An invoice in Russia is a tax document of the established form, which is required to be drawn up by the seller or contractor. Based on received invoices in, and based on issued invoices - “Sales Book”.

According to the Tax Code of the Russian Federation, only VAT taxpayers are required to provide customers with an invoice. Companies that are on the simplified tax system are not payers of this tax and do not have to prepare invoices.

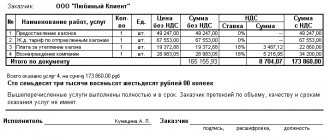

The invoice contains data on the name and details of the seller and buyer, the list of goods or services, their price, value, rate and amount of VAT. This list is mandatory and enshrined in the Tax Code of the Russian Federation. The invoice must also contain information about the number and date of issue of the invoice, and, if necessary, the amount of excise duty, the country of origin of the goods, and the customs declaration number.

In Russia, the purpose of an invoice is tax accounting for VAT. It imposes on the seller the obligation to transfer VAT to the budget; for the buyer it serves as the basis for presenting VAT for deduction.

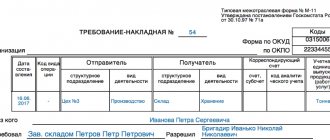

Packing list

The invoice is a primary document, which is drawn up in 2 copies and serves as proof of transfer and the basis for writing off (accepting for registration) the goods. The invoice must contain the signature and seal of the seller and buyer. It is drawn up in two copies, one of which remains with the supplier, the second with the recipient.

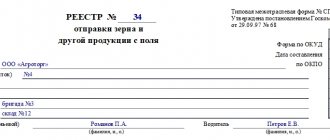

Goskomstat has approved a unified form of consignment note (form No. TORG-12), but an organization can use its own form.

The invoice must contain the following details: name, number and date of the document, name of the supplier organization; name of the product, its quantity and cost; positions of responsible persons, their signatures and seals. If the invoice form does not correspond to the Torg-12 form, it can also be accepted for accounting by the purchasing organization.

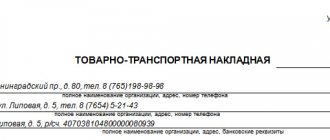

When participating in trade operations of a third-party transport company, experts recommend abandoning the Torg-12 form and using another document - a consignment note (Bill of Lading).

The buyer is always right

However, failure in the first two instances did not cool the defendant’s ardor, and the seller’s representatives decided to appeal to the cassation court. The complaint he filed indicated that the buyer had no debt to the plaintiff. They argued that the fact of acceptance of goods for the disputed amount was confirmed by the signatures and seals of the plaintiff on the invoices drawn up in form No. 1-T, while the invoice of form No. TORG-12 in this case acts only as an attachment, which is why the supplier considered it possible combine them into one document. And, according to this “consolidated” invoice, the plaintiff received goods from the supplier, the cost of which exceeds the amount of the advance payment under the supply agreement.

But, after checking the conclusions of their colleagues from the first and appellate instances, the district arbitrators confirmed that they were right. They recalled that in accordance with paragraph 3 of Article 487 of the Civil Code, in the case when the seller, who has received the advance payment amount, does not fulfill the obligation to transfer the goods within the prescribed period, the buyer has the right to demand the transfer of products or the return of the advance payment amount for the untransferred goods. Moreover, according to paragraph 4 of Article 487 of the Civil Code, if the seller delays the delivery of already paid products, then the supplier must also pay interest on the amount of the “unprocessed” prepayment.

The federal arbitrators also supported the conclusion of their colleagues that the defendant’s argument about the proof of delivery of goods exceeding the amount of the advance was untenable. The judges once again pointed out that in the case under consideration, the appropriate and sufficient evidence of acceptance and transfer under the supply contract are primary accounting documents, namely, invoices (form No. TORG-12), drawn up in accordance with the requirements of the law.

At the same time, the cassation arbitrators emphasized that the supplier simply adjusted the amount in the documents to its size, and at the same time insisted in court that the fact of delivery of goods for the amount of the advance payment was proven. But the judges admitted that, in their opinion, by signing the delivery notes and sending invoices for a lower delivery amount, the seller himself indirectly admitted to deception. The cassation arbitrators confirmed that the demands made by the buyer who did not receive his order are completely legal and must be satisfied in full (Resolution of the Federal Antimonopoly Service of the North-Western District of May 7, 2015 No. F07-2051/2015 in case No. A56-7618/2014).

