What to consider when reflecting indirect expenses in the accounting policy

There are few such requirements in the legislation. Among them:

- Firms using the accrual method are required to establish a list of indirect expenses in their accounting policies (AP) (companies accounting for income and expenses on a cash basis do not have such an obligation).

- Complete independence of the company in choosing a set of indirect costs: the legislation does not contain strict restrictions in this matter. At the same time, the distinction between direct and indirect costs must be justified and not contradict the Tax Code of the Russian Federation.

- The main guideline for classifying expenses as indirect is that established in Art. 318 of the Tax Code of the Russian Federation, a list of direct expenses, and all other expenses of the company (excluding non-operating expenses) automatically form a list of indirect expenses.

ATTENTION! From 2021, all organizations are required to apply the new FSBU 5/2019 “Inventories”, according to which the actual cost will include direct and indirect costs. The organization will have to separate them independently. Indirect costs will need to be distributed between types of products, works, and services. The distribution method must be established in the accounting policy.

- An important classification feature of indirect costs is the degree of relationship with the production process: the weaker this connection, the more justified is the inclusion of a particular expense as an indirect expense.

- The main sign of indirect expenses is a quick write-off to the financial result at the end of the reporting period.

- Distribution of indirect costs is a process relating to a portion of indirect costs related to several reporting periods (“insurance” costs, R&D costs, advertising).

Read about some of the nuances of dividing costs into direct and indirect in the articles:

- “How to divide income tax expenses into direct and indirect?”;

- “How to take into account direct and indirect expenses in tax accounting”.

Let us dwell on the nuances of reflecting certain types of indirect costs in the UE.

Sample reflection of indirect costs in an accounting policy order

Letter No. 24-11/50004 of the Department of Tax Administration of the Russian Federation for the city of Moscow dated July 28, 2004 states that the taxpayer establishes the procedure for maintaining separate accounting of expenses independently on the basis of Order of the Ministry of Finance of the Russian Federation dated December 9, 1998 No. 60n “On approval of accounting regulations “Accounting policy of the organization” PBU 1/98.” The established procedure is annually formalized by order of the head of the organization, the integral applications of which are the methodology for separate cost accounting and the working chart of accounts (sub-accounts).

Accounting policy for tax purposes

This term is mentioned in many articles that discuss certain issues of taxation and tax accounting, which, in turn, are subject to reflection in accounting policies for tax purposes.

In addition, it is advisable to approve in this accounting policy solutions to certain issues that were not disclosed when regulating settlements with the budget for a particular tax or do not have an unambiguous interpretation. Tax policy, like accounting policy, is approved by the relevant order or order of the head of the institution (organization) and is applied from January 1 of the year following the year of its approval.

In this case, the tax policy adopted by the newly created legal entity is approved no later than the end of the first tax period, and is applied from the date of creation of the organization or institution. 12 tbsp. 167 Tax Code of the Russian Federation)

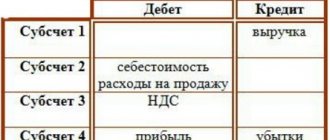

Formation of accounting policies: recognition of income and expenses

In other words, if, as a result of a completed transaction, the organization has already received or will receive in the future money or any property that it does not have to return, or if, say, its debts have been forgiven, this is income.

Upon receipt of such amounts, a creditor's account should be formed

Accounting for direct and indirect costs

These include, in particular, costs:

- remuneration of main production workers (with deductions);

- purchased products and semi-finished products;

- for raw materials and basic materials;

- fuel and electricity;

- depreciation of production equipment.

Indirect costs Indirect costs are costs that are associated with the production of several types of products (works, services).

They cannot be directly attributed to a specific type of product. Therefore, they are distributed by type of product indirectly (conditionally) according to the indicators provided for in the organization’s accounting policies, using pre-calculated coefficients. Indirect expenses include general production and general business expenses.

Reflection of indirect expenses in accounting policies - sample

318 of the Tax Code of the Russian Federation, a list of direct expenses, and all other expenses of the company (excluding non-operating expenses) automatically form a list of indirect expenses.

- An important classification feature of indirect costs is the degree of relationship with the production process: the weaker this connection, the more justified the inclusion of a particular expense among indirect costs.

- The main sign of indirect expenses is a quick write-off to the financial result at the end of the reporting period.

- Distribution of indirect costs is a process relating to a portion of indirect costs related to several reporting periods (“insurance” costs, R&D costs, advertising).

