The conclusion of an agreement between the parties to the transaction is an important stage. When one party is represented by the customer, and the other by the contractor, it is necessary not only to draw up an agreement, but also other important papers.

These include an acceptance certificate, which is required to be drawn up.

It reflects not only the basic conditions for accepting the work performed or part of it, but also covers the issue of the presence of defects, methods for eliminating them and other important aspects.

If there are two parties, one of which is the customer for performing any type of work, and the other is the contractor, then corresponding rights and obligations arise. They are fixed in the contract, which is signed by the parties even before the start of the agreed work.

However, after the work is completed, the contractor must hand it over.

The customer is obliged to accept the result of the work performed and confirm that the contractor did everything correctly and efficiently.

In order to indicate the position of the parties regarding the results of the actions taken, their acceptance and the presence of shortcomings, an acceptance certificate for the work performed is drawn up.

It can be presented in several versions depending on the presence of defects identified during the delivery process:

- if there are none, the customer indicates this in the act and pays the amount of money established in the contract;

- if there are defects, the act indicates their nature and prescribes the conditions for elimination, or a proportionate reduction in cost, etc.

The acceptance certificate for the work performed must be signed by both parties, which means agreement with the points stated there.

According to the law, the specified document must be drawn up exclusively when concluding a construction contract under Art. 753 Civil Code of the Russian Federation.

However, if necessary, the law does not prohibit the parties from signing this act and using it as evidence in the event of a conflict situation.

Thus, the specified document is required to be drawn up as confirmation of acceptance of the work performed by the contractor when signing a construction contract.

It reflects all the characteristics of the quality of performance of the contractor’s actions provided for in the contract. In other cases, it is not legally prohibited to sign such a document.

Responsibility for an incorrectly completed act

It is especially important to comply with the rules and requirements of the law when filling out this act when the parties to the agreement are legal entities and individual entrepreneurs.

If the data, amounts and other parameters are incorrectly indicated in the act, the tax office may refuse to accept for deduction as a VAT-reducing amount the amount specified in the act and the agreement.

In addition, if during the reporting period expenses are not taken into account and the amount of payment of value added tax is not reduced by their amount, then the tax will be paid more than necessary.

If errors are made accidentally, then liability from the point of view of law will not be applied.

However, for the parties to the transaction themselves, the presence of errors, clerical errors and inaccuracies can result in litigation, disputes and conflict situations.

In addition, the act may be declared invalid by a court decision if the presence of serious errors, inaccuracies, discrepancies with other documents, etc. is proven.

Guarantees

In addition to all the mandatory data that should be indicated in the acceptance certificate for the work performed, it may contain information on the warranty period, which is expected according to the features and nature of the actions performed.

The deadline is set in accordance with GOSTs, SNiPs and other norms and rules applied for certain types of results.

In addition, as a guarantee of protecting the interests of the performer, a list or description of events may be indicated to which the guarantee cannot apply.

For example, a violation of the quality of the work done due to the occurrence of circumstances beyond the control of the performer. For example, if there is an act, the performer can protect himself from accidental loss of the result of work due to unforeseen circumstances.

If the warranty period is established in the acceptance certificate, the customer has the right to declare any identified defects during the entire agreed period and demand their elimination.

In the case of complex and lengthy work, it is possible to draw up interim acts that will indicate the acceptance of a specific type or area.

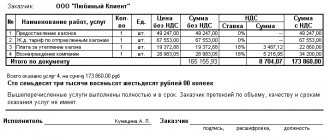

Sample act of acceptance of work performed

To correctly draw up an act of acceptance of transfer (delivery) of completed work, you need to familiarize yourself with its sample, which can be downloaded. This will allow you to see which clauses and conditions are mandatory for inclusion in the text of the contract, what data will need to be clarified in advance and what documents will be required to fill it out.

According to the rules for drawing up a work completion certificate, it must include:

- name of the document and date of its preparation;

- customer and contractor data;

- nature of the work and a brief description of the essence;

- a list of persons, indicating the positions they hold, of all those included in the commission for acceptance of work;

- an indication of the shortcomings, if any, a list of ways to eliminate them; if all the work performed is completely satisfactory to the customer, then this should also be indicated;

- signatures of the parties.

As a result, it is the sample act of completion of work that allows you to draw up this document correctly and include in it all the data that is necessary.

You can download it to study and prepare for compilation, as well as to make sure that all documents comply with legal requirements and are available.

