Issues discussed in the material

:

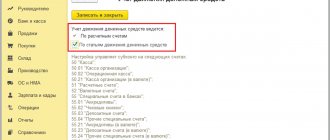

- Why do you need a cash flow statement?

- Which method to use when preparing a cash flow statement - direct or indirect

- What should the sequence of analysis of a cash flow statement built in a direct way look like?

- What is the procedure for preparing a cash flow statement

The cash flow statement shows the movement of a company's finances as a result of activities aimed at investing and other financial investments. This form is included in the list of annual mandatory accounting reports of the organization. This document is not classified as interim reporting. The cash flow statement (CFS) is submitted as part of the annual financial statements by all accounting entities, except for small enterprises. The document shows all transactions regarding the receipt and expenditure of cash and non-cash funds, and also records the cash balance at the beginning and end of the period. In our article we will look in detail at the procedure for preparing a cash flow statement.

Guardian's report 2017–2018 (form, basic rules for drawing up)

The Law “On Guardianship and Trusteeship” dated April 24, 2008 No. 48-FZ provides for the annual submission of a report on the ward’s property, his income and expenditure of funds. The guardian must report for the past year by February 1 (inclusive) of the next year. The report is placed in the personal file of the ward, which is stored in the guardianship authority.

In 2014, major changes occurred in the reporting form for persons guarding minors. The authorities simplified reporting, since the need to account for even minor expenses was a serious problem for guardians. Therefore, when compiling a report for 2017-2018, guardians and trustees of children will no longer have to account for the purchase of food, shoes, clothing, hygiene products, medicines and other similar expenses.

However, when preparing a report on the property of minors, certain rules must be followed:

- the report is not compiled arbitrarily, but according to the form approved by Decree of the Government of the Russian Federation dated May 18, 2009 No. 423 (as amended on September 10, 2015);

- the information reflected in the report must be confirmed by attached documents (copies of receipts, checks, etc.);

- it is possible to fill out the form either by hand (legibly) or using a computer;

- mandatory details - the signature of the compiler with the transcript and date of submission of the report;

- corrections and crossing-outs are unacceptable;

- You should not leave fields blank - if there is no information, write the words “no”, “does not have”;

- it is necessary to take into account that monetary amounts are indicated in thousands of rubles;

- information about income must be reflected in total for the year;

- if the child received income in foreign currency (for example, as a gift), then the report indicates the equivalent of this amount in rubles at the Central Bank exchange rate as of December 31 (or December 30, if the 31st is a day off) of the reporting year.

Providing a report on the expenditure of funds contributed as advance payments.

Information on the movement of funds paid before the start of administration of the payer’s personal accounts in the ELS resource is provided to the payer by the customs declaration and (or) through the “Personal Account” service of the personal account of the foreign trade participant on the official website of the Federal Customs Service of Russia or through the personal account on the websites of legal entities, specified in Part 15 of Article 116 of the Federal Law (hereinafter referred to as the customs payment operator).

Information on the movement of funds paid by the payer after the start of administration of his personal accounts in the ULS resource in accordance with the Schedule may be provided to the payer by the customs authority in accordance with the place of tax registration of the payer or by the Central Energy Customs in relation to payers whose personal accounts are administered by this customs office, and (or) through the “Personal Account” service of the personal account of a foreign trade participant on the official website of the Federal Customs Service of Russia or through a personal account on the websites of customs payment operators.

According to Part 6 of Article 121 of the Federal Law, if the person who made the advance payments disagrees with the results of the customs authority’s report, a joint reconciliation of the expenditure of this person’s funds is carried out. The results of such reconciliation are documented in an act in the form approved by Order of the Federal Customs Service of Russia dated December 22, 2010 No. 2521 “On approval of the form of the advance payment reconciliation act.” The act is drawn up in two copies, signed by the customs authority administering the funds and the person who made the advance payments. One copy of the act after its signing is handed over to the specified person.

In accordance with paragraph 10 of the Temporary Procedure for the work of interested structural divisions of the Federal Customs Service of Russia, the Central Information and Technical Customs Administration and customs authorities with a single resource of personal accounts of payers of customs duties and taxes opened at the level of the Federal Customs Service of Russia, using the software package “Personal Accounts - ELS ", approved by Order of the Federal Customs Service of Russia dated August 24, 2018 No. 1329 "On approbation of the administration of a single resource of personal accounts of payers of customs duties and taxes, opened at the level of the Federal Customs Service of Russia, using the software package "Personal Accounts - ELS" accounting for cash balances from 13.09. 2018 is carried out in the amount of the total cash balance according to the budget classification code in accordance with the TIN of the organization without detailing to payment documents.

