For normal activities, an organization needs to purchase various equipment, machinery, and other goods. Management may not always know what needs to be purchased in addition and why. To inform the employer, formulate a request and justify the need for the acquisition, employees draw up a memo. Let's figure out how to correctly compose it for purchasing equipment.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Account 07 “Equipment for installation”

The instructions for using the chart of accounts (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n) explain in detail what equipment requires installation:

- technological, energy and production equipment (including equipment for workshops, pilot plants and laboratories) requiring installation and intended for installation in facilities under construction (reconstruction);

- equipment put into operation only after assembling its parts and attaching them to the foundation or supports, to the floor, interfloor ceilings and other load-bearing structures of buildings and structures, as well as sets of spare parts for such equipment. This equipment includes control and measuring equipment or other devices intended for installation as part of the installed equipment.

Equipment that does not require installation is not taken into account on account 07: vehicles, free-standing machines, construction mechanisms, agricultural machines, production tools, measuring instruments, production equipment, etc.

Costs for the purchase of equipment that does not require installation are reflected directly in account 08 “Investments in non-current assets” as they are received at the warehouse or other storage location.

Account 07 is active, the opening debit balance reflects the availability of equipment for installation at the beginning of the reporting period.

Debit turnover reflects the receipt of equipment requiring installation. Loan turnover reflects the transfer of equipment for installation.

The ending debit balance shows the availability of equipment requiring installation at the end of the reporting period.

Analytical accounting for account 07 “Equipment for installation” is carried out by equipment storage locations and individual items (types, brands, etc.)

General drafting rules

Absolutely any employee of the organization can write a memo. It is drawn up in the name of the immediate superior, and if the company or enterprise is small, then in the name of the manager.

When writing a document, you must use a formal business style; all wording must be clear and understandable to the reader. In the text you must indicate the brand, model or other characteristics of the requested object, quantity. If many items are requested, it is better to arrange this item in the form of a table.

The text should not contain any kind of errors. There is no need to use long, confusing sentences; you need to express yourself concisely.

As a rule, the HR department or immediate supervisor already has a sample memo from which you can draw up your own document.

The employer, after studying the note, must decide on the advisability of purchasing the equipment and issue an order to issue money for the purchase to an accountable person or instruct the accountant to pay for the purchase.

The employer must remember that providing employees with equipment, documentation, and technology to solve their work problems is his direct responsibility. It is spelled out in Art. 22 Labor Code of the Russian Federation. Equipment needs to be replaced if it is obsolete or if it breaks down.

Purchase of equipment

When purchasing equipment that requires installation for a fee, it is taken into account at a cost equal to the sum of all costs associated with its acquisition.

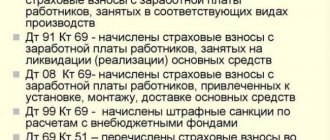

Debit 07 Credit 60 - equipment that requires installation has been received from the supplier.

Debit 19 Credit 60 - VAT on equipment requiring installation has been taken into account.

Debit 07 Credit 60 - the cost of equipment includes delivery costs.

Debit 19 Credit 60 - VAT on delivery is taken into account.

Receipt of equipment as a contribution to the authorized capital

Debit 07 Credit 75-1 equipment requiring installation was capitalized in the assessment agreed upon by the founders.

Transfer of equipment for installation

The cost of equipment handed over for installation is written off from account 07 “Equipment for installation” to the debit of account 08 “Investments in non-current assets”.

Debit 08 Credit 07 - equipment transferred for installation.

Debit 08 Credit 60 - the cost of equipment includes installation costs.

Debit 19 Credit 60 - VAT on installation is taken into account.

When constructing objects by contract, the customer transfers equipment for installation to the construction organization according to the equipment transfer certificate. In this case, the equipment continues to be accounted for by the customer in account 07 “Equipment for installation”, and for the construction organization it is accepted in the off-balance sheet account 005 “Equipment accepted for installation”.

