The certificate of delivery and acceptance of completed work in the KS-2 form is the primary document that is used when handing over and accepting contract work for the construction of industrial, housing, civil and other facilities.

The act is drawn up on the basis of data entered in the Logbook of work performed. The document is affixed with signatures and seals of the customer (general contractor) and the contractor performing construction and installation work. The act is used when drawing up a Certificate of the cost of work performed and expenses in the KS-3 form.

Why do you need the KS-2 form?

This is an integral part of the mandatory final documentation, which is signed by the parties who have entered into a state contract for construction, installation and repair work (Rosstat Letter No. 01-02-9/381 dated 05/31/2005). The document signed by both organizations means that the parties have no claims to the volume and quality of the work performed and is the basis for further mutual settlements.

After the contractor fulfills its obligations under the government contract, the customer carries out inspection and acceptance. Confirmation of fulfillment of contract conditions is a signed act of acceptance of work performed - form KS-2. It is formed at the stage of closing the government order, after the supplier has fulfilled all obligations assigned to him, and the customer has checked the completeness and quality and accepted the work performed.

Which form to use

The final documentation for the procurement of construction, repair or installation activities is generated using a unified register - OKUD 0322005. Forms of the act and certificate were developed and enshrined in Resolution of the State Statistics Committee No. 100 of November 11, 1999. How to fill out KS-2 - an example of filling out and the content of the act depend on the type of work performed.

Although the form of the act is unified, the executor has the opportunity to modify it depending on his needs without violating current regulations.

How to fill out

First, let's look step by step at how to draw up the KS-2 act.

Step 1. Fill out the introductory part - the header of the form. Information about the investor is filled in if there is such an economic entity in the contractual relations of the parties.

The basis for entering information about the customer and contractor is their registration information. Here you need to indicate the name of both organizations, their address, contact phone number and OKPO of each party.

Step 2. Fill in the “Construction” column - the address of the construction site under a government contract. In the “Object” field, indicate the full name of the subject of the contract.

In the fields we indicate the type of activity of the organization according to OKDP, the details of the contract - the number of the government contract and its date.

Step 3. We generate information about the period of work and indicate the details of the act. It is assigned a number in order and its date is indicated. In the “Reporting period” plate we reflect the start and end dates of work.

Step 4. We enter the cost of construction, repair or installation work in accordance with the estimate. The amount must match the price of the work specified in the contract and be written in rubles.

Step 5. Fill out the table. To find out how to correctly fill out the KS-2 sample, you need to understand the formation of information in the tabular part of the form. The table of this act is a reflection of the estimate for performing work under a government contract. In this case, the form can accumulate data from several estimates.

All numbers in order (column 1), items according to the estimate (item 2) and the name of the work performed (item 3) are written down similarly to the lines of the estimate calculation. Numbers from the collections of federal unit rates (FER) are indicated in column 4 for each type of work, if available for this category. Column 5 reflects the unit of measurement - exactly as it is written in the estimate. It is not allowed to record the volume of work performed in percentage and proportional terms. Column 7 - “Price per unit in rubles.” — is formed using data from FER collections. If the terms of the contract require a fixed cost for contractual activities, then dashes are indicated in column 7.

Column 8 reflects the actual cost of work based on the estimate, which is an integral annex to the government contract. This column can also be filled in using the calculated values for each item from the collections of federal unit prices.

Step 6. When the customer verifies the data from the act with the estimate and actual volumes, the KS-2 act is signed by the manager or other responsible person.

The document is drawn up in two copies. The seal is affixed only if it is used by institutions. KS-2 also reflects all the comments that the customer makes to the contractor regarding inadequate quality, volume or deadlines.

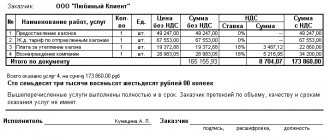

The correct sample for filling out the 2021 KS-2 form looks like this:

Why do you need the KS-3 form?

