According to Article 9 of Law No. 69-FZ dated April 21, 2011, in order to operate a taxi, you need to register an individual entrepreneur or organization and obtain permission from the regional authorities, and for each car that will be used as a taxi. The permit is issued for a period of five years. In the article we will tell you about taxis on UTII and give examples of tax calculation.

ATTENTION! Starting with reporting for the fourth quarter of 2021, a new tax return form for the single tax on imputed income will be used, approved by Order of the Federal Tax Service of Russia dated June 26, 2018 N ММВ-7-3/ [email protected] You can generate a UTII declaration without errors through this service , which has a free trial period.

Features and limitations of UTII

UTII is quite often used by entrepreneurs who have their own taxi fleet. But it is not always possible to switch to this type of taxation; there are restrictions:

- This system is not valid for passenger transportation everywhere. The exception is Moscow; in addition, local authorities of other regions can independently introduce a ban on the use of UTII.

- You can use UTII only if the staff of the service is no more than 100 people.

- The number of cars for business does not exceed 20 units.

Features of UTII:

- financial statements are submitted quarterly;

- literacy and correct execution of all financial documents are required (this is problematic when the individual entrepreneur himself acts as a driver);

- valid until 2021;

- the optimal choice for a taxi fleet with hired staff.

Online cash register in a taxi on UTII

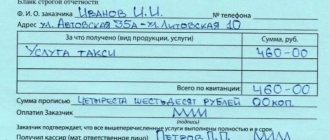

According to the law of the Russian Federation, the presence of an online cash register is mandatory for individual entrepreneurs engaged in passenger transportation by taxi. At the end of the trip, the client is given a receipt or shown a QR code of the receipt. However, this condition is only mandatory for those who hired employees for work. If you are self-employed, you are allowed to work without a cash register until mid-2021. If there is no online cash register, the client is still issued a document confirming payment - a strict reporting form. You can stamp it using a taximeter. For the absence of such forms, the individual entrepreneur is deprived of the right to apply preferential forms of taxes, is subject to a penalty of 10,000 rubles, and the driver is subject to a fine of 1,000 rubles.

Requirements for drivers and cars in a taxi service

The main requirements for taxis are to be equipped with identification marks “checkers” on the side surface of the body, and there must be an orange identification lamp on the roof of the taxi. For the absence of identification marks, in accordance with clause 3 of Article 11.14.1 of the Code of Administrative Offenses, a fine of 3,000 rubles is imposed on the driver, and a fine of 10,000 rubles on an individual entrepreneur, and a fine of 2,500 rubles on an individual for illegally applying identification marks to an individual, and a fine of 20,000 rubles on an individual entrepreneur.

The total driving experience must be at least three years. The driver must undergo a medical examination; the procedure is actually formal, but the mark on the waybill must be mandatory. In essence, such a service can be provided to individual entrepreneurs by dispatch services. Also, before the trip, you need to check the technical condition of the car, making a corresponding note on the waybill. Read also the article: → “Waybill for a passenger car (Form 3). Sample filling, form."

A taxi must have equipment - a taximeter; if the cost of trips is fixed, then installation of the equipment is not necessary. Payment for taxi services can be made in cash or non-cash. When making a settlement with a client, you will need to issue a receipt for payment for taxi services, it indicates information about the carrier, date, cost of the service, the name of the employee who made the payment; failure to comply with these requirements leads to fines. Technical inspection of vehicles for individual entrepreneurs must be carried out at least twice a year.

The taxi interior must contain the following information:

- about the carrier (TIN, OGRNIP, full name and registration data), about the driver with his photo.

- about the rules of transportation by taxi.

- on permission to carry out activities.

- about the supervisory authority that receives passenger requests and its location.

The driver must have the following documents with him:

- MTPL insurance, marked “For taxi”

- inspection certificate or diagnostic card

- waybill with a mark on passing a medical examination.