The contractor removes the cost of this equipment or its parts handed over for installation from off-balance sheet accounting in account 005 “Equipment accepted for installation.” The cost of equipment transferred to a contractor, the installation and installation of which at a permanent place of operation has not actually begun, is not deregistered from the developer’s register.

How to write a memo for an acquisition

The note can be written by hand or typed on a computer and then printed. They compose it in free form, since there is no unified form.

The document must include the following information:

- The position and full name of the manager in whose name the memo is written.

- Position and full name of the note writer.

- Title of the document.

- Description of the problem and a request to purchase this or that equipment.

- Equipment characteristics. Here you can indicate the brand, model, power, volume, article (if necessary).

- Date and signature of the employee who compiled the document.

For your information! The legislation does not establish the mandatory nature of the use of official notes and their registration. However, some companies register them in a special accounting journal.

Input VAT on equipment requiring installation

VAT on equipment requiring installation is deducted in full after it is reflected on account 07 (there is no need to wait for the commissioning of the fixed asset). VAT on additional costs (delivery, installation, installation) is also fully refundable.

To deduct VAT, three conditions must be met:

- The fixed asset will be used in a VAT-taxable activity.

- Correctly executed invoice.

- The fixed asset has been accepted for accounting.

Conditions for purchasing equipment on lease

A person or organization that has decided on the necessary equipment to purchase and decides to conduct a transaction through leasing must follow the following procedure.

- Submitting a leasing application. It can be done either directly at the leasing company’s office or through the organization’s official resource. As a rule, for the convenience of potential clients, websites provide the opportunity to fill out an application online. If the answer is positive, the leasing company will need to provide financial documentation.

- Concluding a deal at the legal level. The relevant accompanying documentation, including the necessary insurance, is drawn up and fully signed.

- Making a down payment. Typically the payment ranges from ten to thirty percent of the total cost of the equipment and property accepted.

- The object of the agreement is transferred to the recipient.

If necessary, you can register the equipment involved in the transaction with government agencies.

Registration is carried out for any of the parties to the transaction. Now the organization or individual who purchased the equipment is required to make the corresponding financial payments according to a pre-agreed schedule. The schedule can be quite flexible - monthly payment, quarterly, or payment of the full cost of the leased property (equipment) at a time.

Until the end of the leasing agreement (or redemption by the acquirer), the property or equipment belongs to the lessor, and accordingly, maintenance is carried out at his expense.

Some distinctive points of equipment leasing

One of the most important aspects of purchasing equipment on lease is depreciation. As already mentioned, those who purchase equipment on lease (as opposed to direct lease) at the end of the lease period have the opportunity to purchase the necessary equipment at a fairly low cost. This is the best solution when it comes to expensive industrial equipment, various large electrical equipment, that is, that property that has an impressive service life.

Since third parties take part in the transaction - a leasing company, an insurance company, such a transaction is more trustworthy. It will be easier to solve emerging problems if there are parties who are not directly interested.

Both legal entities and individuals can contact a leasing company. Moreover, for the latter, the conditions for purchasing large equipment, for example, railway, industrial, large medical equipment, acquire more favorable conditions than lending.

When calculating leasing, various options are used:

- depreciation at an accelerated rate;

- advance payments taken into account in favor of the one who has the subject of the agreement on his balance sheet.

It is easier for small and medium-sized businesses to turn to leasing than to banking organizations to provide a loan. Expensive equipment will require less financial investment.

Sometimes enterprises sell their own equipment to leasing companies in order to subsequently take advantage of the lease - as a result, funds flow into the company’s budget, and much less is spent on the same equipment under leasing.

Accounting for inventory items in accounting: postings and documents

Accounting for inventory items in accounting is reflected on the basis of primary documentation and can be as follows:

- The purchase of materials is made in cash or by bank transfer, confirmed by a purchase agreement, payment and settlement documents or the transfer of a power of attorney to receive goods and materials with subsequent settlement with the supplier. It is received at the warehouse on the basis of a bill of lading or a receipt order. When purchasing materials, additional transportation and procurement costs (for example, delivery) may be reflected.

- Sale of materials - transfer of raw materials to third parties.

