basic information

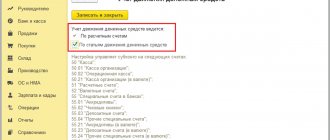

Data on special accounts is collected on account 55. Sub-accounts are created for it:

- 1 – letters of credit;

- 2 – check books;

- 3 – deposit.

Account 55 is needed to summarize information about the movement of funds in different currencies, presented in special payment documents (for example, letters of credit). These can also be means of targeted financing that require separate storage.

Settlements for letters of credit and checks are carried out in accordance with Regulation No. 2-P on non-cash payments established by the Central Bank of October 3, 2002.

Can there be foreclosure on funds accounted for in a special account ?

Working with an online cash register in 1C step by step

For more details, see the online course: “Online cash register management in 1C Accounting 8 from A to Z”

Connecting the cash register to 1C

The 1C program allows you to work with an online cash register. To do this, you need to connect cash register equipment.

From the section Administration - Settings - Programs - Connected equipment, go to the form Connecting and setting up equipment .

From the list of equipment types, select CCP with data transmission . Click the Create to enter an entry for the new equipment.

Fill in:

- Hardware driver - selected from a list of possible ones depending on the brand of cash register;

- Organization - selected from the list (if the database is maintained for more than one organization);

- Workplace - the user’s workplace from which the cash register is installed is automatically filled in;

- Name - the name in the program, is installed automatically when you select the Hardware Driver, you can change it to your own;

- Serial number - enter the serial number of the cash register indicated in the registration certificate (it is not necessary to fill in).

If the driver has not yet been installed, the program will inform you about this when you try to start configuring the cash register by clicking the Configure .

The driver is supplied with the equipment. The program also offers to download it from the supplier's website.

After installing the driver, the program will automatically proceed to setting up the cash register.

After setting up the CCP, perform a connection test.

Registration of a fiscal drive in 1C

When the 1C online cash register is installed, carry out the necessary operations with the fiscal drive (FN) to register the cash register with the Federal Tax Service. The procedure consists of three stages:

- submitting an application for registration of a Federal Tax Service to the Federal Tax Service;

- registration of a fiscal drive in the 1C program;

- completion of registration of the Federal Tax Service on the website of the Federal Tax Service.

The result of the first stage should be a registration number assigned to the cash register by the tax office. It will need to be entered into the CCP registration form in the program.

Log in to Connecting and setting up equipment (Administration – Settings – programs – Connected equipment), open the form for connecting and setting up the selected cash register, click the Operation with fiscal drive and select Registration .

Fill out the form that opens, Registration of a fiscal drive . Upon completion of the operation, click the Continue operation :

- the data will be transferred to the online cash register and recorded in the cash register registration card;

- The cash register will print the report.

Enter the report data into the form at the final stage of registering the cash register on the Federal Tax Service website.

See also Scope of application of cash registers (from the recording of the broadcast dated July 09, 2018)

Working the cash register in 1C 8.3 step by step instructions

When the online cash register is ready to work in 1C, the cashier can begin opening a shift. Opening a shift is a mandatory daily procedure at the beginning of work at the cash register. At the end of work, the shift must be closed (clause 2, article 4.3 of the Federal Law of May 22, 2003 N 54-FZ).

Opening, as well as closing a shift, in 1C is carried out through the section Bank and cash desk – Cash desk – Fiscal device management.

Information about open and closed cash shifts is contained in the Cash Shifts (Bank and cash desk – Cash desk – Cash shifts).

You can punch a check in 1C using different documents, depending on the method of organizing trade and the type of trading operation:

- Check (Sale);

- Cash receipt;

- Cash withdrawal;

- Payment by payment card;

- Debiting from current account;

- Receipt to the current account.

Check (Sales) is suitable for retail transactions when the buyer is impersonal. The document is available from the section Sales – Retail sales – Retail sales (receipts) – Sale button.

The receipt will be printed only from the device on which the same information as in the document Receipt (Sales) :

- Organization;

- The warehouse (or the warehouse was not specified at all when registering the cash register).

The receipt can be provided to the buyer in paper form:

and choose sending to email or phone:

More details Breaking through a cash register check “with data transfer”. Cash payment for retail sales of goods

Documentation:

- Receipt of cash - when paying in cash;

- Payment by payment card - when paying by electronic means of payment;

- Receipt to the current account - in case of non-cash payment by individuals

are used for sales transactions to legal entities, individual entrepreneurs or individuals, when it is important for us to reflect a specific person when paying.

