From September 1, 2014, the sending and receiving of declarations is carried out in accordance with the order of the Federal Tax Service of the Russian Federation dated July 31, 2014 N ММВ-7-6 / [email protected] “On approval of Methodological recommendations for organizing electronic document flow when submitting tax returns (calculations) in electronic form via telecommunication channels." Also, this order, from September 1, 2014, invalidates the order of the Federal Tax Service of Russia dated November 2, 2009 N MM-7-6/ [email protected]

When submitting reports signed with a certificate of an authorized representative, an information message about the representation is sent with each declaration (see What are the features of submitting tax reports through an authorized representative?).

Electronic document management with tax authorities

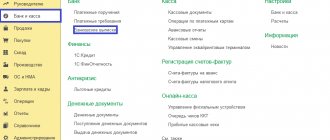

Taxpayers conduct electronic document flow with the tax office through reporting services. Information exchange is provided by e-document flow operators in the b2g sphere (“business-government”). And the exchange of documents with counterparties occurs through the EDI systems of operators in the b2b (“business-to-business”) sector. Therefore, it is more convenient for users to work if EDI and online reporting systems are integrated.

The reporting service Kontur.Extern and the EDI system Diadoc are connected. A few clicks are enough to send documents from Diadoc to the tax office. Users of other reporting systems will need to first download electronic documents from Diadoc to their computer, and then upload them into the system for submission to the tax office.

Submit documents to the Federal Tax Service easily and conveniently

Connect to Diadoc

Information statements

The provision of information services by tax authorities in electronic form via TCS is carried out in accordance with the order of the Federal Tax Service of Russia dated 06/13/2013 N ММВ-7-6/ [email protected] (as amended on 03/04/2014):

- Request for information

: The taxpayer forms a request, signs it with his own, encrypts it and sends it to the regulatory authority. When sending a request by an authorized representative of the taxpayer, an information message about the representation with the data specified in the power of attorney is sent along with the request. - Confirmation of dispatch date

: At the moment the operator receives the request, a confirmation from the EDF operator is generated, which is sent to the taxpayer and the tax inspectorate. - Notification of receipt of confirmation of the date of dispatch

: The taxpayer and the tax office, having received the confirmation, automatically sign it and send it back to the operator. - Notice of receipt of request

: In response to the request, the tax office sends a notice of receipt of the request to the taxpayer. The notification indicates that the document has been received at the reception complex of the Federal Tax Service. If the document cannot be decrypted at the input or does not meet the requirements of the Federal Tax Service, an error message is sent to the taxpayer instead of a notification of receipt. You must correct the errors and resend the request. - Receipt result

: The Tax Inspectorate generates and sends to the taxpayer a receipt, which is the result of format and logical control and confirms the receipt of the NI request. If the format and logical control is not passed, the taxpayer is sent a notice of refusal and the document flow is completed. In this case, in order to receive an extract, you must correct the errors and submit a new request. - Notification of receipt of the acceptance result by the operator : Upon receipt of a notification of refusal or receipt of acceptance, the operator automatically sends a notice of receipt of the acceptance result to the tax office.

- Notification of receipt of the acceptance result by the taxpayer : When the taxpayer receives a notification of refusal or receipt of acceptance, a notice of receipt of the acceptance result is automatically sent to the tax office, which also passes through the EDF operator’s server.

- Result of processing (extract)

: The tax office, having successfully received and processed the request file, generates an extract, which it sends to the taxpayer. The extract is generated automatically using the software package, based on data from the USRN information resource as of the date of the request. It is a file in RTF, XML, XLS, PDF format. - Notification of receipt of the processing result

: When the taxpayer receives an information extract, a notification of receipt of the processing result is automatically sent to the tax office, which also passes through the server of the EDF operator.

Document flow lasts 2 days.

Advantages of EDF with the Federal Tax Service

- Sending electronic documents is fast and convenient. With the transition to an electronic format, the labor costs of accountants are reduced, as they spend several times less time collecting documents at the request of the tax office.

- The EDI system Diadoc automatically checks documents for compliance with formats. This means that when receiving documents there will be no errors due to unfilled fields or the wrong number of characters in the details and the documents will not have to be sent again.

- With electronic document management, organizations reduce transportation costs, paper costs and office supplies.