The insurance policy must indicate that the vehicle is used as a taxi in order for us to receive insurance premium payments in the event of an accident. When diagnosing a car, a diagnostic card must be issued, which must be kept during the validity period of the inspection coupon; it is a strict reporting form that has its own number, and this form is useful for reimbursement of insurance payments.

UTII for taxis in 2021: how to calculate and how to pay

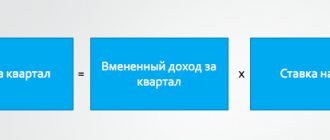

The UTII payment is fixed and is not affected by the amount of income. The legislation establishes potential imputed income depending on the number of staff and the number of cars.

UTII for taxi: calculating car tax for a month

In accordance with the Tax Code of the Russian Federation, UTII is calculated using the formula: Basic profitability (imputed income) * number of seats in the car minus the driver's * deflator coefficient * correction factor * UTII rate, where:

- The basic profitability for this area of activity in 2021 is 1,500 rubles;

- The number of seats in the car minus the driver’s seat is usually 4;

- The deflator coefficient depends on the inflation rate and in 2019 is 1.915.

The correction coefficient for the basic profitability is set for each region; its values are displayed on the official resource of the Federal Tax Service.

The rate for UTII is 15%. However, this figure may be reduced by regional authorities. You can also check its value on the Federal Tax Service website.

Calculation of UTII tax

The physical indicator for calculating tax when transporting passengers is the seat (Ab. 10, Article 346.27 of the Tax Code of the Russian Federation). A seat is a place to sit, other than the driver's and conductor's seats. Their quantity is determined for each vehicle separately according to the manufacturer’s technical passport.

If the number of seats is not indicated in the technical passport, this can be determined by the state technical supervision body for the technical condition of machines.

The basic profitability of passenger transportation services is 1,500 rubles. Imputed income is equal to the base income multiplied by the number of seats.

Example. UTII for a minibus with 10 seats for passengers will be per month: 1,500 rubles. x 10 places x 15% = 2250 rub.

Taxi: payment of tax 2021 according to UTII

Quarterly, before the 20th day of the next month, a tax return is submitted to the regional department of the Federal Tax Service. Payment is due by the 25th of the same month.

UTII for taxis: tax reduction

For individual entrepreneurs with a taxi fleet, it is possible to reduce the amount of tax on the amount of sick leave payments, insurance premiums, and benefits to their employees. The maximum reduction amount is 50%. If an individual entrepreneur works alone, without hired workers, then 100% of the contributions to compulsory medical insurance and the Pension Fund of the Russian Federation.

Taxation of services for the transportation of passengers and goods

Please clarify to which taxation system the following types of activities can be classified:

1. bus services for transporting passengers

2. transportation of goods by Gazelle;

3. repair and maintenance of air conditioners;

4. tractor services for cargo transportation.

(LLC, Ekaterinburg)

According to paragraphs. 5 p. 2 art. 346.26 Tax Code of the Russian Federation

The taxation system in the form of a single tax on imputed income for certain types of activities can be applied to business activities

for the provision of motor transport services for the transportation of passengers and goods

carried out by organizations and individual entrepreneurs who have ownership or other rights (use, possession and (or)) orders) no more than 20 vehicles intended for the provision of such services.

In accordance with Art. 346.27 of the Tax Code of the Russian Federation, vehicles are understood as

vehicles intended for transporting passengers and cargo on roads (buses of any type, cars and trucks).

Does not apply to vehicles

trailers, semi-trailers and trailers.

If your organization owns, leases or otherwise has no more than 20 vehicles

, intended for the provision of motor transport services, then services for transporting passengers by bus, transporting goods by car (in particular, by car of the Gazelle brand) are subject to UTII.

If your organization has more than 20 vehicles

intended for the provision of motor transport services for the transportation of passengers and goods, then the activities for the provision of such services

are not transferred

and are subject to taxation under the general or simplified taxation system (at your choice).

