The current account may be blocked at the request of the Federal Tax Service. There may be several reasons for the tax office to suspend transactions on a current account. In this article we will talk about possible reasons for blocking an account by the tax service, as well as how to find out about blocking an account on the tax service website.

The main reasons for the seizure of accounts by the tax inspectorate:

- Non-payment of tax.

- Reporting delay.

- Violations in electronic document flow with the Federal Tax Service.

Blocking options

The bank can block a client's account in different ways:

| Blocking | Description |

| Complete stop of account transactions | Such blocking means the suspension of all transactions, both outgoing and incoming. Accounts are blocked as part of enforcement proceedings if the account owner is involved in criminal activity |

| Partial blocking of account transactions | The ban applies to incoming transactions, but not to all. You cannot withdraw cash, but you can carry out non-cash transactions. Sometimes access to Internet banking is blocked |

| Pausing a specific operation | The operation cannot be carried out until the reasons that led to the blocking are eliminated |

| Blocking a specific operation | A certain operation cannot be completed or carried out in the future |

| Complete account blocking | The service agreement is terminated with the client and they are asked to withdraw money from the account through another bank. This happens if the bank has blocked transactions on the account two or more times. |

To understand how to act in a given situation, check the type of blocking. Request this information from the bank immediately after the transaction is suspended.

How to check whether an organization's current account is blocked?

You want to check whether your account is blocked or not, but how and where can you do this? The Federal Tax Service website has a service that shows blockings by company or counterparty. Enter your TIN, BIC of the bank and get the necessary information.

A received request to pay a tax, penalty or fine is a sign of a possible block in the near future. There will be no second “bell”: if you do not pay more than 3,000 rubles on time, then within the next two months you should wait for the suspension of operations. As a rule, taxpayers learn about the blocking after the fact.

The Federal Tax Service is obliged to send to the taxpayer copies of the request for payment of tax, penalties, fines and the decision to collect the tax (suspension of transactions on the current account). These copies will be useful to check that you have filled it out correctly. If there are errors, the decision can be challenged, including in court. Check:

- have all deadlines been met;

- whether the amount of non-payment is indicated;

- whether the documents are signed by an authorized person (the head or deputy head of the Federal Tax Service and with the seal of the tax authority);

- whether the decision to collect or suspend transactions on the current account refers to the claim.

For how long are accounts blocked?

The account blocking period differs depending on the reason:

- 5 days. For such a period, banks block specific transactions, except for operations of crediting money to an account - Federal Law No. 115, article 7, paragraph 10.

- 30 days. The account is blocked for such a period based on the order of Rosfinmonitoring.

- Indefinitely. The account is blocked by court decision if the owner finances terrorist or extremist operations. The restriction is valid until a decision is made to cancel the blocking.

In practice, the suspension of the movement of funds through accounts lasts longer than standard periods. The bank automatically extends the block until the situation is resolved. During this period, you may be asked to provide additional documents. The account may be frozen even for the next few months.

Results

To seize an account, tax authorities must decide to block the taxpayer's current account. There may be several reasons for such a decision: the company did not comply with the requirement of the Federal Tax Service to pay taxes (penalties, fines), did not submit a tax return and/or calculation of 6-NDFL, etc.

The seizure of the account can be canceled after its cause is eliminated (payment of arrears (fines, fines), submission of tax reports, etc.).

The arrest from the account is removed automatically if the company is at the stage of liquidation, bankruptcy proceedings or declared bankrupt.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated February 13, 2017 N ММВ-7-8/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How the account owner is notified of blocking

The law does not regulate how financial institutions can inform a client that his account has been blocked. Banks themselves develop a system by which they notify account holders.

For example, a client may be informed that his account has been blocked:

- SMS to the phone number of the account owner or the head of the legal entity;

- by message in your personal online banking account or through the “Client-Bank” system, if we are talking about accounts of a legal entity;

- by calling the account holder.

Any method of notifying the client is considered legal.

How are accounts frozen?

Blocking bank accounts is a measure of coercion or enforcement of the legal obligations of an entrepreneur, because according to Art. 57 of the Constitution of the Russian Federation, he is obliged to pay all established taxes and fees on time and report on his activities.

Blocking procedure

- The tax authority’s decision to suspend monetary transactions of a certain individual entrepreneur or LLC is made by the head or deputy and sent to the bank.

- A copy of the decision is sent to the account owner with notification.

- The bank, having received the decision of the tax authority, immediately and unconditionally implements it, informing about the balance of funds in the seized account. The bank is not authorized to check the legality of the tax inspectorate's decision.

IMPORTANT! It is legal to stop the movement of funds only in accounts opened on the basis of an agreement with the bank. Deposits, loans, letters of credit and other accounts are not subject to blocking by the tax office.

Blocked but not dead

The “frozen” state of an account does not mean an automatic complete ban on all banking transactions. Paragraph 3 p.1. Article 76 of the Tax Code and Art. 855 of the Civil Code explains what settlement operations can be carried out with a seized account.

So, you can top up your account without restrictions.

It is also possible to write off funds from a problem account, but only in an order that precedes the required tax payments.

- It is customary to pay compensation for health and moral damage and alimony established by the court first.

- The second priority belongs to wages or severance pay for hired workers.

- The third stage of payment according to tax requirements is divided with planned contributions to pension and other funds.

PLEASE NOTE! If the order is equal, those funds for which payment documents were received earlier will be written off first.

When is the bank obligated to block an account?

The bank will necessarily block the client’s current account in three cases:

- By the tribunal's decision. The court decides to suspend any transactions on the client's account if it is associated with criminal activity. Another reason is the court’s requirement to block all accounts of the client’s organization. The blocking will last while the case is being considered.

- As part of enforcement proceedings. Bailiffs force the account owner to execute a court decision, pay fines, and debts. By decision of a civil, administrative or arbitration case, not the entire account is blocked, but only a certain amount of money. If there is insufficient amount in the account, when funds are credited, the debts will be written off in parts. If there are several payments, the money will be written off depending on the priority of the payment. The order of debt write-off is established in the Civil Code, Article 855. The account will be unblocked only after all debts have been fully repaid.

- By order of the tax service. The Federal Tax Service blocks the account of a legal entity if it does not submit a tax return on time or does not send receipts for accepting documents when submitting tax reports in electronic format.

If the account is completely blocked, you can pay obligatory payments: taxes, wages, alimony. When only a certain amount is frozen, the money remaining in the account can be used at your discretion.