Anna Mishina

, for the magazine "Calculation"

Bukhgalteriya.ru recommends

Invaluable experience in solving current problems, answers to complex questions, specially selected latest information in the press for accountants and managers. Magazines for accountants and entrepreneurs >>

If you have a question, ask it here >>

Difference between invoice and delivery note

The following can be distinguished between an invoice and a delivery note:

Documents come in various forms;

An invoice has a strictly regulated form, while a delivery note has a free form;

The delivery note is signed in two copies - by the seller and the buyer, the invoice - only by the supplier;

These documents do not replace each other, but complement each other and are issued simultaneously upon transfer of goods;

An invoice is issued for payment for goods and services, while an invoice is issued only upon shipment of goods, the provision of services is formalized by an act;

Unlike an invoice, an invoice does not confirm the fact of transfer of goods to someone, but only serves as a basis for VAT offset;

Based on the invoice, you cannot make a claim against the supplier of the goods.

Many people who have little knowledge of accounting think that an invoice and an invoice are the same accounting document. This opinion is wrong. In fact, these documents are directly related to the creation of the same operation; the difference exists in their purpose and design.

What data is included in the invoice?

The invoice is issued by the seller or contractor upon completion of the work performed or services provided. Presentation of this document is mandatory if the company is refunding VAT (the amount must be indicated in the document), i.e. is on the general taxation system. In other situations, an invoice is usually not required. If the presence of this document is mandatory, it must be executed in the same period when the transaction was made (a service was provided, confirmed by a certificate of completion, or goods were purchased, as evidenced by the presence of a delivery note).

In fact, the accountant issues both an invoice and an invoice both when providing any services and when completing a purchase and sale agreement. The only difference is the purpose of these documents. The buyer needs an invoice in order to pay for the services provided, which are specified in the contract. It is for this purpose that the invoice contains the details for transferring the required amount of money and the services or goods for which this amount will be paid.

An invoice is needed so that the transaction performed is reflected in tax accounting, i.e. VAT must be recorded on the completed service or product that is planned to be performed under the specified transaction.

As a rule, the invoice bears the seal of the service provider (mandatory), while the invoice does not. Another difference between these documents is that the invoice must be submitted to the tax office, since this document is a strict reporting form, while an invoice does not have this function.

Invoice (IF) is a document that certifies the actual shipment of goods, or the provision of services, as well as their cost. In accordance with paragraphs. 6.7 hours 2 tbsp. 9 of the Law of December 6, 2011 N 402-FZ, the Federation Council is not a primary accounting document.

Why is SF needed? An invoice is issued by sellers or performers to the buyer, or customer, after the buyer accepts the product or service.

Attention!

The only purpose of an invoice is to record value added tax. As a result, this document is a tax document and has a strictly established template.

Based on the SF, the accounting department creates a “purchase book” and a “sales book.”

Organizations conducting business under the simplified taxation system do not use them, since in such situations the second party has the right to use other documents, for example, a payment order, to account for VAT.

Invoice and certificate of completion of work: features

Each contract includes a clause that indicates the name of the document issued after the completion of work or services. In this case, the invoice and the certificate of completion of work For confirmation, both standard forms and those developed by a specific enterprise can be used. The preparation of such papers is important because it is required by tax law. The absence of invoices or certificates of completed work may lead to penalties. Costs taken into account in such documents can simply be excluded by tax authorities from expenses when calculating income tax.

Is it possible to buy certificates of completed work?

If the primary accounting documents are lost or were not generated in a timely manner, you can buy certificates of completed work . In this case, we are talking about quickly putting all accounting documentation in order. Sometimes the situation develops in such a way that the need for a form arises when the contractor wants to save money on launching production.

buy certificates of completed work even if an employee of the customer company performed the work and there is no one to receive payment from. In this case, timely received paper will help solve various complex problems.

04 May 2019

Sharing

Can an invoice and a delivery note be issued for the same product? SF and TN not only can, but also must be issued for the same product.

Since, as we have already discussed above, this documentation performs different functions in accounting: the invoice reflects VAT, and delivery notes for the transfer of goods (you can find out who should sign the columns “received the goods”, “received the goods” and others) .

Do the numbers for one product have to match?

There are no requirements under the Tax Code, as well as other regulations stating that the SF and TN numbers must match. The main thing is to ensure that the VAT amounts coincide in both cases. Each organization has the right to choose the order and type of numbering of its documents independently.

Which document should be drawn up first?

Can SF be discharged before TN? Since the SF confirms the VAT on the transferred goods, it cannot be written out in advance to the TN,

except in cases where the transaction agreement provides for prepayment. The invoice must be issued no later than five days after shipment of the goods.

Is it possible to combine them?

In 2013, the Federal Tax Service introduced the UTD form into circulation - a universal transfer document that contains elements of tax and accounting. It is based on the invoice base, the rest is an element of the delivery note.

Is registration with different dates acceptable?

The invoice may have different dates from the delivery note.