The result of the completion of contract work will be its acceptance by the customer organization and the signing of the KS-2 act. To approve the act and final acceptance of the work performed, the contractor draws up a KS-3 certificate.

A certificate of the cost of work performed and expenses in the KS-3 form is a document of a financial nature, on the basis of which the cost of contracting activities is approved. In accordance with this documentation, the results of the execution of the government contract are reflected in the accounting records.

The form reflects information about the total cost and expenses for the object of repair, construction or installation activities. The certificate also indicates costs not taken into account in the estimate (price increases, rental costs, etc.).

Which form to use

KS-3 is filled out according to the unified form OKUD 0322001. Unlike the act, which the executor can modify to suit his needs, the format and content of the certificate are prohibited from changing. You cannot enter new information or remove data lines.

How to compensate VAT under the simplified tax system

The simplified tax system exempts you from paying VAT. But the Tax Code of the Russian Federation provides for several situations when payers of the simplified tax system keep VAT records:

- Execution of construction contracts with companies on OSNO - it is necessary to take into account and compensate for the costs of VAT, which is paid as part of the cost of materials, fuels and lubricants, and consumable tools.

- Import of foreign goods into the Russian Federation for trade - VAT must be charged on the transaction amount and customs duties paid and then transferred to the budget upon sale (clause 3 of Article 346.11 of the Tax Code of the Russian Federation).

- Execution of trust management agreements, simple and investment partnerships, if one of the participants on the simplified tax system, and the second on the OSNO - simplified one, keeps records and pays VAT on all transactions within the framework of the agreement (Article 174.1 of the Tax Code of the Russian Federation).

- Rent or purchase of municipal property into the ownership of a simplified person - VAT should be allocated from the transaction amount, paid to the budget and submitted as a tax agent declaration (clause 3 of Article 161 of the Tax Code of the Russian Federation).

- Issuance by the supplier of an invoice on the simplified tax system indicating the amount of VAT at the request of the buyer - it is necessary to pay the tax and submit reports (clause 5 of article 173 of the Tax Code of the Russian Federation).

In the article we will consider the first situation, since in a construction contract, with the help of VAT compensation, tax risks can be legally minimized.

Why and when is VAT compensation calculated?

VAT compensation is a tax instrument that gives simplified taxation tax payers the opportunity to work with customers on OSNO. Compensation allows you to take into account and deduct VAT paid by simplifiers when purchasing raw materials, materials, fuels and lubricants used in construction work. The amounts of such VAT form the contractor’s costs, which must be covered by the contract price (Article 709 of the Civil Code of the Russian Federation).

When a contractor using the simplified tax system performs work for the customer using OSNO, both are at risk in the event of errors in accounting. The customer - in that the tax paid to the contractor will not be included in the VAT deduction.

The contractor runs the risk that the tax authorities will recognize the tax amount as unjust enrichment and reduce the contract price by the tax amount.

To prevent this from happening, it is important to correctly prepare all primary and accounting documents from the very beginning.

The general scheme of interaction between the parties to a construction contract looks like this:

- Determining the scope of work and preliminary drawing up an estimate.

- Coordination of all conditions and conclusion of the contract.

- Execution of work.

- Acceptance of work and final payment.

The estimate is the primary document that is drawn up at the first stage of interaction when carrying out construction or other contract work. It describes the stages and order of work and fully takes into account all the contractor’s costs. All subsequent documents (invoices, acts, KS-2, KS-3 and others) are drawn up only on the basis of the approved estimate.

Accounting for VAT costs under the simplified tax system

Local estimates must be drawn up according to the rules given in section 4 of the Resolution of the State Construction Committee of Russia dated March 5, 2004 No. 15/1. All construction costs are formed into groups: types of work, resources, equipment operation and others. The cost includes direct costs, overheads, and estimated profit, shown excluding taxes.

