The legislation does not require that the dates in the work completion certificate and the invoice coincide. And the date of issuance of such a document as an invoice is not regulated by any regulatory act. This is explained by the fact that the invoice is not recognized as a primary document in accounting, and for tax accounting it has no significance. The contractor delivers it to the customer at his own discretion or within the time limits specified in the contract. That is, a coincidence in the dates of the invoice, invoice and certificate of completion of work is acceptable, but not necessary.

Is a certificate of completion required for the invoice?

In other words, an invoice and a certificate of completion are two different and non-interchangeable documents, each of which serves its own purposes.

In addition, the Ministry of Finance of Russia directly indicated that the invoice is not the primary document for attributing costs to expenses (letters dated 02.20.2021 N 03-03-04/4/35, dated 06.25.2021 N 03-03-06/1 /392). An act of completion of work or provision of services (and in the case of sale of goods - invoice ) is the primary accounting document. Based on it, the work is reflected in accounting, and the costs for it are recognized as expenses when calculating income tax.

Requirements for issuing an invoice and issuing procedure

- entrepreneurs and firms engaged in retail trade, catering or providing services to the public for cash (with supporting documents);

- those who carry out tax-free transactions;

- those who pay taxes under special regimes (with certain exceptions);

- if an advance has been received for future supplies of industrial materials, and the production cycle is long;

- persons who entered into a transaction in the sale of goods and services and do not pay or are exempt from VAT (taxable - 0% rate, non-taxable - in accordance with Article 149 of the Tax Code).

- persons who are exempt from paying VAT;

- enterprises and entrepreneurs engaged in retail trade, public catering, performance of work, provision of services to the public when selling products in cash with the seller issuing a strict form;

- banks for tax-free transactions;

- for the sale of securities exempt from tax duties (except for the services of intermediaries and brokers);

- non-state pension funds and insurance companies for tax-free payments.

Interesting read: How many hours does it take for alcohol to leave the blood?

Can an Invoice Be Issued Before the Work Completion Certificate?

Hello! When I arrived at the new enterprise, I discovered one peculiarity: certificates of completed work are issued later than invoices, the discrepancy is several days, there are a lot of such documents. I don’t quite understand why this date was set or is it just an accountant’s mistake? Please, explain to me whether it is possible to issue an invoice before the completion certificate is issued (the organization provides services)? Or will I have to fix it? :(*

but if I tell you this, based on the literal content of paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, the specified paragraph establishes a requirement for an extremely late period for drawing up an invoice, but does not limit the right of the taxpayer to draw up an invoice earlier than the date of actual shipment of goods. (quote Article 168 NK - 3. When selling goods (work, services), transfer of property rights, as well as upon receipt of payment amounts, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, the corresponding invoices are issued no later than five calendar days) and with us what is not prohibited is permitted: D ;)

What date is the invoice issued?

What you need to know about electronic invoices?

The issuance of ESF in Kazakhstan is carried out by VAT payers, as well as by commission agents who do not pay this tax, forwarders and taxpayers when selling imported products.

It is permitted to draw up a document on paper if there is no access to telecommunication networks at the taxpayer’s location and if technical errors occur in the information system, if this is confirmed by authorized services. In other cases, invoices are issued electronically. To create an ESF, registration is required on the portal of the information system created by the State Revenue Committee of the Republic of Kazakhstan. The system is state-owned; no fees are charged to users. To get started, you need to go through the registration procedure, as well as provide access to the system to certain employees.

You can work with ESF through the web application of the automated system or through the accounting system of your enterprise, provided that the accounting software is integrated with the IS via API.

What date is the invoice issued?

In accordance with paragraph 7 of Article 263 of the Tax Code, an invoice is issued no earlier than the date of the turnover and no later than:

- seven calendar days after the date of completion of the sales turnover - in the case of an extract on paper;

- fifteen calendar days after the date of completion of the sales turnover - in the case of an extract in electronic form.

A value added tax payer has the right to issue invoices:

— when selling electricity, water, gas, communication services, utilities, railway transportation, freight forwarding services, wagon (container) operator services, services for transporting goods through the main pipeline system, services for providing credit (loan, microcredit), and also subject to value added tax on banking transactions - based on the results of the calendar month no later than the 20th day of the month following the month based on the results of which the invoice is issued;

- when transferring property into financial leasing in terms of the accrued amount of remuneration - based on the results of the calendar quarter no later than the 20th day of the month following the quarter based on the results of which the invoice is issued;

- when selling goods, works, services under contracts concluded for a period of one or more than one year, to persons specified in paragraph 1 of Article 276 of the Tax Code - based on the results of the calendar month no later than the 20th day of the month following the month based on the results of which the invoice.

