An organization that has received a profit faces a logical question: “What should it be distributed to?” For example, it may decide to pay dividends to the founders or increase the reserve fund.

The accrual and payment of dividends is an integral part of business operations when maintaining records in an LLC. In this article we will look at:

- how to calculate dividends in 1C 8.3 Accounting;

- how to quickly and easily arrange the payment of dividends to the founders in 1C 8.3;

- what kind of wiring to create in 1C 8.3.

Restrictions on dividend payments

Payment of dividends is an operation quite strictly regulated by the legislation on LLCs (Federal Law of February 8, 1998 No. 14-FZ) and on JSCs (Federal Law of December 26, 1995 No. 208-FZ).

Before making a decision on dividends, you need to make sure that the company currently has no restrictions on paying dividends:

- The LLC or JSC does not have any signs of insolvency (bankruptcy) and these signs will not arise in the event of payment of dividends;

- the value of the net assets of an LLC or JSC exceeds the authorized capital and reserve fund (if any) and will not decrease after payment of dividends (clause 2 of Article 29, clause 1 of Article 30 of the Law on LLC, clause 4 of Article 43 of the Law on JSC ).

But the conditions for paying dividends are different for LLCs and JSCs.

Payment of dividends in 1C 8.3 Accounting

To issue a payment order in 1C, we recommend using the Pay , since in this case a Payment order is created not only for the payment of dividends, but also for the payment of taxes.

Be sure to access each Payment Order using the link and check them before sending them to the bank.

Clicking the Send to Bank will launch the Client—Bank.

How to set up Client-Bank in 1C, as well as quickly and easily download bank statements, see topic 6.12: Electronic exchange through Client Bank course Accounting and Tax Accounting in 1C: Accounting 8th ed. 3 from A to Z.

If you do not use Client Bank selecting unpaid payment orders Select button in the bank statement journal.

Payment of dividends to the founder-individual - postings in 1C 8.3

Use the Pay and generate payment orders.

When you receive your bank statement, please show the actual debit.

Postings

Upon actual payment, the personal income tax registers will set the actual Date of receipt of income , and the old data on the planned date will be displayed with a minus.

Payment of dividends to the founder-organization - postings in 1C 8.3

The payment to the founder-organization is processed in the same way, only the postings will not contain personal income tax data.

Use the Pay and generate payment orders.

When you receive your bank statement, please show the actual debit.

Postings

Personal income tax payment

After paying dividends, do not forget to pay personal income tax to the budget. This must be done no later than the next business day.

When you receive your bank statement, please show the actual debit.

Postings

Payment of income tax

After paying dividends, do not forget to pay income tax to the budget. This must be done no later than the next business day.

When you receive your bank statement, please show the actual debit.

Postings

We have looked at how to reflect dividends and transactions in 1C 8.3.

Conditions for paying dividends in LLC

The decision to pay dividends to the LLC is made by the general meeting of participants. The presence of such a decision is mandatory for the payment of dividends. They are paid in proportion to the size of the shares of the LLC participants (or in another way - as written in the charter).

The decision of the general meeting of participants determines the timing and procedure for paying dividends.

The period for their payment should not exceed 60 days from the date of the decision on the distribution of profits between the LLC participants (subclauses 1, 2, 3 of Article 28 of the LLC Law).

Conditions for paying dividends to JSC

In a joint-stock company, the decision on the payment of dividends is made by the general meeting of shareholders. The peculiarity is that dividends in joint stock companies are paid according to the order in which they are declared, and the order depends on the category (type) of shares.

First, decisions are made to pay dividends on all preferred shares, and then on ordinary shares.

The decision of the general meeting of shareholders must determine (clause 3 of article 42, clauses 2, 3 of article 43 of the Law on JSC):

- the amount of dividends on shares of each category;

- form of payment;

- the procedure for paying dividends in non-cash form;

- the date on which persons entitled to receive dividends are determined.

