Features of returning money to the cash desk by an accountable person

Organizations (IP) can issue funds on account in two ways:

- transfer to an employee’s account or corporate card (letter of the Ministry of Finance of the Russian Federation dated October 5, 2012 No. 14-03-03/728);

- issuing cash (directive of the Bank of Russia “On the procedure for conducting cash transactions...” dated March 11, 2014 No. 3210-U).

If an employee has not used all the accountable money issued to him, he must return it within the time period established for this by the employer (clause 6.3 of instruction No. 3210-U).

The amount of the refunded amount is determined based on the results of verification and approval of the advance report on the amounts spent. Such a report must be drawn up no later than the number of working days approved by the organization from the expiration date for which the money was issued (clause 6.3 of instruction No. 3210-U).

ATTENTION! From November 30, 2020, the requirement to submit a report within 3 working days has been canceled.

From November 30, 2020, other changes to reporting and cash register came into effect. ConsultantPlus experts spoke in more detail about the innovations. Get trial access to the K+ system and go to the review material for free.

The issuance period is fixed in the application drawn up by the employee for the issuance of an advance, or in the employer’s administrative document on the issuance of money on account. From 08/19/2017 (instruction of the Bank of Russia dated 06/19/2017 No. 4416-U), the completion of an application by an employee is no longer a mandatory condition for the payment of accountable amounts. It can be carried out on the basis of an administrative document of the head of the legal entity (or individual entrepreneur).

You will find an example of such a document in ConsultantPlus. Trial access to the legal system is free.

IMPORTANT! Directive No. 3210-U applies its rules only to the rules for issuing and returning funds in cash. For non-cash payments for accountable amounts, its provisions do not apply, and an employer using this method must approve the procedure for settlements with accountables by an internal document.

Rationale

In accordance with paragraph 1 of Article 1.2 of the Federal Law of May 22, 2003 N 54-FZ “On the use of cash register equipment when making payments in the Russian Federation” (hereinafter referred to as Federal Law N 54-FZ), cash register equipment included in the control register - cash register equipment (hereinafter referred to as cash register equipment), is used on the territory of the Russian Federation without fail by all organizations and individual entrepreneurs when making payments, except in cases established by Federal Law No. 54-FZ.

According to the provisions of Article 1.1 of Federal Law N 54-FZ, settlements for the purposes of this Federal Law are the acceptance (receipt) and payment of funds in cash and (or) by bank transfer for goods, work, services, acceptance of bets, interactive bets and payment of cash funds in the form of winnings when carrying out activities related to organizing and conducting gambling, as well as accepting funds when selling lottery tickets, electronic lottery tickets, accepting lottery bets and paying out funds in the form of winnings when carrying out activities related to organizing and conducting lotteries. Settlements also mean the acceptance (receipt) and payment of funds in the form of prepayment and (or) advances, offset and return of prepayment and (or) advances, provision and repayment of loans to pay for goods, works, services (including lending to citizens by pawnshops on the security of things belonging to citizens and activities for storing things) or providing or receiving other consideration for goods, work, services.

The issuance and return of funds against a report does not fall under the concept of settlement. Accordingly, CCT is not used either when issuing funds on account, or when returning them by an accountable person.

This, in particular, is stated in the Letters of the Ministry of Finance dated 10/01/2018 N 03-01-15/70143, dated 08/10/2018 N 03-01-15/56554, dated 08/05/2019 N 03-01-15/58816) .

Do not give out money from prohibited sources

You can issue money on account only from cash proceeds. The new rules for cash payments prohibit the issuance of money to accountants from other sources (Central Bank Directive No. 5348-U dated December 9, 2019). For example, due to borrowed funds received at the cash desk, and even due to returned accountable amounts. They must first be handed over to the bank.

Previously, returned accountable amounts could be given to another employee for reporting purposes and even as a salary. Now the advance returned by the accountant must be handed over to the bank. If you do not do this, you will violate the rules of cash payments (see letter of the Central Bank dated July 9, 2021 No. 29-1-1-OE/10561). Violation entails a fine of 40,000 to 50,000 rubles. under Part 1 of Article 15.1 of the Administrative Code.

