According to Federal Law 402, individual entrepreneurs using a simplified tax system are required to submit two types of reports:

- tax;

- accounting

There are two types of taxation on the simplified tax system:

- The first is to pay income tax. In this case, you pay 6% of all income for the year;

- the second is to pay tax on the difference between income and expenses. In this case, pay 15% of the profit. This option is suitable for those whose expenses exceed 60% of turnover.

How many reports and where to submit depends on the availability of employees in the company.

Types of reports for individual entrepreneurs

Fiscal reports

Once a year or once every three months, such a report is submitted by those entrepreneurs who operate within the framework of the simplified tax system, unified agricultural tax and UTII regimes. OSNO - naturally too, since they generally file all declarations. But it’s easier for patent holders; they don’t have to report to the tax authorities in the form of fiscal declarations.

Additional reports

This type of declaration includes a kind of data such as the average headcount. You can read more about this type of reporting on our website in a separate article.

Reports to extra-budgetary funds

The funds include the Pension Fund, the Social Insurance Fund and the Compulsory Medical Insurance Fund. Most individual entrepreneurs, especially those who are employers and enter into employment contracts with employees, need to submit documents there.

Reports to Rosstat

They are needed so that the government body can conduct research and understand the business environment in Russia. It is usually taken from those whose business is larger and is of greater interest in terms of data volume. The statistics department itself decides who needs to submit the report.

We’ll talk more about each type of reporting and related papers later. In the meantime, it would be useful to remind you that the most important thing in submitting reports is not to miss deadlines. Violations are strictly suppressed with fines and freezing of current accounts.

Deadline for submitting statistical reports

Reporting to Rosstat is provided by individual entrepreneurs and small enterprises if they are subject to continuous or selective statistical research. Continuous research is carried out once every 5 years, and selective research is carried out monthly/quarterly (for small and medium-sized businesses) or annually (for micro-enterprises). Lists of those who must report are formed on the basis of information from the unified register of small businesses (Article 5 of Law No. 209-FZ dated July 24, 2007).

Rosstat communicates specific information about the forms and deadlines for submitting reports for 2017 to individual entrepreneurs and organizations by mail, but in order to be informed in advance, it is better to track the information on the website of regional statistical authorities in the “Statistical Reporting” section, or check it in your Rosstat branch.

Reports on OSNO

Personal income tax

Personal income tax refers to the income that was received after the sale of property.

Personal income tax is calculated based on income for the tax period. From this amount, deductions must first be made. In the case of OSNO, the costs of commercial activities are subtracted from there. The tax rate is 13 percent. In cases where deductions are actually greater than profits, the tax is equal to zero.

The declaration document for this type of tax must be submitted to the main system before April 30th. The reporting form is filled out according to form 3-NDFL.

4-NDFL is used to calculate advance payments. Those who have just started work must be handed over within five days after the month in which the first profit was received. For those who have been working for a long time - together with 3-NDFL. Refers to those investors whose profits for the current year and the previous year differ by more than twice.

When to pay personal income tax:

- 1st payment – until July 15

- 2nd – until October 15

- 3rd – until January 15

The final one, which takes into account those paid earlier - until July 15

VAT

A lot of things apply to VAT. This includes the sale of goods and the provision of various types of services. This is simply a transfer of rights to property or goods (in the case where expenses on them are not included in profit). This is performing work for your own needs, and even importing. VAT is paid in cases where an individual entrepreneur generates an invoice in which this tax is allocated after a completed transaction is not recorded as taxable.

The tax rate is 18 percent. For some individual entrepreneurs - 10% (in certain categories of goods; details are specified in Decree of the Government of the Russian Federation No. 597 of June 18, 2012).

For those who export goods, the rate = zero.

The first step is to calculate “VAT for crediting”. To calculate this figure, the following calculation formulas are used:

In the case of a rate of 18 percent, the amount of income including VAT is divided by 118 and multiplied by 18.

In the case of a bet of 10 - on 110 and 10, respectively.

Then you need to get “VAT creditable” - from the received amount of expenses we find 18 or 10 percent.

Then we get “VAT payable to the budget.” This is the relationship between “VAT accrued” minus “VAT credited”. If the total amount is negative, then you are entitled to a refund from budget funds.

VAT reporting is submitted once every three months, but no later than the 25th day of the month following the reporting quarter. These are April 25, July, October and January.

Payment of VAT is calculated as follows: take the accrual figure for 3 months, divide by exactly three. Then, in the next three months of the next quarterly reporting period, we pay one amount each (also until the twenty-fifth).

Property tax for individuals

Will be superimposed on the price of inventory property owned by an individual. No reporting is required for this fee. And for those who own real estate, the FSN itself sends notification letters. Must be paid by December 1st.

