In what currency can residents make payments?

Let's turn to Art. 140 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation). According to the general rule established therein, all payments and settlements in Russia can be made in 2 ways:

- cash, in which the only acceptable means of payment are coins and banknotes of the Bank of Russia (Article 29 of the Law “On the Central Bank of the Russian Federation” dated July 10, 2002 No. 86-FZ, hereinafter referred to as Law No. 86-FZ);

- non-cash.

In both cases, the legislator designated the ruble as the main legal tender. All monetary obligations are expressed in rubles (Part 1, Article 317 of the Civil Code of the Russian Federation).

It is permissible to set the payment amount in foreign currency (FC), if in fact the settlement will be in rubles. Conversion into rubles by default occurs based on the official exchange rate valid on the day of payment (a different procedure can be agreed upon in the contract).

In addition, within a very narrow framework established by law, it is permissible to carry out settlements for obligations on the territory of the Russian Federation using IW, as well as payment documents in IW.

General procedure for non-cash currency payments

The specified procedure is defined in Art. 14 of the Law “On Currency Regulation...” dated December 10, 2003 No. 173-FZ (hereinafter referred to as Law No. 173-FZ). Residents have the right to make payments on their bank accounts in any foreign currency. It does not matter in what currency the bank account was opened - if the need arises, a conversion operation will be carried out at the rate of the corresponding bank.

For individuals, the procedure for making non-cash payments in the Internet is similar to the procedure for legal entities.

A number of by-laws establish features:

- purchases of foreign currency by legal entities and entrepreneurs (instruction of the Bank of Russia dated June 4, 2012 No. 138-I);

- payment in currency of the authorized capital of a credit organization (clause 4.3 of the Bank of Russia instructions dated 04/02/2010 No. 135-I).

Procedure for opening a foreign currency account

For legal entities

If the company already has an account with the selected bank, then to open additional ones it is enough to prepare an application, take it to the bank branch and fill out the proposed agreement.

In other cases, the banking institution requests a certain package of documents, including:

- statutory documents;

- certificate of state registration as a legal entity;

- sample signatures of employees authorized to manage the account;

- certificate of registration with state statistics and tax authorities.

Please note: all copies must first be certified by a notary.

In some cases, banks require additional documents confirming the legality of the sources of foreign currency receipts, as well as information about the prospects (goals, directions and volume) of future foreign trade and economic activity.

Do not be surprised if the list of documents includes an audit report or an accounting report for the latest period, contracts and agreements with counterparties confirming the fact of transferring money from abroad in the near future.

As a rule, there is no commission for opening a foreign currency account for companies on cash settlement services. For new clients, banking institutions introduce a fee (about 1,000 rubles), and provide services and Internet banking free of charge. The institution’s staff warns you about these nuances in advance.

For individuals

To open an account, a citizen of the Russian Federation just needs to present a passport and fill out an application for the bank to offer an agreement for opening and servicing a foreign currency account. In rare cases, this will require additional documents (depending on the internal policies of the commercial structure).

As a result, by order of a citizen, money can be transferred:

- to other accounts abroad, as well as to the accounts of stores, companies selling goods and services with payment in foreign currency;

- for deposits, time deposits.

As in the case of ruble accounts, banks charge interest based on the terms of the agreement. If necessary, for a certain fee, banks help with the purchase or sale of foreign currency (and the difference in rates at the time of purchase and write-off is no more than 10%).

The procedure for non-cash payments in foreign currency between residents

Residents can open foreign currency accounts in authorized banks of the Russian Federation without any restrictions. However, currency transactions between residents of paragraph 1 of Art. 9 of Law No. 173-FZ prohibits. But there are still a number of concessions regarding non-cash payments between them. These are the operations:

- on transfers of investment money and currency of the Russian Federation between residents’ accounts in banks located on the territory of the Russian Federation and abroad (subparagraphs “g” and “h”, paragraph 9, part 1, article 1 of Law No. 173-FZ);

- mandatory payments to budgets and settlements and transfers related to their execution;

- settlements and transfers of foreign currency for the purposes of carrying out the activities of diplomatic missions, consulates and other official representative offices of the Russian Federation, as well as those related to the maintenance of their employees;

- non-cash transfers between resident individuals from bank accounts outside the Russian Federation to Russian authorized banks;

- non-cash transfers between resident individuals who are also spouses or close relatives from bank accounts in the territory of the Russian Federation to banks outside its borders;

- settlements related to obtaining a commercial or bank loan from an authorized bank.

