Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

This type of report is included in the annual financial statements. It reflects what sources the funds come from and how they are used. The report is needed to understand whether the organization has enough money, for example, to pay salaries to employees, social and tax duties, payments to suppliers, etc. Such a report is necessary for both internal (for example, managers) and external (investors, creditors, etc.) users, because with its help you can conclude whether the company is able to fulfill its financial obligations and whether it has cash gaps (shortage of funds) , caused by a large time difference between the sale and payment of the goods).

Who should provide ODDS

ODDS in 2021 is provided by all persons who maintain accounting records in their organization. However, there is an exception to this rule; a report is not required for:

- small businesses (i.e. small firms that meet the criteria of Article 4 of the Federal Law “On the Development of Small and Medium-Sized Businesses in the Russian Federation” dated July 24, 2007 N 209-FZ (as amended on November 27, 2017) and operate according to a simplified system taxation);

- Skolkovo residents.

The persons listed above can provide a report if they wish if they are confident that it can provide the most complete description of the state of the organization. If the organization decides that the preparation of such a report is not required and it will not provide any important information, this is reflected in the explanatory note to the annual financial statements. For example, in an explanatory note you can indicate that all the company’s revenues are associated exclusively with the sale of goods, and expenses include only payroll, taxes and payments to suppliers.

The main thing in the article: the methodology for forming and the volume of indicators of Form 4 “Report on the implementation of the estimate of income and expenses of funds from the income-generating activities of a budget organization.”

Heading part of form 4

Form 4 “Report on the implementation of estimates of income and expenses of funds from the income-generating activities of budgetary organizations” is given in Appendix 6 to the Instructions on the procedure for drawing up and submitting financial statements for budget funds and funds from income-generating activities of budgetary organizations, approved by the resolution of the Ministry of Finance dated March 10, 2010 No. 22 (hereinafter referred to as Form 4, Instruction No. 22).

The header part of Form 4 contains the following data:

- the date on which it was compiled;

- full name of the organization (recipient (manager) of budget funds);

- full address, telephone;

- budget (republican, local);

- name of the source of income (extrabudgetary funds in accordance with the classification of income);

- division and subdivision of income;

- chapter code according to the corresponding departmental classification;

- expense codes by functional and program classifications (section, subsection, program, subprogram);

- frequency of presentation (annual, quarterly);

- unit of measurement.

Let us remind you that from February 1, 2021, program codes and subprograms are provided in the header part of Form 4 and are filled out when using the program-target method in the budget process in accordance with the norms of the Ministry of Finance Resolution No. 112 dated December 26, 2016 “On Amendments and Additions to the Instructions on the procedure for drawing up and presenting financial statements on budget funds and funds from the income-generating activities of budget organizations" (hereinafter referred to as Resolution No. 112).

Clause 5.5 of the Program for Socio-Economic Development of the Republic of Belarus for 2016–2020, approved by Decree No. 466 dated December 15, 2016, in order to increase the efficiency of planning and budget execution, provides for the use of a program-target method in the budget process and a phased transition to a medium-term (three-year) budget planning (with an annual shift of one forecast year).

By 2021, the coverage of budget expenditures by state programs is planned to increase to at least 90%.

Frequency, order and timing of submission

Form 4 is drawn up by budgetary organizations, which, in accordance with the legislation of the Republic of Belarus, have the right to carry out income-generating (entrepreneurial) activities (clause 48 of Instruction No. 22).

The frequency of submission of Form 4 is annual and quarterly.

In accordance with paragraphs. 3–5, 7 of Instructions No. 22, annual financial statements (including Form 4) are prepared as of January 1 of the year following the reporting year, and quarterly statements - as of April 1, July 1, and October 1 of the current year.

Like other forms of financial statements, Form 4 is compiled on an accrual basis from the beginning of the reporting year in Belarusian rubles with two decimal places, submitted on paper and (or) electronically in the form of an electronic document.

The deadlines for submitting financial statements (including Form 4) are established in accordance with clause 93 of Instruction No. 22. For managers of republican budget funds they are established by the Ministry of Finance annually, and for managers of local budget funds - by the relevant local financial authorities.

The date of presentation of financial statements is considered to be the date of their actual transfer by ownership. If the deadline for submitting financial statements falls on a weekend or holiday, then the deadline for its submission is considered to be the first working day following it (clause 94 of Instruction No. 22).