In construction work, the contractor’s usual costs are the costs of construction materials, the purchase of fuels and lubricants for equipment, and the costs of repairing mechanisms carried out by third-party organizations. When purchasing materials or services to perform work, the simplifier pays VAT as part of their price, but in the estimate for the customer he must indicate their cost without VAT.

For example, a construction company entered into a contract and purchased materials for 120 thousand rubles, including VAT at a rate of 20% - 20 thousand rubles.

In practice, three cost accounting options are used, but only one is correct. The second option will not allow the customer to take into account the amount of VAT as part of expenses.

And in the third case, the contractor will be obliged to transfer the tax amount to the budget in full and report as a tax agent.

Right wrong

| Option 1 In the estimate, in the “Cost” column, enter the amount without tax. In the “Limits, Costs” section of the “Taxes and Mandatory Payments” chapter, add the column “Costs for VAT compensation under the simplified tax system” and indicate in it the amount of tax paid 20 thousand rubles | Option 2 Include in the estimate the cost of materials without tax in the amount of 100 thousand rubles, and take into account the tax amount of 20 thousand rubles as part of the expenses for the simplified tax system Option 3 Prepare an estimate for the customer, including VAT, for the entire amount of costs. To receive payment upon completion of work, issue an invoice and highlight VAT on it |

In the example, the calculation of compensation is given schematically. In fact, everything is more complicated: compensation is calculated according to a special formula.

Formula for calculating VAT compensation costs for simplified people

To calculate VAT compensation under the simplified tax system, you must use a single formula:

(MAT + (EM - ZPM) + HP × 0.1712 + SP × 0.15 + OB) × 0.20,

Where:

- MAT - materials from the estimate;

- (EM - ZPM) - the total cost of operating machines (fuels and lubricants, repairs, rental payments, etc.) minus the wages of drivers;

- HP - the share of overhead costs in the composition of material costs (the standard for including overhead costs in VAT compensation is 17.12%, in the Far North - 18.2%);

- SP - the company's estimated profit (the standard for including estimated profit in VAT compensation is 15%);

- OB - costs of operating machinery and equipment;

- 0.20 is the VAT rate.

Reducing factors for overhead costs (OOP) and estimated profit (SP) were introduced specifically for simplifiers. They are always used and do not depend on the type of work performed (new construction, reconstruction, repair). When drawing up estimates, we recommend using the “Guidelines for determining the amount of overhead costs in construction” (MDS 81-33.2004).

The main rule of the estimate: it must take into account all the minimum necessary resources to carry out work on site. Overhead expenses are allowed to include the cost of office supplies and other expenses, including office work. The costs of operating machinery and equipment include the cost of fuels and lubricants and repairs of mechanisms involved in the performance of work.

General procedure

Forms KS-2 and KS-3 are widely used in the construction industry. The first document is an act, which is an actual confirmation of the completed volume of construction and installation work. That is, the contractor draws up a special act, which reflects a complete list of the work performed. The document is then sent to the customer for approval. In turn, the customer carries out reconciliation, or acceptance. If there are no disagreements, then the act is signed.

Based on the signed act, a special KS-3 certificate is created. This certificate reflects information about the cost of construction and installation work performed under the current agreement or contract. Forms KS-2 and KS-3 approved, that is, signed by both parties (sample filling below) are the basis for the start of mutual settlements between the customer and the contractor. Based on these forms, the contractor issues invoices for payment and sends them to the customer’s accounting service.

Form KS-2: act of acceptance of completed work

The act of acceptance of completed work, form KS-2 form, sample filling and key rules for document execution were approved by Resolution of the State Statistics Committee No. 100 of November 11, 1999 (OKUD 0322005). However, current legislation provides for the possibility of adjusting the structure of the form. For example, it is permissible to supplement a unified form with specific information that is characteristic of the exclusive activities of a business entity. Please note that such adjustments cannot be contrary to the current provisions of the law.

Officials determined that the unified form KS-2 (filling sample 2020) is required to be drawn up when executing any types of agreements, contracts or agreements for construction and installation work. Without this document, payment for construction and installation work is not allowed (Rosstat Letter No. 01-02-9/381).

