the organization is determined based on the amount of cash collected, each of them has an individual number.

More information about how collection works:

- Before departing along the route, collectors are provided with empty bags for placing money and valuables, keys, powers of attorney (for collection, movement of cash), stamps, and cards.

- Upon arrival at the serviced company, the responsible employee is allowed to carry out the operation after presenting a power of attorney, service ID, collection bag (empty), and card.

- An employee of the enterprise, most often a cashier, presents a sample of the seal to the arriving collection officer, hands over a filled bag and documents (invoice, receipt), and places a transmittal sheet in the bag with cash.

- Afterwards, the collector performs an external inspection of the received item to determine its integrity, determines whether the seal matches the presented sample, and checks whether the information is entered correctly in the documents: invoice, receipt.

- If there are no comments, the cashier fills out an appearance card. The collector verifies the amount of funds and the number of the bag indicated in the documents, after which he hands over to the employee of the organization a receipt signed and bearing the stamp of the collector.

Violations and errors made during the preparation of the statement or during packaging are corrected by collectors. If the duration of the adjustment exceeds the established limit of presence in the organization and, in general, the time schedule of work of collectors, then in order to remove properly registered bags, a second visit of collectors is made at the time chosen by them based on the previously received schedule of arrivals. In this case, a special note about re-entry is added to the card.

For your information! The frequency and time for employees to visit the serviced company are established by the management of the collection service in agreement with the collection organization.

The bank employee accepting cash and valuables checks:

- no external damage to the bag with attachments;

- integrity of the seal on the filled bag;

- compliance with the information indicated in the submitted documents (invoice, receipt, attendance sheet).

The collection employee, who has handed over the bags with valuables to the banking structure, gives the previously received stamp, keys, powers of attorney, and cards to his manager or the employee on duty.

Registration in accounting

After depositing the cash for collection, the cashier is left with a receipt for the bag, on the basis of which a cash receipt order (COS) is drawn up. The Bank of Russia in the Letter of the Central Bank of the Russian Federation dated October 16, 2015 No. 29-1-1-OE/4065 explained how to fill out the cash register for the collected amount of cash:

- In the “Issue” line, the full name of the cashier who generated and handed over the bag of cash to the collector is indicated.

- In the “Attachment” line, indicate the details of the primary document (date and number) - the receipt for the bag.

The collector does not sign the cash settlement; his data is not indicated in the order. The cashier also makes an entry in the cash book based on the issued consumables.

In accounting, the following entries are made:

Debit 57 “Transfers in transit” Credit 50 - funds were transferred to the collector for crediting to the current account (based on the receipt for the bag).

Debit 51 Credit 57 - money has been credited to the current account (based on the statement).

Cash collection services are classified as other expenses in accounting.

Debit 91.2 Credit 60 - collection services are reflected.

Debit 19 Credit 60 - VAT on collection services is reflected.

Collection of funds

Organization of cash register Read more: Responsibility for non-compliance with cash transactions

1.2.2 Cash collection

In order to ensure that the balance of cash in the cash desk at the end of the day does not exceed the limit, the organization for transferring money to the bank can enter into an agreement with the collection service of the bank establishment or a specialized collection service licensed by the Bank of Russia to carry out the relevant cash collection operations.

The procedure for processing and transferring cash to collectors is provided for by the regulations of the Central Bank of the Russian Federation dated October 9, 2002. No. 199-P “On the procedure for conducting cash transactions in credit institutions on the territory of the Russian Federation.”

After concluding an agreement, the organization orders the production of a special seal, on which the number and abbreviated name of the organization or its brand name must be engraved. Samples of seal impressions are certified by the head of the collection department. One copy of a certified sample seal is transferred to the organization for presentation to collectors when transferring valuables to them, and the second to the cash department of the credit institution to exercise control when accepting money from collectors.[6]

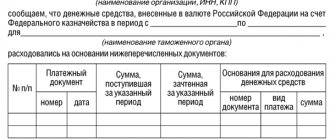

The organization provides samples of seal imprints that will be used to seal bags to the collection department. The number of bags issued to the organization is determined by the volume of collected revenue. Each bag is marked with a serial number. For each bag of cash handed over to collectors, the cashier of the organization writes out a forwarding slip.

The first copy of the transmittal sheet is placed in the bag; The second copy (invoice for the bag) is given to the collector upon receipt of the bag; The third copy (copy of the transmittal sheet) remains with the cashier. The third copy of the transmittal sheet with the signature and seal of the collector serves as the basis for the accountant to draw up a cash expenditure order (Form No. KO-2) (See Appendix 3) and for reflecting in the cash book the expenditure of cash at the organization's cash desk.