The recipient of budget funds - a budget organization - submits financial statements (including Form 4) to the manager of budget funds (superior organization) (clause 87 of Instruction No. 22).

According to paragraph 91 of Instruction No. 22, managers of budgetary funds, based on the indicators of the accounting reporting forms of recipients of budgetary funds, prepare consolidated financial statements (including a summary in Form 4) by summing up the indicators of the same name in the corresponding lines and columns with the exclusion of interrelated indicators for consolidated positions.

Following the norms of paragraph 90 of Instruction No. 22, the consolidated financial statements are made up of:

- managers of budget funds who have separate structural divisions allocated to an independent balance sheet;

- managers of budget funds with subordinate budget organizations, etc.

Managers of republican budget funds submit financial statements to the Ministry of Finance, and managers of local budget funds submit financial statements to the local financial authority.

Managers of budget funds submit consolidated financial statements with a covering letter in a separate folder in bound form (clause 92 of Instruction No. 22).

Formation of Form 4 indicators

General provisions

The methodology for generating Form 4 indicators is defined in Chapter 7 of Instruction No. 22.

Please note that in accordance with Resolution No. 112, Form 4 is presented in a new edition.

Resolution No. 112 came into force on February 1, 2021, therefore Form 4 in the new edition was used for the first time when preparing financial statements for the first quarter of 2021.

According to clause 49 of Instruction No. 22, Form 4 is drawn up for each source of income (according to the income subsection of the income classification) in accordance with the functional, program (when using the program-target method in the budget process), economic classifications and the corresponding departmental classification, as well as a summary of Form 4 for the budgetary organization as a whole.

Managers of budget funds, on the basis of data from the financial statements of budgetary organizations, draw up Form 4 as part of the consolidated financial statements for each source of income (according to the income subsection of the income classification) in accordance with the functional, economic classifications and chapters of the corresponding departmental classification, as well as a summary of Form 4 as a whole on the manager of budget funds (clause 50 of Instruction No. 22).

The classification of budget revenues is established in accordance with Appendix 1 to Resolution of the Ministry of Finance dated December 31, 2008 No. 208 “On the budget classification of the Republic of Belarus” (hereinafter referred to as Resolution No. 208). Functional classification of budget expenditures by type (indicating codes and names of sections, subsections and types of functional classification of budget expenditures), program classification of budget expenditures, departmental classification of republican budget expenditures, economic classification of budget expenditures are established by Resolution No. 208 and are given respectively in Appendices 2, 4 , 5, 6. Departmental classifications of expenditures of the relevant local budgets are established by local executive and administrative bodies in the manner determined by the legislation of the Republic of Belarus (clause 8 of Instruction No. 22).

Changes in the financial statements (including Form 4), relating both to the reporting year and to previous periods, are made in the financial statements prepared for the reporting period in which distortions in its data were discovered (clause 16 of Instruction No. 22).

Expenses in Form 4 and in the estimate of income and expenses of extra-budgetary funds of budgetary organizations (hereinafter referred to as the estimate) are reflected in the following areas:

1) current expenses (costs) necessary to carry out income-generating activities;

2) expenses for paying taxes, fees (duties) and other payments payable to the republican and local budgets in accordance with the law;

3) use of the amounts of excess income over expenses remaining at the disposal of the budgetary organization.

The estimate is drawn up in accordance with Appendix 3 to the Instructions on the procedure for drawing up, reviewing and approving budget estimates, estimates of income and expenses of extra-budgetary funds of budgetary organizations, budget estimates of state extra-budgetary funds, as well as introducing changes and (or) additions to them, approved by the resolution of the Ministry of Finance dated 01/30/2009 No. 8.

According to clause 24 of the Regulations on the procedure for the formation of extra-budgetary funds, the implementation of expenses related to income-generating activities, the directions and procedure for using funds remaining at the disposal of a budgetary organization, approved by Resolution of the Council of Ministers dated July 19, 2013 No. 641 (hereinafter referred to as Regulation No. 641), the amount the excess of income over expenses remaining at the disposal of the budgetary organization is determined monthly for each source of income.

The calculation is made as follows: from the amount of income from business activities (from other income-generating activities), the amounts of taxes, fees (duties) and other obligatory payments paid to the relevant budget, state extra-budgetary funds, and actual expenses within the budget are subtracted.

