The certificate confirms the citizen’s income for a certain period of time.

Often the need for a 2-NDFL certificate arises when obtaining a loan from a bank, submitting a 3-NDFL declaration, or to receive tax deductions.

The validity period of the 2-NDFL certificate is unlimited.

However, the required validity period may be determined by the organization requesting it.

How long is a 2-NDFL certificate valid?

Tax agents (meaning firms, enterprises, individual entrepreneurs paying income to individuals) must, upon receipt of an application from a taxpayer (tax agent employee), issue him a reference calculation of 2-NDFL (clause 3 of Article 230 of the Tax Code of the Russian Federation) for any period, prior to the application date.

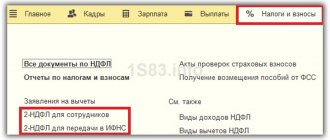

The current 2-NDFL form for 2021 can be downloaded here.

A sample application for issuing a 2-NDFL certificate can be downloaded from ConsultantPlus. To do this, sign up for trial demo access to the K+ system. It's free.

And although the validity period of the 2-NDFL certificate is not limited, its contents and date must correspond to the purposes for which it is taken by the employee. So, 2-NDFL is sometimes needed:

- to prepare the 3-NDFL declaration;

- when applying for a loan.

Let's see how long 2-NDFL is valid in these cases.

General information about the help

Personal income tax or personal income tax is paid by the employer. If the latter is unable to pay the tax on time, then a corresponding note is made on the certificate. However, this tax must be paid not at the end of the calendar year, but every quarter. A separate certificate is prepared for each individual.

According to current legislation, this certificate must contain the following information:

- Number of the Federal Tax Service where this certificate will be submitted.

- Information about the tax agent, namely TIN, KPP, other details and contact information. The tax agent is the employer.

- OKTMO tax agent.

- Information about an individual, namely his last name, first name, patronymic, passport details, TIN, status and citizenship.

- Income of an individual for the entire year with a monthly breakdown.

- Tax deductions applied (if any).

- Accrued and withheld personal income tax.

This certificate contains data for the entire year. However, if the employee has worked for the enterprise for less than one year, then it is compiled taking into account the actual time worked.

The certificate in form 2-NDFL displays information about the correctness of income and tax deductions.

Validity and expiration date of the 2-NDFL certificate for the tax office

Let's move on to the question “How long is the 2-NDFL certificate valid for the Federal Tax Service?” When the year ends, an individual, based on the rule established by law (Article 229 of the Tax Code of the Russian Federation) or by personal expression of will, sends a 3-NDFL declaration to the tax authorities. Figures relating to income are transferred to it from 2-NDFL.

Although, as we have already figured out, there is no validity period for 2-NDFL certificates, the taxpayer is strongly recommended to check whether he has missed the time to contact the tax authority on an issue for which resolution is necessary, including the information presented in 2-NDFL . Most often, individual taxpayers go to the tax office in order to return previously transferred personal income tax from the budget. At the same time, the deadline for tax refund is 3 years (Clause 7, Article 78 of the Tax Code of the Russian Federation).

ATTENTION! Users of their personal account on the website of the Federal Tax Service of Russia have the opportunity to download Certificates to their computer using this service. It is necessary to take into account that tax agents submit information about an individual’s income for the past calendar year to the tax authority no later than March 1 of the following year. That is, the 2-NDFL certificate for 2021 can be available in your personal account no later than 03/01/2021.

Next, we will consider how long a 2-NDFL certificate is valid for a bank.

Why do you need a 2-NDFL certificate?

Certificate 2-NDFL reflects the income received and the tax paid on it.

Article 62 of the Labor Code of the Russian Federation states that if an employee submits a written application for the issuance of a salary certificate, the boss is obliged to provide the document no later than three working days. The Tax Code stipulates that a certificate of income is issued to an employee upon request.

The company is required to prepare this document in the following cases:

- As part of the annual reporting to the tax office.

- For an employee at his request.

In the first case, this document is submitted to the tax office no later than the beginning of April of the year following the reporting year.

If a certificate is issued to an employee, he must indicate where he is going to provide it.

Why a certificate is usually provided:

- bank when applying for a loan;

- tax office;

- when applying for a visa;

- in some other cases.

Validity period and deadline for submitting the 2-NDFL certificate for the bank

It is extremely common for credit institutions to request the calculation of 2-personal income tax (when citizens contact them to borrow money for various needs).

The validity period of a 2-NDFL certificate for a bank will be determined by its requirements for the period of confirmation of earnings and/or the date of its preparation, which may vary in each individual case depending not only on the credit institution, but also on the characteristics of the loan product claimed by the potential borrower .

As for the deadline for submitting 2-NDFL to the bank, it is determined by the time limits for transferring to the bank all the documents necessary to consider the request to receive borrowed funds.

Read about banks checking the 2-NDFL certificate for a loan here.

Validity period of the 2-NDFL certificate

According to domestic legislation, the 2-NDFL certificate does not have an expiration date, however, it becomes irrelevant after the individual receives the next income, as it must reflect all the information about the funds received. That is why many organizations independently set the time frame for the validity of this certificate.

Thus, for the INFS, the validity period of the certificate is one calendar year. It is provided once a year or at the request of the tax authority. If there is no activity of the enterprise or in the absence of accrued wages, it is required to provide a certificate confirming the absence of a tax base for personal income tax.