More details:

- sale to a specific buyer for cash

- sale with payment by payment card

In order for the receipt to reflect the goods indicating the price and quantity when selling according to documents:

- Cash receipt;

- Payment by payment card;

- Receipt to the current account,

It is necessary to indicate in them the Invoice to the buyer , on the basis of which payment is made.

Documentation:

- Cash withdrawal,

- Debiting from current account

used for refund transactions.

Help-report of a cashier-operator in 1C 8.3

At the end of the shift, the cashier generates a certificate-report of the cashier-operator according to the KM-6 form. Since 2021, control and financial departments do not require its completion (Letters of the Federal Tax Service of the Russian Federation dated September 26, 2016 N ED-4-20 / [email protected] and the Ministry of Finance of the Russian Federation dated April 4, 2017 N 03-01-15/19821). But organizations can use it as an internal reporting document.

The cashier's certificate report KM-6 in 1C can be printed from the document Retail Sales Report by clicking the Cashier's report report (KM-6) .

Opening and using an account

To create a special account you need to prepare these documents:

- Corresponding statement.

- A certificate stating that the legal entity is registered with the tax authorities.

- Founding papers.

- Card with sample signatures of the chief accountant and manager.

What is the procedure for keeping a checkbook ?

Letters of credit can include both own funds and funds received through lending. They can be used in settlements with counterparties. If the funds from the letter of credit have not been fully used, they are transferred to the original account.

Checkbooks can also store either company funds or loans taken out.

The debiting of money is carried out only if the bank has issued a statement of clearing of checks provided by the creditor.

If checks issued by company representatives are not cashed, they are returned to the banking institution.

Interest on a special account - whose income?

Account 55 stores funds for targeted financing. What does this mean? For example, the state finances the activities of social entities, capital investments, and provides subsidies. These finances must be kept separately.

The subaccounts of account 55 collect information about the current accounts of branches and structural associations of the organization. They are needed for current calculations. For example, this could be the payment of salary, vacation pay, travel allowance, or the release of funds for business purposes.

Wiring used

Account 55 involves the use of these entries:

- DT55/1 KT51, 52. Transfer of funds from a bank account to a letter of credit.

- DT60, 76 KT55/1. Transfer of money to the supplier's account.

- DT51, 52 KT55/1. Refund of money from a letter of credit that was not used.

- DT55/2 KT51. Storing money for check settlements.

- DT60, 71, 76 KT55/2. Writing off money by checks.

- DT55/3 KT51, 52. Transfer of funds to a deposit account.

- DT51, 52 KT55/3. Crediting money from the deposit to the account.

- DT76 KT91/1. Accrual of interest on deposit.

IMPORTANT! Analytical accounting must be carried out for each letter of credit and check.

Appendix 1C: Cash desk

1C: Cash register is an alternative to the accounting program 1C 8.3 Accounting in terms of maintaining inventory records and sales through cash register systems.

If you have simple merchandise accounting, and the cashier’s workplace is equipped separately from the accounting department and accounting program, and perhaps even involves mobile sales, then the 1C: Cashier may be what you need.

1C: Cash register is compatible with mobile and stationary cash registers:

- Shtrikh-Mpey-F - autonomous online cash register;

- Evotor - smart terminal;

- 1S-ATOL MK-11F - automation kits for mobile trading;

- 1S-ATOL MK-30F - set for stationary trade

- With other cash registers that have a 1C certificate: Compatible!

Correspondence on individual deposit forms

Let's consider the transactions used for specific deposits.

Letter of Credit

A letter of credit is a commitment made by a bank. That is, the bank issues funds to the company's counterparty on behalf of the latter. A letter of credit is used for settlements with one person. To open it, you need to fill out an application indicating this information:

- Details of payment documents.

- Form of letter of credit.

- Terms of payment.

- Account number to be credited.

- Validity.

- The name of the goods and services that are paid for using the letter of credit.

- Number and date of agreement with the counterparty.

- Product shipment time.

The letter of credit is closed under the following circumstances:

- The letter of credit has expired.

- A corresponding application has been received from the supplier or buyer.

- Incomplete use of the account.

