How to draw up and correctly fill out an acceptance certificate for completed work

In Art. 753 of the above-mentioned Code describes the algorithm for the procedure for accepting work under an existing act. So, it must be signed by both parties. Otherwise, the document is considered invalid. In this case, the refusal of any party to obtain a visa must be justified.

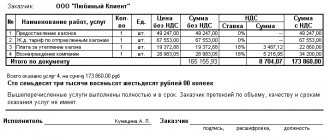

The acceptance certificate is drawn up by the contractor. Often the performer himself develops its form. Be that as it may, the document must contain the following information:

- name of the contractor, indicating its legal form or full name of a private entrepreneur;

- document's name;

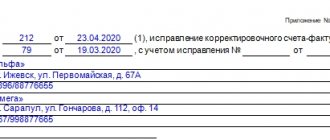

- date of compilation (must match the date of signature);

- the content of the actual transactions that were performed;

- full details, signatures, their transcripts and seals of both parties.

Please note: starting from 2021, according to current legislation, legal entities are not required to have seals or stamps. Their absence from documents is not a violation of the law.

Also:

according to Federal Law No. 402-F3, the contractor must reflect defects or defects in the report, if any are identified;

The contract or annex to the contract must specify what the parties undertake to do if deviations from the norms are detected.

So, if the customer identifies defects, he can:

- do not accept completed work;

- demand compensation from the contractor for poor quality work;

- oblige the contractor to correct the existing defect.

- The form of the act used by the parties must be recorded in the Appendices to the Accounting Policy of the contractor company.

Act of provision of services: why is it needed?

The service does not depend on the act

Why do the parties draw up an act? The answer to the question is obvious: in order to record the fact that the obligations under the contract have been fulfilled. However, if when ordering work everything is more or less clear - the result has a material form, then when providing services the contractor does not transfer any material result to the customer. Accordingly, the customer has nothing to accept, which means that drawing up an act in the form in which it is drawn up when performing work loses all meaning.

Agree, it is difficult to say that, for example, a person who took part in a seminar on taxation did not use the service provided. After all, the service consists precisely in participation in the seminar, which means that after its completion, in any case, it will be considered provided. Consequently, it is completely unimportant whether an act on the provision of services is drawn up or not.

What does the act confirm?

It turns out that an act is not needed to document the costs of services, since the act does not as such indicate the fact of provision of the service. This means that in most cases, an organization can confirm its expenses without an act. For example, the validity of the expenses for the already mentioned seminar will be fully proven by a contract, invoice, payment documents, invoices, or an order to send an employee to the seminar. Moreover, Article 252 of the Tax Code does not provide a specific list of documents that are required as confirmation.

Although, of course, drawing up an act is required to determine the date of provision of the service, which must be known in order to correctly account for expenses. In addition, from the moment the act is signed, the limitation period begins to count.

A rental act is not required

There is no need to draw up a report to confirm expenses in the form of rental payments. After all, rent is not a service either from the point of view of civil law or from the point of view of the Tax Code. Thus, in the Civil Code, provisions on contracts for paid services and leases are located in different chapters. This means that these categories of relationships are independent and different rules are established for them.

According to the Tax Code, rental relations do not fall into the category of “service”, since they do not correspond to its definition given in Article 38 of the code. Let us recall that this norm recognizes as a service an activity whose results do not have material expression and are sold and consumed in the process of carrying out this activity. Renting is not an activity, since it is an opportunity to legally own and use someone else’s thing. In addition, it does not have results that would be realized or consumed during the rental process itself.

This means that the rent is not a payment for a service, but for the use of property. Consequently, the fact of transfer of money will be confirmed not by an act of services rendered, but by a lease agreement, an act of acceptance and transfer of premises, an invoice for payment issued by the lessor, and payment documents confirming payment of this invoice. And to offset VAT, the tenant will also need an invoice.

Let us note that the Federal Tax Service specialists also adhere to the same position. Letter No. 02-1-07/81 dated September 5, 2005 notes that the rental service begins to be consumed from the moment the contract is concluded. At the same time, the Ministry of Finance recently expressed the opinion that certificates of services rendered should still be issued monthly (letter dated June 7, 2006 No. 03-03-04/1/505). Only here the requirement for the mandatory preparation of acts of acceptance and transfer of services is not provided for either by Chapter 25 of the Tax Code or by the legislation on accounting.

A. Smirnov, lawyer, for the Federal Financial Information Agency

Certificate of services rendered. Mandatory or voluntary?

OJSC Uralsvyazinform provides us with communication services and refuses to provide certificates of work performed, although other organizations provide certificates for communication services.

