Financiers report: after the entry into force of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as Law 402-FZ), the forms of primary documents established by authorized bodies in accordance with and on the basis of other federal laws continue to be mandatory for use. laws. This position does not meet with objections - it corresponds to Article 4 of Law No. 402-FZ. It establishes that the legislation of the Russian Federation on accounting includes all federal laws and regulatory legal acts adopted in accordance with them. However, the authors of the commented letter did not explain how to apply this norm to the orders of the Russian Ministry of Construction. It is not clear from the content of the orders on what federal laws they were adopted.

These orders of the Ministry of Construction are addressed to the highest executive bodies of state power of the constituent entity of the Russian Federation, which are recipients of subsidies from the federal budget, but not to construction contractors.

Such bodies are required to submit to the Ministry of Construction certificates in the KS-3 form certifying the use of budget funds.

Contractors are not guided by Orders No. 11/pr and No. 298/pr. They operate on the basis of contracts concluded in accordance with Federal Law No. 44-FZ dated April 5, 2013 “On the contract system in the field of procurement of goods, works, and services to meet state and municipal needs.” According to Article 34 (clause 11, clause 13) of this law:

- for procurement by customers, federal executive authorities that carry out legal regulation in the relevant field of activity develop and approve standard contract terms;

- The contract includes mandatory conditions on the procedure and timing for the customer to accept the work performed (its results), and to document the results of such acceptance.

The Ministry of Construction of Russia is a federal executive body that carries out the functions of developing and implementing state policy and legal regulation in the field of construction.

When executing contracts, contractors will draw up documentation in accordance with the requirements established therein, and not at all in accordance with Orders No. 11/pr and No. 298/pr. And if the contract obliges the contractor to submit monthly KS-3 certificates, then he is obliged to fulfill this condition, despite the general optionality of the unified forms. We will find similar explanations in the letter of the Ministry of Finance of Russia dated December 11, 2014 No. 02-06-05/64022. It states: if the terms of contracts with state (municipal) institutions provide for the submission of forms of primary documents in the established form, then the obligation to comply with this form is an integral part of the contract.

General procedure

Forms KS-2 and KS-3 are widely used in the construction industry. The first document is an act, which is an actual confirmation of the completed volume of construction and installation work. That is, the contractor draws up a special act, which reflects a complete list of the work performed. The document is then sent to the customer for approval. In turn, the customer carries out reconciliation, or acceptance. If there are no disagreements, then the act is signed.

Based on the signed act, a special KS-3 certificate is created. This certificate reflects information about the cost of construction and installation work performed under the current agreement or contract. Forms KS-2 and KS-3 approved, that is, signed by both parties (sample filling below) are the basis for the start of mutual settlements between the customer and the contractor. Based on these forms, the contractor issues invoices for payment and sends them to the customer’s accounting service.

Order printing processing of forms KS-2.3 for 1C: Accounting 3.0

Working efficiently and saving your time is easier than it seems.

Automate your routine with additional processing for printing forms KS-2, KS-3.

We try to take into account the capabilities of different users in one printing solution for KS-2, KS-3. For some, it is enough to print all the information in a row, while others need to group it by type of indicator - services, materials. Or other possibilities for displaying information.

Therefore, we have made print settings for different situations.

Why do you need the KS-3 form?

The result of the completion of contract work will be its acceptance by the customer organization and the signing of the KS-2 act. To approve the act and final acceptance of the work performed, the contractor draws up a KS-3 certificate.

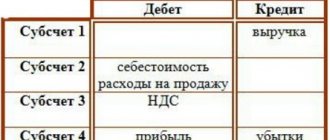

A certificate of the cost of work performed and expenses in the KS-3 form is a document of a financial nature, on the basis of which the cost of contracting activities is approved. In accordance with this documentation, the results of the execution of the government contract are reflected in the accounting records.

The form reflects information about the total cost and expenses for the object of repair, construction or installation activities. The certificate also indicates costs not taken into account in the estimate (price increases, rental costs, etc.).

What is a KS-3 certificate

KS-3 is called a certificate of the cost of work performed and expenses. It is used when making payments to the buyer for actions performed. The documentation is drawn up in the required number of copies. One of them is required by the contractor, and the other by the developer.

