Primary accounting documents or primary records, as accountants call them, are the basis of accounting, both accounting and tax. Without proper execution, maintenance and storage of primary documents, it is impossible to conduct legal business activities.

The Law “On Accounting” dated December 6, 2011 No. 402-FZ indicates that “every fact of economic life is subject to registration as a primary accounting document.”

To make sure you have all the necessary documents, you should regularly check your accounting, and for those who do not have time for this, we recommend a free accounting audit service.

Check your accounting for free

The primary document proves in writing the fact of a business transaction, confirms the commission of business expenses when calculating the tax base, and establishes the responsibility of performers for the performance of business transactions. Primary documents are requested by tax inspectors when checking declarations and reports, and they are necessary when passing audits.

Considering that not only accountants, but also managers, individual entrepreneurs, sales managers and other employees fill out and prepare primary documents, we invite you to familiarize yourself with the requirements for these documents.

Definition and details

Primary accounting document (PUD) is a document that reliably and completely reflects the fact of economic life (PHL) of the organization and gives it legal force.

Each fact of economic life is subject to registration with a primary accounting document (Part 1, Article 9 of Federal Law No. 402-FZ of December 6, 2011 “On Accounting” (hereinafter referred to as Law No. 402-FZ).

The primary accounting document must be drawn up when a fact of economic life is committed, and if this is not possible, immediately after its completion (Part 3 of Article 9 of Law No. 402-FZ).

Expenses will be recognized for income tax purposes only if they are documented, that is, drawn up in accordance with the legislation of the Russian Federation (clause 1 of Article 252 of the Tax Code of the Russian Federation). Costs for which documents are drawn up in accordance with Law N 402-FZ will be considered documented.

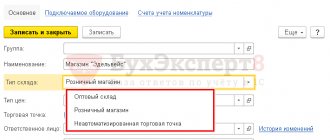

The composition and form of the PUD are determined and approved by the head in the Accounting Policy (AP) of the organization. PDF

Each PUD form must contain 7 mandatory details (Part 2 of Article 9 of Law N 402-FZ): PDF

- Title of the document;

- date of document preparation;

- name of the economic entity – the document preparer;

- content of the fact of the economic life of the organization;

- the value of the natural and (or) monetary measurement of the FHZ;

- name of the position of the person (persons) responsible for the transaction (operation);

- signatures of the persons provided for in clause 6 indicating the surname, initials, or details necessary to identify the responsible person.

It is allowed to include additional details in the form of the primary accounting document.

Invoice and contract: are they “primary”?

Let us dwell separately on documents that are often classified as primary accounting documents, although in fact they are not such. We are talking about invoices and contracts.

As you know, an invoice is required to deduct VAT (clause 1 of Article 169 of the Tax Code of the Russian Federation). Accordingly, the purpose of creating this document does not correspond to the purpose of compiling a primary accounting document. An invoice is not the basis for reflecting any data in accounting registers. It is also necessary to take into account that the invoice is drawn up not during the execution of a business transaction and not even immediately after its completion, but within five calendar days from the date of shipment of goods (delivery of work, services) or from the date of receipt of the advance (clause 3 of Art. 168 of the Tax Code of the Russian Federation).

Generate invoices and invoices in the web service for accounting and reporting

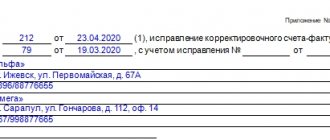

But at the same time, the details of the shipping invoice largely coincide with the details of the primary document for the transfer of goods (work, services) to the buyer (customer). Therefore, the Federal Tax Service of Russia has developed a universal transfer document, which, in addition to the information from the invoice, contains additional details characteristic of the primary accounting document (Appendix No. 2 to the letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3 / [email protected] ). Based on the rules of the Accounting Law, a universal transfer document should be drawn up at the time of the transaction or immediately after its completion. Only in this case, the UPD, which contains the invoice indicators, will be regarded as a primary accounting document. A regular invoice does not apply to the “primary” invoice.

Exchange UPD and invoices with counterparties via the Internet with a 25% discount

The situation is similar with the contract - in itself it is not a primary document for accounting purposes. After all, a contract is just a list of obligations of the parties. The fact of concluding an agreement, as a rule, does not confirm the completion of a business transaction, but speaks only of the intentions of the parties to carry out such a transaction.

In other words, the agreement is an accounting document that records the occurrence, change and termination of obligations (clause 3 of article 5 of the Accounting Law), but does not record the fact of economic life and its content (clause 1 of article 5 of the Accounting Law). In this regard, it cannot be recognized as a primary accounting document. Therefore, one agreement signed by the parties is not enough to reflect business transactions in the accounting records.