Read about some of the nuances of dividing costs into direct and indirect in the articles:

Let us dwell on the nuances of reflecting certain types of indirect costs in the UE.

Considering that the specifics of different companies

Regulations on accounting policies for 2015: indirect expenses in tax policy (Avdeev V.V.)

318 of the Tax Code of the Russian Federation contains only the recommended composition of direct costs, according to which the following can be taken into account: - material costs for the acquisition of raw materials and (or) materials used in the production of products and (or) forming its basis or being a necessary component in its production; - material costs for the acquisition of components undergoing installation and (or) semi-finished products undergoing additional processing from the taxpayer; - costs of remuneration of key personnel involved in the production process; - costs of compulsory pension insurance, used to finance the insurance and savings parts labor pension, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against accidents

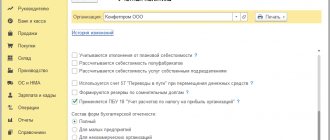

Accounting policy of a production organization

Together with the accounting policy of the organization, the following should be approved: for accounting purposes - a working chart of accounts, forms of primary accounting documents, accounting registers, the procedure for conducting an inventory of assets and liabilities, a document flow schedule; for tax accounting purposes - tax register forms on the basis of which the production organization will calculate taxes.

Free legal assistance

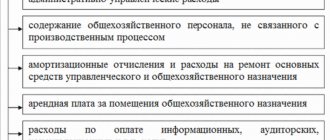

Indirect costs for income tax: list Indirect costs include, for example:

- depreciation of fixed assets for general production and general economic purposes;

- other expenses associated with production and sales (Article 264 of the Tax Code of the Russian Federation).

- expenses for remuneration of employees, except for those employed in the production process, as well as contributions to extra-budgetary funds from these expenses;

- expenses for compulsory and voluntary insurance;

- material costs. These may include materials used to package goods; purchased equipment and workwear; expenses for the purchase of fuel and water used for technological purposes; purchased production services;

Tax Code of the Russian Federation. The list of R&D expenses is not exhaustive, since the legislator allows them to include other expenses directly related to R&D,

Accounting policy: divide expenses into direct and indirect

It is clear that tax officials are closely monitoring this distribution in order to prevent an arbitrary reduction in the amount of tax transferred to the budget (by overestimating indirect costs).

Therefore, the taxpayer must clearly understand which expenses (and, most importantly, why) he classified as indirect and which as direct. You can clearly state your position on this issue in your accounting policy. Who shares the expenses First, let's decide who should think about the distribution of expenses.

Here we can immediately distinguish two categories of taxpayers for whom this section in the accounting policy is not relevant. Firstly, the rules for allocating expenses into direct and indirect can only be used by those organizations that operate on the accrual basis.

Source: https://advokatssr.ru/obrazec-otrazhenija-kosvennyh-zatrat-v-prikaze-po-uchetnoj-politike-12148/

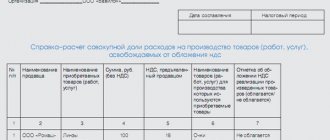

What a sample list of indirect expenses might look like in an accounting policy

Considering that the specifics of different companies are reflected in the types and ratio of direct and indirect costs established in the management program, there is no universal model for such a list.

Nevertheless, it is possible to identify a universal list of indirect costs that may be present in the management programs of many companies. For example, such a list in the UP of a manufacturing company may look like this:

Indirect costs include the following:

- of a communal nature: for heating, lighting and water supply of the administrative building;

- depreciation of buildings used for administrative and managerial needs according to the list specified in the appendix to the accounting policy;

- for wages (including contributions for social needs) of support workers and administrative and management personnel;

- for advertising in the media;

- for rental of transport for administrative needs;

- for the purchase of office supplies and hygiene products;

- entertainment and other expenses (except for direct and non-operating expenses).

To find out whether it is possible to reduce the list of direct expenses and expand the list of indirect expenses, read the material “List of direct income tax expenses” .

A sample of registration of costs in the accounting policy of a manufacturing enterprise on OSNO was prepared by ConsultantPlus experts. To do everything right, get trial access to the K+ system and study the material for free.