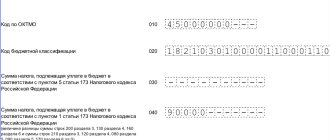

Title page

| Line or block | Entered data | Note |

| TIN | 503801449572 | INN of an individual received from the Federal Tax Service at the place of tax registration |

| Correction number | 0 — | If an initial declaration is submitted, the adjustment number is indicated “0”. If an error is discovered and the individual entrepreneur submits a repeated (updated) declaration, then the number of the updated declaration is indicated in this cell: “1” if the “updated” declaration is submitted for the first time, “2” if the second time, etc. |

| Taxable period | 34 | The value of this cell is constant and never changes: “34”. This is due to the fact that according to the simplified tax system the tax period is a year, and the code “34” corresponds to it. |

| Reporting year | 2016 | The year for which reporting is submitted is reflected here. |

| Submitted to the tax authority | 5038 | Simplified workers always report to the place of registration of the individual entrepreneur, so indicate the inspection code where you are registered |

| Taxpayer | Markov Boris Vsevolodovich | The full name of the individual entrepreneur is indicated line by line in exact accordance with the passport |

| Economic activity type code | 47.41 | When filling out a declaration under the simplified tax system for 2021, the code is indicated in accordance with the new OKVED-2 classifier |

| Phone number | 89164583210 | Please provide a valid phone number |

| Reliability and completeness... | 1 | “1” - if the reporting is submitted directly by the individual entrepreneur himself; “2” – if the declaration is submitted by a representative of the individual entrepreneur. In this case, you must also indicate the details of the power of attorney in the lines below. |

At the very bottom of the reporting, the individual entrepreneur puts the date the document was filled out and his signature.

Hints for filling out each line of sections are in the declaration itself, just follow them. In this case, there should be no errors when filling out the reports, and the declaration itself will comply with the requirements of the Federal Tax Service.

Simplified taxation system

What is taxed: at the individual entrepreneur’s choice, either income or income minus expenses.

The rate in case of taxation of income is 6 percent. If the object of taxation is the difference between income and expenses, then - 15 percent.

The deadline for submitting reports on accrued taxes is April 30 of the following reporting year.

Tax payment deadlines:

- 1st quarter - until April 25

- 2nd—until July 25

- 3rd – until October 25

- 4th – until December 31

Beginning commercial workers who are at the beginning of their career path may be granted a “tax holiday” by the regional authorities. This is a period of two years when an individual entrepreneur is exempt from paying tax contributions. Also, regional and regional administrations have the right to simply reduce the rate for individual entrepreneurs on the simplified tax system.

But such benefits are given primarily to those who begin to develop a line of business that is of priority importance for the development of the region. And only if the entrepreneur did not previously have another individual entrepreneur.

You should look for information on the possibility of obtaining a “tax holiday” on the electronic resources of regional administrations.

Deadlines for submitting financial statements

All organizations, including those that are small businesses, are required to maintain accounting records, regardless of the tax regime they apply (Part 1, Article 6 of Law No. 402-FZ dated December 6, 2011). The annual accounting includes:

- balance sheet,

- financial results report,

- statement of changes in capital,

- cash flow statement,

- report on the intended use of funds.

Small enterprises can report using simplified forms, but the reporting deadline is the same for all legal entities - 3 months after the end of the reporting year (Article 18 of Law No. 402-FZ). The last day for submitting accounting reports for 2021 to the Federal Tax Service and Rosstat will be April 2, 2018, since March 31 coincides with Saturday, a day off.

Patent tax system

With PSN, the object of tax collection is not a certain income, but possible income based on a specific type of activity. The sizes are set by the state. And the options for types of activities for which the patent system is available are regulated by Article 346.43 of the Tax Code of the Russian Federation. It is also important that the list of these species is growing all the time.

The calculation of the price for a patent does not depend on the individual entrepreneur. The amount is set based on the rate for a specific type of commercial activity, as well as the period for which the patent is purchased (up to one year).

Individual entrepreneurs operating on a patent do not need to submit reports.

Taxes are paid within the cost of the patent itself.

Unified tax on imputed income (UTII)

In this regime, a tax is imposed on potential income from a specific type of activity. The regional coefficient is also taken into account, which can either increase or decrease the amount of payment according to the declaration on the “imputed” basis.

What affects the calculation of tax for UTII:

- Basic business profitability. Registered in the Tax Code of the Russian Federation.

- The value of the physical indicator. In its own way for each specific type of activity of entrepreneurs.

- Coefficients K1 and K2. K1 - the deflator coefficient has been equal to 1.798 since 2015. K2 - the correction factor varies depending on the regional setting.

The formula for calculating the UTII tax is: basic profitability* K1 * K2 * tax rate of 15 percent.

Time for filing reports and time for paying tax indicators:

- 1st quarter - until April 20 - reporting and until April 25 - tax.

- 2nd - until July 20 and July 25, respectively.