The responsibilities for drawing up the act are assigned to the executor. The customer, by signing this document, confirms his consent to the list, type and volume of construction and installation work performed. That is, the customer’s signature indicates that there are no disagreements between the parties to the contract.

How to fill out KS-2: example of filling

The structure of KS-2 consists of a title and tabular part. It is recommended to start drafting a document from the title section. So, in accordance with the current rules:

- The fields “Investor”, “Customer”, “Contractor” should be filled out in strict accordance with the constituent and registration documents (charter, certificates or extracts from the Unified State Register of Legal Entities from the Federal Tax Service). Please note that if there is no information about the investor in the agreement, then the corresponding field does not need to be filled in.

- The “Building” and “Object” fields contain information about the location (performing) of construction and installation work. So, in the “Construction” field, indicate the name of the construction and address. In the “Object” field, enter the full name of the construction project in accordance with the design and estimate documentation and the subject of the contract.

- Now we enter the type of activity according to OKPD in KS-2, which is assigned to the customer in accordance with Order of Rosstandart dated January 31, 2014 No. 14-st.

- We register information about the concluded contract, agreement, agreement for construction and installation work. We enter in the appropriate field the date of conclusion of the agreement in the format DD.MM.YYYY and the agreement number.

- Then we indicate the date of drawing up the act, its number, taking into account the chronological order. We also indicate the time period for which the document was compiled.

- We enter information about the estimated cost of the work. The amount is indicated in rubles. Please note that the data must comply with the terms of the concluded contract, and also be confirmed by design and estimate documentation.

The title section is complete. Now we proceed to filling out the tabular part of the KS-2 act; the sample filling in 2021 will be as follows:

- Number in order - assign a serial number, new for each position.

- “Item number according to the estimate” - indicate the number of the construction and installation work item, in accordance with the approved design and estimate documentation. If several estimates are executed within the framework of one contract, then the numbering may be duplicated.

- The name of the work must be written in strict accordance with the approved estimate. Abbreviations, changes or additions to names are not permitted.

- The unit price number is also entered from the estimate documentation data, in accordance with the current classifier and the FER collection.

- The unit of measurement denotes a qualitative expression assigned to a specific type of construction and installation work.

- The number of completed works is a quantitative indicator characterizing the volume completed. Specifying percentages is not allowed.

- In the “Price per unit” column, you should indicate the accounting price that is established for a specific type of construction and installation work. For fixed contract prices, put dashes in the column.

- The “Cost” column is filled in in any case. It reflects the cost expression of completed emergency services taking into account the volume.

If there are disagreements or comments regarding the procedure and timing of fulfillment of the terms of the agreement, appropriate entries are made in the document.

After filling out the KS-2 form (filling example), a certificate of the cost of the work performed is drawn up. Then both documents (see sample completion of KS-2 and KS-3) are sent to the customer for reconciliation, approval and further payment.

How to fill out KS-3

Use the unified form, which is approved by State Statistics Committee Resolution No. 100 of November 11, 1999 (OKUD 0322001).

Filling out the title part of the certificate is similar to the procedure for drawing up the act. We enter registration information about the investor, customer and contractor. We indicate information about the contract, construction, construction and installation work period. Then we register the certificate number and the date of its preparation. Now let's move on to creating a table:

- We write the number in order - a new one for each line.

- We describe in detail the types of construction and installation work, facility, stage or equipment.

- Work type code - indicate if available.

- Cumulative price.

- The cost that is determined by the contractor at the beginning of the reporting period.

- The final cost established at the end of construction and installation works or a stage.

Then the final part of the table is filled in: the total amount of costs for the completed construction and installation work is indicated. VAT is allocated, and at the rate that the performer (contractor) is obliged to apply according to the norms of the Tax Code of the Russian Federation. At the end, the amount of construction and installation works including VAT is indicated.

