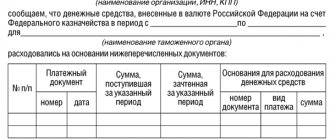

Information about the company’s activities for the reporting period is accumulated in the forms of approved accounting (financial) reports (Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n, as amended on April 19, 2019). Thus, the “Cash Flow Statement”, which is an appendix to the enterprise’s balance sheet and deciphers the data of its line 1250, informs the user about the volume of receipts and cash expenses incurred for the period of time under consideration. It provides complete information on the movement of money in the context of current, investment and financial activities. However, it is customary to display some data in collapsed form. For example, information about revenues that characterize not the actual work of the enterprise, but rather the activities of its partners. The list of cash flows, the volume of which should be indicated in a collapsed manner, is presented in paragraph PBU 23/2011. It also includes VAT, since this tax is contained in the structure of receipts from buyers or payments of various kinds, including to the budget, as well as reimbursement from the budget. Let's talk about how VAT is recorded in the “Cash Flow Statement” (CFDS).

What options are there for showing VAT?

Amounts that are received and paid by an organization to counterparties before being reflected in the ODDS must be cleared of VAT amounts. The difficulty lies in the fact that the tax itself is already included in the meaning of payments. In accounting, the payment and receipt of VAT amounts as part of these payments is not always reflected in the accounts separately and separately.

For this purpose, accountants “clean” the amounts of revenue and other receipts from clients and customers from the amount of VAT using a calculation method. The essence of this technique can be represented by the following algorithm:

- We take the amounts of annual turnover for Dt 62,60,76 accounts with correspondence Kt 51.50;

- the resulting amount must be multiplied by 20/120, which is the process of allocating VAT;

- the amount that remains after the allocation is the “cleared” amount of receipts.

Important! It is possible that certain types of goods (services) of a company are subject to a different VAT rate. In such a situation, the accountant must differentiate the amounts of receipts at different rates and allocate and clear VAT for the resulting categories separately. To simplify settlements, it is possible to open different subaccounts to settlement accounts.

Using the same scheme, you can clear VAT as part of your own payments.

Existing regulations do not provide an opportunity to choose the method of presenting VAT amounts in the ODDS. In a situation where it is not possible to isolate and clear VAT for various reasons, it is necessary to separately refer to this fact in the explanations to the ODDS.

Efremova A.A., General Director of the Audit Office

Instructions for filling

The procedure for generating a cash flow statement for 2021 is outlined in PBU 23/2011, approved.

by order of the Ministry of Finance of Russia dated 02.02. 2011 No. 11n. It is mandatory to fill out a report in accordance with these rules if you submit a cash flow statement (CFS) to the Federal Tax Service as part of your financial statements for 2021. Please note that a cash flow statement for 2021 may be required not only for submission to the inspection. In 2021, it will also be filled out, for example, for banks, founders or Rosstat authorities. In such situations, it is not necessary to follow the rules of PBU 23/2011. Just adhere to the general requirements for the preparation of financial statements, which are prescribed in PBU 4/99. And that will be enough.

The ODDS does not need to reflect the movement of money within the company - for example, depositing cash proceeds into a current account (clause 6 of PBU 23/2011).

What does "reflect collapsed" mean?

This term implies separating separately the amounts of VAT tax from the amount of cash flows both paid and received. The amounts should be grouped as follows:

- the amount of funds received from the sale of products from clients, customers, buyers;

- the amount of money that was paid for goods, services and other work;

- amounts of tax payable to the budget;

- tax amounts that are subject to refund from the budget.

It is necessary to highlight only those values and payments that the company claims for deductions to the budget. Otherwise, no allocation is required.

Purpose and report form

The cash flow statement characterizes all receipts and payments of the organization, as well as fund balances at the beginning and end of the reporting period - 2021. This is the purpose of the report, which is filled out in 2021 (clause 6 of PBU 23/2011). The report for 2021 must show all receipts and payments, as well as indicate cash balances at the beginning and end of 2021. The form of such a report was approved by order of the Ministry of Finance of Russia dated July 2. 2010 No. 66n. It must be completed at the end of 2021 and submitted as part of the annual financial statements for 2021.

How to collapse amounts in a report?

There are situations when the amount of cash flows must be shown collapsed in the report. For example, such cash flows are specified in clause 16 of PBU 23/2011. These amounts include VAT.

