» IP management » Cash desk

A fairly large number of individual entrepreneurs are increasingly using non-cash payments and paying less attention to making cash payments, which leads to the need to maintain special records.

Since the spring of 2014, according to the instructions of the Bank of the Russian Federation, a cash register must be kept exclusively by those entrepreneurs who pay their employees in cash, that is, directly through the cash register and the operator. Not all individual entrepreneurs pay wages using bank cards, so each such individual entrepreneur must know everything related to maintaining such an important document as a cash book. The main thing is to competently and correctly maintain cash books in 2021, making sure to know all the intricacies of filling them out.

- 2 Procedure

- 3 Basic rules for filling out the cash book 2019

- 4 Correction of mistakes made when filling out

What is a cash register?

What is a cash book - a necessary accounting document, the form of which is made in the form of a specialized journal. It records information related exclusively to the movement of cash. The magazine has 50 or 100 pages. The sheet of the cash book must be numbered separately, the book is completely stitched and sealed on the reverse side with the signature of the entrepreneur, which is certified by a seal. However, according to the instructions of the Central Bank of Russia 3210-U, if you do not adhere to these rules in 2021, this will not be regarded as a violation of maintaining a cash book. However, the established form of the document must be maintained by the individual entrepreneur. Those who will be on the so-called simplified system in 2021 are no exception. The cash book is approved by the State Statistics Committee as form KO-4. In other words, this is a new form of the operator’s book, which must be maintained in 2021.

An important point in maintaining accounting records for individual entrepreneurs in 2021. is the correct and competent design - that is, the essence and form. When conducting an inspection, state control authorities will first of all check this document. Incorrect maintenance or absence of a book can result in significant fines. But for ignorance or absence of a cash book, when salary payments are made to bank cards, individual entrepreneurs in 2021. does not bear any legal liability. However, if an entrepreneur keeps a cash register, he must fill it out in accordance with the established template and the existing requirements of current legislation. It is important to receive reliable and timely information from the operator in certain documents.

conclusions

Book KO-5 is a unified form of cash accounting, often used by an economic entity that has a complex, hierarchical structure of its own cash register.

In other words, it is advisable to use it in cases where the organization has a chief cashier who is responsible for working with the cash register at the level of the entire enterprise, and junior cashiers whose competence includes maintaining the corresponding cash registers for individual divisions of this enterprise.

Filling out KO-5 is done by indicating the required information in the columns/lines of this form.

Procedure

It is necessary to maintain a cash book from the beginning of each calendar year, where its validity period must be indicated on the title page. If one book is not enough for a certain period (calendar year), you need to create or download another sample. You can use Excel form, where you can continue to record all income and expenses in chronological order.

Special attention must be paid! On the second copy of the book you also need to write the start and end dates of its maintenance. Thanks to this, neither the individual entrepreneur himself nor the inspector will be able to get confused in the sequence of filling out cash register data.

Nowadays, individual entrepreneurs buy ready-made printed cash books of a sample excel form, which do not need to be drawn on special columns - that is, a ready-made form. In addition, a sample of books can be downloaded for free on our website and, in the future, maintained based on established rules.

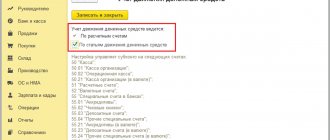

Cash flow accounting in 1C:Accounting 3.0

Every accountant, both beginner and senior, understands the importance of cash in an organization. After all, an accountant keeps records of cash flows and presents to the manager a detailed report on the financial well-being of the enterprise.

Money loves counting

Proper cash flow accounting is necessary for a company to:

– spent money carefully and did not take out unnecessary loans;

– did not suffer from cash gaps;

– invested free money in new projects.

Company managers, through cash flow analysis, will see the financial condition of the organization and predict risks.

Also, correct data generated for cash flow items in the 1C Accounting 8 program (ed. 3.0.) is needed to submit accounting and tax reporting to the Federal Tax Service on time and without errors.