The finished form is certified by the signatures and seals of the responsible persons of each party.

How to fill out

We will provide a sample of filling out forms KS-2 and KS-3; you can download Excel 2020 for free.

Let's start with the first of them - form KS-2, the sample for filling out 2020 will be as follows. First of all, the title part of the document is drawn up:

- the unified form KS-2 has a code according to OKUD - 0322005;

- the lines “Investor” (if any), “Customer” and “Contractor” are filled in in accordance with the exact legal data about the organizations: full name, legal form, legal address, telephone numbers, fax numbers, OKPO;

- in the “Construction” field the name of the construction site and its address are entered, and in the “Object” position - the full name of the construction project;

- Next, the type of activity according to OKDP is entered into KS-2;

- indicate the number and date (DD.MM.YYYY) of the agreement (contract) in the appropriate column;

- the number and date of generation of the form, as well as the reporting period under the above contract are indicated;

- the estimated cost of repairs, installation, construction, which were carried out by the contractor and for which he reports to the customer in accordance with the concluded contract, is written down. The amount must be indicated in rubles.

We continue to figure out how to fill out KS-2; an example of filling out the tabular part of the document will look like this. Let's clarify how to fill in each column separately:

- Serial numbers.

- “Item number according to the estimate” - numbering of the work performed or the material used based on the estimate documentation. If the form is filled out in accordance with several estimates, then the numbering may be duplicated.

- When form KS-2 is drawn up, the filling sample requires that the name of each item be strictly in accordance with the estimate documentation.

- “Unit rate number” - codes from estimates based on FER collections.

- “Unit of measurement” - indicates the qualitative designation of the actions performed under the contract.

- This column contains the quantitative designation of contracting activities. It is forbidden to indicate the percentage of completion.

- Column 7 includes unit price data based on unit rate books. If contract prices are fixed, then dashes are entered in the column.

- The last column is filled in in any case. It indicates the cost of contract work either in accordance with the contract or on the basis of a calculated indicator from the FER collections.

If representatives of the customer organization had comments on the timing, volume or quality of work performed, they also need to be recorded in the KS-2 act, the sample of which you now know how to correctly fill out.

IMPORTANT!

The finished form KS-2 - an act of acceptance of work performed - is signed by the managers of the contractor and the customer (after verification and approval). For approval, you must provide a certificate in form KS-3. In the article you can download KS-2, KS-3 (sample filling in 2020) for free in excel.

Form of the unified form KS-2

The act of acceptance of completed work - form KS-2, a form, a sample of which you can download in the article, was approved by Resolution of the State Statistics Committee No. 100 of November 11, 1999. However, in accordance with the current legislation and in agreement with the customer, the contractor can make adjustments to the formal form of the act based on the needs of a particular business entity, if this does not run counter to the current legislation of the Russian Federation and the interests of society. In the article you can download for free KS-2 and KS-3 - sample filling 2021, Excel.

According to Rosstat Letter No. 01-02-9/381, filling out the act is strictly mandatory for each performer. Based on KS-2, the contractor delivers, and the customer accepts, construction, installation and repair work at residential, industrial and civil facilities. Thus, by signing the KS-2 act, he confirms that there are no complaints about the quality and volume of work performed. In the article you will be able to fill out KS-2 in 2021.

Form KS-3

We looked at filling out the KS-2 form; we’ll look at an example of filling out the KS-3 below. The unified OKUD form is used under the number 0322001. When filling out, you cannot change the form, for example, the number of lines!

How to fill out the KS-3 certificate

Acts KS-2 and KS-3, a sample for which we provide in the article, are drawn up at the stage of closing the contract. KS-3 is filled out in duplicate on the basis of the state contract and the KS-2 act, the 2021 sample for which we described above. If a third party is involved in construction, for example an investor, then the contractor prepares a document for them as well. The article provides a unified form KS-2 and KS-3, a sample filling, instructions for filling. They will help prevent mistakes.

