For many companies located in cities, paying wages to employees on a salary card is common practice. However, for small businesses, individual entrepreneurs and companies located in areas where there are no banks, this practice is inconvenient. At the same time, the Ministry of Finance has repeatedly stated the need to reduce cash expenses, and it is possible that additional restrictions on cash payments will still be established. Therefore, let’s try now to talk about the pros and cons of salary cards.

Bank card and employee loan

Can an employer, based on an employee’s application, transfer wages to his bank card, which was opened by him in the bank where the employee took out a loan, since monthly payments will be debited from it? The employer can transfer wages to the employee’s personal bank account, including the bank where he took out a loan.

However, in this case, the collective or employment agreement must provide for the transfer of wages to the bank account specified by the employee. Rationale. According to Art. 136 of the Labor Code of the Russian Federation, wages are paid to the employee, as a rule, at the place where he performs the work or is transferred to the credit institution specified in the employee’s application, under the conditions determined by the collective or labor agreement. In this case, the employee has the right to change the credit institution to which his wages should be transferred, informing the employer in writing about the change in the details for transferring wages no later than five working days before the day of payment.

Accordingly, in order for the payment of wages by non-cash payment to be legal, the following conditions must be met:

– an instruction on the transfer of wages to the employee’s bank account in a collective or employment agreement;

– availability of a bank account agreement;

– the employee’s indication of the account to which the employer will transfer his wages.

At the same time, the employer cannot oblige the employee to receive wages in non-cash form. Such clarifications are presented in Letter of the Ministry of Labor of the Russian Federation dated March 20, 2015 No. 14-1/OOG-1830 .

Thus, if a collective or labor agreement provides for the transfer of wages to a bank account specified by the employee, accordingly, the employee has the right to demand the transfer of wages to another account opened by him in any bank.

How to find out the details of a Sberbank card?

If you look at the Sberbank card, you will notice on it almost all the necessary data (details) for payment on the Internet:

- on the front side there are: the owner's first and last name,

- card number,

- the period until which it is valid;

- security code - CVV2 or CVC2.

But you can’t find the bank account number on the card itself, but you don’t need it to pay online. We’ll find out where to look for it and why it’s needed later.

How to view card details through Sberbank Online?

- Using a search engine, create a query “Sberbank” or “Sberbank online”;

- Find the website online.sberbank.ru;

- Make a transition to the site;

- Enter your username and password and click the “Login” button;

- Confirm login by entering the SMS password received on your mobile phone number;

- As a result of these actions, you will be taken to the main page of the Sberbank Online website. In the window that opens you can see: the owner’s name and patronymic (in the upper right corner),

- last four digits of the number,

- expiration date of the card;

Let's summarize how to find out the details of a Sberbank card:

- if only such details are needed as: last and first name of the owner, number and expiration date of the card, secret code, then this information can be obtained by carefully examining the card itself;

- if you need the bank account number to which the card is linked, you can find it out, for example, through Sberbank Online.

If the card is blocked by the bailiffs

Bailiffs blocked the employee's bank card, and therefore he asks to transfer wages to his wife's bank account.

Does the employer have the right to do this? Is it possible to hold an employer liable for transferring an employee’s salary to a blocked card, since he was aware of this? Labor legislation does not contain any prohibition on transferring an employee’s salary to an account specified by him, even if this account does not belong to the employee. The employer cannot be held liable in any way for transferring wages to the employee’s bank card blocked by bailiffs, since the employer did not receive the writ of execution.

Rationale. Article 136 of the Labor Code of the Russian Federation establishes that wages are transferred to the credit institution specified in the employee’s application under the conditions determined by the collective or labor agreement. In addition, the employee has the right to change the credit institution to which his wages should be transferred by notifying the employer in writing about the change in the details for transferring wages no later than five working days before the day of payment.

Chapter 11 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings” provides for the conditions and procedure for foreclosure on wages and other income of a debtor-citizen and determines the possibility of sending an enforcement document directly to the person paying wages to the debtor-citizen. If the employer has not received the writ of execution, he does not bear any responsibility.