A notice is sent to the buyer prior to closing. The use of account 55 (subaccount 1) is determined by the type of letter of credit and the conditions for its opening. An uncovered letter of credit is taken into account behind the balance on account 009. When written off, this posting is made: DT55, subaccount 1 KT51, 52, 66. The posting is made on the basis of a bank statement with the documents attached to it.

The amounts used are written off using this entry: DT60 KT55, subaccount 1.

After debiting, the bank performs final operations. In particular, if the letter of credit is not fully used, the balance is returned to the account. In this case, you need to make this entry: DT51, 52 KT55, subaccount 1.

Analytical account accounting is performed for each letter of credit. This allows you to accurately track the movement of funds.

Checks

The movement of funds on checks is carried out on account 55 (subaccount 2). A check represents a security. It involves the order of the owner of the check to pay funds to the holder of the check. The check holder is the person to whom the document was issued. The issuance of a check is recorded using this posting: DT55, subaccount 2 KT51, 52, 66.

Securities presented for payment when purchasing material assets are reflected in this entry: DT60, 76 KT55, subaccount 2.

Unused amounts that were returned to the bank are recorded by this posting: DT51, 52 KT55 (subaccount 2).

Funds from checks that are not cashed remain in the 55/2 account. The amount must be equal to the balance on your bank statement.

Deposit

The movement of funds on bank deposits is carried out on account 55 (sub-account 3). These entries are made:

- DT55/3 KT91/1. Accrued interest on the deposit.

- DT51, 52 KT55/3. Return of deposit.

Analytical accounting is carried out for each of the deposits.

Targeted financing, funds from branches, etc.

Targeted financing is recorded on account 55. Separate sub-accounts are opened for it. A separate sub-account is also needed to record the movement of funds from branches and structural divisions. It is also required to reflect funds transferred from the account for the purchase of bank cards. The purchase of a card is recorded using this entry: DT55 (sub-account “Card Account”) KT51.

The posting is carried out on the basis of an account statement as of the date the money is written off. Card payments are confirmed by bank statements. The issuance of a card to an employee is reflected by this posting: DT71 KT55, subaccount “Card Account”.

Entries are made on the basis of statements and documents on the basis of which the card was issued. The employee is required to confirm the legality of the expenditure of funds. To do this, you need these documents: receipts, sales receipts, invoices, invoices. Typically, the employee prepares expense reports for the card. You need to attach a primary to them. The employee's expenses are recorded using this posting: DT10, 20, 26, 41 KT71.

Analytical accounting is carried out for issuing banks, cards and users of these cards. Information on account 55 is summarized using a PC. The statement must record the balance of debit and credit turnover.

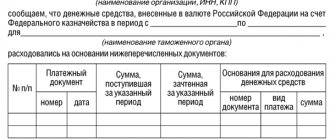

Transfers on the way

Transfers in transit are funds that have been deposited into a bank or post office, but have not yet been credited to the account. They are reflected in account 57. Primary accounts are credit receipts, receipts from a savings bank or post office, statements for the delivery of proceeds to collectors. The transfer of amounts is reflected by this posting: DT57 KT50.

The transfer of money to the account is recorded by this entry: DT51 KT57.

The movement of foreign currency must be recorded separately from other funds. Analytical and synthetic accounting, if the journal-order form of accounting is adopted, is carried out in journal-order No. 3. The primary document is a bank statement.

Working with cash documents

Managing the organization's cash desk involves conducting operations for receiving and issuing funds with daily summing up.

In 1C, such operations are carried out from the section Bank and cash desk – Cash desk – Cash documents.

Coming

The receipt of funds is carried out by the Cash Receipt , which can be created from the Cash Documents using the Receipt .

Cash receipts have several types of transactions, by choosing which, depending on the transaction being carried out, you can quickly fill out a document and correctly reflect the transaction in accounting.

For most types of operations, the following are automatically installed:

- Settlement account;

- Income item.

Transaction type Other income is used for non-standard transactions with any settlement account and type of income (type of cash flow).

More details, generation of the Cash Receipt when:

- sale to the buyer;

- return of unused accountable amounts;

- payment of the management share in cash.

Consumption

Cash expenses are documented in the Cash Issue from the Cash Documents using the Issue .

Cash Withdrawal document also has several types of transactions with predefined settlement accounts and expense types.

Other expenses - for facts of economic life that are not provided for by other types of transactions in the Cash Issue .

More information about the formation of the Cash Withdrawal for:

- issuance of accountable amounts.