Blocking restrictions

The likelihood of Kontur.Accounting clients being blocked is several times lower due to automatic error checking! Get free access for 14 days

Blocking a current account significantly limits the company's capabilities, but some operations can still be carried out. Transactions beneficial to the state and the tax authorities are mainly exempt from blocking:

- Payments of taxes, fines, penalties and insurance contributions to the budget. To make such a transfer, send a payment order to the bank. He is obliged to fulfill it;

- Payments, the order of which precedes the payment of taxes, fees, fines and penalties. This includes (clause 2 of Article 855 of the Civil Code of the Russian Federation):

- 1st stage - payments based on writs of execution for compensation for harm to life and health, claims for alimony;

- 2nd stage - payment of severance pay and wages according to executive documents to current and former employees, authors of the results of intellectual activity;

- 3rd stage - settlements for wages with working employees under an employment contract, tax demands for collection of debts on taxes, fees, fines and penalties.

Tax payments are satisfied after the first and second priority obligations are paid, so the bank will fulfill them even if the company’s accounts are blocked. But it will not be possible to pay wages to working employees without a writ of execution. Many firms are trying to obtain a certificate from the Labor Dispute Commission (LCC), which is also an executive document. But taxpayers often use this method in bad faith, which is why the tax office is constantly suing banks. If you decide to obtain a CTS certificate, we recommend that you do everything according to the rules.

Why might a bank suspend operations?

The bank will block the account if there are suspicions that you are financing criminal or terrorist activities. Even if your account has never been blocked for ten years, an impeccable reputation will not save you if suspicions arise.

The main reasons why banks block transactions on customer accounts:

- An individual carries out a transaction worth more than 600 thousand rubles.

- Either the sender or the recipient of the amount is on the bank’s blacklist.

- The payment order was submitted by a person who is wanted.

- The client did not provide supporting documents to confirm the transaction or these documents aroused suspicion.

- A legal entity often transfers money to individuals or withdraws large amounts of cash from an account.

- The operation makes no economic sense, has no obvious purpose, or is too confusing.

- A legal entity gives an order to carry out a transaction with money credited less than 2 days ago.

- When the organization's tax burden is low. If the amount of taxes paid is less than 0.9% of turnover, the bank may be suspected of evading obligations to the budget.

- Several organizations are opened in the name of one manager, and perhaps at the same time, she never appears at the bank in person.

- The legal entity did not notify the bank about changes to the organization’s constituent documents, a change in OKVED or a change in the manager.

- If a fictitious company address or other significant details of a legal entity are detected.

- The company has no employees and has large cash turnover, which raises suspicion of illegal activities.

This is the main list of reasons for blocking an account, but in reality there are many more. Justify any operation, especially with large amounts, with documents, since the bank may consider it suspicious, and it is not always possible to quickly unblock the account.

Reason 2 - the company looks like cashers

The bank checks potential clients and if the company or its owner resembles cashers, it may not open a current account. Let us list the main reasons that raise doubts.

- The company is registered at a mass address or is registered at one address and operates at another.

- The company does not pay taxes on time or is late in reporting.

- The company pays taxes less than the established tax burden for its industry. Typically, banks pay attention to those whose tax is less than 0.9% of turnover.

- The manager does not know the answers to the bank’s questions and reads them from a piece of paper. For example, he does not know what operations will be carried out on the account, what counterparties the company works with, or how often he plans to withdraw money from the account.

- A company representative says that the business is not his, but that he is helping a friend or wife. This happens if the real owner of the account hides the business, for example, he works in a company where doing business is prohibited. More often than not, it is the cashers who hide themselves, so the bank may doubt the veracity of the representative.

What to do. In the trustworthiness verification services “Transparent Business”, “Kontur.Focus” or “Spark”, check your company, yourself as an individual, key employees and business partners. You can search for information either by the name of the company, its address, or by the full name of the manager and Taxpayer Identification Number.

This is what a counterparty card looks like in the Transparent Business service

Let’s say the service showed that the company has problems.

- Fix everything that can be fixed. For example, the tax office suspended operations due to debts - pay the arrears; if you have not submitted your tax return, submit them. If the service shows that a key employee is included in the register of disqualified persons, he must either be demoted or fired. If the legal address is listed in the register of mass addresses, it will have to be changed.

- Prepare a logical explanation of the situation for the bank if it cannot be corrected . For example, the director of a partner company was included in the register of disqualified persons. You cannot refuse a partnership, so prove that the counterparty actually supplies goods or performs services. Provide the counterparty's telephone numbers, email addresses, detailed reports, information about the partner's employees who provide you with services that close documents.

Aidar Bagaviev, Director of Compliance at Ak Bars Bank:

“Ak Bars Bank will refuse to open a current account only if there is a combination of factors confirming that the organization does not carry out real activities. Compliance with only one basis from the list is not enough.”

What are the most common reasons for blocking?

The most common reasons for blocking an account at the initiative of the bank:

- Suspicion of transit of funds. For example, money came to the account of an entrepreneur, and he transferred it to the account of his spouse, who paid for the goods by card. A supporting document can be a receipt, which shows the purpose of the expenditure.

- Cashing out amounts. For example, an individual entrepreneur kept a savings account in a bank, which he regularly replenished with cash, and then decided to open a deposit in another bank. When cashing out funds, the bank may block it until the circumstances are clarified. To remove the blocking, an agreement to open a deposit account with more attractive conditions can help.

- Receipt of different amounts from a large number of counterparties. You can remove the bank's suspicions if you show contracts with all partners.

Accounts of individuals are blocked much less often than legal entities. But no one can completely guarantee that there will be no suspension of operations.

Banks very often play it safe and freeze any transactions that seem dubious to them. Therefore, if you are traveling abroad and will use a bank card there, and you have never left Russia before, it is better to warn your bank. Employees of a financial institution may suspect fraud after making a payment in the Virgin Islands or Thailand. As a result, you will be left without money when you urgently need it.

For more information about why transactions on an individual’s card can be blocked and how to avoid this, read this article by Brobank.

Which accounts cannot have transactions suspended?

