Appointing a chief accountant: how to take into account all the nuances

The organization maintains accounting records throughout its life, and the manager is responsible for it, who usually entrusts this work to the chief accountant or contacts companies that provide accounting services (Part 3, Article 7 of the Federal Law of December 6, 2011 No. 402-FZ “On accounting"). If an institution has the right to use simplified methods of accounting, including the preparation of simplified accounting (financial) statements, or is a medium-sized enterprise, then the heads of such organizations can take over the accounting. Such a decision must be formalized by an order on maintaining accounting records. The sample order below for the appointment of the chief accountant of an LLC can also be used.

Why do you need an order?

The order clearly stipulates the terms within which the new chief accountant must begin his duties, as well as a list of these responsibilities (defined by Article 7 of the Federal Law and can be supplemented or rejected by the director after agreement with the employee).

In addition, it is recorded how and when the transfer of the enterprise’s accounting affairs will take place, who will be part of the supervisory commission, and whether third parties will take part in the process. Other details are indicated which may vary for each specific case.

With the help of a correctly drawn up and officially certified document, both the employer and the new employee are protected from possible misunderstandings and disagreements during an audit of the organization’s accounting records. In addition, if the accountant has the right to sign, for example, bank receipts, bank employees will also require an order confirming his appointment to the position.

Destination Features

The Labor Code pays special attention to such positions. For example, it determines the special conditions for concluding an employment contract with him. In accordance with Art. 59 of the Labor Code of the Russian Federation, with the chief accountants of organizations of any form of ownership, by agreement of the parties, a fixed-term employment contract can be concluded, and the probationary period (Article 70 of the Labor Code of the Russian Federation) for them can last 6 months, if there are no restrictions.

When hiring an accountant or registering a transfer from another position, you need to issue an Order for Hiring or Transfer. As a rule, in this case, unified forms No. T-1 and No. T-5 are used. In some institutions, an order is additionally drawn up for the appointment of a chief accountant. It seems that the issuance of such an order was caused by the excessive bureaucratic requirements of some banks and electronic platforms, since, in essence, this document repeats the information contained in personnel orders and has no additional value.

Who can be appointed chief accountant?

The professional standard “Accountant”, approved by Order of the Ministry of Labor of Russia dated December 22, 2014 No. 1061n, establishes requirements for the qualifications of such an employee. Labor legislation establishes the mandatory application of the requirements contained in professional standards only to chief accountants working in certain economic entities. These include:

- OJSC (except credit);

- non-state pension funds;

- joint stock investment funds;

- management companies of mutual investment funds;

- other economic entities whose securities are admitted to circulation at organized trading (except for credit organizations);

- governing bodies of state extra-budgetary funds, state territorial extra-budgetary funds (Part 4 of Article 7 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”).

insurance organizations;

A chief accountant working in one of the listed organizations must have:

- higher education;

- work experience in a similar position (have experience in accounting, preparing financial statements) or as an auditor - at least 3 years out of the last 5 calendar years.

If there is no higher education, even more professional experience can compensate for its absence: at least 5 years of work in a similar position out of the last 7 calendar years.

Requirements for undergoing advanced training are not established, that is, the chief accountant, whose length of service and experience meets the requirements of Federal Law dated December 6, 2011 No. 402-FZ “On Accounting,” is not required to undergo additional training and improve his professional level. To the credit of most chief accountants, it should be noted that, despite the absence of such requirements, they regularly undergo additional training.

For institutions not listed above, the requirements for the length of service and experience of the chief accountant are not mandatory.

Appointment of a chief accountant: how to take into account all the nuances

A chief accountant, who regulates all accounting issues, including this position, will help you decide whether or not your organization needs a chief accountant. So, the chief accountant of the organization:

Needed if this

Not needed if this

Individual entrepreneur (they don’t have to keep records at all)

Non-credit financial institution

Individuals engaged in private practice (lawyers, notaries, farmers)

Other organizations not listed in the “not needed” column

Sample order for the appointment of an accountant

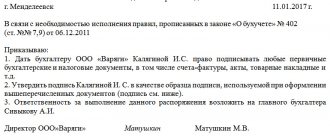

There are no unified forms; we recommend using a sample order for the appointment of the chief accountant of an LLC, located in the commercial version of the ConsultantPlus system, 2021. This document looks like this:

Order on the appointment of chief accountant 2021 Primer LLC

Moscow April 19, 2021

In connection with the responsibility for maintaining accounting records, I order:

1. Appoint Aglaya Ivanovna Koshkina, born on May 10, 1978, as chief accountant / entrust accounting management / Primer LLC to Aglaya Ivanovna Koshkina, born on May 10, 1978 (other information about the person provided for by the charter or internal documents of the employer)

(additional option if necessary: for a period of ______________________).