Extract from the accounting policy of indirect costs of a trading organization sample

Accounting documents Expand the list of categories September 1 - September 25 Subscribe to a special free weekly newsletter to keep abreast of all changes in accounting: Join us on social media.

networks: VAT, insurance premiums, simplified tax system 6%, simplified tax system 15%, UTII, personal income tax, penalties We send letters with the main discussions of the week > > > Tax-tax June 24, 2021 12636 Extract from the accounting policy - a sample of it may be required by a business entity to respond to request from tax authorities or counterparties. We will tell you how to draw up a document with this name in our material.

An extract from the accounting policy is a document that almost all organizations and entrepreneurs have to deal with.

The main properties of the extract: brevity - the ability to present

Direct and indirect costs

5017 FORUM!

pages Any organization that produces products and/or sells them has costs. If an entrepreneur uses the accrual method in determining profits and costs, then the Tax Code in Art.

318 and 320 require expenses to be divided according to their relation to direct or indirect.

- What is the meaning of this division from a tax point of view?

- Who makes the final decision in this matter – tax authorities and entrepreneurs?

- Which costs are considered direct and which are classified as indirect?

- Is this separation always necessary?

Let us clarify in this material. The distribution of an organization's expenses on this basis is important for internal accounting policies, since it directly affects taxation.

They are included in the tax base when calculating income tax.

Formation of accounting policies in a trade organization

> > > Tax-tax November 29, 2021 7846 The accounting policy of a trade organization is its main document that establishes the procedure for maintaining records, both accounting and tax. The accounting policy of a trading organization reflects those accounting aspects that allow the possibility of their selection from several options.

Regardless of the specialization of a trading company (for example, wholesale or retail), the accounting policy (hereinafter referred to as the UP) must contain some introductory information: the applied taxation system; methods of organizing accounting and tax accounting; possible deviations from generally established accounting rules allowed by regulations (for example, small businesses can apply a simplified procedure for reflecting expenses on loans and borrowings in accounting and reporting,

Direct costs in trade: their own characteristics

The article from the magazine “MAIN BOOK” is current as of April 15, 2019 L.A. Elina, economist-accountant It's time to talk about writing off expenses directly related to trading activities.

For trade, the Tax Code has established special rules, as well as its own list of direct expenses:

- transportation costs for delivering goods to the warehouse of a trading organization (if such costs are not included in the cost of purchasing goods).

- cost of goods;

The remaining expenses (except for non-operating expenses) are considered indirect and are immediately written off when calculating the “profitable” base.

These are, for example, import customs duties and taxes paid (not included in the price of the goods themselves) or pre-sale preparation costs. And there is no choice here.

Trade organizations cannot expand the list of direct expenses, because then the “profitable” base of the current period will suffer.

But they have the right to choose where to allocate other (non-transport) expenses associated with the purchase of goods.

An example of an organization's accounting policy for tax purposes (services, OSNO)

When needed: when developing accounting policies in an organization that operates in the service sector.

The sample will help you choose the best options for determining the tax base or paying a specific tax from those allowed by tax legislation.

Source: https://strahovanie-rf.ru/vypiska-iz-uchetnoj-politiki-kosvennye-rashody-torgovoj-organizacii-obrazec-24798/

Accounting policy for tax purposes.

Samples

Reason: Decree of the Government of the Russian Federation of January 1, 2002 No. 1

“On the Classification of fixed assets included in depreciation groups”

, paragraph 1 of Article 258 of the Tax Code of the Russian Federation.

5. The useful life of used fixed assets is determined equal to the period established by the previous owner, reduced by the number of years (months) of operation of these fixed assets by the previous owner.

Reason: paragraph 2 of Article 258 of the Tax Code of the Russian Federation. 7. Depreciation for all objects of depreciable property (fixed assets and intangible assets) should be calculated using the straight-line method.

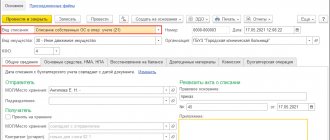

What does a sample extract from an accounting policy look like?

: Accounting Must record all business transactions carried out at the enterprise All types of transactions must be taken into account in the periods when they were completed Business transactions Reflected in tax and accounting, regardless of their legal registration As mentioned above, accounting policies are drawn up on the basis of a standard form , which is updated from year to year. The following documents are attached to the finished document: (clause 4.

PBU 1/2008):

- Methodology for accounting for company assets and liabilities.

- Conducting control over operations.

- The procedure for document flow.

- Chart of accounts and inventory procedure.

- Internal and primary accounting documents (forms).

- Accounting registers.

If an enterprise changes its accounting policy, then it should do this at the beginning of the year - from the moment the accounting of business transactions begins ().

