Cases when an act of form T-73 is required

There are situations when you need to perform some one-time work, but the company’s employees do not have the necessary specialists. Since the work is one-time, the organization does not need to perform these works on an ongoing basis.

For example, an organization needs to prepare documents for subsequent transfer to the archive. In such a situation, a worker even without a specific education and classification will be suitable, and the work will take a maximum of a month. In some situations, a design project is required. This work will only take a few days.

In such cases, employers enter into fixed-term employment contracts with employees. Read more about the grounds for concluding a fixed-term work contract in the article.

After the work is completely completed, the primary document is drawn up. It is on the basis of this document that payment is made.

If the organization does not have Form T-73, it can use Form T-55.

Unified form No. T-73

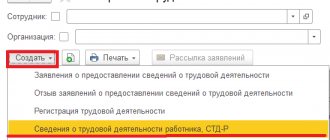

Registration of STD is carried out by enterprises not in all cases of hiring personnel, but only if there are grounds according to the statute. 59 TK.

For example, the need for a temporary specialist may arise during a short-term absence of the main employee, when an employee is sent abroad, when the employer has interns, interns, etc. According to the norms of stat.

79 STD must be concluded for a certain period, but not more than 5 years. If you do not specify the duration of the contract, the transaction is automatically recognized as unlimited.

When a specialist is hired by a company not on a permanent basis, but to perform certain work in accordance with the concluded STD and on the basis of Article 79 of the Labor Code, the employer should properly formalize the acceptance of the work performed.

The specific acceptance procedure must be specified as a separate condition in the concluded contract. The form of the corresponding document, the certificate of completed work, form T-73, was approved at the federal level in Resolution of the State Statistics Committee of Russia No. 1 of 05.01.

04

Note! According to special instructions for the application of this regulatory act, each enterprise has the right, but not the obligation, to use unified forms of documentation in accordance with Resolution No. 1. An employer can independently develop forms, but with the obligatory reflection of all mandatory details.

Recommendations for drawing up the T-73 form

Consequently, we found out that when accepting work under a fixed-term employment contract concluded for the duration of certain work, the parties must sign an act f. T-73.

How is this document compiled? First of all, in the STD itself, participants in labor relations must foresee at what point the work is accepted - at once or in stages.

If the employer uses a form developed independently, the manager must approve the forms of the documents used in the order.

The act reflects data on the nature of the work, the total cost, the responsible specialist, the number and date of the technical documentation, the volume and quality of the results obtained. The form is filled out by an authorized officer of the company, approved by the manager, and payment is calculated by an accountant. The document is drawn up in 2 copies, one for each of the interested parties.

Fixed-term employment contract

Procedure for filling out form T-73:

- Header - here the exact name of the employing company is given, if there is a structural unit, as well as the main codes: OKPO, OKVED. The date and number of the contract concluded with the STD employee, as well as the period of its validity, are indicated separately.

- Act number and date – chronological data is entered. The document is approved by the head of the company.

- Information about the employee - information about the STD and the individual involved in performing the work is duplicated here.

- Tabular part - here information is provided on the list of work performed and their cost, previously issued advances are displayed, additional payments or overpayments are calculated.

- Information about the work - here it is indicated how much work was done, what quality/level it corresponds to, and the exact cost is assigned.

- Handover and acceptance - completed work is confirmed by personal signatures of the parties. At the end, the document is approved by the responsible persons - the manager and the chief accountant of the employer.

To avoid problems with inspectors, including liability and penalties for incorrectly compiled personnel documents, it is recommended to include a reference to the f. in the terms of a fixed-term employment contract. T-73 when accepting work from the contractor.

It is better to agree on the form itself at the stage of signing the STD, so that in the future the employer does not have any misunderstandings with the specialist. Typically, filling out the form does not raise any questions, and a practical example will help you clearly understand the nuances of reflecting all the information.

If the contractor performs various works, you need to enter information separately, broken down by type. This will allow you to accurately calculate the amount of remuneration to an individual and justify the expenses incurred to the employer for tax purposes.