2. Aglaya Ivanovna Koshkina’s work should be paid in accordance with the employment contract concluded with her, with a salary of 90,000 (Ninety thousand) rubles per month.

3. In order to verify A.I. Koshkina’s compliance with the assigned work, set a test period of 3 months (no more than six months)

4. By agreement of the employer and A.I. Koshkina, conclude a fixed-term employment contract for a period of __________.

5. Establish full financial liability of A.I. Koshkina. from 04/19/2017

6. The head of the HR department, Svetlana Petrovna Ivanova, should familiarize Aglaya Ivanovna Koshkina, who is appointed to the position of chief accountant, with this order by April 20, 2021.

Head __________________ Vasechkin Petr Semenovich

I have read the order __________________ Koshkina A.I.

- The following must be included in the Order:

- date, since it will begin the person’s personal responsibility for maintaining accounting records in your organization;

- Full name of the person who will be the future chief accountant or who is assigned accounting responsibilities;

- full and exact name of the legal entity;

- personal signature of familiarization of the individual appointed to the position.

- In line 2, you can indicate not a salary, but a piece-rate payment option.

- Lines 4 and 6 are filled in if appropriate services are available at the enterprise

- Lines 3 and 4 are filled in as needed.

- Line 5 must be filled in with the date.

Any organization can write this document in free text form, indicating in it the data that relates to the specifics of its work. The contents of the order should not contradict other documents, including those that need to be drawn up for the final employment of the chief accountant.

GLAVBUKH-INFO

Job description of the chief accountantAPPROVED General Director Surname I.O. ________________ "________"_____________ ____ G.

1. General Provisions

1.1. The chief accountant belongs to the category of managers. 1.2. The chief accountant is appointed to the position and dismissed by order of the general director of the company. 1.3. The chief accountant reports directly to the general director. 1.4. During the absence of the chief accountant, his rights and responsibilities are transferred to his deputy, in case of his absence - to another official, as announced in the order of the organization. 1.5. A person who meets the following requirements is appointed to the position of chief accountant: higher professional education, experience in financial and accounting work, including in management positions, at least 5 years. 1.6. The chief accountant must know: - accounting legislation; — regulatory materials of higher-level, financial and auditing bodies on the organization of accounting and reporting, as well as those relating to the financial and economic activities of the enterprise; — civil law, financial, tax and economic legislation; — provisions and instructions for organizing accounting at an enterprise, rules for its maintenance; — the procedure for processing transactions and organizing document flow for accounting areas; — forms and procedures for financial settlements; — methods of economic analysis of the economic and financial activities of an enterprise, identifying on-farm reserves; — the procedure for acceptance, capitalization, storage and expenditure of funds, inventory and other valuables; — rules for conducting an inventory of property and liabilities; — the procedure and deadlines for preparing accounting, tax, and statistical reporting. 1.7. The chief accountant is guided in his activities by: - legislative acts of the Russian Federation; — The company’s charter, internal labor regulations, and other regulations of the company; — orders and instructions from management; - this job description. 1.8. The chief accountant is prohibited from accepting for execution and registration documents on transactions that contradict the law. In case of disagreements between the head of the organization and the chief accountant regarding the implementation of certain business transactions, documents on them can be accepted for execution with a written order from the head of the organization, who bears full responsibility for the consequences of such transactions.

2. Job responsibilities of the chief accountant

The chief accountant performs the following job responsibilities: 2.1. Manages the accounting staff of the organization. 2.2. Coordinates the appointment, dismissal and relocation of financially responsible persons of the organization. 2.3. Heads the work on the preparation and adoption of a working chart of accounts, forms of primary accounting documents used to formalize business transactions for which standard forms are not provided, and the development of forms of documents for internal accounting financial statements of the organization. 2.4. Coordinates with the director the directions for spending funds from the organization’s ruble and foreign currency accounts. 2.5. Carries out an economic analysis of the economic and financial activities of the organization based on accounting and reporting data in order to identify intra-economic reserves, prevent losses and unproductive expenses. 2.6. Participates in the preparation of internal control system measures to prevent the formation of shortages and illegal expenditure of funds and inventory items, violations of financial and economic legislation. 2.7. Signs, together with the head of the organization or authorized persons, documents that serve as the basis for the acceptance and issuance of funds and inventory, as well as credit and settlement obligations. 2.8. Monitors compliance with the procedure for preparing primary and accounting documents, calculations and payment obligations of the organization. 2.9. Monitors compliance with established rules and deadlines for conducting an inventory of funds, inventory, fixed assets, settlements and payment obligations. 2.10. Monitors the collection of accounts receivable and repayment of accounts payable on time, and compliance with payment discipline. 2.11. Controls the legality of writing off shortages, receivables and other losses from accounting accounts. 2.12. Organizes timely reflection on accounting accounts of transactions related to the movement of property, liabilities and business transactions. 2.13. Organizes accounting of the organization’s income and expenses, execution of cost estimates, sales of products, performance of work (services), results of the organization’s economic and financial activities. 2.14. Organizes audits of the organization of accounting and reporting, as well as documentary audits in the structural divisions of the organization. 2.15. Ensures the preparation of reliable reporting for the organization based on primary documents and accounting records, and its submission to reporting users within the established time frame. 2.16. Ensures the correct calculation and timely transfer of payments to the federal, regional and local budgets, contributions to state social, medical and pension insurance, and timely settlements with contractors and wages. 2.17. Develops and implements activities aimed at strengthening financial discipline in the organization.