We will tell you how to reflect a cash flow item in the 1C Accounting 8 program (rev. 3.0.). To reflect the cash flow item in payment documents, set the following settings:

– open in the “Administration” section – “Program settings” – “Accounting parameters”;

– in the “Chart of Accounts Settings” attachment, go to the “Cash Flow Accounting” tab for current accounts and cash flow items and check the box for cash flow items, then use the “Record and Close” button to save.

The saved settings are needed for the correct preparation of cash flow analysis in the program.

Why do a cash flow analysis?

Cash flow analysis – information about the receipt and expenditure of funds. To correctly account for cash flow, use the “Cash Flow Items” reference book. The directory includes a list of cash flow items (“Directories” – “Bank and cash desk” – “Cash flow items”), it is used to organize cash flow by type. This accounting is needed to automatically fill out the financial reporting form “Cash Flow Statement”. In the cash flow item in each type of DDS there are two indicators: “name” and “type of cash flow”. The “name” indicator includes an unlimited number of names that an accountant uses when creating cash and bank documents. The indicator “type of cash flow” can be predetermined, since it is compiled taking into account the requirements of the cash flow statement. To analyze cash flows in the 1C Accounting 8 program (rev. 3.0.), use cash flow items by type of movement, and so on. To generate such a report, go to the section “For Manager” -> “Cash” -> “Cash Flow Analysis”. In the “Cash Flow Analysis” tab, select the required period for the report, click “Generate” and display the report indicators on the monitor. The generated report contains information about cash receipts and expenditures based on cash orders and bank documents.

Cash flow items and balance sheet

The directory “Cash Flow Items” serves to classify transactions with an organization’s funds. When preparing payment documents (payment orders, PKO and RKO, etc.), indicate the required DDS item. It is important that with the help of the directory, the cash flow report is generated correctly, since this report is part of the financial statements and is submitted to the Federal Tax Service at the end of the year.

The primary source for generating a cash flow report in the 1C Accounting 8 program (rev. 3.0.) is the balance sheet for the account. 50 and counting 51. To form SALT according to the account. 50 and 51, go to the section “Reports”, “Standard reports” and SALT by account. 50 or 51. Select the period, then click on the “Show settings” button, in the “Grouping” tab, select “Cash flow items” and click “Generate”. The SALT will show for which items the funds were received or written off. Discrepancies between the SALT and the cash flow report mean that some payment document does not reflect DDS items, or perhaps they were indicated in a document that does not require this.

We will help you with setting up a cash flow report in 1C programs - we will advise you for free within 15 minutes. Read more here. Or we’ll teach you how to work in 1C from scratch in the proprietary course “Smart 1C: Accounting.”

Work in 1C with pleasure!

Basic rules for filling out the cash book 2021

An important point is not only the correct filling out of the cash book itself. The title page of the cash book (form) must have all the necessary data established at the legislative level (an example of correct filling can be downloaded):

- name of the enterprise (organization);

- Full name IP;

- OKPO;

- bookkeeping period;

- if this is a department, then you must indicate its name.

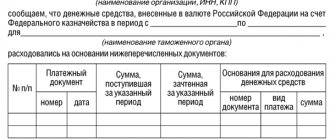

It is necessary to make records of all transactions (expenses/receipts) that were carried out during the entire working time in the cash book. The movement of funds for 24 hours is recorded on one page of the journal. At the end of the working day, the finances that were received and spent are necessarily calculated, and the balance of the finances is displayed, which transfers to the next working day. Entries made in cash register documentation must be confirmed by a report from the person who is directly responsible for receiving and issuing money from the cash register.

The cash book, each sheet of it, consists of 2 parts:

- the first, which contains all the data on completed transactions with the entrepreneur’s finances;

- the second is the report of the cashier-operator (responsible person) for the receipt/expense of funds at the cash desk.