Note! To calculate the amount of remuneration, it is recommended to use a pay slip drawn up in a free form or recommended for calculating vacation payments.

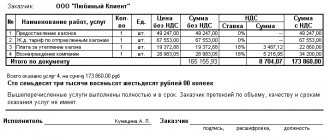

Form and sample of work acceptance certificate form T-73 – download here:

(Form) Form T-73

(Sample filling) Form T-73

, please select a piece of text and press Ctrl+Enter.

Source: //raszp.ru/priem-na-rabotu/opisanie-i-primenenie-formy-t-73.html

Description of the act

The act can be used both in relation to an employment contract and in relation to a civil law contract. It can also be issued for a phased calculation or for a final one.

The act must contain:

- Description of the work performed;

- Cost of work;

- The amount to be paid to the employee;

- Feedback on how well the work was completed;

- Feedback on the scope of work and its level.

All this information is entered into the act, referring to the employment contract that the two parties entered into between themselves.

This form is the basis for payment for work performed.

The act applies to all companies, regardless of their organizational form and activities. The only exceptions are budgetary organizations.

The act is filled out by the employee who is responsible for checking the work performed, approved by his head of the company or an authorized person. Then it is transferred to the accounting department for settlements with the temporary worker.

From all of the above, we can conclude that form T-73, certificate of work performed, is the primary document for payment under fixed-term work contracts and reflecting these expenses in accounting.

Since January 2013, it is not necessary to use forms of primary documents for accounting. However, primary documents established by authorized bodies are still mandatory to fill out. For example, such documents are cash documents.

In what cases is this document needed?

In some situations, a company does not have its own employees with the necessary qualifications to perform a certain one-time job, or there simply are not enough workers to complete a certain project on time.

Replenishing the staff with new employees for the sake of this does not make sense, since in the future they will have to pay salaries regularly, while they will not be fully loaded.

Similar situations may arise if it is necessary to carry out certain repair, construction and restoration work, design, agricultural and many others. The solution is usually found through the conclusion of fixed-term employment contracts between the employer and third-party employees.

After the work is completed, the above-mentioned primary document is drawn up, that is, an act on the basis of which all calculations and payment of due wages are made.

If the enterprise does not have the T-73 form provided for such cases, then the use of the T-55 form is permitted by law.

The act of acceptance and transfer of a building (form OS-1a) is a document on the basis of which the transfer of an immovable fixed asset is made from one owner to another. T-60 forms can be found here.

Contents of the act

The application of the act is possible both in the case of cooperation between the employer and employees under employment contracts and civil law ones. It is planned to draw up an act not only for the final payment after completion of all work, but also for a phased one.

The form of this document is filled out with the obligatory entry of the following information:

- descriptions of the nuances of the work being carried out;

- their value stipulated by the contract;

- the total amount provided for payment to the employee;

- feedback regarding how well the work was carried out, in what volume and at what level.

All this information is entered into the act with reference to the agreement previously concluded between the parties. The completed form serves as the main basis for making payment for completed work.

This act is included in the category of primary documentation, the use of which has been optional for accounting since 2013. However, those primary documents that were established by the relevant authorities, as before, must be completed without fail.

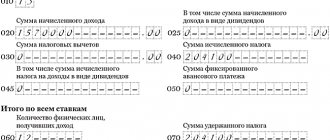

Sample of filling out form T-73

Fill out the form

Like all other forms, ours begins to be filled out at the header. It must contain the following information:

- name of the company or enterprise;

- structural subdivision;

- OKVED;

- OKPO;

- details of the employment contract (date and number);

- the duration of this agreement;

- number and date of drawing up the act to be filled out;

- reporting period.

Next, in the main part, indicate the employee’s full name, terms and details of the contract. Then there is a table where the following data is entered:

- Number in order.

- Title of the work.

- The amount for the work.

At the end of the table, they summarize the amounts for all work done by the employee, indicate the amount of the advance and the amount that must be paid.