In order to reflect the tax amounts collapsed, you must perform the following actions shown in the table.

| Amounts | Name | Order |

| VAT amounts received from buyers and customers | VAT received | Reflect without VAT values the amounts of receipts from customers in the line “receipts from the sale of products, goods, works and services (code 4111) |

| Amounts that went to post office workers | VAT paid | Without VAT value, reflect payments to suppliers using line code 4121 |

| VAT amounts paid to the budget | VAT payable to the budget | |

| VAT amounts refunded from the budget | VAT refundable from the budget |

Important! Only those tax amounts that are subsequently claimed by the company for deduction in accordance with Chapter 21 of the Tax Code of the Russian Federation are subject to allocation.

An example of a blank and completed ODDS report form in 2021 is presented in the attachments.

ODDS blank form

ODDS completed form

Who should take it?

All accounting organizations are required to prepare a cash flow report for 2021 and submit it to the Federal Tax Service. At the same time, organizations that have the right to use simplified forms of accounting and reporting have the right not to submit a report. For example, small enterprises (parts 4–5 of article 6 of Law dated December 6, 2011 No. 402-FZ, clause 6 of order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

What to include in the report

The cash flow statement should summarize information about three types of company activities in 2021: current, investing and financing. For each type of activity, the report has its own section:

- “Cash flows from current operations”;

- “Cash flows from investment operations”;

- "Cash flows from financial transactions."

For each group, highlight how much money was received and how much was decreased, as well as the result of such receipts and expenditures for the reporting period (clauses 12 and 13 of PBU 23/2011).

Determine the cash balances at the beginning and end of 2021 for the organization as a whole, taking into account branches and representative offices. Indicators for 2021 should be reflected in comparison with similar data for 2015.

Self check

It is possible to independently check how accurately the amount is reflected in the report on line 4119. For this purpose, it is enough to use the formula for calculating the final flow in terms of VAT and reconciling the data with line 4119:

IP = VATSp - VATSu - VATSub + VATVb

where VAT – tax amounts received from buyers, etc.;

VAT – amounts of tax paid to suppliers, etc.;

VATsub – the amount of tax that went to the budget as payments, etc.;

VATvb - tax amounts that were reimbursed from the budget, i.e.

The amount of VAT that was received can be reflected in the “Cash flows from current operations” section in the line “other receipts” (if there is a positive result) or “other payments” (if there is a negative result) (code line 4119)

An example of reflecting VAT in the ODDS

Let's take the conditional as an example.

The initial data for the company in terms of VAT movement for the year are as follows:

- the amount of VAT received (from buyers) is 1,000 rubles;

- the amount of the listed VAT amounts (to suppliers) is 600 tr;

- an amount of 100 thousand rubles was allocated to the budget;

The amount of receipts is 300 tr. (1000 -600 -100) is reflected in line 4119 “Other income”.

Next, we present the algorithm for calculating the indicator on page 4121 “Payments to suppliers for raw materials, supplies, work and services”:

- add turnover on accounts 50,51, 52 to each other in correspondence with accounts 60 and 76;

- deduct VAT amounts included in payments to suppliers;

- in parentheses on page 4121 you must indicate the result of the actions described above.

In page 4121 “Proceeds from the sale of non-current assets” calculations are carried out as follows:

- add the turnover of accounts 50,51.52 in correspondence with account 62 for amounts from the sale of fixed assets;

- subtract VAT from the resulting amount;

- indicate the result of the actions on page 4121.

In page 4221 “Payments in connection with the acquisition, creation, modernization, reconstruction and preparation for use of non-current assets”, calculations are carried out according to the algorithm:

- add turnover on accounts 50,51.52 in correspondence with account 60 on the amounts that were paid for fixed assets;

- remove VAT;

- indicate the result of the actions on page 4221.

Example of filling out the ODDS

Let us assume that during the year the following operations were carried out on account 51. Which is reflected in the table below.

| Operation | Correspondent account | Amount, t.r. |

| Receipt of finance from buyers for goods sold (including VAT 20%) | K62.1 | 236 |

| Amounts were transferred to suppliers for purchased goods (including VAT 20%) | D60.1 | 118 |

| Money received from the sale of fixed assets (including VAT 20%) | D62.1 | 59 |

| Transfer of wages | D70 | 50 |

| Transfer of personal income tax | D68.1 | 8 |

| Transfer of contributions | D69 | 15 |

| VAT transfer | D68.2 | 10 |

| Transfer of income tax | D68.4 | 7 |

| Receipt of credit funds | K66 | 1000 |

| Transfer of interest under a loan agreement | D66 | 50 |

| Repayment of loan funds | D66 | 1000 |

| Receipt of funds from the sale of your own bill of exchange | K66 | 250 |

| Transfer of money for the purchase of an intangible asset (excluding VAT) | D60.1 | 100 |

| Repayment of the loan by the borrower | K58.3 | 150 |

The appendix to the work provides a sample of filling out the ODDS in this example.