The services and expenses provided are reflected in the document according to the contractual cost. The form is drawn up for construction work carried out during the period, major repair operations, and other contracting activities. The price for services includes the price for construction and installation work, which is provided for in the estimate, and other costs.

In column 4, the price for actions is displayed as an increasing indicator from the beginning of the work, including the reporting period. In the next column, the price for the work is written on an accrual basis from the beginning of the year, including the reporting period. Position 6 displays information for the reporting period.

Information is provided on construction as a whole, highlighting individual objects and stages. At the discretion of the interested parties, information may be provided on the type of equipment that is relevant to the construction. In the “Total” line the final amount of work is written without taking into account value added tax. The VAT value is displayed as a separate line. In the “Total” column the price of the work performed including tax is written.

The form is a primary accounting document; it is used to make payments between the contractor and the customer of construction work. The need to fill out is due to the fact that it is necessary to register the costs of construction and installation works in the accounting department. The basis for document execution is the information from the log of actions taken. The price for actions in the certificate is indicated according to predetermined prices.

It is mandatory that the documentation must include information about the parties, the name of the customer, and the contractor. Addresses and contact information must be provided. It is required to have information about the development object and information about the contract. A list of construction and installation work is indicated that the contractor must carry out according to the contract, as well as the total price of the work, including and without tax. The collection rate should be shown on a separate line. A separate copy is drawn up for each party to the agreement.

Where to download form KS-3

The certificate form in form KS-3, approved by Decree of the State Statistics Committee of the Russian Federation dated November 11, 1999 No. 100, can be downloaded on our website.

The forms, the form of which was approved by the State Statistics Committee, could be supplemented with rows and columns in the tables, as well as other necessary information. Since now the KS-3 form is used on the basis of other documents, it is better not to adjust its form.

KS-3: sample filling in 2021

The sample for filling out the KS-3 certificate for 2021 consists of two parts: the title and main parts (in the form of a table).

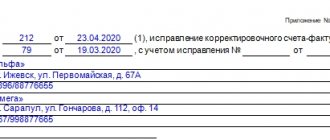

The title part provides information about the parties to the transaction (as in the KS-2 form) and information about the concluded contract. The time period accepted for the report and the date of preparation of the certificate are also indicated here.

In the tabular section, in the 4th column, the cost of construction and installation work and expenses should be indicated, which is entered on an accrual basis from the beginning of the work under the contract (including the reporting period). In the 5th column, the cost of construction and installation works is indicated incrementally from the beginning of the calendar year, and in the 6th column data is entered only for the period for which they are reporting.

The final line reflects the total amount of construction and installation work and expenses excluding value added tax. VAT itself is entered in a separate line, and in the “Total” column the added amount including VAT is indicated.

Update for new versions of 1C:Accounting 3.0

1C:Accounting 3.0 configuration is updated regularly. Therefore, it is possible that it will be necessary to adapt the printed form KS-2, KS-3 for new versions of 1C: Accounting 3.0

We are monitoring changes in 1C: Accounting 3.0 and updating KS-2.3 print processing for new configuration versions.

Updating the printed form KS-2, KS-3 for current releases of 1C: Accounting 3.0 - 1500 rubles .

Moreover, in the first 6 months after purchase we will provide the update free of charge.

In addition to receiving an adapted version of KS-2, KS-3 for 1C: Accounting 3.0, new versions may also contain new functionality.

Legal basis

The registration form is approved by the Federal State Statistics Service. For future accounting, companies need to use a unified sample certificate. The paper will need to indicate the cost of the work without taking into account the premium cost. VAT is indicated as a separate item.

Among the basic rules for the design of KS-3, which are dictated by legislative acts, there are:

- use only a regulated sample to fill out;

- entering information without using abbreviations;

- mandatory writing of the name of the organization of the customer, contractor and investor (if any) indicating the organizational and legal form.

It is worth remembering that this certificate belongs to the category of documents of strict reporting. The accountant is responsible for incorrect preparation.

Why and for what purposes is it used?

This certificate is almost always issued after construction work has been completed under a contract. If the contractor provides a service for budget money, then the preparation of the document is mandatory.