- Transfer - from the founders, contractors or sponsors, is accounted for at the estimated value or on the basis of available documents: contracts, payment documents, appraisal reports, etc.

- Write-off of materials - reflects the expenditure of inventory and materials into production. It may imply both the write-off of materials for actual production and the write-off for general business needs. Depends on corr. accounts (20, 23, 25, 26). Disposal may be reflected due to damage or loss of inventory items.

- Shortage of materials or surplus of materials are recorded as a result of inventory. They may be reflected within the normal limits or as a result of loss/damage.

- Operations with customer-supplied raw materials - features of accounting for materials received from another organization.

For production and for own needs, materials are released from the warehouse upon request - invoice or other documents (based on accounting policies); are written off to the production site, which then includes them in the cost of products or services.

Every year, according to PBU, owners are required to conduct scheduled inventories on the basis of an issued order with designated responsible persons. In addition to them, there may be unscheduled (sudden) audits and inventories. Their goal: control over the safety and correct use and write-off of inventory items.

Relations between the parties

Unless otherwise provided by the contract, the work is performed at the expense of the contractor - from his materials, with his forces and means. This norm is enshrined in paragraph 1 of Article 704 of the Civil Code of the Russian Federation. The price of the contract, according to paragraph 2 of Article 709 of the Civil Code of the Russian Federation, includes compensation for the contractor’s costs and the remuneration due to him. It can be determined by drawing up an estimate.

Thus, the contract may stipulate that the equipment, the cost of which will subsequently be compensated by the customer, is purchased by the contractor.

Why do you need 60 count?

The account is used to record settlements with counterparties. The company's debt for purchased goods or services is recorded as a loan. For example, a company received raw materials from a supplier, which means the accountant will make the following entry:

Dt 10 Kt 60 - goods received from the counterparty

Thus, the company has increased its stock of raw materials, and its debt to the supplier has increased, since the raw materials have not yet been paid for. By debit, the debt is reduced, for example due to payment of a bill for raw materials. Then the accountant makes the following entry:

Dt 60 Kt 51 - supplier invoice paid

Count 60 - active-passive. At the end of the period there may be a debit or credit balance. The debit amount means that the inventory items were paid in advance and the supplier has not yet transferred them. A loan is a company’s debt to a counterparty.

Modernization of equipment and its depreciation

Equipment modernization refers to work related to improving its technological and service properties.

Depreciation on modernized equipment is accrued provided that the modernization will take no more than 12 months. If the improvement process has been carried out for more than a year, then depreciation must be stopped.

Let's look at transactions for depreciation and modernization of equipment using an example: Budapest LLC carried out modernization of equipment by a contractor in the amount of 62,500 rubles, VAT 9,534 rubles.

- initial cost of equipment - 418,000 rubles;

- useful life - 3 years;

- annual depreciation rate 1/3*100% = 33.33%;

- monthly depreciation amount 418,000 * 33.33% / 12 months. = 11,610 rub.

The transactions were reflected by the following entries:

| Dt | CT | Description | Sum | Document |

| 26 | 02 | Depreciation on modernized equipment | RUB 11,610 | Depreciation statement |

| 08 OS upgrade costs | 60 | Cost of contractor's work | RUB 52,966 | Certificate of completion |

| 19 | 60 | VAT on the cost of the contractor's work | RUB 9,534 | Certificate of completion |

| 68 VAT | 19 | VAT deductible | RUB 9,534 | Invoice |

| 60 | 51 | Payment to the contractor | 62,500 rub. | Payment order |

| 26 | 02 | Depreciation on modernized equipment | RUB 11,610 | Depreciation statement |

| 01 | 08 OS upgrade costs | Increase in the book value of equipment by the amount of modernization | RUB 52,966 | Act of modernization |

Receipt of fixed assets that require and do not require installation

29.2 Setting parameters for generating the “Subconto Analysis” report

The first type of subconto is set to “Counterparties”. Next to it is indicated the mode for generating the statement for the submitted analytical attribute – “Select”. Thus, it is assumed that a specific subconto value must be determined according to which information will be selected for the statement. This value is set in the field below. This field specifies the value we are interested in – the Fraser plant. The value of the second analytical characteristic is determined in a similar way - the document - the basis “Account 345/21 dated 01/22/99.”. The statement is generated by clicking the “Generate” button located in the report settings window. Formation of the statement will give the following result.