3. Rights of the chief accountant

The chief accountant has the right: 3.1. Establish job responsibilities for employees subordinate to him. 3.2. Establish a mandatory procedure for all departments and services of the organization for documenting transactions and submitting the necessary documents and information to the accounting department. (Lists of officials who are responsible for drawing up primary documents and who are given the right to sign them are agreed upon with the chief accountant.) 3.3. Coordinate the appointments, dismissals and relocations of financially responsible persons. 3.4. Review and endorse contracts and agreements concluded by the organization. 3.5. Demand from heads of departments, and, if necessary, from the head of the organization, to take measures to strengthen the safety of the organization’s property, ensure the correct organization of accounting and control. 3.6. Check in the structural divisions of the organization compliance with the established procedure for acceptance, posting, storage and expenditure of funds, inventory and other valuables. 3.7. Act on behalf of the accounting department of the organization, represent its interests in relations with other structural divisions of the organization and other organizations on financial, economic and other issues. 3.8. Submit proposals for improvement of accounting activities for consideration by the organization's management.

4. Responsibility of the chief accountant

The chief accountant is responsible for: 4.1. For failure to perform and/or untimely, negligent performance of one’s official duties. 4.2. For failure to comply with current instructions, orders and regulations on maintaining trade secrets and confidential information. 4.3. For violation of internal labor regulations, labor discipline, safety and fire safety rules.

Source: Rabota.ru

Attachments:

| < Previous | Next > |

Important nuances

An entry into the work book of an employee of any position with any responsibilities is made on the basis of a hiring order, and not on the basis of an appointment order, a sample of which is given above. Hiring is formalized by an order (instruction) of the employer, issued on the basis of an employment contract concluded in accordance with Article 16 of the Labor Code of the Russian Federation.

The content of the employment contract with the chief accountant is the subject of a separate discussion. Its most important provisions are urgency (indefinite or for a certain period), completeness of reflection of job duties and responsibilities, and terms of remuneration. Before drawing up an employment contract, employment order and appointment order, it is necessary to ensure that the candidate for the position of chief accountant meets the requirements set by law for this position in paragraphs 4-7 of Law No. 402-FZ “On Accounting”.

Appointment of a chief accountant: how to take into account all the nuances

Accounting is maintained throughout the existence of the organization - from its registration as a legal entity to the termination of activities as a result of liquidation or reorganization. The head of the organization is responsible for maintaining accounting and storing relevant documents, who is obliged to entrust its maintenance to the chief accountant or other official or to enter into an agreement for the provision of accounting services. An exception to this rule are organizations that have the right to use simplified accounting methods, as well as medium-sized businesses. However, in practice, most managers prefer to have a chief accountant on their staff, even if the law allows not to do so.

How to write a document correctly

There is no single form of order; in each company, the document is drawn up separately for each specific case. What data and provisions must be included in it?

- Personal details of the new accountant – first name, last name, patronymic, date of birth.

- Responsibilities - temporary or permanent.

- Be sure to have clear deadlines for the delivery and acceptance of business affairs. In accordance with the current legislation of the Russian Federation, the previous accountant is given no more than two weeks

to prepare and transfer all matters to the new official. Based on the date of dismissal of the old employee, the terms of entry into office of the new one are determined. - Information about the composition of the commission that will control the process of preparing all documentation, as well as its transfer to the new employee. At the same time, do not forget that he, like the previous chief accountant, must be included in the list of inspectors.

- In the case when third parties will take part in the preparation of all cases - auditors, an additional inspection commission from a higher organization, etc. - this should also be recorded in the order. All data of third parties, their responsibilities and the nature of their activities in the process of preparing and transferring enterprise documents are indicated.

