The concept of SNT

SNT (garden non-profit partnership) is a non-profit structure established on a voluntary basis with the aim of helping its members in solving various economic and social problems when conducting vegetable gardening, horticulture or dacha farming.

Such issues include providing the participants of the association with water, electricity, heat, gas, etc. The main regulatory act regulating the activities of SNT, since 2019, is the law “On the conduct of gardening and vegetable gardening by citizens...” dated July 29, 2017 No. 217-FZ. Before this, the law “On gardening, gardening and dacha non-profit associations of citizens” dated April 15, 1998 No. 66-FZ was in force.

NOTE! SNT is not subject to the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ (clause 3 of Article 1 of Law No. 7-FZ). But for the purposes of applying accounting standards, SNT is considered as a non-profit structure.

The procedure for maintaining accounting records in SNT is not defined by individual provisions of the law. Therefore, it is necessary to be guided by uniform standards in the field of accounting, on the basis of which a local regulatory document should be developed - the company’s accounting policy.

Compensation for losses in SNT power grids: judicial practice

Let's consider the indicative court decision in the case of “inflated” electricity tariffs in SNT.

A resident of the Krasnoyarsk Territory appealed to one of the local district courts with a claim against her SNT “Agrarnik”. In the statement of claim, the woman demanded to cancel the decision of the general meeting of SNT members, which set an inflated (from her point of view) electricity tariff of 2 rubles. for 1 kWh. Despite the fact that in the Krasnoyarsk Territory at that time (2012) the tariff for the population was only 1.6 rubles. per kWh

In the court proceedings, a representative of SNT stated that the decision to assign an increased tariff was made in order to cover losses arising in the electricity networks and transformers of the partnership. Their volume is 5.2%. According to the SNT representative, the decisions made did not contradict the current legislation, since payment was made for the amount of energy actually received by the subscriber in accordance with energy metering data.

However, the court did not agree with this point of view. The court decision states that the current legislation (namely, Order of the Federal Tariff Service dated August 6, 2004 N 20-e/2 “On approval of guidelines for calculating tariffs and prices for electricity and heat in the retail consumer market” ) horticultural non-profit associations are equated (in terms of electricity tariffs) to the “population” category.

In this case, the decision on the size of the electricity tariff for the population is made by the authorized regional executive body. In the case of the Krasnoyarsk Territory - the Regional Energy Commission (REC). And payment for electricity consumption by SNT members must be made precisely at the tariff approved by the Krasnoyarsk Regional Energy Commission.

On the part of SNT, objections were presented at the trial in the sense that 2 rubles. per kWh This is not a tariff, but a “payment for electricity”. It is established as a “comprehensive indicator for settlements within a gardening partnership”, with its help the costs of losses and maintenance of the partnership’s electrical networks are covered, and this is not at all the same as the regional electricity tariff.

The court did not agree with this interpretation. A tariff, from a judge’s point of view, is a tariff. It is used to pay for consumed electricity. And fees for maintaining networks and covering losses should be charged through special additional fees.

As a result, the SNT member’s application to cancel the inflated tariff was granted. You can read the court's decision in full at this link.

There are quite a lot of such solutions. And, despite this, practice shows that gardening associations still en masse set their own “internal” inflated electricity tariffs.

The latest news on this topic is the results of an inspection by the prosecutor's office of the Nizhny Novgorod region of compliance with the law when paying for electricity in gardening associations in the region. In total, about forty cases of establishing an “inflated” electricity tariff in SNT were identified. Their chairmen received recommendations from the prosecutor's office to eliminate the identified violations.

Nuances of accounting for fixed assets in SNT

Important! From 01/01/2022, PBU 6/01 is cancelled. Instead, two new FSBUs are being introduced: 6/2020 “Fixed Assets” and 26/2020 “Capital Investments”. ConsultantPlus experts explained in detail what the new standards will change compared to PBU 6/01 in their Review, which you can view for free after receiving trial access to K+.

