Most companies are faced with the need to build a facility using fixed assets. In order to do this, most often they turn to third-party organizations, and in order to ensure the greatest control over those who perform the work, they purchase materials themselves.

This is especially true in those companies that operate and manage residential buildings and other real estate. A simple example: a management company intends to improve the territory of the village it serves. They also need to build a playground, or a winter shed to store equipment for work.

To do this, the management company hired a contractor to carry out the work and purchased all the necessary materials. In this case, the organization’s accountants may have reasonable questions: how is the accounting of trade and material assets organized? Do you need documents from the contractor? If necessary, what documents should be required from him? How is an object registered? We decided to show you, using the example of the 1C: Accounting program, how all this is formalized and done officially and correctly.

For example, you have an agreement, the clause of which sounds something like this:

In this case, the customer takes into account not only his own costs for the material, but also the cost of the contractor’s work, which is why the total cost will be the sum of these two factors and will be much higher, which is not always profitable.

The next step is the purchase of trade and material assets that may be needed for construction, as well as their further transfer to the contractor. To reflect this operation in the 1C: Accounting program there are two methods:

- through a system for recording trade and material assets, which are transferred to the contractor through a separate warehouse;

- through a special document “Transfer of raw materials for processing”, which is generated in the program.

We will now talk about the advantages and disadvantages of both methods using examples:

Initial cost

Fixed assets constructed by contract are accepted for accounting at their original cost (clause 7 of PBU 6/01). Include in the initial price:

- amounts paid to the contractor in accordance with the contract;

- amounts paid for information and consulting services related to the creation of fixed assets;

- the amount of VAT claimed (if the fixed asset will not be used in activities subject to this tax);

- other expenses directly related to the creation (for example, the cost of purchased materials; equipment intended for installation at the facility; costs of examining the safety of the facility, etc.).

This procedure is provided for in paragraph 8 of PBU 6/01, paragraph 5.1.1 of the Regulations approved by the Ministry of Finance of Russia dated December 30, 1993 No. 160, paragraphs 11–15 of PBU 2/2008.

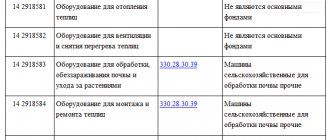

A detailed list of expenses that form the initial cost of constructed (manufactured) fixed assets is given in the table.

During the operation of a fixed asset, its initial cost does not change. The exceptions are cases of completion (retrofitting), reconstruction, modernization, partial liquidation and revaluation of fixed assets. Therefore, if any costs associated with the construction (manufacturing) of an object (for example, interest on a loan) are incurred by the organization after its inclusion in fixed assets, do not change the original cost. And consider the costs as part of current expenses. This procedure follows from paragraph 14 of PBU 6/01.

How is the OS created?

In fact, there are two possible ways to organize the OS creation process:

- create an object on your own;

- involve contractors and third-party resources in the process - accounting for the contract method of construction.

In both cases, the accountant’s task is to correctly take into account all expenses and reflect the accepted object correctly at its original cost.

To organize correct accounting of a created, constructed, erected object, it is necessary to correctly determine the costs incurred, make sure that the created property is really a fixed asset, and determine how VAT on expenses will be taken into account. Accounting depends on the method of creating an asset - business or contract. Postings and paperwork will be slightly different.

Documenting

Determine the amount of expenses that form the initial cost of the object based on:

- primary accounting documents used in construction (act of acceptance of work performed in form No. KS-2, certificate of the cost of work performed and expenses in form No. KS-3, etc.);

- other primary documents confirming the costs incurred (customs declarations, business trip orders, etc.).

For registration, accept documents that contain the mandatory details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

To accept the created fixed assets, the organization should create a commission, which should determine:

- whether the fixed asset meets the technical specifications and whether it can be put into operation;

- whether it is necessary to bring (rework) the fixed asset to a state suitable for use.

If the organization's staff consists only of a director, do not create a commission. In this case, its functions must be assumed by the director.