Before receiving valuables, the collector presents to the cashier of the organization an identification document, a power of attorney to receive valuables, an appearance card and a bag. The cashier of the organization presents a seal imprint, a bag with valuables and two copies of the transmittal sheet.

The collector accepts the bag with valuables, checking the integrity of the packaging, the presence of intact and clear seals, their compliance with the existing sample, checks the correctness of filling out the transmittal sheet and hands over the empty bag and the appearance card to the cashier of the organization to fill out. The collector checks the correspondence of the amount indicated in the appearance card by the cashier, the amounts in the invoice and the copy of the transmittal sheet, then puts a stamp on the copy of the transmittal sheet, the date of receipt of the bag and signs.

To account for funds issued from the organization's cash desk, for crediting to its current account, but not yet credited for its intended purpose, account 57 “Transfers in transit” is intended. The basis for accepting amounts for account 57 (for example, when delivering proceeds from a sale) may be copies of accompanying statements for the delivery of proceeds to collectors.

Expenses associated with payment for services provided by credit institutions are operating expenses (clause 11 of PBU 10/99) [7] Such expenses are accepted for accounting in an amount calculated in monetary terms equal to the amount of payment in cash and other forms or in the amount of accounts payable (subclause 14.1.6 of PBU 10/99). Account 91 “Other income and expenses”, subaccount 91.2 “Other expenses” is intended for their accounting; To account for settlements with the bank, account 60 “Settlements with suppliers and contractors” can be used.

The amount of payment for collection services is usually debited from the organization’s account without acceptance at the beginning of the month following the settlement month.

As the organization pays for collection services and receives invoices, in accordance with the generally established procedure, it can claim the paid amounts of VAT for deduction in accordance with Article 170-172 of the Tax Code of the Russian Federation.

1.3 Documentation of cash transactions

The basis for recording cash flow registers are unified forms of primary accounting documentation for recording cash transactions.[8]

Documents are the basis for performing cash transactions and are received by the accounting department, where accounting employees, in accordance with their job responsibilities:

— check the correctness of the execution of documents, their compliance with the law, the nature of the transactions being performed, as well as the presence of the necessary written instructions from the head of the organization or persons authorized by him to carry out business transactions;

— draw up receipts and expenditure cash orders or documents replacing them;

— receive the necessary signatures of authorized persons provided for by the blinkers of cash documents;

— registered (before transfer to the cash desk) in the journal for registering incoming expenditure documents;

- hand over to the cashier receipt and debit orders or documents replacing them, along with supporting or administrative documents attached to them.

Documents must be filled out in one copy clearly and clearly, in ink, with a ballpoint pen or printed. All corrections, erasures or erasures are not permitted.

The cash receipt order is filled out simultaneously with the receipt that is part of it and signed by the chief accountant or an authorized person. A receipt is issued only after receiving the money (receipt cash order, see Appendix 4).

An expense cash order is drawn up on the basis of payroll statements and other documents equivalent to it, which are recorded in the journal after their issuance. Signed by the manager and chief accountant or a person authorized to do so.

Cash orders can be accepted and issued only on the day they are issued. The issuance of receipt and debit orders or documents replacing them for raku to persons depositing or receiving money is prohibited.

Cashier upon receipt of cash receipts and debit orders or documents replacing them:

— checks the presence and authenticity of the signature of the chief accountant, and on the expense order or a document replacing it - the authorization signature of the manager;

— check the correctness of the documents;

— checks the presence of the applications listed in the documents.

If one of the requirements is not met, the cashier returns the documents to the accounting department for re-registration.

If all requirements are met and documents are met, the cashier accepts cash. Checks the solvency of money in accordance with the signs of solvency of banknotes and coins of the Bank of Russia.[9] The amount received must correspond to that indicated in the cash receipt order.

After accepting the money, the cashier signs the receipt and deciphers the signature, certifying it with the cashier’s seal. A receipt for the receipt order, signed by the chief accountant and cashier, certified by the cashier's seal or a cash register imprint, is handed over to the person who deposited the money. Receipt orders or documents replacing them are immediately signed by the cashier after receiving or issuing money on them, and the documents attached to them are canceled with a stamp or the inscription “paid” indicating the date (see Appendix 4).

Cash not confirmed by a receipt order is considered a cash surplus and is credited to the income of the enterprise.

Cash issuance from the cash register is carried out using cash receipt orders or other documents duly executed with a stamp on these documents containing the details of the cash receipt order. Documents must be signed by the head, chief accountant or a person authorized to do so. In cases where the documents, statements, and invoices attached to the cash receipts order contain the authorization signature of the head of the enterprise, his signature on the cash receipts receipts is not required. If these requirements are met and the documents match, the cashier issues cash.