Analysis of subconto Counterparties: "Frezer" plant Ground: Account 345/21 dated 01/22/99

| Subconto | Balance at the beginning of the period | Period transactions | balance at the end of period | ||

| Debit | Credit | Debit | Credit | Debit | Credit |

| "Frezer" plant | |||||

| 12 000.00 | |||||

| Total | 12 000.00 |

In the statement you can see that the counterparty “Freser” on account 345/21 has a receivable that was formed on account 60. To reflect the fact of the receipt of fixed assets from the supplier, we will use the universal document “Receipt of fixed assets”. In Fig. Figure 32 shows a document entry form filled with data corresponding to the problem statement. When filling out the dialogue form, you must enter the document number and date in the document header. The supplier is determined by selecting it from the “Counterparties” directory, and the document on the basis of which the payment was made is invoice 345/21 dated 01/22/99, which is selected from the “Agreements” directory. Next, you need to fill out the tabular part of the document. Each row of the table contains information about one OS object. When filling out the “Fixed Assets” column, you are asked to select an asset from the “Fixed Assets” directory. By pressing the screen button, document entry is completed. Posting the document will cause the generation of transactions for the receipt of fixed assets.

Fig. 32 Form for filling out the document “Receipt of OS”

Document input results

A record of the entered document is recorded in the transaction log. In addition, a record of the entered document is automatically registered in the document journal “Asset Accounting”. The document automatically generates two transactions that reflect the fact of receipt of fixed assets in computer accounting:

| № | Dt | SubcontoDt | CT | SubcontoKt | Currency | Quantity | Val.Sum. | Sum |

| Well | Sod.Prov. | No. Ж | ||||||

| 08.4 | Drilling machine SDU-11 | 60.1 | "Frezer" plant | 10 000.00 | ||||

| Score 345/21 | Arrival of OS. | OS | ||||||

| 19.1 | 60.1 | "Frezer" plant | 2 000.00 | |||||

| Score 345/21 | VAT allocated | OS |

Document “Putting fixed assets into operation”

It is used to reflect the fact that the OS has been put into operation. To enter a new document, in the “Documents” menu of the main menu of the program, select the item “Asset Accounting – OS Commissioning”.

Fig.33 Form for filling out the “Commissioning” document

Filling out the dialogue form requires entering the number and date of the document. The document should be used to credit the organization’s balance sheet (on the debit of account 01 “Fixed Assets”) of fixed assets. The “For leasing” checkbox determines the account to be credited to the balance (01 for a checked box or 03 for an unchecked box). The details “Source of receipt” and “Type of capital investments” are set by selecting from the drop-down list of values. With one document you can put several operating systems into operation at once; to do this, they all need to be entered into the tabular part of the document. To make filling out the document easier, as well as for additional control, the document form has a “Fill” button. When you click this button, the document tries to find and fill the tabular part with OS names that were not put into operation on the date of the document. The OS search is carried out only using the form that is selected in the document at the time of clicking the “Fill” button. When posting a document, transactions for putting the operating system into operation are automatically generated.

Document input results

A record of the entered document is recorded in the transaction log. In addition, a record of the entered document is automatically registered in the document journal “Asset Accounting”. Note that in the “Amount” field of both journals the book value of the fixed assets without VAT is indicated. The document automatically generates one transaction.

| № | Dt | SubcontoDt | CT | SubcontoKt | Currency | Quantity | Val.Sum. | Sum |

| Well | Sod.Prov. | No. Ж | ||||||

| 01.1 | Drilling machine SDU-11 | 08.4 | Drilling machine SDU-11 | 10 000.00 | ||||

| OS commissioning | OS |

What assets are classified as fixed assets?