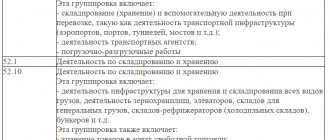

Regarding services for transporting goods by tractor

, then in letter dated May 25, 2005 No. 03-06-05-04/142, the Ministry of Finance of the Russian Federation explained that motor transport services for the transportation of passengers and goods include paid services classified in accordance with the All-Russian Classifier of Services to the Population OK 002-93 according to codes from 021520 to 021553 and subgroup code 022500.

Therefore, according to the Ministry of Finance of the Russian Federation, cargo transportation services provided by tractors with platform trailers and dump trailers do not fall under

under UTII.

As we can see, the Ministry of Finance of the Russian Federation refers as an argument to the All-Russian Classifier of Services to the Population, although the Tax Code of the Russian Federation does not prescribe this in this case.

However, the same conclusion can be drawn by reasoning differently.

So, in Art. 346.27 Tax Code of the Russian Federation

It is clearly stated that vehicles include all types of buses, cars and

trucks

.

All-Russian classifier of fixed assets OK 013-94

, approved by Decree of the State Standard of the Russian Federation dated December 26, 1994 No. 359, classifies

cars

in category 15,0000,000 “Vehicles,” and

tractors

in category 14,0000,000 “Machinery and Equipment,” that is, it separates the concepts of “tractors” and “cars.”

Thus, tractor services for the transportation of goods are not subject

and income from such activities must be taxed under the general or simplified taxation system.

According to paragraphs 1 item 2 art. 346.26 Tax Code of the Russian Federation

The taxation system in the form of a single tax on imputed income for certain types of activities can also be applied to business activities

in the provision of household services

, their groups, subgroups, types and (or) individual household services classified in accordance with the All-Russian Classifier of Services to the Population.

Domestic services

– these are paid services provided

to individuals

(with the exception of pawnshop services and services for repair, maintenance and washing of vehicles), provided for by the All-Russian Classifier of Services to the Population (

Article 346.27 of the Tax Code of the Russian Federation

).

In accordance with the All-Russian Classifier of Services to the Population OK 002-93

, approved by Decree of the State Standard of the Russian Federation dated June 28, 1993 No. 163,

household services

, in particular, may include services for installation, repair and maintenance of air conditioners in the group “Repair of room air conditioners” (code 013355).

Consequently, activities to provide individuals

(that is, to the population) repair and maintenance services for air conditioners are subject to transfer to payment of UTII.

The Ministry of Finance of the Russian Federation made similar conclusions in a letter dated January 12, 2006 No. 03-11-04/3/192.

If you provide repair and maintenance services for air conditioners to legal entities or individual entrepreneurs

, then such activities are not subject to UTII and are taxed according to the general or simplified taxation system.

A patent for an individual entrepreneur for a taxi: what is the limitation?

- The use of this system is allowed only in the status of an individual entrepreneur; when registering a legal entity, choosing a PSN is not possible.

- The staff should not have more than 15 people.

- Annual income is less than 60 million rubles.

- Validity period: from 1 month to 1 year.

How much does a taxi license cost and how to pay for it?

Depending on the region, the cost of a patent depends on the number of passenger seats or on the number of cars. You can accurately calculate it using the online calculator on the official website of the Federal Tax Service.

The price will also be affected by the validity period:

- for a period of 1-6 months. the full cost is paid before the expiration date;

- for a period of 6-12 months. one third of the cost is paid within the first 90 days, the rest until the expiration date.

Taxi patent in 2021: how to obtain

This year you just need to submit an application to the territorial department of the Federal Tax Service. This is done either together with documents for registration of individual entrepreneurs, or no later than 10 days before the start of activity. The patent is issued within 5 days.

Taxi patent application sample

To submit an application, you need to fill out three pages out of a possible five. The application form has the established form No. 26.5-1 and is presented on the Federal Tax Service website; when submitting online, you do not need to download it. In this case, the application for a patent at a zero rate is filled out on a special form with a different barcode. The first two pages are required to be completed: “About the applicant and the expected validity period of the patent”, “Name of the type of activity” and the fourth: “About the vehicles used by individual entrepreneurs whose business is related to the transportation of cargo or passengers.” All entries are made in strictly capital letters in black.

