Recently, tax authorities have been particularly strict with regard to taxpayers who, in their opinion, are making fictitious transactions. In addition to the fact that they themselves suffer, tax authorities are increasingly trying to punish their counterparties for failure to exercise due diligence. This is usually implemented through the refusal to deduct VAT, additional taxes, and the imposition of fines. Companies often manage to defend their integrity in court. Let's consider an interesting case from the judicial practice of the Twelfth AAS (case No. A06-4229/2016), when the company was able to achieve the lifting of sanctions, partly because of the formal approach to their responsibilities of the tax authorities themselves.

What to check for VAT

What to check:

- completeness and correctness of input of primary VAT,

- settlements with counterparties,

- reconciliation of VAT accounting data with buyers and suppliers - 1C: Reconciliation,

- checking the VAT rate for the transition period 2018-2019,

- re-processing of documents for the period,

- setting a ban date for changing data,

- performing Regular VAT operations,

- Analysis of the state of tax accounting for VAT,

- Express check of the Purchase Book and Sales Book,

- generation and verification of VAT returns,

- checking the Purchase Book and Sales Book reports,

- checking VAT accounting data and confirming the amount of tax to be paid to the budget,

- completeness of accrual (payment) of VAT sanctions.

Clause 9. Purchase of VAT from tax authorities

I am sure that after identifying the gaps, many of you were invited to a confidential conversation outside the tax office. There they propose to close the VAT from them. This is a very bad option. I’ll explain why and give specific examples from life.

The most important thing is that most often this is a personal initiative of the heads of the desk inspection department. How do they cover VAT? Elementary. They identify abandoned shops on their territory, at mass addresses, numbers, with blocked accounts. And they hang them on them. And then they ignore the red color in ASC.

The tax authorities do not need to spoil the statistics of their territory; they make money elsewhere. When the inspector or the head of the collection accumulates a large amount, the management will see it. The management will hit the territorial authorities on the head. Territorial - to the inspector.

There were guys who accumulated critical mass and then left when the facts of their work came to light. They left having earned a normal amount, which with their salary they would have saved for another 500 years. But all their clients then received harsh consequences.

The taxman may try to shift VAT onto someone else's territory. But I also don’t particularly want to spoil someone else’s territorial statistics. The inspector will have to share with other cameramen; here the price tag will already go beyond the market.

In general, practice shows that no one covers VAT as poorly as the tax authorities themselves. They simply take advantage of their official position, picking up already used throws.

There have been much worse cases.

A living example. The inspector provided a service to a large enterprise. The VAT was collected from the inspector almost immediately. We came to the inspector: “How is this possible, and what should we do?” The inspector threw up his hands: “Like, this is the authorities, I did everything I could. You're just out of luck. There’s nothing to be done.” The next invitation to the tax office, to the same inspector: a BEP employee is already sitting there.

Result: the client was unloaded with a large amount of cash in order to close the issue. Plus, most of the VAT went to the budget. After a while, the unfortunate man was forced to pay the profit as well. In fact, a banal setup.

In general, buying a service from tax authorities means immediately identifying yourself to them. I don’t know of examples where people on a subscription or buying VAT from tax officials would not end up being milked.

Completeness and correctness of primary input with VAT

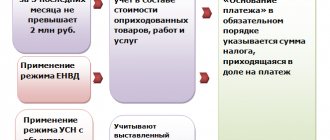

Completeness and correctness of input of primary VAT:

- Receipt to the current account (at the cash desk)

=> correct VAT rate, invoices for advances received from customers have been generated: Bank and cash desk – Registration of invoices – Invoices for advance payments.

=> correct VAT rate, invoices for advances issued to suppliers are registered:

- Debiting from the current account – Create based on – Invoice received.

=> correct VAT rate, invoices received are registered.

