Accounting for non-cash transactions of a business entity is carried out using a balance sheet compiled for account 51.

It is noteworthy that this document is not just an analytical tool that generates information about the balances and turnover of funds in bank current accounts.

In addition, it is used by the organization as an important source for the preparation of final financial documentation.

The use of a balance sheet for accounting and analysis of non-cash money will effectively help the accountant avoid mistakes when preparing the relevant reports.

It is necessary to understand what shows how the turnover balance sheet (SAS) of 51 accounts intended for accounting and analysis of non-cash transactions is read.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Current balance (turnover sheet) for synthetic accounts”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Form T-51. Payslip

9596 The payroll form T-51 is drawn up if an employee’s salary is transferred to a payment card of one of the banks.

It cannot be used to pay an employee (unlike settlement and payment).

Filling out payment and settlement forms is optional. FILES The responsibility for filling out this paper in the vast majority of cases falls on the payroll accountant.

If there is only one accountant in the company, then it will be him. He must assign a serial number to each statement that is formed.

It is more convenient to do this from the beginning of the year or reporting period, creating new ones every calendar month.

Information from the payroll goes to the payroll, and according to it, wages are calculated. Only the last column T-51 takes part in this process.

Found documents on the topic “turnover sheet for accounting accounts sample”

- Working balance ( turnover sheet ) for synthetic accounts Accounting statements, accounting → Working balance (turnover sheet) for synthetic accounts

working balance ( turnover sheet ) for synthetic accounts +-+ namebalance at the beginningturnovers for the month balance at the beginning... - Sample. Statement accounting sales of products for shipment (No. 16/1)

Accounting statements, accounting → Sample. Product sales accounting sheet for shipment (No. 16/1)statement no. 16/1 accounting for sales of products for shipment for 20 +-+ line-settlement buyer, according to invoices (other documents) shipped...

- Sample. Statement No. 7 in Analytical accounting

Accounting statements, accounting → Sample. Statement No. 7 on analytical accountingstatement no. 7 on analytical accounting to accounts no. 06 “long-term financial investments”, no. 09 “lease obligations due...

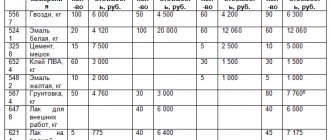

- Sample. Statement accounting remaining materials in the warehouse. Form No. m-14

Accounting statements, accounting → Sample. A list of remaining materials in the warehouse. Form No. m-14…2.89 no. 241 sample of the 1st page of the form +-+ (enterprise, organization) code for okud warehouse (storeroom) +-+ statement of balance of materials in the warehouse for 20 financially responsible person (position, acting, last name) ...

- Statement accounting accounts, issued by a branch of a foreign legal entity to buyers of products (works, services). Form No. 5-vpp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended dated December 29, 1995 No. vz-6-06-672))

Accounting statements, accounting → Statement of invoices issued by a branch of a foreign legal entity to buyers of products (works, services). Form No. 5-vpp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended dated December 29, 1995 No. vz-6-06-672))...no. 3 to the instructions of the state tax service of the Russian Federation dated June 16, 1995 no. 34 form no. 5-vpp statement of invoices issued by the department (full name of the foreign legal entity) to buyers of products (work...

- Sample. Statement accounting intangible assets and depreciation (No. 17)

Accounting statements, accounting → Sample. Statement of accounting for intangible assets and depreciation (No. 17)statement no. 17 accounting for intangible assets and depreciation for 20 +-+ line type non-short balance for movement...

- Statement accounting accounts suppliers accepted for payment by a branch of a foreign legal entity. Form No. 6-vpp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended dated December 29, 1995 No. vz-6-06-672))

Accounting statements, accounting → Statement of accounts of suppliers accepted for payment by a branch of a foreign legal entity. Form No. 6-vpp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended dated December 29, 1995 No. vz-6-06-672))...no. 3 to the instructions of the state tax service of the Russian Federation dated June 16, 1995 no. 34 form no. 6-vpp statement of accounting invoices accepted for payment by the department (full name of the foreign legal entity) for (...

- Accounting statements, accounting statements

, accounting - Sample. Statement accounting issuance (return) of workwear, safety footwear and safety equipment. Form No. MB-7

Accounting statements, accounting → Sample. Record sheet for the issuance (return) of workwear, safety footwear and safety equipment. Form No. MB-7form no. MB-7 was approved by the Decree of the State Statistics Committee of the USSR dated December 28, 1989 no. 241 +-+ okud code +-+ record sheet for the issue (return) of work clothes, safety shoes and safety equipment +-+ month number, type workshop code, department...

- Sample. Statement accounting financing a branch of a foreign legal entity. Form No. 1-vop (simplified) (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

Accounting statements, accounting → Sample. Statement of financing of a branch of a foreign legal entity. Form No. 1-vop (simplified) (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))...no. 4 to the instructions of the state tax service of the Russian Federation dated June 16, 1995 no. 34 form no. 1st statement of accounting for the financing of the branch (full name of the foreign legal entity) for (month, quarter, year) +…

- Sample. Statement accounting expenses of a branch of a foreign legal entity. Form No. 2-vop (simplified) (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

Accounting statements, accounting → Sample. Statement of accounting of expenses of a branch of a foreign legal entity. Form No. 2-vop (simplified) (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))...no. 4 to the instructions of the state tax service of the Russian Federation dated June 16, 1995 no. 34 form no. 2nd statement of accounting of expenses of the department (full name of the foreign legal entity) for (month, quarter, year) +-+ n...