The Inspectorate does not have the right to suspend operations:

- on transit accounts, since they do not correspond to the characteristics of the account specified in paragraph 2 of Art. 11 Tax Code of the Russian Federation . Transit accounts are opened for conducting transactions with foreign currency simultaneously with a current foreign currency account, regardless of the will of the organization (clause 2.1 of the Instruction of the Central Bank of the Russian Federation dated March 30, 2004 No. 111-I , Letter of the Ministry of Finance of the Russian Federation dated April 16, 2013 No. 03 02 07/1/12722 ) ;

- on loan accounts, since they are used to provide borrowers and return funds (loans). A loan account is not an account within the meaning of a bank account agreement ( clause 1 of the Information Letter of the Central Bank of the Russian Federation dated August 29, 2003 No. 4 , Letter of the Ministry of Finance of the Russian Federation dated November 21, 2007 No. 03 02 07/1-497 );

- for deposit accounts, since these accounts are opened on the basis of a bank deposit agreement ( clause 1 of Article 834 of the Civil Code of the Russian Federation ). Organizations cannot transfer funds from them, which means that such accounts do not correspond to the concept of a bank account ( Letter of the Ministry of Finance of the Russian Federation No. 03 02 07/1-497 ). The following must be taken into account. According to paragraph 5 of Art. 46 of the Tax Code of the Russian Federation , tax is not collected from a deposit account if the validity period of the deposit agreement has not expired. If there is such an agreement, the tax authority has the right to give the bank an order to transfer, after the expiration of the deposit agreement, funds from the deposit account to the settlement (current) account of the taxpayer (tax agent), if by this time the order of the tax authority sent to the specified bank has not been executed. tax transfer. Banks are required to inform tax authorities, among other things, about the availability of deposits in the bank and about the cash balances on them ( clause 2 of Article 86 of the Tax Code of the Russian Federation );

- on current accounts opened for the joint activities of the partnership, due to the fact that the funds in such an account are common property and not the property of the taxpayer. Moreover, tax collection can only be made at the expense of funds owned directly by the taxpayer by right of ownership ( Resolution of the Federal Antimonopoly Service of August 28, 2009 No. A 68-9966/2008-5/18 ).

What to do if blocked

If an account is frozen due to non-payment of taxes at the request of the Federal Tax Service, it will be unblocked after the debt is paid off. It usually takes about a day for restrictions to be lifted. After this, you can freely use your account and conduct transactions as before.

If your account is blocked due to failure to file a tax return , submit the document to the inspectors as soon as possible. A day after reporting, the inspector will issue a decision on unblocking.

If your account is blocked due to errors in the electronic document flow with the tax office, present the original documents, explanations and an electronic receipt for accepting the requirements. The account will be unblocked after 1 business day.

A current account may be blocked after a tax audit if the organization has debts . Such an order is given so that the company cannot hide property and evade paying the debt. The account is unfrozen immediately after the cancellation of interim measures of the Arbitration Procedure Code of the Russian Federation, Art. 91.

If the bank blocked your account when charging you for work , you can provide the bank with a service agreement.

When freezing a specific transaction, present a document explaining the purpose of the transaction. Send documents to the bank that confirm the legality of the money in your account if transactions are blocked and ask to explain the origin of the amount. The bank reviews submitted documents within 10 working days.

If your account has been blocked, but there are funds on it that exceed the amount specified in the decision of the Federal Tax Service, you can contact the tax office to cancel the blocking:

- Submit a bank statement showing the balance of funds in blocked accounts.

- Write an application to the Federal Tax Service in free form. Be sure to indicate in it the account numbers in which there is money and the account numbers that need to be unblocked. Attach a bank statement with the indicated balances.

- Within two days, the tax office must release the remaining money.

The Federal Tax Service will decide to cancel the blocking; it must send the document to the bank to unblock it. After this, the money can be managed.

Violations in electronic document flow with the Federal Tax Service

Companies that are responsible for submitting electronic reporting (clause 3 of Article 80 of the Tax Code of the Russian Federation) must first of all sign an agreement with the EDI operator. If this is not done, the taxpayer will not be able to receive and send data to the Federal Tax Service. As soon as the inspector discovers such a discrepancy, the account will be blocked until the violation is eliminated (Clause 3 of Article 76 of the Tax Code of the Russian Federation).

You also need to be careful when sending electronic receipts. Any tax request requires sending an electronic receipt. By ignoring the requirement of the Federal Tax Service, suspension of the transaction account is unlikely to be avoided.

The receipt must be sent within six days (Clause 5.1, Article 23 of the Tax Code of the Russian Federation). After this, payers have exactly 10 more days to correct the situation and send a receipt if it has not yet been sent to the Federal Tax Service (clause 2, clause 3, article 76 of the Tax Code of the Russian Federation).

What not to do when your bank account is blocked

Many clients do not agree with the actions of bank employees. Such frosts can lead to large losses. There seems to be money, but in fact it is impossible to use it. For some individual entrepreneurs and LLCs, this may become a prerequisite for bankruptcy. In order not to bring the situation to its climax and not aggravate the conflict, avoid the following actions:

- Do not get into arguments with bank employees. Such behavior will only turn people against you. If you try to establish contact, the bank specialist will tell you what documents to bring and what to do to resolve the situation as quickly as possible.

- Don't try to scare people with complaints. You can contact the Central Bank of the Russian Federation or the Interdepartmental Commission without informing bank employees. But it is better to do this only after the bank has given a written refusal to carry out the operation.

- Do not intimidate bank specialists with the prosecutor's office or the court. The more you get into conflict, the more seriously the bank employees are determined to stand their ground. It is much more effective to hear how to correct the situation than to try to crush it with authority.

- Do not replace some incomplete documents with others of the same kind. Additional agreements to contracts or invoices in isolation from the contract itself will not be sufficient to unblock the account.

- Don't give confusing explanations. Any comments on a transaction that the bank has suspended must be logical and reasoned. If you yourself do not understand well what you are trying to do or want to back up your words with verbal agreements, nothing will work. The bank will not remove the block from the account.

Always be friendly when communicating with bank specialists. This will help not only in the situation when the account is already blocked, but also in the future, when the bank first becomes suspicious. Even if your accounts have never been blocked, this does not guarantee that this cannot happen.

Reason 5 - company or manager documents are not in order

The bank carefully checks the submitted documents, and any error or inaccuracy may cause a refusal.

- Incomplete package of documents. The bank may refuse if the company has not provided the entire package of documents required to open an account.

- Documents with errors. The bank may refuse to open an account if the document is overdue or contains errors in numbers or names.

- Dirty or torn passport of the manager. Such a document is considered invalid. The passport must be clean, its series and number must be readable.

- The information in the questionnaire is not documented. For example, the company refuses to answer questions about its activities or provide information about planned banking operations.

What to do. Treat the requested package of documents for opening an account responsibly, even if it seems too large. Collect everything according to the bank's list, you can additionally attach to it:

- recommendations from clients - they will help the bank quickly understand whether a business is legal or not;

- statements from the old bank - the new bank will see that the company pays partners and employees legally, and not in an envelope.