Then they write a short conclusion about the quality, volume and level of work performed and indicate the amount in words.

At the end of the document, the following people put their signatures: the employee, the employee accepting the work, the head of the structural unit and the chief accountant. After this, the document is approved by the head of the company.

After the act is completed and the employee receives the money, management must issue an order to terminate the contract.

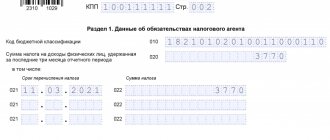

Expense cash order (form KO-2) in 2021

In the line "Organization"

the legal form is indicated (LLC, CJSC, etc.) and the name of the organization (for example, LLC “Company”).

In the line “Code according to OKPO”

it is necessary to indicate the OKPO code in accordance with the notification received from Rosstat. If the code has not been assigned, put a dash.

Next, indicate the name of the structural unit

the organization issuing cash settlement services (if the organization has no structural divisions, put a dash).

In the "Document number"

the serial number of the cash register is indicated (the numbering of incoming and outgoing cash documents during the year must be continuous, and start anew from the beginning of the next year).

In the “Date of Compilation”

the date of issue of money from the cash register is indicated in the format DD.MM.YYYY (for example, 03/05/2016). RKO must be issued on the day the money is issued from the cash register, so the date of issue of money and the day the order is generated coincide.

Block "Debit"

:

In the column “Code of structural unit”

indicate the code of the division of the organization issuing cash settlements (if the organization does not have structural divisions, put a dash).

In the column “Corresponding account, sub-account”

the account number is indicated, the debit of which reflects the issuance of money from the cash register in accordance with the chart of accounts:

- 51 – delivery of money to the bank for crediting to the current account;

- 60 – settlements with suppliers and contractors;

- 70 – settlements with employees regarding wages;

- 71 – settlements with accountable persons;

- 73 – settlements with employees for other transactions;

- 75-2 – settlements with founders for payment of income.

Column "Analytical Accounting Code"

filled in only if the corresponding codes are available.

In the "Credit"

the number of the accounting account is indicated, the credit of which reflects the issuance of money from the cash register (as a rule, this is account

50.1 - “cash desk”

).

In the "Amount"

The amount of money dispensed from the cash register is indicated in numbers.

Column “Purpose code”

filled out if the organization uses the appropriate coding system in its activities. In this case, the code for the purpose of using the retired funds is indicated.

In the "Issue"

The full name of the individual is indicated (in the dative case, for example, Ivanov Ivan Ivanovich) or the name of the organization to which funds must be issued.

In the line "Base"

it is necessary to indicate the basis for issuing money from the cash register, for example:

“Issuing financial assistance”

or

“Depositing money to the bank”

, etc.

In the line "Amount"

The amount of money dispensed from the cash register is indicated in words. In this case, rubles are written with a capital letter, and kopecks with numbers. In empty fields you must put a dash.

In the "Application"

the attached primary documents are reflected, indicating their numbers and dates, on the basis of which money is issued from the cash desk (powers of attorney, receipts, orders, statements, etc.).

Next, fill in the details of the head of the organization

(position, signature and signature transcript) and

chief accountant

(signature and signature transcript).

Note

: the manager does not have to sign for the cash register if he makes an authorization inscription on the attached documents to the cash receipt order.

The line "Received"

filled out by the person to whom money is given from the cash register. In it, he indicates the amount of money received (in this case, he must write rubles in words with a capital letter, and kopecks in numbers). Next is his signature and the date of receipt of the money.

When issuing money via cash register, the cashier must check the identity document

recipient (passport or other document). The cashier indicates the name, number, date and place of issue of this document in the corresponding line of the cash register.

Line “Issued by the cashier”

filled in by the cashier only after the cash is issued via cash register. In it he puts his signature with a transcript (last name and initials).

fully filled order remains at the cash desk

enterprise (and not handed over to the recipient of the money) and serves as confirmation that the funds were issued legally.

note

, it is prohibited to make corrections in the cash receipt order.