A universal adjustment document includes an adjustment invoice and a notice of changes in the price of goods, services, etc. The document is important for companies that pay VAT, so you need to take it seriously so that the tax office does not have any complaints. Let us tell you in more detail what this paper is and how to correctly enter all the information into it.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

General information

The tax office, in its letter dated October 17, 2014 No. ММВ-20-15/ [email protected], recommended a new document to firms - a universal adjustment document. The form itself is published in Appendix No. 1 to the letter; the rest tell us in what situations it needs to be filled out, how to do it correctly, etc.

The nature of this form is advisory, so organizations decide for themselves whether they will use this paper or not.

The document is formed on the basis of Federal Law No. 402 of December 6, 2011 (“Accounting Law”), since a change in the price of a product after it has been sent is a fact of the organization’s economic life and must be confirmed by a primary accounting document.

In addition, paragraph 3 of Art. 168 of the Tax Code of the Russian Federation states that if the value of goods sent or transferred, etc. changes. The selling organization must issue an adjustment invoice (hereinafter referred to as CFI) 5 working days in advance. The CSF form itself is already included in the UKD - it is placed in a black frame.

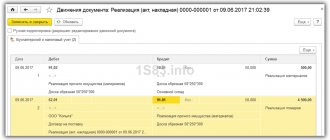

Registration of adjustment invoices by the buyer

When the cost of purchased goods decreases, the buyer must register an adjustment invoice or source document (for example, an invoice with a discount) in the sales ledger.

This must be done in the quarter when the “primary” with the new cost of goods or an adjustment invoice (depending on what happens first) is received from the seller. In this case, columns of the sales book 5, 6, 13a, 13b, 14, 15, 16, 17, 18 and 19 are filled in based on the data of the adjustment invoice.

Thus, the buyer recovers part of the VAT previously accepted for deduction.

note

He does not need to submit an updated declaration for the period when the goods were accepted for registration, and he does not need to pay penalties.

Adjustment invoices received by buyers when the cost of shipped goods increases are registered by them in the purchase book (clause 13 of article 171 of the Tax Code of the Russian Federation). Purchase book columns 2b, 2c, 7, 8a, 8b, 9a and 9b are filled in based on the data from the adjustment invoice.

Based on the adjustment invoice, the buyer deducts the difference between the new (higher) VAT amount and the tax amount in the original invoice.

note

The buyer can claim a deduction within three years from the date of drawing up the adjustment invoice by the seller (Clause 10, Article 172 of the Tax Code of the Russian Federation). There is no need to submit an updated VAT return for the period when the goods were accepted for registration.

When companies fill out the UCD

The document is used:

- If the cost of a previously completed delivery has changed due to a change in price and/or clarification of the number of goods shipped, etc. and the proposal for change comes from the seller, whether the buyer's consent is required or not (if agreements were previously established).

- If the seller needs to document agreement with the buyer company’s claim in case of detection of shortcomings in the quantity and quality of goods, etc. upon their acceptance and the document on the discrepancy was not signed by the seller’s authorized representative.

The document does not need to be used:

- If the price has changed due to the seller making any errors in the documents.

- If there is a situation for which it is necessary to use a special procedure for processing paperwork (return of goods, for example).

Results

After a shipment has already been made, it may be necessary to adjust the data on the quantity or price of goods sold in connection with reaching an agreement to change 1 of these indicators. In this case, an adjustment document is drawn up reflecting the original shipment data, their new value and the amount of change. Such a document is not used to correct errors made during registration.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to fill out the UCD

There are many details in the form, let’s look at each of them.

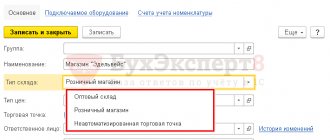

What is UCD status and what to note

This information is for informational purposes only. Select code “1” if the document acts as a CSF + primary document, that is, an agreement or notification of a price change. In this case, the paper will be the basis for deducting VAT.

The number “2” is written if the document is used only as a primary accounting document, that is, it is simply an agreement or notification of a price change. Simplified business entities can use a document with status “2”; there will be no obligation to transfer VAT.

UKD hat

Here you need to indicate the following information (they are similar to what is written in the CSF form):

- Number of the document to be filled out, date.

- Which CSF is corrected (number and date). Fill in if necessary.

- Which invoice is generated for (also paper number and date). This item is not filled out if the document has status “2”.

- Number subject to adjustment.

Note! If the document acts as a CSF, then the number is assigned according to the general chronology of invoice numbering. You should take into account the special order of numbering of adjustment documents by separate divisions. When the UCD has status “2”, the number is designated according to the general order of numbers of adjustment documents. Such details as a number are not included in the list of mandatory ones in Art. 9 Federal Law No. 402-FZ.

- Name of the selling company, its address, INN, checkpoint.