=> correct VAT rate, invoices issued:

- Journals Receipts (acts, invoices) and Sales (acts, invoices) - registers of documents and status of invoices (Posted, Not posted , Not required, Absent ) => sort by status;

Arbitrators' opinion

As a result, the court considered the reasoning of the Federal Tax Service inspectors unconvincing. Business entities are not obliged to check whether a potential counterparty is located at its legal address and whether it pays taxes. As for the latter, this is completely the concern of the tax service, and inspectors do not have the right to shift it to taxpayers. The lack of equipment, transport and employees that are necessary to fulfill the terms of the contract does not mean that the company cannot fulfill its obligations. After all, nothing prevents her from temporarily attracting all the necessary resources: renting premises and transport, hiring temporary performers or a third-party organization to fulfill the terms of the contract. Yes, the counterparty did not file returns and did not pay taxes in the period under review, but this only indicates that he fulfilled his duties as a taxpayer in bad faith. However, it does not follow from this that he entered into fictitious transactions, and even more so that the company itself, which was audited by tax officials, received an unjustified tax benefit by declaring VAT deduction on transactions with this counterparty.

As for the false information that was present on the stamps in the invoices, then, according to the courts, they also cannot be a basis for refusing to deduct VAT. After all, the main document for his application is an invoice issued in accordance with Article 169 of the Tax Code of the Russian Federation. It is appropriate to talk about the impossibility of a deduction if a document is drawn up in violation of the requirements of this article, which prevent one from accurately determining the supplier or buyer, the subject of the contract or its price, rate or amount of VAT payable. For example, if the name of the product or its value is incorrectly indicated on the invoice, then the deduction for such a document will not be accepted. In this case, there were no such violations. The tax authorities only appealed to the fact that the signatures on the documents were affixed by unidentified persons, but they could not prove this.

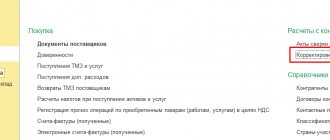

Settlements with counterparties

Settlements with counterparties:

- Reports – Standard reports – Analysis of sub-accounts

–

Counterparties

(sub-account Counterparties, Agreements, Documents of settlements with counterparties) => there is no detailed balance for: Accounting accounts (60, 62, 76), - Treaties,

- Documents of settlements with counterparties.

- Sales (Purchases) – Settlements with counterparties – Settlements reconciliation statements

– Settlement accounts => separate statements for buyers of accounts. 62, suppliers of accounts. 60 and other calculations. 76.

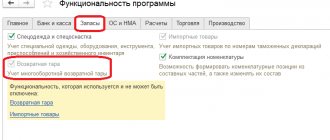

Reconciliation of VAT accounting data through 1C: Reconciliation

Reconciliation of VAT accounting data with buyers and suppliers:

- Sales (Purchases) – Settlements with counterparties – Reconciliation of VAT accounting data.

Find out more What is the 1C:Sverka service and how to work with it

If the counterparty is duplicated in the 1C database, the message “An error was detected while loading supplier registers” will appear.

If the counterparty is duplicated (TIN/KPP) in the 1C database, then the message “An error was detected when loading supplier registers” will appear.

How to fix:

- open a letter with a file in email and save it to a new folder;

- Downloaded

tab –

More

(top right) –

Download from file

– select a file previously saved from email; - Click Load registry

.

Perfect option

– checking the

Contractors for duplicates

and deleting them.

Clause 10. Updates for past years and quarters for replacing broken chains

You need to be extremely vigilant with clarifications. You do not have the option to refine for curved circuits. After all, they have already paid attention to you. And if the new chains fail as specified, this is a guaranteed path to additional charges.

According to clarifications, exactly the same points as described above apply. You also need a non-linear chain, and dozens of counterparties on the link.

And here the biggest problem arises: most VAT holders do not have a sufficient number of legal entities to provide services of this level. After all, this means that they need to keep hundreds of companies in reserve for each past quarter.

The majority, after an appeal in the spirit of: “I need 50 million for 1/18,” will run throughout the market to look for what the registrars have in stock. And there is always the worst horror. Something that the market has not dared to do in all this long time.

In general, a good VAT manager is, first of all, a large-scale register with an incredible number of shops. Both for the current quarter and in reserve.

Without our own “factory” for the production of legal entities, it is impossible to provide high-quality services for paper VAT. Companies bought off the market are usually trash. And in the case of clarifications, more often than not, it’s rubbish that has been sitting for a couple of years. Therefore, a good VAT employee always has a large supply of his own, homemade, high-quality goods.

