Currently, the construction business is developing at warp speed. New technologies and materials are emerging. Having good knowledge in this area, you can create a very successful business. There are quite a lot of options for developing your undertaking. Having chosen the one that is more suitable for you, you need to take into account all the nuances so as not to lose your invested money. This is what scares most entrepreneurs away. So what should you pay attention to so that your business does not fall into the category of unprofitable ones? The answer is simple: Accounting for construction costs. If you wisely control construction costs, the amounts spent will not only pay off, but will also turn into a good profit.

Features of construction as a type of business and their impact on accounting

All enterprises in the Russian Federation use uniform accounting standards, but taking into account industry specifics. The main regulatory act that reflects the features of accounting in construction is PBU 2/2008 “Accounting for construction contracts.”

The start and end dates of construction work often fall in different periods. Therefore, the results are reflected in accounting “as soon as they are ready.”

In the general case, accounting must be kept separately for each object for which there is a separate estimate or project. Even if a single contract has been concluded for the entire complex, consisting of several objects, accounting is often carried out separately for each of them. To do this, the following conditions must be met:

- income and expenses can be distinguished for an object;

- there is separate technical documentation for the object

But the opposite situation is also possible, when several contracts are concluded for the construction of one complex facility. From an accounting point of view, they can be considered as a single contract if:

- they relate to one object for which, according to the accounting policy, uniform standards are established;

- work under contracts is performed simultaneously or within a sequential cycle.

Another peculiarity of the construction industry is that facilities owned by one company may be located in different regions. Therefore, branches are often opened at the location of construction sites. The parent enterprise is obliged to report the opening of a branch to the tax authorities at its location within a month, and about the closure - within three days (Clause 2 of Article 23 of the Tax Code of the Russian Federation).

If branches are created within the structure of the organization, a number of issues related to the organization of accounting should be resolved:

- determine the features of accounting in separate divisions;

- determine the list of persons responsible for the timely preparation of the “primary report” according to the approved document flow schedule;

- determine the timing of the transfer of documentation to the parent company for timely reflection in accounting.

Results

Accounting for costs when performing construction work is always carried out for a designated object (contract) and is inextricably linked with accounting for revenue from construction work. The fact of recognition of revenue (or part of it) allows us to recognize costs associated with this revenue. Wherein:

- direct costs are subject to accounting as part of the contract according to established standards;

- indirect costs are included in the cost of the contract only to the extent that they are included in the contract and are compensated by the customer;

- other costs incurred in the current period are included in the expenses of this period

Basically, when accounting for costs in construction, the same accounting accounts are used as in production. However, the use of account 46 is also typical, due to the fulfillment of the requirements of PBU 2/2008.

Sources:

- Tax Code of the Russian Federation

- PBU 2/2008, approved. by order of the Ministry of Finance of Russia dated October 24, 2008 N 116n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Contractor's expenses before construction starts

Even before signing the contract, the construction company incurs preliminary costs, which must be reflected in account 97 “Future expenses” (FPR). This could be, for example, the costs of participating in a tender or paying for a bank guarantee.

DT 97 – KT 76 – costs incurred are taken into account as RBP

DT 20 – KT 97 – RBP included in cost after the start of main work

Insurance costs can also be reported as BPO, as shown above. However, another option is also possible. The amount paid to the insurer can be taken into account as an advance, and then the insurance costs can be written off gradually as the period expires. Most often, the insurance amounts are distributed in equal shares over the entire construction period.

DT 76 – CT 51 – advance payment from the insurance company is transferred

DT 20 – KT 76 – insurance payments are expensed

An insurance contract can be concluded for several objects, the construction of which is carried out under one contract. In this case, the method of dividing costs between objects must be reflected in the accounting policy. For example, in proportion to the cost of work for each object, but it is possible to use other criteria.

Standardization of direct costs is another important nuance of construction

From the above, one significant conclusion can be drawn - during the construction process, accounting is carried out based on calculated indicators. In order for the final result to not differ much from the planned one, strict planning and cost regulation are necessary.

IMPORTANT! Rationing of costs in construction is carried out not only for accounting purposes. Construction is one of the most highly regulated industries, so setting and complying with standards is mandatory from both a technology and safety point of view, as well as several other parameters.

First of all, the contractor's direct costs accounted for in account 20 are subject to rationing. These include:

- cost of materials and structures used;

- wages of construction workers;

- depreciation of own construction equipment;

- rental of construction equipment;

- transportation and procurement costs related to the items listed above (for example, costs of moving equipment and machinery).

How standards are set in practice can be read here: “We approve standards for the write-off of building materials.”

Accounting for the main construction work of the contractor

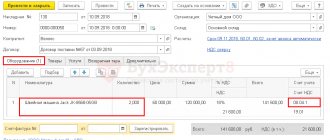

Transactions are reflected in the accounting of the contracting organization on the basis of the following main documents (Resolution of the State Statistics Committee of the Russian Federation dated November 11, 1999 No. 100):

- KS-2 – “Certificate of acceptance of completed work”;

- KS-3 – “Certificate of the cost of work performed”, on the basis of which settlements are made between the customer and the contractor;

- KS-6 – “Journal of work”.

Most approved forms of primary documentation (except for cash and banking) have not been mandatory since 2013. But construction companies, as a rule, continue to use proven forms.

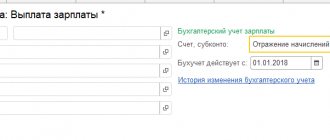

All contractor costs for work on the facility are accumulated in the debit of account 20 in correspondence with the accounts:

- 10 - write-off of materials;

- 69.70 – salary of key personnel with accruals;

- 23 - reflection of services received from auxiliary production;

- 25, 26 - general production and general economic expenses;

- 60, 76 payments for services.

If a contracting organization engages a subcontractor for certain work, the costs of its services must be accounted for in a separate subaccount of account 20.

DT 20 – KT 10 (69, 70, 23...) – construction costs taken into account

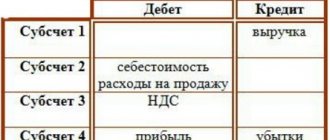

DT 62 – KT 90.1 – the object was handed over to the customer

DT 90.3 – KT 68.2 – VAT charged

DT 90.2 – KT 20 – costs for the commissioned object are written off

DT 51 – KT 62 – payment received from the customer

If the contract provides for stage-by-stage acceptance of the object, use account 46 “Completed stages for work in progress”:

DT 46 – KT 90.1 – the completed stage of work was handed over to the customer

DT 90.2 – KT 20 – costs related to this stage are written off

DT 62 – KT 46 – revenue taken into account upon completion of all work

Nuances associated with discrepancies between planned and actual costs

The first main point that distinguishes accounting according to PBU 2/2008 from other standards is that when certain cost items change, revenue is subject to adjustment. This happens in the following cases:

- If during construction work, for objective reasons, more expensive materials or more complex technology (and also more expensive) methods of performing work were used. At the same time, revenue is adjusted upward.

- If during the work, for some reason, part of the work was not completed (without prejudice to the result of construction). In this case, revenue is adjusted downward.

- If upward changes in costs occur due to the fault of the customer. For example, the contractor was forced to incur additional costs due to the technology of work that were not taken into account in the estimate provided by the customer. In such a situation, revenue is adjusted upward by presenting a special requirement to the customer.

- Another case of adjusting revenue is if the contract provides for incentive payments to the contractor. For example, for meeting deadlines for completing work.

In all these cases, you should change the amount of revenue reflected on the credit of the 90th account. In this case, the amounts of additional costs collected on account 20 are subject to debit to account 90:

- as part of the cost of the completed stage of work, if the customer recognized and paid additional costs;

- as part of other expenses for ordinary activities, if the customer did not recognize and pay for these expenses.

The second important aspect of cost accounting in construction is a specific approach to the classification and accounting of indirect costs.

Only those costs that are compensated by the customer under the terms of the contract are subject to distribution to the cost of the contract and, accordingly, to accounting and write-off according to the above principles. For example:

- costs of insuring the facility (refer to general production costs and are accounted for on account 25);

- costs for technical support and expert support for the work performed (also related to general production costs);

- costs of maintaining the contractor's management staff (the provision for compensation must be specified in the contract as a separate clause. These costs are classified as general economic costs and are accounted for on account 26).

All other expenses not included in the contract are considered expenses for the contractor for ordinary activities and are subject to accounting and write-off in the period in which they were incurred.

Find out how to correctly account for construction costs if you apply the simplified tax system “income minus expenses”, using the advice of ConsultantPlus experts. If you do not have access to the system, get a trial online access for free.

IMPORTANT! Expenses that do not produce a production result (for example, construction defects) cannot be included in the contract value in any case. Such expenses are always written off in the period in which they occur.

For information on how specific construction costs are taken into account, read: “Accounting and taxation in construction (nuances).”

Features of materials accounting in construction

The contract between the customer and the contractor must reflect the method of purchasing materials. The following options are possible:

- Paid transfer of materials from the customer to the contractor

In this case we are talking about the usual purchase and sale of material assets. For the customer this is the implementation:

DT 62 – KT 90.1

DT 90.3 – CT 68.2 – if the customer works with VAT

The contractor purchases goods and materials with attribution to account 10:

DT 10 – KT 60

DT 19.3 – CT 60 – if the contractor also uses the general tax system

The contractor includes the price of purchased materials in the cost of work performed and reflects it in forms KS-2 and KS-3.

DT 20 – KT 10 – materials written off as expenses

The contractor may pay the customer the cost of purchased materials.

DT 60 – KT 51

But more often these calculations upon completion of the work by the contractor are “closed” through offset against the cost of construction.

DT 60 – KT 62

- Transfer of customer-supplied materials to the contractor

The main feature of the transfer of customer-supplied materials is that the contractor does not pay for them and does not include them in the price of the work performed. In the customer's accounting, this operation is not a sale. The cost of transferred inventory items is not debited from the customer’s balance sheet, but is reflected in account 10, subaccount “Materials transferred for processing.”

The Contractor keeps records of materials transferred as customer-supplied raw materials on off-balance sheet account 003 “Materials accepted for processing”, separating two sub-accounts:

- customer-supplied raw materials (DSM) in the warehouse;

- DSM in production.

The contractor must provide the customer with a report on the materials used. Based on this report, the customer will write off their cost.

If after completion of construction there are unused customer-supplied materials, they must be returned to the customer. This operation is not an implementation for the contractor.

- Independent procurement of materials by the contractor

The contractor can purchase the necessary materials from “third” organizations that are in no way connected with the customer. To do this, he can use both his own funds and an advance received from the customer.

In this case, the price of purchased materials is included in the cost of construction work reflected in forms KS-2 and KS-3. The purchase of materials from third parties and their write-off is reflected in accounting in the same way as when purchased from a customer (option 1).

When transferring materials using any of the methods, you must fill out an invoice. Typically, the standard M-15 form is used for this.

Accounting in a construction organization: an example

Vesna LLC provides construction services. A contract was concluded for the construction of an office building. Acceptance is carried out in two stages: the first in the amount of 2 million rubles, the second - 2.4 million.

The terms of the contract provide for an advance payment of 90% of the cost of the stage. So, the advance for the first is 1.8 million rubles, for the second - 2.16 million rubles.

The start of work is February 2021, the end of the first part of construction is May, the second is July.

The cost price for the first is 1.72 million rubles, for the second - 1.98 million rubles.

Accounting entries:

| Period | Debit | Credit | Amount (rub.) | Operations |

| 20.02 | 51 | 62-1 | 1 800 000 | Advance payment for stage 1 of work is credited to the current account |

| 20.02 | 62-1 | 68-1 | 274 576 | VAT charged on advance payment |

| 25.03 | 46 | 90-1 | 2 000 000 | Completion of the first stage of construction, KS-2 signed |

| 25.03 | 90-3 | 68-1 | 305 085 | VAT charged |

| 25.03 | 68-1 | 62-1 | 274 576 | VAT on advance has been restored |

| 25.03 | 90-2 | 20 | 1 720 000 | The cost of the first stage of work has been written off |

| 25.03 | 90-9 | 99 | 100 610 | Profit accrued from acceptance of the first stage of work |

| 15.07 | 51 | 62-1 | 2 160 000 | The second advance was credited to the bank account |

| 15.07 | 62-1 | 68-1 | 486 000 | VAT charged on the second prepayment |

| 20.07 | 62 | 46 | 2 000 000 | The cost of construction work of the first stage was written off |

| 20.07 | 62 | 90-1 | 2 400 000 | Revenue reflected |

| 20.07 | 90-3 | 68 | 366 102 | VAT charged |

| 20.07 | 68 | 62-1 | 486 000 | VAT on prepayment has been restored |

| 20.07 | 90-2 | 20 | 1 980 000 | The cost of the second stage is written off |

| 20.07 | 90-9 | 99 | 420 000 | Profit from the second stage of work performed is reflected |

| 20.07 | 62-1 | 62 | 3 960 000 | The amount of the received advance payment is credited |

Accounting in construction for the customer

- Construction for own needs.

If the customer builds an object for himself, then this is an investment in non-current assets, which is reflected in account 08. The customer takes into account costs on the basis of forms KS-2 and KS-3.

The customer can independently carry out some of the necessary work. For example, develop design documentation or order it from a third party. Also, the customer can buy the materials himself and ship them to the contractor on a toll basis. All these costs also increase the cost of the facility being built.

DT 08 – KT 60 – reflects the cost of work performed by the contractor

DT 08 – KT 70 (69.76, 10...) – reflects the customer’s costs associated with construction

DT 01 – KT 08 – the facility was put into operation

As part of construction, landscaping is often carried out. This type of work must be taken into account as follows:

- If improvement work is carried out before the construction project is put into operation, then the costs are reflected in the following entries:

DT 08 – KT 60 (10, 69, 70...)

- if the work is postponed until after the facility is put into operation, you need to create an expense reserve in account 96 according to the estimated cost.

DT 08 – KT 96 – reserve created

DT 96 - CT 60 (10,69,70...) - actual costs of performing work are written off at the expense of the reserve.

- Construction for investors

Often, the customer hires a contractor and organizes construction work not for himself, but for another organization - the investor. In this case, account 76 is used in accounting, on which a special sub-account “Settlements with investors” should be opened.

DT 51 – KT 76 – advance received from investor

DT 26 (25) – KT 70 (69.60...) + DT 20 – KT 26 (25) – customer costs for organizing construction

DT 08 – KT 60 (70, 69, 76, 10...) – customer costs for the construction of the facility

DT 76 – KT 08 – the object was transferred to the investor (cost excluding VAT)

DT 76 – KT 19 – transferred to the investor VAT included in the cost of the object (according to the consolidated invoice)

DT 76 – KT 90.1 – customer’s remuneration reflected

DT 90.2 – KT 20 – the customer’s own costs are taken into account.

Conclusion

When organizing construction work, a businessman can act as an investor, customer or contractor. For each of these situations, accounting has its own specifics.

The main features of the construction business that affect accounting: a long cycle of work, territorial distribution and management of several objects at the same time. Therefore, it is necessary to pay special attention to the division of costs by object and their write-off by period.

When reflecting costs in the contractor's accounting department, it is important to take into account the option of using materials: their own or toll.