When performing various services, an agreement is drawn up, which is signed by both parties. It reflects the timing, type of service provided (legal, medical, educational, transport, etc.), the essence of the service and details of the parties. The document has a registration number and a stamp is affixed to it. Each party receives one copy, which can become the basis for transferring money for the service provided.

After some time, a controversial situation may arise in which the parties begin to find out whether assistance was really provided or not. Another piece of paper will help clarify the situation – the certificate of services performed.

Why do you need an act of provision of services?

First of all, it should be said that the act records the fact that all necessary services were performed on time and in proper quality. He also confirms that the customer has no claims against the contractor (a list of all services provided is entered in a special table contained in the document).

Thus, the act is the legal basis for making final payments under the contract between the interested parties.

If we talk about the customer, then the act is also included in the financial statements, including accounting for expenses incurred, and on its basis the tax base is reduced.

In cases where the customer remains dissatisfied with the quality of the services provided, this is also reflected in the act as a separate paragraph. It lists in detail the identified shortcomings, defects, errors and indicates the period during which they need to be eliminated. If work to eliminate violations is not carried out, the customer has the right to sue the contractor. In the same way, the contractor can sue, for example, if the customer delays or evades payment.

That is, an act of provision of services can become an argument in a legal dispute between counterparties, both on one side and on the other.

In other situations, the document, on the contrary, can be a guarantee against unfounded claims and the occurrence of litigation.

It is worth noting that if the case goes to court and there is no agreement between the parties, the judge may interpret its absence as an unwillingness to comply with the legally established procedure for registering the provision of services. This in turn may lead to the imposition of penalties by supervisory authorities.

What does the legislation say?

The legislation does not force the parties to the agreement to draw up an act of performed services under a service agreement, however, Chapter 39 of the Civil Code provides clarifications regarding the provision of services for a fee. The contract must include a clause explaining exactly how and on what basis the fact of carrying out the work or service is confirmed.

It turns out that even before the execution of the contract begins, the need to draw up such a document is indicated. Such documents are usually called an acceptance certificate or a certificate of services performed.

Since the legislation does not establish a special form of the document, the act is drawn up in any form. The main thing is that it makes it possible to understand when and what services were actually provided. The document can be the basis for calculations and subsequent taxation; it represents an addition to the main agreement.

Certificate of work performed and services provided including VAT.

Tax Code Provisions

Article 38 (section 4, chapter 7) of the Tax Code provides detailed explanations regarding the definition and criteria of works and services subject to taxes. Article 39 reflects the principles of their execution and pricing.

In accordance with the interpretation given by the Tax Code, work and service differ in that the result of the first is a material expression that satisfies the needs of individuals and legal entities. In other words, the performer transfers something, and the customer acquires it .

Based on the results of completion of the work, an acceptance certificate or a work completion certificate is drawn up. The fruits of the services provided are intangible; the service is accepted in the process of its provision. Thus, there is nothing to transmit or receive. In this case, the participants draw up an act of provision of services, which proves only that the service was performed at a certain time.

Provisions of the Civil Code

As practice shows, the cause of disputes is often precisely the fact that the parties do not take into account the difference between work and service. The Civil Code does not contain specific wording for works or services, but Chapter 39, entitled “Paid provision of services,” provides some clarification.

This chapter will apply to contracts for the provision of medical, auditing, educational, information, consulting, veterinary services, as well as communication services, tourism, etc.

This list does not include services provided under a contract, research, technological and development services, transportation services, forwarding services, bank deposits, bank accounts, settlement services, storage and assignment services, commission services, trust management.

The contract for the implementation of work and the provision of services provides for a clause that determines what kind of paper confirms the delivery and acceptance of the subject of the agreement. Most often, for this purpose, an act of performed services is drawn up, signed by the contractor and the customer.

If an act is drawn up without a documented conclusion of an agreement, the tax authorities may regard such an action as a violation. However, this is permitted if the work or service is performed at the time the transaction is concluded.

