Hello, dear blog guests, in this article we will examine such an interesting topic as Sberbank bills for legal entities, since this information may be useful to those of our compatriots who are engaged in entrepreneurial activities.

According to available statistics, many domestic entrepreneurs periodically experience serious difficulties when making settlements with counterparties. This credit institution relatively recently began issuing its own bills of exchange, designed to relieve entrepreneurs from the difficulties mentioned above. It will be useful for you to know that since their inception, promissory notes from Sberbank have become quite popular among domestic entrepreneurs.

First of all, it is necessary to mention that a Sberbank bill of exchange is nothing more than a promissory note of the described banking structure. It is important to understand that the described bills of exchange can be used not only for settlements with counterparties, but also as an effective tool for generating additional profit.

You should know that bills from this banking structure occupy a leading position in the domestic market among similar securities. The reason for this phenomenon is that Sberbank is rightfully considered the most reliable Russian banking structure, due to which the securities it issues are also considered the most reliable.

About accounting

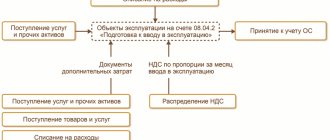

Accounting for bank bills purchased for the purpose of generating income on them is carried out in accordance with PBU 19/02 “Accounting for Financial Investments” [1] and the Instructions for the Application of the Chart of Accounts [2]. Such securities belong to financial investments ( clause 3 of PBU 19/02 ) and are reflected in the same account 58 “Financial investments”, subaccount 2 “Debt securities”[3].

For your information

Such bills are reflected in the balance sheet:

- in the group of articles 1170 “Financial investments” of section I “Non-current assets” - if the repayment of the bill or its transfer for payment is not expected within 12 months after the reporting date;

- in the group of articles 1240 “Financial investments (except for cash equivalents)” of section II “Current assets” - if the repayment of the bill or its transfer for payment is expected within 12 months after the reporting date.

It is recommended to reflect the interest receivable on a bill of exchange separately from its value (traditionally, the corresponding subaccount of account 76 “Settlements with various debtors and creditors” is used for these purposes). As a rule, interest is accrued for each expired reporting period ( clause 16 of PBU 9/99 “Income of the organization” [4]), that is, monthly. This accounting option (as opposed to the one-time accrual of interest) allows you to avoid the occurrence (as a result of differences in the rules for recognizing income for accounting and tax accounting purposes) of a taxable temporary difference that must be reflected in accounting in accordance with the requirements of PBU 18/02 “Accounting for income tax calculations.” organizations" [5].

note

Interest (the rate for their calculation must be fixed in the text of the bill) is accrued from the day following the day the bill is drawn up (unless another date is specified). This follows from clauses 5 , 73 and 77 of the Regulations on bills of exchange and promissory notes [6] (see also letters of the Ministry of Finance of Russia dated November 6, 2008 No. 03-03-06/2/150 , dated August 27, 2010 No. 03-03- 06/1/574 , Federal Tax Service for Moscow dated March 25, 2011 No. 16-15/ [email protected] ). An exception is a bill with a payment term “at sight, but not before.” If it does not contain a specific reference to the date from which interest is accrued, such interest is accrued from the date “not earlier” ( clause 19 of the Resolution of the Plenum of the RF Armed Forces and the Plenum of the Supreme Arbitration Court of the Russian Federation dated December 4, 2000 No. 33/14 “On some issues of dispute resolution practice related to the circulation of bills" ).

On the date of transfer of the bill of exchange as compensation to pay off debt under a service agreement, the organization will reflect the disposal of the financial investment ( clause 25 of PBU 19/02 ). At the same time, it recognizes other income from the disposal of bank bills in the amount of repaid accounts payable ( clauses 6.3 , 7 , 10.1 of PBU 9/99 ).

Example 1

On January 26, 2015, the organization acquired a bill of exchange from Vneshtorgbank, issued on January 26, 2015, with a payment term “at sight, but not earlier than May 6, 2015” at a par value of RUB 1,000,000. The bill provides for the accrual of interest at a rate of 7% per annum, which is reflected on the form of the bill.

On April 6, 2015, the organization executed a compensation agreement, involving the transfer of a bank bill to the counterparty who provided services for it in the amount of 1,000,000 rubles. (without VAT).