Reporting

Electronic document flow between the taxpayer and the tax inspectorate is regulated by Order of the Federal Tax Service dated July 31, 2014 No. ММВ-7-6/ [email protected]

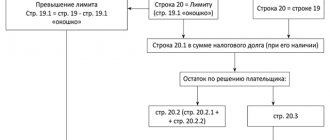

- Primary document

: The taxpayer generates a report, signs it with his own, encrypts it and sends it to the regulatory authority. When submitting a report by an authorized representative of the taxpayer, an information message about the representation with the data specified in the power of attorney is sent along with the report. - Confirmation of dispatch date

: When the operator receives the report, a Confirmation of dispatch date is generated. One is sent to the taxpayer, the other, along with the report, is sent to the NI. - Notice of receipt of confirmation of dispatch date

: The taxpayer and NI, having received confirmation of the dispatch date, automatically sign it and send it back to the operator. - Notification of receipt of the primary document

: In response to the report, the tax office sends to the taxpayer a notification of receipt of the primary document, which also passes through the server of the electronic document management operator. The notification is sent automatically. The notification indicates that the document has been received at the reception complex of the Federal Tax Service. If the document could not be decrypted at the input or does not meet the requirements of the Federal Tax Service, an Error Message is sent to the taxpayer instead of a notification of receipt. This means that the report has not been accepted and the document flow on it is stopped. You must correct the errors and resend the report. - Result of acceptance

: In case of a positive result of the format and logical control, an acceptance receipt is automatically generated.

The receipt is sent to the taxpayer and passes through the EDF operator’s server. The receipt confirms that the taxpayer has fulfilled his obligation to submit reports, but does not confirm that the report has been submitted . If the submitted report does not pass the format check, then instead of an acceptance receipt, the taxpayer receives a notice of refusal indicating the reasons for the refusal. This means that the report has not been accepted. The document flow on it is stopped. You must correct the errors and resend the report. - Notification of receipt of the acceptance result by the operator

: Upon receipt of a notification of refusal or receipt of acceptance, the operator automatically sends a notice of receipt of the acceptance result to the tax office. - Notification of receipt of the acceptance result by the taxpayer

: When the taxpayer receives a notice of refusal or receipt of acceptance, it automatically sends a notice of receipt of the acceptance result to the tax office, which also passes through the server of the EDF operator. - Result of processing

: The tax office, having made sure that the completed report is correct, generates an entry notice, which it sends to the taxpayer.

The notice confirms the fact of transfer of report data to the information resources of the tax authority. This document means that your report has been accepted

. If the report contains errors, the tax office sends a clarification notice to the taxpayer, which indicates the errors and contains a message about the need to provide explanations or make appropriate corrections. This means that the report has been accepted, but clarification is required. It is necessary to generate and send a corrective report with the necessary clarifications. also passes through the server of the EDF operator. - Notification of receipt of the result of processing by the operator

: Upon receipt of a notification of clarification or notification of input, the operator automatically sends a notification of receipt of the result of reception to the tax office. - Notification of receipt of the processing result by the taxpayer

: When the taxpayer receives a notification of clarification or a notification of entry, a notification of receipt of the processing result is automatically sent to the tax office, which also passes through the server of the EDF operator.

Document flow lasts up to 3 working days

. You can view the progress of reporting in more detail (phases of document flow, identifier, number of files in the letter) through the letter parameters.

According to the messages listed below, in accordance with the Order of the Federal Tax Service dated June 9, 2011 N ММВ-7-6/ [email protected] (as amended on November 21, 2011 N ММВ-7-6/ [email protected] ) the tax inspectorate sends only a receipt of acceptance or notification of refusal. Notification of entry is not provided in this case.

. These messages include:

- Form N S-09-1 “Notification on the opening (closing) of an account (personal account), on the emergence of the right (termination of the right) to use a corporate electronic means of payment (CESP) for electronic money transfers”;

- Form N S-09-2 “Notification of participation in Russian and foreign organizations”;

- form N S-09-3-1 “Notification on the creation on the territory of the Russian Federation of separate divisions (except for branches and representative offices) of a Russian organization and on changes to previously reported information about such separate divisions”;

- Form N S-09-3-2 “Notification about separate divisions of a Russian organization on the territory of the Russian Federation through which the activities of the organization are terminated (which are closed by the organization)”;

- Form N S-09-4 “Notification of reorganization or liquidation of an organization.”

An example of document flow with the Federal Tax Service in Diadok

To download documents from Diadoc for submission to the Federal Tax Service, download the entire document archive. Open the desired document, click on the “Download” link and select “Entire document flow”.

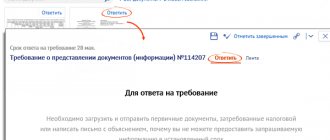

If you use the Kontur.Extern system, send a receipt for the request and click on the “Respond to request” button. In the new window, select download documents from Diadoc. The system will generate an inventory of documents automatically.

What it is?

Before starting to consider such a scheme as maintaining a “formal document flow”, it is worth familiarizing yourself with the concept of “tax benefit” in more detail.

A tax benefit means a reduction in the size of a business’s fiscal liability. You can reduce the amount of contributions by reducing the tax base or by obtaining a tax deduction or benefit. The amount of taxes paid will be less if the company applies a lower tax rate or receives the right to a refund (offset) or refund of tax from the budget.

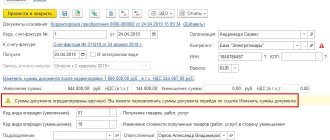

Accordingly, an unjustified tax benefit arises when a company reduces its tax burden without real grounds, using false documents and fictitious transactions. Formal document flow allows a company to receive such preferences. Formal is a document flow that is not confirmed by real business transactions and created to obtain an unjustified tax benefit.