- Sample. Statement accounting salaries of branch employees in the Russian Federation. Form No. 3-pp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

Accounting statements, accounting → Sample. Payroll records for branch employees in the Russian Federation. Form No. 3-pp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))…no. 3 to the instructions of the state tax service of the Russian Federation dated June 16, 1995 no. 34 form no. 3-pp statement salary accounting

- Analytical card accounting To account No. 52 "currency" check«

Accounting statements, accounting → Analytical accounting card for account No. 52 “currency account”analytical accounting for account no. 52 “currency account ” name of currency +-+ balance at the beginning of the month currency at the rate +- bank statement...

- Statement accounting results identified by inventory (Unified form N INV-26)

Enterprise records management documents → Statement of results identified by inventory (Unified Form N INV-26)The document “ Statement of accounting of results identified by inventory (unified form n inv-26)” in excel format can be obtained from the link...

- Record sheet for the issuance of workwear, safety footwear and safety devices (Standard interindustry form N MB-7)

Enterprise records → Record sheet for the issuance of workwear, safety footwear and safety devices (Standard interindustry form N MB-7)

* * *

So, we looked at why a balance sheet , as well as how it is compiled using the example of a specific account.

The balance sheet is maintained for internal accounting and is provided upon request to the tax authorities. It indicates the movement of goods, materials and cash, other assets, as well as the liabilities of the company, its capital, reflected in the accounting accounts. In addition, it reflects the balances at the beginning and end of the specified period for these accounts.

We hope that our article will help you in the process of accounting and in preparing the specified statement.

Similar articles

- How is the balance sheet formed for account 70?

- How to correctly prepare a balance sheet?

- How to read the balance sheet?

- How to check the balance sheet?

- How is the balance sheet for account 01 formed and used?

Related documents

- Sample. The act of disposal of low-value and high-wear items. Form No. MB-4

- Sample. Act of inventory of precious stones, natural diamonds and products made from them. Form No. inv-9 (Decree of the State Statistics Committee of the USSR dated December 28, 1989 No. 241)

- Sample. Act of inventory of precious metals and products made from them. Form No. inv-8 (Resolution of the USSR State Statistics Committee dated December 28, 1989 No. 241)

- Sample. Inventory report of materials and goods in transit (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. The act of inventorying the availability of funds. Form No. inv-15 (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. Inventory report of unfinished repairs of fixed assets. Form No. inv-10 (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. Act of inventory of future expenses. Form No. inv-11 (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. An act of inventory of settlements with buyers, suppliers and other debtors and creditors. Form No. inv-17 (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. Inventory report of goods shipped. Form No. inv-4 (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. Act on the transfer of goods, containers and equipment when changing barmen

- Sample. Act of damage, damage, scrap of goods (material). Form No. 12

- Sample. An act for writing off tools (devices) and exchanging them for suitable ones. Form No. MB-5

- Sample. Act on writing off damaged work record forms

- Sample. Act on write-off of low-value and high-wear items. Form No. MB-8

- Sample. Act on write-off of fixed assets. Form No. os-3 (Resolution of the USSR State Statistics Committee dated December 28, 1989 No. 241)

- Sample. Act on mutual settlements (offsets)

- Sample. Act on liquidation of fixed assets. Form No. os-4 (order of the Central Statistical Office of the USSR dated December 14, 1972 No. 816)

- Sample. Certificate of valuation of machinery, equipment and other fixed assets (appendix to the agreement on the procedure for using federal property assigned to a state educational institution with the right of operational management) (pi

- Sample. Certificate of assessment of the cost of unfinished capital construction and uninstalled equipment (appendix to the agreement on the procedure for using federal property assigned to a state educational institution on the right

- Sample. An act of assessing the value of isolated water bodies, forests, perennial plantings, buildings, structures, aircraft and sea vessels, inland navigation vessels, space objects and other property that is subject to special regulations

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Current balance (turnover sheet) for synthetic accounts” was useful for you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

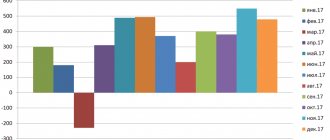

Why is OSV needed?

There are at least five reasons why an accountant cannot do without drawing up the SALT.

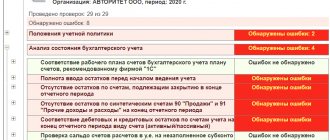

- Based on the data from the company's statements, they draw up a balance sheet. Data on balance sheet assets is filled in on the basis of information on the final balance on the debit of accounts. Closing loan balance – data for the liabilities section of the balance sheet.

- According to the SALT, the accountant checks himself for the absence of arithmetic errors. It is necessary to ensure that the document contains three pairs of equalities. There are no errors in the calculations if:

- the amount of debit funds at the beginning of the reporting period is equal to the amount of credit funds of the same reporting date;

- turnover on debit accounts is similar to turnover on credit;

- the value of its assets is the same as the amount of its liabilities.

The analysis of the SALT is to check these indicators and make sure that the rule of three equalities is observed in the SALT.

- SALT makes it possible to analyze indicators that cannot be calculated from the balance sheet or income statement.

- The company may not wait until the end of the reporting period to analyze the situation on a specific date. Typically, SALTs are made once a month.

- An organization can do a cost-benefit analysis based on the data in the statement.