Accounting for fixed assets (Fixed Assets) is regulated by PBU 6/01 “Accounting for Fixed Assets” (approved by Order of the Ministry of Finance dated March 30, 2001 No. 26n). According to clause 4 of this provision, non-profit organizations (hereinafter referred to as NPOs) accept fixed assets for accounting if the object is used in activities aimed at achieving the goals of creating an NPO, including business activities. The following conditions must also be met at the same time:

- the period of expected use of the OS object is more than a year;

- the object was purchased for the purpose of further use and not for resale.

An asset is accepted for accounting at its historical cost, which is the sum of the actual expenses incurred in the process of acquiring, constructing or manufacturing the asset. These include amounts paid to the seller under the purchase and sale agreement for the property, as well as transportation costs, information and consulting services, non-refundable taxes, etc.

NOTE! If a fixed asset is acquired strictly for non-commercial activities (that is, they do not plan to associate the receipt of VAT-taxable revenue with its use), then the amount of input VAT is included in the cost of the object (clause 2 of Article 170 of the Tax Code of the Russian Federation).

All costs for the acquisition of an asset are collected on account 08 “Investments in non-current assets”, and upon commissioning of the asset, account 08 is credited to the debit of account 01 “Fixed assets of the organization”.

The wiring looks like this:

Dt 08 Kt 60 - an asset was purchased from the seller (including VAT amounts);

Dt 08 Kt 60, 76 - reflects the direct costs of purchasing an asset (transport, consulting, etc.);

Dt 01 Kt 08 - the asset was put into operation;

IMPORTANT! The use of funds from targeted contributions for capital investments should be reflected using account 83 (according to the instructions to the Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n).

Dt 86 Kt 83 - targeted funds aimed at capital investments are taken into account as an increase in additional capital;

Dt 83 Kt 01 - reflects the disposal of a capital investment item purchased using targeted proceeds.

All operations involving the movement of OS objects are documented with primary documents. For which ones, see the material “Documentation of the movement of fixed assets”.

In accounting, fixed assets are valued at less than 40,000 rubles. can be taken into account as part of the MPZ (clause 5 of PBU 6/01).

IMPORTANT! Depreciation on fixed assets acquired from targeted proceeds and used in non-commercial activities is not accrued (clause 17, section 3 of PBU 6/01, subclause 2, clause 2, article 264 of the Tax Code of the Russian Federation). The amount of depreciation is calculated using a linear method and is taken into account in off-balance sheet account 010 “Depreciation of fixed assets” at the end of the year. Such assets are also not revalued.

When disposing of fixed assets acquired through targeted financing, the sources of financing are not repaid and are not taken into account in the financial results of the company. In accounting, such an operation is recorded as Dt 83 Kt 01.

Moreover, if SNT acquired an asset using funds from business activities and uses it to generate income, then depreciation is charged on this property and it is accounted for separately from the target property. Depreciation in this case is written off as expenses by posting Dt 20 (26) Kt 02.

If SNT received an asset at the expense of targeted funds, but uses it in commercial activities, then the cost of the asset is recognized as income of the non-profit organization (clause 14 of Article 250 of the Tax Code of the Russian Federation). The cost of property in this case is repaid by calculating depreciation (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Difference between SNT and ONT

The main difference between SNT and ONT is the possibility of constructing permanent buildings and structures on the land plots of the owners:

- Gardeners from SNT can erect capital construction projects on the ground: houses, garages, bathhouses, sheds, carports, greenhouses and gazebos. If the house on the site meets the housing requirements, you can register in it, even if the property is located outside the village. If the construction of an object with an area of >50 sq.m. only in plans, you need to get a technical plan.

- Gardeners from ONT cannot install capital construction projects on their plots. This is the difference between SNT and ONT. On the territory of the garden you can build a shed, a temporary shed, a booth, a toilet - anything that does not have a foundation. If a gardener builds a small house, it will be impossible to obtain ownership of it.