The amount of excess income over expenses remaining at the disposal of the organization is used for purposes in accordance with clause 25 of Regulation No. 641.

The procedure for reflecting in accounting the use of extra-budgetary funds in terms of the amount of excess income over expenses remaining at the disposal of budgetary organizations for the purposes provided for in paragraph 25 of Regulation No. 641 is determined by letter of the Ministry of Finance dated January 28, 2014 No. 15-1-19/75 (see table below).

Accounting for the use of excess income over expenses remaining at the disposal of budgetary organizations

| No. | Contents of a business transaction | Subaccount correspondence | |

| debit | credit | ||

| 1 | Using the amount of excess income over expenses remaining at the disposal of the organization | 411 | 178, 180, 250, 260, etc. |

| 2 | Monthly write-off of the used amount of excess income over expenses remaining at the disposal of the organization, reflected in the debit of subaccount 411 “Use of profit” | 410 | 411 |

Methodology for forming individual indicators

Column 4 “Approved according to the estimate for the year” of Form 4 reflects the indicators of the approved estimate for the year.

Planned indicators in Form 4 must correspond to the approved estimates, taking into account changes made in the reporting period in the prescribed manner (clauses 15, 51 of Instruction No. 22).

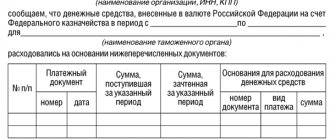

Column 5 “Executed by bank account” of Form 4 in accordance with clause 52 of Instruction No. 22 reflects:

1) the amount of balances of extra-budgetary funds at the beginning of the year and the end of the reporting period (lines 001 “Balance of funds at the beginning of the year” and 066 “Balance of funds at the end of the reporting period”). The summary data of these lines must correspond to the bank statement, cash balances, as well as balance sheet data for bank accounts for extra-budgetary funds;

2) the amount of receipts for the reporting period, incl. the amounts of advances received, minus the amounts returned (line 002 “Income”);

3) the amount of differences arising when recalculating the value of assets and liabilities expressed in foreign currency, funds at the official exchange rate of the official monetary unit of the Republic of Belarus in relation to the corresponding foreign currency established by the National Bank, on the date of the business transaction in foreign currency, as well as on the reporting date (line 003 “Sources of financing (differences arising when converting the value of assets and liabilities expressed in foreign currency into the official monetary unit of the Republic of Belarus)”). Line 003 in Form 4 was introduced by Decree No. 112 from February 1, 2017;

4) the amount of cash expenses incurred in the reporting period for the relevant items, sub-items and elements of expenses of the economic classification of budget expenses (lines 004–047, 051–065).

From clause 52 of Instruction No. 22 it follows that the indicator on line 002 “Income” of column 5 “Executed on a bank account” must correspond to the amount of the difference between the debit and credit turnover of subaccounts 111 “Current account for extra-budgetary funds” and 118 “Current foreign currency account for extra-budgetary funds."

The content of the indicator reflected in line 002 of column 5 differs significantly from the concept of income (revenue) from income-generating (entrepreneurial) activities reflected in subaccount 237 “Other sources” and subaccounts of account 28 “Sales”.

Currently, budgetary organizations, when carrying out income-generating (entrepreneurial) activities, revenue from the sale of products, goods, performance of work, provision of services, and other income must be recognized in accounting on an accrual basis. The accrual method refers to the reflection of business transactions in accounting and reporting in the reporting period in which they were actually completed, regardless of the date of settlements for them. The above is determined by clause 1 of the resolution of the Ministry of Finance dated 02/08/2013 No. 11 “On some issues of accounting for income in budgetary organizations and introducing amendments and additions to some resolutions of the Ministry of Finance of the Republic of Belarus.”

The accrual principle is one of the principles of accounting and reporting established by paragraph 1 of Art. 3 of the Law of July 12, 2013 No. 57-Z “On Accounting and Reporting” (hereinafter referred to as Law No. 57-Z).

In connection with the introduction of line 003 into Form 4 (see above), let us recall the legal norms related to the recalculation of the value of assets and liabilities expressed in foreign currency into the official monetary unit of the Republic of Belarus.