How to cancel account blocking through an interdepartmental commission

If the bank does not cancel the blocking of the account, you can try to resolve the issue through an interdepartmental commission:

- Send an application to the MVK through the online reception on the Bank of Russia website.

- Attach a document confirming the bank’s refusal to unfreeze the account and the confirmations for the transaction that you sent to the bank.

- Wait for the answer. Within 20 working days, the commission staff will consider your application.

If during the review the bank turns out to be wrong, the interdepartmental commission will inform it about this. Within 24 hours, the bank is obliged to send information to Rosfinmonitoring, which will update the refusal database and send it to the Bank of Russia. The regulator will send the same information to all other banks in the Russian Federation.

When you receive a notification that the interdepartmental commission has made a decision in your favor, contact the bank again. After this, the account will be unblocked and the operation will be carried out.

But if the interdepartmental commission finds your evidence unconvincing, try to collect other evidence that will confirm the purpose of your operation. Please contact the bank again with these documents. You cannot submit an application to the MVK repeatedly on the same issue.

How to unblock a bank account blocked by the tax office

In fact, everything is quite simple and obvious. To unblock an account, you need to eliminate the violations: pay tax, submit a report, establish electronic document flow.

Having corrected all errors, you should notify the Federal Tax Service. Personal visit or written notice is the taxpayer's choice. Naturally, a personal visit can speed up the process of lifting the blocking.

After receiving a letter from the company, the account will be unblocked within one day (clauses 3.1 and 3.2 of Article 76 of the Tax Code of the Russian Federation). But it’s better not to make the situation critical, but to submit reports on time and pay all taxes on time. Blocking an account can significantly undermine the stability of the company, and profitable deals can also fall through.

Recommendations for protecting your accounts from blocking

To protect your bank accounts from blocking, follow the rules for organizing cash flow. All payments must be justified, and all counterparties must be verified clients.

Follow a few tips to help protect your accounts from being blocked:

- Please indicate the truthful and complete purpose of the payment. State in payment orders: what you are paying for - for goods or services; under which contract – number and date of conclusion; indicate the payment option - with or without VAT. Warn counterparties to also provide full information in their payment orders.

- Check counterparties through the electronic system of the Federal Tax Service before signing contracts.

- Work only in officially registered activities. Don't try to hide from the attention of the tax service.

- Withdraw cash only when necessary for a strictly limited amount. Make the majority of payments by bank transfer.

- Submit supporting documents requested by the bank as soon as possible. Do not shy away from communicating with bank employees or from personal meetings with its representatives to clarify unclear situations.

- Pay taxes and contributions for yourself and your employees on time. Carry out the operation from the account through which all others are processed. Do not split accounts into different types of activities in an attempt to reduce the tax base.

- Inform the bank about changes in constituent documents or changes in address or telephone number.

These recommendations will reduce the likelihood of account freezing, although they will not eliminate it completely.

Another way to protect all your money from being frozen is to open an additional account at another bank. When blocked, money can be transferred to another bank, albeit with a huge commission. Please remember that banks exchange information about questionable transactions with other organizations. You can open an account in a small bank, as they can be more loyal to attract customers. But in this case, there is a risk of losing money as a result of the revocation of the license by the Central Bank.

The most reliable way to protect your accounts from blocking is not to conduct questionable transactions or participate in suspicious schemes.

Reason 3 - the company has a lot of debts and lawsuits

The bank sees that a potential client has tax debts in excess of 1,000,000 rubles or lawsuits. For a bank, this looks suspicious - perhaps the company does not pay taxes, salaries to employees and does not pay partners.

What to do. Check what your company looks like from the bank's perspective.

- On the website of the Federal Bailiff Service, check to see if enforcement proceedings have been opened. For individuals, it is enough to enter your full name and date of birth in the search bar, for organizations - the name of the enterprise and region. If enforcement proceedings are opened, the service will show the amount of the debt and the subject of the debt. For example, three years ago there was a tax debt, which you paid off, but a penalty of 200 rubles remained unpaid. The amount is insignificant, but for the bank such a client looks suspicious and unreliable. Pay your debts and close the enforcement proceedings.

- Check the file of arbitration cases to see if there are any lawsuits against the company. You can search by company name, INN or OGRN. If there are lawsuits, it’s bad—it means the company has problems. While the trial is ongoing, the company's position looks unstable for the bank and it most likely will not open an account.

FAQ

What should I do if my remote banking channels are blocked?

Contact your bank. Sometimes the bank temporarily suspends servicing legal entities through remote channels. Contact a bank specialist to clarify the reason. In most cases, a conversation is enough, but sometimes you will have to come to the office to explain the situation.

The bank sent a request for supporting documents under Federal Law-115, what should I do?

Look at the entire list of documents that the bank requested. Bring them to the office as quickly as possible. The more complete information you provide, the more likely it is that the operation will be able to be carried out if it does not violate the law.

How many times can an account be blocked?

The account can be blocked every time the operation raises doubts among bank employees. But if there are too many transactions like this, you will most likely be asked to close the account and be denied further service.

The bank doesn’t ask for anything, but it doesn’t carry out any transactions on the account, what’s the problem?

The bank probably decided to refuse the transaction. Contact a bank employee and ask clarifying questions. Perhaps we are not talking about any blocking of the account, but the payment order sent contains an error. A specialist will answer your call and, based on it, you will be able to understand what to do.

What happens if I do not bring supporting documents for a blocked transaction?

Most likely, the bank will not remove the block from the transaction and will transmit information about the refusal to Rosfinmonitoring. If you consider such a decision of the bank to be unfounded, you can contact the Interdepartmental Commission.

Sources:

- Internet reception of the Central Bank of the Russian Federation.

- “Memo for organizations and individual entrepreneurs, except those supervised by Rosfinmonitoring and the Bank of Russia”

- Order of Rosfinmonitoring dated April 22, 2015 No. 110 “On approval of the instructions on providing the federal service for financial monitoring with information provided for by the federal law of August 7, 2001 No. 115-FZ “On combating money laundering and the financing of terrorism” »

- Federal Law of 07.08.2001 No. 115-FZ “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism”

- Civil Code of the Russian Federation Article 855. Sequence of debiting funds from the account

- Arbitration Procedural Code of the Russian Federation" dated July 24, 2002 No. 95-FZ (as amended on December 8, 2020) Article 91. Interim measures

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Suspension by the tax authority of transactions on taxpayer accounts

Suspension of transactions on accounts is one of the most effective measures to influence the taxpayer. Since 2021, there have been more grounds for using such a measure to ensure that organizations and individual entrepreneurs fulfill their obligations. About this - an exclusive interview with an expert - Sergei Razgulin, active state adviser of the Russian Federation, 3rd class.