The paper is drawn up after the work has been completed and the acceptance certificate has been signed. At the moment, their use is not mandatory, but most companies, when collaborating with each other, prefer to issue KS-2 and KS-3.

The paper is drawn up by the organization performing the construction and installation work. It is necessary for all parties to the contract for accounting purposes in order to keep records. The certificate reflects information about the amount of expenses for each type of service provided. Based on the specified data, the final settlement between the customer and the contractor is made.

The certificate may be required in the future if claims arise against the counterparty. With its help, it will be possible to provide information in court about the total cost of the work performed, as well as the price for each type separately.

Sample filling ks 3 with standard.

Category “Samples of a contract

In this article we will touch on the following topics: KS-3 (Certificate of the cost of work performed and expenses). Let's find out how to design it and where it is used.

Let's figure out how you can make changes and corrections to the form. For the construction industry, it is mandatory to reflect the cost of the work performed. For this purpose, document KS-3 is used.

The basis for issuing this form is the existence of an agreement and an act in the KS-2 form. At the same time, documents such as KS-2 and KS-3 must always be filled out when performing construction and installation works, and one of these documents is invalid in the absence of the other. A certificate of the cost of work performed and expenses is the primary accounting document and strict requirements are imposed on its execution. Important!

Despite the fact that the document has a unified form, companies, starting from 2013, have the right to supplement it with the necessary information due to the specifics of the activities of each individual enterprise in the construction industry. This certificate must be provided by the contractor of a certain type of construction work to his customer as a report on the amount of construction costs incurred, which are already taken into account in the estimate for the work, as well as those costs that were not reflected in the total cost of construction and installation work.

Step-by-step instruction

To fill out the certificate correctly, you will need to prepare a contract and other sources of information. First of all, you need to create a title page. It is filled out as follows:

Enter information about the contractor, customer and other construction participants (name of organization, contact details) on the title side of the certificate. Next to the name of the organization, in the appropriate cell, indicate the OKPO code (issued to each company upon registration).- Indicate the location of the construction site and the type of construction ongoing.

- Enter the date and number of the agreement on the basis of which the certificate is created, and the date of creation of the document itself.

- Indicate the dates of the reporting period (start and end dates of the construction manipulation stage).

The main part of the document contains a table with 6 columns (see Table 1).

| Column number | Filler actions |

| 1 | indicate serial number |

| 2 | enter the name and type of service provided |

| 3 | indicate the code (if the performed action has a code) |

| 4 | indicate the price on an accrual basis |

| 5 | indicate the planned cost |

| 6 | indicate a specific price for the reporting period |

If the price of work for the reporting period has not changed, and the certificate is issued for the first time, then the same values are indicated in columns 4, 5 and 6.

After specifying all the numbers, the final calculation is carried out. The data is indicated at the very bottom of the table. In the required fields you will need to indicate the price of all work without VAT, the amount of VAT and the amount including VAT.

The last step is signing. On the customer’s side, the signature is carried out by the director or his representative. On the part of the contractor, the director or person responsible for performing the work.

How it is used in practice

After signing the acceptance certificate and a certificate of the cost of the work performed, the accounting department of the customer’s company can begin to pay the organization to the contractor for the services provided.

The Contractor creates documentation in the required quantity for all parties involved. Each party uses it to create reports. After the reporting period has passed, the certificate is sent to the archive for storage. If necessary, paper is removed from the archive and used again, for example, during legal proceedings.

Practical use

Why do you need a KS-3 certificate?

The KS-3 certificate is the basis for payment for completed construction and installation work. The amount in the KS-3 certificate must correspond to the amount in the KS-2 act (or several KS-2 acts) for the reporting period.

The contractor submits to the customer for signing, together with the work performed and as-built documentation, Certificate KS-3 , Certificate KS-2 and Invoice (if the contractor works under the simplified taxation system (USN), then the invoice is not provided).

The accounting department of the customer (general contractor) cannot make payment for work performed without a signed KS-3 certificate.

All materials KS-2 and KS-3 from the customer

The “Demand-invoice” document writes off the materials used for production. These can be either purchased materials or received from the customer.