Accounting for target funds in SNT

The SNT budget is formed from funds contributed by SNT members.

NOTE! From 01/01/2019, SNT can accept contributions from participants only to a current account, not to the cash desk (Article 14 of Law No. 217-FZ). CCT is not used when accepting contributions. Contributions are not payment for goods, work, services, and therefore do not fall under the concept of “settlements” in the sense of the Law “On CCP” dated May 22, 2003 No. 54-FZ. Similar explanations are given in the letter of the Ministry of Finance dated September 11, 2018 No. 03-01-15/65041 regarding targeted contributions to TSN.

Such contributions include:

- membership fees - funds periodically paid by members of the association, which are allocated for the current expenses of the organization;

- targeted contributions are funds that can be used to purchase public facilities.

NOTE! As of January 1, 2019, SNT no longer collects entry fees from participants. Entry fees paid earlier are not returned to participants (Clause 31, Article 54 of Law No. 217-FZ).

How to organize accounting for target financing for profit taxation is explained in detail in the Ready-made solution from ConsultantPlus. Get trial access and access the material for free.

In accounting, account 86 “Targeted financing” is used to reflect the movement of these contributions. To divide contributions, it is more convenient to enter separate subaccounts, for example, 86.1 “Membership fees”, 86.2 “Target contributions”. To account for mutual settlements with SNT members, account 76 “Settlements with various debtors and creditors” is used.

SNT receives and spends funds on the basis of the income and expenditure estimate approved at the general meeting by the members of the partnership (Clause 8, Article 14 of Law No. 217-FZ). Contributions can be spent strictly on a specific budget item. There is no unified form of estimate, and the management of the partnership develops it independently.

Expenses incurred can be reflected in the debit of standard cost accounts (20, 26), but it is also possible to immediately reflect in the debit of account 86, bypassing cost accounts, with the choice of subaccount depending on the type of costs.

Example

The estimate of SNT "Romashka" provides for the following payments: membership fees - 150 rubles. per hundred square meters, targeted contributions for equipping a waste collection site - 1,000 rubles.

SNT "Romashka" accepted a new gardener as a member - N. A. Fadeev. His plot is 5 acres. He made all contributions to the association's cash desk: 750 rubles. (150 × 5 cells) - membership; 1,000 rub. - targeted. The accountant reflected these contributions in accounting as follows:

Dt 50 Kt 76 — 1,750 rub. - contributions from Fadeev N.A. arrived at the cash desk.

Dt 76 Kt 86.2 — 750 rub. — membership fees are accrued as part of targeted funds;

Dt 76 Kt 86.3 — 1,000 rub. — target contributions have been accrued.

For the month, SNT “Romashka” incurred the following expenses:

Dt 86.2 Kt 70 - 15,000 rub. - remuneration of the chairman and accountant;

Dt 86.2 Kt 69 - 4,500 rub. — contributions from the payroll;

Dt 86.2 Kt 71 — 500 rub. — stationery purchased;

Dt 86.3 Kt 10 - 23,800 rub. — materials and tanks for waste site equipment were written off;

Dt 86.3 Kt 60 - 3,200 rub. — services for installing a fence and concreting a waste site.

You can find out what kind of reporting to submit to SNT for targeted financing from the Typical Situation from K+, having received free access to the system.

Example

SNT “Rassvet” has monthly membership fees of 100 rubles. per hundred. In addition, in March 2021, the general meeting decided to collect 1,000 rubles in targeted contributions from each participant for the repair of the fence.

Ivanov A.V. owns a plot of 6 acres. In March he paid membership fees (600 rubles) and half of the target fee (500 rubles). Postings for settlements with Ivanov in March will be as follows:

DT 76 - CT 86.1 (600 rub.) - membership fees charged

DT 76 - CT 86.2 (1000 rubles) - target contributions accrued

DT 51 - CT 76 (600 rub.) - membership fees paid

DT 51 - CT 76 (500 rub.) - target contributions partially paid

The debit balance on account 76 is in the amount of 500 rubles. as of 03/31/2021 shows Ivanov’s current debt to SNT for contributions.