Only after completing a full and thorough check, making sure that he will not be held responsible for the actions of the previous chief accountant, does the new employee sign the order and assume his rights and responsibilities.

A legal entity is required to maintain accounting records throughout the period of its activity. The responsible head of the organization and the chief accountant are responsible for its correctness. In this case, it is mandatory to have an order appointing the chief accountant of the LLC.

Who can be appointed chief accountant

Contained in Art. 7 of the Accounting Law, the requirements for the chief accountant to have a higher education and a certain work experience do not apply to limited liability companies, unlike joint stock companies. Accordingly, the provisions of the Professional Standard for Accountants approved in 2014 are only advisory for such organizations.

However, no manager in his right mind would entrust the position of chief accountant to a person who does not have in-depth knowledge in the field of accounting and tax law, as well as experience in his specialty. Therefore, you can set the necessary requirements for a candidate for this position yourself, based on the specifics of your organization. Just don’t forget to indicate these qualification requirements in the job description of the chief accountant - this, among other things, will make it possible to reject candidates for this position who do not have the necessary skills.

Who can be appointed to the position

Since the duties and powers of the chief accountant at the enterprise include maintaining all accounting affairs, preparing reports, organizing the normal functioning of the accounting system, monitoring the compliance of all ongoing operations with respect to the current legislation of the Russian Federation, as well as the property and financial condition of the organization, it is most advisable to appoint a qualified specialist with higher economic education

.

Sometimes a so-called professional accountant is appointed. Such a person may not have a corresponding higher education diploma, but he has sufficient work experience in this field - at least three years

. In some cases, for example when the company has few employees, the director may appoint himself to this position.

How to create an order

The legislation does not establish any special form or sample order for the appointment of an accountant. However, unlike documents on the appointment of other specialists, the order on the appointment of a chief accountant quite often has to be submitted to banks, the tax office and other institutions, so questions sometimes arise regarding its execution.

An order to appoint this employee is issued upon hiring and concluding an employment contract. Like other orders for personnel, it must contain:

- date and serial number of the order;

- full name of the organization;

- FULL NAME. the appointed person;

- date of appointment to the position of chief accountant (if different from the date of publication of the document);

- manager's signature;

- personal signature of the employee confirming familiarization.

The order can also reflect the issues of establishing a probationary period, imposing full financial responsibility and granting the right to sign financial documents.

Combining the positions of chief accountant and director

Sometimes managers decide to do the accounting themselves. This often happens if the company is very small. In this case, the simplest form of order is issued.

Don’t know what to open – an LLC or an individual entrepreneur? You will find all the answers right there.

You need to act differently if there is already a chief accountant at the enterprise, but the director performs his duties temporarily.

First, you need to draw up an additional agreement to the employment contract,

issued to the director. What needs to be included in it?

- Amount of surcharge associated with combination.

- The period for which the combination is issued. For example, while the chief accountant is on vacation.

- An indication of the fact that for some time the director will also perform the duties of another employee.

An example of an order when working with a combination of positions.

After this, they move on to the simplest form of order for combining positions. It is not necessary to enter into the director’s personal card

information that

he will perform additional work.

The same applies to the work book. Rostrud agrees with this option for part-time registration.

The position of chief accountant may not be added to the staff at all if the manager is personally responsible for maintaining finances and carrying out all financial transactions. Then accounting is one of the manager’s job functions.

and are you afraid of doing something wrong? Instructions on how to properly close can be found at this link.

If the combination is formalized temporarily, then the duties cease automatically as soon as the main employee returns to duties. No additional documents are required for this.

You can find out how to formalize the transfer of affairs by the chief accountant in this video:

The chief accountant is the second most important and powerful person in the enterprise after the director. Therefore, when it is replaced, it is necessary to approach drawing up an order for its appointment with special responsibility.

Fundamentally, it is not much different from the template document used to hire full-time employees, but it still has its own nuances that should not be ignored.

Features of labor relations

Appointment to the position of chief accountant may be made by the general director of the LLC or another person having such authority.

By agreement of the parties, a fixed-term employment contract may be concluded with the chief accountant. The probationary period for him, unlike other employees, has been extended and can be up to 6 months (part 5 of article 70 of the Labor Code of the Russian Federation).

Also, for the chief accountant, additional grounds have been established for terminating the employment contract with him: when the owner of the organization’s property changes, the new owner, no later than three months from the date of his ownership rights, has the right to terminate the employment contract with him in accordance with clause 4, part 1, art. 81 Labor Code of the Russian Federation. Just do not confuse a change in the owner of property with a change in company participants - in this case there are no grounds for dismissing the chief accountant.