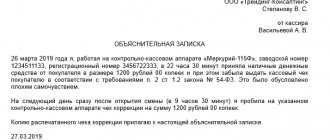

In accordance with paragraph __ Art. 81 of the Tax Code of the Russian Federation LLC "____" submits an updated tax return for VAT for _____.

In the originally submitted declaration, the amount of VAT payable was underestimated by ___ rubles. due to non-inclusion in the tax base of proceeds from the sale of goods under invoice No. __ dated ____. The unaccounted invoice is reflected in the additional sheet to the sales book.

Amount of unaccounted revenue__ rubles, including VAT — ____ rubles.

The following corrections were made to the VAT return for __:_.

The correct amount of VAT payable based on the results of _____ was _____ rubles.

"___" ___ 20___ additional VAT in the amount of ___ rubles was paid. and a penalty in the amount of ___ rub. using the following details: ____. Payment order No. ___ dated ___ is attached.

In the upper right corner you need to indicate to whom and from whom it is sent, and the details of the parties. The signature of the chief accountant and general director is placed below. Covering letters for the declaration are not mandatory elements when sending reports to the tax authorities, but their presence helps to avoid a number of problems and questions. Read about how to draw it up correctly, as well as whether it is necessary to provide such an annex to personal income tax and how to do it on our website.

It is also necessary to correct the data in these tax registers in cases where there is no obligation to submit an updated declaration and the taxpayer needs to correct technical errors. If errors are discovered after the end of the quarter in which they were made, corrective entries in the sales book or purchase book are made in additional sheets of the sales book (purchase book) in which the errors were made (clause 4 of the Rules for maintaining the purchase book, clause 3, 11 Rules for maintaining a sales book, approved by Resolution No. 1137)

To make an entry in the sales book or purchase book about invoices that were not previously included in them, you must register “forgotten” invoices in an additional sheet to the sales book or purchase book, respectively. And in order to remove the erroneous entry, in an additional sheet to the purchase book (sales book) it is necessary to repeat the “extra” entry on the invoice, indicating the numerical indicators of the invoice with a negative sign.

Let's take a closer look at the most common errors and options for correcting them.

Invoices must be registered in the sales book in the period in which tax obligations arose (clause 2 of the Rules for maintaining the sales book). Accordingly, the “forgotten” invoice should be registered in an additional sheet of the sales book of the quarter in which the VAT tax base arose. It is also necessary to submit an updated VAT return, having previously paid the arrears and penalties.

Requirement from the Federal Tax Service

If the tax inspectorate has any questions during a desk audit of VAT reporting, a demand to the taxpayer will not be long in coming. The reasons for sending a request to reporting organizations are divided into two groups. Most often, the Federal Tax Service requires clarification:

- information on preferential transactions that were included in VAT reporting;

- identified discrepancies and errors in the declaration report (there are nine in total).

Each reason will have to be explained differently. When receiving a request from the Federal Tax Service, the company will have to explain to the controllers only the information that was requested. No additional information required. Of course, if the taxpayer himself has not discovered other shortcomings in the VAT return.

When sending an updated VAT return, attach an explanatory note

When registering correctly completed invoices, you can make a mistake when filling out the purchase book (sales book) by entering incorrect data. In this case, to correct errors, incorrect invoice entries are canceled, i.e. in an additional sheet of the sales book (purchase book), they repeat erroneous entries, but indicate numerical indicators with a minus sign and make the correct entry.

In such a situation, regardless of the results of the recalculation, an updated VAT return must be submitted. If the taxpayer has underestimated the amount of VAT payable, then before submitting the “clarification” it is necessary to pay the arrears and the corresponding penalties.

Explanation of VAT to the tax office: sample

VAT return for the 2nd quarter of 2021

What is reflected on line 170 of the VAT return

VAT return for the 4th quarter

New VAT return for the 1st quarter of 2021: example of filling out

Explanations to the VAT return are explanations of the taxpayer, formed in response to a request received from the Federal Tax Service with a list of discrepancies found in tax reporting. If during a desk audit (CP) the Federal Tax Service Inspectorate has questions about the declarant’s information, a demand will certainly be sent to him. Let's consider what the grounds for making demands may be, and how the company's responses should be formed.