It must be taken into account that the basis for attributing expenses to the costs of the cost of work or services are an act and a document reflecting the payment for the service at the time of the transaction, or an act and an agreement drawn up in ordinary written form in other cases. An act of performed services may become the basis for legal proceedings and determination of statute of limitations.

Read our new article about the procedure for filling out tax returns for individual entrepreneurs and LLCs using the simplified taxation system.

Rules for drawing up an act

The act of provision of services does not have a standard, unified sample that is mandatory for use, so it can be drawn up in any form, based on the needs of the company, or according to a template developed by the company (if the second option is chosen, then the form of the act must be fixed in the accounting policy of the organization ).

When preparing a document, you must adhere to certain rules and regulations. In particular, the act must include:

- information about both parties to the contract,

- information about the contract under which the work was carried out,

- Services list,

- date

- cost of services provided.

If any additional documents are attached to the act (this can be not only printed papers, but also photographs, checks, receipts, etc.), they must be indicated in a separate paragraph.

How to fill out a certificate of services rendered with an individual

In the event that one party to the execution of the act is a private person, the rules for filling it out practically do not change. Here, the parties still have the right to use a free form of the act or a standard template if the document is filled out by an organization. When specifying information about the parties to the transaction, an individual must enter his passport data.

Many companies choose a specific template to draw up an act of services rendered. In such situations, they are filled out using computer typing. After the document is printed, both parties, or their representatives, must verify it with “live” signatures. In addition, if there is no ready-made form, the act can be drawn up on a regular sheet of A4 paper.

Sample

Form

Design rules

The document can be drawn up on a regular A4 sheet or on the company’s letterhead, either by hand or on a computer (it doesn’t matter). You need to make two copies - one for each side. In this case, both copies of the act must be signed by the heads of both organizations (or employees authorized to act on their behalf) and stamped with seals (only if they are available, since from 2021 legal entities by law have the right not to endorse their papers using stamps and seals ).

After the service has been provided and cooperation has been completed, including full payment, the act should be transferred to the company’s archives, where it should be stored for the period required by law.

How to fill out a certificate of completed work for services

The document is usually drawn up by the executor. After all, he is the one responsible for the quality and results of the services provided. After he fills out all the points, the customer only needs to familiarize himself with the information entered and confirm its accuracy. This document should be filled out carefully. If any mistakes were made, it is better not to correct them, but to fill out a new document. When filling out by hand, try to keep your handwriting legible. It should be clear here what work was performed and how much it cost.

After the parties have signed the act and the customer has made all payments, the cooperation is considered completed. In this case, the act is transferred for storage to the organization’s archive. If there is a large list of services provided, you can use a table to list them in the act. Here it is convenient to note the works, their cost and other features. If the act is drawn up between legal entities, their managers must sign at the bottom. Although other employees of the organization can also play the role of responsible persons if they are vested with appropriate authority.

Sample

Form

Sample of drawing up an act on the provision of services (tabular form)

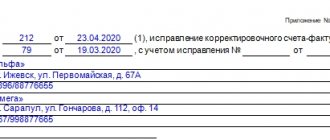

- At the beginning of the document it is written

- its name with a short indication of the meaning (in this case “about the provision of services”),

- a number is entered according to the internal document flow of the enterprise,

- and date of compilation.

- Then the parties between whom the contract for the provision of services has been drawn up are indicated below:

- full names of organizations (this can be individual entrepreneur or LLC)

- and information about their representatives (enter positions, last names, first names, patronymics).

- Next comes a table in which

- names of services (works) in order,

their cost in numbers (if the company uses VAT, then it is highlighted).

Below the table the final price is recorded in words.

The second part of the document should indicate that all services were provided in proper quality, on time and in full. It is also necessary to enter that the customer has no complaints . Here you must indicate to which agreement this act is an annex (its number and date of preparation).

The last thing that should be included in the act of provision of services: details of the parties . Their set is standard:

- company names,

- TIN,

- checkpoint,

- address (legal and actual),

- information about servicing banks: their names, BIC, settlement number and corr. business accounts,

- contact phone numbers.

Finally, the act must be certified by the signatures of directors of organizations or other persons acting on behalf of the companies.