Draw up contracts for free in Kontur.Elbe using ready-made templates

At the same time, an agreement can be recognized as a primary accounting document if it is drawn up directly during a business transaction, contains all the necessary details of the “primary” document and is approved as such by the head of the organization. In particular, an agreement can be considered a primary accounting document if it is drawn up not in the form of a single document signed by the parties, but in the form of an invoice for payment (invoice), which formalizes an already accomplished fact of economic life (sale of goods, performance of work, provision of services). This conclusion is confirmed in the Recommendations for conducting annual financial statements of organizations for 2021, given in the appendix to the letter of the Ministry of Finance of Russia dated January 21, 2019 No. 07-04-09/2654.

Thus, an invoice for payment (invoice) sent to the buyer after shipment of the goods can be regarded as a primary accounting document if it contains all the details provided for by the Accounting Law, and the form of the invoice (invoice) is approved by the head of the organization as a “primary” . Also see “The Ministry of Finance announced whether it is necessary to draw up an act of acceptance and transfer of services provided.”

Signatures

The manager approves the list of persons authorized to sign the primary accounting document PDF. A power of attorney on behalf of the organization is issued to persons authorized to sign the PUD for the manager or other responsible persons. PDF

Can primary documents be signed by persons who are not employees of the organization?

Sometimes there is a need for primary documents to be signed by outsiders. For example, if the organization is under the accounting services of a third-party legal entity or individual entrepreneur.

The “primary document” can be signed by persons who are not employees of the organization. The Ministry of Finance, in its recommendations to auditors on conducting an audit of the annual financial statements for 2013, noted that in this case, the information contained in the DMP should make it possible to identify the person who completed the transaction, operation and the person responsible for its execution (Letter of the Ministry of Finance of the Russian Federation dated January 29, 2014 N 07-04-18/01).

A power of attorney on behalf of a legal entity is issued signed by its head or another person authorized to do so in accordance with the law and constituent documents (clause 4 of Article 185.1 of the Civil Code of the Russian Federation).

In order for the PUD, signed by an authorized person on behalf of the individual entrepreneur, to be used for tax purposes, the power of attorney to sign the individual entrepreneur’s documents must be notarized (paragraph 2, paragraph 3, article 29 of the Tax Code of the Russian Federation).

A facsimile, electronic copy or otherwise reproduction of the manager’s signature upon receipt of documents that have financial consequences are not supporting documents for the purposes of accounting for corporate income tax (Letter of the Ministry of Finance of the Russian Federation dated April 13, 2015 N 03-03-06/20808, Resolution of the Federal Arbitration Court Court of the Volga District dated June 20, 2012 N A12-13422/2011).

A document signed with a facsimile signature is not the basis for confirming expenses in order to reduce the tax base.

Seal

The seal on the primary document is not a mandatory requisite (Part 2 of Article 9 of Law No. 402-FZ).

Since 2015, the mandatory use of the seal has been abolished, unless expressly provided for in the Charter. Changes have been made to the laws:

- N 208-FZ of December 26, 1995 “On joint stock companies” (clause 7);

- N 14-FZ dated 02/08/1998 “On limited liability companies” (clause 5).

If a stamp is provided on the form of the primary document approved by the organization, then the organization is obliged to affix it when filling it out.

Mandatory and recommended forms

For some types of transactions, the use of document forms established by authorized bodies on the basis of regulations is mandatory. For example:

- cash documents (Instruction of the Central Bank of the Russian Federation dated March 11, 2014 N 3210-U):

- PKO (KO-1); PDF

- RKO (KO-2); PDF

- transport bill of lading (Resolution of the Government of the Russian Federation of April 15, 2011 N 272). PDF

By letter dated October 21, 2013 N ММВ-20-3/ [email protected] the Federal Tax Service of the Russian Federation proposed the form of the primary document - a universal transfer document (UDD) PDF. The document combines two:

- invoice (certificate of services rendered);

- invoice.

On the one hand, the UPD contains all the features of a primary document and can be documentary evidence of expenses incurred for the acquisition of goods (works, services); on the other hand, it is the basis for claiming VAT for deduction. The form is advisory in nature.

UPD is a document that can be used to confirm costs taken into account when calculating corporate income tax (Letter of the Federal Tax Service of the Russian Federation dated 03/05/2014 N ГД-4−3/ [email protected] ).

Within the framework of one contract, you can use simultaneously a consignment note (for the transfer of one consignment of goods) and a UTD (for the transfer of another consignment of goods) and this will not be an obstacle to accounting for costs for tax purposes (Letter of the Federal Tax Service of the Russian Federation dated May 27, 2015 N GD-4- 3/8963).