As a rule, materials received from the customer are reflected in off-balance sheet account 003.1. When transferring the “Request-Invoice” document, such materials are indicated on the “Customer Materials” tab.

If for some reason you do not select customer materials in this way, but want them to be taken into account as customer materials, then this setting has been implemented for you.

This setting makes sense with the “Grouping Group Totals by groups” option, then under each group there will be a total amount

Form KS-2: act of acceptance of completed work

The act of acceptance of completed work, form KS-2 form, sample filling and key rules for document execution were approved by Resolution of the State Statistics Committee No. 100 of November 11, 1999 (OKUD 0322005). However, current legislation provides for the possibility of adjusting the structure of the form. For example, it is permissible to supplement a unified form with specific information that is characteristic of the exclusive activities of a business entity. Please note that such adjustments cannot be contrary to the current provisions of the law.

IMPORTANT!

Officials determined that the unified form KS-2 (filling sample 2020) is required to be drawn up when executing any types of agreements, contracts or agreements for construction and installation work. Without this document, payment for construction and installation work is not allowed (Rosstat Letter No. 01-02-9/381).

The responsibilities for drawing up the act are assigned to the executor. The customer, by signing this document, confirms his consent to the list, type and volume of construction and installation work performed. That is, the customer’s signature indicates that there are no disagreements between the parties to the contract.

Demonstration of printing KS-2.3 forms in “1C: Accounting 3.0”

See for yourself how printing KS-2, KS-3 forms works in our demo database “1C: Accounting 3.0”.

To open the demo “1C: Accounting 3.0” follow the link Open demo.

“1C:Accounting 3.0” will open and do the following:

- Select user Demo

- to the “Sales” section and select “Sales (acts, invoices)”

- Open any sales document that uses services, or create your own document.

- In the document “Sales of goods and services”

in the

“Print”

, select

“Print forms KS-2, KS-3”

.

How to fill out KS-2: example of filling

The structure of KS-2 consists of a title and tabular part. It is recommended to start drafting a document from the title section. So, in accordance with the current rules:

- The fields “Investor”, “Customer”, “Contractor” should be filled out in strict accordance with the constituent and registration documents (charter, certificates or extracts from the Unified State Register of Legal Entities from the Federal Tax Service). Please note that if there is no information about the investor in the agreement, then the corresponding field does not need to be filled in.

- The “Building” and “Object” fields contain information about the location (performing) of construction and installation work. So, in the “Construction” field, indicate the name of the construction and address. In the “Object” field, enter the full name of the construction project in accordance with the design and estimate documentation and the subject of the contract.

- Now we enter the type of activity according to OKPD in KS-2, which is assigned to the customer in accordance with Order of Rosstandart dated January 31, 2014 No. 14-st.

- We register information about the concluded contract, agreement, agreement for construction and installation work. We enter in the appropriate field the date of conclusion of the agreement in the format DD.MM.YYYY and the agreement number.

- Then we indicate the date of drawing up the act, its number, taking into account the chronological order. We also indicate the time period for which the document was compiled.

- We enter information about the estimated cost of the work. The amount is indicated in rubles. Please note that the data must comply with the terms of the concluded contract, and also be confirmed by design and estimate documentation.

The title section is complete. Now we proceed to filling out the tabular part of the KS-2 act; the sample filling in 2021 will be as follows:

- Number in order - assign a serial number, new for each position.

- “Item number according to the estimate” - indicate the number of the construction and installation work item, in accordance with the approved design and estimate documentation. If several estimates are executed within the framework of one contract, then the numbering may be duplicated.

- The name of the work must be written in strict accordance with the approved estimate. Abbreviations, changes or additions to names are not permitted.

- The unit price number is also entered from the estimate documentation data, in accordance with the current classifier and the FER collection.

- The unit of measurement denotes a qualitative expression assigned to a specific type of construction and installation work.

- The number of completed works is a quantitative indicator characterizing the volume completed. Specifying percentages is not allowed.

- In the “Price per unit” column, you should indicate the accounting price that is established for a specific type of construction and installation work. For fixed contract prices, put dashes in the column.

- The “Cost” column is filled in in any case. It reflects the cost expression of completed emergency services taking into account the volume.