The certificate includes data on the cost and expenses of the repairs, installation, construction, as well as costs that were not taken into account in the estimate documentation and the contract. This could be, for example, an unexpected increase in prices for rental equipment or construction materials. The certificate can be filled out not only for the entire construction project, but also for its individual part. In this case, you need to indicate the full cost of the entire object.

Step 1. Title page.

Form KS-2 and KS-3, a sample of which we are considering, begin to be filled out from the title part.

You need to enter:

- data of the customer, contractor and, if necessary, investor. Provide full name and contact information;

- OKPO code;

- name and address of the construction site;

- details of the government contract;

- current certificate number and date;

- reporting period in which the work was carried out.

Step 2. Fill out the table.

As in the case of KS-2, the sample filling in 2021 for the KS-3 reference continues with filling out the tabular part. Carefully enter the information in the following columns:

- Serial number.

- Description of the work and the object or its stage, as well as equipment and materials. If the contract and documentation allow, you can divide the work performed by the type of technical equipment used.

- Code of types of work.

- Cumulative price.

- The cost determined by the contractor at the beginning of the reporting period (year).

- The total cost of the completed contract for the reporting period.

At the end of the tabular part, the “Total” lines are filled in - the final amount of construction performed, as well as the cost including VAT. At this point, the sample filling of KS-2 and KS-3 can be considered complete.

Step 3. We certify the document.

At the end of the document, responsible persons from the customer and the contractor must sign. The certificate must also be certified by the seals of the organizations.

Sample of filling out the KS-3 certificate

Certificates of completed work

Organizations carrying out various types of work are required to record the progress of their implementation in the relevant documents. You will receive the document you need, and it will also be published soon on our website - certificates of completed work.[/tip] Contents

- 2.1 Nuances of filling out KS-2

- 1 What are KS-2 and KS-3 used for?

- 3 Shelf life of KS-2 and KS-3

- 4 KS-2 sample filling in 2021 and blank forms in WORD and EXCEL

- 2.2 Nuances of filling out KS-3

- 2 How to fill out KS-2 and KS-3 correctly

- 2.1 Nuances of filling out KS-2

- 2.2 Nuances of filling out KS-3

- 5 KS-3 sample filling in 2021 and blank forms in WORD

The procedure for filling out the KS-2 form

Conventionally, the KS-2 form can be divided into three parts. The first is the title page, which includes all the basic information about the organizations whose interaction led to the conclusion of contractual relations, the carrying out of certain construction work and the signing of this act.

First part

So, first fill out the lines relating to the investor (if there is one), customer and contractor . Here you need to enter their full names, indicating their organizational and legal status (IE, LLC, CJSC, OJSC), as well as contact information: their address and telephone number. The OKPO code is written opposite each organization (can be found in the registration documents).

Just below you should write down the name and address of the construction project , the number and date of the contract, and the date of drawing up this document (act KS-2).

In the same part, it is necessary to note the cost of the work performed according to the estimate (it is indicated in full accordance with the contract) - this amount can be entered in numbers, there is no need to decipher it in words.

Second part

The second part of the KS-2 form includes a table of eight columns, each of which will need to be filled out.

- The first column is the serial number of the construction and installation work performed in this act.

- The second column is the position number according to the pre-compiled estimate.

- The third column is the name of the work. They need to be written succinctly, but with a fairly clear decoding. Each type of work must be indicated separately, without allowing combinations. Otherwise, the customer may refuse to sign this form and require the drawing up of a new act.

- The fourth column is the unit price number. Here it is also worth giving a special explanation: this means that construction estimates are usually compiled based on the prices of special collections of Uniform Standards and Prices. However, if the estimate for construction work is prepared at fixed prices, then this column does not need to be filled in.

- The fifth column is the unit of measurement (square meters, pieces, kilograms, etc.).

- The sixth column is the number of completed works based on the final data.

- The seventh column is the price per unit (indicated in rubles).

- The eighth column is the cost of work performed for each indicator.