- Name of the second party to the transaction, address, TIN, checkpoint.

- Name of the currency and its code.

What is important to know about dates! The paper indicates 2 dates: the date of compilation (line (1)) and the date when the buyer agreed to change the price of the goods (or the date of receipt of notification about the change in price) - this is line [13]. The first date is set by the seller, and the second by the buying company.

If the status is “1”, then the real date of execution of the primary document and the CSF is entered in line (1). The day of compilation is a mandatory requisite. According to the law, this document must be presented no later than 5 calendar days from the date of formation of the papers on the basis of which the cost of goods is changed.

If the contract with the client does not indicate that when the price changes, his consent is required, then the UCD is issued only to notify the buyer, and the date of issuing the UCD will be the same as indicated in line (1). If consent is required, then the date indicated in line [13] will be considered such a date.

If the status is “2”, then the date of the transaction must be indicated (Article 9 of Federal Law No. 402-FZ).

The dates in lines (1) and [13] may be the same or different: in line [13] a later date is noted than in (1).

Change in the cost of goods (work, services) after shipment. Universal adjustment document

(Letter of the Federal Tax Service of the Russian Federation dated October 17, 2014 No. ММВ-20-15/ [email protected] “On adjusting the universal transfer document”)

A change in the total cost of delivery after the fact of shipment (in the absence of errors in its registration) may be due to a change in price (tariff) and (or) a change in the quantity (volume) of goods shipped (work performed, services rendered), or transferred property rights.

This change in requirements

and obligations of the seller and buyer as a fact of economic life in accordance with clause 8 of Art.

3 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” is subject to registration as a primary accounting document

.

Before the release of the commented letter, a single unified form of the document

, which is subject to registration of the specified fact of economic life,

has not been established

.

In this case, the seller and buyer can formalize the change

the amount of claims and obligations

in any independently determined form

(provided that it contains all the mandatory details established by Part 2 of Article 9 of Law No. 402-FZ).

Chapter 25 of the Tax Code of the Russian Federation for special requirements

there is no requirement

to register such transactions for the purposes of calculating income tax .

Therefore, the primary accounting document

, compiled on paper (or in the form of an electronic document)

in any form

that meets the specified requirements, may

be the basis for reflecting the amount indicated in it

in the tax registers (

Article 313 of the Tax Code of the Russian Federation

).

From paragraph 10 of Art. 172 Tax Code of the Russian Federation

It follows that

the presence of a document

(contract, agreement, other primary document)

confirming the consent

(fact of notification) of the buyer

to change the cost of goods shipped

(work performed, services provided), transferred property rights,

is the basis for the seller to issue an adjustment invoice

in in the manner established

by clause 5.2 of Art.

169 Tax Code of the Russian Federation .

At the same time, Chapter 21 of the Tax Code of the Russian Federation and Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 do not contain restrictions on the introduction of additional details into the forms of adjustment invoices

.

Thus, according to the Federal Tax Service of the Russian Federation, information on adjustment invoices can be combined with information related to the document

, confirming the consent (fact of notification) of the buyer to change the cost of shipment.

Such a comprehensive document

subject to the requirements of Law No. 402-FZ and Chapter 21 of the Tax Code of the Russian Federation, it allows an economic entity

to use the right to a tax deduction for VAT

(seller and buyer on the basis of

clause 13 of Article 171 of the Tax Code of the Russian Federation

), as well as

corporate income tax (and other taxes).

The Federal Tax Service of the Russian Federation recommends for use the developed form of a universal adjustment document

(

UCD

) based on the form of the adjustment invoice.

As well as the form proposed earlier in the letter of the Federal Tax Service of the Russian Federation dated October 21, 2013 No. ММВ-20-3/ [email protected] UPD

, the UCD form is

advisory in nature

.

Non-use of this form

for registration of cases of changes in the cost of shipment

cannot be a basis for refusal to take these changes into account for tax purposes

.

In addition, the proposal of this form does not limit the rights of economic entities

to use other independently developed and complying with the provisions of Art. 9 of Law No. 402-FZ of the forms of primary accounting documents and the form of adjustment invoices established by Resolution No. 1137.

Changes in the total cost of delivery may also be

due to

errors made by the seller

in the documents originally drawn up upon shipment.

errors in the UTD originally issued upon shipment.

and in other indicators, except for the total cost of delivery.

Recommended ways to correct information contained in the originally issued UPD

, are presented in Appendix No. 7 to the commented letter.

Cases of registration of the UKD form

The UKD form can be used to formalize changes in the total cost of previously produced

(properly documented)

delivery due to a change in price

(tariff)

and

(or)

change in the quantity

(

volume

)

of goods shipped

(work performed, services provided), transferred property rights,

in the case where the proposal for such a change comes from the seller and requires the buyer's consent

to such a change or does not require it.