In addition, if a JSC has a board of directors, its recommendations on the amount of dividends are necessary to pay dividends (clause 4 of Article 42, clause 1 of Article 64 of the Law on JSC).

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Consultations on accounting and taxation » Income tax » Accounting for accrued but not received dividends from equity participation in a foreign organization, in accounting and tax accounting

Question

How to take into account accrued but not received dividends from equity participation in a foreign organization in accounting and tax accounting? And should accrued dividends be reflected in the income tax return?

Expert's answer

In accordance with paragraph 1 of Art. 43 of the Tax Code of the Russian Federation, any income received from sources outside the Russian Federation, related to dividends in accordance with the laws of foreign countries, is recognized as dividends for profit tax purposes.

Dividends received by the organization are recognized as non-operating income (clause 1 of Article 250 of the Tax Code of the Russian Federation).

The date of receipt of income in the form of dividends, regardless of the method of accounting for income and expenses used by the organization, is the date of receipt of funds to the current account of the participating organization. With the accrual method, this date is determined based on paragraphs. 2 clause 4 art. 271 of the Tax Code of the Russian Federation, and with the cash method - by virtue of clause 2 of Art. 273 Tax Code of the Russian Federation.

The income tax declaration indicates the amount of dividends received (clauses 5.2, 5.3, 6.2 of the Procedure for filling out the declaration), so for now the amount of only accrued dividends does not need to be reflected in the declaration.

The amount of dividends is included by the organization in income from ordinary activities if participation in other organizations is the subject of its activities, or is recognized as other income (clauses 4, 5, 7 of the Accounting Regulations “Organizational Income” PBU 9/99, approved Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n). In this consultation, we proceed from the fact that participation in the authorized capitals of other organizations is not the subject of the organization’s activities and dividends are taken into account as other income.

In accounting, the amount of income is determined in an amount equal to the amount of cash and other property received and (or) the amount of accounts receivable, that is, in the amount specified in the decision on the distribution of profit (clause 10.1, 6 of PBU 9/99). The Ministry of Finance of Russia in Letter dated December 19, 2006 N 07-05-06/302 recommends recognizing receipts in the form of dividends as income in the amount minus the amount of tax withheld by the tax agent in accordance with the legislation of the Russian Federation on taxes and fees.

According to clause 16 of PBU 9/99, income in the form of dividends is recognized when the conditions stipulated in clause 12 of PBU 9/99 are met, that is, if the organization has the right to receive dividends (clause “a” of clause 12 of PBU 9/99 ), and also, if possible, determine the amount of dividends to be received (clause “b”, clause 12 of PBU 9/99). In this case, these conditions are met on the date of distribution of profits by the foreign company.

If the amount of dividends is determined and paid in foreign currency, then in accordance with clauses 4, 5, 6 of the Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” (PBU 3/2006), approved by the Order Ministry of Finance of Russia dated November 27, 2006 N 154n, Appendix to PBU 3/2006, income (dividends) due to the organization, as well as the debt of a foreign company (source of payment of dividends) are recognized in the amount calculated at the Bank of Russia exchange rate valid on the date of announcement of the decision on the payment of dividends . Subsequently, the receivables of the organization - the source of payment are recalculated on the reporting date, as well as on the date of tax withholding and debt repayment at the Bank of Russia exchange rate in effect on the specified dates (clauses 7, 8, 6 of PBU 3/2006).

Thus, in the situation under consideration, income in the form of dividends is recognized in accounting on the date of the decision to distribute the profit of a foreign company, and in tax accounting on the date of receipt of funds. In addition, the amount of income in accounting and tax accounting is determined based on various foreign exchange rates. At the same time, negative or positive exchange rate differences are recognized in accounting, which do not arise for profit tax purposes.