The transaction for the acquisition of a bill of exchange was carried out on the basis of an agreement for the transfer of promissory notes of OJSC VTB Bank, which defines the main essential conditions of the transferred property (bill of exchange) and its price, as well as an act of acceptance and transfer of securities, in which the parties clearly indicated which bill of exchange transferred (form number, all its details, purpose of transfer and moment of transfer of ownership of this bill).

The operation of transferring a bill of exchange in payment for services rendered is accompanied by the execution of a compensation agreement, as well as an act of acceptance and transfer of the bill of exchange. In the act of acceptance and transfer of the bill of exchange, in addition to the details of the security, it must be indicated in payment for which services the bill of exchange is transferred, on the basis of which (number, date) agreement such services were provided, and also reflect the total amount of the obligations to be repaid (may differ from the face value bills). The VAT amount should be highlighted separately in the act.

In accounting, the organization will make the following entries:

| Contents of operation | Debit | Credit | Amount, rub. |

| 26.01.2015 | |||

| Funds were transferred to the bank to pay the bill | 76-b. | 51 | 1 000 000 |

| The bank's bill is accounted for as a financial investment | 58-2 | 76-b. | 1 000 000 |

| 31.01.2015 | |||

| Interest accrued on the bill for January was 1,000,000 rubles. x 7% / 365 days. x 5 days | 76-pr. | 91-1 | 960 |

| 28.02.2015 | |||

| Interest accrued on the bill for February was 1,000,000 rubles. x 7% / 365 days. x 28 days | 76-pr. | 91-1 | 5 370 |

| 31.03.2015 | |||

| Interest accrued on the bill for March 1,000,000 rubles. x 7% / 365 days. x 31 days | 76-pr. | 91-1 | 5 945 |

| 06.04.2015 | |||

| The services provided were registered | 20 | 60 | 1 000 000 |

| Interest accrued on the bill for April was 1,000,000 rubles. x 7% / 365 days. x 6 days | 76-pr. | 91-1 | 1 150 |

| To repay the debt, the bank’s bill of exchange was transferred to the counterparty | 60 | 91-1 | 1 000 000 |

| The book value of the bill is written off | 91-2 | 58-2 | 1 000 000 |

| Expenses are recognized in the form of interest on the bill (960 + 5 370 + 5 945 + 1 150) | 91-2 | 76-pr. | 13 425 |

Validity

When signing the issuance agreement, the parties agree on the date of payment of funds. At the moment, the following time frames for receiving income can be established for promissory notes:

- On a certain day.

- Not earlier than a certain day.

- Not earlier and not later than a certain date.

You can purchase a bill of exchange from a bank

The maximum period for holding a bill cannot exceed 730 days. After the expiration of this period, interest accrual stops. How to simply cash a Sberbank bill for an individual? To do this, you must personally visit a bank branch that deals with securities. The holder of the bill has the right to apply for funds within 3 years from the date of payment. If this time is missed, the security is cancelled.

Income on a bill

Initially, during the entire period of stay with the organization, the security is considered as a debt obligation ( clause 6 of Article 250 of the Tax Code of the Russian Federation ).

The procedure for including non-operating income (in our case, interest on a bank bill) in the tax base is regulated by clause 1 of Art. 328 of the Tax Code of the Russian Federation : the amount of income is reflected in analytical accounting (separately for each bill) based on the conditions of the bill of exchange or its transfer (sale).

Recognition of income in the form of interest on debt obligations is carried out by the taxpayer on a monthly basis, regardless of the deadline for their payment stipulated by the agreement, under which its validity period falls on more than one reporting (tax) period. In analytical accounting, on the basis of certificates from the responsible person entrusted with keeping records of income (expenses) on debt obligations, the taxpayer is obliged to reflect in the income the amount of interest determined in the manner established by clause 6 of Art. 271 of the Tax Code of the Russian Federation ( paragraph 3, clause 4, article 328 of the Tax Code of the Russian Federation ).

In the income tax return (we believe, starting with reporting for the tax period of 2014, it must be submitted in a new form [7]), income in the form of accumulated interest is shown on line 100 of Appendix 1 to sheet 02 ( clause 6.2 of section VI of the Procedure filling out a tax return [8]).