Thus, the employee’s explanations and the employer’s awareness of the relevant circumstances do not make the latter’s actions to transfer the employee’s wages to another person unlawful. The employer’s actions in question are not prohibited by law, and liability for them is not provided.

Assistant accountant at 1C

In this lesson we will get acquainted with the capabilities of Troika (1C: Accounting 8.3, edition 3.0) in terms of employees ’ wages through a bank .

Accountants who are faced with such payments for the first time have many questions, and today we will try to sort out the main ones.

So, let's begin

There are two ways to pay salaries through a bank:

- With the help of a salary project.

- No salary project.

According to the salary project

A salary project is an agreement with a bank, according to which the bank opens its own personal account for each employee .

On payday, the organization transfers the wages of all employees to a special salary account in this bank in one amount .

In this case, a statement indicating the personal accounts of employees and the amounts to be paid . In accordance with this statement, the bank itself distributes funds to the personal accounts of employees.

At the same time, different banks have different capabilities and requirements for working with a salary project, if we are talking about electronic document management, that is, when we transfer money to a salary account through a client bank.

In this case (client bank), after sending the payment order to the bank, a letter is sent in any form with one of the following options attached (depending on the requirements and capabilities of the bank):

- printed and scanned statement of payments for personal accounts

- upload file directly from 1C

- upload file from a special program provided by the bank

If we send a statement to the bank in the form of a file (upload), then usually the bank responds by sending us a confirmation file, which we can also upload to 1C.

Creating a salary project

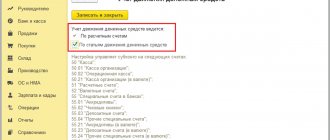

We go to the “Salary and Personnel” section and the “Salary Projects” item:

We create a salary project for Sberbank:

Here is his card:

We deliberately do not check the “Use electronic document exchange” checkbox in order to deal with the case when we send the bank statement in printed form.

We introduce personal accounts for employees

Let's assume that the bank has created a personal account for each of its employees. How to enter these accounts into the system? By the way, why do we want to do this? Then, so that in the statement that we will generate for the bank, opposite the employee’s full name, there will also be his personal account.

If we have a lot of employees, we can use the “Entering personal accounts” processing:

But in the example we have only 2 employees, so we will enter their personal accounts manually, directly into their cards (at the same time we will know where they are stored).

Go to the “Salaries and Personnel” section, “Employees” item:

Open the card of the first employee:

And go to the section “Payments and cost accounting”:

Here we select the salary project and enter the personal account number received from the bank:

We do the same with the second employee:

We calculate salaries

Go to the “Salaries and Personnel” section and select “All accruals”:

We calculate and process wages:

We pay salaries

Next, go to the “Salaries and Personnel” section, “Bank Statements” item:

We create a new document in which we indicate the salary project and select employees (note that their personal accounts are picked up):

We post the document and print out the statement for the bank:

Here's what it looks like:

Based on the statement, we generate a payment order:

In it, we transfer the total amount of the salary to the salary account of the bank in which we have an open salary project:

Along with this payment, do not forget to attach a statement (with a register of personal accounts and payments), printed above in the form required by the bank (usually this is an arbitrary letter through the client’s bank).

Uploading the register to the bank

Let's consider the possibility of uploading the statement (register) as a file to the bank. If your bank supports this option (or this is its requirement), then go to the “Salaries and Personnel” section, “Salary projects” item:

Open our salary project and check the box “Use electronic document exchange”:

We go again to the “Salaries and Personnel” section and see that two new items have appeared. We are interested in the item “Exchange with banks (salary)”:

There are three basic options for uploading to a bank:

- Payroll transfer

- Opening personal accounts

- Closing personal accounts

Let's focus on the first point. It allows us to upload our statement to a file, which is then sent by arbitrary letter through the client bank.

To do this, select the statement we need and click the “Upload file” button:

When a response comes from the bank, it will contain a confirmation file. You need to go into the same processing and upload this file through the “Download confirmation” button. Using this wonderful mechanism, we will be able to track which statements were paid by the bank and which were not.