If there are disagreements or comments regarding the procedure and timing of fulfillment of the terms of the agreement, appropriate entries are made in the document.

After filling out the KS-2 form (filling example), a certificate of the cost of the work performed is drawn up. Then both documents (see sample completion of KS-2 and KS-3) are sent to the customer for reconciliation, approval and further payment.

Accounting press and publications

"Chief Accountant". Appendix “Accounting in construction”, 2005, N 2

FILLING IN FORMS N KS-2 AND N KS-3

The delivery of work performed by the contractor to the customer is documented in acts (clause 4 of Article 753 of the Civil Code of the Russian Federation). In this case, the Certificate of Acceptance of Work Performed in Form N KS-2 and the Certificate of Cost of Work Performed and Expenses in Form N KS-3 are used. Both forms are approved by Resolution of the State Statistics Committee of Russia dated November 11, 1999 N 100. Based on the Certificate of the cost of work performed and expenses, the customer includes the cost of work performed by the contractor as part of capital investments. Thus, both the contract, Form N KS-2, and Form N KS-3 must reflect the same cost of work performed.

By agreement of the parties, the estimated cost of work can be established in prices of 2000 (1984 or 1991 - depending on when construction or construction and installation work began) using conversion factors. Then in form N KS-2 the amount of costs is reflected in the prices of the specified year, in a separate line - the conversion factor, as well as the total cost. This cost is then transferred to Form N KS-3.

———————————————————————————————— About what prices to take as a basis when drawing up estimates using the basis-index method, read the interview with P.V. Goryachkin, published in the journal “Accounting in Construction” No. 2, 2004, p. 8.

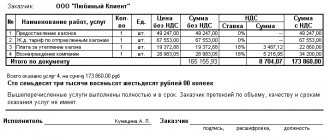

Example. Construction Plant LLC (customer).

The subject of the contract is the reconstruction of plant unit No. 7 in workshop No. 4. The estimate was compiled in 2000 prices. It includes:

— installation of radial fan units;

— installation of stands (frames) for ventilation equipment;

— installation of fire escapes;

— dismantling of structure equipment;

— dismantling the platform;

— dismantling the lining;

— loading and unloading of waste (metal structures) onto dump trucks;

— loading and unloading of waste (bricks) onto dump trucks;

- cost of transport.

The cost of these works in 2000 prices (taking into account the contractor’s profit, regional coefficient, hazard coefficient and winter price increase) amounted to 3931.38 rubles. And taking into account the conversion to 2005 prices - 261,043.63 rubles. (excluding VAT) or RUB 308,031.48. (including VAT - 46,987.85 rubles).

Here are examples of filling out forms N KS-2 (see Appendix 1 on pp. 67 - 68) and N KS-3 (see Appendix 2 on p. 69) in this case.

Moreover, for the convenience of calculation, additional details have been introduced in Form N KS-2, which makes it possible to make clause 13 of the Regulations on Accounting and Financial Reporting in the Russian Federation (approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n).

In this case, the “new” form of the document must be approved in the accounting policy of the organization. The same explanations are given in the Procedure for using unified forms of primary accounting documentation, approved by Resolution of the State Statistics Committee of Russia dated March 24, 1999 No. 20.

Note. The procedure for signing forms N KS-2 and N KS-3

The Act in Form N KS-2 and the Certificate in Form N KS-3 are signed by authorized representatives of the parties (contractor and customer). If one of the parties unreasonably refuses to participate in the delivery or acceptance of the work results or the signing of the act, unilateral delivery and acceptance of the work results may be carried out. Such an act will have legal force (clause 8 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 24, 2000 N 51 “Review of the practice of resolving disputes under construction contracts”). A unilateral act of delivery or acceptance of the result of work can be declared invalid by the court only if the reasons for the refusal of the party to the contract to sign the act are recognized as justified (for example, there are complaints about the quality of the work performed).