Legally permitted foreign exchange transactions

All citizens of Russia, individual entrepreneurs, as well as companies with different forms of business have the right to open foreign currency accounts for storing funds, making payments and transactions, as well as receiving interest (also in foreign currency).

At the same time, the legislation stipulates a list of operations that can be carried out without any sanctions or restrictions.

Current operations include:

- money transfers within Russia or abroad as part of payments for the purchase or sale of goods, services or other types of work;

- transfers in both directions related to the provision of credit funds for import and export operations (for a period of less than six months);

- loans issued in the form of cash or non-cash funds for a period of up to 6 months (receipt and provision);

- accrual or receipt of income related to the movement of capital (for example, interest on deposits);

- social benefits - pensions, wages, scholarships, alimony.

In addition, the law separately considers operations related to the movement of funds:

- any investments in foreign companies;

- purchase of securities;

- money transfers for the purchase of real estate (including buildings for various purposes, land and subsoil);

- providing a loan for a period of more than 6 months for carrying out activities related to export and import operations, sale of goods, services and works;

- loans in the form of non-cash or cash (receipt and provision) for a period of more than six months;

- other currency transactions not included in the current list.

Today, banks can offer both separate accounts for each type of currency, as well as multi-currency ones, allowing you to work with monetary units of different countries.

Important! Failure to comply with the requirements for storage and transactions with foreign bank notes entails a fine in the amount of all foreign currency earnings.

The procedure for cash payments in national and foreign currencies in the Russian Federation

Special rules apply to individuals: they have the right to carry out the activities listed in paragraph 3 of Art. 14 of Law No. 173-FZ currency transactions in cash (for example, donating currency to a spouse or transferring it under a will, purchasing coins for a collection by numismatists, etc.).

The rules by which cash payments are made on the territory of the Russian Federation, both in the national and in the IW, are established by the instruction of the Bank of Russia “On making cash payments” dated October 7, 2013 No. 3073-U (hereinafter referred to as instruction No. 3073-U). They apply to individuals and a number of exceptional cases when a legal entity or entrepreneur has the right to spend cash in foreign currency (clause 2 of instruction No. 3073-U).

Clause 5 of Directive No. 3073-U allows for cash payments in national and foreign currencies between settlement participants and individuals in any amounts. But in the next paragraph, paragraph 6, limits are still established. They extend their effect to cash payments in the above-mentioned currencies made by legal entities and individual entrepreneurs, and are expressed in limiting the size of the amount - no more than 100,000 rubles. (for foreign currency - the equivalent amount at the Central Bank exchange rate on the date of cash payments). This is the so-called cash payment limit.

It works:

- for such calculations that are made within the framework of 1 agreement;

- fulfillment of civil obligations stipulated by the agreement that was concluded between the participants in cash payments and arising from it;

- issuance of cash by a credit institution, when such issuance is made upon request for the return of the balance of funds transferred to a special account with the Bank of Russia.

There are no exceptions in this case either. About them - in the last paragraph of paragraph 6 of instruction No. 3073-U.

How do you receive funds into a foreign currency account in a Russian bank?

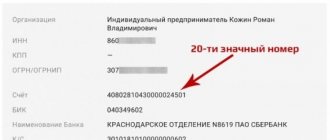

After a resident of the Russian Federation receives payment for goods, services rendered or work under an agreement, act or other official document, foreign exchange earnings are generated. To transfer and legalize it, you should open a special bank account (current, transit and special transit).

Next, the algorithm of actions is as follows:

- a notification is sent to the Federal Tax Service about opening an account - if the deadline for filing a notification is violated, the law provides for fines of up to 5,000 rubles;

- each separate account requires a separate notice;

- You should also report the accounts of branches (for legal entities);

- a package of documents is submitted to the bank to legalize the amount received (usually a contract and its copy certified by a notary are sufficient);

- if the transaction amount is more than $50,000, the bank issues a transaction passport (TS).