It is allowed to issue loans only to microfinance and some other specialized organizations, for example, consumer cooperatives (clause 1 of the Guidelines).

Issue cash on account only from revenue. If it is not there, you need to withdraw money from your bank account. You can also switch to non-cash payments with subordinates.

Regulations on settlements with accountable persons

This document establishes uniform rules for the issuance of accountable funds by companies to their employees. It allows you to control the intended use of advance funds and correctly record expense documents in the organization’s accounting department.

The procedure for issuing accountable funds is as follows:

- Accountable money is provided only to employees of the organization included by the manager in the appropriate list of persons who have the right to receive and spend accountable money. The list of such employees is approved by order of the head of the company.

- All company employees with whom an employment contract has been officially signed are entitled to receive funds for travel expenses. A separate order is issued for each such employee, which is signed by the head of the enterprise.

Accountable persons are employees of the enterprise who received sums of money in advance.

The procedure for returning accountable funds is as follows:

- An employee who has received money for a business trip, business, or other needs of the enterprise is obliged to document the intended use of the advance and return the balance. The return of funds by an employee of a joint-stock company is carried out in one of the available ways: by depositing cash into the cash register, by wire transfer to the company's account, incl. using Internet banking of a credit institution.

- When using an online bank to return unused travel allowances or other advances issued for administrative expenses, the employer reimburses the employee for the commission charged for a wire transfer. To do this, the worker must submit certified copies of expense documents to the accounting department: a bank account statement and a payment order.

Money provided to employees for travel, representative, administrative and economic needs and other expenses of the company are accountable amounts (subaccounts).

Employees who receive these funds against signature are called accountable persons.

Certificate of return of funds at the cash desk: details of registration

Often during a work shift, cashiers develop a cash gap. This may be due to several reasons:

- The employee mistakenly entered an incorrect check (for example, the amount in the fiscal document is greater than the cost of the actual purchased goods).

- The cashier punched the receipt, but the client changed his mind about purchasing it - the situation is relevant for retail outlets, where they first pay for the purchase, and then release the products in the desired department.

- The buyer returns the goods directly on the day of purchase and is reimbursed from the operating cash register.

In all of the above cases, it is necessary to draw up an act f. KM-3. It is drawn up in a single copy when closing a shift and making a Z-report on the same day when the cash gap occurred. When conducting a tax audit, Federal Tax Service employees pay special attention to the correctness of the document and the supporting documents attached to it. Therefore, when designing, it is necessary to take into account some nuances.

The act of returning funds from the cash register is signed by a commission, which includes: the head of the company (branch manager), the head of the department, the senior cashier and the cashier. After signing, the cashier enters the total amount of the act (for all canceled fiscal documents) in gr. 15 register f. KM-4 (Cashier-operator's journal).

You must also attach incorrectly punched checks. For convenience, they can be glued to a sheet of paper. Each document must bear the signature of the manager and a stamp with Fr. The fiscal document is not always available. This may be because it was not presented by the buyer or was lost by the cashier.

In the first case, the client must write a statement indicating the reason why he was unable to present the check. The document is endorsed by the head of the outlet and attached to the act. If a cash register provides the ability to print information about a purchase, it can also be an application.

If a fiscal document is missing due to the fault of the cashier, but a decision is made not to punish him, then the employee only needs to write an explanatory note and draw up a sales report. In this case, Federal Tax Service employees can fine the entrepreneur for not posting the proceeds, but, based on judicial practice, the courts most often side with the businessman.

In the absence of supporting documents, tax authorities may equate this to illegal trafficking and bring both tax and administrative liability. However, in accordance with Part 1 of Art. 4.5 of the Administrative Code, a legal entity or individual entrepreneur cannot be held accountable after 2 months have passed from the date of the offense.

Preparation of accounting entries

When funds are received into the company's account, the corresponding accounting entries are made:

- Dt51, Kt71 - receipt of unused advances to the account.

- Dt52, Kt71 - receipt of unused advance funds to the foreign currency account.

- Dt73, Kt51, Kt52 - transfer to an employee of a bank commission withdrawn from him for a money transfer.

- Dt91, Kt73 - commission of a banking institution, taken into account in the company’s expenses.