The Federal Tax Service will also require an explanation if an updated return is submitted with a lower amount of VAT payable than in the initial report. If the company discovers that there is an error, it will have the right to submit a new “clarification” without providing additional explanations. If no errors are found (for example, the company adjusted VAT for the amount of a previously unaccounted deduction), then in the explanations the company should convincingly prove the correctness of the corrected amount:

It is also necessary to correct the data in these tax registers in cases where there is no obligation to submit an updated declaration and the taxpayer needs to correct technical errors. If errors are discovered after the end of the quarter in which they were made, corrective entries in the sales book or purchase book are made in additional sheets of the sales book (purchase book) in which the errors were made (clause 4 of the Rules for maintaining the purchase book, clause 3, 11 Rules for maintaining a sales book, approved by Resolution No. 1137)

To make an entry in the sales book or purchase book about invoices that were not previously included in them, you must register “forgotten” invoices in an additional sheet to the sales book or purchase book, respectively. And in order to remove the erroneous entry, in an additional sheet to the purchase book (sales book) it is necessary to repeat the “extra” entry on the invoice, indicating the numerical indicators of the invoice with a negative sign.

Let's take a closer look at the most common errors and options for correcting them.

Invoices must be registered in the sales book in the period in which tax obligations arose (clause 2 of the Rules for maintaining the sales book). Accordingly, the “forgotten” invoice should be registered in an additional sheet of the sales book of the quarter in which the VAT tax base arose. It is also necessary to submit an updated VAT return, having previously paid the arrears and penalties.

We are preparing explanations on VAT benefits

If the Federal Tax Service requests information about preferential transactions, then formulate the explanations in the form of a register of documents confirming the right to VAT benefits. This follows from Letters of the Federal Tax Service of Russia dated 02/22/2018 N SA-17-3/52, dated 01/26/2017 N ED-4-15/ [email protected]

You do not need to provide the documents themselves. All you need is a register in the prescribed form. The Federal Tax Service will request copies of supporting documentation later. A specific list of requested securities will be established depending on the assigned level of tax risk according to the reconciliation of the ASK VAT-2 RMS (Letter of the Federal Tax Service of Russia dated January 26, 2017 N ED-4-15 / [email protected] ).

The registry form is recommended in Appendix No. 1 to the Letter dated January 26, 2017 N ED-4-15/ [email protected]

VAT discrepancies

In 2021, tax authorities have more reasons to submit VAT reporting requirements. Previously, there were only four defect codes in the declaration. Now the number has almost doubled. There are currently nine codes for markings in the VAT return.

Codes for types of errors in the value added tax return:

| Code | Explanation |

| 0000000001 | Discrepancy with counterparty reporting |

| 0000000002 | Inconsistency of information in sections 8 (purchase book) and section 9 (sales book). |

| 0000000003 | Discrepancies between invoices issued and received in sections 10 and 11 |

| 0000000004 | Error in a specific column of the report (the number of the erroneous declaration line is indicated in brackets) |

| 0000000005 | The invoice date in sections 8-12 is incorrect |

| 0000000006 | The date of the application for deduction exceeds the allowable period of three years |

| 0000000007 | The date of the invoice claimed for VAT deduction does not correspond to the period of activity |

| 0000000008 | The transaction code is incorrectly indicated in sections 8-12 of the declaration (the codifier is given in the Federal Tax Service order dated March 14, 2016 No. ММВ-7-3 / [email protected] ) |

| 0000000009 | Canceling entries are incorrectly reflected in section 9 of the declaration |

Details in the article: Error codes in the VAT return.

How to recover VAT from the budget

There are two options for tax refund: refund before or after the end of the chamber. Each method has differences and nuances, so we will consider both orders.

General VAT refund

The rules are established by Article 176 of the Tax Code of the Russian Federation. They apply to all taxpayers: those selling goods both in Russia and abroad.

To receive a tax refund in the general manner, three conditions must be met:

1. Submit a VAT return to the Federal Tax Service

The total amount of VAT to be refunded is reflected in line 050 of section 1 of the declaration. To receive the tax amount, you must first fill out sections 3–6.

