Accounting account 90 is an active-passive “Sales” account, used to reflect information related to the sale of finished products for the main activity of the enterprise. The account is one of the most difficult in terms of accounts. Its peculiarity is that at the end of the period it must be closed without any balance. Using standard postings and practical examples for dummies, we will understand the specifics of using account 90 and consider closing account 90 at the end of the month and at the end of the year.

Account 90 in accounting

The financial result from sales from the main activity is reflected on the account monthly. During the year, the account accumulates the financial result of the enterprise's main activities.

The movement pattern for the analytical subaccounts of account 90 is reflected in the table:

The main activity of the enterprise can be:

- sale of finished products and semi-finished products (own production);

- services of a non-productive or production nature;

- sale of purchased goods;

- construction, installation, research, geological exploration, etc.;

- rent;

- transport services;

- transportation of passengers;

- other.

Subaccounts of account 90

Closing a synthetic account is provided at the expense of your own analytical accounts. Some of them are active, some are passive. The difference between the active and passive balance is closed to account 90.09.

Sub-accounts can be opened for account 90:

- 90.1 - “Revenue”. The revenue subaccount reflects the amount of proceeds from sales. This is a passive subaccount;

- 90.2 - “Cost of sales”. Active subaccount reflects the cost of goods sold;

- 90.3 - “VAT on sales”. The VAT account is also active, in correspondence with account 68 it reflects the amount of VAT accrued to the budget;

- 90.4 - “Excise taxes”. The active excise subaccount reflects excise taxes included in the amount of goods sold;

- 90.9 - “Profit (loss) from sales.” The subaccount acts as a regulator; all other subaccounts are closed to it.

Typical correspondence for account 90:

Closing 90 accounts, postings

At the end of the month, the sales result is formed in subaccount 90.9. It happens like this:

- The balance is calculated for each subaccount.

- The total turnover for all subaccounts (debit and credit) is calculated, and the credit turnover is subtracted from the debit turnover. A positive balance means a loss, a negative balance means a profit.

- The financial result is reflected using account 90.9 and written off to account 99, in accordance with the accounting rules. Profit is reflected by posting Dt 90.9 - Kt 99.1, loss - Dt 99.1, Kt 90.9.

Thus, at the end of the month, each subaccount 90 has a balance, but there should be no balance on the synthetic account.

At the end of the year, each subaccount of account 90.x is closed to 90.9. Debit subaccounts are closed by posting Dt 90.9 - Kt 90.x, credit - Dt 90.x - Kt 90.9.

As a result, the balance of account 90 at the end of the year will be reset to zero. This process is part of the balance sheet reform carried out at the end of each year.

With the beginning of the new year, the account will be opened again, from scratch.

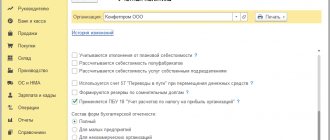

Allocation of indirect costs

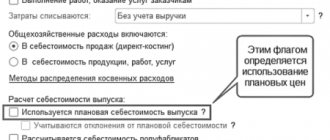

Settings for the distribution of indirect costs for accounting purposes are made in the Accounting policy form (Section Main) using the Indirect costs group of details (Fig. 1).

Rice. 1. Indirect cost distribution settings

In the Distribution base field, the distribution base is indicated, which is selected from the drop-down list and can take the following values:

- Issue volume;

- Planned production cost;

- Salary;

- Material costs;

- Revenue;

- Direct costs.

The selected distribution base is used as the basic rule for the distribution of all types of indirect costs by product.

Sometimes businesses have special allocation rules, for example for certain departments or for certain costs. Such rules can be configured as exceptions. To do this, use a separate Cost Allocation Rules form, which can be accessed by following the hyperlink located next to the text Special Allocation Rules.

In the form that opens, click the Add button to fill out the tabular part, indicating the cost account, division and (or) cost item for which special rules apply, as well as the distribution base different from the main one (Fig. 2).

Rice. 2. Special rules for the distribution of indirect costs

Special rules also apply when an organization uses an allocation base that is not in the list of possible values for the main rule. For example, you cannot select distribution according to a list of cost items as a basic rule. But such a distribution can be indicated in the form of exceptions.

Accounted for 25

Now the program allows you to reflect on account 25 the costs of departments that service production, but do not produce products, do not perform work and do not provide production services.

In other words, these are the costs that were previously taken into account in account 26 and distributed among the cost of finished products (work, services). For example, account 26 could take into account the costs of laboratories, boiler houses, repair shops, etc.

Costs recorded on account 25 are distributed automatically when performing the routine operation Closing accounts 20, 23, 25, 26, which is included in the Closing of the month processing (section Operations).

Since the scope of account 25 has been expanded, the procedure for distributing costs accounted for in account 25 has changed and takes place in two stages.

At the first stage, general production costs of divisions that produce products (work, services) are distributed.

The costs of production divisions are distributed within each such division into item groups according to the rules specified in the accounting policy settings. In this order 25 the account was distributed before (distribution “to itself”).

At the second stage, all remaining costs (costs of service departments) are distributed between production departments according to product groups. This is how count 26 was previously distributed (distribution to “everyone”).

Let's look at the new procedure for distributing account 25 using an example.

Example

Modern Technologies LLC produces textile products in two production divisions:

- in “Workshop No. 1” - a light women’s dress and bed linen;

- in “Workshop No. 2” there are pillows and blankets, as well as soft toys.

Account 25 “General production expenses” takes into account both the costs of production departments and the costs of the quality laboratory, which serves both production departments.