But you need to consider:

- The SF must be issued no later than five days after shipment of the goods, that is, TN.

- If one of the five days is a weekend, then the required date is postponed to the next working day.

There is no liability for violating this five-day deadline, however, the Ministry of Finance indicates that the buyer cannot claim a deduction for late documents.

Answer

It is not necessary to sign the acceptance certificate of goods if the TORG-12 consignment note is properly executed. Only primary accounting documents can serve as proof of the fact of delivery, based on the fact that any business transaction requires proper documentation (Part Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”).

It is important that the invoice contains all the fields regarding the product (otherwise it cannot be identified) and its quantity, that it is signed by the supplier and the buyer (consignee), and also has the seals of both parties (see, for example, the resolution of the Federal Antimonopoly Service of the North-Western Territory dated 03/31/14 No.).

The courts recognize as established the fact of the transfer of goods under a supply agreement, recorded in signed delivery notes, which have a link to the supply agreement (see, for example, resolutions of the Federal Antimonopoly Service ZSO dated 09/08/2009 No.).

The rationale for this position is given below in the materials of the “Lawyer System”

«

Delivery is perhaps one of the most popular contracts in business. Moreover, this type of contractual relationship most “painlessly” reacts to the absence of an agreement, both in the form of a single document signed by both parties, and in the form of documents emanating from the parties, which could be regarded as an offer and acceptance. To prove in court the fact of concluding a one-time supply transaction, primary accounting documents indicating the accomplished fact of transfer of goods by the supplier and their acceptance by the buyer are sufficient. Such judicial practice helps bona fide suppliers, but it can also benefit unscrupulous individuals. For example, the author of this article is involved in a legal dispute in which a company unexpectedly received a claim from a bank to collect a significant amount of debt arising from a supply. The bank refers to the fact that it received the right to claim this debt under a factoring agreement from another company that supplied the goods to the defendant. The defendant denies the fact of delivery, but in support of the fact that it was, the plaintiff presented invoices and other primary documents. As a result, the defendant is forced to prove that there was no delivery and could not have been, relying only on numerous shortcomings in the execution of primary documents, as well as indirect evidence that the company, which appears in the documents as a supplier, was not able to make the delivery. This dispute has not yet been completed, but preparation for it required the author to deeply analyze judicial practice on the question of what documents in similar circumstances are sufficient for the plaintiff to prove the fact of delivery, and, conversely, how the defendant can refute the fact of delivery.

Practice in such disputes is also relevant for cases where a “full” supply agreement has been signed between the parties, since debt collection in any case depends on proving the fact of actual fulfillment of obligations under the contract, namely the fact of acceptance and delivery of goods.

Documents that confirm the fact of delivery of goods

The fact of delivery (that is, transfer of goods to the buyer) is confirmed by primary accounting documents, based on the fact that any business transaction requires proper documentation (Federal Law of 06.12.11 No. 402-FZ “On Accounting”, hereinafter -). Previously, all companies were required to use unified forms of primary accounting documents, but as of January 1, 2013, there is no such requirement, and only indicates the mandatory details that must be present in the primary accounting document. Each company can now approve the form of this document itself. Nevertheless, business is accustomed to unified forms, and the development of new forms requires not only time, but also the reconfiguration of special accounting programs. In addition, it is inconvenient for turnover when the supplier and buyer use different forms of primary accounting documents. Therefore, in practice, in most cases, unified forms are still used.

The court evaluates the evidence according to its internal conviction, therefore, bona fide suppliers, when filing a claim for collection of a delivery debt and proving the fact of transfer of goods, as a rule, do not limit themselves to invoices, but present all possible documents related to the delivery, including acts of reconciliation of mutual settlements, guarantees letters, etc. (decrees, ).

Ideally, the fact of transfer of goods is accompanied by a whole set of primary documents: a consignment note (form No. TORG-12), and if the supplier also delivers the goods, then a consignment note (form No. 1-T), an act of acceptance of goods (form No. TORG-1 or in another form established by the parties to the transaction). The supplier also prepares and transfers to the buyer an invoice, which, although not a primary accounting document (it is a tax document), often appears in disputes about the reliability of the fact of delivery. But the complete set does not exist in every situation. In addition, the available documents are not always prepared properly - sometimes they lack some information, signatures, seals, etc.

The absence of some primary documents may make it difficult or even impossible for the supplier to prove in court that the delivery took place. But the general trend of arbitration practice can be characterized as follows: if there is a properly executed delivery note, then in most cases the courts will consider the delivery of goods proven. At the same time, if the buyer, despite the presence of the invoice, denies the fact of transfer of the goods and can provide any evidence that the delivery could not have taken place, then the court will most likely invite the supplier to provide additional documents confirming the delivery. The list of required evidence may depend on the terms of the supply contract itself (sometimes contracts contain references to certain types of documents used to formalize the delivery, for example, the parties agree on a special form of the acceptance certificate) or on the type of goods supplied.