What is the regime for suspending account transactions?

Suspension of account transactions is a special procedure for performing debit transactions on an account. All expense transactions are prohibited, except those expressly permitted by Article 76 of the Tax Code of the Russian Federation. Funds are credited to the account as usual.

What payments are made during the period of validity of the decision to suspend operations?

Payments to budgets for taxes and insurance contributions for compulsory social insurance and payments, the order of execution of which precedes the fulfillment of the obligation to pay tax. The order of execution of payments is established by Article 855 of the Civil Code of the Russian Federation as amended by Federal Law No. 345-FZ dated December 2, 2013.

The third stage includes the write-off of funds:

—

in wages (an exception to the general rule on the priority of executive documents);

—

on instructions from the tax authorities and the bodies of the Pension Fund of the Russian Federation and the Social Insurance Fund for the payment of taxes and insurance premiums (in this case, we mean forced repayment of debts on mandatory payments).

Requirements relating to one queue are fulfilled in the calendar order of receipt of payment documents. This means that if instructions from the tax authority to write off funds to pay taxes were not presented to the account, the taxpayer’s payments for wages are executed without restrictions. The taxpayer's order to transfer wages will have priority in execution over the tax authority's order to write off the debt if it was received by the bank earlier than the tax authority's order.

The fourth stage is other executive documents.

The fifth priority is other voluntary payments. For example, a taxpayer’s instructions to transfer taxes are assigned to the fifth priority of execution.

From these provisions, the conclusion suggests itself that during the period of operation of the suspension of transactions on accounts, regardless of the date of presentation of the account, payments of the fifth order - the taxpayer’s orders, are not executed, with the exception of his calculations for wages and taxes (insurance contributions).

That is, the writs of execution submitted to the account and providing for the write-off of funds in favor of a commercial creditor have priority over the taxpayer’s payments to the budget?

From the clarifications of the Ministry of Finance, in particular, letter dated 03/05/2014 No. 03-02-07/1/9544, we can conclude that the phrase “payments preceding the fulfillment of the obligation to pay taxes and fees” refers to the first and second priority payments indicated in paragraph 2 of Article 855 of the Civil Code of the Russian Federation, that is, those payments that precede the execution of orders from the tax authorities to write off and transfer debts for taxes and fees to the budgets of the budget system of the Russian Federation.

A second approach to the interpretation of this phrase is possible, based on the fact that “a taxpayer’s order to write off funds to pay taxes (advance payments), fees, insurance premiums, relevant penalties and fines and to transfer them to the budget system of the Russian Federation” is also fulfilling the obligation to pay tax, and it is classified as the fifth priority.

In the previous edition of paragraph 2 of Article 855 of the Civil Code of the Russian Federation, in the articles of the federal law on the federal budget for the corresponding year, the write-off of funds under settlement documents providing for payments to the budgets of the budget system of the Russian Federation was classified as one priority (regardless of the basis for payment - voluntary or forced). Federal Law No. 345-FZ dated December 2, 2013 changed the legal regulation of the order of debiting funds from an account.

That is, payments, the order of execution of which, in accordance with the civil legislation of the Russian Federation, precedes the fulfillment of the obligation to pay taxes and fees - these are payments classified as the first - fourth priority. Thus, during the period of operation of the regime of suspension of transactions on accounts, regardless of the date of presentation to the account, payments of the fifth stage - orders of the taxpayer, with the exception of his calculations for wages and taxes (insurance contributions) are not executed.

What approach should the bank take?

The second approach seems more justified, since a different interpretation allows for priority of voluntary transfers for taxes, the payment period of which has not yet expired, before the write-off of funds under enforcement documents of other creditors of the debtor. The illegality of such an interpretation is indicated in the Resolution of the Constitutional Court of December 23, 1997 No. 21-P.

In other words, if the taxpayer’s account is presented with a writ of execution from the creditor under a business agreement and an order from the taxpayer himself to pay the tax, then if there are insufficient funds in the account, they must first be written off to pay off the debt to the creditor, and only then to pay taxes.

There is an intermediate position, according to which the suspension of debit transactions on a taxpayer’s account only due to his failure to submit a tax return, in the absence of documented debt to the budget, cannot interfere with the execution of court decisions that have entered into legal force (letter of the Ministry of Finance of Russia dated July 6, 2015 No. 03- 02-07/1/38928).

We also draw attention to paragraph 2 of Article 70 of the Federal Law of 02.10.2007 No. 229-FZ “On Enforcement Proceedings”, according to which the transfer of funds from the debtor’s accounts is carried out on the basis of a writ of execution or a resolution of a bailiff without submission to the bank or another credit organization as a collector or bailiff of settlement documents. According to the Regulations on the procedure for acceptance and execution by credit institutions and divisions of the Bank of Russia settlement network of executive documents presented by collectors, approved by the Bank of Russia on April 10, 2006 No. 285-P, the bank draws up a collection order on the basis of the executive document.

Thus, since a collection order is a different form of non-cash payments than a payment order, regardless of the resolution of the issue, payments related to the fourth priority are subject to or not subject to execution during the period of validity of the decision to suspend transactions on the taxpayer’s accounts, liability under Article 134 of the Tax Code of the Russian Federation for their execution should not be applied to the bank.

Can an organization open an account in another bank if its account in the servicing bank is blocked?

Banks, under threat of a fine, are prohibited from opening new accounts for those persons in respect of whom a decision has been made to suspend operations (clause 12 of Article 76, clause 1 of Article 132 of the Tax Code of the Russian Federation).

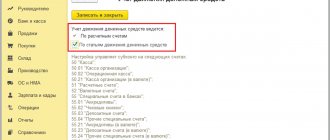

The procedure for informing banks about the suspension of transactions and about canceling the suspension of account transactions (electronic money transfers) is established by Order of the Federal Tax Service of Russia dated March 20, 2015 No. ММВ-7-8/117. According to the order, information is provided by contacting the bank to the Internet service “System for informing banks about the status of processing electronic documents.”

The Internet service contains information from the decision to suspend transactions on accounts (transfers of electronic funds) in the bank, in particular, the number and date of the tax authority’s decision to suspend transactions on accounts (transfers of electronic funds) in the bank, indicating the date and time its placement (Moscow time) in the Internet service.