Administrative costs are accounted for on account 26 “General business expenses”. Management costs include administration costs, with the exception of the costs of remunerating the deputy director for production, who deals exclusively with production issues. His wages with accrued insurance premiums are credited to account 25.

According to the accounting policy of the organization, direct production costs are used as the basis for the distribution of all indirect costs.

In January 2021, the amount of direct costs recorded on account 20.01 “Main production” amounted to RUB 1,575,000.00, including by item groups:

- “Light women's dress” - RUB 225,000.00;

- “Bed linen - RUB 1,230,000.00;

- “Soft toy” - RUB 20,000.00;

- “Pillows and blankets” - RUB 100,000.00.

The amount of indirect costs recorded on account 25 amounted to 350,315.05 rubles, including by department:

- “Administration” - RUB 130,200.00;

- “Laboratory” - 50,000.00 rubles;

- “Workshop No. 1” - 89,495.05 rubles;

- “Workshop No. 2” - RUB 80,620.00.

According to the terms of the Example, when performing the routine operation Closing accounts 20, 23, 25, 26, indirect costs recorded on account 25 are distributed in proportion to direct costs.

First, the costs of production departments are distributed:

- costs of Shop No. 1 - by item groups “Light women's dress” and “Bed linen”;

- costs of Shop No. 2 - for the product groups “Soft Toy” and “Pillows and Blankets”.

A detailed calculation of the results of the first stage of distribution is given in the first part of the help-calculation Distribution of indirect costs (Fig. 3).

Rice. 3. Distribution of indirect costs of production units

Then all remaining costs are distributed between production departments according to product groups. A detailed calculation of the results of the distribution of service departments is given in the second part of the help-calculation Distribution of indirect costs (Fig. 4).

Rice. 4. Distribution of indirect costs of service departments

Based on the calculation results, postings are generated in the context of analytics:

Debit 20.01 Credit 25

- for the calculated amounts presented in columns 9 of the calculation certificate Distribution of indirect costs (see Fig. 3, 4).

Thus, the combined method used to distribute costs recorded on account 25 allows it to be closed without errors.

How in the program “1C: Accounting 8” edition 3.0 from 2021 the costs accounted for in account 25 are distributed

Accounted for 20

The basic distribution rule will also apply when distributing indirect costs accounted for on account 20.01. We remind you that in account 20.01 you can take into account indirect costs in cases where they are not directly related to a specific product, that is, when the Products subaccount is not filled in. Such costs will be distributed by type of product within the product group.

If for any reason the distribution base specified by the user cannot be applied to the costs accounted for in account 20, the program uses an automatic distribution algorithm. This procedure allows, when closing account 20, to avoid errors associated with minor errors made by the user when setting up the distribution of indirect costs.

A detailed calculation of the results of distribution of costs assigned to a product group and accounted for on account 20.01 (including the distribution base automatically selected by the program) is given in the help calculation Cost of manufactured products and services.

Examples of transactions using 90 accounts

Example 1

Artel Group LLC sold two batches of goods in May 2021. The cost of the 1st batch amounted to 90,000.00 rubles, revenue - 130,000.00 rubles. The cost of the 2nd batch was 96,000.00 rubles, the revenue amounted to 148,000.00 rubles. VAT accrued for the 1st batch - 19,830.42 rubles, for the 2nd batch - 22,576.27 rubles.

We calculate the sales result for the month: credit turnover (revenue), 130,000 + 148,000 minus debit turnover (VAT + cost), 19,830.42 + 22,576.27 + 90,000 + 96,000, it turns out 49,593.31 rubles.

The following entries were made for account 90 to reflect the sales results of Artel Group:

| Dt | CT | Operation description | Amount, rub. | Document |

| 62 | 90.1 | Reflection on the implementation of the 1st batch | 130 000,00 | Act |

| 90.3 | 68 | VAT accrual on sales | 19 830,42 | SF issued |

| 90.2 | 43 | Reflection of the cost of the 1st batch | 90 000,00 | Accounting information |

| 62 | 90.1 | Reflection of the implementation of the 2nd batch | 148 000,00 | Act |

| 90.3 | 68 | VAT calculation | 22 576,27 | SF issued |

| 90.2 | 43 | The cost of the 2nd batch is reflected | 96 000,00 | Accounting information |

| 90.9 | 99 | We reflect the sales result (profit) for May | 49 593,31 | Accounting information |

Calculation of financial results of the month

According to the transactions presented above, all sales during the month are reflected. As soon as the month is completed, the accountant (or automated accounting program) calculates the balance for each subaccount and displays the financial result.

- Summation of transactions for each subaccount - Kt90.1, Dt90.2 and Dt90.3.

- The totals of Kt90.1 are subtracted from the amount of debit turnover (Dt90.2 + Dt90.3).

- Depending on the result obtained, accounting entries are generated:

- a positive number indicates losses, so they use the wiring Dt99 - Kt90.9;

- a negative number indicates profitable activity and is reflected in the posting Dt90.9 - Kt99.

Every month, account 90 is re-opened, and the balance of each sub-account is transferred to the sub-accounts of the new account. And this continues until the end of the year.

Annual account closure

At the end of the year, account 90 must be closed so that the balance for each subaccount becomes zero. The accounting entries for this operation will look like this:

- Dt90.1 – Kt90.9 – resetting the final balance for subaccount 90.1;

- Dt90.9 – Kt90.2 – resetting the final balance on subaccount 90.2;

- Dt90.9 – Kt90.3 – resetting the final balance on subaccount 90.3.

As a result of all operations, the final balance in subaccount 90.9 will become zero. From January 1 next year, account 90 will be reopened with a zero balance for each of the subaccounts.