The delivery note is the minimum document required to prove delivery.

In most cases, the supplier will only need one invoice to prove the fact of delivery (see, resolution of the Federal Antimonopoly Service of the East Siberian District dated 06/09/14, section No. A33-16983/2013,).

Conditions under which an invoice is sufficient.

For the invoice to work as 100% reliable evidence, it must be completed correctly. Otherwise, the court may not accept it as inadequate evidence.

It is important that the invoice contains all the fields regarding the product (otherwise it cannot be identified) and its quantity, that it is signed by the supplier and the buyer (consignee), and also has the seals of both parties (see, for example,). Of course, the signature placed on the invoice must belong to an authorized person - in particular, an employee of the buying company, whose job responsibilities include acceptance of goods (resolution of the Federal Antimonopoly Service of the Moscow District dated May 21, 2014, section No. A40-70534/13,). The right to accept goods on behalf of the company may be confirmed by a power of attorney, or these powers may be apparent from the situation. In the first case, it is important that the invoice contains the details of the power of attorney (its number and date). In addition, it would be good for the supplier to have a copy of this power of attorney, otherwise the buyer may refer to the fact that the person indicated in the invoice is unknown to him and the power of attorney was never issued to him.”

Was there any transportation or what is more important: a certificate of completion of work or a waybill?

PROBLEM.

The chief logistician of the enterprise Voskhod-Center LLC (Bonape brand) – hereinafter referred to as the “enterprise”, taking advantage of its position as responsible for all transportation of the enterprise’s products, having certain broad powers, taking advantage of the trust of management, organized for itself, according to the conclusions of the internal investigation at the enterprise, in addition wages, obtaining additional income. This person contributed to the registration of his elderly mother as an individual entrepreneur, indicating as the main activity the activity of road freight transport, entered into a freight forwarding service agreement with his mother on behalf of the enterprise, and took under “his wing” all the drivers and carriers who Thus, transportation services were already provided to the enterprise directly, but contracts and primary transportation documentation were handed over and executed in the logistics department. The above-mentioned contract for transport and forwarding services allowed the chief logistician to make “his own” markup on the cost of services of all driver-carriers of the enterprise, issuing a general invoice to the enterprise on behalf of his mother-entrepreneur for all transportation, taking into account a certain margin. That is, allegedly individual carriers (individuals) worked on behalf of this woman or were carriers with whom she entered into contracts. Although they worked as before and continued, not even knowing that there was someone who seemed to be controlling them. This woman did not draw up any documentation with “her carriers”; she worked insolently. Such documents were drawn up by her later in the legal proceedings. The company's management was in the dark for several years. In the spring of 2015, the new head of the enterprise’s security service discovered this “interesting scheme”, surprised by the high cost of transportation; It turned out that the company has a certain number of carriers, the cost of services of which is acceptable, but for some reason, at some point, a woman appeared who began to position herself as the “main” carrier or as the organizer of these transportations (in court, her side did not agree with this was able to decide), and the total price of transportation then increased significantly. The chief logistician of the enterprise had broad powers and completely controlled all transport movements of the enterprise, no one was interested in this area, the management trusted the logistics department, therefore, for a long time these circumstances remained secret. In this regard, after bringing the circumstances to the attention of management, it was decided not to pay for the controversial services of the mother of the chief logistician for the last period - March and April 2015, and to continue the proceedings. At the same time, the chief logistician had already resigned and, on behalf of her mother, filed a claim with the Arbitration Court of the Moscow Region against the company for the collection of an alleged debt for services provided under a freight forwarding service agreement. The amount of the claim amounted to more than 3 million rubles, which subsequently only increased. The difficulties in protecting the interests of the enterprise were that the management of the enterprise, before identifying the above facts, had already signed part of the acts of work performed during the disputed period; also, the plaintiff’s side could very convincingly, which they did, appeal to the established cooperation with the enterprise for several years, in the process in which the enterprise, without any complaints, signed certificates of completed work and paid for the services of the entrepreneur.

The main legal problem in this case for a general resolution is due to the fact that the opponent of the enterprise (the mother of the former chief logistician) did not have any documents directly recording the fact of transportation (and she did not carry them out or even organize them, she simply took money from the enterprise for invented services), such as transport or waybills, and there were only single acts of work performed, signed on both sides, the question was: does the presence of signed acts of work performed prove the fact of the transportation taking place?

SOLUTION PROCESS.