For opening an account in the presence of a decision of the tax authority to suspend operations on the accounts, a fine of 20 thousand rubles is collected. (Clause 1 of Article 132 of the Tax Code of the Russian Federation). In this case, to hold the bank accountable, only the very fact of the existence of the suspension decision is sufficient, the existence of which the bank had to check by contacting the Internet service of the Federal Tax Service of Russia.

But during the period of suspension of operations, it is permissible to extend (prolongation) a previously concluded deposit agreement, unless a new deposit account is opened (letter of the Ministry of Finance of Russia dated November 20, 2015 No. 03-02-07/67417).

Does an organization have the right to open a deposit or nominal account?

According to Article 11 of the Tax Code of the Russian Federation, an account is a settlement (current) and other bank account opened on the basis of a bank account agreement.

If there is a decision of the tax authority to suspend transactions on accounts, banks do not have the right to open accounts, deposits, deposits for an organization and grant this organization the right to use new corporate electronic means of payment for electronic money transfers.

In accordance with Article 860.1 of the Civil Code of the Russian Federation, a nominal account is opened for the account owner to carry out transactions with funds, the rights to which belong to another person - the beneficiary. Regulation of a nominal account is carried out on the basis of the provisions of Chapter 45 “Bank Account” of the Civil Code of the Russian Federation. Thus, a nominal account is a type of bank account (clause 2.8 of Bank of Russia Instruction No. 153-I dated May 30, 2014 “On opening and closing bank accounts, deposit accounts, and deposit accounts”).

Consequently, if operations on an organization’s accounts are suspended, the bank does not have the right to open a nominal account for the organization (an account whose owner is declared by such an organization).

But at the same time, the responsibility of the bank for opening a deposit in the presence of a decision to suspend operations on the accounts of a taxpayer under the Tax Code of the Russian Federation has not been established.

Under what conditions does the tax authority have the right to make a decision to suspend transactions on accounts?

Operations are suspended by the head (deputy head) of the tax authority for several reasons, which, in turn, can be combined into two groups. The first may include decisions taken as a measure to ensure the collection of tax debts. The second group includes decisions taken as a measure to ensure the submission of individual documents.

The first group includes the decision to suspend operations, taken in order to ensure the execution of the decision to collect taxes. It should be noted that in addition to the decision on collection by the tax authority, the taxpayer must also be sent a demand to pay the tax. The tax authority's order to write off funds to pay tax and the decision to suspend operations can be sent to different accounts of the taxpayer.

The taxpayer has the right to appeal the decision to suspend transactions on accounts if the tax authority violated the collection procedure. For example, a decision was not made to collect the tax or the deadline for its issuance was missed (Resolution of the Ninth Arbitration Court of Appeal dated October 7, 2013 No. 09AP-31156/2013).

If the decision of the arbitration court to declare illegal the decision of the inspectorate to bring to tax liability has entered into legal force, the tax authority is obliged to cancel the decision to collect taxes, as well as the decision to suspend transactions on accounts. The taxpayer should appeal the illegal inaction of the tax authority, which is expressed in the failure to make a decision to lift the suspension of account transactions (Resolution of the Moscow District Arbitration Court dated December 8, 2014 No. F05-14131/2014).

This group of grounds also includes a decision taken to ensure the execution of a decision made based on the results of consideration of tax audit materials (clause 10 of Article 101 of the Tax Code of the Russian Federation).

The subsequent cancellation of the decision to prosecute (refusal to prosecute for committing a tax offense) does not in itself mean that the decision to suspend operations was made illegally. It becomes illegal if it is not canceled in a timely manner.

According to Article 16 of the Arbitration Procedure Code of the Russian Federation, judicial acts of the arbitration court that have entered into legal force are binding on state authorities, local governments, other bodies, organizations, officials and citizens and are subject to execution throughout the Russian Federation.

The taxpayer can obtain a reversal of the decision to suspend transactions on accounts by filing a petition for interim measures in the arbitration court in a dispute with the tax authority.

After the court has taken interim measures, the inspectorate must cancel the decision to suspend operations on the account in relation to the provisions of Article 76 of the Tax Code of the Russian Federation (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 25, 2012 No. 10765/12).

But each of the grounds for suspending account transactions is independent and can be applied independently of each other. This means that if transactions on a taxpayer’s bank accounts were suspended for two reasons, one of which ceased to be valid, this does not entail the cancellation or non-execution of interim measures taken by the inspectorate on the other basis.

The fact that the court has taken interim measures prohibiting the tax authority from taking actions to forcibly collect tax debt, in the presence of a decision made in accordance with paragraph 10 of Article 101 of the Tax Code of the Russian Federation that has not been canceled by the tax authority, does not serve as a basis for the resumption of debit transactions on the taxpayer’s accounts.

What grounds for suspending operations can be conditionally classified as the second group?

First of all, this is the failure to submit a tax return.

The deadline for making a decision to suspend transactions on accounts for failure to submit a declaration since 2015 is 3 years and 10 working days from the date established by the Tax Code of the Russian Federation for the submission of a declaration. This limitation on the time limit for making a decision also applies to declarations not submitted to the tax authority before 2015.

Since 2015, for failure to submit a declaration, operations on the accounts of any person who, in accordance with the Tax Code of the Russian Federation, must submit tax returns, and not just the taxpayer, can be suspended.

Can transactions be suspended for failure to submit an income tax return at the end of the reporting period?

Suspension of transactions for failure to submit a declaration should be applied provided that a certain document is a tax return in content and not in title.

For failure to submit a tax return for corporate income tax at the end of the reporting period, suspension of operations should not be applied, since the specified document does not meet the concept of “tax return” established by Article 80 of the Tax Code of the Russian Federation.

Failure to submit what other documents may result in the suspension of account transactions?

From January 1, 2015, another reason for blocking an account was failure to fulfill the obligation to transfer to the tax authority a receipt for the acceptance of documents sent by the tax authority in electronic form via telecommunication channels through an electronic document management operator.

The decision to suspend a taxpayer’s transactions on his bank accounts and transfers of his electronic funds is made in relation to persons obliged to submit tax returns in electronic form, who, in violation of paragraph 5.1 of Article 23 of the Tax Code of the Russian Federation, did not submit a receipt for the receipt of the following documents:

—

requirements for the submission of documents;

—

requirements for providing explanations;

—

notifications of summons to the tax authority.

The receipt must be sent no later than six days from the date the documents were sent by the tax authority. The decision to suspend account transactions can be made within ten days after the expiration of the deadline established for sending the receipt.