Accounting for other income and expenses in SNT

- Income accounting.

According to Art. 5 of Law No. 217-FZ, citizens have the right to run their own households individually and not join the ranks of SNT participants. At the same time, they have the right to use SNT infrastructure facilities for a fee stipulated by the concluded agreement.

Such payments do not relate to target contributions, are taken into account as part of the partnership’s income and are subject to taxation.

In addition, SNT has the right to engage in commercial activities in order to achieve the main goal of creating a partnership.

NOTE! These incomes will fall within the scope of the law “On CCP” and will require SNT to use a cash register.

Accounting entries are reflected in accordance with PBU 9/99 “Income of the organization” (approved by Order of the Ministry of Finance dated 05/06/1999 No. 32n) and methodological recommendations thereto:

Dt 62 Kt 90.1 - sale of services.

- Cost accounting.

SNTs are required to keep separate records of targeted and commercial expenses (clause 2 of Article 251 of the Tax Code of the Russian Federation). It is most convenient to organize accounting of business costs on accounts 20 and 26.

In this case, indirect costs must be distributed. Indirect costs are those costs that relate to several types of activities or to all activities of the NPO.

For accounting purposes (hereinafter referred to as accounting), indirect costs can be distributed in 2 ways:

- By revenue volume. In this case, the percentage of costs related to commercial revenue is determined by the formula:

Vk / (Vk + CPU) × 100,

Where:

Вк — revenue from commercial activities;

Tsp - target revenues.

- Based on the share of employee costs. Then the percentage of costs related to commercial activities will be equal to:

PHOTk / (PHOTk + PHOTc) × 100,

Where:

FOTK - wage fund for employees engaged in commercial activities;

FOts - remuneration of “target” personnel.

In addition, SNT is allowed to write off indirect costs, such as expenses for the maintenance of the organization itself, administration salaries, maintenance of premises, structures and transport related to statutory activities, only through targeted contributions (letter from the Department of Tax Administration of Russia for Moscow dated 22.01. 2003 No. 26-12/4743).

In tax accounting (hereinafter referred to as TA), it is allowed to distribute costs in proportion to revenue (clause 1 of Article 272 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated March 16, 2015 No. 03-03-10/13805 and dated June 25, 2015 No. 03-03-10/ 36660). In this regard, it is more convenient to choose a single option “based on revenue” and consolidate it as an element of accounting policy.

All indirect costs collected on account 26 “Indirect costs” are distributed among the types of activities by records at the end of the month:

Dt 86.2 Kt 26 - indirect costs are allocated to current statutory activities;

Dt 86.3 Kt 26 - indirect costs are allocated to target programs;

Dt 20 Kt 26 - indirect costs of business activities are distributed to production;

Dt 90.2 Kt 20 - costs are charged to the cost of commercial revenue.

- Accounting for financial results.

At the end of each month, SNT closes 90 accounts to account 99 of profits (losses), and at the end of the reporting period, the balance of 99 is taken into account as part of retained earnings (uncovered loss) on account 84. But since entrepreneurial activity is carried out to achieve the goals of statutory activities, then the profit received is not distributed among the participants, but is credited to the account of targeted financing of the statutory activities of the NPO by entry Dt 84 Kt 86.

Payment for electricity in SNT: the main problem

The practical side is that an electricity meter is installed at the border of the SNT internal network. It shows how much electricity was supplied to the gardening association. SNT is obliged to pay for this entire amount.

The association collects funds for payment from its members, as well as from persons running a household on the territory of SNT individually, and who are not members of the association (let’s call them “individuals” for simplicity). Both members of SNT and “individuals” record consumption in their areas using individual electricity meters.

The problem, however, is that the sum of the readings of all individual meters will in any case be lower than the electricity consumption recorded by the general meter at the “input” to the SNT.