The procedure for filling out a payment order for payment of customs duties

The “KBK” field in the payment order is filled in incorrectly.

The procedure for returning advance payments from a personal account

WE PROVIDE SERVICES TO LEGAL ENTITIES AND INDIVIDUAL ENTREPRENEURS (WE DO NOT WORK WITH INDIVIDUALS), INCLUDING: DECLARANTS (IMPORTERS and EXPORTERS), CUSTOMS REPRESENTATIVES, TSW OWNERS, AUTHORIZED ECONOMIC ENTITIES SKI OPERATORS, CUSTOMS CARRIERS. WE PROVIDE LEGAL SERVICES RELATED TO OPERATIONS PERFORMED WHEN MOVEMENT OF GOODS AROSS THE CUSTOMS BORDER OF THE EAEU IN THE RUSSIA REGION. WE ARE READY TO EXPLAIN THE MECHANISM OF REGULATORY REGULATION OF PROCESSES RELATED TO THE MOVEMENT OF GOODS ALONG THE BORDER, TO EVALUATE THE LEGALITY OF THE ACTIONS OF THE STATE CONTROL AUTHORITIES, TO APPEAL INDEPENDENTLY OR TO HELP YOURS RISTS ARE NOW TO APPEAL ILLEGAL ACTIONS TO HIGHER AUTHORITIES AND THE COURT.

First oral consultation is FREE (call or WhatsApp +7(906)4-313-865 ) Oral consultation – 1000 rubles Written consultation – 5000 rubles Subscription service for a month (written and oral consultations) – 15000 rubles Subscription service for a month (written and oral consultations, appealing illegal actions and decisions) – 30,000 rubles Departmental appeal (decisions on classification, customs value, preferences, application of forms of control) – 20,000 rubles Supporting an administrative investigation and preparing a complaint against a decision in a case of an administrative offense – 20 000 rubles Legal challenge (preparing a position on the case + travel expenses) – 40,000 rubles Support of customs inspection (preparing a response to a request, drawing up objections to the inspection report) – 40,000 rubles The list and price of services can be changed by agreement of the parties. The price of services does not include VAT, since the services are provided under an agreement with an individual entrepreneur using a simplified taxation system. Email WhatsApp +7(906)4-313-865

Tweet

Filling out a report from a guardian of a minor child

The header indicates the period for which the guardian is reporting. Sections 1–3 of the report contain information about its compiler and the ward. Section 4 reflects information about the child’s property. Table 4.1 contains information about real estate owned by a minor (type, method of acquisition, location, etc.). The following table (4.2) is intended to indicate the vehicles owned by the ward. Table 4.3 indicates the amounts of funds in bank accounts as of December 31 of the reporting year.

Subsection 4.4 of the report reflects information about the ward’s shares in the authorized capital of commercial organizations and the availability of shares or other securities in his possession. Section 5 contains information about the guardian’s withdrawal of funds from the ward’s account (including details of the act of the guardianship authority authorizing such withdrawal). In the same section, the child’s things that have become unusable are indicated.

Section 6 deals with the ward's income. For each type of income (alimony, benefits, etc.) there is a separate line indicating the amount of this income for the year. Next, the total (total) annual income is reflected. Section 6 does not indicate income from the use of property, since a separate table is provided for this - 7, which reflects the benefits from leasing or selling real estate, interest on bank deposits, income from securities, etc. It is necessary to indicate documents guardianship authorities authorizing real estate transactions.

Section 8 contains information about the child’s spending:

- for his treatment in medical institutions;

- purchase of durable goods (costing more than 2 subsistence minimums);

- repair of the person's home.

There is no need to report small household expenses for 2017-2018.

Section 9 reflects information on the payment of taxes on the property of a minor.

The Ministry of Internal Affairs of Russia has prepared a draft order “On establishing the form and deadline for submitting a Report on the expenditure of funds and (or) other property collected for the purpose of organizing and holding a public event.”

The document was developed in connection with the adoption of the Federal Law of December 30, 2021 No. 541-FZ “On Amendments to the Federal Law “On Meetings, Rallies, Demonstrations, Marches and Pickets”, which entrusts the Ministry of Internal Affairs of Russia with the authority to approve the form of the report of the organizer of public events with more than 500 participants on the expenditure of funds and (or) other property collected for its implementation, as well as the deadline for its submission to the executive body of the constituent entity of the Russian Federation or local government body.

As a result of checking the report, violations provided for in Article 20.2 of the Code of the Russian Federation on Administrative Offenses may be revealed.

The deadline for submitting a report to the executive body of a constituent entity of the Russian Federation or the local government body with which the place and time of the public event was agreed upon is set at 45 days from the date of the event. The specified period was determined based on the need to provide the organizer of a public event with time for high-quality preparation of the presented materials in full.

