Closing account 91 “Other income and expenses”

91 accounting accounts are closed depending on the period:

- the difference between credit and debit is reflected at 91.09;

- at the synthetic level monthly at 99;

- analytical levels of subaccounts are reset at the end of the year;

- in 1C, closing is automated;

- At the end of the year, the balance sheet is reformed.

Closing the month is, in essence, clearing the balances on some synthetic accounts. The law suggests that there should be no balance in the accounts responsible for collecting costs, income and expenses from core and other activities.

Types of income and expenses

In other words, in the organization’s balance sheet, only the assets and liabilities included in the financial statements, that is, the balance sheet, are transferred to the next month. Among the indicators that collect information about profits and losses, 91 accounts “Other income and expenses” are responsible for the additional activities of the enterprise.

It provides for maintaining mandatory sub-accounts:

- 91.01 “Other income” - formed on the loan.

- 91.02 “Other expenses” - formed by debit.

- 91.09 “Balance of other income/expenses” - loss is reflected on the debit side, profit on the credit side.

This account is not used for the sale of products (works, services), as it must contain information about all kinds of income and expenses not related to the production or performance of work (services). Income that is reflected on 91.01:

- sale of own assets;

- written off accounts payable;

- penalties and fines won in court;

- surpluses found during inventory;

- materials received after liquidation of fixed assets;

- revaluation of assets.

Accordingly, the wiring will look like this:

- Dt 01 (10, 62, 76) Kt 91.01.

Organizational expenses accumulating in account 91.2:

- accruals to reserves for overdue debts and upcoming holidays;

- commission for banking services;

- state registration fees;

- fines and penalties received from control authorities;

- penalties and compensation under business agreements;

- asset write-down;

- interest on loans and borrowings not related to core activities.

Entries for expense generation:

- Dt 91.02 Kt (01, 60, 62, 66, 68, 69, 76).

How to close a period?

At the end of the month, it is necessary to close account 91. For this, the third subaccount 91.09 is constantly used, which is designed to reduce turnover at the synthetic level to zero.

From the author! It shows the interim financial result from the turnover of other activities of the company, showing a profit on debit or a loss on credit.

After the positive or negative balance becomes known, the posting is made:

- Dt 91.09 Kt 99 “Profits and losses” - profit is reflected;

- Dt 99 Kt 91.09 – loss from the company’s activities is taken into account.

For example, Bubbles LLC at the end of the month had accumulated amounts in subaccounts, which are more convenient to view in tabular form:

Table 1. Analytics for subaccounts Name of incomeAmount of incomeName of expenseAmount of expense

| Scrap metal obtained from the liquidation of OS | 6 000,00 | Reserve accrued for PDZ | 50 000,00 |

| Overdue accounts payable with expired statute of limitations | 98 000,00 | Vacation reserve accrued | 300 000,00 |

| Sold a refrigerated display case made from our own OS | 1 000 000,00 | Received a fine from the Federal Tax Service | 2 000,00 |

| Penalty received under the contract | 400,00 | Bank service fee | 3 000,00 |

| TOTAL | 1 104 400,00 | 355 000,00 |

So, the balance at the end of the month is:

- 91.01 – in the amount of 1,104,400 rubles accrued to other income;

- 91.02 – in the amount of 355,000 rubles included in other expenses.

Thus, you can calculate the balance 91.09:

- 1,104,400 – 355,000 = 749,400 rubles profit received.

When closing the month, the accountant will make an entry in the program:

- Dt 91.09 Kt 99 – in the amount of 749,400 rubles.

Or you can show a simple double entry accounting:

Table 2. Balances in accounting Subaccount numberDebit turnoverCredit turnover

| 91.01 | 1 104 400,00 | |

| 91.02 | 355 00,00 | |

| 91.09 | 749 400,00 | |

| Total revolutions | 1 104 400,00 | 1 104 100,00 |

| Total account balance 91 | 0,00 | 0,00 |

Features of annual closure

According to the accounting rules, every month it is necessary to close exclusively the synthetic level of the account, without taking into account subaccounts. They accumulate analytical data all year long:

- By type of income/expenses.