The first reason for this is technological losses in the partnership’s networks. They can range from a few percent to 10% of the “incoming” volumes of electricity. This figure depends on the state of the partnership’s infrastructure: transformers, power line wires, metering devices.

In addition to technological losses, the difference between the readings of individual and general meters also arises due to unaccounted consumption (consider theft) of electricity, as well as a delay in the transmission of meter readings.

The result is this: SNT, based on the readings of the general electricity meter, owes the energy sales company one amount. And based on the current tariffs and their meter readings, they may collect another, noticeably smaller amount from SNT members.

And even if it is possible to cope with theft and achieve simultaneous reading of meters, the problem of technological losses remains. There are two ways to solve this:

- increase the tariff at which gardeners pay for light, make it higher than officially approved for the population of a given region

- introduce an additional fee to cover network losses.

And although the current legislation does not contain direct explanations on this matter, based on current judicial practice, the second path is correct.

Features of accounting in SNT under the simplified tax system

In order to reduce the tax burden and be exempt from paying VAT (except for import VAT), income tax and property tax (except for real estate, the value of which is determined by Roskadastre), SNT for commercial activities has the right to choose a special regime in the form of a simplified tax (subclause 14 Clause 3 of Article 346.12 of the Tax Code of the Russian Federation), choosing one of the available options for the object of taxation: income or income minus expenses.

In this case, accounting for targeted revenues and expenses is also kept on account 86 “Targeted Financing” and is not subject to taxation (subclause 1, clause 1, article 346.15, clause 2, article 346.16 of the Tax Code of the Russian Federation).

Accounting for income and expenses from commercial activities is carried out in the book of income and expenses using the cash method (Clause 1, Article 346.17 of the Tax Code of the Russian Federation).

Results

The activities of gardening non-profit partnerships are in a special legal field and are regulated by a special federal law.

The status of an organization’s activities also determines the specifics of its taxation. SNT is not exempt from paying income tax, VAT, etc. But when calculating these taxes, the database does not include targeted funds aimed at carrying out the statutory activities of the partnership.

SNT also has the right to apply the simplified tax system. In this case, a special feature is the exclusion of amounts of target funds from income for the purposes of taxation of the simplified tax system.

Due to the fact that targeted funds are not taken into account for tax purposes, SNT needs to organize separate accounting of income and expenses by allocating a special account 86 “Targeted Financing” for this purpose.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Tax accounting system

The most optimal choice for SNT will be a simplified tax system (“simplified tax system”, or simplified tax system).

When applying the simplified tax system, in accordance with Part 2 of Article 246.11 of the Tax Code of the Russian Federation, the organization is exempt from paying value added taxes (VAT), on profit and on property.

Horticultural non-profit partnerships are organizations that do not produce products, do not sell goods and do not provide services to third parties, therefore in SNT it is better to apply the simplified tax system with the definition of profitability at the rate of 6% of turnover (revenue received).

The applied system is approved during the registration of SNT, this fact is reflected in the Unified State Register of Legal Entities extract.

Since most gardening partnerships were created in the late 80s and early 90s of the last century, basically they all used the basic taxation system (OSNO). To change the system, you need to submit an application for the application of the simplified tax system to the territorial tax office. This must be done before the end of the year. Then the transition to the “simplified” system will be made from January 1.

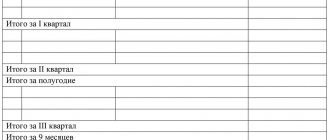

What kind of reporting does SNT submit?

Both on the simplified tax system and on OSNO, gardening partnerships are required to submit monthly, quarterly and annual financial statements to the territorial offices of the tax inspectorate, pension fund, social insurance fund and statistics.

The mandatory submission of “Form-1” and “Form-2” to the territorial statistics body was canceled from January 1, 2021 on the basis of Federal Law No. 444-FZ of November 28, 2018.

