From January 1, 2021, the UTII tax regime was finally abolished. The last time you had to report was for the 4th quarter of 2021 - before January 20, 2021. If you have to submit a declaration now, then only the updated one for 2021 and earlier periods. How to do this, in what time frame and are there any special features? The answers to these and other important questions are in our material.

A calculator will help you choose a new tax system.

UTII declaration form download free (excel)

Are you switching from UTII? Connect Kontur.Accounting

45% discount in November: RUR 7,590 instead of 13,800 rub. per year of work

Easy bookkeeping

The system itself will calculate taxes and remind you of the deadlines for payments and submission of reports.

Automatic calculation of salaries, vacation pay and sick leave

Technical support 24/7, tips inside the service, reference and legal database

Sending reports via the Internet

Reports and KUDiR are generated automatically based on accounting data

Electronic document management and quick verification of counterparties

Documents, transactions, analytical reports, VAT reconciliation

Dates and place of submission of the UTII declaration

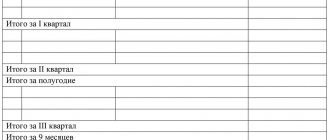

You must submit UTII by the 20th day of the month following the last month of the reporting quarter.

Report for the 1st quarter of 2021 - until April 20, 2020 (the 20th falls on a Saturday, so the deadline has shifted to Monday the 22nd) .

Report for the 2nd quarter of 2021 - until July 20, 2020.

Report for the 3rd quarter of 2021 - until October 20, 2020.

Report for the 4th quarter of 2021 - until January 20, 2021.

Tax on imputed income must be paid by the 25th day of the month following the reporting quarter.

The UTII declaration is submitted to the tax office at the place of registration of the business or at the actual location. For example, for private cargo carriers, the workplace is constantly moving.

In the accounting calendar from Kontur.Accounting, you can see what taxes need to be paid this month and read how to do it.

Declaration on UTII from January 1, 2020

Back in 2021, section No. 3 appeared in the declaration with the calculation of insurance premiums that reduce tax. Remember that companies cannot reduce the amount by more than half, however, individual entrepreneurs without employees can even reset the tax to zero and not pay it at all.

To allow individual entrepreneurs to include a tax deduction for the purchase of an online cash register in their declaration, tax authorities have developed a new reporting form. It was approved by order of the Federal Tax Service dated June 26, 2021 N ММВ-7-3/ [email protected]

You won't have to spend a lot of time learning a new form. The form remained the same, but was supplemented with an additional section. Section 4 was introduced to reflect the costs of purchasing, installing and configuring online cash register systems by entrepreneurs. Let us remind you that the transition to online cash registers ended on July 1, 2021, so there is a need to update the form. When purchasing cash register equipment in this section you need to reflect:

- name of the purchased cash register model;

- serial number of the cash register;

- registration number received from the tax office;

- date of registration of the cash register with the inspection;

- expenses for purchase, installation and configuration - expenses in the amount of no more than 18,000 rubles per cash register can be deducted.

Declaration on UTII for the 1st quarter

The reporting period for imputed tax is quarterly. Therefore, the report must be submitted again in April 2021. The generally accepted deadline is the 20th of the month following the reporting quarter. In 2021, April 20 falls on a Monday, so the deadline will not be postponed. Tax must be paid no later than April 25th.

Keep in mind that even if you did not purchase an online cash register and you do not have the opportunity to apply a deduction, you are required to use the new reporting form. Do not forget that from 2021, increased deflator coefficients are in effect, K1 is equal to 2.005, and check the value of K2 with your local tax office.

On the title page, enter the reporting year in the field as 2021, and in the tax period code as 21 for the first quarter. When reorganizing or liquidating an organization in the second quarter, enter period code 51.

Declaration on UTII for the 2nd quarter

Prepare the second report in 2021 for the period April-June. The generally accepted deadline is the 20th of the month following the reporting quarter. This year, July 20 falls on a Monday, so the deadline will not be postponed. You can submit your declaration in electronic or paper form. On paper, the report can be taken to the tax office in person, delivered with a representative, or sent by mail. Tax must be paid by July 25th.

Don't forget to apply the new deflator coefficient K1, which is 2.005 this year. Ask your local Federal Tax Service for new K2 values.

On the title page, enter the reporting year in the field as 2021, and in the tax period code as 22 for the second quarter. When reorganizing or liquidating an organization in the second quarter, enter period code 54.

declarations for 2021 or fill out online

fill out the UTII declaration and submit it to the tax office in 2021:

- on paper and submitted in person or through a representative;

- on paper and send by mail (by mail with a list of attachments);

- electronically and send via the Internet.

Which method to choose is decided by the compiler himself.

You can download the new UTII declaration form for further filling out and printing in paper format on our website .

To generate an electronic xml file for sending via electronic communication channels, you will need a special program. It could be:

- The program offered by the Federal Tax Service portal is “Legal Taxpayer”. It also contains a package of reports for individual entrepreneurs, including UTII. You can download the latest version of the program or get updates on the Federal Tax Service portal: https://www.nalog.ru/rn77/program//5961229/.