Nuances of advertising expenses in accounting policies

The inclusion of advertising costs in the list of indirect costs is a common situation for many companies, regardless of the specifics, scale and other features of their activities.

Read about how the tax system affects the recognition of advertising expenses in the following articles:

- “How to take into account advertising costs under the simplified tax system”;

- “Income tax: standardized and non-standardized advertising costs”.

In the UE, this type of indirect costs requires the following detail:

- list of documents (agreement for the provision of advertising services, price agreement protocol, work completion certificate, marketing policy, protocols, orders);

- differentiation of types of advertising for tax accounting purposes - non-standardized (in the media, the Internet, on television, by posting information on billboards) and standardized (holding sweepstakes, awarding prizes during a mass advertising campaign);

- algorithm for calculating normalized advertising expenses when calculating income tax - the total amount of normalized advertising expenses, calculated on an accrual basis from the beginning of the year, should not exceed 1% of revenue without VAT and excise taxes (clause 1 of article 248, clause 3 of article 318 of the Tax Code RF);

- specification of the date of implementation of advertising expenses (subclause 3, clause 7, article 272 of the Tax Code of the Russian Federation);

- the accounting account used to reflect advertising costs - in accordance with the Chart of Accounts and instructions for its use, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, advertising costs are accounted for in a separate subaccount. 44 “Sales expenses”;

- the procedure for writing off advertising expenses - writing off the full amount in the period of occurrence or with distribution (the method of distribution must also be reflected in the UP);

- tax register for analytical accounting of advertising expenses - is developed by the company independently or accounting registers supplemented with certain details are used (paragraph 10, article 313 of the Tax Code of the Russian Federation), the form of the register is fixed in the UP.

To avoid mistakes when creating tax registers, familiarization with the material “How to maintain tax accounting registers (sample)?” .

How to register indirect expenses in accounting policies

Selections from magazines for an accountant

- Details Category: Selections from magazines for an accountant: 06/03/2015 00:00 Source: Glavbukh magazine Let's consider a practical situation. The organization carries out general construction work.

The accounting policy stipulates that income and expenses for the purpose of calculating the tax base are determined on the basis of forms No. KS-2, signed by the customer.

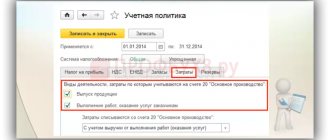

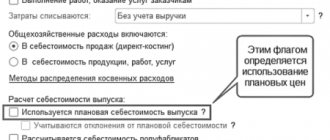

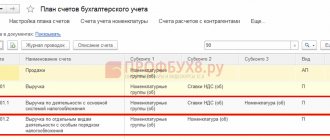

Distribution of indirect costs in 1C 8.3: settings and methods

07/15/2019 Indirect costs in 1C 8.3 include those costs that cannot be attributed to a specific manufactured product.

These include payment for water, electricity, accountant’s wages, etc.

n. The organization produces goods, spending materials on their production. But we cannot know exactly how much indirect costs were spent on a specific unit of production.

At the very bottom of the window that opens, click on the “Income Tax” hyperlink.

After this, a window will appear with several settings sections. Select “Income tax” and in the section that opens, open the “List of direct expenses” link.

Accounting policies: income and expenses

Accounting policies are developed and approved in each company annually.

It is necessary to establish the accounting procedure for tax purposes. Tax policy must contain complete and reliable information about the procedure for reflecting business transactions for the reporting period, as well as information for monitoring the correctness, completeness and timeliness of calculation and payment of taxes to the budget.

In this document, each company establishes its own tax accounting features, for example, such as the procedure for generating the amount of income and expenses. Tax consultant I.R. Semenova Income The amount of its income tax depends on how a company accounts for income.

Therefore, she needs to prescribe in her accounting policy for tax purposes the methods of recognizing revenue, its classification, as well as how to reflect income that relates to several reporting periods.

Revenue recognition To calculate income tax, revenue can be recognized using one of the methods: accrual or cash.

Mysterious transport costs: when they can be classified as indirect and when they cannot

Transportation costs are one of the ambiguous types of costs, which are not always possible to be classified directly as indirect and reflected in the corresponding list of costs in the UE.

Specialists forming a management program face a difficult task - to accurately distinguish between direct and indirect transport costs. To find a solution, it is necessary to proceed from the basic distribution principle: whether an expense is included in direct or indirect depends on what stage of production and (or) sales it is associated with.