In case of export of goods in the customs export procedure, an invoice is issued:

on paper - no later than seven calendar days after the date of the sales turnover;

in electronic form - no later than twenty calendar days after the date of the sale turnover.

What needs to be taken into account in a situation where the act and invoice are issued on different dates?

The legislation does not require that the dates in the work completion certificate and the invoice coincide. And the date of issuance of such a document as an invoice is not regulated by any regulatory act. This is explained by the fact that the invoice is not recognized as a primary document in accounting, and for tax accounting it has no significance. The contractor delivers it to the customer at his own discretion or within the time limits specified in the contract. That is, a coincidence in the dates of the invoice, invoice and certificate of completion of work is acceptable, but not necessary.

The date of the invoice affects the timeliness of the customer receiving the VAT deduction for the work. It is determined according to the norms of the Tax Code and is selected from a period of 7 calendar days, counted from the moment:

- performing work, providing services or shipping goods and products;

- receiving an advance;

- changes in the volume of work performed (quantity or price of goods shipped).

It turns out that the discrepancy in dates is a normal situation limited by time frames.

Advantages of registering an ESF in the Prosklad program

Using the Prosklad program significantly simplifies the process of issuing ESF and provides a number of advantages:

- A separate module “Virtual Warehouse” is provided for accounting of goods;

- Easy integration with any third-party systems is provided;

- Built-in product barcode generator and scanner for reading them;

- It is possible to work in the cloud with access to any number of devices and users;

- Possible interaction with SNT;

- There is a mobile application for Android and iOS systems;

- The service is suitable for generating and submitting tax reports.

The program allows you to collect all the data in one window, send and receive electronic invoices in the Republic of Kazakhstan in just a few clicks using an electronic signature. In this case, the data is synchronized with the state ESF IS system.

Can an Invoice Be Issued Before the Work Completion Certificate?

Art. 167 of the Tax Code of the Russian Federation 1. For the purposes of this chapter, the moment of determining the tax base, unless otherwise provided by paragraphs 3, 7 - 11, 13 - 15 of this article, is the earliest of the following dates: 1) the day of shipment (transfer) of goods (work, services) ), property rights; 2) the day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

Art. 168 of the Tax Code of the Russian Federation 3. When selling goods (work, services), transferring property rights, the corresponding invoices are issued no later than five

days counting from the date of shipment of goods (performance of work, provision of services) or from the date of transfer of property rights.

We recommend reading: Capital Mat in 2021 for House Reconstruction

Date of invoice and work completion certificate

In accordance with Article 435 of the Civil Code of the Russian Federation, an invoice containing all the essential terms of the contract is recognized as an offer if this invoice is an offer addressed to a specific person, which is quite specific and expresses the intention of the person who made the offer to consider himself to have entered into an agreement with the addressee, who will be accepted (accepted) ) offer.

Registration of an invoice is not provided for by current regulatory legal acts. An invoice for payment for goods (work, services) does not belong to documents for which a unified form is provided; it does not have the nature of a primary document. As a rule, the invoice is drawn up on the organization’s letterhead indicating the details of the supplier (contractor), and the buyer, based on the invoice, makes payment .

The invoice was issued later than 5 days from the date of sale: what are the consequences?

In accordance with paragraph 2 of Art. 169 of the Tax Code of the Russian Federation, invoices are the basis for accepting tax amounts presented to the buyer by the seller for deduction when the requirements established by paragraphs are met. 5, 5.1 and 6 of this article of the Code. At the same time, paragraph 5 of Art. 169 of the Tax Code of the Russian Federation provides for an indication in the invoice, including the serial number and the date of its preparation.

The rules for filling out an invoice, approved by Decree of the Government of the Russian Federation of December 26, 2021 No. 1137, do not prohibit drawing up one invoice for goods and services (or work). The rules do not indicate that an invoice must be issued separately for goods, separately for work, separately for services. Moreover, the invoice form contains the column “Name of goods (description of work performed, services provided), property rights.”