Regardless of the taxation system used, all SNT pass:

1. To the territorial branch of the Pension Fund:

- “SZV-M” - monthly until the 15th (the form is submitted when employees are actually paid);

- “SZV-STAZH” - annually until March 1;

- “SZV-TD” - in case an employee submits an application to switch to an electronic work book, as well as when an employee is fired or hired, the next day after the order is issued (due date - February 15).

2. To the regional tax authority:

- quarterly calculation of insurance premiums (DAM) - until the last day of the month following the reporting quarter (submitted regardless of the actual availability of employee payroll). The sample changed in 2021 in accordance with Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/470;

- quarterly “6-NDFL” - until the last day of the month following the reporting quarter (in case of actual calculation of wages to employees);

- annual “6-NDFL” and “2-NDFL” - annually until March 1 (when employees are actually paid);

- annual information on the average number of employees - until January 20 of the current year;

- tax return for land tax - annually before March 1 (if there is collective land owned by SNT).

In 2021, the submission of a tax return for land tax for 2020 is cancelled. The tax office will independently send tax payment notifications. Its calculation is determined by the type of land use and according to the Unified State Register of Lands.

- transport tax return for the year - submitted before February 1 only if the partnership owns registered vehicles (in 2021, filing a tax return for this type of tax has been cancelled).

3. To the territorial department of the Social Insurance Fund:

- “4-FSS” is submitted every month on paper by the 20th day and electronic transmission of the report by the 25th day of the month (submitted regardless of the actual availability of employee payroll);

- application and confirmation of the main type of economic activity (OKVED) - annually until April 15.

4. To the Rosprirodnadzor office:

- “2-TP” (municipal waste) - annually until February 1.

5. To the Ministry of Housing and Communal Services (MHKH) (Moscow region) - the annual report to the waste accounting system of the Moscow region (Waste Cadastre) is submitted by April 20.

SNT reporting on the simplified tax system

For SNTs that have chosen the “simplified” system, the list of reports is much smaller than under the main OSNO tax system. Additionally, in simplified financial statements, only the annual declaration according to the simplified tax system is added. It is submitted to the regional department of the tax service (IFTS) until March 31. The standard sample was approved by Order of the Federal Tax Service of the Russian Federation dated February 26, 2016 No. ММВ-7-3/99.

SNT reporting on OSNO

The main tax system requires more documentation.

- The quarterly value added tax (VAT) declaration is submitted only in electronic form before the 25th day of the month following the reporting period. The form was approved by Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 No. ММВ-7-3/558. It is rented even if there is no economic activity - then only the title page is filled out in the declaration, and the remaining sections will be zero.

- Quarterly income tax return - by the 28th day of the month following the reporting quarter. It is drawn up according to the model approved by order of the Federal Tax Service of the Russian Federation dated September 23, 2019 No. ММВ-7-3/475.

- Annual financial statements - balance sheet according to “Form-1” and profit and loss statement according to “Form-2”, about the expenditure of funds “Appendix 6” are submitted by March 31.

- Annual declaration on property tax of organizations - annually before March 30 in the event that property is listed on the balance sheet of the partnership. Since 2021, a new sample document has been in force, approved by order of the Federal Tax Service of the Russian Federation dated August 14, 2019 No. SA-7-21/405.

How to simplify your accounting work without hiring an accountant

As you can see, there are not as few reporting documents as it seems.

And compiling them is only part of the accounting work. Therefore, it is not recommended for the chairman to take on all the accountant’s work. It is much more effective to simplify this process with the help of special services and programs. They will help:

- organize and maintain accounting and reporting;

- correctly reflect payroll to employees in accounting;

- keep records of the payment of membership, target fees and other payments from land owners and draw up a statement of debts;

- generate payment documents to be sent to the bank for payment of taxes and services to counterparties;

- manage certain issues of personnel records management;

- interact with regional regulatory authorities regarding notifications and requirements received by your partnership.

If you already have an accountant, make his work more efficient using the program for SNT 1C: Gardener. This program is easy to learn and allows you to generate reports without errors. It also has a calendar that will remind you of reporting deadlines.