Annex 1

———————————¬ | Code | +——————————+ OKUD form | 0322005 | — +——————————+ Investor ———————————————————————————————————— —— according to OKPO | | (organization, address, telephone, fax) +——————————+ JSC “Plant”, Krasnoyarsk, | | st. Severnaya, 25, | | tel. | | Customer (General Contractor) ———————————————————————— according to OKPO | 13297059 | (organization, address, | | telephone, fax) +——————————+ Construction Plant LLC, Krasnoyarsk, st. Severnaya, 25, | | tel. | | Construction ——————————————————————————————————————————————— | | (name, address) +——————————+ Reconstruction of unit No. 7 in workshop No. 4 | | Object ———————————————————————————————————————————————— | | (name) +——————————+ Type of activity according to OKDP | | ——————+——————————+ Contract agreement (contract) |number| 33 | +—————+——T——T————+ | date|01|02|2005| L—————+——+——+————+ Type of operation | | L——————————— ——————————T———————————¬——————————————— ———————¬ | Number | Date || Reporting period | |document|drawing|+——————————T——————————+ | | || with | by | +—————————+———————————++——————————+——————————+ | 58 | 02/14/2005||02/01/2005|02/28/2005| ACT L—————————+————————————L——————————+——————————— ABOUT ACCEPTANCE OF COMPLETED WORKS

Estimated (negotiable) cost in accordance with the contract

308 031,48

(subcontract) ———————————————— RUR.

——————————————T———————————————T———————T———————T——— —————————————————————————————————————————————————— ——————————————¬ | Number | Name |Number |Unit| Completed work | +——————T——————+ work |unit—|measured—+—————T————————————————————— —————T——————————————————————————————————+ |by |posi- | |noy |nia |Koli—|Cost of a unit in rubles| Total cost in rubles | |order—|tions by| |price—| |honest—+—————T————————————————————+——————————T———————— ———————————————+ |ku |estimate | |ki | |in |Total| including: | Total | including: | | | | | | | | +—————T——————T———————+ +————————T——————T———————+ | | | | | | | | basic|exploit| including| | basic |exploit| including| | | | | | | | |s/pl.|cars | salary | | salary |cars | salary | | | | | | | | | | | mash. | | | | mash. | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 1 | 1 |Installation |E20—722|pcs. | 1 | 5.21| 3.4 | 0.3 | 0.09 | 5.21| 3.4 | 0.3 | 0.09| | | |units | | | | | | | | | | | | | | |fan | | | | | | | | | | | | | | | radial | | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 2 | 2 |Installation |E20—697|100 kg | 0.6 |37.2 | 3.5 | 0.25| 0.08 | 22.32| 2.1 | 0.15| 0.05| | | |stands (frames)| | | | | | | | | | | | | | |under | | | | | | | | | | | | | | | ventilation | | | | | | | | | | | | | | |equipment | | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 3 | 3 |Installation of firefighters|E9—46 |tons | 0.04|58 |13.8 | 32.1 | 11.8 | 2.32| 0.55| 1.28| 0.47| | | |stairs | | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 4 | 4 | Dismantling | E9—123 | tons | 3 |22.98|20.58| 0.7 | 0.21 | 68.94| 61.74| 2.1 | 0.63| | | | snap | | | | | | | | | | | | | | |designs | | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 5 | 5 | Dismantling | E9—57 | tons | 20 |56.04|13.14| 31.5 | 9.94 | 1,120.80| 262.8 |630 | 198.8 | | | |platforms | | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 6 | 6 | Dismantling | E13—29 | sq. m | 80.3| 8.39| 7.3 | 1.09| 0.32 | 673.72| 586.19| 87.53| 25.7 | | | |lining | | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 7 | 7 |Loading— |SCP |tons | 11.5| 2.45| 2.45| | | 28.18| 28.18| | | | | |unloading |p. 6 | | | | | | | | | | | | | |garbage |p 21 | | | | | | | | | | | | | |(metal | | | | | | | | | | | | | | structures) on | | | | | | | | | | | | | | |dump trucks | | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 8 | 8 |Loading— |SCP |tons | 43 | 1.18| 1.18| | | 50.74| 50.74| | | | | |unloading |p. 6 | | | | | | | | | | | | | |garbage (bricks)| | | | | | | | | | | | | | |on | | | | | | | | | | | | | | |dump trucks | | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 9 | 9 |Transport |SCP |tons | 43 | 1.22| | 1.22| | 52.46| | 52.46| | | | | |page 28| | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 10 | |Direct costs | | | | | | | | 2,024.69| 995.7 |773.82| 225.74| +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 11 | |Taking into account | | | | | | | | 2,391.12|1,294.41|841.54| 293.46| | | |district | | | | | | | | | | | | | | | coefficient | | | | | | | | | | | | | | |30% | | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 12 | | Coefficient for | | | | | | | | 533.99| 323.6 |210.39| 73.37| | | |harmfulness - 25%| | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 13 | |Total direct | | | | | | | | 2,925.11| | | | | | | costs | | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 14 | |Invoices | | | | | | | | 596.72| | | | | | |expenses - 20.4%| | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 15 | |Smetnaya | | | | | | | | 281.75| | | | | | |profit - 8% | | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 16 | |Total | | | | | | | | 3,803.58| | | | | | |with invoices | | | | | | | | | | | | | | | expenses | | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 17 | |Winter | | | | | | | | 127.80| | | | | | | rise in price - | | | | | | | | | | | | | | |3.36% | | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 18 | |Total with winter | | | | | | | | 3,931.38| | | | | | |increasing prices | | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 19 | |Taking into account | | | | | | | |261,043.63| | | | | | | coefficient | | | | | | | | | | | | | | |conversion to | | | | | | | | | | | | | | |prices 2005 | | | | | | | | | | | | | | |(66.40) | | | | | | | | | | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 20 | |VAT 18% | | | | | | | | 46,987.85| | | | +——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————+ | 21 | |Total cost| | | | | | | |308,031.48| | | | | | |including VAT | | | | | | | | | | | | L——————+——————+———————————————+———————+———————+——— ——+—————+—————+——————+———————+——————————+————————+ ——————+———————— Sergeev

