Let's look at this situation. The company employs specialists with a shift work schedule.

When calculating the advance for the first half of the month, the employee is paid the amount before personal income tax is withheld, and if the employee has no earnings for the next two weeks (for example, the employee took unpaid leave), then by the time the salary is paid there will be nothing to withhold personal income tax from.

As a result, at the end of the month there is an overpayment of wages to the employee and the amount of personal income tax not withheld.

When should personal income tax be withheld from an employee? When is a company obliged to transfer personal income tax to the budget in this case?

What risks exist in this situation if the organization does not accrue and transfer personal income tax to the budget?

Will it be legal to include in the payroll software used a reduction in the amount payable minus 13%?

How it was?

“Our company has a rule that we issue an advance on the 25th of the month, and pay the balance on the 10th following the settlement. It so happened that due to financial difficulties, we did not issue an advance to employees on the 25th, and we had to do it the next month, on the 4th. We plan to safely issue the rest on the 10th, i.e. as it should be. It is not entirely clear how personal income tax will be paid in this case. Should it be paid from your salary or from an advance payment?”

For help in answering this question, we turned to tax experts who were able to give a clear answer. Based on the essence of the conversation, we were pointed out several fundamental points for correctly determining the personal income tax base. In particular, we were asked not to forget that the day of payment of income received in the form of wages, according to paragraph 2 of Article 223 of the Tax Code of the Russian Federation, will be considered the last day of the month for which it was accrued. Moreover, the tax agent has the right to withhold personal income tax at the end of the month in which it was accrued (i.e. the next). Moreover, this rule is not affected by the obligation of companies to pay employees income twice a month. Based on this, we can conclude that if the advance was issued for the next month following the settlement month, then personal income tax will be paid from it as from an advance, and not as from a salary. Officials came to the same conclusion in a letter from the Federal Tax Service of Russia dated March 24, 2021 No. BS-4-11/4999.

Read the article: “Both laughter and sin. How to fill out a 2-NDFL certificate if there is no money for a salary?

Methods for calculating an advance

As already mentioned, there are no clear dates for payment of salaries for the first half of the month. The same applies to the amount of cash payment, as well as to the methods of calculation. This allows the company to organize payroll at its own discretion, but without violating the law. By the way, the Ministry of Finance does not recommend including various types of premiums and bonuses in the advance payment.

If the law does not provide for the procedure for monetary settlements, then these obligations are transferred to local acts. They require establishing all the details of the financial relationship between the organization and the employee.

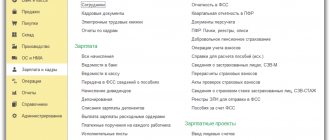

Thanks to such initial data, 1C was able to provide in the program the following methods of paying an advance:

- Calculation for the first half of the month.

- Fixed amount.

- Percentage of the tariff.

In the program, the calculation conditions are determined by personnel documents. It is enough to correctly fill out the appropriate cards for a specific employee.

Calculation for the first half of the month

This option involves calculating the amount of money based on hours worked. In this case, the amount is calculated based only on the salary or salary + additional payments. For example, an employee worked a night shift. He is entitled to double payment. These payments can be included in the advance by indicating this in the 1C program in the appropriate card, as in the figure.

Accounting for estimated personal income tax

With this option, you can also set a calculation rule. That is, to provide for the withholding of personal income tax, but not to actually pay it. This is necessary for the correctness of future tax calculations. This can also be indicated in the organization’s accounting policy and the order can be transferred to electronic form.

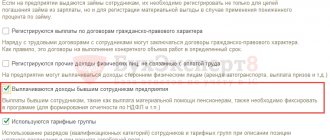

In the corresponding tab in 1C you can check the boxes, as in the example below. At the same time, software tools allow you to take into account personal income tax in different ways: you can take it into account when paying an advance, or you can not do so. It is also possible to adjust the payment every month. In the “Personal Income Tax” tab, all three methods are available to the user.

But don't forget about the following. If you choose accrual for the first half month, then you need to decide on the actual tax calculation. In the corresponding card in the program you need to pay attention to the points. allowing you to transfer payroll at the end of the month. The figure shows where these graphs are located.

Therefore, do not forget to link the procedure established in the accounting policy and the actual actions for calculating the advance and personal income tax.

Fixed amount

This is the simplest method of calculating an advance provided by the program. Perfect for small companies with a minimum number of employees. At the same time, the salary in accordance with the name is fixed. Therefore, the advance amount does not change from month to month. The program does not require any additional actions.

Percentage of tariff

In 1C you can set any percentage of the total salary. But at the same time it must be justified by documentary evidence. At the same time, it is necessary that this correspond to comfortable working conditions for the employee. The default is 40%, which can often be found in real practice.

To calculate the amount of the payment, you need to correlate it with the wage fund of a particular employee. Changes in the amount of the advance payment are possible only with corresponding changes in the amount of the wage fund. It is possible to increase the calculation base. including bonuses, bonuses and other additional payments.

When else do you need to pay personal income tax?

Just in case of emergency, we remind our readers when it is still necessary to pay PFDL on salaries and other payments to employees, based on the requirements of Part 6 of Article 226 of the Tax Code of the Russian Federation (we extract it from the text):

- When receiving cash from the bank to pay wages - no later than the day of receipt;

- When transferring salaries to employees’ bank accounts - no later than the day of transfer;

- When paying wages in kind - no later than the day following the day when personal income tax was withheld from the next cash payment to the employee.