Requirements for certificates of work completed in 2018

Return to Certificate of Completion 2018

The certificate of completed work (services) is drawn up taking into account the requirements for the mandatory composition of details, the list of which does not contain requirements for mandatory reflection of the details of the work (services) performed.

Under a contract for the provision of paid services, the contractor undertakes to provide services (perform certain actions or carry out certain activities) on the instructions of the customer, who, in turn, undertakes to pay for them (Clause 1 of Article 779 of the Civil Code of the Russian Federation). According to Article 783 of the Civil Code of the Russian Federation, the general provisions on contracts, as a rule, apply to the said contract. They are given in articles 702-729 of the Civil Code of the Russian Federation. Thus, according to paragraph 1 of Article 720 of the Civil Code of the Russian Federation, the customer is obliged to accept the work performed (its result) within the time frame and in the manner prescribed by the contract. In this case, acceptance of services provided (work performed) is documented in the appropriate act.

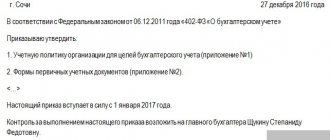

According to the clarifications of the Russian Ministry of Finance in a published letter, in accordance with the current legislation, the act of completed work (services) is drawn up in any form, reflecting all the necessary details.

The required details of the primary accounting document are listed in paragraph 2 of Article 9 of Federal Law No. 402-FZ, these are:

• name of the document and date of its preparation;

• name of the economic entity that compiled the document;

• the content of a fact of economic life, the value of its natural and (or) monetary measurement, indicating the units of measurement;

• the names of the positions of the persons who made the transaction, operation and those responsible for its execution, or the names of the positions of the persons responsible for the execution of the accomplished event;

• signatures of the mentioned persons indicating their surnames and initials or other details necessary to identify these persons.

As we can see, this list does not contain requirements for mandatory reflection of the details of the work performed (services provided). This is what the financial department pointed out in the commented document.

However, in practice, tax services require more detailed clarification in the act of actions taken, including the availability of information about the period of their implementation.

The fact that tax authorities make complaints about insufficient detail of the types of services provided in the act is evidenced by extensive judicial practice. However, in most cases, arbitrators consider such claims to be unreasonable.

After all, the legal norms do not indicate with what degree of detail the content of the service should be reflected. This is evidenced, for example, by the decisions of the Ninth Arbitration Court of Appeal No. 09AP-22191, as well as the FAS Volga District in case No. A55-40076, the FAS Moscow District No. KA-A40/6672-10 and No. KA-A40/7049-09, FAS Volga district No. A55-9765.

Details of the services provided can confirm the economic justification of the costs incurred by the customer for its acquisition, as well as the connection of a specific service with activities aimed at generating income.

However, there are court decisions in favor of the tax authorities. Thus, in the resolution of the Federal Antimonopoly Service of the Volga Region No. A55-12359, the arbitrators came to the conclusion that the taxpayer did not submit all the necessary documents for a tax deduction.

The fact is that the presented report on the provision of consulting services is not detailed, does not contain data on the actual work performed (services provided), their volume and nature, the timing of their implementation and the results of the work performed.

And in the decisions of the Federal Antimonopoly Service of the Volga District in case No. A55-12359, the Eighth Arbitration Court of Appeal No. 08AP-7994, the courts noted the following. If the acceptance and transfer act does not disclose the content of the services provided, then the company, in confirmation of the fact of the actual performance of services, can submit documents indicating that the contractor has performed specific types of services and the result of each service in the form of a report, conclusion, etc.

Similar conclusions are given in the decisions of the Arkhangelsk Region Court in case No. A05-4792/, in case No. A05-7717, the Samara Region Court in case No. A55-17531, and the Yamalo-Nenets Autonomous District Court in case No. A81-2271.

Thus, the details of the services provided can confirm the economic justification of the costs incurred by the customer for its acquisition, as well as the connection of a specific service with activities aimed at generating income.

Filling example

In addition to the sample acceptance certificate for work performed, you can download a completed example of such a document. This allows you to better understand the essence and structure of the act, its features and rules for filling it out. In addition, understanding the rules for filling out approximate data allows us to conclude that all the required documents are available to fill out the parameters of the act.

The difference between work and services is the following: the result of work performed is always material, but services are not.

In accordance with paragraph 4 of Art. 753 of the Civil Code of the Russian Federation: “The delivery of the result of work by the contractor and its acceptance by the customer is formalized by an act signed by both parties.”