The UCD form can also be used to document the seller’s agreement with the buyer’s claim

when the latter identifies

a discrepancy in the quantity and quality of goods

(work, services, property rights) upon their acceptance (without registration), if the document on discrepancies was not signed by the seller’s representative (unilateral act on discrepancies).

Moreover, when the parties sign a bilateral agreement on discrepancies

When accepting goods,

an additional primary document

about the change in the financial status of the seller and buyer

is not required

.

Availability of signatures of the seller and buyer

such a document

indicates

not only a change in the state of settlements between them, but also

the buyer’s consent to such a change

in the cost of shipped goods in connection with the clarification of their quantity, which, according to

clause 3 of Art.

168 of the Tax Code of the Russian Federation is sufficient for the seller to issue an adjustment invoice without additional documents .

The UCD form does not apply in all cases of return

(movement from buyer to seller) of goods accepted by the buyer for registration.

The UCD form is not intended

for use in cases where

a change in the total cost of shipment

is due to an error made by the seller

in the initial set of documents

accompanying the shipment (UPD, other primary accounting document for shipment and invoices).

Correcting such errors

in the previously applied form, UPD can be carried out in the manner specified in Appendix No. 7 to the commented letter.

In this case, issue a separate adjustment invoice

when the cost of shipped goods (work performed, services rendered) changes, transferred property rights

are not required

.

However, the form can only be used as a primary accounting document

to document a fact of economic life, expressed in a change in the cost of previously shipped goods (work, services, property rights) (

document status

– “

2

”).

Then the document is not filled

(or dashes are placed in the appropriate fields)

indicators

established as mandatory

exclusively for the adjustment invoice

:

– “to the invoice (invoices) No. ... from ..., taking into account the correction No. ... from ..." (line 1b);

– “including the amount of excise tax” (column 6);

– “tax rate” (column 7).

In the field of line (1) the date and serial number of the adjustment are entered, and the date and number of the UPD or other primary accounting document, the indicators of which are being adjusted, are indicated in line [5].

Using the proposed document form with the name “Adjustment Invoice” in the status of only a primary accounting document

organizations and entrepreneurs

that are not VAT payers does not entail

for them the obligation to calculate and pay VAT to the budget (at the same time, such organizations will not have values in the indicators of columns 7 and 8).

Document status used by economic entities

It is recommended to place it in the upper left corner of the form.

Determination in the UCD form of indicators established as mandatory

When an organization uses a document with status “1” as a basis for applying the right to deduct VAT

It is recommended to check the indicators of lines (1)–(4), columns (1)–(9) and the signatures of the head of the organization (or other authorized person) and the chief accountant (or other authorized person) for compliance with the requirements of

clauses 5.2

and

6 of Art.

169 of the Tax Code of the Russian Federation , taking into account the provisions

of paragraph.

2 paragraph 2 of this article.

When using the UKD by an individual entrepreneur

requirements

for the content of information about the signatory

established

by clause 6 of Art.

169 of the Tax Code of the Russian Federation for this category of economic entities.

When an organization or individual entrepreneur uses a UCD document with status “1” or “2” as a primary accounting document

It is recommended to make sure that the information entered into it contains the indicators established as mandatory in paragraph 2 of Art. 9 of Law No. 402-FZ.

Document status

, indicated by the economic entity in the upper left corner of the UCD,

is for informational purposes only

.

Actual document status

determined by the presence/absence in it of all mandatory indicators established by Law No. 402-FZ in relation to primary accounting documents and (or)

clauses 5.2

and

6 of Art.

169 of the Tax Code of the Russian Federation regarding adjustment invoices.

Absence of line [13] “Date of the parties’ actions” in the document or a dash in it

give reason to believe that

the date of the actions of the receiving party coincides with the date of the actions of the transferring party

(with the date of drawing up the document (line 1) (unless otherwise follows from other documents).

Reflection of UCD indicators with status “1”* (adjustment invoice and agreement (notification)) in tax accounting in accordance with the requirements of Chapter 25 of the Tax Code of the Russian Federation

*When using the UKD only as an accounting document

(

document status “2” “Agreement

(

notification

)

”

), accounting for the transaction executed in this way for tax purposes is carried out in the general manner.

For the purpose of calculating income tax

when the cost of shipment changes downwards/increases, the primary accounting document drawn up upon the fact of a change in the total cost of delivery

may be the basis for

:

– appropriate adjustment of the cost of acquired assets from the buyer;

– appropriate adjustment of the seller’s revenue.

The main indicators

of the UKD are data on the cost of a unit of goods

(work, services, property rights)

before and after changes

.

Thus, this comprehensive document recommends documenting cases of revision of the unit price of goods by the parties

.

Seller's income tax

Unit price change

(cost of work, services provided, transferred property rights)

entails an adjustment of tax accounting data on the cost of

goods sold (work, services, property rights), that is,

tax liabilities for corporate income tax for the period of sale must be adjusted

.