In the example below, the accounting option considers the situation if the foreign currency rate decreased:

| Contents of operations | Debit | Credit | Primary document |

| On the date of distribution of profit by a foreign company, income in the form of dividends is reflected | 76-3 | 91-1 | Decision on distribution of profits, Notification of the amount of dividends due, Accounting certificate-calculation |

| IT is reflected | 68 | 77 | Accounting statement for the reporting date |

| Negative exchange rate difference reflected | 91-2 | 76-3 | Accounting certificate-calculation |

| IT has been reduced | 77 | 68 | Accounting statement as of the date of receipt of funds |

| Negative exchange rate difference reflected | 91-2 | 76-3 | Accounting certificate-calculation |

| IT has been reduced | 77 | 68 | Accounting certificate-calculation |

| Reflects the withholding of tax on the amount of dividends by a foreign company | 68 | 76-3 | Accounting certificate-calculation |

| Received funds from a foreign company | 52 | 76-3 | Bank statement for foreign currency account |

| IT is extinguished | 77 | 68 | Accounting certificate-calculation |

The explanation was given by Maria Pavlovna Rogozneva, accounting and taxation consultant of LLC NTVP Kedr-Consultant, in January 2021.

When preparing the answer, SPS ConsultantPlus was used.

This clarification is not official and does not entail legal consequences; it is provided in accordance with the Regulations of the CONSULTATION LINE ().

This consultation has passed quality control:

Reviewer - Bushmeleva Galina Vladimirovna, professor of the Department of Accounting and ACD, Izhevsk State Technical University named after. M.T. Kalashnikov

Dividend payment form

Dividends can be paid:

- in kind;

- in monetary form.

Officials equate the in-kind form with sales, and when issuing dividends in property, they require VAT to be charged (see, for example, letters from the Ministry of Finance dated February 7, 2021 No. 03-05-05-01/7294, dated August 25, 2021 No. 03- 03-06/1/54596, letter of the Federal Tax Service dated May 15, 2014 No. GD-4-3/ [email protected] ).

The courts sometimes take a different position, but if you do not charge VAT, you will not be able to do without a trial.

Calculation of dividends

The accrual of dividends payable to the founders is reflected in accounting as follows.

The allocation of part of the profit of the reporting year to the payment of income to the founders (participants, shareholders, owners of property) of the company is reflected in the accounting on the date of the decision on the distribution of net profit (clauses 3, 5, 10 of PBU 7/98).

In this case, the accountant makes the following entries:

- Debit 84 “Retained earnings (uncovered loss)” Credit 75 “Settlements with founders”, subaccount “Settlements for payment of income”

- if the founder is a legal entity or individual who is not an employee of the organization;

- if the founder is an employee of the company.

The tax agent, that is, the company that pays dividends, is obliged to withhold and transfer income tax or personal income tax to the budget.

Withholding taxes

Tax withholding from accrued dividend amounts is reflected in accounting entries:

- Debit 75-2 Credit 68

- personal income tax or income tax is withheld (if the recipient of the dividends is an individual entrepreneur, an individual who is not an employee of the company, or a legal entity);

- personal income tax is withheld (if the recipient of the dividends is an individual who is an employee of the company).

Dividends are paid minus withholding tax and reflected in the following entries:

- Debit 70 (75-2) Credit 50 (51)

- dividends paid.

The transfer of withheld tax to the budget is reflected by the following posting:

- Debit 68 Credit 51

- the withheld income tax or personal income tax is transferred to the budget.

The rules for taxation of dividends are established by Article 275 of the Tax Code of the Russian Federation. The tax agent is responsible for the calculation and payment of tax on dividends. Recipients of dividends do not have to pay anything to the budget.

Dividends in 1C 8.3 Accounting

Dividend account

First, let's decide which dividend account in 1C to use. Settlements with the founders are reflected in account 75. The 1C chart of accounts provides the following sub-accounts:

For settlements with the founder on accrued and paid dividends, use account 75.02.

Analytical accounting of settlements with founders is carried out for each founder separately, but unlike standard analytical accounting, where most often Subconto = a separate directory, the Founders is not provided in 1C. This Subconto contains data from two separate directories, Individuals and Counterparties, to reflect the founders - legal entities.