Thus, the primary accounting document confirming the fact of completion of work is the act of acceptance. Despite the fact that such an act of the Civil Code of the Russian Federation is not provided for confirming the fact of provision of services, in order to confirm the production orientation of the services provided, it is desirable that an act of acceptance of services be available. Moreover, in accordance with paragraph 2 of Art. 272 of the Tax Code of the Russian Federation “the date of material expenses is recognized... the date of signing by the taxpayer of the act of acceptance and transfer of services (work) - for services (work) of a production nature.”

There is no unified form of acts, so the document can be developed independently. As an example, we recommend paying attention to the following options.

1. Sample work acceptance certificate

:

2. Let's assume a simplified version

:

3. If the work is accepted under a contract, you can use the following form

: 4.

Sample of drawing up an acceptance certificate for services rendered

Separately, it should be noted the act signed by the participants in intermediary transactions (between the principal and the commission agent, the attorney and the principal, the agent and the principal).

Such an act can simultaneously serve as a commission agent’s report on the fulfillment of the principal’s instructions.

The document must contain information about the execution of the commission order, the commission agent's commission and the costs that the principal must reimburse.

In accordance with Art. 999 of the Civil Code of the Russian Federation, if the principal has objections to the commission agent’s report, then he must report them within 30 days from the date of receipt of the report (unless another period is established by agreement of the parties).

5. Act-report on the sale of goods accepted for commission

Contract agreements - sample 2021, certificate of completion - a sample of

their completion may be required by both the contractor and the customer. You will learn about where to get a sample of such documents from our article.

The contractor must submit the result of the work

In accordance with civil law, the contractor must transfer to the customer the result of work performed under a construction contract. The delivery of the result of work by the contractor and its acceptance by the customer is formalized by an act signed by both parties (clause 1, 4 of article 753 of the Civil Code of the Russian Federation).

That is, only a specific result can be delivered, because the customer accepts the risk of the consequences of death or damage to the result of the work, which did not occur through the fault of the contractor.

The result can be transferred either under the contract as a whole, or according to a separate stage, if the contract provides for stage-by-stage delivery of work.

For example, in the construction of buildings (structures), a stage is the construction on one site of one of several planned objects, if such an object can be put into operation and operated autonomously. A stage can also be a part of an object that can be put into operation and operated autonomously, that is, regardless of the construction of other parts of this object (Section I of the Regulations on the organization and conduct of state examination of design documentation... approved by Decree of the Government of the Russian Federation of March 5, 2007 No. 145).

Is there a special form for the acceptance certificate for completed work, and where can I download it?

The acceptance certificate for completed work is the final document with which the parties to the contract (you can download the 2018 sample for free in this article) approve the completion of the work upon completion.

In addition to the final acts, interim acts can be drawn up.

Read about them in the article .

There is no special form for the act of acceptance and transfer of the result of work (with the exception of activities in which it is necessary to draw up an act in the KS-2 form, which we will discuss below). When concluding a contract, the partners (customer and contractor) develop and agree on the form or sample of the work completion certificate themselves. Moreover, it is important for an accountant that it contains those details that are established by law for the primary document. That is, the details from Art. 9 of the law of December 6, 2011 No. 402-FZ. After all, based on the certificate of completion of work, the contractor company will record revenue, and the customer will record expenses. In particular, the acceptance certificate for completed work must contain:

- Name;

- date of compilation;

- name of the person who prepared the document (contractor);

- characteristics of the work, including its types, unit of measurement (if any) and cost indicators;

- positions and signatures of persons carrying out delivery and acceptance.

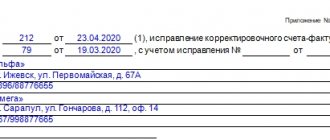

For more information about correcting primary documents, see the article.

You can view the acceptance certificate for completed work on our website.

How to apply

The document can be prepared on the customer’s letterhead or in a standard format on A4 sheet. It is drawn up in two or more copies for each party to the government contract. More than two copies are drawn up if it is submitted to the customer’s supervisory or control authorities, for example to the Federal Treasury, for payment. The agreement is signed by both parties and sealed if used by organizations.

The document must include the following parameters:

- subject of purchase;

- contract price;

- turnaround time.

As a general rule, a document agreeing on the results of the work performed is drawn up by the supplier, since he is responsible for the result and quality of the work.

When is the KS-2 form applied?