On the first page indicate:

- TIN (also written on the following sheets);

- UFNSK code. In order to find out, you need to open the calculation of the cost of a patent on the official website of the Federal Tax Service and find your region in the list of the Federal Tax Service. The required code will be indicated next to it;

- your full name;

- ORGNIP, if the individual entrepreneur is already registered;

- address of the place of registration;

- validity. It varies from 1 to 12 months, but must fit within the reporting year. To obtain a 12-month patent, it must be issued no later than January 1;

- number of pages. There are three of them, two mandatory for everyone and one in the field of activity.

Next, fill out the left part: mobile phone number, date of application and signature. The right part remains for the inspection to fill out. On the second sheet, fill out a line indicating the type of activity and its identification code. It consists of six digits. The first two of them are the code of the type of activity, then - the code of the subject of the Russian Federation, the last - the type of activity according to the Classifier. Below is the number of employees and the tax rate - 6%. On the fourth sheet, information about all vehicles that will be involved in the work is filled out. Next, the completed but unsigned application is sent to the tax office, where it is signed and submitted in the presence of an inspector. After 5 days, a patent is issued or it is refused.

Transportation of taxi passengers

Transportation of taxi passengers is also subject to UTII. Number of seats - 4 (except for route). The tax is calculated the same: 1500 rubles. x 4 x 15% = 900 rub. per month from one car. The taxi driver must register an individual entrepreneur and pay UTII.

There is a second tax option for taxis. This is a patent for passenger transportation. In this case, the entrepreneur uses the simplified tax system and pays the cost of the patent.

passenger transportation services . Next time - cargo transportation.

Receive new blog articles directly to your email:

simplified tax system

The simplified taxation system for entrepreneurs has a number of advantages:

- The individual entrepreneur independently chooses the subject of taxation: income or income minus expenses;

- accounting documentation does not require special knowledge and does not take much time;

- Individual entrepreneurs are exempt from paying personal income tax and personal property tax. persons and VAT.

Payment modes of the simplified tax system

The percentage tax rate is 6% of income or 15% of the difference between income and expenses. The simplified tax system is paid in advance payments quarterly until the 25th day of the month following the quarter. At the end of the year, a declaration of annual income is submitted, payment is made until April 30 for individual entrepreneurs (March 31 for organizations). You can change the simplified tax system to another system only at the end of the tax year.

Taxi at the object "STS income"

When choosing the tax object “Income”, the rate will be 6%. Regional authorities can reduce the rate down to 1%. The amount for calculating tax is taken for the reporting period. For example, if reporting is for a quarter, then income for 3 months is summed up.

Accounting in taxi services

All organizations, with the exception of individual entrepreneurs, must maintain accounting records. Heads of firms or organizations must entrust accounting to the chief accountant or enter into an agreement for the provision of accounting services. All organizations must maintain annual reports - balance sheet, income statement and appendices. There will be no need to submit quarterly reports in 2021. In 2017, deflator coefficients changed, which increased the amount of taxes on trade fees - 1.237. according to UTII, the deflator coefficient is equal to 1.798, and for the simplified tax system, the deflator coefficient has increased to 1.425 and the limits do not need to be multiplied by it until January 1, 2021.

Taxi accounting is based on primary documentation; any economic fact: the purchase of fuel, lubricants, rental or purchase of a car is subject to accounting in accordance with the accounting policies of the organization. Primary documents must contain an established set of details: name of the document, date of preparation, name of the organization or person drawing up this document; content of the fact of economic life; monetary value; job title and names of those responsible for processing documents.