When issuing money according to an expense order or a document replacing it to an individual, the cashier:

- Requires an identification document of the recipient. Money is issued only to the person indicated in the cash receipt order. If the issuance of money is made by power of attorney, executed in the prescribed manner, in the text of the order after the surname, first name and patronymic of the recipient, the surname, first name and patronymic of the person entrusted with receiving the money is indicated. The power of attorney remains in the documents as an attachment to the cash receipt order.

— records the name and number of the document, when and by whom it was issued and selects the recipient’s receipt. The receipt can be written by the recipient in his own hand, with a ballpoint pen and indicating the exact amount received (rubles and kopecks are written in words).

— gives money to the recipient.

After completing the operation, the cashier is required to sign the cash receipts and cancel the documents attached to them with a stamp or the inscription “paid” indicating the date. (For cash receipt order, see Appendix 3.)

The issuance of money can also be carried out according to pay slips and without drawing up a cash receipt order. On the title page of the payroll, an authorization signature is made regarding the issuance of money signed by the manager and chief accountant of the enterprise or persons authorized to do so.

In a similar manner, funds can be issued for one-time needs, as well as the issuance of deposited amounts and money on account for expenses associated with business trips to several persons.

The issuance of money from the cash register, unconfirmed by the recipient's receipt in the cash receipt order or other document replacing it, is not accepted to justify the balance of cash in the cash register. This amount is considered a shortage and is collected from the cashier.

At enterprises with a large number of divisions serviced by central cash desks, wages and social benefits payments can be made by several cashiers or authorized representatives. In this case, the senior cashier, before the start of the working day, gives to other cashiers in advance the amount of cash necessary for debit transactions against a receipt in the book of accounting of funds accepted and issued by the cashier (form No. KO - 5, Figure 2.)

At the end of the working day, cashiers are required to report to the senior cashier on the amounts received and hand over the balance of cash to him against a receipt in the book of accounting for funds accepted and issued by the cashier.

1.3.1 Maintaining a cash book

The responsibility of the cashier is to maintain the cash book (Form No. KO - 4). All receipts and withdrawals of cash from the enterprise are recorded in the cash book.

Rules for maintaining a cash book:

1. The company has only one cash book

2. The cash book must be bound, pages numbered and sealed on the last page. In this form

3. Entries in the cash book are made in duplicate using carbon paper in ink or a ballpoint pen.

4. Each sheet consists of two equal parts: one of them is filled out by the cashier as the first copy, the second is filled out by the cashier as the second copy from the front and back through carbon paper. First, the sheet is folded in half. The first copies remain in the cash book, the second are detachable, used as a cashier’s report and are not torn off until the end of the day. Both the first and second copies are numbered with the same numbers.

5. Erasures and unspecified corrections in the cash book are not allowed. The corrections made are certified by the signatures of the cashier, as well as the chief accountant.

6. Entries in the cash book are made by the cashier immediately after receiving or issuing money for each order or other document replacing it.

7. Every day at the end of the day, the cashier calculates the total of the transaction for the day, withdraws the balance of money in the cash register for the next date and moves to the accounting department as a cashier’s report, a tear-off sheet with incoming and outgoing cash documents against a receipt in the cash book (Cash Book Form No. KO - 4 , see Appendix 5).

Control over the maintenance of the cash book rests with the chief accountant of the enterprise.

Organization of cash register Read more: Responsibility for non-compliance with cash transactions

Information about the work “Accounting for cash at the cash desk”

Section: Accounting and Auditing Number of characters with spaces: 48920 Number of tables: 0 Number of images: 0

Similar works

Documentation and accounting of funds in the cash register

46207

0

9

... for July 18, 2004, an extract from the journal for registering incoming and outgoing cash orders. 6. Ways to improve the accounting of funds at the cash desk of Luch LLC. We analyzed documents reflecting transactions with funds at the cash desk of Luch LLC. Despite the documented rules for conducting cash transactions at an enterprise, which are reflected in the Accounting Regulations, you can...

Accounting for cash in cash, in settlement, currency and special bank accounts

50803

2

0

... sheets for them, receipts of waybills for vehicles, etc.) are taken into account in off-balance sheet account 006 “Strict reporting forms”. 2. ACCOUNTING FOR MONEY ON CURRENT AND SPECIAL ACCOUNTS IN BANKS 2.1 Accounting for transactions on a current account In the process of economic activity, various settlement and monetary relations arise between organizations in connection with the supply of materials and payment for services, ...

Accounting for cash in the cash register and in the accounts of the enterprise, analysis of the availability and efficiency of their use

92374

3

0

... client funds and crediting funds to his account no later than the next business day after receipt of the corresponding payment document. 2.3. Synthetic and analytical accounting of funds in bank accounts In the accounting department of an enterprise, operations are carried out on the basis of settlement documents together with a bank statement. Periodically, within the time limits established with the account owner, the bank issues...