There are several reasons why a bank refuses to formalize a transaction agreement and, therefore, to recognize foreign currency earnings as legal:

- discrepancies in information in the contract (agreement) and the PS;

- failure to comply with legal requirements regarding permitted foreign exchange transactions;

- incorrect registration of the PS;

- the absence in the contract (agreement) of a clause stipulating the fact of receipt of funds to the account;

- lack of certified translation of contract documentation.

For each owner of a foreign currency account, after registration of the PS, a so-called resident dossier is compiled, which records all transactions on funds crossing the border in one direction or another.

For law firms, the dossier contains the following documents:

- transaction passport (in original);

- notarized copies of the contract;

- product registration cards;

- a copy of the customs declaration for the cargo certified by a notary;

- other documents related to the export or import of products.

You can find out a detailed list of required documents in the help desk of a particular bank.

Making payments in foreign currency abroad

The procedure for settlements through accounts opened outside the Russian Federation is stipulated by the legislator in Art. 12 of Law No. 173-FZ.

According to the general rule, paragraph 6 of Art. 12, without any restrictions, settlements can be made between residents (legal entities and individuals) with funds credited to their accounts in banks outside the Russian Federation. But there are still a number of exceptions. Their complete list is given in paragraph 1 of Art. 9 of Law No. 173-FZ.

At the same time, the legislator provided for a number of exceptions to the established ban. As for currency transactions between residents outside the Russian Federation, these exceptions are listed in clause 6.1 of Art. 12 of Law No. 173-FZ.

The resident must notify the territorial tax authority (at the place of his/her own registration) about all actions with the investment account on a bank account outside the Russian Federation (opening, closing, changing details).

Settlements between residents and non-residents in foreign currency: features and nuances of the procedure

Art. 6 of Law No. 173-FZ allows for currency transactions between residents and non-residents. However, not without some reservations. They are listed in Art. 11 of the said law, namely:

- Only specially authorized banks can carry out the procedure for the purchase and sale of investment money and checks (including traveler's checks) with the nominal value indicated in them, expressed in foreign currency.

- When buying and selling foreign currency in cash, as well as checks with an IW face value, the currency regulation authority (Central Bank of the Russian Federation) imposes special requirements on credit institutions regarding the preparation of documents (for example, see Article 20 of Law No. 173-FZ).

In addition, the separate rules by which cash payments are made in the currency of the Russian Federation and foreign currency between resident legal entities and non-residents are discussed in Part 2 of Art. 14 of Law No. 173-FZ.

Features of passing a transit account

The instructions published by the Central Bank back in 1992, as well as subsequent amendments, introduce the obligation for legal entities and individuals to credit any proceeds received from abroad to a transit account. To do this you need to submit:

- certificate of currency transactions;

- application for transfer or sale of funds from a transit account;

- justification for the amount received (agreement or contract, certificate of completion, invoice, etc.).

Note! If the basis for the transfer is an agreement with a specified amount of more than $50,000 (or equivalent), it is necessary to additionally issue a transaction passport with the assignment of an individual number and endorsement by the banking service. The law defines the deadline for registration - no later than 2 weeks from the date of receipt of funds. It is also attached to the above documents.

After checking the papers, the bank either unblocks funds for further transactions, or requests additional information (or permanently blocks funds in case of suspicion of the legitimacy of the transaction). It is important that each time funds are credited, the bank receives a certain remuneration (commission) for carrying out currency control functions.

If the check does not reveal any violations, the client can sell the foreign currency amount or transfer it to a current account.

Important! Since exchange rates are constantly changing, all foreign currency accounts are subject to regular revaluation of balances in terms of rubles. Exchange rate differences arising during transactions are credited to the account in the form of debit or credit orders (advice notes).

Principle of repatriation

The special conditions regime applies when making payments by residents in the IV within the framework of foreign trade activities (Article 19 of Law No. 173-FZ). This is the so-called principle of repatriation, which imposes certain responsibilities on residents (Parts 1 and 1.1 of this article):

- ensuring receipt of currency (national and foreign) due in accordance with the terms of agreements and contracts;

- repatriation to the Russian Federation of funds paid by non-residents for goods, work, services and information that were never imported into the Russian Federation, fulfilled, transferred (failure to fulfill this condition even provides for liability under Article 193 of the Criminal Code of the Russian Federation).