Differences arising when converting assets and liabilities expressed in foreign currency into Belarusian rubles are applied by budgetary organizations to increase or decrease sources of financing in the manner established by law (clause 3 of Article 12 of Law No. 57-Z).

The procedure for converting assets and liabilities expressed in foreign currency into Belarusian rubles and reflecting exchange rate differences in accounting is determined by the Methodological Instructions on the procedure for accounting for funds by organizations financed from the budget, approved by Order of the Ministry of Finance dated December 17, 1999 No. 364 (hereinafter referred to as the Methodological Instructions No. 364) .

In accounting and reporting, foreign currency and funds acquired with foreign currency, receivables and payables are reflected in Belarusian rubles at the National Bank exchange rate on the date of the transaction, as well as on the date of preparation of the financial statements. The difference that arises when the National Bank changes foreign currency exchange rates is credited by budgetary organizations to increase or decrease the budgetary or extra-budgetary source of financing (clause 8 of Methodological Instructions No. 364).

Guidelines No. 364 should be applied taking into account the norm of paragraph 3 of Art. 12 of Law No. 57-Z, according to which no recalculation of received and issued advances, prepayments, and deposits expressed in foreign currency is carried out.

Liabilities and assets in foreign currency as of the reporting date are recalculated at the exchange rate of the last calendar day of the reporting period (clause 2 of Article 101 of the Budget Code).

From the above it follows that for transactions carried out through income-generating (business) activities, exchange rate differences should be charged to the debit (credit) of subaccount 410 “Profits and losses” or subaccount 237 “Other sources”.

Column 6 “Actually completed” of Form 4 reflects the balances of subaccounts 237 “Other sources”, 238 “Borrowed funds”, 280 “Sales of products (work, Profits and losses”) of the balance sheet liability, taking into account unwritten expenses and losses in subaccounts 080 “Costs” for production", 082 "Costs on research and development work under contracts", 211 "Expenditures on extra-budgetary funds", 212 "Expenditures on extra-budgetary funds on capital investments", 410 "Profits and losses" of the balance sheet asset (clause 53 of Instruction No. 22).

According to paragraph 21 of Instruction No. 22, the balance sheet as of January 1 of the following year is drawn up after the annual conclusion of accounts. The annual conclusion of accounts means the reflection in the accounting of final entries on the write-off of actual expenses incurred during the current reporting year, both at the expense of the budgetary source of financing and at the expense of extra-budgetary sources.

The norm of paragraph 21 of Instruction No. 22 that the write-off of expenses when carrying out income-generating (entrepreneurial) activities is carried out at the end of the year, contradicts the provisions of the Instruction on the procedure for accounting expenses in budgetary organizations, approved by Resolution of the Ministry of Finance dated December 31, 2009 No. 157 (hereinafter - Instruction No. 157).

According to clause 11 of Instruction No. 157, expenses for extra-budgetary funds (in an amount equal to the actual cost of manufactured products, work performed, services provided) are written off without any reservations on a monthly basis (in subsidiary rural and educational experimental farms - at the end of the year).

Due to the seasonal nature of production in subsidiary rural and educational experimental farms, all calculations related to the calculation of the actual cost of agricultural products are made only at the end of the year, therefore expenses are written off at the end of the year.

However, despite the fact that in subsidiary agricultural farms the actual cost of agricultural products is determined at the end of the year, accounting for these products (release from production, shipment to customers, use for the organization’s own needs) is carried out throughout the year (as these operations are carried out). The above-mentioned operations during the year are reflected in accounting at planned cost and are adjusted to actual cost only at the end of the year after reporting calculations have been compiled.

From the above it follows that at the end of the year only the difference between the actual cost of agricultural products produced and its planned cost is subject to write-off.

It should also be noted that Instruction No. 22 does not include in the concept of annual accounts the write-off of the financial result from the sale of products (works, services) and other material assets.

Therefore, budgetary organizations have the right to write off financial results (profit or loss) monthly or at the end of the year (in accordance with accounting policies).

The amount of profit is reflected in the accounting entry:

D-t subaccount. 237 “Other sources”, 280 “Sales of products (work, Profit and loss”).

The amount of the loss is reflected in the reverse accounting entry:

D-t subaccount. 410 "Profits and losses"

Set of subaccounts 237 “Other sources”, 280 “Sales of products (works, Profits and losses”. Such an accounting methodology can be provided for in the accounting policy of the organization. When using it, subaccounts for accounting for sold products (works), and 280 “Sales of products (works, services)” ) must be closed monthly and there should be no balances on these subaccounts in the balance sheet.