2. Submit an application for VAT refund/credit

You can return the tax to your checking account or offset it against future payments. Submit an application for a refund using the KND form 1150058, and for a credit – using the KND form 1150057.

It is better to submit the application simultaneously with the declaration - this will help to reimburse the tax in an accelerated manner, provided for in paragraphs 7–11 of Art. 176 of the Tax Code of the Russian Federation. If the tax office decides on a refund, but does not receive the application, it will act in the general manner provided for in Art. 78 Tax Code of the Russian Federation.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

3. Pass a desk audit of the declaration

According to standard rules, the camera room lasts two months. But it can be either shortened or extended. Extension of a cell to three months is usually associated with found violations of the law. A reduction of the audit to a month can only be obtained by some conscientious taxpayers in relation to declarations that were filed after October 1, 2021 for tax periods after the third quarter of 2021 (letter of the Federal Tax Service dated October 6, 2020 No. ED-20-15/129).

During the cameral, the tax office often requests documents confirming the right to deductions: invoices and UPD, primary documents on registration; confirmation of zero rates, payment documents, contracts, etc.

In addition, tax authorities sometimes request books of purchases and sales, invoices, analytical documents, account cards, etc. Not all taxpayers agree with such requirements, so disputes reach the courts. Judicial practice is still ambiguous. If you are ready to sue the tax authorities, you can try to refuse to submit documents.

The check may or may not succeed:

- If no violations are found, the tax office will decide whether to refund VAT within 7 days.

- If there are violations, taxes will not be refunded immediately. First, the tax office will draw up an audit report and then give it to you. This will take up to 15 business days. You can challenge the act within a month.

The result of the entire procedure will be a tax decision on reimbursement. She can reimburse the entire declared amount, partially reimburse or refuse completely (clause 3 of article 176, clause 1 of article 101 of the Tax Code of the Russian Federation). The tax office will announce the final decision to you within five days.

If you requested a tax refund, the inspectorate will approve it in the absence of arrears and send an order to the treasury to return the money.

VAT refund on request

In this procedure, the tax can be returned immediately while the desk audit is ongoing (Clause 1, Article 176.1 of the Tax Code of the Russian Federation). In this way, companies return both all VAT at once and part of it.

This can be used by:

- Organizations that, over the previous 3 years, have transferred at least 2 billion rubles to the budget for VAT, excise taxes, income tax, and mineral extraction tax.

- Taxpayers with a bank guarantee.

- Taxpayers with a guarantee from a Russian organization.

- Residents of special territories with a guarantee from the management company.

There are additional conditions for each group. For example, not every organization can become a guarantor, but only one that has paid 2 billion rubles in taxes over the previous three years. And the guarantee from the bank from the moment of filing the VAT return must be valid for at least another 10 months.

To apply the application procedure, submit an application in any form along with sureties and guarantees. This must be done within five days after filing the declaration or immediately along with it.

Keep in mind that you will need to take on the responsibility to return the excessively refunded VAT to the budget if the tax office reverses its decision in whole or in part. This can happen if, following an audit, it turns out that you requested a refund for a larger amount than the tax office approved after the audit.

The IRS will refund the tax only if you have no arrears. She will check this for 5 days, and then within another 5 days she will communicate her decision.

If you are refused a tax refund in accordance with Article 176.1 of the Tax Code of the Russian Federation, then you can use the standard rules. In this case, the camera room will continue automatically, and after its completion, the tax office may change its opinion.

Preparing error clarifications

If the Federal Tax Service’s request contains a specific error code, then the taxpayer’s actions are as follows. First of all, you need to check your VAT return:

- check the correctness of filling and arithmetic calculations;

- check the data with documents (accounting journals, invoices, purchase/sales books);

- check the amounts of accrued tax at rates.

Pay special attention to how the information for which the request from the Federal Tax Service was received is reflected in the declaration (dates, amounts, invoice numbers, etc.).