Line 020 of sheet 02 reflects the total amount of non-operating income recorded for the reporting (tax) period in accordance with Art. 250 of the Tax Code of the Russian Federation and indicated on line 100 of Appendix 1 to this sheet ( clause 5.2 of Section V of the Procedure for filling out a tax return ).

Example 2

Let's continue example 1.

When drawing up an income tax return for the first quarter of 2015, the organization will reflect on line 100 of Appendix 1 to Sheet 02 the accrued interest on the bill in the amount of 12,275 rubles. (960 + 5,370 + 5,945). The same amount (as part of other non-operating income) will find its place in line 020 of sheet 02.

Existing tariffs

Sberbank tariffs are not adjusted too often. You can check current positions on the official website or by calling support. To date, the following parameters have been set:

- operations related to the account, execution of a bill of exchange, as well as the provision of information or exchange and replacement are carried out without charging a fee;

- the cost for storage ranges from 15 to 45 rubles per day;

- interest is determined on an individual basis, since it is impossible to accurately predict the exchange rate and profitability of the institution.

As a result, it is impossible to predict with confidence even an approximate amount of income. The cost of a bill depends on a variety of indicators: inflation, bank profitability, exchange rate fluctuations and other factors. Typically, security holders receive up-to-date information about profits only on the day of return.

Transfer of a bill of exchange to a counterparty: income and expenses

The transfer of a bill of exchange in payment for goods, works, services (as well as its repayment, including early) is considered as an operation for the sale of a security, to which the rules of Art. 280 Tax Code of the Russian Federation . The Ministry of Finance insists on this (without changing its position over the years) - see, for example, letters dated 04.03.2013 No. 03-03-06/1/6365 , dated 09.11.2012 No. 03-03-06/1/582 , dated 21.03 .2011 No. 03‑02‑07/1-79 .

For your information

Article 280 of the Tax Code of the Russian Federation has been in force since January 1, 2015 in a new edition[9]. Changes in this rule apply to a greater extent to securities traded on the securities market, which we do not consider.

True, there is another approach: the transfer of a bill of exchange as a means of payment is not implementation[10]. However, it has to be proven in court, which few prefer. Most taxpayers share the position of the Ministry of Finance. Our organization (let’s agree) shows solidarity with the latter, that is, when transferring a bank bill as payment for services rendered to it, it appeals to Art. 280 Tax Code of the Russian Federation .

In accordance with paragraph. 1 clause 2 of the said norm, income from operations on the sale or other disposal of securities (including from the redemption or partial redemption of their nominal value) is determined based on the price of the sale or other disposal of the security, as well as the amount of accumulated interest (coupon) income paid to the taxpayer by the buyer, and the amount of interest (coupon) income paid to the taxpayer by the issuer (issuer of the bill). At the same time, the taxpayer’s income from the sale or other disposal of securities does not include amounts of interest (coupon) income previously taken into account for tax purposes.

Expenses for this operation are determined based on the purchase price of the security (including the costs of its acquisition), the costs of its sale, the amount of discounts on the estimated value of investment shares, the amount of accumulated interest (coupon) income paid by the taxpayer to the seller of the security. At the same time, the expense does not include the amounts of accumulated interest (coupon) income previously taken into account for taxation ( paragraph 1, paragraph 3, article 280 of the Tax Code of the Russian Federation ).

But that is not all. A taxpayer conducting transactions with non-negotiable (income-interest-bearing or discount) securities should take into account clause 16 of Art. 280 Tax Code of the Russian Federation . According to it ( paragraph 1 ), first, using a bill of exchange, you need to determine its settlement price and the maximum deviation of prices from it.

The procedure for determining the settlement price of non-traded securities for the purposes of applying Ch. 25 of the Tax Code of the Russian Federation is established by the Central Bank of the Russian Federation in agreement with the Ministry of Finance ( paragraph 5 of clause 16 of Article 280 of the Tax Code of the Russian Federation )[11]. Since this document has not yet been approved, the previous procedure, established by Order of the Federal Financial Markets Service of Russia dated November 9, 2010 No. 10-66/pz-n [12] (hereinafter referred to as the Procedure ), is in effect.

The value of the maximum deviation is fixed in paragraph. 2 clause 16 art. 280 Tax Code of the Russian Federation . It is 20% upward or downward from the estimated price of the security.