Having carried out a thorough analysis of all the intricacies of this case, I, representing the interests of the enterprise, drew up a promising legal plan that worked in the arbitration process. It should be noted that initiating a criminal case was quite problematic due to the vague interpretation of the actions of the chief logistician of the enterprise. One of the main emphasis I placed, among other things, on the established judicial practice in such disputes, according to which certificates of work performed as such do not confirm the very fact of transportation; this is confirmed by transport or invoices. This is, for example, the Resolution of the Arbitration Court of the West Siberian District dated 06/22/2015 No. F04-20363/2015 - “Billing notes are the primary accounting documents confirming the fact of transportation of goods”, Resolution of the Arbitration Court of the Moscow District dated 03/12/2015 No. F05- 983/2015, Resolution of the Arbitration Court of the Moscow District dated 08/11/2014 No. Ф05-8435/2014, Resolution of the Federal Antimonopoly Service of the Moscow District dated 05/05/2014 No. Ф05-2401/2014, Resolution of the Arbitration Court of the Far Eastern District dated 05/27/2015 No. Ф03 -1772/2015, etc. According to the norms of the legislation of the Russian Federation on transportation, a bill of lading (bill of lading or other document for cargo) is the main document indicating the existence of legal relations for transportation, and its proper completion and signing indicates the provision of services. Regardless of who the plaintiff positioned himself in the disputed legal relationship (the question arose - a forwarder or a carrier), he should have had a technical specification or technical specification, drawn up jointly with the enterprise or carrier drivers. Why were they absent? Yes, because she was not involved in transportation as such at all. The plaintiff only had certificates of work performed and explanations of the case. The work I organized allowed me to collect and present the following evidence to the court:

— waybills, which included the shipper (enterprise), consignee (enterprise client), direct driver-carrier of the cargo,

— route sheets that included the company and the direct driver-carrier,

- waybills, in which the shipper (company), consignee (company client) appeared, and in the column provided for this, the direct driver-carrier was also listed,

- testimony of some delivery drivers who have never seen or known the entrepreneur - the mother of the chief logistician of the enterprise, and always thought that they were collaborating directly with the enterprise, and their services were paid for by a person authorized by the enterprise,

- written explanations that made it clear to the court of first instance that the plaintiff did not fulfill and cannot confirm the fulfillment of any of the conditions of the contract of transport and forwarding services concluded with the enterprise, the plaintiff did not carry out transportation during the disputed period, and also did not organize such.

The totality of evidence, the masterly use of the plaintiff’s “weaknesses,” and the necessary motions filed in a timely manner—all this allowed the trial court to achieve an almost 100% result. The plaintiff’s claim was denied in full, but the only thing was that the defendant was also denied a counterclaim related to the premature payment of a small part of the plaintiff’s services during the disputed period. This conclusion of the court is quite controversial, to put it mildly, since the refusal to satisfy the claim automatically should have led to the satisfaction of the counterclaim, based on the essence of this dispute.

Subsequently, the proceedings moved to the appellate instance, where the panel of judges made a radically different conclusion on the circumstances of the case, grossly violating the norms of the Arbitration Procedure Code of the Russian Federation - they accepted additional evidence from the plaintiff, and even in copies. Such evidence, firstly, was not presented or mentioned in the first instance; in the second instance, explanations of the impossibility of presenting such evidence were not previously made; and secondly, the originals of these documents never appeared on appeal. And thus, including on the basis of this additional evidence, I am sure, concocted by the plaintiff at the last moment, the appeal ruling satisfied the interests of the plaintiff in terms of collecting the debt for transportation services (the decision of the first instance was canceled in part), but only according to the signed acts of execution works, the rest of the claim was rejected, and the defendant’s counterclaim, accordingly, also remained unsatisfied. How this could happen, with such a gross violation of procedural law, is an open question. The conclusions of the appellate court, in my opinion, of course, contradict the legal doctrine and judicial practice on the topic of documentary evidence of actual transportation.

The dispute reached the third instance, but the cassation, in my opinion, approached the consideration of the dispute formally and left the appeal verdict unchanged.

RESULT.

Despite the partial reversal of the decision of the Arbitration Court of the Moscow Region by the Tenth Arbitration Court of Appeal and the satisfaction of part of the plaintiff’s demands, the enterprise still remained in a winning position, since transportation of products during the disputed period was carried out in the required volume, but was not fully paid for - at the prices of the pseudo-carrier, and in a rather impressive amount, which was not received by the former chief logistics officer of the enterprise, represented by her mother-entrepreneur, who was counting on this. That is, they still saved some money for the enterprise. This victory is even more valuable because at the very last moment, when the company wanted to make a decision on agreeing to the demands or concluding a settlement agreement with the plaintiff on negative terms, the management’s opinion was changed based on my analytics.