After verification, the taxpayer has three options:

| There are no errors in the declaration | If there are no errors in the reporting, then the Federal Tax Service will have to explain the reason for the identified discrepancies. The explanation should indicate that:

The rules are enshrined in the Letter of the Federal Tax Service of Russia dated December 3, 2018 N ED-4-15/ [email protected] |

| There are shortcomings, but the tax is not underestimated | If a flaw in the report does not lead to a distortion of the tax base amounts and an understatement of VAT, the taxpayer has a choice. Three options are allowed:

The last option is recommended by the Federal Tax Service. But this method of submitting explanations is a taxpayer’s right, not an obligation. |

| There are errors, the tax is underestimated | If errors led to an understatement of tax in reporting, then submit an adjustment. But in this case, it is not necessary to provide explanations to the Federal Tax Service. Do not forget to pay part of the tax if, as a result of correcting an error, arrears to the budget have arisen. |

Organizations that switched to paying VAT from January 1 have probably already “tasted” all the delights of this tax. This tax is indeed a headache for many organizations. But you should know that you can not only not pay it, but also reimburse it from the budget. And this happens very often and, as a rule, this is exactly the situation that arises in agricultural organizations. True, the refund process is very difficult; tax authorities, in principle, are not inclined to allow the budget to lose money, even if there are legal grounds for doing so. So what should I do?

The company that showed VAT as deductible will be called to the commission and convinced to make the corrections necessary for the tax authorities. The regulatory authorities have no legal grounds for such demands, and if you are confident that you are right, then calmly ignore them. When conducting a desk audit, tax authorities will ask many questions, doubt the authenticity of documents, the reality of counterparties, etc. As a result, it is often possible to defend their rights to a VAT refund only in court, which is why many organizations are afraid to claim VAT for deduction.

Therefore, it is easier for accountants to postpone purchases to the next tax periods (clause 1.1 of Article 172 of the Tax Code of the Russian Federation), to “stretch” the input VAT so as not to attract the attention of the tax authority to their organization with unnecessary checks. And as a result, money returns to the company’s circulation much later and its value decreases due to inflation. If the deduction is denied, the money remains in the budget.

However, VAT needs to be reimbursed from the budget and there is no need to be afraid of this process and its result, despite all its complexity.

In fact, agricultural organizations, as well as organizations working with exports (sales at 0%), have a very high probability of VAT being refundable, since sales of agricultural products are mainly carried out at a rate of 10%, and purchases are made at a rate of 20% (for example , fuels and lubricants, fertilizers, machinery, equipment, etc.).

For example, an agricultural enterprise purchased fuel and lubricants for a harvesting campaign in the amount of 1,000,000 rubles, including 20% VAT - 166,666 rubles. In the tax return, the enterprise has the right to deduct 166,666 rubles. During the same period, the farm also sells grain in the amount of 1,000,000 rubles, while the VAT rate was 10% (in accordance with Article 164 of the Tax Code of the Russian Federation) - 90,909 rubles. This amount is calculated to be paid to the budget. But according to the rules for deducting VAT, this amount can be reduced, since the farm purchased fuel and lubricants in the form of input VAT for 166,666 rubles. This gives rise to grounds for VAT reimbursement in the amount of the difference between the deduction and the amount payable to the budget. In this case, it is 75,757 rubles, and the reason for it was the difference in VAT rates - 20% and 10%.

You must understand that the excess of the amount of deductions over the amount of accrued VAT for the tax period does not yet guarantee a VAT refund. To return VAT, you must go through a complex procedure established at the legislative level.

So, the first thing you must do is submit a declaration with the amount of VAT to be refunded; its desk audit is carried out by the tax inspectorate within two months, but in some cases (if violations are identified) it can be extended up to three (Clause 1, Article 176, Art. 88 Tax Code of the Russian Federation).

And before you decide to reimburse the tax from the budget, you must be confident in the contents of your accounting, starting from primary documents and ending with closing accounting registers in 1C. Be sure to check the original documents for the correct completion of all details and lines in accordance with the Accounting Law, the presence of signatures (not facsimiles), and seals.

When creating accounting registers provided at the request of tax authorities, check the closure of the period, linking all the data reflected in them with the information in the report and the reflection of primary documents.

On your own or with the help of a lawyer, check your suppliers declared in the purchase book, the conduct of their activities and the absence of unreliable information in the Unified State Register of Legal Entities. This can be done in the “Transparent Business” service on the official website of the tax services or other available information sources (for example, www.rusprofile.ru, online.sbis.ru). If it turns out that your supplier is on the “black list” of tax authorities, then the inspectors will remove such deductions immediately.