In the first two cases, the organization's accountant carries out documents based on an extract from a banking institution. No additional documents are required.

Postings No. 3 and No. 4 are recorded in the accounting department only if the return of bank commissions is provided for by a local act (collective agreement) of a legal entity.

What to do with the transfer fee?

If a transfer fee was charged for a refund transaction, whether to reimburse it or not and accept it as expenses or not will depend on the wording in the organization’s local act on the procedure for reimbursement of travel expenses and in the local act on non-cash payments.

If the local regulations of the enterprise do not provide for a way to return an unspent advance through an online bank, as well as reimbursement of the bank’s commission for such a transaction, then the employer is not obliged to return to the employee the amount paid to the bank for the transaction.

Thus, a collective agreement or a local act of an organization may establish the types and amounts of reimbursable travel expenses, the procedure for their reimbursement, the procedure and method (cash and/or non-cash, including through online banking) of returning an unused advance, a list of documents accepted in confirmation of expenses (including in the form of a bank commission charged when returning an unspent advance through online banking).

An example of including in a local act a provision on the method of returning unused amounts to the organization’s current account:

The employer's local act may contain a provision on reimbursement to the employee for any expenses incurred with the permission or knowledge of the employer. In this case, the decision to reimburse the bank’s commission for returning money through online banking can also be made.

If reimbursement of the commission is provided for by local regulations, then the employer can take it into account in income tax expenses, like other expenses associated with production and (or) sales (clause 49, paragraph 1, article 264 of the Tax Code of the Russian Federation, Letters No. 03-03 -06/1/18005, No. 16-15/105572).

How funds are disbursed for reporting

The provision of money by the employing company to its employees for administrative, business, travel and other needs related to its work activities is standard practice. This procedure is regulated by Directive of the Central Bank of Russia No. 3210-U/11.03.14.

To minimize cash circulation, enterprises carry out non-cash payments to their employees. In 2013, the Russian Ministry of Finance confirmed the possibility of using debit and salary cards for payments of accountable funds (see letter No. 2-3-10/37209). All information is displayed in the act on the implementation of non-cash payments.

Many people are interested in whether it is possible to transfer unspent money to a bank account of an enterprise and in what time frame this can be done if the employer has transferred accountable money to a plastic card.

If an employee of an organization has not completely spent the accountable funds provided to him for economic and other needs or on a business trip, he must return the balance:

- before the expiration of the period for which the money was provided;

- immediately after a business trip, sick leave, vacation (1 working day), if the deadline for issuing a report falls within this period.

Issuing money on account is one of the most common operations.

Options for the return of advances are not specified in Russian legislation. Therefore, employees of enterprises can return the advance by wire transfers and cash to the cash desk. And if the company’s management has reduced cash transactions to a minimum, then returning funds by bank transfer to the organization’s account is the only way.

How is the amount of return of funds taken into account reflected in accounting?

The company, having received accountable amounts from the employee, reflects the following entries in accounting:

- Dt 50 Kt 71 - return of cash to the cash desk;

- Dt 51 Kt 71 - return of accountable amounts to the ruble bank account of the enterprise;

- Dt 52 Kt 71 - return of the sub-report to the company’s foreign currency account;

- Dt 94 Kt 71 - reflection of the debt of the accountable in case of non-repayment of the amounts issued by him.

For information on what to do if an employee does not have enough accountable funds, read the article “ What to do if an accountable person has spent his money? "

Return of accountable amounts to the current account, postings

Receipt of funds to the organization's current accounts in accounting is documented by the following transactions:

Dt 51 Kt 71 - unused accountable funds were received into the organization’s bank account.

Dt 52 Kt 71 - unused accountable funds were received in the foreign currency account of the organization’s company.

Dt 73 Kt 51, 52 - the amount of the bank commission for the transfer was returned to the employee.

Dt 91 Kt 73 - bank commission is recognized as an expense.

The last two entries are recorded in accounting if the local act of the enterprise stipulates the possibility of compensating the bank’s commission.

Personal income tax and contributions from accountable amounts without an advance report

If the trustees discover that the accountable person has not reported on the accountable amounts, you will have to pay additional personal income tax and insurance premiums.