Without salary project

In this case, each employee himself opens an account in any bank (at his discretion) and informs the organization of the full details of this account. The employee also writes a statement on the transfer of his salary in this regard.

On the payment day, the organization transfers the amount due to the employee to his account in a separate payment order.

This method is very inconvenient for accounting , especially when the company has a large staff, so many accountants prefer to remain silent about this possibility.

In this case, we do not indicate the salary project in the payment statement:

And we create a separate payment order for each employee with the type of operation “Transfer of wages to employee.”

In this order, select the recipient “Employee”, indicate the employee and from here create or select the employee’s current account. Unfortunately, in the latest version of accounting, this account can only be created from a payment order:

We're great, that's all

By the way, subscribe to new lessons...

Sincerely, Vladimir Milkin (teacher at the 1C school of programmers and updater developer). How to help the site: tell (share buttons below) about it to your friends and colleagues. Do this once and you will make a significant contribution to the development of the site. There are no advertisements on the site

, but the more people use it, the more energy I have to support it.

Click one of the buttons to share:

An employee does not agree to a salary project

When concluding an employment contract with an employee, the employer indicated that the salary would be transferred to the employee’s bank account, which was opened as part of a “salary” project in a certain bank.

A similar provision is enshrined in the collective agreement. Can an employer refuse to transfer wages to the account designated in the employee’s written application? The employer cannot refuse to transfer wages to the employee’s bank account specified by him in a written application.

We have instructions on what to do if an employee does not want to agree to your salary project.

Rationale. Article 136 of the Labor Code of the Russian Federation states that wages are paid to the employee, as a rule, at the place where he performs the work or is transferred to the credit institution specified in the employee’s application, under the conditions determined by the collective or labor agreement.

In this case, the employee has the right to change the credit institution to which his wages should be transferred, informing the employer in writing about the change in the details for transferring wages no later than five working days before the day of payment of wages. Thus, it follows from labor legislation that an employee can, in writing, replace the credit institution, that is, the bank from which he wants to receive wages.

Disadvantages of payments to a salary card

The main disadvantage for the company is that employees may refuse payments to the card. Older people are reluctant to agree to switch to non-cash wages. They are afraid that there will be no ATM near their house, that the ATM will break and “eat” the card, or that the card may be hacked and all the money will be withdrawn from it. Indeed, cases of money theft or ATMs not dispensing money are not uncommon. And it is the employee’s right not to switch to card payments. It is established in Article 136 of the Labor Code.

Many salary projects are not suitable for accumulating funds, since, as a rule, interest on cards is less than deposits. When withdrawing funds from ATMs of other banks, a commission is often charged, which is paid by the card user himself.

Another disadvantage is the additional costs that the company must bear when transferring funds and which are usually provided for in the agreement with the bank.

The contract may include the following costs:

- payment for bank services for the production of bank cards for employees;

- remuneration for transferring money to employees’ card accounts;

- payment for bank services for servicing employee card accounts.

In addition, the contract may contain special conditions. For example, when an employee is dismissed, the bank has the right to demand that the employer hand over the employee’s card or close it. Of course, having written the appropriate application, the employee can continue to use it, only he will bear the costs of its maintenance himself. However, a number of employees come with complaints to their former employer, who did not warn about the closure of the card.

Salary to a charity fund

When concluding an employment contract with an employee, the employer indicated that the salary would be transferred to the employee’s bank account, which was opened as part of a “salary” project in a certain bank.

A similar provision is provided for in the collective agreement. The employee submitted a written application to the accounting department with a request to transfer his salary to a third party (charitable organization). Is the employer obliged to do this? If the labor and collective agreements indicate that wages are transferred to the employee’s bank account opened as part of a “salary” project in a certain bank, and the employment contract with the employee does not provide for the possibility of transferring wages to the accounts of other persons, the organization is not obliged to transfer wages payment to the account of a third party (charitable organization), even if the employee has submitted a corresponding application.