In the UE, transport costs can be reflected in the list:

- indirect - if the company delivers goods (products) to the buyer (the method of delivery does not matter: by its own transport, rented or using a third-party carrier);

- direct - if the company incurs expenses for the transportation of purchased goods, raw materials and supplies and takes them into account separately from the cost of inventories: such expenses require distribution taking into account the balance of unrealized inventories at the end of the reporting period.

According to these criteria, certain transport costs may be classified into one of these groups or even both.

“Distribution of transport costs for the balance of goods” will help you get acquainted with the algorithm for distributing transport costs and understand the corresponding accounting entries using examples .

Composition of direct and indirect costs

The composition of direct and indirect costs differs for manufacturing and trading organizations.

Production of goods, works or services

You have the right to determine yourself which costs in the production of goods, works or services are classified as direct and which as indirect. The list of expenses is approved by the head of the organization and recorded in the accounting policy.

When making your choice, be guided by the following principles. As part of direct expenses, reflect those costs that are directly related to production or sales. In this case, you can focus on industry specifics and proceed from the specific features of the production process in the organization itself.

Typically, direct production costs include:

- material costs. In particular, the costs of purchasing raw materials and materials that will be used directly in production, as well as components undergoing installation, and semi-finished products that require additional processing;

- expenses for remuneration of employees engaged in production activities and social insurance contributions accrued from these amounts. The same applies to contributions for insurance against accidents and occupational diseases;

- depreciation of fixed assets that are used in the production of goods, works or services.

This follows from paragraph 1 of Article 318 of the Tax Code of the Russian Federation.

The remaining costs that are not directly related to production or, according to technical regulations, are not included in it, are classified as indirect. In addition to non-operating expenses, they are considered separately.

At the same time, recognize as indirect only those expenses that cannot be classified as direct for objective reasons. For example, the costs of raw materials and supplies, which are included in the cost of a unit of production, can only be classified as direct.

All this follows from Article 318 of the Tax Code of the Russian Federation. This is confirmed by letters from the departments - the Ministry of Finance of Russia dated February 7, 2011 No. 03-03-06/1/79 and the Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3 / [email protected] A similar position is expressed in the definition of the Supreme Arbitration Court RF dated May 13, 2010 No. VAS-5306/10 and resolution of the Federal Antimonopoly Service of the Ural District dated February 25, 2010 No. F09-799/10-S3.

Trade

For trade organizations, the list of direct expenses is fixed. It is given in Article 320 of the Tax Code of the Russian Federation. Direct costs include:

- purchase price of goods. How to calculate it, organizations have the right to determine independently. For example, you can include expenses that are associated with the purchase of goods. These are, in particular, expenses for packaging, warehouse and other costs paid by another organization. Fix the selected option in your accounting policy for tax purposes;

- costs of delivering goods to the buyer's warehouse (when they are considered separately from the cost of the goods themselves).

All other expenses (except for non-operating expenses provided for in Article 265 of the Tax Code of the Russian Federation) are considered indirect and reduce income from sales of the current month.

This procedure is provided for in Article 320 of the Tax Code of the Russian Federation.

Situation: can the costs of delivering goods from the supplier to your warehouse using your own transport be considered direct expenses when calculating income tax? The organization is engaged in trade.

Yes, you can.

The cost of delivering goods to the buyer’s warehouse should be included in direct costs by a trading organization. However, no separate conditions or restrictions have been established. This means that it does not matter whether the buyer pays for delivery to a third party or transports the goods on his own.

But the costs of maintaining your own vehicles used for transporting goods should be classified as indirect costs. They are not directly related to the purchase of goods. This follows from the provisions of Article 320 of the Tax Code of the Russian Federation. A similar opinion is expressed in the letter of the Ministry of Finance of Russia dated January 13, 2005 No. 03-03-01-04.

Situation: can a trade organization include as direct expenses when calculating income tax the costs of delivering goods that it ships to customers directly from manufacturers' warehouses? The organization is engaged in trade.

No, he can not.

Direct costs include the costs of delivering purchased goods (transportation costs) only to the organization’s warehouse, if they are not included in the purchase price. Since during transit trade the goods are shipped directly to the buyer, bypassing their own warehouse, the specified conditions are not met. Therefore, such transport costs should be considered as expenses associated not with the acquisition, but with the sale of goods.