At the same time, the deadline for submitting a report to the internal affairs bodies by the executive body of the constituent entity of the Russian Federation or the local government body with which the place and time of the public event was agreed upon has not been determined, and therefore, in order to increase the efficiency of the relevant inspection, it is possible to indicate the full name in the report form , the position of an authorized representative of the internal affairs body (Article 14 of the Federal Law of June 19, 2004 No. 54-FZ “On meetings, rallies, demonstrations, processions and pickets” - hereinafter Law No. 54-FZ).

The report form provides for the presentation of a comprehensive amount of information and documents confirming this information necessary to conduct the relevant audit. Taking into account the requirements of Part 7 of Article 11 of Law No. 54-FZ, an exception is provided for the presentation of information received as part of the implementation of Parts 5 and 6 of Article 11 of Law No. 54-FZ.

Grounds for issuing money on account

In order to issue funds on account, the organization must have one of the following documents (clause 6.3 of the Central Bank Instruction No. 3210-U dated March 11, 2014, as amended, valid from August 19, 2017):

- administrative document of a legal entity;

- written statement from the accountable.

Let us recall that until August 19, 2017, a written statement by the accountable person was mandatory (clause 6.3 of the Central Bank Instruction No. 3210-U dated March 11, 2014, as amended, valid until August 19, 2017). Now the organization itself decides how to justify the issuance of cash. Draw up an administrative document (for example, an order) or receive from a person an application for the release of funds to the account (we will discuss a sample of it below).

Such an application, drawn up in any form, must contain information about the amount of cash and the period for which it is issued. The application must bear the manager's signature and date. Similar information, as well as full name. accountable, the registration number must be contained in the administrative document (CBR Letter dated 09/06/2017 No. 29-1-1-OE/20642).

If an organization decides to use an application for the issuance of funds against a report, a sample of it can be viewed here.

In the event that an organization draws up an order to issue money on account, it can be drawn up as follows:

Order for the release of funds for reporting: sample

Limited Liability Company "Svetotekhnika"

109544, Moscow, Entuziastov Blvd., 11

TIN 7705217099 / KPP 770501001

On the issuance of funds for reporting

Moscow 09/13/2017

For the purpose of making expenses by employees of Svetotekhnika LLC

1. Submit for report to manager S.P. Gavrikov. cash from the cash register in the amount of 35,000 rubles for travel expenses;

2. Set the period for which the funds are issued - until September 29, 2017 inclusive.

3. Control over the execution of this order is assigned to the chief accountant S.P. Maslova.

General Director V.I. Loginov

I have read the order: __________ /Gavrikov S.P./

Please note that if funds for reporting are issued in non-cash form (for example, by crediting to an employee’s salary card), the mandatory execution of an application or order for issuance is not required. In this case, the organization can justify the issuance of funds in any other way provided by it (for example, an official memo).

Why do you need a cash flow statement?

“Cash flow statement” is one of the main forms of accounting financial statements. It displays data about money coming into the company and leaving it. It is in addition to the following reports: balance sheet and income statement.

The balance sheet shows the financial position of the company at the end of the accounting period (that is, at some specific point in time). While the cash flow statement shows the changes that occurred with one of the components of the material statement (with money) in the period between two balance sheets.

The income statement reflects the results for a certain period of the company's key activities. We are talking about the manifestation of activity in a direction that is the main factor in the inflow and outflow of money. In this case, the financial flow statement is the main basis for assessing the enterprise in the following areas: attractiveness to investors, efficiency of the turnover of financial proceeds, equivalence.

In addition, cash flow statement data can be used to assess the financial flexibility of an enterprise, the essence of which is the company's ability to generate large sums to respond in a timely manner to unforeseen needs and opportunities. If an enterprise has information about financial movements for previous periods, this makes it possible to assess its financial flexibility.

For example, when assessing a company's ability to cope with temporary difficulties associated with a short-term decrease in demand for products, cash flow data for previous periods will be needed. Large financial flows provide a greater chance of coping with the situation (the higher the flows, the greater the chances).

Many creditors and investors attach great importance to the cash flow statement, since it is the basis by which the quality of a company's earnings is assessed. In order to take into account and reflect all income using the accrual method, the accountant needs to make many entries: accrual and reflection of funds for the future reporting period, their distribution and evaluation. Applying an approach where adjustments are allowed deprives the report of the objectivity that some users of financial statements want to see. They need not only data on net profit (the movement of material assets associated with the company’s core activities), but also an objective assessment of efficiency. Such users are sure: the higher the efficiency, the “better quality” the income.

Top 3 articles that will be useful to every manager:

- Financial control at the enterprise

- Net profitability of the enterprise

- How to build a company's financial structure