The widespread legal conclusion, supported by the majority of courts, about confirmation of the fact of transportation only on the basis of a bill of lading or a similar document, and not an act of work performed, in our opinion, should always be relevant and continue to build uniformity of judicial practice on such disputes in order to optimize legal proceedings and to avoid miscarriages of justice.

Case No. A41-51135/2015 in AS MO.

Certificate of acceptance and transfer of goods under 44-FZ

The act of acceptance and transfer of goods is a document that confirms the fact of transfer of goods from one person to another. The act is filled out at the stage of contract execution. This may be the acceptance of work, goods or services in full, or their individual stages. It is worth noting that the act can be drawn up both for one unit of goods and for an entire batch of goods.

Let's consider who signs the acceptance certificate for the transfer of goods. According to Law No. 44-FZ, the goods are accepted and checked for compliance with the requirements by the customer. However, by his decision, an acceptance committee of five or more people can be created. In the first case, the act is signed personally by the customer; in the second, the document must contain the signatures of all members of the commission, and it must be approved by the customer.

The act is drawn up in two copies. One remains with the customer, the second is taken by the contractor.

Do you work under 44-FZ?

A selection of special materials is ready for you »

Do you purchase according to 223-FZ?

We know that you will find it useful to watch"

The act of acceptance and transfer of documents, information or material means

It is important to understand that by signing the act, the customer agrees that the goods were supplied to him in the required quantity and proper quality, and he has no complaints. If claims are nevertheless identified, the customer can send the supplier a refusal to sign the act. The time frame within which acceptance of the goods must take place, as well as the time period within which it is necessary to send the contractor a refusal to sign the act, are specified in the contract.

The difference between the act of acceptance of the transfer of goods and the delivery note

The question often arises: what is the difference between an invoice and an act of acceptance and transfer of goods - are these documents interchangeable or not? These are different documents. An invoice is an accounting document required for reporting. Formalizing it is a legal requirement.

As for the transfer and acceptance certificate, everything depends on the terms of the contract. The regulatory authorities do not ask for it. But, if the act is specified in the contract, it must be filled out. If the signing of the act is not provided for in the contract, then a delivery note will suffice as an acceptance document. The form of the consignment note – TORG-12 – is approved by the state.

However, remember that the act is important for resolving controversial issues. This is not possible with a regular delivery note. After all, the act is the only paper confirming the fact of transfer of the goods, which indicates all the characteristics of the goods, possibly its defects. The act is signed by both parties and sealed. Therefore, it can provide assistance in court if, for example, the contractor is faced with an unscrupulous customer.

“How to ensure the fulfillment of a contract and warranty obligations under 44-FZ?”

Konstantin Edelev

, expert of the State Order System

Do not sign the contract or acceptance documents until you receive security from the winner. The counterparty chooses in what form to provide contract security or guarantee obligations - provide a bank guarantee or transfer money to the customer’s account. Include the requirement to provide security in the notice or invitation to participate in the procurement, documentation and draft contract. Read how much and how participants provide contractual obligations and guarantees »

Excel for Procurement Specialists An add-in that will greatly simplify the work of a contract manager! Works without transmitting data to the Internet. Download for free to your computer!

What does the transfer acceptance act include?

The form of this document is not legally approved, but there are some requirements for its content. A sample act of acceptance of the transfer of goods under 44-FZ must include the following information:

- The header indicates the number of the application, as well as the number and date of conclusion of the agreement to which the application was drawn up;

- The name of the legal entities, the names of the people acting on their behalf, as well as the name of the documents on the basis of which they act;

- List of goods indicating for each name, quantity, price with and without VAT. Here you can also register product defects;

- Total cost of the goods;

- A footnote that all contract requirements have been met, including quality, quantity and timing, and that the customer has no complaints against the supplier;

- Signatures of both parties.

✔

Required details

A standard document for acceptance and transfer of a product or product must include established essential details, without which, in the event of disagreement between the parties, it will be considered invalid.

This act must include the following essential details, and in particular:

- Title of the document;

- the current date and place of its composition;

- detailed information about the persons receiving the goods - the seller, the buyer or trusted persons. This is primarily the first name, last name, passport information, identification code number, citizenship, contact telephone numbers, residential addresses;

- act number;

- a clear representation of the numerical data of the transferred product, and the actual assortment and number;

- indication of the quality data of the product;

- presentation of absolutely all detected defects of the product (if there are no defects, it should be noted that there are no defects);

- probable complaints of the two parties to the agreement that arose during the acceptance and transfer of the product are indicated;

- signatures of both parties;

- seals of the institutions that transferred and received the product;

In addition to the integral data that must be enshrined in the product acceptance certificate, there may also be other auxiliary details noted at the request of the parties.