As we can see, everything is quite simple and no problems should arise. Moreover, we would like to note that the Federal Tax Service accepts these payments based on the above points without any difficulties, not to mention individual cases of “arbitrariness” on the part of inspectors. As a rule, they affected the Far East and territories adjacent to Kamchatka, judging by the reviews of some specialized media.

Tax liability

The duties of a tax agent for personal income tax imply that he must calculate, withhold from the taxpayer and pay the amount of tax to the budget (clause 1, clause 3, article 24, clause 1, article 226 of the Tax Code).

Failure of a tax agent to fulfill the duties assigned to him entails liability under Art. 123 of the Tax Code of the Russian Federation. This provision establishes penalties for unlawful non-withholding and (or) non-transfer (incomplete withholding and (or) transfer) of tax amounts within the prescribed period.

However, it is obvious that non-calculation of personal income tax entails its non-withholding and, as a consequence, non-payment. The amount of sanctions in this case is 20 percent of the amount of tax subject to withholding and (or) transfer. In addition to penalties for paying taxes later than required by law, the organization will have to pay penalties for each day of delay.

About residents and non-residents

The usual 13% personal income tax on wages of residents of the Russian Federation may differ in its amount in the case of payments to a foreign citizen, as well as other income reflected in Article 224 of the Tax Code of the Russian Federation. Let's take a quick look at them, including:

- Personal income tax will be 9% if we are talking about income received from mortgage-backed bonds;

- 15% personal income tax will be deducted from the income of foreign citizens from equity participation in Russian companies;

- 30% of personal income tax will be deducted from the income of foreign citizens whose legal status of being on the territory is usually called “temporary stay.” As a rule, such income includes wages, and a foreign citizen carries out labor activities on the basis of a patent (for citizens of visa-free countries) and a work permit (for visa countries);

- Personal income tax will be 35% if we are talking about a certain prize fund or lottery winnings. Those. if a person wins 1 million rubles, then he should receive 650 thousand after tax withholding, which is also not bad.

Obviously, any accountant needs to be prepared to correctly calculate personal income tax in the event of an “extraordinary situation.” Our note on this matter, we hope, will be a good help for a more in-depth study of this issue. Fortunately, with the help of a specialist, there is a real opportunity to make a correct calculation in the program and at the same time save the lion’s share of the cost of purchasing the product.

Don't miss: “We are hiring citizens of the EAEU. Step-by-step instruction"

How to pay an advance in 1C ZUP 3.0 (8.3)

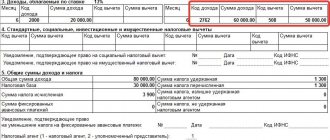

Having made a preliminary calculation in 1C ZUP 3.0, you can pay an advance. In the “all statements” section, we create a corresponding payment statement, the purpose of which indicates the payment of an advance.

Select the “Payments” menu, then “all statements” - statement to the cashier. In the document we indicate “pay an advance”, select the month of payment, January, the date of payment of the advance and click the “fill out” button. 1C ZUP 3.0 automatically generates everything accrued in the advance:

If we talk about working in conjunction with 1C ZUP 3.0 and 1C 8.3 Accounting, then first in 1C ZUP 3.0 a statement for payment is drawn up, synchronized with 1C 8.3 Accounting, where the payment is reflected. You can reflect the payment in 1C 8.3 Accounting to a current account or to the personal accounts of employees, or through the cash register. After you have reflected the transfer of personal income tax in 1C 8.3 Accounting, in 1C ZUP 3.0 you must indicate the details of the payment document with which the personal income tax is transferred and conduct the statement.

Main contradictions

Not long ago, certain groups of parliamentarians came up with an initiative to increase the personal income tax by several percent. The idea was motivated by the fact that at the moment the state does not receive adequate income from the sale of minerals, as it did 10 years ago. Due to the fact that the “party line” boils down to not cutting social benefits and not raising the retirement age, citizens need to “tear off” a piece of their income in favor of more vulnerable segments of the population. This approach seemed extremely offensive to many. So on social networks, users expressed, at a minimum, “bewilderment” as to why they should pay for this project, and not the same deputies or oligarchs, who have access to much greater material wealth than ordinary residents of Russia. In any case, the initiative was “spit on” by civil activists and the matter did not get the desired progress, but this is only for now... In any case, the topic is very interesting and we will definitely try to talk about it in more detail in one of the following articles.

So where did we stop?

It has been approved at the government level that personal income tax rates will not change in the near future. By the way, regarding initiatives. There has been talk recently about lowering the tax rate on income from lottery winnings. We found out the opinion of one of our colleagues on this matter and, what is most surprising, she even won the lottery, albeit an insignificant amount.

“Yes, I won the lottery. It was “Sportloto”, my winnings were 7800 rubles – I managed to guess a small combination of numbers. Of course, it was nice, although in 2012 it wasn’t very much money either. When I applied to the company for them, personal income tax was deducted from me, and I received 5,070 rubles in my hands. When you buy a lottery ticket, you want to win an amount that exceeds your expectations, but here it turned out that it turned out to be even lower... Well, it’s okay, we happily “sat” with our friends at the bar with this money.”

It is difficult to say how fair this rate is in principle. In Russia, in fact, personal income tax is not yet as high as in many other countries that are usually called “developed”. For example, in Western Europe it is customary to calculate income tax on a progressive scale based on the calculation: “The more you earn, the more you pay.” I remember that several years ago Gerard Depardieu tore up his French passport because he had to pay as much as 70% of personal income tax... He went to Russia, received a Russian passport from the hands of the president and now can even receive a pension... If he wants, of course...