- By cost item.

- By department.

At the end of the year, the accounting department must reform the balance sheet. This means that when closing 91 accounts, transactions must reset all analytical subaccounts that are subject to such an operation:

- Dt 91.01 Kt 91.09 – the accumulated balance in the subaccount is reset to zero;

- Dt 91.09 Kt 91.2 – accumulated expenses are closed.

The resulting result as of September 91 closes at 99 “Profits and Losses”, depending on the financial result of the company.

How can 1C help an accountant?

Automation of final operations significantly saves time when compiling reports. Therefore, 1C.8 versions 2.0 and 3.0 provide for a whole cycle of regulatory operations. They must be carried out gradually, strictly in the sequence in which they were conceived.

Important point! Violation of the sequence of routine operations leads to incorrect data in analytical reports. We must remember that some of the operations are interconnected. It is impossible to calculate profit if cost accounts are not reset.

Regular operations are located in the “Accounting, Taxes and Reporting” menu, “Period Closing” section, “Month Closing” subsection. Here in the third stage you can see “Closing 90, 91 accounts”.

This processing deals with zeroing the required account. 91, just like other accounts, is not closed if there are errors. Incomplete cost items and other analytical sub-contos may result in the transaction being rejected. You can learn more about how the operation works from the video:

Empty subcontos form negative balances in analytics, which confuse the balance sheet, leading movements into chaos. Therefore, it is necessary to fill out the analytics very carefully and thoughtfully, entering primary operations in the program.

Source: https://moneymakerfactory.ru/articles/zakryitie-scheta-91/

Balance Reformation: An Example

When using specialized accounting programs, the balance sheet reformation at the end of the year is carried out automatically.

Let us show with an example how to perform the reformation manually.

Let's assume that at the end of the year the following balances were accumulated on accounts 90 and 91:

| Account 99 “Profits and losses” | |

| Debit | Credit |

| 37 037,22 | 366 232,72 |

| 123 674,27 | 8 012,43 |

| Turnover 160,711.49 | Turnover 374,245.15 |

| — | 213 533,66 |

Let us reflect the closure of subaccounts to accounts 90 and 91:

| Operation | Account debit | Account credit | Amount, rub. |

| The closure of subaccount 90-2 is reflected | 90-9 | 90-2 | 821 370,92 |

| The closure of subaccount 90-3 is reflected | 90-9 | 90-3 | 207 101,95 |

| The closure of subaccounts 90-9 and 90-1 is reflected | 90-1 | 90-9 | 1 357 668,37 |

| The closure of subaccount 91-2 is reflected | 91-9 | 91-2 | 217 029,01 |

| The closure of subaccounts 91-9 and 91-1 is reflected | 91-1 | 91-9 | 101 367,17 |

Let’s complete the balance sheet reformation operations with the accounting entry for closing account 99:

| Operation | Account debit | Account credit | Amount, rub. |

| The closing entry for December reflects the closure of account 99 | 99 | 84 | 213 533,66 |

Closing the month is a list of mandatory transactions and entries made to determine the interim financial result. Let's look at the basic transactions for closing a month manually using an example.

closing account 91 in 1s.8

Quote Ksyusha 758 Well, there is no pack, but we trained the workers, bought a punishment, equipment, depreciation, tools, a truck crane - all this will not be 92

Then let the sums weigh. Write it down when you start producing))

Quote Ksyusha 758 Well, there is no pack, but we trained the workers, bought a punishment, equipment, depreciation, tools, a truck crane - all this will not be 92

Then let the sums weigh. Write it down when you start producing))

Page 3

Quote Ksyusha 758 Well, there is no pack, but we trained the workers, bought a punishment, equipment, depreciation, tools, a truck crane - all this will not be 92

Then let the sums weigh. Write it down when you start producing))