There will also be a fine - 20% of the arrears.

Even the Armed Forces of the Russian Federation will not help (see Determination of February 3, 2021 No. 310-ES19-28047).

In addition, if the bank requests advance reports and there are none, it may block your Bank-Client system, as it will suspect prohibited transactions.

Therefore, if advance reports of accountable persons are not received on time, it is better to play it safe. Within a month after the expiration of the refund period, issue an order to withhold money, familiarize the employee with it and obtain his consent to return.

How to return funds from the account if an employee no longer works for you

If the current employee does not return the accountables, you will find recommendations for further actions in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

In a situation where the employee did not return the accountable money and quit, you can do the following:

- If the employee has not yet been paid, then the debt can be withheld from his salary, subject to the decision of the manager and the consent of the employee. In this case, the withholding should not exceed 20% of the salary (Article 138 of the Labor Code of the Russian Federation).

- If all settlements with the employee are terminated or he does not agree with the amount of withheld amounts, the debt can only be collected through legal proceedings.

To find out whether it is possible to delay the payment of funds due to an employee upon dismissal if he has not returned the accountable amounts, read the material “What payments are due to an employee upon dismissal”.

How to correctly return funds to the company account

Today, most employers transfer wages and advance funds to their employees on bank cards - plastic media. The employee then returns the unspent money to the employer to the company's account from the card account through the Internet banking account.

It is necessary to correctly return accountable funds to the current account.

The possibility of providing an advance and returning unused funds through a bank account or plastic media is fixed by a local act of the company. For example, the manager enters such monetary transactions into the company’s accounting policy and draws up a separate provision for the rules for the provision/return of advances by the persons in question.

An employee who returns money to the employer’s account through his personal online banking account indicates in the “Name of Payment” column that he is returning the balance of the money issued to him on account. This entry is necessary to avoid taxation on the refunded amount (excluding VAT, income tax for individual entrepreneurs, joint-stock companies).

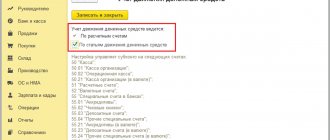

PKO return from an accountable person in 1C Accounting 3.0

The article will tell you how to use the document “Cash receipt order” to make a return from an accountable person in 1C: Accounting 3.0.

Let’s go to the “Bank and cash desk” tab and on the right side of the screen, in the “Cash desk” section, select “Cash receipt order”. The PQS journal will open; in order to create a new one, click the “Create” button, and the form for a new PQS document will open.

By default, the type of operation for a new cash receipt order is “Payment from the buyer,” but we will take the type of operation “Return from an accountable person,” so we will select it in the “Type of operation” field. Next, you need to select the accountable person who will return the money, the amount of the return, select the cash flow item (select “Return of funds by the accountable”), and in the basis field we will also write the line “Return of funds by the accountable.” In the “Application” field, write the document on which this operation is carried out (can be left blank).

All required fields have been filled in and you should now submit the document by clicking the corresponding button on the top panel. PKO with the transaction type “Return from an accountable person” makes entries 50.01 - 71.01 for the amount of the transaction. By clicking on the “Print” button, the document can be printed.

Video:

Determining the amount of advance for a business trip

The amount of the advance is determined independently by the organization, taking into account the duration of the business trip, the norms of expenses for renting housing, daily expenses, as well as the cost of travel to the destination and back. The amount of daily allowance and standards must be specified in a collective agreement or in the local regulations of the organization.

Currently, the daily allowance is set at 700 rubles for trips within Russia and 2,500 rubles for trips abroad. Please note that the organization has the right to set the amount either less or more than the established amounts. The question is about additional taxes on daily allowances, so if these amounts are exceeded, income tax will be charged to the employee.

What happens if the daily allowance is less than 700 rubles? Daily allowances can be set in a smaller amount; the organization has such a right. The established norms do not oblige them to be adhered to; the established value affects taxation. However, you should take a reasonable approach to determining the amount of daily allowance, because an employee leaves on a train to perform the organization’s tasks, and not of his own free will, and setting small amounts means that he will have to spend his personal money on food, travel, etc.

Read more about how to send an employee on a business trip under the new rules here.