So, the actual transaction price is recognized as the market price and accepted for tax purposes only if it is in the interval between the maximum and minimum prices determined on the basis of the estimated price of the security and the maximum price deviation (unless otherwise established by clause 16 of Article 280 of the Tax Code of the Russian Federation ) .

In the case of the sale of non-traded securities at a price below the minimum price, the financial result for tax purposes is determined based on the minimum price ( paragraph 3, clause 16, article 280 of the Tax Code of the Russian Federation ).

In the case of the acquisition of non-traded securities at a price higher than the maximum price, when determining the financial result for tax purposes, the maximum price is accepted, determined based on the estimated price of the security and the maximum price deviation ( paragraph 4, clause 16, article 280 of the Tax Code of the Russian Federation ).

Example 3

The estimated price of the bill (conditionally) is 100 rubles.

The maximum deviation, accordingly, is 20 rubles.

The maximum price is 120 rubles, and the minimum is 80 rubles.

When selling a bill at a price of, for example, 75 rubles. the financial result for tax purposes is determined based on the bill price of 80 rubles.

If the bill was purchased at a price of, say, 125 rubles. (such as, for example, the cost of goods for which the security was received), the financial result is determined based on the price of the bill of exchange 120 rubles. (see also Letter of the Ministry of Finance of Russia dated March 29, 2013 No. 03-03-06/2/10054 ).

Controversial issues and additional services

A controversial issue is payment to foreign organizations that have branches in the Russian Federation. The fact is that income on bills is the company’s income, which means it is subject to taxation. In order to avoid double taxation, you need to provide the bank with the following documents:

- confirming that the organization is permanently located in a country that has concluded an agreement with the Russian Federation on the impossibility of double taxation;

- document for the right to receive income;

- identification document of the authorized recipient company.

Documents must be submitted before the date indicated on the bill of exchange. A sample form and copies of applications can be requested from a specialist in the office.

Sberbank cares about the convenience of its customers and offers a bill delivery service. Delivery is formalized by an appropriate agreement and carried out by collectors, which ensures high protection of the transported securities.

There are also storage and examination services. They are also intended for the safety of securities. The examination is carried out to verify the authenticity of the bill. Storage is especially important if the owner does not have a reliable place to store papers.

Thus, a bill is a tool for preserving and increasing funds. Often these securities are used to increase the guarantee of payment in transactions with real estate, large goods, etc. Both parties receive protection of financial interests at initially low costs.

On the issue of determining the settlement price of a security

The procedure for determining the settlement price of non-traded securities, as already noted, is established by Order of the Federal Financial Markets Service of Russia No. 10-66/pz-n .

It has been in effect for more than one year, but, unfortunately, there have been no clear explanations on its use. Meanwhile, dealing with him is not easy. So, in accordance with clause 2 of the Procedure , the estimated price of non-negotiable bills can be determined:

- as a price calculated based on the prices of this security existing on the securities market in accordance with clause 4 of the Procedure ;

- as the price of a security calculated by the organization according to the rules provided for in clauses 5 – 19 of the Procedure ;

- as the estimated value of a security determined by the appraiser ( clause 19 of the Procedure ).

Clause 20 of the Procedure establishes that the methods for determining the estimated price of non-traded securities and the conditions for using specific methods are prescribed by the taxpayer in the accounting policy for tax purposes.

Moreover, it can contain one or more methods for determining the estimated price of a security that is not traded on the securities market[13]. And now a little more detail.

Determining the estimated price with the involvement of an appraiser (the last of the proposed options) would seem to be the most convenient, but not the cheapest (the corresponding services must be paid for). The same cannot be said about the first option. However, it is not suitable for everyone, but only for those who have bills of exchange from large companies and famous banks (purchase quotations may be announced for such securities; the settlement price will appear as the weighted average price of purchase offers; if quotations are not announced, you can contact request to professional securities market participants and obtain from them the data you are interested in).

Example 4

The nominal value of the Sberbank bill is 100,000 rubles, the maturity date is in 90 days.

The organization has data on the sale of bills of exchange of this series by professional participants in the securities market (see table).

| Broker who provided the data | Sales price, rub. | Sales volume, pcs. |

| First | 97 400 | 20 |

| Second | 96 900 | 30 |

| Third | 97 000 | 25 |

| Fourth | 97 200 | 20 |

Let's determine the settlement price of the bill.