Rationale. Article 136 of the Labor Code of the Russian Federation provides for the possibility of transferring an employee’s salary to the account of a third party, if this is established by federal law or an employment contract. From the above provision it follows that the current labor legislation determines the possibility of paying wages to an employee by transferring them to the account of another person, but the main condition is that such a procedure follows either from federal law or from an employment contract. This means that in order to transfer an employee’s salary to a third party’s account, the consent of both the employee and the employer is required. In this case, the employee can, in writing, replace the credit institution from which he wants to receive wages, but in this case he has no right to indicate a third party as the wage recipient without the consent of the employer.

Salary project from Sberbank: instructions for an accountant

Sberbank's salary project is a modern, convenient tool for paying salaries and crediting them to employee accounts in the shortest possible time.

The banking tool will help the client company reduce financial costs and labor costs in the process of paying employees.

At the same time, the company will be able to take advantage of preferential connection conditions and appreciate the advantages of banking technologies.

What are the benefits of the Sberbank Salary Project for legal entities?

- There is no need to pay for the service of cashing the total amount of the company's wages;

- Sberbank has provided flexible tariffs for account servicing, crediting funds to a client’s card, as well as providing other services as part of the company’s salary project.

The cost is discussed individually; - The procedure for concluding a contract has been simplified. A constructor agreement developed for these purposes will help with this;

- Large clients can submit a request to install a Sberbank ATM directly on the premises of the enterprise.

Employees will be able to withdraw funds without leaving the premises of the enterprise.

How does the salary project work?

The client company enters into an agreement with Sberbank. The document design scheme has been simplified as much as possible. It is also possible to submit an application for a salary project remotely online.

After signing the documents, the company and the bank will organize the issuance of plastic cards to employees, as well as the opening of accounts for each employee. The principle of the project looks like this:

- The company's accounting department transfers the total amount of wages (monthly fund) to a single bank account opened in the name of the client company.

- A statement indicating the salary of each employee is provided to the Sberbank branch.

- Sberbank, within the period specified in the agreement, credits the transferred funds to employees’ salary cards (according to the enterprise statement).

Important! The client company is recommended to register in the Sberbank Business Online service. There you can submit statements remotely and independently control the presence of funds in the company account. To interact with a banking institution, an accountant does not have to visit a Sberbank branch.

How to submit information as part of the Salary Project? Instructions for an accountant

You can send salary information remotely. To do this, fill out a form on the Sberbank website indicating all the information about the company:

- Full title.

- The total period of activity.

- Number of employees.

- Amount of monthly wage fund.

- Address and telephone numbers of the enterprise.

- The contact person.

After receiving the documents, the organization is assigned a specific bank employee who will deal with the preparation of documentation and resolving issues that arise during the period of servicing the client company.

Sberbank of Russia has developed a convenient tool for issuing salary cards for individuals. The registration process has become as simple and convenient as possible.

Instructions for registering:

>

- The file “Register for opening accounts” is downloaded to your computer. It can only be downloaded from the official website of Sberbank of Russia.

- All fields in the Register are filled in.

Provide information about employees. The “Export” button is pressed. - An electronic digital signature (EDS) is affixed to the document, and the Register is sent to Sberbank.

Conditions:

- Issuing a Sberbank card, the cost of annual maintenance is free.

- Cash withdrawals from ATMs within the daily limit are free.

- The card opens an overdraft line with a rate of 20% per annum. In case of delay – 40% per annum.

- The daily withdrawal limit is set based on the card type (Classic, Gold, Platinum). The Classic card has a daily limit of 50 thousand rubles. Platinum – 1 million rubles.

- A commission is charged on funds withdrawn in excess of the established limit.

The employee register in the salary project contains the following fields:

- Employee profile data (full name).

- Full name of each employee in Latin. This information is filled in automatically after specifying the information in Russian.

- Date of birth, city of residence, country.

- Registration address and actual place of residence.

- Passport data (series, number).

- A secret code by which a person will be identified.

- Employee telephone numbers (at least two).

- The position that the employee holds in the company.

- Email address (personal).

- The type of banking product being issued is Sberbank Salary Project cards (Classic, Gold, Platinum).

- Information about the bank (branch name, branch code).

After entering information about employees, the register is exported. For this purpose, there is a corresponding button on the Sberbank website.