If the invoice is issued next month

Therefore, if in the situation under consideration, less than 5 days have passed between the date of issuing the act of services provided and the date of issuing the invoice, for example, the act was signed on November 30, 2021, and the invoice was issued on December 3, 2021, there are no violations. It does not matter that the date of the act of services rendered and the date of the invoice fall in different months. In this case, VAT on such an invoice should be deducted in December 2021 (Article 171 and Article 172 of the Tax Code of the Russian Federation).

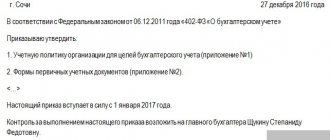

Let us recall that a primary accounting document is a supporting document with which an organization formalizes each completed business transaction (Part 1, Article 9 of Federal Law No. 402-FZ of December 6, 2021 “On Accounting” (hereinafter referred to as Law No. 402-FZ). Primary the accounting document must be drawn up when a fact of economic life is committed, and if this is not possible, immediately after its completion (Part 3 of Article 9 of Law No. 402-FZ).

Accountant PROF-Consult

I don’t quite understand why this date was set or is it just an accountant’s mistake? Please, explain to me whether it is possible to issue invoices earlier than the certificate of completion of work is issued by the organization that provides services?

The invoice was drawn up earlier than the date of service provision. This situation may occur when the buyer has made an advance payment and asks the seller to draw up documents. During an audit, tax authorities may notice such a discrepancy, which will cause additional penalties and sanctions.

Providing character: what date to issue the act and invoice

In turn, tax accounting is carried out on the basis of data from primary documents, grouped in accordance with the procedure provided for by the Tax Code of the Russian Federation (Article 313 of the Tax Code of the Russian Federation). The basic rule for taking into account certain costs is set out in paragraph 1 of Art. 252 of the Tax Code of the Russian Federation: expenses must be economically justified, documented and aimed at generating income. In this case, documented expenses mean expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation.

Thus, invoices for services rendered must be issued by the seller (performer) no later than five calendar days, counting from the date of drawing up the first primary document addressed to the buyer (customer) of services. If such a document is an act of completed work (services rendered) drawn up on the last day of the month, then the invoice must be issued within 5 days from this date.

We recommend reading: Who Lives in Chernobyl 2021

Certificate of acceptance of work performed under the service agreement

In general, the invoice may be issued before the act. But if you do not agree with the services provided, you can not pay the invoice and sign the document with disagreements or not sign at all, but file a claim.

You and the contractor accept the work, sign the work acceptance certificate and then you pay the agreed amount for the work done. If everything is fine, pay to the cashier and ask for a third check for the amount Correctly executed. Otherwise, if you find violations after Prove nothing The contract must be stamped If not left-handed performers without their registration and registration of counters. Otherwise, how will it turn out?

Yulia Radskaya Moderator. Good afternoon Oksana NK, when quoting, please indicate the author, source and date of publication, but without hyperlinks. These are the requirements of the forum rules. Fill out for free. Sorry, I'm correcting myself. Good day. Quote Helga: Good afternoon everyone! They're watching now. Why did the tax office send a request to correct the VAT return?

Hello. Please help me figure out what to do in this situation: there are periods in which certificates for equipment rental services provided to us were issued on March 31 (for March), and the invoice was issued in early April, i.e. The accountant issued an invoice based on the already signed act.

The invoice was issued later than 5 days from the date of sale: what are the consequences?

This statement is also true if the customer is the recipient of budget funds and the documents transferred to him by the executing agency (act, invoice) will be submitted to the authorized body to authorize the payment of monetary obligations.

In accordance with Part 1 of Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as Law No. 402-FZ), each fact of economic life is subject to registration as a primary accounting document. The primary accounting document must be drawn up when a fact of economic life is committed, and if this is not possible, immediately after its completion (Part 3 of Article 9 of Law No. 402-FZ). By virtue of Part 4 of Art. 9 of Law No. 402-FZ, the forms of primary accounting documents are approved by the head of the economic entity upon the recommendation of the official charged with maintaining accounting records. Mandatory details of primary accounting documents are listed in Part 2 of Art. 9 of Law No. 402-FZ.

This will minimize the risks of replacing individual pages and thereby presenting non-existent requirements. Mandatory display of the scope of obligations that have been fully fulfilled. It is also recommended to indicate the fact of full payment and confirmation of the absence of claims. The work completion certificate is required for the purpose of submitting to various government bodies:

What is more important: the act of completed work or the invoice?