In taxi accounting, special programs are used to account for it. For small organizations, the law provides for relaxations - they do not need to maintain standard registers with double entry of accounts, if there are less than 30 business transactions per month, it is enough to keep a ledger (where all the data is reflected). Next, a balance sheet is formed, which includes:

- revenue (information about the organization’s turnover),

- expenses (costs associated with production activities and cost of sales),

- interest payable (for possible loans and borrowings),

- other income (funds received from non-core activities),

- expenses of non-operating activities (indirectly related to core activities),

- taxes to the budget.

For other larger organizations, the balance sheet must contain detailed information about all transactions (receipts, expenses, property, etc.). The balance sheet must be submitted to the tax office by March 31 of the year following the reporting year. Errors made in reporting can lead to fines and inspections. Responsible persons may face administrative penalties.

In this case, the rate will be 15%. At the same time, depending on the region, the rate may be reduced. There are cases when only 1% of taxes are paid:

- If the amount of expenses exceeds the amount of income. That is, if you find yourself at a loss, you will still have to pay tax.

- If the amount of tax calculated according to the standard scheme does not exceed the minimum tax for this period.

Individual entrepreneur on the simplified tax system for taxi 2021: conditions

Not every individual entrepreneur can apply the simplified tax system. This must be taken into account when deciding which taxation to choose for an individual taxi. To switch to the simplified tax system, you need to comply with limits on income and fixed assets, as well as a number of restrictions:

- The number of employees is no more than 100 people;

- Annual income is not more than 150,000,000 rubles;

- The residual value of fixed assets does not exceed RUB 150,000,000.

Organizing a taxi on the simplified tax system: conditions

For the transition of legal entities to the simplified tax system, the same restrictions apply as for individual entrepreneurs, but there are additional ones:

- the taxi company has no branches;

- participation of other legal entities in the authorized capital is no more than 25%;

- income for January-September of the previous year is not more than 112,500,000 rubles.

If any of these criteria are not met, the simplified tax system cannot be applied.

Reporting and receipts in taxi services

Soon, from February 1, 2021, the law “On the use of cash register equipment when making cash payments” will come into force, which obliges all legal entities and individual entrepreneurs to issue checks to passengers for payment or strict reporting forms in the established form. The taxi service will be required to purchase cash register equipment. This can be a simple model with several modes and just a program in a smartphone; installation of a taximeter is required if the cost of the trip depends on the actual mileage of the trip (or time) and is not a fixed tariff.

New cash registers (CCMs) will have to be equipped with the ability to connect to the Internet, which will allow data to be transferred to the Federal Tax Service immediately after payment has been made. For this reason, KKM received the name “online cash registers”. Taxi owners will have to modernize old equipment. While, until July 1, 2021, individual entrepreneurs and organizations working under the UTII and patent system will be able to issue a strict reporting form, but in the future they must switch to an automated system that sends data about each purchase to the operator.

The new system will allow you to control all sales facts in real time, each buyer will have access to all their own receipts. Moreover, the data will not be immediately transferred to the tax office; it will be transferred through a fiscal data operator, who will collect data on sales and receipts. In this case, each organization will have to enter into an agreement with fiscal data operators and maintain a personal account on the tax website, through which an online cash register will be maintained; in this case, there will be no need to take the cash register to the tax office, because registration will take place remotely.

At the accreditation certification center of the Ministry of Communications of the Russian Federation, you will need to purchase an electronic signature for registering an online cash register, having prepared the following documents: for individual entrepreneurs this is a passport and SNILS, and for other organizations - constituent documents, charter, agreement), extract from the Unified State Register of Legal Entities,) delivery certificate registered with the National Tax Service.

Taxi tax according to OSNO

If, when answering the question: “Which taxation should I choose for an individual taxi?”, an entrepreneur leans towards the basic system, then he will have to pay VAT, personal property tax and personal income tax. This system is complex and expensive; it requires a complete accounting workflow. It is necessary to correctly process all financial transactions and observe all the nuances when submitting reports. Therefore, there is a need to hire an accountant and oblige drivers to fill out primary cash documents every time.