Express check of the Purchase Book and Sales Book

Express check of the Purchase Book and Sales Book:

- Reports – Accounting analysis – Express check

– Setup: Maintaining a sales book for value added tax, - Maintaining a book of purchases for value added tax.

Not only errors

, but also

warnings

.

Checking VAT accounting data and confirming the amount of tax payable to the budget

Checking VAT accounting data and confirming the amount of tax payable to the budget:

- Reports – Standard reports – balance sheet broken down

by Types of payments to the budget, - Reports – Standard reports – Account analysis

with grouping by subaccounts.

Check that the balance on account 68.02 (68.32, 68.42, 68.52) coincides with the amount of tax payable in the VAT return and the turnover on the accounts coincides with the Purchase Book and the Sales Book.

Completeness of accrual (payment) of VAT sanctions

Completeness of accrual (payment) of VAT sanctions:

- Transactions – Accounting – Transactions entered manually – Create – Transaction – Dt 91.02 Kt 68.02.

- line 2340 Other income 91.01 – 91.02 VAT (- 5,000),

- line 2350 Other expenses 91.02 VAT (- 5,000).

Download the memo:

Algori checklist for VAT

See also:

- What is the 1C:Sverka service and how to work with it

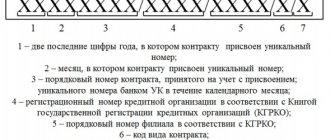

- The procedure for submitting the invoice journal

- Algorithm for checking a VAT return

- VAT accounting in 1C 8.3: step-by-step instructions

- Check your VAT return for the 1st quarter of 2021 according to the new rules!

- The certificate for last year’s services was drawn up in 2021 - what is the VAT rate?

- For shipments in 2021, you can sometimes be subject to a 20% VAT rate

- Inventory of settlements with counterparties

- How to make a reconciliation report with a counterparty in 1C 8.3: step-by-step instructions

- Codes for types of VAT transactions

- Finding and deleting duplicates in 1C

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Algorithm for Closing the Month - Add to Favorites If you want to know how to quickly put things in order in 1C...

- How can I change the date of an invoice received to a different date after the month is closed? ...

- The general edit ban date does not work in Month Closing operations Hello! Why does a set general ban date not work in operations...

- Account balance is 08 after the end of the month Good day! I shout sos)) We produce asphalt and so...

Clause 1. Number of counterparties in the chain and on each link

This is the key point. How do most people prepare paper VAT? We take 3-4-5-6-7 companies. And puts them sequentially. The entire amount is transferred from one shop to the next, in its entirety. When the inspector makes a printout of the tree, he sees a straight line from the technical instructions and everything is immediately clear to him. Your legal entity comes first. Then the entire amount goes away, as if on rails, through several links. And at the end there is a break. This was the working practice until the 2nd quarter of 2021. And then everything began to fall apart for everyone who worked like that. Now, if you're lucky, the service life of such a chain is a quarter. It does not matter what happens at the last stage: alternative liquidation by a non-resident, official liquidation, or something else. It will still fly to you.

What do experienced people do?

At each link it is good to have not one counterparty, but at least a dozen. More is better. For example, some boom performers. VAT is used by 20 counterparties per link. When receiving a printout of the tree, the inspector will see not a straight line consisting of 7 links, but a giant tree consisting of many contractors on each link. Tens or hundreds of your counterparties, live work.

Or the inspector won't see anything. The fact is that if you unload such a branched tree in graphical mode, the equipment simply freezes.

But you can upload it in Excel.

As a result, the inspector sees his own hell before his eyes: 140 or more contractors in the chain. And for each counterparty, in the end, there is a meager amount. In general, this is a high-quality imitation of the work of a real business.

Thus, conducting a desk inspection becomes extremely difficult for the inspector. Instead of traditionally identifying one or two legal entities, proving the fictitiousness of transactions on them, and nullifying the entire volume, the inspector must make a hundred times more effort. And this is time, of which he has very little. Because he has a lot of “clients”. It is easier for the inspector to deal with those who make a chain the old fashioned way.