When paying dividends to LLC participants, the Organization is recognized as a tax agent: it calculates, withholds and pays tax on the founder’s income to the budget.

Important! When working with founders, be sure to list the LLC member in the correct directory. The tax that the Organization must calculate depends on which directory the LLC participant is selected from:

- income tax - if the participant is selected from contractors (Article 275 of the Tax Code of the Russian Federation);

- Personal income tax - if the participant is selected from individuals (clause 1 of article 226 of the Tax Code of the Russian Federation).

The tax base

If the company that pays dividends did not itself receive dividends, then the tax on dividends distributed in favor of Russian participants is calculated simply. The tax base is taken as the amount of dividends, which is multiplied by the tax rate (clause 5 of Article 275 of the Tax Code of the Russian Federation).

If the company itself received dividends (except those taxed at a rate of 0%), then the tax on the amount of dividends of each specific participant will be calculated in two stages:

- first, from the amount of dividends accrued to all Russian participants, you need to subtract the amount of dividends received that were not previously taken into account when calculating the tax;

- The participant’s taxable amount is determined in proportion to his share in the total amount of all accrued dividends and multiplied by the tax rate.

Dividend tax rates

The types and amounts of taxes depend on who is the recipient of the dividends.

If the recipient is a Russian legal entity, then when paying dividends, income tax is withheld:

- at a general rate of 13% (subclause 2, clause 3, article 284 of the Tax Code of the Russian Federation);

- at a rate of 0%, if the payment is made to the parent company, and on the day the decision on payment is made, it owns 50% of the authorized capital of the company for at least a year (subclause 1, clause 3, article 284 of the Tax Code of the Russian Federation).

Personal income tax is withheld from Russian individuals at the following rates:

- 13% (clause 1 of article 224 of the Tax Code of the Russian Federation);

- 15% - when paying dividends in the amount of 5,000,000 rubles or more (paragraph 2, clause 1, article 224 of the Tax Code of the Russian Federation).

Read in the berator “Practical Encyclopedia of an Accountant”

Unclaimed dividends

Unreceived dividends

Calculation of dividends in 1C 8.3 Accounting

March 30 profit in the amount of 1,000,000 rubles. distributed among the LLC participants:

- LLC "AZBUKA COMFORT" (10% share) - 100,000 rubles.

- Trofimova Lyubov Andreevna (90% share) - 900,000 rubles.

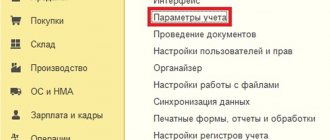

Go to the Salaries and Personnel and enter the document Accrual of dividends for each LLC participant:

- Recipient - the founder's affiliation with individuals or legal entities. The selected value affects the calculation of tax and the possibility of adjusting the calculated amount.

- Amount - the amount of manually calculated dividends.

Accrual of dividends - postings in 1C 8.3 (payment to an individual)

If the LLC participant is an individual, personal income tax will be calculated automatically without the possibility of adjustment. The tax rate at which personal income tax is calculated is determined by taxpayer status .

To view the current status of a taxpayer, go to the individual’s card and follow the link Income tax .

Postings

1C will not only generate postings for accounting and accounting records, but will also reflect the need to withhold personal income tax upon payment. At the same time, the planned date of receipt of income will be established in the personal income tax registers - the date of accrual of dividends + the maximum period for their payment of 60 days.

Study the flow chart for personal income tax registers in topic 9.3 Payroll for March of the course Accounting and Tax Accounting in 1C: Accounting 8th ed. 3 from A to Z.

Calculation of dividends - postings in 1C 8.3 (payment to a legal entity)

If the LLC participant is a legal entity, the income tax will also be determined automatically at a rate of 13%, but it can be changed manually. If a legal entity has shares in the authorized capital of 50% or more for more than one year, income is taxed at a rate of 0%. In this case, set the tax amount to zero.