- The program is from the “1C: Entrepreneur” series - it also contains all the necessary updates for generating the current version of IP declarations. However, please note that the program is paid.

- EDF operator program - in the operator’s system, you can either download a ready-made report file from another system or manually fill out an up-to-date electronic form. This method is also paid, as it requires concluding an agreement with an EDF operator.

You can send the completed declaration electronically:

- through the Federal Tax Service website;

- through the EDF operator;

- through the 1C program used, if it has such a function (the latest versions of officially purchased programs usually have it).

Declaration on UTII for the 3rd quarter

Submit the third report on the UTII system for the third quarter - for the period from July to September. The declaration must be submitted by October 20, but since this day falls on a Sunday, you can still have time to submit the reports on Monday. You can submit your UTII declaration in electronic or paper form. The paper report can be sent to the tax post office, with a representative, or brought in person. It is more convenient to submit an electronic declaration online through the Kontur.Accounting service.

Remember to apply the K1 deflator factor, which is 2.005 this year. Check the K2 values with your local Federal Tax Service.

On the title page, enter the reporting year in the field as 2021, and in the tax period code as 23 for the third quarter. When reorganizing or liquidating an organization in the third quarter, enter period code 55.

Results

The UTII declaration in 2017 can be generated and submitted both on paper and online.

Despite the fact that the declaration form has been changed (taking into account changes in legislation), the procedure for filling it out remains approximately the same. Both in paper form and in electronic form, you should carefully approach such points as determining the code at the place of registration (the place of delivery and payment of tax will depend on it). You should also correctly determine the physical indicator of UTII when calculating the tax base. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Declaration on UTII for the 4th quarter

The tax authorities are waiting for the fourth UTII declaration for the period from October to December. The declaration must be submitted next year 2021 by January 20. You can submit your UTII declaration in electronic or paper form. The paper report can be sent to the tax post office, with a representative, or brought in person. It is more convenient to submit an electronic declaration online through the Kontur.Accounting service.

Remember to apply the K1 deflator factor, which is 2.005 this year. Check the K2 values with your local Federal Tax Service.

On the title page, enter the reporting year in the field as 2021, and in the tax period code as 24 for the fourth quarter. When reorganizing or liquidating an organization in the fourth quarter, enter period code 56.

How to generate a UTII declaration for the 3rd quarter of 2021?

Today we will take a closer look at this process in the 1C Accounting 3.0 program.

The program must include the corresponding option in the organization’s card in the tax system section and fill in the types of activities for which UTII and information about the tax office are paid.

You can proceed to the preparation of the declaration by opening Regulated reports in the Reports section. In the workplace, click Create and select the appropriate report type.

A window will open for you to fill in the data. It requires you to specify the reporting period, select the organization and edition of the form, and then start generating reports.

As a result, the screen will display the completed Tax Declaration for UTII for certain types of activities, consisting of a title page, sections 1, 2 and 3 proposed for it and an explanatory note.

What sections does UTII consist of?

The UTII declaration consists of a title page and four sections. Individual entrepreneurs on UTII who wish to receive a deduction at the cash register must fill out all sections.

On all sheets of the declaration, the company’s tax identification number and checkpoint are indicated. If an organization is simultaneously registered at the location of a separate division (branch) and at the place where it conducts activities subject to tax on imputed income, then the declaration must indicate the checkpoint assigned to the company as a payer of this tax, and not the checkpoint of the branch.

There have been no changes to the title page. It must be filled out according to the old rules. Indicate basic information about the business: name or full name, tax period, reporting code, code for the place of representation, which OKVED code your business corresponds to, etc.

The first section is usually completed last. It reflects the obligation to pay UTII to the budget.

In the second section you need to calculate the amount of tax. The second section is filled out separately for each type of activity and for each OKTMO. Indicate in section 2 the address of work, UTII code, basic profitability and coefficients K1 and K2. On lines 070-090, indicate the value of the physical indicator by month of the quarter. Enter a tax rate of 15% (or less if your region has incentives) and calculate the tax for the quarter.

The third section contains financial information on the business and insurance premiums. Here you need to combine the information from the second and fourth sections to calculate the total tax amount. First, the tax is reduced by insurance premiums, and then by the deduction for the purchase of cash registers.

The fourth section must be completed for each unit of cash register purchased for work on UTII. The amount of expenses for purchasing a copy of the cash register is accepted for deduction and is indicated in line 040 of Section 3.

New tax return for UTII: what has changed and how to prepare it

By order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected] an updated form of the UTII declaration was introduced. Changes in it were needed primarily due to the fact that the law of June 2, 2016 No. 178-FZ amended subparagraph. 1 item 2 art. 346.32 Tax Code of the Russian Federation.