- 3rd - until October 20 and 25, respectively.

- 4th - until January 20 and 25, respectively.

What threatens violators?

If an individual entrepreneur does not pay taxes and does not submit reports on time, then the law provides for financial and administrative liability

In case of violation of tax laws, fines are imposed if three years have not elapsed from the date of violation, according to Art. 102.114 NKU. There are no penalties for non-payment of the unified social tax.

An administrative fine is imposed within 2 months from the moment the violation is discovered. If the violation continues for a long time, an administrative protocol is drawn up and the fine is collected through the court.

Employee tax for individual entrepreneurs

The requirements for an individual entrepreneur who has become an employer are such that he is forced to pay a portion of the entire amount of funds paid to his employees (under an employment or civil law contract) to the treasury.

The calculation of this tax is calculated according to the following principle: (employee’s income for the month minus tax deductions) * tax rate.

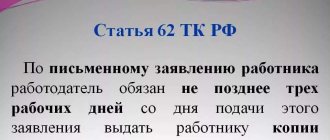

2-NDFL is issued separately for all individual entrepreneurs. The 2-NDFL declaration must be submitted before April 1 of the reporting period.

The payer will have to transfer the withheld personal income tax before the day following the payday. In the case of personal income tax on sick leave, benefits and vacation pay, payment of these components is due until the last day of the month. 3 percent is paid for persons with Russian citizenship and 30 percent for foreign persons.

Payments to extra-budgetary funds

For self-employed people without employees

When the profit does not exceed 300 thousand rubles, the following calculation principle is used: minimum wage * rate 26% * 12 months. Both “Pensionka” and the compulsory medical insurance fund will wait for money from the entrepreneur until December 31.

And if the profitability exceeds this mark, then the formula will look like this: minimum wage * rate of 26 percent * 12 months. + 1 percent of the amount of profit above.

At the same time, if you are also required to make basic payments before December 31, then one percent in excess of income can be paid later - before April 1 of the next year.

You need to pay an amount equal to 8 minimum wages * 26 percent rate * 12 months to the pension fund.

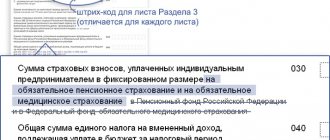

You will need to pay into the compulsory medical insurance fund according to the following system: minimum wage * 5.1 percent * 12 months.

The payment to the compulsory medical insurance fund is calculated as follows: minimum wage * 5.1% * 12 months.

Information to the Pension Fund and the Compulsory Medical Insurance Fund comes directly from the Federal Tax Service. Therefore, there is no need to report additionally.

For individual entrepreneurs who have employees

Payments to the Pension Fund and the Compulsory Medical Insurance Fund are calculated according to the same scheme: monthly contribution = the amount that was accrued to the employee from the beginning of the reporting year to the end of the current month multiplied by the Pension Fund tariff or the Compulsory Medical Insurance Fund tariff, respectively. Moreover, tariffs vary depending on the type of payer.

So in the main mode, the PFR tariff = 22+10%, the compulsory medical insurance fund tariff = 5.1%.

On the patent: Pension Fund tariff = 20%, compulsory medical insurance fund - zero.

The situation is the same for entrepreneurs in the “proschenka” market and for those “investors” who have received a license for pharmaceutical activities, activities in the niche of scientific research, education and healthcare. And also culture, art and mass sports.

There are several types of payers. These are those individual entrepreneurs who operate within the free economic zone of Crimea and Sevastopol, residents of the free port of Vladivostok and residents of specially designated territories that are designated as “territories of rapid socio-economic development.”

For these taxpayers, the Pension Fund tariff will be counted as 6 percent, and the Compulsory Medical Insurance Fund tariff will be 0.1 percent.

There are also individual entrepreneurs who act under obligations to implement tourism and recreational activities. Their tariffs by fund are the same as those of those included in the department of technology-innovation special economic zones:

Pension = 8 percent. Compulsory medical insurance = 4 percent.

Reducing the simplified tax system by the amount of paid insurance premiums for individual entrepreneurs

If an individual entrepreneur has chosen the simplified tax system Income option, then he has the right to reduce the calculated advance payments or the annual tax by the amount of insurance premiums paid. In the simplified taxation system Income minus expenses, contributions paid are taken into account in expenses, but do not directly reduce the calculated tax. The amount by which the tax can be reduced depends on whether the individual entrepreneur has employees.

Reduction of simplified tax system 6% for individual entrepreneurs without employees

To be able to reduce the advance payment or tax at the end of the year, you must pay insurance premiums on time. The amount of fixed insurance premiums in 2021 is at least 27,990 rubles. An individual entrepreneur without employees can reduce the amount of tax calculated for payment without restrictions.