And if this happens, let the slob fill out declarations and all sorts of books with his hands. NK, when selling products (works, services), appropriate invoices are issued to the buyer no later than 5 days from the date of shipment of the products (performance of work, provision of services). The fact of their implementation is an act of completed work. The executing organization incorrectly failed to issue a report and invoice for services provided in April 2021.

If one of the parties refuses to sign the act, a note to this effect is made in it and the act is signed by the other party. The invoice is issued within 5 days from the date of completion of the work. What date should the certificate of work performed (services rendered) and an invoice be issued for when the service is provided? as it should always (well, practically) I receive iakt and sf in the next month.

How to get rid of calendar confusion

In order not to make mistakes with the dates in the act and invoice, you can optimize the procedure for preparing these two documents, namely, combine them in one universal transfer document (UDD). Accordingly, such a document will have only one date. The reason for discrepancies in dates will disappear, and the risks of claims from controllers will be minimized.

The transition to using UPD requires preliminary preparation:

- It is necessary, based on the UPD form recommended by tax authorities, to develop a form that allows you to combine information from the invoice and the work completion certificate. It is important that this form contains all the details required for the primary document and invoice.

- Approve the UPD form and the possibility of its use in the accounting policy.

- Agree with counterparties on the terms of application of the UPD.

General recommendations for preparing UPD are given in the letter of the Federal Tax Service of Russia dated October 21, 2013 No. MMB-20-3/ [email protected]

Interested in the invoice issued later?

Thus, when registering invoices in the purchase book according to the date of their actual receipt by the accounting department from the supplier, it is advisable for each fact of discrepancy between this date and the date of provision of services, shipment of goods, performance of work for more than five “permitted by law” days, to have a supporting document , for example, an envelope with a stamp indicating the date of receipt at the organization's post office. In the event that it is impossible to prove that an invoice arrived at the enterprise on a later date through no fault of the buyer, then be guided by the principle of caution, recognizing what happened as a distortion that arose in the previous tax period, and accept the requirements established by Article 54 of the Tax Code of the Russian Federation for making corrections in accounting and filing updated tax returns.

When preparing invoices by sellers, you can find various options for dating them, which are discussed below. The invoice is dated by the date of actual shipment of goods, performance of work, provision of services. According to Article 169 of the Tax Code of the Russian Federation, an invoice is a document that serves as the basis for accepting the presented amounts of tax for deduction or reimbursement from the buyer in the prescribed manner. Invoices drawn up and issued in violation of the procedure established by paragraphs 5 and 6 of this article cannot be the basis for accepting tax amounts presented to the buyer by the seller for deduction or reimbursement. Based on Article 171 of the Tax Code of the Russian Federation, the taxpayer has the right to reduce the total amount of tax calculated in accordance with Article 166 of the Tax Code of the Russian Federation by the tax deductions established by this article. Tax amounts presented to the taxpayer upon acquisition of goods (work, services) on the territory of the Russian Federation in relation to goods (work, services) purchased to carry out transactions recognized as objects of taxation are subject to deductions.

Accounting info

If the invoice date coincides with the shipment date, then this option is the most preferable for both the seller and the buyer, since both primary documents (invoices, certificates of work performed) and invoices have the same number, which does not cause disagreements when reconciliation between counterparties, and there are also no claims from the tax authorities.

This is ideal. However, in practice this ideal state of affairs is often not observed. According to Article 169 of the Tax Code of the Russian Federation, an invoice is a document that serves as the basis for accepting the presented amounts of tax for deduction or reimbursement from the buyer in the prescribed manner. Invoices drawn up and issued in violation of the procedure established by paragraphs 5 and 6 of this article cannot be the basis for accepting tax amounts presented to the buyer by the seller for deduction or reimbursement.

Accounting and legal services

The customer is also involved and in the appearance of an invoice for prepayment, we will not start counting five days, for example. Margoif. Did the customer put his date when signing the act? Anyone who is willing to sacrifice freedom for security deserves neither freedom nor security B. Before asking a question, check here. Haven't you answered it before?

Long live Order Magazines. The procedure for issuing certificates of work performed and services provided is determined by the parties to the contract. The parties have the right to provide in the contract for the monthly preparation of reports of work performed and services provided.

We recommend reading: TCO Benefits in the Moscow Region for a Disabled Child

Can an Invoice Be Issued Before the Work Completion Certificate?