The document is endorsed with an electronic digital signature of authorized persons of the enterprise and sent to Sberbank.

If changes are made to the instructions, Sberbank will develop new services, and the client company will be automatically connected to them.

Undeniable advantages for employees of the institution:

- You can issue additional bank cards for relatives and loved ones.

- Individual clients of the Sberbank salary project will be able to obtain loans, credit cards, take advantage of mortgage lending and car loan offers on preferential terms.

- Employees take part in special offers with discounts from Sberbank partners.

- Each client will be able to take part in the “Thank you from Sberbank” bonus program.

- While staying abroad, bank clients will be able to pay using an international bank card anywhere in the world where products of international payment systems are accepted.

- If your Sberbank card is lost or stolen, it is enough to make one call to the hotline or to the nearest Sberbank branch and the card will be blocked. Client funds will remain safe.

- You can access your own funds around the clock.

Sberbank has the largest network of ATMs throughout Russia. - By accumulating funds on a card account, the client will be able to receive additional income in the form of interest from Sberbank.

- allows you to receive information about the account status and any movements of funds by sending an SMS message to the client’s mobile phone.

- Internet banking (Sberbank Online) will allow you to make transfers at any time of the day, pay for services, traffic police fines, and repay loans. Internet banking service is provided to clients free of charge.

What does a client company need to know before signing a contract?

- By signing a cooperation agreement, the client agrees to adhere to the public conditions indicated on the company’s website.

- If changes are made to the terms of provision, an additional agreement with the client is not signed.

- Any legislative changes and technological improvements are put into effect for all clients who have signed the Design Agreement. In this case, the additional agreement is not signed.

Sberbank of Russia is constantly improving products for private clients and partner companies. This also applies to the Salary Project. Using the program from Sberbank will significantly simplify the process of paying wages to employees, as well as reduce the company’s expenses to ensure this process.

Source: https://creditvsbervbanke.ru/sbbol/zarplatnyiy-proekt-ot-sberbanka-instruktsiya-dlya-buhgaltera

Paying salaries to relatives without a power of attorney

An employee of the organization is unconscious because he was involved in an accident.

Can an employer give wages not received by an employee to his relatives in the absence of a power of attorney? An employer does not have the right to pay wages to an employee's relatives without a power of attorney to receive it.

Rationale. According to clause 6.1 of the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses,” when issuing cash according to an expense cash order, the cashier also checks the presence of supporting documents listed in this order. The cashier issues cash after identifying the recipient of the cash, in particular, according to the power of attorney and identification document presented by him. Cash is issued by the cashier directly to the recipient specified in the cash receipt order (payroll slip, payroll slip) or power of attorney.

It follows from the provisions of the law that an employee’s wages can be issued to his relatives only on the basis of a power of attorney issued by the employee himself.

Withholding taxes from salary

Can an employer withhold money from an employee’s salary to pay transport, land taxes and personal property taxes?

The employer does not have the right to withhold money from the employee’s salary for the purpose of paying transport, land taxes and property taxes on individuals.

Rationale. Article 137 of the Labor Code of the Russian Federation establishes that deductions from an employee’s salary are made only in cases provided for by the Labor Code or other federal laws. By virtue of paragraph 1 of Art. 45 of the Tax Code of the Russian Federation, tax payment can be made for the taxpayer by another person. Such amendments were made to the specified paragraph by Federal Law No. 401-FZ of November 30, 2016 “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation ,” which came into force on January 1, 2017. At the same time, transport, land taxes and property taxes for individuals are subject to payment by taxpayers - individuals in accordance with tax notices, which indicate the amounts of the corresponding taxes payable.

However, the Tax Code does not provide for the payment of such taxes by the employer withholding funds from the taxpayer’s salary and transferring them to the budget system of the Russian Federation. These clarifications are presented in Letter of the Ministry of Finance of the Russian Federation dated September 18, 2017 No. 03-02-07/2/59998 .

Changes in salary transfer rules in 2020

From June 1, 2021, new codes must be indicated on salary transfer slips. Banks will not accept payments without these new details from 06/01/2020.