When the price of a product decreases, pp. 19.1 clause 1 art. 265 of the Tax Code of the Russian Federation does not apply

.

At the same time, according to para. 3 p. 1 art. 54 Tax Code of the Russian Federation

the taxpayer has the right to

recalculate the tax base

and the amount of tax for the tax (reporting) period in which errors (distortions) relating to previous tax (reporting) periods were identified, in cases where the errors (distortions) led to excessive payment of tax.

To overpayment of tax

In this case, the profit of organizations

is caused by excessively recorded income

.

Therefore , the seller who provided a discount in the form of a reduction in the unit price of the product

(cost of work, services, property rights),

has the right to adjust

the tax base for corporate income tax

in the period of making relevant changes

:

– in the tax notice period

on the fulfillment of previously agreed conditions that determine the possibility of a subsequent change in value -

line indicator

(

1

);

– in the tax period, agreement with the buyer on changes in the cost of goods

(works, services, property rights) –

line indicator

[

13

].

When the cost of previously shipped goods increases

(work performed, services rendered, property rights transferred)

the norms of paragraph.

2 p. 1 art. 54 of the Tax Code of the Russian Federation do not apply .

Consequently, with an increase in the cost of previously shipped goods

(work performed, services provided, property rights transferred)

tax liabilities

for corporate income tax

must be adjusted

(

increased

)

for the tax period of recognition of income from sales

.

Buyer's income tax

Reducing the cost of purchased goods

(works, services, property rights)

as a result of a change in price

entails an adjustment of tax accounting data on the cost of purchased goods (works, services, property rights).

If the purchased goods have already been sold

, then it is necessary

to adjust

the tax base for income tax

for the tax period of recognition of expenses

.

Moreover, in the case when, according to clause 8 of Art. 254 Tax Code of the Russian Federation

when determining the amount

of material costs when writing off raw materials and materials

used in the production (manufacturing) of goods (performing work, providing services), in accordance with the accounting policy adopted by the organization for tax purposes,

the method of valuing raw materials and materials at average cost is used

, when changing ( recalculation) their prices must

be recalculated

(

adjusted

)

the average cost

of the corresponding material assets in tax accounting

starting from the period of capitalization until the moment of write-off

.

In the event of an increase in the cost of purchased goods

(works, services, property rights)

the taxpayer has the right to take into account the increase in cost

:

– in the tax notice period

on the fulfillment of previously agreed conditions that determine the possibility of a subsequent change in value (line indicator (1));

– in the tax approval period

with the buyer changes in the cost of goods (works, services, property rights) – line indicator [13].

The commented letter also provides the procedure for the buyer to reflect the UCD with status “1” in the sales book and purchase book

, as well as in the log of received and issued invoices, and

the procedure for making corrections

in connection with the detection of errors in the UPD form

Main part

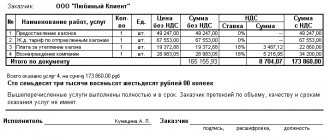

Here you need to fill out the table. It is similar to that presented in the adjustment document.

What needs to be entered:

- Serial number of the record. These are additional details to fill out. It is indicated at will.

- Product/service/work code. It is also not considered mandatory for inclusion in the document.

- Name of the product or description of the work performed, services provided, etc.

- Indicators in connection with changes in the cost of goods.

- Unit of measurement and its code according to OKEI.

- Quantitative indicators.

- Cost indicators.

- Excise tax amount. There is no need to write anything if the document has status “2”.

- Tax rate. There is no need to write anything if the document has status “2”.

- Tax amount.

- Total cost.

At the end of the table you need to summarize the results - indicate the resulting cost.

Next, you need to indicate the details of the transfer/shipping papers, the basis document for the cost adjustment and any other data.

Features of signing

The UKD form contains 6 lines for signing the document. Signatures under the table are always affixed when the paper status is “1”. The head of the company or authorized representative and the chief accountant sign there. If the UCD status is “2”, such signatures are not required.

In the signature lines [8] and [9], it is necessary to note the employee who has the right to offer the buyer to change the price of goods or notify about such a fact. You need to write the employee's position and full name. If he has the right to sign this paper, then he does not need to sign it again. You can only indicate your position and full name.

In line [10] it is necessary to note information about the employee who is responsible for documenting the fact of the company’s economic life. This person may coincide with what is indicated above (lines [8] and [9]): similarly, only the position and full name are indicated without a signature.

In line [12] enter data about the employee who has the right to agree on changes in the cost of goods, etc. on behalf of the buyer, if this action is required. In line [14] the employee who is responsible for registering the fact of the economic life of the organization signs. If this is the same employee as in line [12], then indicate the full name and position, and there is no need to sign a second time.

Important! You can read about filling out an invoice and CSF in our article.