This procedure follows from the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

After examining the object, the commission must give an opinion on the possibility of its use. This conclusion is reflected in the act in form No. OS-1.

Fill out the act in form No. OS-1 when accepting the object for accounting (at the time of reflection on account 01 “Fixed Assets” or 03 “Income Investments in Material Assets”) (paragraph 2 of the instructions approved by the Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7, Part 3, Article 9 of the Law of December 6, 2011 No. 402-FZ). Draw up the report on the basis of primary accounting documents and technical documentation attached to the construction contract.

Do not fill out the details of the donating organization, which are provided at the beginning of the act, as well as the sections “Information on the condition of the fixed asset object on the date of transfer” and “Passed over”. This is explained by the fact that for the contractor the constructed facility is not a fixed asset. Consequently, he is not obliged to draw up an act in form No. OS-1 (paragraph 8 of the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7, letter of Rosstat dated March 31, 2005 No. 01-02-09/205).

In the act in form No. OS-1, indicate:

- number and date of its compilation;

- full name of the fixed asset;

- place of acceptance of the fixed asset;

- factory and assigned inventory numbers of the fixed asset;

- depreciation group number and useful life of the fixed asset;

- information about the content of precious metals and stones;

- other characteristics of the fixed asset (total area, number of floors, etc.).

In addition, the act must contain the conclusion of the acceptance committee (for example, the entry “Can be used”). The executed act is approved by the head of the organization.

If a building or structure was manufactured under a contract, when accepting it for registration, fill out an act in form No. OS-1a. When filling it out, apply the same rules as when drawing up form No. OS-1.

If, under a contract, fixed assets (a group of homogeneous fixed assets) other than buildings and structures were manufactured, when accepting them for accounting, fill out a report in form No. OS-1b. When filling it out, apply the same rules as when drawing up form No. OS-1.

This procedure follows from the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

Simultaneously with drawing up the act in form No. OS-1a (OS-1, OS-1b), fill out the inventory card in form No. OS-6a (OS-6) or the inventory book in form No. OS-6b (intended for small enterprises) in one copy. Prepare an inventory card (book) based on the data in the act and primary documents. In the future, enter into the card (book) information about all changes that affect the accounting of fixed assets (revaluation, modernization, disposal). Reflect this information on the basis of primary documents (for example, on the basis of the acceptance certificate for modernized fixed assets in form No. OS-3).

This procedure is provided for by the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

Situation: is it necessary, in addition to form No. KS-14, to also draw up form No. OS-3? The organization carried out technical re-equipment of production buildings, the acceptance committee drew up only an act in form No. KS-14.

Answer: yes, it is necessary.

Form No. KS-14 indicates that the customer accepted the work that the contractor performed for him, that is, the construction of the facility is completed. This act provides general information about who carried out the work at the site, indicates the author of the design and estimate documentation, and the cost of the order. The commission’s conclusion on the condition of the fixed asset is also given here. This conclusion can be drawn from the instructions for filling out the KS-14 form, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a.

Form No. OS-3 reflects other information: on the condition of objects before repairs (reconstruction, etc.), data on the costs of reconstruction or modernization. As well as the conclusion of the commission that carried out the acceptance and transfer of the fixed asset. In form No. OS-3, they record whether the restoration work has been completed and list the changes that have occurred. This follows from the instructions for filling out form No. OS-3, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

Thus, Act No. OS-3 is a document on the basis of which the initial cost of a fixed asset increases after reconstruction or modernization.

Therefore, it is necessary to draw up both Form No. KS-14 and Form No. OS-3.

Attention: the absence (failure to submit) primary documents for accounting for fixed assets is an offense (Article 106 of the Tax Code of the Russian Federation, Article 2.1 of the Code of Administrative Offenses of the Russian Federation), for which tax and administrative liability is provided.

simplified tax system

Organizations using the simplified system are required to keep accounting records, including fixed assets, in full (Part 1, Article 2 of Law No. 402-FZ of December 6, 2011). At the same time, in order not to lose the right to apply the simplification, the organization must control the residual value of fixed assets, which cannot exceed 100,000,000 rubles. (Subclause 16, Clause 3, Article 346.12 of the Tax Code of the Russian Federation).