This concept is defined by PBU 6/01 “Accounting for Assets” and tax legislation. The company's fixed assets include assets (structures, buildings, equipment, communications, machines, machines, office equipment, furniture, etc.) that are reused in production and management and that meet the following criteria:

- operated for more than a year;

- not processed as raw materials;

- not originally intended for resale;

- bringing profit in the process of work.

The characteristics of the operating system also include the initial cost. In accounting (clause 5 of PBU 6/01), the minimum price of fixed assets is considered to be 40 thousand rubles, in tax accounting – 100 thousand rubles. (Article 257 of the Tax Code). The assignment of property to fixed assets determines the conditions for the gradual write-off of its value through the calculation of depreciation, as well as the formation of value upon receipt.

Accounting press and publications

The organization purchased production equipment that required installation at a cost of 600,000 rubles, including VAT of 100,000 rubles. The delivery and installation of equipment was carried out by auxiliary production, the costs of which were: for delivery - 10,000 rubles, for installation of equipment - 140,000 rubles. In addition, materials worth RUB 24,000 were used during installation, including VAT of RUB 4,000. Accounting is maintained according to the new Chart of Accounts, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n.

The procedure for accounting for the costs of purchasing equipment that requires installation is established by clause 3.1.3 of the Regulations on accounting for long-term investments, approved by Letter of the Ministry of Finance of Russia dated December 30, 1993 N 160, according to which the costs of purchasing equipment consist of its cost according to suppliers’ accounts, transportation costs for the delivery of equipment and procurement and storage costs (including markups, commissions paid to supply and foreign economic organizations), the cost of services of commodity exchanges, customs duties, etc. In this case, the costs of purchasing equipment include its cost paid to the supplier, as well as the costs of auxiliary production for the delivery of equipment.

Information on the availability and movement of production equipment requiring installation is reflected in accordance with the Chart of Accounts for accounting financial and economic activities of organizations and the Instructions for its use (approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n) on account 07 “Equipment for installation”. The receipt of equipment for installation from the supplier is reflected in the debit of account 07 in correspondence with the credit of account 60 “Settlements with suppliers and contractors” (for the amount of the cost of equipment without VAT) and the credit of account 23 “Auxiliary production” (for the amount of delivery costs).

The amount of VAT presented by the equipment supplier is reflected in the debit of account 19 “Value added tax on purchased assets” and the credit of account 60. The organization has the right to accept the specified amount of VAT for deduction on the basis of Articles 171, 172 of the Tax Code of the Russian Federation, if any invoices - invoices and documents confirming payment to the supplier after the equipment has been registered as part of fixed assets.

The cost of equipment handed over for installation is written off from account 07 to the debit of account 08 “Investments in non-current assets”, subaccount 08-3 “Construction of fixed assets”.

The procedure for accounting for costs for equipment installation work is determined by clause 3.1.2 of the Regulations on Accounting for Long-Term Investments, according to which, in the economic method of performing the specified work, cost accounting is carried out in accordance with the procedure established by the Standard Methodological Recommendations for Planning and Accounting for the Cost of Construction Works (approved Ministry of Construction of Russia 04.12.1995 N BE-11-260/7), based on actual costs incurred.

The costs of auxiliary production for the installation of equipment are written off to the debit of account 08, subaccount 08-3, in correspondence with the credit of account 23.

Carrying out construction and installation work for one’s own consumption is recognized as subject to value added tax on the basis of paragraph 3 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation. Since equipment installation work is classified as construction and installation work, its implementation by auxiliary production is subject to VAT.

The tax base when performing construction and installation work for one’s own consumption is defined as the cost of the work performed, calculated on the basis of all actual expenses of the taxpayer for their implementation (clause 2 of Article 159 of the Tax Code of the Russian Federation).

Thus, the tax base in this case is the amount of expenses of auxiliary production for the installation of equipment.

Since the cost of the installed equipment itself is not included in the costs of installation work, we believe that it is not subject to inclusion in the tax base when calculating VAT on installation work performed for own consumption.