Costs associated with the transportation of goods sold are indirect. At the same time, they reduce income from the sale of these particular goods. This procedure follows from the provisions of Article 286 and paragraph 3 of Article 320 of the Tax Code of the Russian Federation.

Specifics of different companies: how not to confuse indirect costs with direct ones

The previous section examined a type of expense that can be equally classified as indirect and direct. And this is not the only case where direct and indirect costs are intertwined. At the same time, there are often situations when the same expense for one company can only be indirect, and for another - only direct.

One such example is the company’s costs for product packaging. The following court decisions have confirmed the unambiguous location of such expenses as follows:

- indirect - when the company was engaged in the production of paper and, upon completion of production, packaged the finished product (roll paper) in packs and boxes (Resolution of the Federal Antimonopoly Service of the North-West District dated June 20, 2011 No. A56-46595/2010);

- direct - when the company used containers in the production of alcoholic products: bottling alcoholic products into glass containers is one of the stages of production (Resolution of the Presidium of the Supreme Arbitration Court of November 2, 2010 No. 8617/10).

“Accounting for returnable packaging: price, postings, taxes” will tell you what nuances of working with returnable packaging need to be included in the UP .

Thus, an initial adequate and logical justification (in accordance with the technological process) for including a particular expense among indirect and direct expenses will allow any company in any situation to defend its case before controllers and (or) judges.

Accounting policy: divide expenses into direct and indirect

One of the conditions that the legislator requires to be included in the accounting policy for income tax purposes is the procedure for classifying expenses as direct and indirect (Article 318 of the Tax Code of the Russian Federation). And there is no need to treat this requirement formally.

Correctly consolidating this procedure is important because it directly affects the amount of tax paid. After all, indirect costs can be taken into account in full during the period of their implementation. Direct payments are recognized as products, works, and services are sold, in the cost of which they are taken into account.

It is clear that tax officials are closely monitoring this distribution in order to prevent an arbitrary reduction in the amount of tax transferred to the budget (by overestimating indirect costs). Therefore, the taxpayer must clearly understand which expenses (and, most importantly, why) he classified as indirect and which as direct.

You can clearly state your position on this issue in your accounting policy.

Who splits the costs?

First, let’s decide who should think about allocating expenses. Here we can immediately distinguish two categories of taxpayers for whom this section in the accounting policy is not relevant.

Firstly, the rules for allocating expenses into direct and indirect can only be used by those organizations that operate on the accrual basis. For taxpayers who determine income and expenses on a cash basis, expenses are not divided into direct and indirect, so the corresponding section in the accounting policy is simply not needed.

Secondly, such a division is not relevant for organizations that provide services. They have the right to take into account all expenses during the period of their incurrence (clause 2 of Article 318 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated June 15, 2011 No. 03-03-06/1/348). That is, such taxpayers, in fact, have nothing to share - in fact, all their expenses are indirect.

https://www.youtube.com/watch?v=-7PO9CTJyhM

All other taxpayers must distribute expenses into direct and indirect, fixing the procedure for such distribution in the accounting policy for income tax purposes. How to do this?

Tax Code of the Russian Federation - not rules, but guidelines

Article 318 of the Tax Code of the Russian Federation lists the types of expenses that the legislator considers possible to be classified as direct.

According to Article 318 of the Tax Code of the Russian Federation, direct expenses may include, in particular:

- material expenses for the acquisition of raw materials, materials used in production or serving as a necessary component in the production of goods (works, services), as well as for the acquisition of components undergoing installation, semi-finished products undergoing additional processing in the organization.

- expenses for remuneration of personnel involved in the production of goods, performance of work, provision of services, as well as insurance payments accrued on such amounts;

- depreciation of fixed assets used in the production of goods, works, and services.

However, it is important for an accountant to know that this list is only a guideline. After all, the Code directly states “may be attributed, in particular.” Simply put, the taxpayer has the right to classify even the costs directly named in this list as indirect in his accounting policy. Conversely, any other costs not directly named in Article 318 of the Tax Code of the Russian Federation can be included in direct costs.

However, such “transfers” cannot be made arbitrarily. The classification of expenses as direct or indirect must be justified. This requirement is made by both the tax authorities (letter of the Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3 / [email protected] ; see “Federal Tax Service: the distribution of direct and indirect expenses must be justified”), and the courts (see the definition of the Supreme Arbitration Court RF dated June 22, 2012 No. VAS-7511/12).