Remember that the package of documents required by the tax office to confirm VAT for reimbursement must be as complete as possible; the tax office has the right to request from you any list of documents, the list is open (Article 172 of the Tax Code of the Russian Federation). They have the right to request documents only until the end of the desk audit.

Any explanations required by the Federal Tax Service during a desk audit of the VAT return must be submitted only in electronic form using the TKS in the format approved by the Federal Tax Service. Otherwise, they will be considered unrepresented (clause 3 of Article 88 of the Tax Code of the Russian Federation). If the taxpayer refuses to provide additional information, the tax authorities will regard this as a violation of the law and will entail a fine.

If requesting certain documents is not practical for your business, you should not ignore this list, simply provide appropriate explanations. For example, the tax office asks for a statement of the estimated cost of construction of facilities, acts and certificates for construction and installation works (forms KS-2, KS-3, KS-6), SROs of contractors performing construction and installation work. At the same time, you are not performing construction work - then explain this, confirming the main type of activity and disclosing its nature in the explanatory note.

If, after all your troubles, the tax authorities still identify violations (the probability of this is 99%), then we move on to the next stage. If you are one of the “lucky ones” and no violations were found, then proceed directly to the sixth and seventh stages.

The second stage is the formation of a tax audit report within 10 days after the end of the audit, which reflects the identified violations (clause 3 of Article 176 of the Tax Code of the Russian Federation, Article 100 of the Tax Code of the Russian Federation).

The third stage - within one month from the date of receipt of the tax audit report, you have the right to submit written objections to the identified violations (clause 6 of Article 100 of the Tax Code of the Russian Federation).

The fourth stage - within 10 working days after receiving objections, the tax inspectorate considers the inspection materials and objections (Article 101 of the Tax Code of the Russian Federation) and makes a decision (clause 3 of Article 176 of the Tax Code of the Russian Federation) on VAT refund (in whole or in part) and a decision on attracting or refusal to hold the taxpayer liable. Tax authorities must notify the taxpayer of the decision made within 5 working days from the date of its adoption (clause 9 of Article 176 of the Tax Code of the Russian Federation).

But before making a decision on a VAT refund or offset (clauses 3 and 7 of Article 176 of the Tax Code of the Russian Federation), the tax authorities clarify the issue of the presence of arrears for VAT, federal taxes, debts for penalties and fines related to federal taxes.

If your organization had arrears, then move on to the next stage. If there are no tax arrears, then we proceed directly to the seventh stage.

Fifth stage - tax authorities offset VAT to pay off existing debt (clause 4 of article 176 of the Tax Code of the Russian Federation). If the arrears arose during the period from the date of filing the declaration to the date of VAT refund, then penalties are not charged on it if the amount of the arrears does not exceed the amount of VAT subject to refund.

If the amount of VAT is less than the amount of arrears (fine, penalties), then the remaining debt must be repaid by the taxpayer.

If the VAT amount is greater than or equal to the amount of the arrears, then the arrears are considered repaid.

To recover the remaining VAT refundable, proceed to step seven.

The sixth stage - within five working days after the end of the inspection, the Federal Tax Service must inform you about the accepted ones (clause 2 of Article 88, clauses 2, 9, Article 176 of the Tax Code of the Russian Federation):

— decision on VAT refund;

— decision on VAT refund (offset);

- or refusal of compensation.

If you have not received messages from the Federal Tax Service, you should call the department for working with taxpayers or the department of desk audits and ask whether a decision has been made on your declaration.

The seventh stage is tax refund in the absence of arrears on taxes, penalties, fines (clause 8 of Article 176 of the Tax Code of the Russian Federation). Remember that the application for a VAT refund must be submitted before the decision on the refund is made, preferably together with the declaration, but it can be later. Otherwise, the tax will be returned “on a general basis”, i.e. you will have to wait another month (clause 6 of article 78 of the Tax Code of the Russian Federation).