For information on the features of accounting for fixed assets built (manufactured) using economic methods, when simplified, see How to take into account the receipt of fixed assets and intangible assets using the simplified tax system.

Situation: is it possible to take into account when calculating the single tax the costs of constructing a fixed asset built on an economic basis? The organization applies a simplification and pays a single tax on the difference between income and expenses.

Yes, you can.

The right to take into account the costs of constructing a fixed asset is in no way connected with the method of construction or manufacture of fixed assets (subclause 1, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Therefore, the organization has the right to take into account in expenses when calculating the single tax the costs of constructing a fixed asset using economic methods.

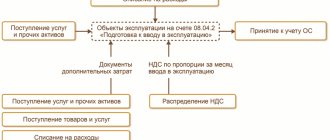

Accounting: cost reflection

In accounting, all costs associated with the construction (manufacturing) of an object (the cost of the contractor’s work, materials consumed, equipment transferred for installation at the site, etc.) are reflected in account 08-3 “Construction of fixed assets”. In this case, make the following entries:

Debit 08-3 Credit 60 (76)

– the cost of contract work for the construction of fixed assets is reflected (based on forms No. KS-2 and No. KS-3);

Debit 08-3 Credit 07

– reflects the cost of equipment transferred for installation to the contractor in the facility under construction;

Debit 08-3 Credit 23 (25, 26, 70, 76...)

– reflect other costs associated with bringing the object to a state suitable for use;

Debit 19 Credit 60 (76)

– VAT charged by the contractor is reflected, as well as on other costs associated with the creation of a fixed asset.

Situation: how to reflect the cost of construction work performed by a contractor in accounting? The construction contract provides for phased delivery of work.

The construction contract may provide for phased delivery of work (Articles 740 and 753 of the Civil Code of the Russian Federation). This means that as each stage is completed, the organization and the contractor must sign an act in form No. KS-2 and a certificate in form No. KS-3. Such rules follow from the instructions approved by Resolution of the State Statistics Committee of Russia dated November 11, 1999 No. 100.

At the moment when the act is signed, include the cost of the completed stage in the capital investments for the construction (manufacturing) of the fixed asset. That is, take into account account 08 “Investments in non-current assets”. This follows from the Instructions for the chart of accounts.

At this moment (subject to other conditions required for deduction), the input VAT presented by the contractor upon completion of this stage can be deducted (clauses 1 and 6 of Article 171, clauses 1 and 5 of Article 172 of the Tax Code of the Russian Federation, letters from the Ministry of Finance Russia dated March 5, 2009 No. 03-07-11/52, dated February 19, 2007 No. 03-07-10/06).

Include the finished object in fixed assets upon completion of the last stage of construction (manufacturing) (Instructions for the chart of accounts). In this case, draw up an act in form No. OS-1a (OS-1, OS-1b) (Part 1 of Article 9 of Law No. 402-FZ of December 6, 2011, instructions approved by the Resolution of the State Statistics Committee of Russia of January 21, 2003. No. 7).

Situation: how to reflect in accounting the cost of own materials transferred to the contractor for the construction (manufacturing) of a fixed asset?

In accounting, the cost of materials purchased for use in the construction (manufacturing) of a fixed asset is included in its initial cost. In this case, only those materials that are actually used can be included in the initial cost. This procedure follows from paragraph 8 of PBU 6/01.

The mere transfer of materials to the contractor does not mean that all of them were used in construction. Therefore, it is impossible to include the cost of all transferred materials in the initial cost of the object. You need to know how much materials were actually consumed. This information may be reflected in the contractor's report. There is no standard template for such a report, so it can be compiled in any form. The main thing is that it contains the mandatory details specified in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. The contractor's obligation to prepare such reports, as well as the frequency of their submission, should be stipulated in the contract. The right to demand the organization’s reports from the contractor is given by Part 1 of Article 748 of the Civil Code of the Russian Federation, according to which the customer can control, among other things, the contractor’s use of the materials transferred to him.