At certain points, it makes sense to indicate by what method and in what period the payment for the goods was made - before or after the practical transfer of the product.

Also, if the contract takes into account not a one-time, but a long-term supply of goods, an independent document is drawn up.

In addition, counterparties are required to streamline the issue regarding whether it is enough to draw up an acceptance certificate for a single product item, or for a specific batch of product.

the goods acceptance certificate can be found here (Word, .doc format)

Requirements for filling out in accordance with Article 9 of the Federal Law on Accounting

Article 9 of the Federal Law “On Accounting” states that all business procedures, including monetary procedures, must be documented in the main papers on the basis of which accounting is carried out in the company.

This kind of act must be collected during the procedure or immediately after its completion.

The document that proves the implementation of currency transactions must be drawn up exactly in accordance with the law and be signed by the manager of the organization, the main accountant or an authorized person.

Primary accounting papers must be drawn up in the appropriate form and have the following details:

- Title of the document;

- formation period;

- name of the institution;

- natural and currency expression of a business transaction;

- information about officials;

- signatures of persons;

Bill of lading form

By virtue of the norms of Federal Law dated December 6, 2011 N 402-FZ “On Accounting,” all facts of an organization’s economic activities are subject to registration with primary accounting documents approved by the head of the organization upon the proposal of the official charged with maintaining accounting records.

In this case, the organization can use both independently developed documents and unified forms of primary documentation contained in special albums and approved by the State Statistics Committee of Russia.

Thus, Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132 approved the Album of unified forms of primary accounting documentation for recording trade operations, among which is the consignment note (form N TORG-12), used to register the sale of inventory items to a third-party organization.

Therefore, in practice, organizations use a consignment note in the TORG-12 form to register the sale (release) of inventory items to a third-party organization.

A consignment note can be generated and stored both in paper form and electronically.

Has no evidentiary value

In the courtroom, the plaintiff's representative presented to the arbitrators payment orders, invoices drawn up in form No. TORG-12, as well as reconciliation reports, the preparation of which was provided for in the contract. According to these documents, the customer transferred more than ninety-seven million rubles to the supplier, and the latter transferred goods to the buyer for a significantly smaller amount. In turn, the defendant-seller referred to “his” invoices: according to the documents, goods were delivered to the buyer for an amount much greater than the advance payment, about one hundred and ten million rubles.

Having carefully checked all the documents, the arbitrators found that the “primary” data presented by the defendant did not meet the accounting requirements. The judges recalled that, by virtue of paragraph 1 of Article 9 of the Accounting Law, every fact of economic life is subject to registration by a document on which, in fact, records are kept. According to the rule set out in paragraph 1.2 of the Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132, such documents also include a consignment note in form No. TORG-12, the execution of which has clear requirements, failure to comply with which, in fact, makes the paper invalid and, accordingly, it does not prove anything.

On a note

The judges recalled that every fact of economic life must be documented in a document on which, in fact, records are kept. These include the consignment note in form No. TORG-12, the execution of which has clear requirements, non-compliance with which, in fact, makes the paper invalid.

And in the case under consideration, the defendant presented the so-called combined invoices: the first sheet of the consignment note, drawn up in form No. TORG-12, without the signature and seal of the consignee, and the first sheet of the consignment note, drawn up in form 1-T. In this regard, it should be noted that the consignment note in form No. 1-T is intended to record the movement of inventory items and payments for their transportation by road (see Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78). And it applies in case of involvement of a third party - a cargo carrier. But during the actual execution of the transaction, there was no carrier. Therefore, the judges recognized the partial use of the 1-T invoice as incorrect, and the defendant’s “homemade” invoice with an amount exceeding the advance payment made by the customer, and the unilateral act drawn up on its basis as unreliable. But the arbitrators considered the document drawn up in form No. TORG-12, as well as the invoices drawn up precisely on its basis, as admissible evidence, and decided that the claim filed by the buyer should be satisfied in full - both in terms of debt collection for undelivered goods, and in terms of payment of interest for the use of other people's funds (Decision of the Arbitration Court of the city of St. Petersburg and Leningrad Region dated August 25, 2014 in case No. A56-7618/2014).

Dissatisfied with this decision, the seller's representative filed an appeal. But even in this instance, a fiasco awaited the defendant. The appeal arbitrators fully supported the position of their colleagues, emphasizing that, having signed the delivery notes and sent invoices for amounts other than those indicated in “his” documents, the supplier nevertheless agreed that the goods were actually delivered to him for a lesser amount (Resolution of the Thirteenth Arbitration Court of Appeal dated December 9, 2014 in case No. A56-7618/2014).

Registration of a delivery note

Drawing up a delivery note

The delivery note is drawn up in two copies, one of which remains with the supplier organization and is the basis for writing off inventory items.