List of primary accounting documents

What documents can be classified as primary documents? The list of primary accounting documents that are used in a particular transaction depends on the characteristics of a particular transaction.

The list of primary documents may be as follows.

1. Account. There is no unified invoice form, so each company can develop its own form. The invoice, in addition to generally accepted data (seller's details, buyer's name, number, date of issue), may contain other information about the terms of the transaction: terms and procedure for payment and delivery, advance payment notifications, etc.

2. Payment documents. A payment document can be a payment order, a payment request, a cash and sales receipt, a strict reporting form. Such documents are used for non-cash payments. The payment confirms the fact of payment for goods, works or services.

3. Consignment note. Used to formalize the sale (release) of inventory items to a third-party company. The invoice is issued in two copies. The first copy remains with the seller (confirms the release of goods), and the second is transferred to the buyer (used by him to capitalize the received values). The invoice data must not differ from the data indicated on the invoice.

3. Certificate of acceptance of work performed (services provided). The act confirms the fact, cost, timing of work (provision of services). It is necessary to confirm compliance of the work performed with the terms of the contract.

4. Payroll. Used when solving problems related to company employees. Such statements take into account all the circumstances regarding the payment of wages. The payroll includes not only wages, but also all bonuses, overtime, etc.

5. Cash documents. Necessary for accounting for financial transactions for the sale of goods or services. This category includes not only the cash book, but also receipt and expense orders.

Electronic document form

Since 2013, Law N 402-FZ has equalized paper and electronic forms of documents.

The primary accounting document is drawn up on paper and (or) in the form of an electronic document signed with an electronic signature (clause 5 of Article 9 of Law No. 402-FZ).

What signature should be used to sign electronic primary accounting documents?

The types of electronic signatures of accounting documents must be established by federal accounting standards (clause 4, clause 3, article 21 of Federal Law N 402-FZ). Before the adoption of the relevant federal standards, an electronic accounting document can be signed with any signature provided for by Federal Law dated 04/06/2011 N 63-FZ “On Electronic Signatures” (hereinafter referred to as Law N 63-FZ), according to the Ministry of Finance of Russia (Letter of the Ministry of Finance of the Russian Federation dated 12.09. 2016 N 03-03-06/2/53176, Letter of the Federal Tax Service of the Russian Federation dated 05/19/2016 N SD-4-3/8904, Letter of the Federal Tax Service of the Russian Federation dated 01/17/2014 N PA-4-6/489).

Federal Law N 63-FZ provides for the following types of electronic signatures (ES):

- simple EP;

or

- enhanced EP:

- enhanced unqualified electronic signature;

- enhanced qualified electronic signature.

Signing an enhanced qualified electronic signature is equivalent to a paper document signed with a handwritten signature, except in cases where the document must be drawn up exclusively on paper.

Signing a simple electronic signature or an enhanced unqualified electronic signature is equivalent to a paper document signed with a handwritten signature, if expressly provided for by law or an agreement between the participants.

Electronic document flow using a simple and (or) enhanced unqualified electronic signature will be valid between counterparties if there is a legally valid agreement. The agreement must contain a section on the procedure for verifying electronic signatures (Letter of the Federal Tax Service of the Russian Federation dated May 19, 2016 N SD-4-3/8904).

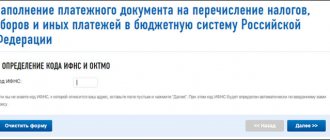

To sign electronic invoices, as well as reporting to the Federal Tax Service, it is necessary to use only an enhanced qualified signature (clause 1 of article 80 of the Tax Code of the Russian Federation, clause 6 of article 169 of the Tax Code of the Russian Federation).

Is it necessary to print electronic documents at the end of the year?

Documents not signed with digital signature

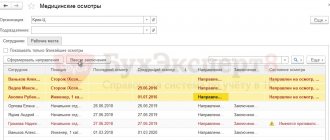

Working with 1C allows you not only to keep records, but also to generate accounting documents in electronic form. Do I need to print them out at the end of the year?

Accountants often think that if a document or register is maintained electronically, then there is no need to print it out, since this is provided for by accounting legislation.

A document or register takes on the status of an electronic document only if it is signed with an electronic digital signature (EDS) (clause 5 of Article 9, clause 6 of Article 10 of Federal Law N 402-FZ). Electronic documents cannot include documents created using a computer and maintained in computer programs, including accounting ones, if they are not signed with an electronic signature.