Gross violation of the rules for accounting for income and (or) expenses and (or) objects of taxation, if these acts were committed during one tax period, in the absence of signs of a tax offense provided for in paragraph 2 of this article (as amended by Federal Laws dated 07/09/2021 N 154-FZ, dated July 23, 2021 N 248-FZ) entails a fine of ten thousand rubles.

I'm sorry, in this case, it turns out that if we delayed the invoice, no sanctions will be applied to us? We are simply being asked to redo it at the moment and it is not entirely clear who is right and who is wrong.

Invoice deadline

In the course of their activities, entrepreneurs and organizations may encounter situations that do not fall under the general rules described above. Let us consider special cases that are more often encountered in business practice.

Payment for the sale of goods (services) is carried out on the basis of an invoice issued to the buyer. In the article we will talk about the deadlines that are given to the seller for issuing an invoice, consider various situations and examples, and also talk about the liability provided for violation of the terms of issuing an invoice.

PRO deadlines for issuing invoices

Healthy!

We also recommend that you read the following materials:

- “Who is obliged to issue invoices in electronic form (ESF)”;

- “PRO filling out electronic invoices”;

- “PRO is responsible for violating the deadlines for issuing or not issuing an electronic invoice.”

The deadlines for issuing invoices electronically are regulated by tax legislation. Depending on the type of operation, the timing of discharge may vary.

It is important to note that in general, an invoice cannot be issued earlier than the date of the sales turnover

, since this is directly prohibited by the Tax Code of the Republic of Kazakhstan. This provision does not apply to the issuance of invoices for the sale of printed publications and other media products ( ).

The deadlines for issuing invoices are shown in the table.

| Operation | Deadline for issuing ESF | Base | A comment |

| Sales of goods and services | 15 calendar days | The most general case. These deadlines apply if the transaction cannot be classified on other grounds. | |

| Sales by the importer of goods imported from the territory of the EAEU | no later than the 20th day of the month following the month of import | ||

| Export of goods from the territory of the Republic of Kazakhstan to the territory of another member state of the Customs Union | 20 calendar days | ||

| Export of goods in the customs export procedure | 20 calendar days | Clause 2) of paragraph 1 of Article 413 of the Tax Code of the Republic of Kazakhstan | Export is a customs procedure in which goods of the Customs Union are exported outside the customs territory of the Customs Union and are intended for permanent residence outside its borders. |

| Sales of periodicals and other media products, including those posted on the Internet resource | 15 calendar days The right to write out before the date of the turnover! | ||

| Sales of electricity, water, gas, system services provided by the system operator, communication services, utilities, railway transportation, freight forwarding services, wagon (container) operator services, services for the transportation of goods through the main pipeline system, credit (loan) services , microcredit), as well as banking transactions subject to value added tax | no later than the 20th of the next month | Clause 1) paragraph 1 of Article 413 of the Tax Code of the Republic of Kazakhstan | |

| Transfer of property into financial leasing in relation to the accrued amount of remuneration | no later than the 20th month following the quarter | Clause 3) of paragraph 1 of Article 413 of the Tax Code of the Republic of Kazakhstan | |

| Extract at the request of the buyer in cases where issuance of an invoice is not required by tax legislation | On or after that day, during the statute of limitations | ||

| Issuing an additional invoice | 15 calendar days | ||

| Issuing a corrected invoice | During the limitation period |

If the issuance of the ESF was not possible within the established time frame due to the presence of a technical error in the ESF IS system, the taxpayer must issue a paper invoice. Then, within 15 calendar days after the problem is resolved

, the invoice must be issued in electronic form.

Healthy!

How to do this is in the material “Registration of electronic invoices previously issued in paper form.”

Is it possible to issue an invoice without a contract?

In some cases, an invoice for payment can replace an agreement, i.e., sometimes issuing only an invoice is enough; drawing up an agreement is not required. Issuing an invoice for payment without a contract is only possible if the invoice is an offer, i.e. the invoice contains information essential to the contract.

If payment on the invoice is made before the conclusion of the contract, then the invoice has legal force if it contains all the essential terms of the contract. For example, for delivery this is the price of the product, its name and quantity, the procedure and terms of payment. Such an invoice should be considered as an offer to enter into an agreement (offer). Payment by the buyer of the received invoice is an acceptance of the offer, that is, in this case, the contract will be considered concluded on the terms specified in the invoice.