FAQ

Question No. 1: What if a situation arises when the amount of VAT paid to the supplier is not subject to deduction (example: the transaction is not subject to VAT). What can be done in such a situation?

Answer: In this case, there is no need to allocate VAT amounts from transfers for suppliers. Such values are simply reflected as part of payments to suppliers on line 4121.

Question No. 2. Is it obligatory to reflect the amounts in the ODDS in a collapsed form? Is it possible to avoid this? If necessary, how to reduce the labor intensity of the process?

Answer: Currently, the current regulations (namely PBU 23/2011) do not provide the opportunity to choose, which means that the amounts of VAT received and paid must be reflected in a collapsed manner. It is possible to reduce the labor intensity of the process by using various software tools, of which there are quite a lot on the modern market.

Question No. 3. What is classified as collapsed cash flows?

Answer: Such flows include:

- amounts of proceeds from counterparties to reimburse payments for utility services;

- payments for cargo transportation with receipt of compensation from the counterparty.

Question number 4 . What is the formula for calculating the collapsed VAT indicator?

Answer: The formula looks like this:

VATpurchase-VATpost-VATbudget+VATinvoice = Other receipts (payments),

where VATpurchase is the amount of tax on receipts;

VAT post – tax amounts on payments;

VAT budget - the amount of tax payable to the budget;

VAT - tax amounts reimbursed from the budget;

Other receipts (payments) - the indicator is reflected on line 4119 or 4129 depending on the result.

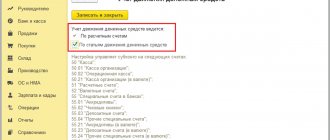

Methods for compiling ODDS

Even at the institutes, we were told that the ODDS can be compiled in both direct and indirect ways. How many of you have formed a clear concept of how to compose an ODDS in these two ways? If the ODDS, compiled in a direct way, is logically understandable to many, then the indirect method is understood and accepted by a minority, although it definitely has its advantages.

I propose to consider both of these methods using a simple example.

Example

The aspiring entrepreneur decided to bake pies and sell them at retail. To implement his business idea, he rented a room for 50 thousand rubles. per month, purchased baking equipment and tools for 100 thousand rubles. and raw materials (flour, eggs, etc.) for the first 100 pies, since he expected to sell an average of 20 pies per day. He made all these investments with his own money, with the expectation of recouping them in six months. He started operations in November 2019 and business went well, with turnover doubling in three months. But there was no more money in the current account.

The initial data for the example is given below, in thousands of rubles:

| Index | Sum | |||

| Bakery equipment | 100 | |||

| Rent, per month | 50 | |||

| Own investments | 250 | |||

| Index | Per unit | November | December | January |

| Sold, pcs. | 500 | 750 | 1 000 | |

| Raw materials | 0,3 | 150 | 225 | 300 |

| Revenue | 0,5 | 250 | 375 | 500 |

Before drawing any conclusions, our wise entrepreneur decided to draw up simple management statements - an income and expense statement (to calculate his profit) and a cash flow statement (to find out why there is still no money in the current account).

The entrepreneur dealt with the first report quickly:

| Income and Expense Report | November | December | January | Total |

| Revenue | 250 | 375 | 500 | 1 125 |

| Cost price | 150 | 225 | 300 | 675 |

| Overheads | ||||

| Rent, per month | 50 | 50 | 50 | 150 |

| Depreciation | 4,2 | 4,2 | 4,2 | 13 |

| Total operating profit | 45,8 | 95,8 | 145,8 | 287,5 |

Having compiled it, he realized that the profit from his business was sufficient, and he definitely decided to continue. However, he still did not understand how, with such a profit, he could not get his 250 thousand rubles back. invested money, and has only 38 thousand rubles. on the current account.

Then he moved on to compiling a cash flow statement.

ODDS compiled in a direct way allows you to clearly show and calculate for the future incoming and outgoing cash flows and the cash gap.