As for financial and credit institutions, for them the validity period of the 2-NDFL certificate is 1 calendar month when receiving mortgage loans or car loans, and for small consumer loans its period can be limited to 10 days. It is important that the information in the bank certificate is identical to the actual income of the individual, since many banks compare the information with tax deductions. If a discrepancy is detected, the loan is denied without explanation.

Deadline for issuing certificate 2-NDFL

The law does not directly say how quickly this paper is issued by the tax agent. But there is Art. 62 of the Labor Code of the Russian Federation, which limits the time for an enterprise to prepare documents for its employee at the latter’s request to 3 days, including the period for issuing a 2-NDFL certificate. Thus, if an employee has submitted an application for registration of 2-NDFL, it is within this period that it should be done and given to him.

Read more about the procedure for issuing a 2-NDFL certificate to an employee here.

For information about who can endorse the 2-NDFL, see the material “Who has the right to sign a 2-NDFL certificate?” .

What are the consequences of not issuing a 2-NDFL certificate at the employee’s request, read in the article “The employee was not issued a 2-NDFL certificate? Wait for the trial .

Recommendations

Before ordering a certificate in form 2-NDFL, it is recommended to check with the authority that requires it about its validity period. This will allow you to prepare all the necessary documents in advance, and order this certificate at the last moment. It is usually produced free of charge within 2-3 business days.

If for some reason an organization differentiates the base for personal income tax and the employee’s total income, you can order a certificate in the form of a bank, which will take into account all of the employee’s income for the reporting period. However, many financial and credit organizations do not accept such a certificate, and those that accept it offer their clients an increased interest rate.

When contacting several banks at once, it is worth ordering several certificates. In this case, it is possible to choose the bank that provides the most favorable lending conditions.

Results

The 2-NDFL certificate does not have a validity period, but it does have a deadline for its submission by the employer to the tax authorities and a deadline for issuing it to the employee. The employer is obliged to issue a 2-NDFL certificate to the employee within 3 working days. In addition to the employer, a 2-NDFL certificate for previous tax periods can be requested from the INFS.

Read more about this in the material .

Sources:

- tax code of the Russian Federation

- labor Code

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What income is shown in the certificate?

This certificate must display all income that an individual received during the reporting period, namely:

- Income received while performing your work duties.

- Income received in kind.

- Income received from the actions of an individual outside the Russian Federation.

If the certificate is made for foreign citizens, then it indicates income received in the territory of the Russian Federation.

Alternative to certificate 2-NDFL

Some financial institutions allow their clients to confirm their income level with a certificate on a bank form. Information that should be indicated in it:

- Full name of the future borrower;

- start date of work in the company;

- average income for 6–12 months (including compensation, bonuses, etc.);

- signature of the chief accountant or manager;

- seal.

A form for such a certificate can be obtained by contacting a branch of a financial institution or downloaded from its official website. The validity period of the document is limited - from 14 to 30 days.

Have your company's accounting department fill out the document. After all, the bank can contact the accounting department to double-check the specified data.

Certificate 2-NDFL is a document reflecting the income of a working citizen for a certain period. It contains information about the employer and his employee, the amount of accrued and paid wages, as well as tax.

Get a loan in 1 hour Fill out the form and find out which banks are ready to approve a loan for you. Choose a bank, submit an online application and get a loan today.

The document may be required by various authorities and institutions. For example, banks when considering applications for loans and credit cards. The validity period of the income certificate varies from 7 to 30 days, depending on the selected product.

The employer must issue a certificate of income within 3 days after receiving a written application. An alternative for banks to confirm their solvency is a certificate on the creditor’s letterhead.

2-NDFL for a loan

When issuing a loan, the bank wants to make sure that the borrower will be able to pay for it. To do this, he needs to know what financial capabilities he has. The presence of regular income and its amount play an important role. The more funds the loan recipient has, the easier and more favorable conditions the bank will be able to offer him.

By requiring a 2-NDFL certificate from the client, the bank can see his income in the near future. Since such a certificate issued by an enterprise does not have a limited validity period, the bank’s requirements for this document are more important here.

Based on Article 230 of the Tax Code of the Russian Federation, an employee has the right to receive a 2-NDFL certificate for any period of time that he specifies. However, the bank usually requires data on income received over the last six months of work.

In this case, the time during which the certificate remains valid is determined by the deadline for completing the loan application.

There is no need to complete the document in advance. It is important for a credit institution that the income data provided is up to date. Therefore, the certificate is usually valid for them for 30 days from the date of issue.

Banks that give loans without a 2-personal income tax certificate

| Bank | Bid | Sum |

| from 12% | up to 2,000,000 rub. |

| from 9.9% | up to 3,000,000 rub. |

| from 10.5% | up to 4,000,000 rub. |

| from 8.9% | up to 400,000 rub. |

| from 9.9% | up to 700,000 rub. |

| Microloan | Bid | Sum |

| from 0.66% | up to 30,000 rub. |

| from 0.34% | up to 70,000 rub. |

| from 0.95% | up to 30,000 rub. |

| from 0.27% | up to 100,000 rub. |

| from 0.99% | up to 30,000 rub. |