Amendments to Art. 346.32 of the Tax Code of the Russian Federation eliminated some previously existing “discrimination” against individual entrepreneurs on UTII. From 01/01/2017, individual entrepreneurs on UTII paying wages to employees can reduce the single tax due for payment by the amount of insurance premiums paid both for employees and for themselves. In the same way, for example, those individual entrepreneurs who are on the simplified tax system have the right to do this.

Let us remind you that until 2021 Art. 346.32 of the Tax Code of the Russian Federation contained a restriction that did not allow individual entrepreneurs with hired employees to reduce the amount of UTII payable to the budget for insurance premiums paid for themselves.

Thus, in the new UTII declaration, corresponding new calculation formulas have been added for the columns that record the amount of insurance contributions accepted as a tax reduction.

In addition, some changes have been made to the barcoding of the form, as well as to the names of the columns.

After the changes have been made, the UTII declaration should be drawn up:

- for the 4th quarter of 2021 - according to the “old” form, approved by order of the Federal Tax Service of Russia dated 07/04/2014 No. ММВ-7-3/ [email protected] (since the changes are valid from 01/01/2017);

- for the 1st quarter of 2021 - according to the new form according to order No. ММВ-7-3/ [email protected]

We’ll talk further about how to draw up a new declaration.

How to calculate UTII

The following formula is used to calculate tax:

Tax amount = Tax base × Tax rate.

To calculate the tax base (the amount of imputed income), the following formula is used:

Imputed income for the month = Basic profitability × K1 × K2 × Physical indicator

Basic profitability is determined by the type of business in accordance with clause 3 of Art. 346.29 Tax Code of the Russian Federation. There you can also find physical indicators for UTII.

The physical indicator depends on the type of activity. If you provide household services and are an individual entrepreneur, then your physical indicator is your employees. And for an entrepreneur on his bus that transports passengers, the physical indicator is the seats in the car. Accordingly, the tax base will be different.

As for the adjustment deflator coefficients K1 and K2, they can be found in Order No. 595 dated October 30, 2018 (K1) and in the decision of the local government at the place of registration of the business (K2). K1 has increased to 2.005 since 2021.

Sample of filling out a declaration for UTII using the example of an individual entrepreneur without employees

The procedure for filling out the UTII tax return itself has not undergone significant changes. Let's look at how to fill out a UTII declaration - 2017 using the example of an individual entrepreneur who does not have hired employees.

Our individual entrepreneur is registered in the city of Mytishchi Moscow Region and is engaged in private cargo transportation.

The principle of entering data into the title page remains the same - all initial identification information is entered into it. In particular, the code for the place of registration, since UTII is paid at the actual place of business. The individual entrepreneur is engaged in cargo transportation, that is, he is not tied to a specific place other than his place of residence. Therefore, he puts code 120. And if an individual entrepreneur, for example, owned premises for the provision of services on UTII in another district of the Moscow region, he would have to register with the Federal Tax Service at the place where the premises are located and report there, putting code 320 in the declaration (according to place of business).

The completion of other sections also did not change significantly. Correction factors for correct tax calculation should be used:

- K1 - from the relevant order of the Ministry of Economic Development. In 2021, order No. 698 dated November 3, 2016 is in effect.

- K2 - from the decision of the local municipal authority for the area for which UTII is paid (in our example, this will be the decision of the council of deputies of the Mytishchi district “On UTII for certain types of activities” dated October 20, 2016 No. 12/3).

NOTE! In 2021, a new minimum wage is in force - 7,500 rubles. Let us remind you that for calculating insurance premiums for individual entrepreneurs, the minimum wage valid at the beginning of the year is used. Therefore, the new minimum wage introduced on July 1, 2016 will only affect individual entrepreneurs’ contributions for themselves starting from January 1, 2017.

And it will have a big impact. So much so that our individual entrepreneur, who paid these contributions and put them into deduction, did not have UTII to pay for the quarter.

Zero declaration on UTII

Even if the company/individual entrepreneur did not conduct any activity in the reporting quarter, it is not worth handing over an empty (zero) UTII. You will still be charged tax, but for the last period when there was non-zero reporting.

The fact is that the tax is calculated based on physical indicators, not actual income. The absence of physical indicators is a reason to deregister, and not to refuse to pay tax. Even if the payer has not worked under UTII for some time, he must submit a declaration indicating the amount of tax calculated on the basis of the physical indicator and the rate of return.

Nuances of determining the value of a physical indicator

Separately, when filling out the declaration, it is worth focusing on determining the value of the physical indicator used to calculate the tax base on a monthly basis.

The indicator depends on the type of activity and “ties” the size of the tax base to the characteristics of the activity being carried out.

For example, in the example given, our individual entrepreneur independently carries out transportation using one truck. Accordingly, its physical indicator by type of activity is 1 (one truck).

For comparison: if an individual entrepreneur began to transport passengers, the physical indicator would no longer be the car, but the number of seats in this car. For example, 15. And then we would get a completely different calculation and a different value of the tax base for UTII.

For more information on how to determine a physical indicator, read: “Calculation of physical indicators for UTII 2015-2016” .