Therefore, all registers and documents that you maintain in 1C, if they are not signed with an electronic signature, must be printed at the end of the year and signed with a handwritten signature. Don't forget to print the following documents and registers:

| Document | When to print | A normative act requiring the maintenance of a document/register |

| Cash book | At the end of the year | pp. 4.7 clause 4 of Bank of Russia Instructions dated March 11, 2014 N 3210-U |

| Accounting registers | Within the time limits established by the accounting policy or at the end of the year | Art. 9 Federal Law dated December 6, 2011 N 402-FZ, clause 4 PBU 1/2008 |

| Tax accounting registers | Within the time limits established by the accounting policy or at the end of the year | Art. 313, 314 Tax Code of the Russian Federation |

| Purchase book, sales book | Until the 25th day of the month following the end of the quarter | clause 24 of the Rules for maintaining the purchase book, clause 22 of the Rules for maintaining the sales book, approved. Decree of the Government of the Russian Federation dated December 26, 2011 N 1137 |

| Invoice journal | By the 20th day of the month following the end of the quarter | clause 13 of the Rules for maintaining an invoice journal, approved. Decree of the Government of the Russian Federation dated December 26, 2011 N 1137 |

| Account cards for insurance premiums, personal income tax registers | Within the time limits established by the accounting policy or at the end of the year | clause 1 art. 230 Tax Code of the Russian Federation |

Documents signed with digital signature

The end of the reporting (tax) period is not considered a basis for the mandatory printing of electronic documents signed with an electronic signature. Such documents may be stored electronically and printed only upon request or if necessary (Letter of the Federal Tax Service of the Russian Federation dated 02/06/2014 N GD-4-3 / [email protected] , paragraph 4.7 clause 4 of the Bank of Russia Instructions dated 03/11/2014 N 3210 -U).

Primary documents compiled in electronic format and signed with an electronic digital signature should be printed out (Parts 5, 6, Article 9 of Federal Law dated 06.12.2011 N 402-FZ, paragraph 2 of Article 93 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated 11.01.2012 N 03-02-07/1-1, Letter of the Ministry of Finance of the Russian Federation dated 04/03/2015 N 03-02-07/1/18808):

- if by virtue of the contract you are obliged to provide the counterparty with documents on paper;

- at the request of government agencies and other persons who are required by law to submit a paper primary report;

- if the document formats used do not technically allow you to transmit the document electronically (for example, when you do not use unified documents, but those developed according to your own formats).

The Tax Code of the Russian Federation also does not contain requirements for the mandatory production of paper copies of electronic reporting (Order of the Federal Tax Service of the Russian Federation dated 03/04/2015 N ММВ-7-6/ [email protected] , Letter of the Federal Tax Service of the Russian Federation dated 02/06/2014 N ГД-4-3/ [email protected] ] ).

If you manage document flow electronically using an electronic digital signature, you need to make sure that this information is not lost, for example, if the electronic media is damaged.

If you are not yet a subscriber to the BukhExpert8 system:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C Accounting, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- The procedure for approving the primary document You do not have access to view. To gain access: Complete...

- Registration of primary registration in the absence of the person entrusted with this responsibility Hello! Please tell me how to correctly sign documents (TORG-12, invoice) in...

- Form 7-injury. Statistical form Good afternoon! Tell. Please, statistics form 7-injuries is not provided for...

- Basic details of accrual documents: document date, accrual month, planned payment date...

List of unified forms

The table shows a list of primary documentation most often used in the activities of a commercial organization, and details of forms approved by the State Statistics Committee. The organization can decide for itself whether to use this particular form, modify it to include only the data that is necessary, or develop its own.

| Accounting section | Document | Unified form |

| Personnel accounting | The order of acceptance to work | T-1 |

| Personal card | T-2 | |

| Staffing table | T-3 | |

| Transfer order | T-5 | |

| Order on granting leave | T-6 | |

| Order of dismissal | T-8 | |

| Time tracking and wages | Time sheet | T-12, T-13 |

| Payslip | T-51 | |

| Payment statement | T-53 | |

| Cash transactions | Account cash warrant | KO-1 |

| Receipt cash order | KO-2 | |

| Advance report | AO-1 | |

| Bank operations | Payment order | 0401060 |

| Collection order | 0401071 | |

| Payment request | 0401061 | |

| Payment order | 0401066 | |

| Accounting for inventory and trade operations | Packing list | TORG-12 |

| Power of attorney | M-2 | |

| Receipt order | M-4 | |

| Request-invoice | M-11 | |

| Invoice for issue of materials to the side | M-15 | |

| Fixed Asset Accounting | Certificate of acceptance and transfer of fixed assets | OS-1 |

| Certificate of write-off of fixed assets | OS-4 | |

| Inventory card | OS-6 |