What regulates

Order No. ED-7-2/448 dated July 16, 2020 approved the procedure:

- sending and receiving documents provided for by the Tax Code of the Russian Federation and used by tax authorities;

- submission of documents at the request of the tax authority in electronic form via telecommunication channels (TCS).

At the same time the following were declared invalid:

- Order of the Federal Tax Service dated December 29, 2010 No. ММВ-7-8/781 with the Procedure for transmitting the act of joint reconciliation of payments for taxes, fees, penalties and fines in electronic form via TKS;

- Order of the Federal Tax Service dated February 17, 2011 No. ММВ-7-2/168 with the Procedure for sending a request for the submission of documents (information) and the procedure for submitting them at the request of the tax authority in electronic form via TKS;

- Order of the Federal Tax Service dated November 7, 2011 No. ММВ-7-6/735 with the Procedure for submitting applications, notifications and requests in electronic form for the purposes of accounting with the tax authorities of organizations and individuals;

- Order of the Federal Tax Service dated April 15, 2015 No. ММВ-7-2/149 with the Procedure for sending documents used by tax authorities;

- a number of federal laws and regulations.

To be more precise, the new order essentially combined the provisions of the listed acts into one document.

Governing legislation

As such, there is no established legislative framework establishing formal document flow. It is possible to consider this concept from the legal side through an unjustified tax benefit. The main legislative acts regulating the concept of “unjustified tax benefit” and the schemes for obtaining it, including formal document flow, are Resolution of the Plenum of the Armed Forces of the Russian Federation dated December 21, 2021 No. 53 and Article 54.1 of the Tax Code of the Russian Federation.

The latter establishes that companies do not have the right to reduce their tax base and the amount of tax payable to the budget by distorting information about the economic life of the organization and its processes. This article of the Tax Code of the Russian Federation prevents the creation of tax schemes aimed at illegally reducing fiscal obligations, including by not taking into account taxable items, illegally declared benefits and the use of other tax benefits provided for by law.

Please note: the rule also applies to past tax periods, namely the three years preceding the audit. When scheduling an on-site control event in 2021, the tax period for 2021 can also be checked (Article 89 of the Tax Code of the Russian Federation, Determination of the Constitutional Court of the Russian Federation of May 29, 2021 No. 1152-O).

In addition to the above documents, there are many court decisions in cases related to formal document flow, and letters of explanation from inspection authorities.

Which digital signature should I choose for an employee?

To organize HR EDI, it is necessary for employees to have an electronic digital signature. It can be of three types:

- simple (PEP);

- enhanced unskilled (NEP);

- reinforced qualified (KEP).

Depending on what document is being signed, it is necessary to use one or another type of electronic signature. For example, to maintain a vacation schedule in Excel format, it is enough to use a simple digital signature, but to familiarize yourself with the company’s local documentation, you need to use a non-qualified signature. If you need to hire an employee remotely, you will have to issue and use only an enhanced, qualified digital signature.

Electronic signatures can be used for the following documents:

- orders for vacations, business trips, pay slips, time sheets - all types of electronic signature (PEP, NEP, KEP);

- job descriptions, labor safety briefing logs, internal labor regulations - NEP and CEP;

- employment contracts, dismissal orders - only CEP.

A simple and unqualified digital signature is issued only once - during employment. The employer can do this independently in his information system. Important: NEP requires an additional purchase of a special program.

A qualified digital signature is issued annually through an application to a certification center accredited by the Ministry of Telecom and Mass Communications.

Signs of formal document flow

In order not to arouse suspicion among regulatory authorities, companies should check themselves for signs of formal document flow. The following are “symptoms” indicating an artificial reduction in the size of business tax deductions:

- creation of an organization shortly before a business transaction;

- interdependence of participants in transactions;

- irregular nature of business operations;

- violation of tax laws in the past;

- one-time nature of transactions;

- carrying out the operation at a location other than the location of the enterprise;

- making payments using one bank;

- making transit payments between participants in interrelated business transactions;

- the use of intermediaries in carrying out business transactions.

It is worth noting that the presence of one of the listed signs does not necessarily mean malicious intent and an offense. To make a conclusion on the use of a tax optimization scheme, such as formal document flow, it is necessary to study each specific case by the inspection authorities separately

Why do you need an electronic signature?

All documents must be signed, electronic ones too. In this case, a special program that is protected from hacking acts as a signature. It guarantees that the document was “signed” by its owner. This is a “strengthened qualified signature”. It is issued by special certification centers, for example Kontorovsky.

A signature is required for any electronic document flow: for transactions, reporting and working with employees. Sometimes it is released as part of the tariff. For example, entrepreneurs buy Elba and receive a signature for submitting reports for free.

By the way, issuing a signature is not enough to submit reports. It is necessary to work with a special operator, for example with the same Elba. This rule was invented to secure the database of government agencies. Suddenly, attackers will bombard the tax server with tax requests or slip viruses into reports.