Can we attribute these services to costs without acts? (Infoservice-plus LLC, Yekaterinburg)

Art. 252 Tax Code of the Russian Federation

It is established that

expenses are recognized as

justified and documented expenses (losses) incurred (incurred) by the taxpayer.

Documented expenses mean

costs confirmed by documents drawn up in accordance with the legislation of the Russian Federation.

In addition, according to Art. 313 Tax Code of the Russian Federation

Taxpayers calculate the tax base at the end of each reporting (tax) period based on tax accounting data.

Tax accounting

– a system for summarizing information to determine the tax base for a tax

based on data from primary documents

, grouped in accordance with the procedure provided for by the Tax Code of the Russian Federation.

The Ministry of Finance of the Russian Federation in letter dated April 30, 2004 No. 04-02-05/1/33 “On the recognition in tax accounting of expenses under civil law contracts”

noted that confirmation of tax accounting data are:

1) primary accounting documents

(including an accountant's certificate);

2) analytical tax accounting registers;

3) calculation of the tax base.

According to paragraph 1 of Art. 11 Tax Code of the Russian Federation

the concept of

“primary accounting documents”

should be defined in accordance with the legislation of the Russian Federation on accounting.

In accordance with Art. 9 of the Federal Law of the Russian Federation of November 21, 1996 No. 129-FZ “On Accounting”

all business transactions carried out by the organization must be documented

with supporting documents, which are primary accounting documents

.

Primary accounting documents are accepted for accounting

, if they are compiled according to the form contained in the albums of unified forms of primary accounting documentation, and documents whose form is not provided for in these albums must contain the following mandatory details: name of the document, date of preparation of the document, name of the organization on behalf of which the document was compiled, content business transaction, measures of a business transaction in kind and in monetary terms, names of positions of persons responsible for carrying out a business transaction and the correctness of its execution, personal signatures of these persons.

Albums of unified forms of primary accounting documentation do not contain forms of primary documents

, formalizing the relationship between the parties arising

under a contract for the provision of paid services

.

Thus, in order to recognize taxpayers’ expenses incurred under civil contracts, the act

work performed (services provided)

is a mandatory

supporting document only

if the preparation of this document is mandatory in accordance with civil law and (or) a concluded contract

.

The relations of the parties under a contract for the provision of services for a fee, which is an agreement for the provision of communication services, are regulated by Chapter 39 of the Civil Code of the Russian Federation “Paid provision of services”

.

Mandatory execution of a work acceptance certificate is provided for by civil law only in relation to construction contracts

.

So, for example, according to Art. 720 of the Civil Code of the Russian Federation “Acceptance by the customer of work performed by the contractor”

a customer who discovers deficiencies in the work upon its acceptance has the right to refer to them in cases

where the act or other document certifying acceptance

stipulated these deficiencies or the possibility of subsequent submission of a demand for their elimination.

Art. 753 Civil Code of the Russian Federation

It has been established that the delivery of the result of work by the contractor and its acceptance by the customer

are formalized by an act

signed by both parties.

If one of the parties refuses to sign the act, a note to this effect is made in it and the act is signed by the other party.

However, according to Art. 783 of the Civil Code of the Russian Federation “Legal regulation of contracts for paid services”

general provisions on contracts (Articles 702-729) and provisions on domestic contracts (Articles 730-739)

apply to an agreement for the provision of services for a fee

, unless this contradicts Articles 779-782 of the Civil Code of the Russian Federation, as well as the specifics of the subject of the agreement for the provision of services for a fee.

Thus, since this provision contains a reference to Art. 720 Civil Code of the Russian Federation

,

drawing up a delivery and acceptance certificate under a contract for the provision of paid services is mandatory

.

On the other hand, the specifics of the subject matter of the contract for the provision of paid services should be taken into account.

If the contract for the provision of communication services does not stipulate the mandatory drawing up of an acceptance certificate, then the drawing up of this act will not be mandatory

.

At the same time, the communication organization provides its client with a call printout

, which is

documentary evidence of the organization's expenses

.

Sometimes tax authorities require an act, based on the provisions of paragraph 2 of Art. 272 Tax Code of the Russian Federation

.

However, this requirement in relation to contracts for the provision of communication services is unlawful, since in paragraph 2 of Art. 272 Tax Code of the Russian Federation

We are talking about the date of

material expenses

.

Let us recall that in accordance with paragraph 2 of Art. 272 of the Tax Code of the Russian Federation, the date of material expenses is recognized

date of signing by the taxpayer of

the certificate of acceptance and transfer

of services (works) - for services (works) of a production nature.