Improving cash accounting at the Kuban educational farm

85321

6

0

... as the coefficient of loss of solvency is greater than 1, this means that the enterprise has a real opportunity not to lose its solvency in the next three months. 3. ACCOUNTING FOR CASH IN THE UCHKHOZ ,,KUBAN,, 3.1.Tasks of accounting for cash in an enterprise All available funds of enterprises are stored in the bank’s service institutions at the settlement ...

Collection process

First, the bank enters into an agreement with the company that requires these services. During the cooperation process, the employee registers the client’s application. Depending on the volume of revenue, bags are allocated, each of which has a serial number. A schedule for cash delivery must be agreed upon. The collector must always have with him a bag with a number, keys, an application card, a company stamp and a power of attorney, on the basis of which he can transport valuables.

The entrepreneur sets the maximum allowable collection amount (limit) so that the remaining cash in the cash desk allows the enterprise to continue to function normally. The limit is approved based on the order and agreed with the bank.

After signing the contract, the businessman is obliged to adhere to the conditions regarding the delivery of money. Violations will entail administrative liability. If necessary, you can only cancel the limit and stop using collection services.

Receiving bags at the bank

This procedure has some characteristic differences and is considered more complex than receiving banknotes and other material assets by the collection service. First, it is necessary to note the procedure of actions performed by an employee of a banking structure. He is obliged to check the compliance of the entries made in all attached documents: invoice, appearance card or receipt, and also carefully inspect the bag for damage (such as patches, tears in the fabric, external seams, tears in the strapping or the appearance of knots there), and identify defective seals and locks . After this, you should check the numbers indicated on the bag and on the accompanying documents.

Collection - why is it needed?

Collection is the secure transportation of any valuables to the bank. Specialists (collectors) bear financial responsibility for the transportation of money, securities, payment, financial and other documents on the basis of a concluded agreement. The collection procedure is carried out by special services, based on the Regulation of the Bank of Russia dated January 29, 2021 N 630-P.

This service is provided on a paid basis by security companies that have a license giving the right to collect money or by banks in which the businessman has an account.

Collection has the following advantages:

- responsibility for the safety of money and valuables;

- fast and regular delivery of cash or securities, regardless of the number of applications;

- ensuring safe transportation and storage of proceeds, maximum protection from intruders.

For commercial organizations, the law establishes a mandatory procedure for the collection of cash during settlements, payments and cash transactions. If money is received in cash in excess of the established indicator, it must be handed over to the bank and subsequently credited to the account. This measure simplifies the accounting of money in an enterprise and ensures the protection of valuables from theft. Most often, collection services are used by shops, restaurants and other establishments where the flow of customers is stable, and cash is more often used for payments.

Who can handle collection

Collection can be carried out by the bank or internal services. Banking institutions may engage specialized organizations with a collection license for this activity. Often small banking structures use the services of collection services assigned to larger banks.

Transportation of money is carried out on special transport with enhanced body protection and bulletproof glass. There are cameras installed inside that record traffic conditions. The collectors themselves need to wear body armor and firearms, which they can use in an attack. Also, collectors move accompanied by security guards.

How is the transportation of money organized?

The procedure for collecting funds is as follows:

- The cash desk employee checks the collector's passport details, power of attorney, application card, and accepts the bag.

- The collector shows a sample of the seal, fills the bag, and attaches documents and receipts.

- The cashier fills out the documents, indicating all the actions taken within the framework of collection.

- The money is put in a bag. The collector, in the presence of the cashier, needs to inspect it and the seal to make sure there is no damage and that there is no access to the contents.

- The cashier fills out the accompanying documents and signs.

- Valuables are transported to the bank. If the banking day is over, the package can be sent to the collection office for temporary storage - this issue is resolved at the stage of concluding the contract.

- The bank carries out a count of money, an inventory of valuables, and verification of their authenticity and integrity. After this, the amount is credited to the company’s account.

Violations at this stage

If a banking service employee identifies inconsistencies in the accompanying papers, a note is made in the notes column of the audit log, which is subsequently endorsed by both the receiving and the delivering party. If any traces of damage are found on the bag, it must be opened and the contents (piece or sheet) counted. Identification of a shortage or surplus is recorded in the autopsy report. The name and details of the organization, the date and reason for the autopsy, as well as the positions, surnames and initials of the workers who performed the autopsy and were present at it, and information about the premises where this procedure was carried out are also entered there.

Pros and cons of collection

| pros | Minuses |

| reliability and safety | you have to pay for it |

| saving money – no expenses for company transport (fuel, depreciation, driver’s salary) | there are additional costs (collection bags, sealer, seals, etc.) |

| no need to leave your place of work | |

| The cashier is engaged in his direct duties, and does not accompany the proceeds to the bank |