How to justify indirect expenses

The letter from the Federal Tax Service of Russia mentioned above says: although Chapter 25 of the Tax Code of the Russian Federation does not limit the organization in classifying certain expenses as direct or indirect, from the provisions of Art.

252, 318 and 319 of the Tax Code of the Russian Federation it follows that this choice must be justified.

The justification must be that indirect costs cannot be those associated with the production of goods (performance of work, provision of services).

In other words, the cost distribution mechanism must contain economically sound indicators determined by the technological process. It is possible to classify individual costs associated with the production of goods (works, services) as indirect only if there is no real possibility of classifying them as direct costs using economically sound indicators.

Representatives of the judiciary echo the tax authorities: by giving the taxpayer the opportunity to independently determine accounting policies, including the formation of the composition of direct expenses, Chapter 25 of the Tax Code of the Russian Federation does not consider this process as depending solely on the will of the organization. On the contrary, Art. 318 and art.

319 of the Tax Code of the Russian Federation classifies as direct costs only those costs that are directly related to the production of goods (performance of work, provision of services).

Therefore, if it is impossible to attribute direct costs to a specific production process for the manufacture of a given type of product (work, service), then in the accounting policy it is necessary to determine the mechanism for their distribution using economically feasible indicators (see the definition of the Supreme Arbitration Court of the Russian Federation dated June 22, 2012 No. VAS-7511/12 ).

Amazing unanimity! But, unfortunately, no specifics. Therefore, let's look at specific examples of what the use of such “economically justified indicators” should look like in an accounting policy.

Depreciation on movable fixed assets

Any organization has fixed assets that are not used for production. We are talking about office equipment, computers, furniture, and transport intended for management personnel. Accordingly, depreciation on such fixed assets can rightfully be recognized as an indirect expense, indicating this in the company’s accounting policy.

Depreciation on real estate

The situation with premises is somewhat more complicated. After all, often both production and non-production facilities are located in the same building. The Tax Code does not allow dividing the depreciation of a single object. This means that the company needs to clearly decide whether such costs are classified as direct or indirect.

This can be done through economic analysis. It is necessary to look at how much (as a percentage) of the area is occupied by production facilities, and how much by non-production facilities.

If it turns out that the production space clearly occupies less than half, then the depreciation amounts for the entire premises can be considered indirect expenses (see the definition of the Supreme Arbitration Court of the Russian Federation dated August 16.

12 No. VAS-9792/12, where the judges recognized as legal the inclusion of depreciation in the indirect costs of a building where production equipment occupied no more than 30-50% of the premises).

At the same time, we recommend that in the accounting policy not only the fact that these costs are classified as indirect, but also the main points of the calculations. This can be done, for example, in an annex to the accounting policy. In the event of a dispute, the accountant will not have to re-prepare the evidence - it will always be at hand.

Salary

As already mentioned, in any organization there are personnel who are not directly involved in the production of products. At the same time, Article 318 of the Tax Code of the Russian Federation lists labor costs and the amount of insurance premiums for compulsory insurance as direct expenses.

But in relation to management personnel, the taxpayer has the right to recognize such costs as indirect (see letter of the Ministry of Finance of Russia dated September 20, 2011 No. 03-03-06/1/578).

In particular, indirect costs may include the cost of remuneration for the manager, employees of the accounting department, financial and personnel services. Thus, the cost of paying non-production personnel, including the amount of insurance premiums, can be taken into account as expenses at a time.

The only condition for this is the inclusion of the corresponding clause (on classifying these expenses as indirect) in the accounting policy of the organization.

Rental payments

Whether rental payments are classified as direct or indirect expenses directly depends on what exactly is being rented and how the leased item is used by the company. It is clear that rental payments for machines or computers that are used to produce products cannot be classified as other than direct expenses.

But the office rental fee can already be considered from the point of view of the share that the “production part” occupies in this office (see resolution of the Moscow District AS of September 30, 2014 No. F05-10544/14).

And since these ratios can change from year to year, this is another reason to audit accounting policies and bring them into line with reality, so as not to overpay taxes and avoid conflicts with inspectors.

Source: https://www.Buhonline.ru/pub/beginner/2014/12/9323

Results

The list of indirect costs in the UE is an element necessary primarily for the company itself.

The presence of such an “expenses” list in the UE allows you to correctly formulate the cost of production, calculate taxes, as well as protect your expenses before the tax authorities during audits and have a strong argument in case of litigation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.