The weighted average price (also the settlement price of the bill) will be 97,095 rubles. (97,400 rub. x 20 pcs. + 96,900 rub. x 30 pcs. + 97,000 rub. x 25 pcs. + 97,200 rub. x 20 pcs.).

Finally, you can determine the estimated price of the bill of exchange yourself, using the formulas proposed by the Procedure : in clause 13 - for a discount bill of exchange not traded on the ORSB, in clause 14 - for an interest-bearing bill.

Since the article discusses interest-bearing bills, we will turn to the corresponding formula.

The estimated price of a bill of exchange, on which interest accrual is provided, is determined by the following formula:

| R | = | N H [1 + S H ( t/t1)] | , Where: |

| 1 + r H ( t / t1) |

P – settlement price of the interest-bearing bill;

N – denomination of the bill;

C – interest rate on the bill;

r – discount rate corresponding to the level of risk of investment in the bill. The level of risk of investing in a bill and the interest rate are determined by the taxpayer based on an assessment of market conditions on the date of determining the settlement price in accordance with the procedure established by the accounting policy for tax purposes;

t – period from the purchase (sale) of a bill to the repayment of the bill in calendar days. If the bill matures, the t indicator is taken equal to zero;

t1 – base for calculating the period, equal to 365 (366) days or 360 days in accordance with the convention of the currency in which settlements on the bill are made.

What might be confusing about this formula? Well, of course, the concept of “risk level of investment in a bill”, which the Procedure , it must be said, does not disclose (nor does it establish methods for assessing market conditions).

Taxpayers began to contact the Ministry of Finance with a request to clarify the situation, but in vain. In its response letters, the department recommended contacting the Federal Financial Markets Service of Russia (see, for example, Letter dated April 26, 2011 No. 03‑03‑06/2/73 ).

For your information

In accordance with Decree of the President of the Russian Federation dated July 25, 2013 No. 645 , the Federal Service for Financial Markets was abolished from September 1, 2013. From this date, its powers to regulate, control and supervise the financial markets were transferred to the Central Bank of the Russian Federation ( 251-FZ dated July 23, 2013 ). Currently, to ensure the execution of these functions, structural divisions have been created within the central apparatus of the Central Bank of the Russian Federation, responsible for the development and functioning of financial markets ( Information of the Central Bank of the Russian Federation dated 02/28/2014 , dated 11/29/2013 , dated 08/22/2013).

The capital's tax authorities, referring to the position of financiers, also acted: clarification of issues relating to methods and methods for assessing the market conditions of securities does not fall within the competence of the tax authorities ( Letter dated May 16, 2011 No. 16-15/ [email protected] ), in order to find out how to apply the formulas, you should contact the Federal Service for Financial Markets ( Letter dated September 27, 2011 No. 16-15/ [email protected] ).

Of course, such answers do not add optimism. However, if we concentrate on the fact that the official bodies have provided “complete freedom”, the taxpayer needs to carefully consider the economic justification for the choice made, write down the corresponding provision in the accounting policy ( Article 313 of the Tax Code of the Russian Federation ) and appeal to it if necessary (disputable situations arise) . If the factors that guide economic decisions are taken into account, it will be difficult for tax authorities to challenge your calculation.

When determining the level of risk of investing in a bill of exchange that is not traded on the securities market, in our opinion, it is necessary to focus attention (first of all) on the reliability of the bank issuing the bill (you must agree, Sberbank occupies a priority place in this matter), its established reputation, duration of activity and other factors (interest rate, payment term, etc.).

Example 5

Let's use the data from examples 1 and 2, adding them slightly.

The accounting policy of the organization states that the estimated price of securities not traded on the organized securities market is determined as follows:

- for shares - according to an independent assessment, and if such an assessment was not carried out - using the net asset method;

- for bills - according to an independent assessment, if such an assessment has not been carried out - according to the methods specified in clauses 13, 14 of the Procedure, depending on the category of the bill (discount, interest).

In paragraph 18 of Art. 280 of the Tax Code of the Russian Federation states that the estimated price of non-negotiable securities must be determined as of the date of the agreement establishing all the essential conditions for the transfer of the security.