The date of completion of construction and installation works for own consumption is determined as the day of registration of the corresponding object completed by capital construction (Clause 10 of Article 167 of the Tax Code of the Russian Federation).

According to clause 1 of Article 171 of the Tax Code of the Russian Federation, the taxpayer has the right to reduce the total amount of accrued value added tax by the tax deductions established by this article.

In accordance with clause 6 of Article 171 of the Tax Code of the Russian Federation, the amounts of VAT charged to the taxpayer on goods (work, services) purchased by him for the performance of construction and installation work, as well as the amount of tax calculated by taxpayers when performing construction and installation work for their own consumption, subject to deductions.

The specified tax amounts are subject to deduction after registration of the corresponding objects of completed or unfinished capital construction.

Paragraph 46 of the Methodological Recommendations for the Application of Chapter 21 “Value Added Tax” of the Tax Code of the Russian Federation, approved by Order of the Ministry of Taxes and Taxes of Russia dated December 20, 2000 N BG-3-03/447, explains that the amount of VAT subject to deduction for construction and installation works performed for one’s own consumption , is determined as the difference between the amount of VAT accrued on the cost of these construction and installation works and the amount of VAT paid to sellers on goods purchased (work performed, services provided) used in the implementation of these construction and installation works.

Thus, in this case, the amount of VAT accrued on the volume of installation work performed, minus the amount of VAT on the materials used in their implementation, is subject to deduction.

According to clause 5.1.2 of the Regulations on accounting for long-term investments (approved by Letter of the Ministry of Finance of Russia dated December 30, 1993 N 160), the inventory cost of equipment requiring installation consists of the actual costs of purchasing equipment, as well as expenses for construction and installation work, other capital costs attributable to the cost of equipment put into operation for its intended purpose.

The cost of equipment installed and put into operation is written off from account 08, subaccount 08-3, to the debit of account 01 “Fixed assets”.