Submitted by: Director of Construction Plant LLC —————— Petrov N.A.

(signature)

M.P.

Appendix 2

Unified form N KS-3

———————————¬ | Code | +——————————+ OKUD form | 0322001 | — +——————————+ Investor ———————————————————————————————————— —— according to OKPO | | (organization, address, telephone, fax) +——————————+ JSC “Plant”, Krasnoyarsk, | | st. Severnaya, 25, | | tel. | | Customer (General Contractor) ———————————————————————— according to OKPO | 13297059 | (organization, address, | | telephone, fax) +——————————+ Construction Plant LLC, Krasnoyarsk, st. Northern, | | 25, tel. | | Construction ————————————————————————————————————————— according to OKPO | | (name, address) +——————————+ Reconstruction of unit No. 7 in workshop No. 4 | | Object —————————————————————————————————————————— by OKPO | | (name, address) Type of activity according to OKDP | | | | ——————+——————————+ Contract agreement (contract) |number| 33 | +—————+——T——T————+ | date|01|02|2005| L—————+——+——+————+ Type of operation | | L——————————— ——————————T———————————¬——————————————— ———————¬ | Number | Date || Reporting period | |document|drawing|+——————————T——————————+ | | || with | by | +—————————+———————————++——————————+——————————+ | 58 | 02/14/2005||02/01/2005|02/28/2005| REFERENCE L—————————+————————————L——————————+——————————— ABOUT THE COST OF COMPLETED WORK AND COSTS ——————T———————————————————————————T———T———————— —————————————————————————¬ |Number| Name of launchers |Code| Cost of completed | |by | complexes, stages, | | work and costs, rub. | |by- |objects, types of completed| +——————————T——————————T——————————+ |row|work, equipment, costs| | from the beginning | from the beginning | in that | | | | |carrying out| year | number for | | | | | works | | reporting | | | | | | | period | +—————+————————————————————————————+———+—————————+ ——————————+——————————+ | 1 | 2 | 3 | 4 | 5 | 6 | +—————+————————————————————————————+———+—————————+ ——————————+——————————+ | 1 |Total work and costs, | |261,043.63|261,043.63|261,043.63| | | included in the price | | | | | | |works | | | | | +—————+————————————————————————————+———+—————————+ ——————————+——————————+ | |including: | | | | | +—————+————————————————————————————+———+—————————+ ——————————+——————————+ | 1 |work according to act N 58 | |261,043.63|261,043.63|261,043.63| | | | | | | | L—————+———————————————————————————+———+—————————+ ——————————+——————————+ Total |261,043.63| +——————————+ VAT amount | 46,987.85| +——————————+ Total including VAT |308,031.48| L——————————— General Director of OJSC “Plant” Petrov Petrov N.A. Customer (General Contractor) ——————— ——— ——— ———— (position) (signature) (signature transcript) M.P. Director of Construction Audit Center LLC