In our case, this is a compensation agreement dated 04/06/2015 (by the way, on the same day the bill was transferred to the counterparty). The period from the transfer of the bill to the date of its repayment ( t ) is 30 calendar days (from 04/06 to 05/06).

The base for calculating the period ( t1 ) is 365 days.

The risk of investing in a VTB bill is estimated at 2%.

The settlement price of the bill is determined as follows:

| 1,000,000 rub. | H | 1 + 7% H (30 days / 365 days) | = | RUB 1,004,106 |

| 1 + 2% H (30 days / 365 days) |

The minimum estimated price is calculated as follows: RUB 1,004,106. x 20% — 1,004,106 rub. = 803,285 rub.

The maximum estimated price is determined as follows: RUB 1,004,106. x 20% + 1,004,106 rub. = 1,204,927 rub.

Since the sale price of the bill (1,000,000 rubles) is within the specified price range, income in tax accounting is recognized in this amount - 1,000,000 rubles.

In expenses, the accountant will take into account the face value of the bill (it does not exceed the maximum estimated price).

My two best brokers

It will be useful for you to know that since their inception, promissory notes from Sberbank have become quite popular among domestic entrepreneurs.

First of all, it is necessary to mention that a Sberbank bill of exchange is nothing more than a promissory note of the described banking structure. It is important to understand that the described bills of exchange can be used not only for settlements with counterparties, but also as an effective tool for generating additional profit.

You should know that bills from this banking structure occupy a leading position in the domestic market among similar securities. The reason for this phenomenon is that Sberbank is rightfully considered the most reliable Russian banking structure, due to which the securities it issues are also considered the most reliable.

What are the advantages of purchasing a bill of exchange from Sberbank for individual entrepreneurs?

Debt has a number of advantages. They flow from the very “nature” of this document. Bearer securities can be used in various business schemes:

- as a financial instrument for generating additional profit;

- as an option for bank collateral when lending;

- presentation as a bank guarantee>;

- You can get a loan against a Sberbank bill.

Their main advantage is their settlement as a cash equivalent during the conclusion of various transactions.

What explains the bank's leadership in the Russian bill market? Several factors influence this position:

- an established system that allows clients in any region to carry out all possible operations with debt receipts;

- high reputation of the banking institution;

- unified electronic database;

- high level of protection against counterfeiting;

- conducting an examination;

- exchange of promissory notes during their circulation is permitted;

- the variety of uses for these securities;

- an entrepreneur can not only buy debt securities at a favorable price, but also receive services for depository storage and provision of operational advice;

- individual selection of financial schemes for bill settlement for legal entities and individual entrepreneurs.

Sberbank bills for legal entities have a number of advantages:

- high liquidity (they are highly quoted on the securities market),

- ease of release,

- no need to open a current account,

- receiving a guaranteed profit,

- allow you to avoid the risk associated with a fall in the ruble exchange rate.

Features and nuances

A bill of exchange is a financial document in A4 format. The form contains all the mandatory details required by federal law. The amount that was contributed by an individual or business entity to their balance sheet must be recorded. The date of preparation and the locality in which the security was issued and issued to the client are also indicated.

Important! To obtain a bearer security from Sberbank, an individual must personally apply to a branch of the financial institution with a passport. On the spot, he will have to write an application to adhere to the conditions for providing simple forms. Simple forms are issued by Sberbank in three types of currencies: rubles, euros and dollars. The client will be asked to independently determine in what equivalent the security will be issued.

Sberbank bills have a large number of advantages, the list of which can be expanded:

- The security can be provided as a guarantee when receiving large loans.

- The bearer form can be given as a gift or transferred to third parties who, if they have a passport, will be able to cash out the funds.

- With its help, security holders can accumulate savings, receiving passive interest income.

- The financial institution provides the maximum level of protection to forms that are almost impossible to forge.

- The document can be obtained at a Sberbank branch located in any region of the Russian Federation, without reference to the place of registration.

- Sberbank has established more favorable conditions and high interest rates for its securities.

Despite the visible and significant advantages of the bills of this financial institution, they have several disadvantages. One of them is the loss of funds when you miss the cash out date. For example, if an individual cannot come and receive money on a bill within three days, it will be forever lost to him. That is why, when purchasing securities, clients