He compiled a cash flow statement using the direct method without difficulty:

- since the pies are sold for “real money”, the receipts from buyers were substituted in the amount of revenue;

- The entrepreneur made payments for raw materials in advance, a week in advance, so that the balance in the warehouse always allowed him to freely sell more. Therefore, the entrepreneur paid more for raw materials than revenue from buyers in November and is comparable to revenue in December and January;

- by adding rent, he received cash flow from operating activities;

- he included payment for baking equipment in the cash flow from investing activities;

- in cash flow from financial activities - initially invested 250 thousand rubles.

The final ODDS, compiled in a direct way, is in front of you:

| Index | November | December | January | Total |

| Remaining DS at the beginning | — | 50 | 37 | |

| Receipts from buyers | 250 | 375 | 500 | 1125 |

| Payment for raw materials | (300) | (338) | (450) | (1 088) |

| Payment for rent | (50) | (50) | (50) | (150) |

| Total cash flow from operating activities | (100) | (13) | (113) | |

| Purchase of equipment | (100) | (100) | ||

| Total cash flow from investing activities | (100) | (100) | ||

| External funding | 250 | 250 | ||

| Total cash flow from financing activities | 250 | 250 | ||

| Remaining DS at the end | 50 | 37 | 37 |

Having compiled it, the entrepreneur realized that, despite the profit from operating activities of 287.5 thousand rubles, operating activities brought him a shortfall of 113 thousand rubles.

Investment in equipment 100 thousand rubles. further widened the box office gap. Thus, the balance on the current account is 250 - 113 - 100 = 37 thousand rubles. quite justified.

Having compiled the ODDS in a direct way, the entrepreneur intuitively began to guess that part of the money “lies” in the equivalent of goods, but he did not understand how much money it was and whether it was correct.

ODDS, compiled indirectly, provides information for analyzing the cash gap by item: how much money is “settled” in inventories, accounts receivable, work in progress, in the finished goods warehouse, etc.

Then he compiled the ODDS in an indirect way.

- substituted the calculated result from operating activities by month;

- added to the financial result adjustments for non-cash items of operating activities (in the example, such adjustments include only depreciation, but below we will look at what else may be included in this section);

- received a “monetary” result from activities before accounting for changes in balance sheet and capital items;

- according to the lines of the entrepreneur’s balance sheet, there was an increase in inventories in each period equal to the amount of payment for inventories minus the cost of inventories released for the production of pies;

- It is clear that the amount held as inventory reduces cash flow (later we will look at other changes in balance sheet items that affect cash flow). By subtracting changes in balance sheet items from the amount of the “cash” result, the entrepreneur received cash flow from operating activities;

- We considered cash flow from investment activities earlier, here nothing has changed in the logic of formation;

- cash flow from financing activities is calculated in the same way as in the direct method.

The final ODDS compiled indirectly:

| Index | November | December | January | Total |

| Operating profit | 46 | 96 | 146 | 287 |

| Adjustments by item | ||||

| Depreciation | 4 | 4 | 4 | 13 |

| Profit before changes in current assets and equity | 50 | 100 | 150 | 300 |

| Decrease/(increase) in inventories | (150) | (113) | (150) | (413) |

| Total cash flow from operating activities | (100) | (13) | — | (113) |

| Purchase of equipment | (100) | (100) | ||

| Total cash flow from investing activities | (100) | — | — | (100) |

| External funding | 250 | 250 | ||

| Total cash flow from financing activities | 250 | — | — | 250 |

| Remaining DS at the beginning | — | 50 | 37 | |

| Remaining DS at the end | 50 | 37 | 37 |

Having looked at the ODDS compiled indirectly, the entrepreneur noticed some patterns. For example, his warehouse of raw materials is growing and in three months in total it has grown more than profit. This may be good for a business growing at a fast pace, but it results in a cash gap.

After analyzing the situation, the entrepreneur decided:

- Take out a loan for operating activities.

- Work on ways to reduce inventory, perhaps organize purchases more often or find regular suppliers who are willing to deliver goods themselves twice a week.

For us, as financiers, it is important to draw conclusions from the described example: both methods of compiling ODDS are good, but each in its own way.

ODDS compiled in a direct way allows you to clearly show and calculate for the future incoming and outgoing cash flows and the cash gap. This method of reporting has another unobvious advantage - in contrast to world practice, in the Russian Federation only the direct method of compiling ODDS is included in regulated reporting.