The second copy of the consignment note is transferred to the buyer (consignee) and is the basis for recording these values and deducting VAT.

Signing the delivery note

Primary documents are signed by the manager and chief accountant or authorized persons.

The list of persons authorized to sign primary documents is approved by the manager in agreement with the chief accountant. Thus, the manager can transfer the right to sign the delivery note and formalizes this right with a power of attorney or order.

In this case, 5 signatures can be affixed to TORG-12:

three from the seller’s side: (manager, accountant, responsible for shipment). In some large organizations, one person signs the delivery note upon shipment. Usually this is a certain “operator” who, based on information received from the accounting department and warehouse, generates a document and signs it with his signature. This procedure must be enshrined either in an order, or in a power of attorney, or in the job descriptions of the “operator”;

In what cases is it necessary to draw up an act?

Typically, the process of transferring goods does not take into account the formation of an act of acceptance and transfer of goods; as a rule, a consignment note is sufficient. The delivery note represents proof of the product's shipment process.

But in isolated cases, the circumstances of the supply agreement call for the compulsory preparation of a goods acceptance and transfer certificate upon acceptance and transfer of goods from the supplier to the buyer.

In addition, there are often situations when the actual volume of the product differs from the declared one, the wrong baggage arrived, or the batch turned out to be defective. In order to demonstrate complaints to the supplier, these facts must be registered in the proper way by issuing an acceptance certificate stating absolutely all detected inconsistencies.

Some types of products (for example, equipment) are always transferred according to the act, due to the fact that this is directly required by the procedure for their acceptance: inspection, work ability testing, etc.

If the products are sent for serious storage, an act is drawn up in order to explain the place of the valuables being handed over, determine the conditions of their stay and identify the financially responsible person.

When concluding a supply contract, the parties have every opportunity to introduce into it a clause on the strict signing of an important document on acceptance of the product during its transfer to the buyer.

This action establishes the entire process of transferring the product, its detailed characteristics, high-quality and quantitative properties, and also the cost of the product.

It is worth noting that the product acceptance document is drawn up in two copies. At the same time, the two documents must not be copied, but originals. It must contain all the necessary details and information. In the absence of the necessary details, it is possible to prove its inauthenticity. The act is considered real only if it includes all the necessary data and details.

Electronic form of trade invoice

The form and procedure for compiling an electronic invoice are no different from the form and procedure for compiling its paper counterpart, with the exception that the electronic document is compiled in one copy, which consists of two files.

One of them is formed on the seller’s side, and the second, when sending a document, on the buyer’s side.

To sign electronic invoices, instead of a handwritten signature, an electronic signature (ES) is used, and the electronic consignment note is signed with one electronic signature on the part of the seller and one on the part of the buyer. Total of two signatures.

At the same time, in the lines “Vacation authorized”, “Chief (senior) accountant”, “Cargo released”, “Cargo accepted” and “Cargo received by consignee” the full names and positions of the relevant persons are indicated, and in the line “By power of attorney No.” - information on the power of attorney of the authorized person.

Combining an invoice and delivery note into one document

An invoice and a delivery note (TORG-12) can be combined into one document.

Options for combining an invoice and a delivery note into one document

In order to create one document instead of an invoice and a delivery note, there are two options:

Option 1. Use the form of a universal transfer document (UDD) recommended by the Federal Tax Service. In this case, “1” must be indicated in the “Status” field of the UPD.

Option 2. Develop the form of the combined document yourself. To do this you should:

1) supplement the invoice form with the following details (part 2 of article 9 of Law N 402-FZ, clause 9 of the Rules for filling out an invoice)):

a description of the business transaction - the release of goods (for example, “the goods were released” or “the cargo was released”);

the title of the position of the representative of your company who released the goods, with his signature, surname and initials;

a description of the business transaction - acceptance of goods (for example, “received the goods” or “received the goods”);

the title of the position of the company representative - buyer or consignee, with his signature, surname and initials;

2) by order of the head of the organization, to approve such an amended invoice form as a primary document as an annex to the accounting policies.

However, you cannot exclude any invoice details from the combined document.

The procedure for issuing and registering a combined document

The supplemented invoice or UPD must be drawn up:

upon shipment, and not within five calendar days from the date of shipment;

in two copies, one of which is given to the buyer, and the second is recorded in the sales book - just like a regular invoice.

An amended invoice or UPD for the purposes of calculating VAT, income tax, as well as accounting will be documents confirming the shipment.

The buyer's procedure for handling the combined document

Based on the amended invoice or UPD, the buyer can:

accept goods for accounting;

deduct VAT, just like on a regular invoice;

take into account the cost of goods in tax expenses.