However, according to paragraphs 25 clause 1 art. 264 Tax Code of the Russian Federation

expenses for postal, telephone, telegraph and other similar services,

expenses for payment for communication services

, computer centers and banks, including expenses for fax and satellite communication services, e-mail, as well as information systems (SWIFT, Internet and other similar systems),

include to other costs associated with production and sales

.

And according to paragraphs 3 paragraph 7 art. 272 of the Tax Code of the Russian Federation, the date of incurring other expenses is recognized

the date of settlements in accordance with the terms of concluded agreements or the date of presentation to the taxpayer of documents serving as the basis for making settlements, or the last day of the reporting (tax) period - for expenses in the form of expenses for payment to third-party organizations for work performed (services provided).

To recognize these expenses, the Tax Code of the Russian Federation does not require the presence of an acceptance certificate.

Thus, the absence of a certificate of services rendered cannot serve as an obstacle to including the costs of payment for communication services as expenses.

taken into account when taxing profits.

Provided that the organization has all other supporting documents.

Is a certificate of completion required for a contract for the provision of paid services? | Kemerovo

Anna, good day to you!

NO, the law does not contain a mandatory requirement to draw up and sign an act, but it is this document that will confirm the fulfillment by the parties of their obligations under the Agreement.

Of course, when proving, for example, the fact of provision of services or payment under a contract, you can attach witness testimony and other evidence (for example, correspondence between the parties), BUT AS A LAWYER, I WOULD RECOMMEND SIGNING AN ACT FOR INSURANCE.

Let me explain in more detail!

Very often, accountants of organizations refuse to transfer money under contracts to counterparties if the provided package of documents does not contain a Certificate of Work Completed.

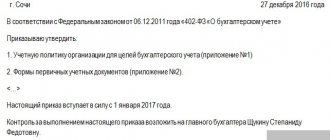

The certificate of work (services) performed refers to primary documents and is regulated by Federal Law N 402-FZ of December 6, 2011 “On Accounting”.

This document reflects the types of transaction between counterparties, such as work performed and services provided.

The certificate of work performed and services rendered is filled out in two copies and signed by the customer and the contractor. The document reflects the cost of work (services), deadlines for completing the order, as well as claims or shortcomings under the contract, if any. If there are no shortcomings in the work, then the absence of claims from each party should also be recorded in the document.

First of all, the Certificate of Work Completed or Services Rendered is a documentary confirmation of the fulfillment of the agreement by the parties and the basis for payment.

The question often arises: is it necessary to sign a Certificate of Work Completed or Services Rendered?

The law provides for the existence of an Act only in one case.

Chapter 39 of the Civil Code of the Russian Federation regulates the provision of paid services. Services can be information, consulting, auditing, accounting, tourism, communication services, training, etc. But this document does not oblige to draw up a Certificate of Completion of Work (Services).

Despite the fact that we classify this document as primary accounting documents, the Law “On Accounting” states that every fact of the economic life of an organization must be confirmed by primary documents, but which ones and when are not deciphered.

Each organization must have an Accounting Policy, which approves all local documents of the organization, including the Certificate of completion of work, services provided, or acceptance and transfer of work (services).

Also, the presence of this document can be indicated in signed agreements with the counterparty. In these cases, the Act must be submitted along with other documents for payment to the counterparty for the work (services) performed.

From all of the above, we can conclude that the Civil Code of the Russian Federation and the Law “On Accounting” do not provide for the mandatory preparation of such a document.

The Tax Code requires that an act be drawn up only if we are talking about services of a production nature, the costs of which are taken into account by the customer using the accrual method, according to sub. 6 clause 1 art. 254 Tax Code of the Russian Federation.

Any accountant always tries to play it safe. So, the Certificate of completed work (services), acceptance and transfer, etc. will not be superfluous, and even more so will not carry any responsibility.

Act and accounting of the organization

The certificate of completion of work refers to the primary accounting documents on the basis of which payment is made. In addition, this document, together with the contract, can be used during legal proceedings or to calculate the statute of limitations. This is clearly stated by Federal Law-129 “On Accounting”, which states that all business transactions carried out by an organization of any form of ownership must be reflected in accounting.

Not everyone knows that for incorrect execution of the act, fines (or additional taxes) may be imposed on the organization, and the tax authorities may exclude the costs indicated in such acts from the costs when calculating income tax, and this is already quite serious.

The dates indicated in such documents are of great importance for attributing them to a specific reporting period, and untimely submission of acts may lead to a violation in the attribution of costs. Consequently, the income tax for a specific period will be underestimated or overestimated. In addition, expenses to reduce tax must be related to the activities of the organization. Article 9 of the Accounting Law lists all the details that are of decisive importance during registration. Therefore, before drawing up an act, you should carefully study this law.