Consequently, the decision to suspend transactions on this basis should be made no earlier than the seventh day and no later than the sixteenth day after the documents are sent by the tax authority. The specified periods are calculated in working days.

Operations cannot be suspended if the taxpayer complies with the received requirement (notification) on the merits: documents, explanations are presented, the summoned person appears at the tax authority.

In addition, the tax authority does not have the right to decide to suspend transactions on accounts if the taxpayer does not receive a receipt for other documents sent electronically that are not a requirement to submit documents, a requirement to provide explanations, or a notice of summons to the tax authority.

What has changed in the list of grounds for suspending account transactions?

Since 2021, Federal Law No. 113-FZ dated 05/02/2015 has established a new type of reporting for tax agents - calculation of the amounts of personal income tax calculated and withheld by the tax agent (clause 1 of Article 80 of the Tax Code of the Russian Federation).

The tax agent will submit this calculation for the first quarter, six months, nine months - no later than the last day of the month following the corresponding period. For the year (tax period) - no later than April 1 of the next year (clause 2 of Article 230 of the Tax Code of the Russian Federation). The calculation in Form 6-NDFL must be submitted to the tax authority with which the tax agent is registered, in electronic form via telecommunication channels.

If the tax authority does not receive a calculation from the tax agent within 10 days after the expiration of the established period, then the head (deputy head) of this tax authority may decide to suspend the tax agent’s operations on his bank accounts and transfers of his electronic funds (new paragraph 32 Article 76 of the Tax Code of the Russian Federation).

Suspension of transactions on accounts does not apply if the calculation of personal income tax amounts calculated and withheld by the tax agent is submitted within the prescribed period on paper (regardless of the number of individuals who received income from the tax agent).

The Tax Code of the Russian Federation does not establish a pretrial period for the tax authority to make a decision to suspend transactions on accounts for failure to submit Form 6-NDFL.

Before the introduction of preemptive deadlines in the Tax Code of the Russian Federation for making a decision to suspend operations for failure to submit a declaration, in judicial practice there were examples of invalidation of a tax authority’s decision made more than 3 years after the grounds for its adoption arose. The court proceeded from the fact that exceeding a reasonable time for making a decision may mean its invalidity (Resolution of the Federal Antimonopoly Service of the Moscow District dated 03.08.2007, 08.08.2007 No. KA-A40/7460-07).

The tax agent can be recommended to use this argument in a dispute in the case where the tax authority decided to suspend transactions on accounts not immediately (after 10 days from the date established for submitting the calculation), but after some time.

How does an organization learn about decisions made regarding account blocking?

From the tax authority. Copies of all decisions made by the tax authority are sent to the organization no later than the day following the day of their adoption. The bank will also notify the client organization of the decision.

Taxes are paid in rubles. Is it possible to suspend transactions on a foreign currency account?

The tax authority has the right to suspend transactions on all accounts that are opened on the basis of a bank account agreement. That is, the tax authority does not have the right to suspend operations on a deposit account. And for a current (current) account, including a foreign currency account, you have the right.

If the suspension of operations ensures the collection of tax, then the amount in the foreign currency account within which operations are suspended is calculated as dividing the debt specified in the decision by the ruble exchange rate to the desired currency, established by the Central Bank on the day the bank received the decision.

What if the account details change during the validity period of the decision?

The previously made decision remains in effect and is automatically applied to the account with new (changed) details, including when the name of the organization is changed.

What to do when the tax authority decides to suspend transactions in relation to all accounts of the taxpayer?

The actions of the taxpayer depend on the basis on which the decision to suspend operations was made.

For failure to submit a declaration, the Tax Code of the Russian Federation allows a decision to be made to suspend transactions on all accounts of the taxpayer and for the entire amount of funds in these accounts.

From 2015, transactions to the same extent may be suspended for the taxpayer’s failure to transmit a receipt for the receipt of a request for the submission of documents sent by the tax authority electronically, a request for the submission of explanations or a notice of summons to the tax authority, and from 2021 - for failure by the tax agent to submit Form 6-NDFL.

Suspension of operations in the event of debt collection is limited to the amount of funds collected. If operations are suspended to ensure the execution of a decision made based on the results of consideration of the audit materials, then the blocked amount is determined as the difference between the debt and the value of the taxpayer’s property, which has already been subject to a ban on alienation (pledge).

Therefore, the excess of the amount in the accounts for which transactions are suspended over the amount collected can, at the request of the taxpayer, be eliminated by the tax authority canceling the decision on suspension in the relevant part.

The taxpayer has the right to challenge the calculation of the amount in respect of which a decision was made to limit expenditure transactions.

Suppose the tax authority decides to suspend transactions on accounts without sufficient grounds, for example, if the taxpayer does not receive a calculation of advance payments for property tax or a receipt for acceptance of a decision sent electronically to extend the audit...

The grounds for making a decision to suspend transactions on accounts are defined exhaustively by the Tax Code of the Russian Federation.

The decision taken by the tax authority to suspend operations in the absence of proper grounds is unlawful. In this case, on the entire amount of funds in respect of which the decision was in force, interest is accrued at the refinancing rate of the Central Bank for each calendar day the decision is valid. Let me remind you that from January 1, 2021, the refinancing rate is equal to the key rate and is 11%.

Similar consequences occur:

—

when deciding to suspend operations after a specified period;

—

if the tax authority fails to make a timely decision to cancel the decision to suspend operations, including when a taxpayer’s application is received that the total amount of blocked funds exceeds the amount of debt;

—

if the decision to cancel the suspension decision is not sent to the bank in a timely manner. The tax authority must cancel the decision to suspend operations no later than the day following the day the reasons that led to its adoption are eliminated (repayment of arrears, submission of a declaration, etc.). No later than the next day, the decision to cancel must be sent to the bank.

In all of these cases, the taxpayer has the right to make claims for payment of interest.

How can a taxpayer receive interest?

Interest is payable to the taxpayer upon his application. If the tax authority refuses to pay interest, it is recommended to go to court.

Interest is calculated based on the period that begins from the day the bank receives the decision on suspension and ends on the day the bank receives the decision to cancel it or the occurrence of other circumstances provided for by federal laws (in such situations, the adoption by the tax authority of a special decision to cancel the suspension of transactions on accounts is not required).