Next is the eighth stage - VAT is transferred to the taxpayer’s bank account within 5 working days from the date of receipt of the OFC order (paragraph 2, clause 8, article 176 of the Tax Code of the Russian Federation). And if the VAT refund deadline is not violated, then the refund procedure is considered completed.

If the VAT was returned in violation of the deadlines, then starting from the 12th day after the end date of the desk audit, interest is accrued in accordance with clause 10 of Art. 176 of the Tax Code of the Russian Federation. In this case, proceed to the next final step.

And the final stage is the ninth. If the tax authorities are overdue for VAT refunds, then when they pay the interest in full, the refund procedure is considered completed.

If the interest has not been paid in full to the taxpayer, then within three working days from the date of receipt of the notification from the territorial OFC about the date of return and the amount of money returned to the taxpayer, the tax authorities make a decision on transferring the remaining amount of interest (clause 11 of Article 176 of the Tax Code of the Russian Federation ).

Please note that if documents received subsequently indicate that the VAT refund is unlawful, and the funds have already been refunded to the company, then the tax authorities will conduct an on-site audit of this taxpayer (question 3 of the Letter of the Federal Tax Service of Russia dated December 18, 2014 No. ED-18-15/1693 ).

In accounting, possible options for VAT refund (debit balance on account 68-2 “VAT”) are reflected as follows:

| Account correspondence | Name of business transactions |

| Dt 68 - 4 “Income tax” - Kt 68 - 2 “VAT” | The amount of VAT to be refunded is offset against the arrears of income tax |

| Dt 51 - Kt 68-2 “VAT” | The amount of VAT subject to refund has been returned from the budget |

| Dt 76-5 - Kt 91-1 Dt 51 Kt 76-5 | If money is received from the budget untimely, the organization has the right to interest received from the tax authorities |

Let's look at the most common reasons for refusal of VAT refund, and possible accounting gaps that are worth paying attention to. First of all, these are errors when filling out documentation, made both when filling out the application and when preparing other documents:

1) indication of the incorrect address of the company at which it carries out its business activities;

2) errors in encodings and details;

3) discrepancy between the quantity and price of goods in invoices and the data specified in the supply contract;

4) making changes and corrections to documents after shipment of goods;

5) lack of important information (for example, the code of the currency in which goods are accounted for);

6) facsimile signatures on documents;

7) the deduction is claimed on an invoice with errors or after the expiration of a three-year period.

A common mistake that leads to the refusal of VAT refund is also the lack of confirmation of the transaction from the supplier; signs of a fictitious transaction; the supplier is on the list of unscrupulous counterparties; transfer of the taxpayer to another tax office due to a change in legal address; determining the moment of VAT refund on invoices received late.

The Federal Tax Service Inspectorate will indicate the specific grounds for refusal of compensation in the inspection decision (clause 7 of Article 101 of the Tax Code of the Russian Federation).

Remember, if you do not agree with the tax authorities’ decision to refuse a refund, you have the right to appeal it to the Federal Tax Service of your region (clause 2 of Article 138 of the Tax Code of the Russian Federation), and then in court no later than three months from the date of the decision (Part 4 of Article 198 of the Tax Code of the Russian Federation).

Let's summarize. Despite the fact that the VAT refund procedure is complex and lengthy, even in the best scenario it will take about 2.5 months, a tax refund from the budget is possible if the amount of deductions for the period exceeds the amount of accruals. But you must check your counterparties and the documents received from them very carefully so that “the mosquito does not undermine your nose.”

How to submit clarifications to the Federal Tax Service on the new rules

It is important to follow the new rules for submitting explanations to the Federal Tax Service in 2020. For preferential transactions, it is permissible to send the register both on paper and electronically. In this case, the method of submitting the declaration to the Federal Tax Service is not taken into account.

If you submit explanations for errors and discrepancies, then you are allowed to report only in the form in which you submit the declaration. If the method is violated, the company or individual entrepreneur will be fined. The electronic format for submitting clarifications is fixed by Order of the Federal Tax Service of Russia dated December 16, 2016 N ММВ-7-15/ [email protected]

If a company or individual entrepreneur has the right to report on paper, then explanations can be sent in the form of a paper document. Otherwise, the explanations will be considered not provided, and the taxpayer will face penalties.