The unified form KS-2 is used in capital construction. The current legislation does not provide for the mandatory use of unified forms, including such documents as the act of acceptance and transfer of the result of work in the KS-2 form. However, in practice, the implementation of construction and installation work for industrial, housing, civil and other purposes is formalized by an act in the KS-2 form, which, if necessary, is modified to suit the needs of the organization. The basis for its preparation is the journal of work performed (form No. KS-6a). And the act itself is used to generate a certificate of the cost of work performed and expenses (form No. KS-3).

A sample act of acceptance of completed work in form KS-2 and explanations for its preparation can be found in the article

.

How to develop a template yourself

Each customer organization has the right to independently decide what the work completion certificate should look like, develop a form and approve it in its local documents. When preparing it, provide the following information:

- Document Number;

- number of the contract that is being closed;

- date of preparation and signing;

- name, quantity and cost of work performed;

- cost taking into account the applicable taxation system;

- details of the parties;

- signatures and seal.

IMPORTANT!

If errors are found in the document, draw up a new one and cancel the old one.

Where to find a sample contract for 2021

A contract with an individual of the 2021 model (or a civil contract) is quite often used by businessmen if it is necessary to hire an employee to perform a certain amount of work, but there is no need to conclude an employment contract with him.

Particular attention should be paid when drawing up a contract with a foreign citizen of the 2021 model - it is important to take into account all the nuances. To make the task easier, we present you with a form for such a document.

Find the nuances of a contract with an individual in the article.

Only the existence of a contract guarantees that any work will be completed without problems

. Such agreements set out conditions that suit both parties to the transaction. Special acts are required to ensure that the results of work and taxable costs are accepted without problems. If the act is signed, it means that the contract has been completed in full and meets all requirements.

This document is required for the customer to confirm that all work has been completed

. Many articles of the Civil Code mention details regarding this issue.

- Article 753 Regulates the construction contract process in general. It specifically talks about the rules for processing the results of the work performed. And about how customers should accept it. The document states the obligation of both parties to sign. The document is considered invalid if one of the parties refuses to sign. Exceptions are situations where the reasons for refusal were serious.

- Article 720. It contains the requirement for the mandatory presence of a document confirming the fact of acceptance of work.

On the basis of the acceptance certificate, some operations in tax and accounting are carried out.

- Write off costs in the future. In other words, they are given a business case

. - Without this, it is impossible to record the result obtained after completing the work.

- Accounting for expense items based on the contract agreement and its terms.

But this document is also needed to correct existing defects.

Reception and transfer of goods must be carried out in a certain way. Look for a sample act.

The customer is legally obligated to accept the work performed by the other party.

But the act can be signed either with an inspection of the object, or without performing such an action. After the inspection, each customer has the legal right to:

- The requirement to eliminate all defects at the expense of the contractor.

- Claiming compensation for work that was performed poorly.

- Refusal to accept the project.

Customers are granted rights only in situations where correction of deficiencies is possible. It is mandatory to list the defects in the report after the work is accepted. And it is important to indicate in the document itself that performers are obliged to eliminate identified deficiencies

.

If the acceptance of work is carried out only formally, there is a high probability that the customer will lose the right to make demands on the results.

There is a concept in accounting. Read about what it is in the article at the link.

When the act is drawn up

This document indicates that, on the basis of the contract (agreement), work was performed or services were provided in full and on time.

It reflects the quantitative and qualitative characteristics of the contractor’s fulfillment of the terms of the concluded government contract. It is signed by both the customer and the supplier and is the final stage of the implementation of the government contract. One copy remains with the organization acting as the customer, the other is transferred to the contractor. They draw up an act of provision of services or work performed even if the customer refuses to accept the work, and when the work is not completed in full or not at all. In such situations, the current protocol must reflect the detected violations that prevent the government customer from accepting the results, and indicate the period during which they will have to be eliminated.

Documentation serves as essential evidence in legal proceedings with the contractor when controversial issues arise under a contract, the subject of which is intangible services, the result of which cannot be demonstrated, assessed or measured. Examples of such purchases are orders for the use of the intellectual, professional knowledge of the contractor in order to fulfill the needs of the customer organization. In this case, the document indicates completion and reflects the completeness and timing of the work.

Documentation on the approval of results is also important for the customer organization when preparing interim and final accounting reports on the use of allocated budget funds. A document signed by both parties is the basis for payment to the contractor and confirms the intended use of budget allocations.