Page 4

Quote Ksyusha 758 Well, there is no pack, but we trained the workers, bought a punishment, equipment, depreciation, tools, a truck crane - all this will not be 92

Then let the sums weigh. Write it down when you start producing))

Page 5

Quote Ksyusha 758 Well, there is no pack, but we trained the workers, bought a punishment, equipment, depreciation, tools, a truck crane - all this will not be 92

Then let the sums weigh. Write it down when you start producing))

We close accounting account 90 “Sales”

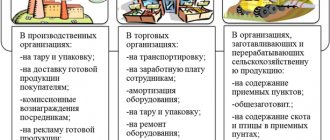

At the end of the reporting month, the company is obliged to determine the financial result of its activities. This operation is a comparison of subaccounts. 90. That is, the accountant compares the indicators of subaccount 90-1 “Revenue” and the value of cost of sales, which is defined as the sum of subaccounts 90-2 “Cost”, 90-3 “VAT”, 90-4 “Excise taxes”, 90-5 “Trade and export duties."

If the company made a profit (revenue exceeded total costs), then the accountant generates the following entry:

Dt 90-9 Kt 99 - profit from sales is reflected.

If the company operates at a loss (revenue is lower than total costs), then the following entry is recorded:

Dt 99 Kt 90-9 - reflects the monthly loss for the company’s activities.

Consequently, subaccounts. 90 may have a balance at the end of the reporting month, but the total value of the synthetic BSC must be equal to zero.

Which accounts are closed at the close of the year? The following accounting entries are generated for this account at the end of the year:

| Operation | Debit | Credit |

| The “Revenue” sub-account was closed at the end of the year | ||

| The cost of production is included in the financial result | ||

| VAT is written off in favor of profits and losses | ||

| Excise taxes are included in the financial results of operations | ||

| Export trade duties written off at the end of the year |

Account 91 - features of accounting for other income and expenses in 2021

> accounting > Account 91 - features of accounting for other income and expenses in 2021

In the previous article, we examined the accounting of income and expenses received from the normal activities of the organization. Other income and expenses are recorded on 91 accounting accounts. The data from this account also forms the final financial result of the enterprise.

In its structure, account 91 “Other income and expenses” is in many ways similar to account 90 “Sales”. It also consists of several subaccounts; income, expenses and financial results are reflected in different subaccounts.

Regulatory framework

The name of account 91 - Other income and expenses - indicates that data on the organization's receipts and disposals, which are generally considered to be other, is entered into it. To correctly determine what income and expenses can be included here, the accountant must use the following regulatory documents:

- PBU 9/99 “Income of the organization”;

- PBU 10/99 “Expenses of the organization”;

- Order of the Ministry of Finance of the Russian Federation “On approval of the chart of accounts for accounting of financial and economic activities of organizations and instructions for its application” dated October 31, 2000 No. 94n.

In paragraph 4 par. I PBU 9/99 states that other income can be defined as income received from activities other than usual. Paragraph III provides a list of income that may be called other income. This is not a final list, therefore the enterprise has the right to independently determine which income is considered other, based on the provisions of PBU 9/99 and based on the nature of the company’s activities.

The situation is similar with the recognition of other expenses. That is, other expenses are derived from activities that are not normal for the firm. Steam. III PBU 10/99 contains an open list of expenses that should be classified as other. So the company can determine the type of expense itself, taking into account the provisions of the regulatory framework.

Closing the month in accounting: an example for novice accountants

Let's look at the process of “closing the month” for a real company providing services. Once again, let’s learn to “look at the turns.”

According to the basics of accounting theory and our new knowledge, let's try to predict what we should see after the “closing of the month.” For clarity, let’s take as a basis the Turnover Balance Sheet (TSV) of our enterprise. Here is an example of OSV.

Is this not what we expect to see?

- Account 26 should have no balance at the end of the month. those. BalanceEndingDebit(SKD) = 0

- Accounts 90 and 91 must be without balance

- Some amounts should appear in the Turnovers for the period for account 99

We launch the procedure “Closing the month”

Let's see how our turnover has changed.