In accounting, the receipt of materials purchased for use in construction (manufacturing) is reflected in account 10-8 “Building materials”. When transferring materials to the contractor, transfer their cost to account 10-7 “Materials transferred for external processing”:

Debit 10-7 Credit 10-8

– reflects the cost of materials transferred to the contractor for the construction of the facility.

This procedure is provided for in paragraph 157 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

After the contractor submits a report on the materials used, include their cost in the costs that form the initial cost of the facility under construction:

Debit 08-3 Credit 10-7

– reflects the cost of materials spent on the construction of the facility.

This procedure is provided for in the Instructions for the chart of accounts.

Situation: how can a developer reflect in accounting the transfer of an unfinished construction project to conservation?

The decision to mothball an unfinished facility is made by the head of the organization (which is the construction developer). It is formalized by an order (instruction) in any form. In this document, indicate the time frame within which the documentation necessary to carry out the work and ensure the safety of equipment, structures and materials at the site will be prepared. An order for the conservation of an unfinished construction object is issued in the same way as an order for the conservation of a fixed asset object. Notify the contractor of your decision.

During conservation, an inventory of unfinished construction is carried out (clause 26 of the Regulations on Accounting and Reporting). The procedure for its implementation is established by paragraphs 3.32–3.35 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49. For unfinished capital construction, the inventories indicate the name of the object and the volume of work performed on this object, for each individual type of work, structural elements, equipment, etc. Inventory is carried out through control measurements. At the same time, the actual volumes of construction and installation work performed must be compared with the data of local estimates, as well as with the accounting data of the developer and contractor. After the inventory, the developer accepts from the contractor mothballed objects, as well as material assets that the contractor cannot use in the construction of other objects. For more information on conducting an inventory, see How to conduct an inventory.

After this, the parties must sign:

- estimates for work related to conservation and construction safety;

- act on suspension of construction in form No. KS-17 (approved by Resolution of the State Statistics Committee of Russia dated November 11, 1999 No. 100).

This procedure is confirmed by the letter of the USSR State Construction Committee dated August 18, 1986 No. 61-D.

A design organization is engaged to develop an estimate for the conservation and protection of a construction site. According to this estimate, the contractor performs construction and installation work on the basis of an additional agreement to the general contract. The developer pays the contractor for all work performed and costs associated with conservation. These rules follow from the provisions of Articles 452, 740, 752 of the Civil Code of the Russian Federation, paragraph 17.10 of the Methodological Recommendations, approved by Protocol No. 12 of January 5, 1999.

The costs associated with the conservation of an unfinished construction project, including the costs of its maintenance, should not be included in the cost of construction. Such costs in accounting form other expenses of the customer (clause 14 of PBU 2/2008). Reflect them on account 91 “Other income and expenses”. This procedure follows from paragraph 11 of PBU 10/99, Instructions for the chart of accounts (account 91) and letter of the Ministry of Finance of Russia dated January 13, 2003 No. 16-00-14/7.

In accounting, reflect this operation by posting:

Debit 91-2 Credit 10 (23, 60, 68, 69, 70...)

– the costs of conservation and maintenance of mothballed property are taken into account.

For the convenience of tracking information about the condition of the property for account 08, open a separate sub-account - “Objects of unfinished construction under conservation.” This approach is consistent with the Instructions for the chart of accounts (account 08).

Reflect the transfer to mothballing of an unfinished construction project by posting:

Debit 08 subaccount “Unfinished construction objects under conservation” Credit 08 subaccount “Construction of fixed assets”

– an unfinished construction site was transferred for conservation.

An example of reflecting the costs of conservation of an unfinished construction project in a developer’s accounting

Last year, Alpha LLC (developer) entered into an agreement with Proizvodstvennaya LLC (contractor) for the construction of an office for a period of two years. This year, construction has been stopped due to a lack of funds to cover costs. At the time of construction termination, the total cost of the work performed was RUB 1,852,000.