Krasnoyarsk

Signed for seal

18.04.2005

—————————————————————————————————————————————————————————————————— ———————————————————— ——

Completion requirements

All data that is entered is directly related to the cost and expenses of the repairs, installation, construction, etc. performed. The act of acceptance of completed work KS-3 includes costs that were not previously taken into account in the estimate documentation and the contract:

- an increase in wages for the contractor’s employees, which entailed an increase in contributions to extra-budgetary funds;

- increase in the cost of building materials;

- movement in the price level for rental of equipment and machinery involved in the performance of contract services;

- additional payments and allowances for hazardous working conditions and employment in the Far North;

- other unplanned expenses that adjusted the final cost.

IMPORTANT!

Since the form is standardized and unified, the contractor leaves the example of filling out KS-3 unchanged and does not make adjustments to it. Changing the number of lines in the form is prohibited!

A certificate of the cost of work performed and expenses applies not only to the entire construction project, but also to its constituent parts. The full cost of the entire construction project must be indicated.

Which form to use

The final documentation for the procurement of construction, repair or installation activities is generated using a unified register - OKUD 0322005. Forms of the act and certificate were developed and enshrined in Resolution of the State Statistics Committee No. 100 of November 11, 1999. How to fill out KS-2 - an example of filling out and the content of the act depend on the type of work performed.

Although the form of the act is unified, the executor has the opportunity to modify it depending on his needs without violating current regulations.

How to fill out

Instructions for filling out forms KS-2 and KS-3 will help you enter the data correctly, a sample of which you can download in the article.

First, let's look step by step at how to draw up the KS-2 act.

Step 1. Fill out the introductory part - the header of the form. Information about the investor is filled in if there is such an economic entity in the contractual relations of the parties.

The basis for entering information about the customer and contractor is their registration information. Here you need to indicate the name of both organizations, their address, contact phone number and OKPO of each party.

Step 2. Fill in the “Construction” column - the address of the construction site under a government contract. In the “Object” field, indicate the full name of the subject of the contract.

In the fields we indicate the type of activity of the organization according to OKDP, the details of the contract - the number of the government contract and its date.

Step 3. We generate information about the period of work and indicate the details of the act. It is assigned a number in order and its date is indicated. In the “Reporting period” plate we reflect the start and end dates of work.

Step 4. We enter the cost of construction, repair or installation work in accordance with the estimate. The amount must match the price of the work specified in the contract and be written in rubles.

Step 5. Fill out the table. To find out how to correctly fill out the KS-2 sample, you need to understand the formation of information in the tabular part of the form. The table of this act is a reflection of the estimate for performing work under a government contract. In this case, the form can accumulate data from several estimates.

All numbers in order (column 1), items according to the estimate (item 2) and the name of the work performed (item 3) are written down similarly to the lines of the estimate calculation. Numbers from the collections of federal unit rates (FER) are indicated in column 4 for each type of work, if available for this category. Column 5 reflects the unit of measurement - exactly as it is written in the estimate. It is not allowed to record the volume of work performed in percentage and proportional terms. Column 7 - “Price per unit in rubles.” — is formed using data from FER collections. If the terms of the contract require a fixed cost for contractual activities, then dashes are indicated in column 7.

Column 8 reflects the actual cost of work based on the estimate, which is an integral annex to the government contract. This column can also be filled in using the calculated values for each item from the collections of federal unit prices.

Step 6. When the customer verifies the data from the act with the estimate and actual volumes, the KS-2 act is signed by the manager or other responsible person.

The document is drawn up in two copies. The seal is affixed only if it is used by institutions. KS-2 also reflects all the comments that the customer makes to the contractor regarding inadequate quality, volume or deadlines.

The correct sample for filling out the 2021 KS-2 form looks like this: