If an organization carries out any actions with cash, it is obliged to register them in accounting in accordance with the Procedure for cash transactions approved in the Russian Federation. Each movement of “cash” must be recorded by a cash document - an incoming or outgoing cash order.

In addition, it is necessary to maintain a cash book in the KO-4 form, which will record transactions for each “cash day” (that is, for each day when cash was received and/or issued). Each sheet of the book is prepared in two identical copies: a loose sheet of the cash book and a cashier’s report.

The cash book can be maintained either manually (in this case, the sheets are stitched and sealed before starting maintenance) or in a computer accounting program. In 1C Accounting 8.3, the cash book is implemented as a report. An accountant or cashier does not need to make separate entries for it, especially in double form. It is enough to enter the primary documents for receipt and withdrawal of cash into the program. The cash book in 1C will be generated automatically based on them.

Where is the cash book located in 1C 8.3

The cash book in 1C 8.3 is located in the Bank and cash desk menu - in the Cash documents section:

The cash book in 1C is a reporting form. It is based on documents of incoming and outgoing cash orders, as well as other documents issued simultaneously with the primary cash orders.

Note! Not only PKOs and RKOs form the movement of money in the cash book. We will return to this fact later:

Federal Tax Service on the new procedure for conducting cash transactions

By letter dated December 22, 2011 No. AS-4-2/ [email protected], the Federal Tax Service of Russia reminded tax inspectors, as well as all taxpayers (legal entities and individual entrepreneurs) that a new procedure for conducting cash transactions has been in effect in Russia since January 1, 2012 .

The new procedure is introduced by the Regulations on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation, approved by the Bank of Russia on October 12, 2011 No. 373-P.

New for individual entrepreneurs

The Federal Tax Service draws attention to the fact that individual entrepreneurs are obliged to:

— determine the cash balance limit;

— store cash in bank accounts in excess of established limits;

— process cash transactions with incoming cash orders 0310001 and outgoing cash orders 0310002;

— ensure the availability of cash documents and other documents drawn up when conducting cash transactions within the time limits established by the legislation on archival affairs in the Russian Federation;

— maintain cash book 0310004.

On a note

Unified forms for recording cash transactions were approved by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88:

- cash receipt order (form according to OKUD 0310001) - unified form No. KO-1;

- cash receipt order (form according to OKUD 0310002) - unified form No. KO-2;

- cash book (form according to OKUD 0310004) - unified form No. KO-4.

Storage periods for cash documents

The storage periods for documents generated in the activities of organizations are established in the List approved by order of the Ministry of Culture of the Russian Federation dated August 25, 2010 No. 558. This order was adopted on the basis of clause 2, part 1, art. 4 and part 3 of Art. 6 of the Federal Law of October 22, 2004 No. 125-FZ “On Archival Affairs in the Russian Federation.”

According to paragraph 362 of the List, cash documents and books must be stored for at least 5 years. However, they can be destroyed subject to an inspection (audit) during this 5-year period. Documents for the unrevised period, even if it exceeds 5 years, cannot be destroyed.

The storage period for documents begins on January 1 of the year following the year in which they were processed.

Administrative responsibility

The letter from the Federal Tax Service states that administrative liability for violation of the procedure for working with cash and the procedure for conducting cash transactions provided for in Part 1 of Art. 15.1 of the Code of Administrative Offenses of the Russian Federation applies equally to organizations and individual entrepreneurs.

Violations of cash discipline include:

— making cash payments with other organizations in excess of the established amounts;

— non-receipt (incomplete receipt) of cash to the cash desk;

— failure to comply with the procedure for storing available funds;

— accumulation of cash in the cash register in excess of established limits.

On a note

According to the Directive of the Central Bank of the Russian Federation dated June 20, 2007 No. 1843-U, cash payments between organizations, individual entrepreneurs, as well as between an organization and an individual entrepreneur cannot exceed 100 thousand rubles. within the framework of one agreement concluded between these persons.

The above violations entail a fine:

— for officials in the amount of 4,000 to 5,000 rubles;

— for legal entities – from 40,000 to 50,000 rubles.

Who will be checked first?

The Federal Tax Service of Russia drew the attention of tax inspectors that the priority is tax control over the use of cash register equipment and the completeness of revenue accounting by taxpayers who do not use the taxation system in the form of UTII.

Features for payment agents

The paying agent is required to keep separate records:

- cash, except for money accepted by him as a paying agent;

— cash from the paying agent.

In this regard, the paying agent:

a) when determining the cash balance limit, does not take into account the funds accepted by him while carrying out activities as a paying agent;

b) at the end of the day, at the end of the day, for funds received via cash register, issues two cash receipt orders 030001:

- for the amount excluding cash accepted by him as a paying agent;

- for the amount of money accepted by him as a paying agent;

c) maintains two cash books 030004: without taking into account the activities of the paying agent and for the activities of the paying agent.

On a note

A payment agent is a legal entity, with the exception of a credit organization, or an individual entrepreneur, carrying out activities of accepting payments from individuals aimed at fulfilling the monetary obligations of the payer of funds to the supplier to pay for goods (works, services), including payment for housing premises and utilities. At the expense of funds received from individuals, the payment agent carries out settlements with suppliers on behalf of individuals (Articles 2, 3 of the Federal Law of June 3, 2009 No. 103-FZ).

Setting up and creating a cash book in 1C 8.3

The cash book is generated in two modes:

- Based on your own activities. Cash transactions for their main activities are displayed in accounts 50.1 Cash of the organization, 50.21 Cash of the organization in foreign currency.

- According to the activities of the paying agent. Agency transactions go to account 50.4 Cash for the activities of the paying agent.

The cash book is generated according to the following settings:

- Select period;

- Formation mode: by main activity or by the activity of the paying agent;

- If necessary, display the reasons for cash orders;

- When the cash book is prepared at the end of the reporting (tax) period, check the box for the formation of the cover and end sheet:

Features of tax accounting of cash transactions

Article 313 of the Tax Code of the Russian Federation establishes that tax accounting is a system of summarizing information to determine the tax base for a tax based on data from primary documents, grouped in accordance with the procedure provided for by the tax code.

If the accounting registers do not contain enough information to determine the tax base in accordance with the requirements of the Tax Code of the Russian Federation, the taxpayer has the right to independently supplement the applicable accounting registers with additional details, thereby forming tax accounting registers, or maintain independent tax accounting registers.

Tax accounting is carried out in order to generate complete and reliable information on the accounting procedure for tax purposes of business transactions carried out by the taxpayer during the reporting (tax) period, as well as to provide information to internal and external users to monitor the correctness of calculation, completeness and timeliness of calculation and payment in income tax budget.

The tax accounting system is organized by the taxpayer independently and is applied consistently from one tax period to another. The procedure for maintaining tax accounting is established by the taxpayer in the accounting policy for tax purposes, approved by the relevant order or executive order. Tax and other authorities do not have the right to establish mandatory forms of tax accounting documents for taxpayers.

Changes in the procedure for maintaining tax accounting are carried out by the taxpayer in the event of changes in the legislation on taxes and fees or applied accounting methods. The decision to make changes to the accounting policy for tax purposes when changing the applied accounting methods is made from the beginning of the new tax period, and when changing the legislation on taxes and fees, no earlier than from the moment the changes in the norms of this legislation come into force.

If the taxpayer began to carry out new types of activities that he had not previously carried out, he is also obliged to determine and reflect in the accounting policy for tax purposes the principles and procedure for reflecting such types of activities for tax purposes.

Tax accounting data must reflect the procedure for forming the amount of income and expenses, the procedure for determining the share of expenses taken into account for tax purposes in the current tax (reporting) period, the amount of the balance of expenses (losses) to be attributed to expenses in the following tax periods, the procedure for forming the amounts of created reserves , as well as the amount of debt for settlements with the budget for taxes.

Tax accounting data is confirmed by:

- primary accounting documents (including an accountant’s certificate);

- analytical tax accounting registers;

- calculation of the tax base.

Forms of analytical tax accounting registers must necessarily contain the following details:

- register name;

- period (date) of compilation;

- transaction meters in physical and monetary terms;

- name of business transactions;

- signature and transcript of the signature of the person responsible for compiling these registers.

The content of tax accounting data, including data from primary documents, is a tax secret. Persons who have access to information contained in tax accounting data are required to maintain tax secrets. For its disclosure they bear responsibility established by current legislation.

The simultaneous use of primary documents for accounting and tax purposes is possible, but in practice this cannot always be realized. First of all, this is due to the fact that the documentation of accounting transactions is strictly regulated by the documents of the system of regulatory regulation of accounting and the current Law on Accounting. With regard to primary tax accounting documents, the Tax Code of the Russian Federation is most often limited to only general recommendations.

Consequently, copies of the corresponding primary documents used in accounting can serve as primary accounting documents in tax accounting.

It is more rational to regroup data from primary accounting documents in accordance with the goals and objectives of tax accounting and prepare them in the form of accounting certificates.

When developing analytical tax accounting registers, one should be based on the requirements established by Articles 313 and 314 of the Tax Code of the Russian Federation.

Article 314 of the Tax Code of the Russian Federation determines that analytical tax accounting registers are consolidated forms of systematization of tax accounting data for the reporting (tax) period, grouped in accordance with the requirements of Chapter 25 of the Tax Code of the Russian Federation, without distribution among accounting accounts.

Tax accounting data is data that is taken into account in development tables, accountant’s certificates and other taxpayer documents that group information about taxable objects.

The formation of tax accounting data presupposes the continuity of reflection in chronological order of accounting objects for tax purposes (including transactions, the results of which are taken into account in several reporting periods or are postponed for a number of years).

Analytical accounting of tax accounting data must be organized by the taxpayer in such a way that it reveals the procedure for forming the tax base.

Analytical registers are designed to systematize and accumulate information contained in primary documents accepted for accounting, analytical tax accounting data for reflection in the calculation of the tax base.

Tax accounting registers are maintained in the form of special forms on paper, electronically and any computer media.

The correct reflection of business transactions in tax accounting registers is ensured by the persons who compiled and signed them.

When storing tax accounting registers, they must be protected from unauthorized corrections.

Correction of an error in the tax accounting register must be justified and confirmed by the signature of the responsible person who made the correction, indicating the date and justification for the correction made.

When developing primary tax accounting forms, one should proceed from the fact that they should separately reflect data accepted for accounting and tax accounting in full, and data on the organization’s income and expenses, which for taxation and accounting purposes are accepted in full. various amounts. The Tax Code of the Russian Federation proposes to supplement the applicable accounting registers with additional details if the accounting registers do not contain enough information to determine the tax base. In practice, it may be advisable to prepare separate accounting statements for all types of income and expenses of the organization involved in calculating the tax base - regardless of whether they are accepted for tax accounting in the amounts reflected in the accounting records or are accepted in full.

Cash book of a separate division in 1C 8.3

The question often arises of how to maintain a cash book by division in 1C 8.3, if the enterprise actually has two cash registers: a central one and a separate division.

In 1C Accounting 8.3 for not very large enterprises it is not possible to maintain two cash registers. Thus, in the database of an organization with a separate division, only the “head” cash book will be formed. The ability to maintain several cash registers in one database for the main activity is provided only by 1C Accounting 8.3 CORP.

And in the basic version and version PROF 1C Accounting 8.3, account 50.02 available in the plan is intended for accumulating and transferring funds through the cash desk of a separate division, but not a single transaction involving account 50.02 will be included in the cash book. Moreover, if it is necessary for documents for the central cash register to be numbered consecutively continuously, you will have to manually adjust the numbers of cash documents with the account 50.02.

How to restore the chronological numbering of cash documents in 1C 8.3 using Express check, read our article.

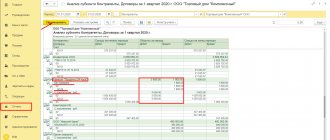

This is what it looks like. Let's consider in the basic version and the PROF 1C Accounting 8.3 version the receipt of revenue from a separate division and its delivery to the head division, and then to the bank in one day:

- PKO 9: Dt 50.02 Kt 90.01.1 – 26,000 rub. (revenue from a separate division was received);

- RKO 11: Dt 57.01 Kt 50.02 – 26,000 rub. (the OP’s revenue was transferred to the central cash desk);

- PKO 10: Dt 01 Kt 57.01 – 26,000 rub. (the OP’s revenue is credited to the central cash desk);

- RKO 12: Dt 51 Kt 01 – 26,000 rub. (OP's revenue from the central cash desk is deposited in the bank):

Note! Four documents: PKO 9, PKO 10, RKO 11 and RKO 12, but only two were reflected in the cash book: PKO 10 and RKO 12:

The cash register of a separate division will have to be maintained in a separate database or manually.

Results

There are two possible ways to maintain a cash book on a PC: with printing, subsequent stapling and storage on paper, or completely electronically using certain mechanisms against unauthorized access and electronic signatures.

Which one to choose depends on your technical capabilities and willingness to use new technologies in your work. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

If the turnover according to documents and postings does not match in 1C 8.3

Often, when 1C 8.3 displays the cash book on the screen, you can see the message: “The turnover of documents and transactions for “hh.mm.yyyy h.mm.ss” do not match!”

In this case, it is necessary to check whether all cash orders generated transactions for cash transactions.

For example, receipt of payment for a retail sale, if this did not occur at the NTT warehouse (manual retail outlet), then it must be recorded in two documents: the PKO and the retail sales report. The PKO creates an entry in the cash book, and the Retail Sales Report generates transactions to the appropriate accounts.

Preventing errors in the cash book

The cash book in 1C 8.3 is a report. But he does not exercise control over the correct conduct of cash transactions. And if the cash balance limit in the cash register is not observed or, conversely, a negative balance is formed on some date, the generated cash book will not “signal” about this.

From the list of cash documents, you can print form KO-3 “Journal of registration of cash documents.” This report will allow you to check for errors in the numbering of cash documents.

Therefore, in order to avoid errors in the cash book, it is necessary to conduct an Express check of accounting for cash transactions. The check is launched from the Reports menu – Express check of accounting, Cash Operations tab:

What to do if express check in 1C 8.3 gives an error for cash transactions, read our article.

The results of the check are reflected in the table, and recommendations for elimination are also given there:

A correctly created cash book only needs to be printed!

How you can monitor the correct compliance with the cash limit set by the bank in 1C 8.2 is discussed in the following video:

The electronic cash book does not need to be printed every day

Having come to check the cash register, the inspectors did not find a printout of the company's cash book for the period they were interested in. They tried to impose a fine. But the court made a different conclusion: if the cash book is kept electronically, it is not necessary to print it out every day.

Arguments of the tax authorities The company did not capitalize funds in the amount of more than 500,000 rubles received at the cash desk for the period from September 1 to September 3, 2008.

This conclusion is made due to the fact that at the time the inspectors arrived, there were discrepancies between the information on the fiscal report tape and the revenue reflected in the organization’s cash book.

That is, the Procedure for conducting cash transactions, approved by the decision of the board of directors of the Central Bank of the Russian Federation dated September 22, 1993 No. 40, was violated. This entails sanctions under Article 15.1 of the Code of Administrative Offenses of the Russian Federation. In this case, the fine is 40,000 rubles.

Taxpayer's Arguments

In fact, the cash book was kept, information was entered there in a timely manner and in full. Another issue is that the document was printed only once a week, and the information at the end of the day was reflected in an electronic version.

However, this is not a violation. According to paragraph 25 of the Procedure for Conducting Cash Transactions... the cash book at an enterprise can be maintained in an automated way - subject to the complete safety of cash documents, that is, in electronic form. At the moment when the tax authorities came with the check, the week had not yet ended, which is why the company could not provide them with printouts. But this is not her responsibility.

Court findings

The cash book can indeed be maintained electronically. The fact that inspectors were not provided with printed sheets is not a violation.

The main thing is that the electronic version contains relevant and reliable information. So it was, at least the tax authorities did not prove otherwise.

Accordingly, their decision to bring them to justice for violating the procedure for handling cash under Article 15.1 of the Code of the Russian Federation on Administrative Offenses is illegal.

From the editor

We are faced with a rare situation when the court’s opinion, favorable for the company, is also completely shared by the higher tax authority.

Back in February 2006, in a letter from the Federal Tax Service of Russia in Moscow, a similar situation was considered: inspectors came with an inspection on December 13, 2005 and received all the necessary documents, except for the cash book and primary cash documents for the period from December 1 to December 8, 2005.

The reaction was an attempt to fine the company under Article 15.1 of the Code of Administrative Offenses of the Russian Federation, although the chief accountant explained that the necessary documents are maintained electronically, are printed once a week and were simply not printed when the inspectors arrived.

The Tax Administration considered that in this case there is no reason to fine the company under this article, since there is no event of an administrative offense (letter of the Federal Tax Service of Russia for Moscow dated February 27, 2006 No. 09-24/14819).

In general, maintaining a cash book in electronic form is, of course, very convenient, and it is unlikely that anyone will want to print it out every day, wasting time and resources on this.

However, if your company decides to switch to electronic document management, we recommend that you include this in your accounting policies. In case of a dispute, this will be another argument in your favor.

Source: resolution of the Federal Antimonopoly Service of the Moscow District dated March 11, 2009 No. KA-A40/1416-089