After filling out all the lines, you need to calculate exactly how much money was actually spent on all construction and installation work and enter this amount in the “Total” line.

The third part

The third final part is the signatures of the interested parties. In particular, this act is signed on behalf of the contractor by the employee responsible for the execution of the work (in the “Passed” line), and on behalf of the customer either by the director of the organization or his authorized representative (in the “Accepted” line). Both parties must certify the document with a seal (with the exception of individual entrepreneurs, since entrepreneurs are not required to use a seal in their activities).

After drawing up the KS-2 act form, it is necessary to issue a certificate of the cost of the work performed in the KS-3 form - both of these primary documents should be considered only in a single bundle, since without each other they have no legal force. Both of these documents, in accordance with the rules for storing primary accounting documents, after registration and signing, must be stored for at least five years.

Where is the act form KS-2 used?

The document, filled out according to the unified form KS-2, refers to the primary documentation, which reflects the fact of acceptance and transfer of construction and installation work (hereinafter referred to as construction and installation work). The form of the document, which is advisory and not mandatory, was approved by Decree of the State Statistics Committee of November 11, 1999 No. 100, and then was edited many times.

Form KS-2 report, No. 0322005 , is used exclusively in the construction industry. When registering other completed work (except for construction and installation work), a standard acceptance certificate should be used.

Find out how often you need to draw up an act of form KS-2 in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

How to fill out the certificate of completed work, form KS-2

To fill out the form, use the data from the completed form No. KS-6a “Accounting Journal”. The form of the document for acceptance of construction and installation works consists of 2 parts - tabular and title.

The title page indicates:

- full information about the parties (name, legal addresses and contact information);

- information about the construction site (name and address);

- information about the facility where the work transferred under the report was carried out;

- OKPO codes of the contractor and the customer;

- code by type of activity and type of operation;

- information about the concluded contract.

The tabular part of the document lists all expenses incurred at current prices. This includes all costs incurred by the contractor.

Important! The cost of construction and installation works transferred according to the document of this form is indicated excluding VAT.

Then the information from KS-2 is used to draw up a certificate confirming the cost of construction and installation work and expenses. This information will subsequently be needed to fill out the KS-3 form. The document drawn up according to the sample is signed by both parties (there may also be a third party - the investor). The number of original copies of the form is discussed by the parties.

Where can I download a sample form for KS-2?

What is form No. KS-2?

Forms No. KS-2 and No. KS-3 are among the primary documents for accounting for repair and construction work. They must indicate the investor, customer, contractor (subcontractor) and their addresses, the name and address of the construction site, the name of the object, and the estimated cost.

Starting from 2013, the forms of primary accounting documents used (with the exception of government organizations) are determined by the head of the economic entity (clause 4 of article 9 of Law No. 402-FZ). These can be unified forms or your own, developed in compliance with the mandatory details of the primary documents. When using unified forms, you cannot delete the existing details of such documents (Letter of the Ministry of Finance of the Russian Federation dated July 8, 2011 No. 03-03-06/1/414), you can only supplement the form with new lines or columns.

When developing your own forms of primary accounting documentation, it should be taken into account that the forms of primary accounting documents established by authorized bodies in accordance with other federal laws and on their basis remain mandatory for use (Information of the Ministry of Finance of the Russian Federation dated December 4, 2012 No. PZ-10/2012) .

But in practice, unified forms No. KS-2 and No. KS-3 are used, especially since these are the forms that are mentioned in the explanations and acts of various departments (Orders of the Ministry of Sports of the Russian Federation dated March 28, 2014 No. 158, Rosrybolovstvo dated October 14, 2011. No. 1015, Ministry of Energy of the Russian Federation dated September 26, 2011 No. 418).

Form No. KS-2 is used for customer acceptance of completed contract construction and installation work for industrial, residential, civil and other purposes.