The Tax Code of the Russian Federation provides for the accrual of interest on the amount in respect of which the actual suspension was in effect, and not on the amount specified in the decision on suspension (Determination of the Supreme Arbitration Court of the Russian Federation dated May 15, 2013 No. VAS-5501/13). Therefore, if there is an actual absence of funds in the accounts during the entire period of suspension of operations on the accounts, there are no grounds for charging interest.

accounting reporting tax reporting

Send

Stammer

Tweet

Share

Share

Comments: 2

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Sergey

05/16/2021 at 20:55 Is the passage of funds through the banking system an infiltration of proceeds of crime? That is, when you withdraw money from your bank account, do you receive clean or dirty money from the bank? If every bank has criminal money filters, then what is the size of the cell through which criminal money can leak? In one case, the bank asked me for documents about the origin of 82 rubles 95 kopecks. Is the bank obliged to provide documentary guarantees that the money issued by it through the cash desk (or transferred by non-cash means) is not of criminal origin (for presentation to another bank).

Reply ↓ Anna Popovich

05/18/2021 at 09:25Dear Sergey, banks are obliged to suppress assistance to terrorist activities and money laundering. Therefore, banks can check any suspicious receipts into your account. However, no one can give an absolute guarantee that money does not have a certain past.

Reply ↓

Reason 4 - the company uses activity codes from different areas

An extract from the Unified State Register of Legal Entities (USRIP) must be attached to the documents for opening an account; from it, the bank will know what the company does. For example, the main code is the transportation of passengers by road (bus) transport, then additional codes can be associated with the transportation of goods, bus rental, storage and warehousing of goods. But the carrier company, which has registered codes for the decoration and repair of premises, arouses the bank’s suspicion, since these types of activities are not related to each other.

It is important that the company really has resources confirming that it can conduct all types of activities declared in OKVED. Equipment, premises, licenses, personnel, etc.

Also, some banks do not work with clients from a certain area, for example, with microfinance organizations.

What to do. Ask your bank employee in advance for exception codes that the bank does not work with. Check your OKVED codes in the unified state register:

- through the tax authority - submit a request for a Unified State Register of Legal Entities sheet in person or by mail;

- through the online service of the Federal Tax Service - indicate the TIN and receive an extract from the Unified State Register of Legal Entities.

If among the codes there are those that the company does not operate with, it is better to remove them from the Unified State Register of Legal Entities. If you have an LLC, then submit an application using form P14001 - you only need to fill out the title page, sheets H and P. On the second page of sheet H, indicate the codes that need to be removed from the register. Have the printed application certified by a notary and take it to the Federal Tax Service. Or send it to the tax office through your personal account, signing it with an electronic signature. Individual entrepreneurs fill out an application in form P24001; it does not need to be certified by a notary. Sign it and take it to the tax authorities.

The account is blocked at the initiative of the bank

In accordance with Law 115-FZ on combating money laundering, banks can refuse clients certain transactions, suspend the movement of funds through accounts or freeze them. Such actions may be taken if the client’s transactions seem dubious to the bank. All the reasons for this are listed in Article 7 of the mentioned law.

Account blocking

no transactions can be carried out with the funds on it . However, if the account owner is an individual, it is allowed to withdraw funds from him in the amount of up to 10,000 rubles for each family member monthly.

Such a measure can be applied by the bank if the client is included in the list of organizations and individuals suspected of involvement in extremism, terrorism or the proliferation of weapons of mass destruction. Registers of such organizations and citizens are available on the Rosfinmonitoring website.

What should a business entity do if it is included in such registers by mistake? It is necessary to immediately submit a statement to Rosfinmonitoring that this information should be clarified. It will be necessary to prove that the subject has nothing to do with the mentioned illegal activity. If this succeeds, he will be removed from the register. On the same day, the bank is obliged to unblock his accounts.

Suspension of operations

In some cases, the bank introduces a temporary suspension of transactions on client accounts for up to 5 business days . It does not apply to all operations, but only to specific transfers. Such a measure may be taken due to the involvement in the operation of a legal entity that is controlled by another organization or individual previously included in the Rosfinmonitoring register mentioned above. Another reason is if the operation is carried out by an individual from this register.

Having suspended operations, the bank will report this to Rosfinmonitoring. If no other orders are received from there within 5 days, the blocking is lifted. If Rosfinmonitoring has identified suspicious connections, it can extend the suspension of operations for another 30 days . A period is given for the inspection. If it does not reveal any violations, the operations will be unblocked. During the inspection, additional documents and data may be requested.

Refusal to perform an operation

If any operation is perceived by the bank as suspicious, it will not be carried out . By and large, it is enough for the bank to simply suspect that the client is trying to legalize income that he received illegally. Or participate in the financing of terrorist activities.

The law does not precisely define which transactions a bank may consider suspicious. This is regulated by the instructions of the Central Bank, of which there are many issued. For example, there are methodological recommendations No. 10-MR dated April 13, 2021. They identify the following signs of dubious transactions :

- have no economic sense or purpose;

- may be described as confusing or unusual;

- are of a transit nature.

And if the following signs are present, the bank will consider the organization suspicious :

- small authorized capital - minimum or slightly more;

- mass registration address;

- the owner and manager are one person and at the same time he also keeps accounting records;

- the executive body is not at the address specified in the Unified State Register of Legal Entities.

There are also criteria for suspicious current accounts :

- accounts unused, used rarely and irregularly;

- accounts from which taxes are not paid at all or are paid in an amount of no more than 0.5% of the debit turnover.

An account will seem suspicious if, in addition to the above circumstances, it turns out that it:

- there is no payment of wages, personal income tax and insurance premiums (or wages and personal income tax are paid, but no insurance premiums);

- the amount of money spent on wages indicates that they are underestimated (based on the average number of employees);

- there is no cash balance or it is small compared to the normal volume of transactions.

If such violations occur, access to the Internet bank will be blocked . At the same time, the bank will send the client a list of documents that he needs to submit to continue working. He will need to prepare at least copies of tax returns and financial statements, but in principle the bank can ask for absolutely any data.

Documents and explanations will need to be given to the bank in the way it requests (remotely or during a personal visit). The bank will consider the information received within 10 days . As a result, service will either be completely restored or the client will be refused. In the second case, it will be possible to unfreeze the account only through an interdepartmental commission at the Central Bank.

If the client does not provide documents

The bank’s requirements cannot be ignored, because then the matter will not be limited to blocking remote access to the account. The client will not be able to submit a payment order even when visiting the office. In any case, a suspicious transaction will not be carried out unless the bank can prove its legality.

a double refusal to perform an operation occurs within a year , the bank will have grounds to terminate the account servicing agreement. Information about this will be transmitted to Rosfinmonitoring, and from there to all commercial banks. This will lead to the fact that if the client wants to open an account in another place, he will encounter refusals.