For the development of an estimate for the conservation of the facility, Alpha paid the design organization 11,800 rubles. (including VAT (18%) - 1800 rubles).

An additional agreement was concluded with “Master” to carry out conservation work. The “Master’s” expenses for these works amounted to 118,000 rubles. (including VAT (18%) - 18,000 rubles). Alfa bears monthly expenses for the maintenance of the mothballed facility in the amount of 50,000 rubles. (watchman's salary including insurance premiums).

To make it easier to track information about the condition of property, Alpha’s accountant opened separate sub-accounts for account 08:

- “Object of unfinished construction under conservation”;

- "Construction of fixed assets."

This year, the accountant made the following entries in the accounts:

Debit 08 subaccount “Object of construction in progress” Credit 08 “Construction of fixed assets” – 1,852,000 rubles. – the unfinished office building was transferred for conservation;

Debit 91-2 Credit 60 – 10,000 rub. (RUB 11,800 – RUB 1,800) – reflects the costs of preparing estimate documentation for the conservation of the office building;

Debit 19 Credit 60 – 1800 rub. – VAT is taken into account on the amount of costs for preparing estimate documentation;

Debit 91-2 Credit 60 – 100,000 rub. (RUB 118,000 – RUB 18,000) – reflects the costs of paying the contractor for the conservation of the office building;

Debit 19 Credit 60 – 18,000 rub. – VAT is taken into account on the cost of the contractor’s work on conservation of construction;

Debit 60 Credit 51 – 129,800 rub. (RUB 11,800 + RUB 118,000) – bills of the design organization and contractor have been paid;

Debit 91-2 Credit 70 (69) – 50,000 rub. – the salaries of the guards guarding the mothballed facility were accrued, as well as contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases from it.

What is the idea behind cost accounting in construction?

As soon as the construction organization is registered as a legal entity, the management process begins. Management decisions can be made by managers only when there is data obtained in the course of work. The result should be an analysis of all decisions made on a particular issue. It is most convenient to monitor decisions made using indicators. They can be expressed both numerically and as a percentage.

We can conclude that competent management is possible only when all the data is reliable. To create an overall picture, it is important to take into account not only general information, but also information about the work of all departments.

In the modern world, for a company to be successful, it is important to make the right decisions. But this cannot be achieved without planning, analysis and control. Cost accounting in construction using Finoco technologies is the method that allows you to combine all this.

Accounting: acceptance of ready-made objects for accounting

Reflect the acceptance of ready-made objects for accounting on account 01 “Fixed Assets” or account 03 “Profitable Investments in Material Assets”, to which open the subaccounts “Fixed Assets in Warehouse (In Stock)” and “Fixed Assets in Operation”. If the time of registration of a fixed asset and its commissioning coincides, make the following entry:

Debit 01 (03) subaccount “Fixed assets in operation” Credit 08-3

– the created fixed asset was accepted for accounting and put into operation at its original cost.

If the moments of registering a fixed asset and its putting into operation do not coincide, make the following posting:

Debit 01 (03) subaccount “Fixed asset in warehouse (in stock)” Credit 08-3

– the created object is taken into account as part of fixed assets at its original cost.

This procedure is provided for in paragraph 20 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, and the Instructions for the chart of accounts.

UTII

Organizations that pay UTII are required to keep accounting records in full (Article 2 of the Law of December 6, 2011 No. 402-FZ). Therefore, when reflecting fixed assets built on an economic basis in accounting, apply the same rules as under the general taxation system.

Operations related to the receipt, movement and disposal of fixed assets do not affect the calculation of UTII (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

If the fixed asset created by economic means is a piece of real estate, then the organization must register the ownership of it (Part 1, Article 4 of Law No. 122-FZ of July 21, 1997). For information on the specifics of accounting for such objects, see How to record the receipt of fixed assets subject to state registration.