Anna Chernyuk, associate professor

Operations (current operations)

Cash flow for current operations is the result of the company’s main activities, which generates the organization’s revenue, i.e. affects the formation of net profit (or loss). Examples of cash flows from operating activities:

- settlements with suppliers of goods and services;

- settlement of wages with employees;

- payment of insurance premiums;

- receipt of funds from the sale of goods/provision of services, etc.

Providing funds and making advances to financial institutions also qualify as current transactions because This is the company's activity that generates revenue.

There are also two methods for reporting on operating activities:

- direct method (used in Russian organizations, based on revenue from sales of products and includes cash inflows and outflows);

- indirect method (practised by foreign companies, it involves analyzing changes in balance sheet items).

Each method has its own strengths and weaknesses. The direct method very simply, logically and accessiblely reflects the inflow and outflow of funds and shows the organization’s ability to cover current expenses. But this method, unlike the indirect one, does not allow one to compare cash flow from operating activities and net profit, and this can distort the company’s performance results. With the indirect method, all items of assets and liabilities are used, which also allows you to track sources of financing, as well as the state of your own working capital.

Form 4 financial statements: structure and content

ODDS consists of 3 sections reflecting monetary transactions in the main areas of the company’s activities - current, financial, investment.

To avoid duplication of data and an unreliable increase in turnover, financial movements occurring within the enterprise (for example, currency exchange transactions, transfers between accounts) are not included in the report.

In the ODDS, all amounts are recorded regardless of the currency of payment or receipt - they are converted into Russian rubles at the current exchange rate.

The indicators of the reporting year are indicated in comparison with the data of the previous year, which clearly reflects the movement of flows in absolute values for a particular item. Amounts that reduce revenues and expenses are placed in parentheses.

The structure of all three sections of the report is identical - the first lines are allocated to the data on receipts from the relevant areas of activity, then the amounts of expenses incurred are entered and, in conclusion, the balance of funds for the section is displayed.

Investment activities

A report on this type of activity allows you to estimate the amount of expenditure on resources that will create income and generate cash flows in the future. Investment activities include transactions with non-current assets and investments that are not cash. Here are some examples of flows for investment activities:

- purchase of non-current assets;

- receipt of funds from the sale of non-current assets;

- payments for the acquisition of shares, shares in other companies;

- receipt of funds from the sale of shares of other companies;

- lending to other organizations, etc.

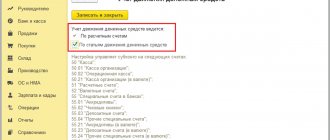

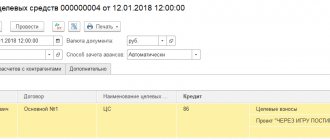

Generating a cash flow report

The form is filled out according to the rules established by PBU 23/2011. Here are some of them:

- revenue and payments to suppliers and contractors are included in the appropriate lines without indirect taxes (VAT, excise taxes);

- indirect taxes are reflected in a collapsed manner (letter of the Ministry of Finance dated January 27, 2012 No. 07-02-18/01). For example, incoming VAT is subtracted from outgoing VAT: a positive difference is reflected in line 4119 “Other receipts”, a negative difference is reflected in line 4129 “Other payments”;

- the amount of remuneration of employees includes personal income tax and insurance contributions (line 4122);

- separate lines are allocated for income tax;

- for other taxes and fees, the subject has the right to add a line, for example, with code 4125 and the name “Other taxes and fees”. This will include all mandatory payments, except for indirect taxes, personal income tax, insurance premiums and income tax.

Financial activities

The implementation of financial activities affects the capital structure, as well as borrowed funds of the company. This happens by attracting financing (for example, on an equity or debt basis). A complete list of transactions that relate to financial activities can be found in paragraph 11 of PBU 23/2011. Here are some of them:

- payment of dividends to owners of company shares;

- income from the issue of shares (as well as bills, mortgages, etc.);

- receipt of funds under finance lease;

- repayment of company loans, etc.

If the cash flow does not relate to any of the above areas (current, investing or financing activities), then it is classified as operating (current) activities.