To fill out a form in a book faster, you should bend the sheet along a special break line and, using carbon paper, fill out the sheets of the magazine at the same time. The loose leaf here is written exclusively with a ballpoint pen, where the entry will be copied on the tear-off part. After that, the sheet is cut off and filed along a special line, and the primary sample is attached to the operator’s (cashier) report. The cash book can also be filled out on a computer in excel form - a ready-made form.

How to fill out the book in 2021:

- at the top of the page you need to enter page numbers and the full date;

- in the “Balance at the end of the day” column, the exact amount that was transferred from the previous one, according to the operator, is recorded;

- in the “Document number” column, enter the order number;

- Next, all the data of the person from whom the funds were directly received (issued) from the cash register are recorded. If this is a legal entity, then its name is indicated, and if it is an individual, then its full name;

- in the “Incoming” and “Outgoing” columns, the operator makes an entry regarding the amount of money in rubles that was deposited or spent for a given working day;

- all information about the movements of funds indicated in the higher lines is recorded in the “Transfer” column;

- It is necessary to keep records of currency movements per day in the “Total for the day” column;

- in the column “Balance at the end of the day” the amount is recorded, which includes the balance at the beginning of the day + receipts for the day and – all issued funds.

Note! The total amount of money that is directly indicated in the book must exactly match the balance of cash that is available in the cash register!

In the lines of the form that are not filled out, the Z icon must be indicated. At the end of each completed page, the signature of the cashier-operator and accountant must be placed. If throughout the day the individual entrepreneur had no financial movements, then the balance is recorded in the journal without changes. A sample of filling out the new cash register form can be viewed or downloaded for free in Excel form.

Purposes and procedure for using the document

The book is kept by the senior cashier of the central division of the business entity. In the document, he notes the fact of transferring money to cashiers of other departments. Cash is issued at the beginning of the shift, and this fact is then noted in the book using the KO-5 form. The amount of the amount issued must correspond to the economic needs of the unit. In a situation where at the end of a working day or shift the money has not been completely spent, the balance is returned to the main cash register. This action is also recorded in the document.

The book allows you to quickly determine how much cash was issued and accepted, how much was left at the end of the working day, and how much the organization received in revenue.

For your information! The document was created and approved by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88.

What kind of document is this?

This book reflects similar operations that have a certain economic essence and justification. They are associated with the moment of transfer of cash and monetary documents from one official to another: from the chief (senior) cashier to an ordinary cashier - at the beginning of the work shift, and in the reverse order - at the end of the shift .

The journal is filled out in order to record as accurately as possible the direct fact of the transfer of the specified material assets, and is used only when there is a central cash desk and departmental cash desks. Naturally, if the organization’s staff includes only one cashier, then the specified register does not need to be maintained.

You can see the procedure and sample for filling out the cash book in this article. How to properly maintain a general ledger in accounting - read here.

Procedure, rules, example of filling out a book for recording accepted and issued cash

Title page

The information entered must not contradict the content of the enterprise’s Charter.

If you receive the OKPO code, we enter that too.

Enter the name of the structural unit if available.

Title page of the cash book (form KO-5)

Amendments and corrections are not welcome. If an erroneous entry needs to be corrected, it must first be carefully crossed out. The current entry is written next to it. The corrected code (date), the signature of the person who made the entry, the surname and a stamp must be indicated.

We draw up odd-numbered pages (form KO-5)

Sample of filling out the odd pages of the cashier's book

Administrative responsibility

Violation of the rules for maintaining a cash book or its absence is an administrative offense; liability for it is provided for in Article 15.1 of the Code of Administrative Offenses of the Russian Federation, as for violation of the handling of cash. For such an offense, the Federal Tax Service may impose an administrative fine:

- in the amount of 40 thousand to 50 thousand rubles for the organization itself;

- in the amount of 4 thousand to 5 thousand rubles per manager or chief accountant.