About the form and procedure for filling out the act

Responsibility for drawing up the act rests with the performers. There are several solutions you can use for this:

- Application of document forms previously used as mandatory. Many businesses operate this way, and there is nothing illegal about it.

- A document in a form developed independently by managers.

When choosing the second option, you should rely on No. 402-FZ

. Such primary documentation must indicate:

- Artist's name. It is established when an individual or individual entrepreneur registers

.

Both full and abbreviated names of organizations are accepted. The main requirement is the mandatory presence of a legal form. If we are talking about an individual entrepreneur, you must write your full name

. - Document's name.

- The date the document was issued. It is recommended to draw up any primary document either at the time of the transaction or after its completion, if there is no possibility for preliminary registration.

- Description of the business operation along with its content.

- The operation must be evaluated. Which is expressed in monetary or in kind forms.

- Information about the units that are used in the assessment. When work is performed, the presence of such units is not always provided. Using value alone is not a violation.

- If necessary, it is necessary to affix the signatures of those who have the right to represent the interests of the parties

. Each signature requires decoding.

The law does not prohibit bringing other documents as a supplement if the need arises. For example, you can list the responsibilities of performers to eliminate deficiencies if discovered. Or information about the shortcomings themselves, if they were identified.

The main thing is that the developed document is approved in the accounting policy of the organization. This applies, first of all, to performers. Therefore, many organizations try to use those forms that are already approved by law

. This allows you to avoid many unpleasant situations.

- Form T-73.

It is drawn up if an employment contract is concluded with limited conditions and execution time. - Act KS-2.

An excellent option for those who need to undertake construction, repair, installation and other similar types of work. Based on the KS-2 form, an additional cost certificate is drawn up, but the form will already be called KS-3.

Where can I get a sample document?

In order to correctly draw up the acceptance certificate for the work performed, it is better to look at the completed form. A sample form can be downloaded.

The procedure for issuing an acceptance certificate for completed work

The form of this act varies. But there are design requirements that must be met.

- Performers of the work are usually responsible for preparing the document.

- The act is signed either when all work is completed, or when the results are submitted at each specific stage. But this procedure must be provided for in the text of the agreement

. - The act is signed only after the customer has accepted the work. It takes on the status of completed after signature by the customer. It is believed that the conditions and payment correspond to what was originally stated in the contract.

- If customers refuse to sign, performers have the right to make appropriate notes in the document. Or if this is done only unilaterally. Only in court will it be possible to prove later that the act has no force

. - It is important that the actual work performed and what is described in the document correspond to each other.

- Entrepreneurs can sign the document without a power of attorney. Or it is done by persons acting on behalf of the organization. Some persons are given a power of attorney for just one action - to accept work and sign the completion certificate.

- If the customer does not want to sign the act, he draws up the document in any case. Even if his intentions and reasons are recognized as serious.

- The minimum number of acts drawn up is 2.

- The delivery of any type of work requires the execution of documents. When drawing up contracts for work.

About some additional design nuances

When performing repair work, capital construction and other similar operations, the following set of factors requires consideration.

- Editing KS-3 is a mandatory addition to documents of a unified form.

- When preparing acts, they rely on the information set out in the contents of the execution log.

- A digital designation of the contract

is required . The same applies to the name of the object under construction and the address of the construction site. - The contractor and the customer are not the only parties who must be present in the act. We need information on the investor, whose role is played by third parties. The act also displays data if the investor is the customer himself. A dash is not allowed on this line.

- The approved cost of work in the contract and the estimated price should not contradict each other.

- Each type of work performed is indicated separately, with its own position.

- To accept work, use the KS2 form, and for payments for the work - KS3.

What is a power of attorney with the right of substitution? What are its differences from the usual one? Detailed information is available.

On the nuances of recognizing income and expenses

Correctness in accounting and tax services is ensured only by carefully entering data into the act. The basis for writing off funds as expenses can only be a document filled out in accordance with all the rules.

Otherwise, the amount of income tax will not decrease. All expenses must have an economic justification and be related to the main activities of the company.

The obligation to pay for the work, depending on the contract, occurs at the moment of either signing the act or handing over the work. This also determines the date on which expenses are taken into account.

If you determine the date incorrectly, then there is a high probability of errors when determining taxes. In one period the amount will be more, and in another - less.

The funds received by the contractor are counted as income on the date specified in the act. It doesn’t matter when or after what period the money actually arrived. Repeated tax assessments or penalties threaten those who are found to have deficiencies.

The income tax base increases, because the costs do not have any confirmation in this case.