Accounting Form 4: document version updated

Reporting form No. 4 was approved by Order of the Ministry of Finance No. 66n dated July 2, 2010 and is periodically transformed by legislators. Thus, by order of the Ministry of Finance of the Russian Federation No. 61n dated April 19, 2019, the ODDS was again subject to changes. They all relate to the header part of the document:

- The word “according to OKVED” is replaced with “according to OKVED2”;

- Units in “millions” are excluded. rub." and, accordingly, code 385, you have to fill out the ODDS only in thousand rubles;

- OKUD document code 0710004 has been changed to 0710005.

The tabular part of Form 4 of the financial statements in 2021 remained unchanged. The legislator obliges the use of the updated version for reporting for 2021, but it is not forbidden to form the ODDS according to the newly approved version for 2021. The balance sheet, financial results report and other forms (3, 4, 6) of financial statements must be submitted to the Federal Tax Service no later than 03/31/2020. Let us remind you that it is no longer necessary to submit accounting reports to Rosstat - from 01/01/2020, the maintenance of the state accounting information resource is entrusted to the tax authorities.

When filling out the ODDS, you should take into account the provisions of PBU 23/2011.

Cash Flow Statement: Example

As an example, consider Finist LLC, which is engaged in the wholesale trade of cars.

Here are the main indicators that served as data sources for filling out the lines of the DDS report for 2021:

| Index | Amount, thousand rubles | Line, amount thousand rubles. | Reflected amount, thousand rubles. |

| Current Operations | |||

| Revenue from the sale of cars, incl. VAT 20% | 150 000 | 4111 | 125 000 |

| Receiving funds from renting out property, incl. VAT 20% | 600 | 4112 | 500 |

| Payment to suppliers, incl. VAT 20% | 90 000 | 4121 | 75 000 |

| VAT (shown collapsed) | Outgoing: (150,000 + 600) x 20 / 120 = 25,100; Incoming: 90,000 x 20 / 120 = 15,000 | 4119 | 10 100, because outgoing VAT is greater than incoming VAT: 25,100 – 15,000 = 10,100 |

| Salary | 18 200 | 4122 | 18 200 |

| Income tax | 6 800 | 4124 | 6 800 |

| Other taxes (property tax) | 250 | 4125 (added by Finist LLC independently) | 250 |

| Receipt total | X | 4110 | 135 600 (125 000 + 500 + 10 100) |

| Payment summary | X | 4120 | 100 250 (75 000 + 18 200 + 6 800 + 250) |

| Balance by block of transactions | X | 4100 | 35 350 (135 600 – 100 250) |

| Investment operations | |||

| The loan issued in 2021 was returned to the company | 5 000 | 4213 | 5 000 |

| Dividends received from participation in other organizations | 1 200 | 4214 | 1 200 |

| A new building was purchased, payment includes VAT 20% | 12 000 | 4221 | 10 000 |

| Shares of a third-party organization were purchased | 2 000 | 4222 | 2 000 |

| VAT on the purchased building is reflected | 2 000 | 4229 | 2 000 |

| Receipt total | X | 4210 | 6 200 (5 000 + 1 200) |

| Payment summary | X | 4220 | 14 000 (12 000 + 2 000) |

| Balance by block of transactions | X | 4200 | (7 800) (6 200 – 14 000) |

| Financial operations | |||

| A contribution to the authorized capital of a new participant was received | 200 | 4312 | 200 |

| Dividends paid to founders | 13 000 | 4322 | 13 000 |

| Receipt total | X | 4310 | 200 |

| Payment summary | X | 4320 | 13 000 |

| Balance by block of transactions | X | 4300 | (12 800) (200 – 13 000) |

In the example under consideration of filling out a cash flow statement for 2021, Finist LLC looks like a completely successful enterprise: a positive result from current activities allows the company to purchase a new building and pay off the owners, i.e. cover the negative balance on investment and financial transactions.

The DDS report ends with the lines:

- 4400 – total balance for the year: 35,350 – 7,800 – 12,800 = 14,750;

- 4450 – balance of cash and cash equivalents at the beginning of the year: 9,870;

- 4500 – balance of cash and cash equivalents at the end of the year: 9,870 + 14,750 = 24,620.

As of December 31, 2020, at the cash desk and in the accounts of Finist LLC - 24,620 thousand rubles.