I'll comment a little.

Look, account 26 at the end of the month was “closed” - it became 0. This is good. Here's a wiring diagram showing how it happened.

As we can see, expense accounts “transfer” their accumulated amounts from their Credit to Debit account to the financial result account. Remember the financial result formula? What accounts are involved?

So, Debit 90 and 91 accounts collect the expenses of our company for the current month. Now we can calculate the financial result for each of them. Calculating the financial result is some kind of action on 90, 91 accounts. As you remember, accounts 90 and 91 after summing up the financial result should be equal to 0. And the final result of financial activity will be on account 99.

Zero balances for accounts 90 and 91 should be for the account as a whole. Sub-accounts of these accounts will have balances until December 31, pending the procedure - balance reformation. But more on that later.

This is how the situation looks in our SALT for accounts 90, 91 and 99. This situation arises after the “transfer” of expenses to account 90, BUT before closing 90, 91.

Look, I have highlighted key accounts from the entire SALT to show the intermediate stage of “closing the month”. We see that account 26 has been closed: its balances are zero. And, in our case, the amount of account 26 was displayed in the Debit of account 90.

https://www.youtube.com/watch?v=FLkYKZ6Ubsg

In our example, the company has only account 26. If there were an account 44, it would also be closed and the amount from it would go to the Debit of account 90.

Thus, Debit 90 of account collects amounts from the company’s expense accounts, plus accumulates the cost of goods sold and products. Cost, as you understand, is available to manufacturing and trading companies. For us, only accumulated expenses from account 26.

Now we see that on accounts 90 and 91 different amounts were formed for Debit Turnover (DO) and Credit Turnover (CR). It turns out that for each of these accounts there is a final balance: 1705778.54 and 11374.53. Now it doesn’t make much difference for us where this balance is - in Debit or Credit. Only one thing is important to us:

Closing accounts 90 and 91 implies such actions so that the balance turns to zero. Those. we must make such entries for each account in correspondence with 99 so that our numbers - 1705778.54 and 11374.53 - go away. Those. the remainder would become zero. This is the rule for closing a total of 90 and 91 accounts - the balance on them should be zero.

And in order for the balances to become zero, we must transfer the existing differences between DO and KO (these are final balances) by posting to account 99. In other words, for account 90 we will “add” 1705778.54 to Debit.

— for 91 accounts we will “add” 11374.53 to the Credit

The following report shows how we “add the necessary numbers” through postings, thereby closing accounts 90 and 91. The closure of these accounts will be correct if, after that, their balances at the end of the period (month) become 0.

As you can see, the closure of accounts 90 and 91 goes through their internal subaccounts 90.9 and 91.9 in correspondence with account 99. Where 90.9 (91.9) will appear in the Debit or Credit entry depends on where there are not enough amounts so that the account at the end of the period gives 0.

All comments (19)

- Olga, good afternoon! If you do not reclose periods, you can adjust the balance using the “Operation” document (Section Operations - Operations entered manually). You need to write off the balance from account 91 since errors from previous periods are in correspondence with account 84.

Thanks a lot. Please tell me. What’s the best way to do it: reclose periods or adjust them manually? If you reclose periods, what should you pay attention to?

Re-closing periods of previous years entails changes in accounting and tax reporting. Your account balance is 91, this is your financial result. The issue of clarification of reporting will arise, that is, submission of updated reports. What further entails the opening of a desk audit. I consider adjustments in the current period to be the best option.

- Olga, good afternoon! I suggested that you correct it in the current period, without getting into the past. I agree that when you re-close previous periods, the account balance will be 91.

Good evening Svetlana. I'll try to do it now.

Good afternoon, Olga. It is necessary in the current period to close account 91.02 on 91.09, account 91.09 on 99.01.1, account 99.01.1 on 84.02. See attached file.

- I did. There is no balance at 91 now. I wanted to clarify - should a manual operation be done before reforming the balance?

Comments are closed