—————————————————————————T——————T——————T———————T— ———————————————¬ | Contents of transactions |Debit |Credit| Amount,| Primary | | | | | rub. | document | +—————————————————————————+——————+——————+———————+— ———————————————+ | | | | | Shipping | | | | | | documents | |Reflected purchase | | | | supplier, | | equipment cost, | | | | Acceptance certificate | |requiring installation | 07 | 60 |500,000| equipment | +—————————————————————————+——————+——————+———————+— ———————————————+ |Reflects the amount of VAT on | | | | | |equipment | 19 | 60 |100,000| Invoice | +—————————————————————————+——————+——————+———————+— ———————————————+ |Costs reflected | | | | | |auxiliary | | | | | |production for delivery | | | | Accounting | |equipment | 07 | 23 | 10,000| help—calculation | +—————————————————————————+——————+——————+———————+— ———————————————+ |Payment made | | | |Bank statement by| |equipment supplier | 60 | 51 |600,000|current account| +—————————————————————————+——————+——————+———————+— ———————————————+ | | | | | Acceptance certificate— | | | | | | transmissions | |Transmission reflected | | | | equipment | |equipment for installation | 08—3 | 07 |510 000| in installation | +—————————————————————————+——————+——————+———————+— ———————————————+ |Transmission reflected | | | | | |auxiliary | | | | | |production of materials | | | | | | to perform installation | | | | Requirement— | |works | 23 | 10—8 | 20,000| invoice | +—————————————————————————+——————+——————+———————+— ———————————————+ | | | | | Settlement— | |Reflects the costs of | | | | payment | | installation | | 70, | | statement, | |works auxiliary | | 69 | | Accounting | |production | 23 | etc.|140,000| help—calculation | +—————————————————————————+——————+——————+———————+— ———————————————+ |Costs written off | | | | | |auxiliary | | | | | |production on | | | | | |execution of work on | | | | Accounting | |installation of equipment | 08—3 | 23 |160,000| help | +—————————————————————————+——————+——————+———————+— ———————————————+ | On the date of acceptance of the installed equipment for accounting | | as part of fixed assets | +————————————————————————T——————T——————T———————T— ———————————————+ |VAT charged on the amount | | | | | |construction and installation work completed for the needs of | | | | Accounting | |own consumption | | | | reference—calculation,| |(160,000 x 20%) | 08—3 | 68 | 32,000| Invoice | +—————————————————————————+——————+——————+———————+— ———————————————+ |Reflected subject | | | | | | deduct the amount of VAT | | | | | | Construction and installation work performed for | | | | Accounting | |own consumption | | | | reference—calculation,| |(32,000 - 4000) | 19 | 08—3 | 28,000| Invoice | +—————————————————————————+——————+——————+———————+— ———————————————+ |Input reflected in | | | | | |exploitation | | | | Accounting | |mounted | | | | reference—calculation,| |equipment | | | | Acceptance certificate— | |(510,000 + 160,000 + | | | | transfers | |+ 32,000 - 28,000) | 01 | 08—3 |674,000|fixed assets| +—————————————————————————+——————+——————+———————+— ———————————————+ | | | | | Invoice, | |Amount accepted for deduction | | | | Acceptance certificate— | |VAT paid | | | | transmissions | |equipment supplier | 68 | 19 |100,000|fixed assets| +—————————————————————————+——————+——————+———————+— ———————————————+ |Amount accepted for deduction | | | | Invoice, | |VAT on materials, | | | | Acceptance certificate— | | used for | | | | transmissions | |installation of equipment | 68 | 19 | 4,000|fixed assets| +—————————————————————————+——————+——————+———————+— ———————————————+ |Amount accepted for deduction | | | | Invoice, | |VAT on completed | | | | Acceptance certificate— | | installation work | | | | transmissions | |equipment | 68 | 19 | 28,000|fixed assets| L—————————————————————————+——————+——————+———————+— ———————————————— ———————————————————————————————— A similar position on The issue of deducting VAT amounts on construction and installation works carried out for one’s own consumption was taken up by the Supreme Court of the Russian Federation (see Decision of the Supreme Court of the Russian Federation dated July 24, 2001 N GKPI 2001-916, Determination of the Supreme Court of the Russian Federation dated September 6, 2001 N CAS 01-325). To register the equipment received at the warehouse for installation, the Equipment Acceptance Certificate is used in form N OS-14, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a “On approval of unified forms of primary accounting documentation for accounting of labor and its payment, fixed assets and intangible assets , materials, low-value and wearable items, capital construction work.” According to the Chart of Accounts and clause 3.1.3 of the Regulations on accounting for long-term investments, equipment requiring installation is reflected in account 08 starting from the month in which work began on its installation at a permanent place of operation (attachment to the foundation, floor, interfloor ceiling or other load-bearing structures of the building (structure)) or large-scale assembly of equipment has begun. The transfer of equipment to installation organizations for its installation is formalized by the Certificate of Acceptance - Transfer of Equipment for Installation in Form N OS-15, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a. We believe that this form can also be used when transferring equipment for installation performed by auxiliary production. When accepting installed equipment for registration as part of fixed assets for the amount of VAT payable to the budget for installation work performed for own consumption, an invoice is issued in one copy and registered in the sales book (clause 25 of the Rules for maintaining logs of received and issued invoices - invoices, purchase books and sales books when calculating value added tax, approved by Decree of the Government of Russia dated December 2, 2000 N 914). When accepting installed equipment for registration as part of fixed assets for the amount of VAT in the form of the difference between the amount of tax accrued on the cost of installation work and the amount of tax paid to sellers for purchased materials used in performing these works, an invoice is issued in one copy and is registered in the purchase book (clause 12 of the Rules for maintaining logs of received and issued invoices). The commissioning of equipment is formalized by the Certificate (invoice) of acceptance and transfer of fixed assets in form N OS-1, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a. An invoice received from the seller of materials used to perform equipment installation work is stored in the journal of received invoices and is registered in the purchase book at the time the installed equipment is registered as part of fixed assets (clause 4, 12 of the Rules maintaining logs of received and issued invoices). Y.S. Orlova Center for Research on Taxation and Accounting Problems 10.30.2001 ————