So, in field 20 of the payment order “Name. Pl.” indicate the type of income code .

There are different codes for wages, benefits and compensation.

The new coding was required so that bailiffs knew from which payments funds could be withheld under writs of execution. Starting from 2021, you must indicate one of three codes for payments:

Until June 1, 2021, bailiffs had no way to find out what funds an individual received in their account. Neither the bailiffs nor the bank could separate the money that they had the right to withhold by law from those that could not be touched. To eliminate the problem, the new Law with amendments to the Federal Law “On Enforcement Proceedings” dated February 21, 2019 No. 12-FZ obliges employers to reflect the type of income code every time they transfer money to employees.

According to writs of execution, bailiffs have the right to write off money from the accounts of “physicists”. But not all income is legally withheld from debt. For example, you cannot write off sickness benefits or payments for a work injury. The list of such income is in paragraph 1 of Art. 101 of the Law of October 2, 2007 No. 229-FZ. The new law added one more item to it - financial assistance in emergency situations.

Legislators obliged the Bank of Russia to develop the appropriate codes and describe the system for reflecting them in salary slips (clause 5.1 of Article 70 of the Law “On Enforcement Proceedings” dated 02.10.2007 No. 229-FZ as amended by Law No. 12-FZ). Which is what he did, issuing instructions dated October 14, 2019 No. 5286-U.

The new rules apply to salary payments, settlements under GPC agreements, as well as other amounts from which debts cannot be collected.

In addition, from June 1, 2021, when transferring wages (or other income from this amount) to a bank account, the payment order must indicate the amount collected under the executive document (Part 3 of Article 98 of Law No. 229-FZ). A special procedure for indicating the collected amount in payments is given in ConsultantPlus:

It is recommended to indicate information about the collected amount in the “Purpose of payment” details of the payment order in the following sequence... (read in full).

Salary more than twice a month

Does the employer have the right to provide for more frequent payment of wages than twice a month?

Yes, the employer, by local regulations or employment contract, may provide for the payment of wages more than twice a month.

Rationale. By virtue of Art. 136 of the Labor Code of the Russian Federation, wages are paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective or labor agreement no later than 15 calendar days from the end of the period for which it was accrued.

Thus, the Labor Code provides for the requirement to pay wages at least twice a month. In this regard, the employer can establish in a local regulatory act or employment contract a provision on paying wages more often than twice a month.

These clarifications are given in Letter of the Ministry of Labor of the Russian Federation dated November 28, 2016 No. 14-1/B-1180 .

You cannot pay wages only once a month, even at the request of the employee ( Letter of Rostrud dated 01.03.2007 No. 472-6-0 ).

Examples of payment orders for salary transfers in 2021

Let us explain what to indicate in some fields of the payment order for the transfer of wages to the cards of several employees in 2020:

- in the “Recipient” field – the name and location of the bank in which the employees’ accounts are opened (for example, Sberbank);

- in the “Amount” field – the total amount that needs to be transferred to the employees’ accounts;

- in the “Purpose of payment” field – the purpose of the payment and a link to the date and number of the salary register (for example, “Transfer of wages for July 2021 according to register No. 13 dated August 4, 2020”).

Payment due June 1, 2021

Here is a sample payment order for the transfer of wages to the card until 06/01/2020:

Sometimes, by force of law, the employer is obliged to pay compensation to the employee for delayed wages (Article 236 of the Labor Code of the Russian Federation). ConsultantPlus knows which type of income code to indicate in a payment order when transferring such compensation

Answer: When transferring compensation to an employee for delayed wages, the payment order should indicate the code of the type of income... (view in full).

Payment after June 1, 2021

And this is a sample payment order for the transfer of wages to the card starting from 06/01/2020, indicating new codes. Let's assume that the company transfers salaries. Then in the “Payment purpose” field you need to add code 1.

Often, an employer has to fill out a payment order for the transfer to the Federal Bailiff Service (FSSP) of Russia of alimony withheld from the employee’s salary. you how to do this correctly, taking into account all the changes in 2021 :

View the entire sample of filling out the payment.