Let us immediately note that the act in form No. KS-2 and a certificate of the cost of work performed in form KS-3 (which, in turn, is filled out on its basis) are adequate evidence of the completion of work under a construction contract.

That is, in essence, form No. KS-2 serves as an invoice for payment.

At the same time, according to the position of the Armed Forces of the Russian Federation, set out in the Determination of July 30, 2015 No. A40-46471/2014, certificates of completed work, although they are the most common documents in civil circulation that record the contractor’s performance of work, at the same time are not the only means of proving relevant circumstances.

How to fill out form No. KS-2?

As we have already noted, in practice, participants in construction contracts use unified forms No. KS-2 and No. KS-3, which are approved by Resolution of the State Statistics Committee of the Russian Federation dated November 11, 1999 No. 100.

The column “Contract agreement (contract)” indicates the number of the contract agreement concluded between the customer organization (or general contractor) and the contractor organization (subcontractor), as well as the date of its signing in the format DD.MM.YYYY.

The column “Reporting period from to” indicates the dates of the period for which the contractor reports to the customer.

In the column “Estimated (negotiated) cost in accordance with the contract (subcontract)” the total amount under the contract in rubles is indicated (entry of amounts in other currencies is not acceptable).

Next, a table consisting of columns is filled in.

Column 1 “Sequence number” indicates the serial number of the material or work in this table.

Column 2 “Item number according to the estimate” indicates the number of the material or work in the estimate.

Column 3 “Name of work” indicates the name of the work corresponding to the name in the estimate.

Column 4 “Unit price number” indicates codes from the collections of Federal unit prices for construction, special construction and repair and construction work.

If, under a work contract, the cost of construction or repair work entrusted to the contractor is determined by the fixed price agreed upon in the contract and payments for work performed and costs are made within the specified fixed contract price, then in columns 4 “Unit price number” and 7 “Work completed; price per unit, rub.” a dash is inserted (Letter of Rosstat of the Russian Federation dated May 31, 2005 No. 01-02-9/381).

In column 5 “Unit of measurement” the name of the measure of work or materials is written, for example, sq. m, pcs., t, etc.

Column 6 “Work completed, quantity” indicates the number of those units of measurement that are written in column 5 (in this case, indicating the percentage of work completed is unacceptable).

In column 7 “Work completed, price per unit” prices are set based on the mentioned collections of unit prices. If the price of contract work is fixed by contract, this column is filled in with a dash.

Column 8 “Work completed, cost, rub.” filled in in any case: either with the amount from the contract, or with the estimated amount based on unit prices.

Is the discrepancy between the cost of work in forms No. KS-2 and No. KS-3 acceptable?

From the Letter of Rosstat of the Russian Federation dated May 31, 2005 No. 01-02-9/381 “On the procedure for applying and filling out unified forms of primary accounting documentation No. KS-2, KS-3 and KS-11”, it follows that in the act according to the form No. KS-2 indicates the cost of work, which is provided for in the estimate drawn up at the conclusion of the work contract, and the certificate in form No. KS-3 indicates the estimated cost, taking into account price changes, if such changes are provided for in the work contract.

As a result, the cost indicated in the certificate in form No. KS-2 may differ from the cost in the certificate in form No. KS-3.

Important! For example, this can happen when the construction of a fixed asset lasts more than one year and the cost of work and construction materials has changed during this period. Thus, the discrepancy in cost in forms No. KS-2 and No. KS-3 is not a violation in the preparation of documents

Type of operation in the work completion certificate

Under a contract agreement with an individual, the Certificate of delivery under the contract is the primary documentation and is used for accounting purposes. It can be formed according to a form that was developed by the company in-house.

Federal Law No. 402 displays specific points that must be indicated in the document.

It is possible to supplement the document with your own sections. The document must contain:

- description of the work performed (an invoice can be used for these purposes);

- Name;

- initials of the authorized person who drew up the act;

- signatures of authorized persons from each party.

- cost of work including VAT;

- formation time;

A template for a work completion certificate in Word can be downloaded here.