ODDS, compiled indirectly, provides information for analyzing the cash gap by item: how much money is “settled” in inventories, accounts receivable, work in progress, in the finished goods warehouse, etc.

Next we'll talk about the structure of each report.

Detail until the value of detail exceeds the cost of such detail.

Most common mistakes

Mistake No. 1. A common mistake is the correct reflection of the amounts of calculated VAT in the report itself, especially if these amounts are obtained with a minus sign.

In a situation where the VAT amount turns out to be negative with a minus sign, it must be indicated in the report in parentheses:

- if the amount is small, then it is reflected in the structure of the indicator on page 4129 “other payments”;

- when the value is significant, the amount is indicated as a VAT amount separately (range p. 4125-4128) in the “Payments-total” group.

Error No. 2. A fairly common error is the error of correctly reflecting a positive VAT amount in the report.

If during calculations the tax amount turns out to be positive, then it must be indicated in the report in the following order:

- in the structure of the indicator on page 4119 “other receipts” in a situation where the amount is not very large (insignificant);

- if the value is significant (significant), then the amount is indicated as a separate value (indicator) in the “VAT” line (range p. 4114-4118) in the “Receipts-total” group.

Line 4490: change in exchange rate

If an organization conducts cash transactions in foreign currency, then the amounts of payments or receipts must be converted into rubles.

To do this, convert foreign currency into rubles at the official exchange rate on the date of payment. When an organization has quite a lot of similar transactions in foreign currency, and the official exchange rate of this currency has changed slightly, the average rate for the month (or for a shorter period) can be used for recalculation - clause 6 of PBU 3/2006. The difference resulting from the recalculation of the organization's cash flows and cash balances in foreign currency at rates for different dates should be reflected in the report separately from current, investment and financial flows. Show this as the impact of changes in foreign currency exchange rates against the ruble on line 4490 of the Cash Flow Statement for 2021.

Sample report

Of course, when filling out the financial results report for 2021 line by line, all sorts of difficulties and new questions are possible. Here is a sample of a completed financial results report for 2016, which will be submitted in 2021. Let’s assume that from January 1 to December 31, 2021, the following transactions took place on account 51:

| Operation | Corresponding account | Amount, rub. |

| Received money from buyers for goods (including VAT 18%) | K 62.1 | 236000 |

| Money was transferred to suppliers for goods (including VAT 18%) | D 60.1 | 118000 |

| Money received from the sale of the OS (including VAT 18%) | K 62.1 | 59000 |

| Salary transferred | D 70 | 50000 |

| Personal income tax listed | D 68.1 | 8000 |

| Contributions transferred | D 69 | 15000 |

| VAT transferred | D 68.2 | 10000 |

| Income tax transferred | D 68.4 | 7000 |

| Credit received | K 66 | 1000000 |

| Loan interest transferred | D 66 | 50000 |

| Credit returned | D 66 | 1000000 |

| Received money from the sale of your own promissory note | K 66 | 250000 |

| Money was transferred for the purchase of intangible assets (excluding VAT) | D 60.1 | 100000 |

| The borrower repaid the loan | K 58-3 | 150000 |

Then an example of a completed calculation will look like this:

You can also see another example of filling out a cash flow statement for 2021:

Relationship between balance sheet and report

Some figures in the 2021 cash flow statement must be reconciled, that is, must be consistent with the figures in the 2021 Balance Sheet. We will explain the relationship in the table so that you can check the sections of your OODS. Tax inspectorates use special programs to check and compare reports.

| Balance sheet | Cash flow statement | |

| II. Current assets | ||

| line 1250 “Cash and cash equivalents” | column “At the end of the reporting period” | line 4500 “Balance of cash and cash equivalents at the end of the reporting period”, column “For the reporting period” |

| column “As of December 31 of the previous year” | line 4450 “Balance of cash and cash equivalents at the beginning of the reporting period”, column “For the reporting period” is equal to line 4500 “Balance of cash and cash equivalents at the end of the reporting period”, column “For the previous year” | |

Insurance premiums: which group to include?

The amounts of insurance contributions to the funds are reflected in the cash flow statement for 2021 in the section “Cash flows from current operations” under the group of items “in connection with compensation of employees.”

Please note that in this section, payments for workers' compensation are reflected in the amount that includes amounts subject to deduction from workers' wages, for example, personal income tax, payments under writs of execution (Appendix to the Letter of the Ministry of Finance of Russia dated January 29, 2014 No. 07-04-18/01 ).