An example of calculating the simplified tax system of 6% for 2021 for individual entrepreneurs without employees:

Individual entrepreneur Sergeeva works alone, the income received in the 1st quarter is 150,000 rubles. In March, she paid part of the insurance premiums for herself in the amount of 7,000 rubles. Calculation of the advance payment for the 1st quarter: (150,000 * 6%) – 7,000 = 9,000 – 7,000 = 2,000 rubles.

Income in the 2nd quarter is 220,000 rubles, in total for the six months the total amount of income received is 370,000 rubles. Individual entrepreneur Sergeeva paid the second part of the insurance premiums for herself in the amount of 7,000 rubles in April. When calculating the advance payment for the six months, it is reduced by the contributions paid and by the advance payment based on the results of the first quarter. We find that the advance payment for six months is equal to: (370,000 * 6%) – 7,000 – 7,000 – 2,000 = 6,200 rubles.

In the third quarter, income of 179,000 rubles was received, while insurance premiums in the amount of 8,000 rubles were paid in September. We calculate the advance payment for nine months incrementally from the beginning of the year: (150,000 + 220,000 + 179,000 = 549,000 rubles). We multiply the tax base by 6%, we get 32,940 rubles.

The calculated payment can be reduced by all paid insurance premiums (7,000 + 7,000 + 8,000 = 22,000 rubles) and by the transferred advance payments (2,000 + 6,200 = 8,200 rubles). Based on the results of nine months, the amount of the advance payment payable is equal to: (32,940 – 22,000 – 8,200 = 2,740 rubles). By the end of the year, individual entrepreneur Sergeeva earned another 243,000 rubles, that is, the total income for the year is 792,000 rubles. In December, she paid the remaining amount of insurance premiums for herself - 10,910 rubles.

Let's calculate the tax for the year: 792,000 * 6% = 47,520 rubles. Let's take into account that during the year insurance premiums (7,000 + 7,000 + 8,000 + 10,910 = 32,910 rubles) and advance payments (2,000 + 6,200 + 2,740 = 10,940 rubles) were paid. Let's calculate the remaining tax amount at the end of the year: 47,520 – 32,910 – 10,940 = 3,670 rubles. Tax for 2017 must be paid by April 30, 2021.

Reduced tax simplified tax system 6% for individual entrepreneurs with employees

Entrepreneurs-employers can also reduce advance payments and taxes at the end of the year due to timely paid insurance premiums, but tax payments can be reduced by no more than 50%.

At the same time, not only the insurance premiums of individual entrepreneurs for themselves are taken into account, but also the amount of insurance premiums paid for employees. The calculation of the simplified tax system of 6% for individual entrepreneurs with employees is similar to that indicated above, but the advance payment or tax at the end of the year can only be reduced by half.

If you have questions about paying tax on the simplified tax system and preparing reports, we recommend getting a free consultation from 1C:BO specialists

Free tax consultation

Additional pension fund tariffs

According to Federal Law 173 (“On labor pensions of the Russian Federation”), special tariffs apply to certain types of entrepreneur employees. This mainly applies to those who are employed in an enterprise with increased danger or harmfulness. In this case, the following will need to be added to the main calculation:

- With increased harmfulness of category 3.4 - a 7 percent tariff.

- With a harmfulness of 3.3 - 6 percent.

- At 3.2 - 4 percent.

- At 3.1 - 2 percent.

In case of increased danger, a tariff of four percent is applied.

An entrepreneur with hired employees submits a declaration to the pension fund using the RSV-1 form.

- For the first quarter - until May 16.

- For the first half of the year - until August 15.

- For the past three quarters - until November 15.

- For the whole year - until February 15.

Payment is due monthly by the 15th of the following month. If the day falls on a weekend - until the next working day.

Payments to the Social Insurance Fund

The entrepreneur is required to submit a report in Form 4-FSS. The formula for calculation will look like this: amount to be accrued at the beginning of the year and until the end of the current month * 2.9 percent.

There are two ways to report to the Social Insurance Fund - paper and electronic. At the same time, if you employ more than 25 people, then the report is accepted only in electronic format.

The rules for reporting deadlines are:

- For the 1st quarter - until April 20 in paper form and until April 25 in electronic form.

- For the 1st and 2nd - until July 20 and 25, respectively.

- For 9 months of work - until October 20 and 25.

- For the whole year - until January 20 and 25.

Payments for reporting are transferred until the 15th of the next month.

Method of submitting a declaration under the simplified tax system for 2017

A tax return for a single tax under the simplified tax system for the years 2-2017 can be submitted to the Federal Tax Service both on a regular paper form (for example, through a representative or by mail), or electronically via telecommunication channels (TCS).

In companies using the simplified tax system, the average number of employees does not exceed 100 people. Therefore, they can submit declarations under the simplified tax system electronically only on their own initiative. Tax inspectorates do not have the right to require such organizations to transmit a single tax declaration electronically.