Receipt of executive documents

The writ of execution can be received by the organization from a bailiff (usually by mail) or from the claimant himself (for example, from the ex-wife of an employee with a demand to pay alimony).

Notify the employee of the receipt of the writ of execution. This must be done under signature (letter of Rostrud dated December 19, 2007 No. 5204-6-0). If the writ of execution is sent by mail, a special notice will come with it. It must be returned to the bailiff (this is stated on the back of the notice). In the notification it is necessary to make a note about the receipt of the writ of execution (incoming number and date), indicate the telephone number of the organization, as well as put the signature of the accountant and the seal of the organization. This will be proof that the organization received the writ of execution and began to withhold the amounts specified in it. Such clarifications are contained in paragraph I of Appendix No. 1 to the Methodological Recommendations of the FSSP of Russia dated June 19, 2012 No. 01-16.

Situation: how to keep records of executive documents received by the organization?

Register the received enforcement documents in a special journal (clause I of Appendix No. 1 to the Methodological Recommendations of the FSSP of Russia dated June 19, 2012 No. 01-16).

In addition, executive documents can be registered in the incoming correspondence journal. This option is convenient if the organization receives few executive documents.

How to pay bailiffs in 1c

» » In this article, lawyer Alexey Knyazev answers the popular question: “?”. Unfortunately, from time to time there are situations when an organization performs work, but the customer does not pay it.

As a result, you have to go to court and forcefully collect debts. In this case, there are some features of reflecting this fact of economic activity in the 1C Accounting information system.

It is established by common business practice, current regulations and decisions of courts of various instances that have entered into force that the customer, if he has no complaints about the results of the work, is obliged to accept them and pay for them in accordance with the provisions of the concluded contract. In a situation where the customer violates his obligations and does not make timely payments, a debt must be generated in 1C Accounting 8.3.

Moreover, it is assigned the status of doubtful, which means that the creation of a reserve for doubtful debts is required (provided for by the regulatory documents of the Ministry of Finance of the Russian Federation regulating accounting in organizations).

It must be borne in mind that there is a difference between reflecting the fact of creating the described reserve in tax and accounting.

When accounting for the provision for doubtful debts in 1C Accounting, it is necessary to generate the following entries:

- Debit of account 91.2 – Credit of account 63. This posting directly forms the reserve itself and applies it to other expenses of the enterprise.

After receiving a positive court decision and collecting the debt through the court, the following entries should be generated in 1C Accounting 8.3:

- Debit of account 51 – Credit of account 62 – reflects the repayment of the customer’s receivables (receipt of funds to the current account).

Documentation of deductions

An organization may, at its own discretion:

- use unified forms of documents if this is approved by the head of the organization in the order on accounting policies;

- use independently developed forms approved by the head (provided that they contain all the necessary details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

This procedure follows from Part 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ and is confirmed by the letter of Rostrud of February 14, 2013 No. PG/1487-6-1.

Amounts withheld under writs of execution shall reflect:

– in the column “Withheld and offset” of the settlement and payment (payment) statement of form No. T-49 (No. T-51), if the organization uses unified forms;

– in the corresponding column of the settlement and payment (payroll) statement, if the organization uses independently developed forms.

Record information about the amounts collected in the employee’s personal account (unified forms No. T-54 or No. T-54a, or a self-developed form). Indicate the type of deduction, the period for which it is made, the amount or percentage of collections, and the amount of deductions per month.

Transfer of deductions

The withheld amounts can be transferred to the claimant by mail or to his current account (subclause 9 of clause II of Appendix No. 1 to the Methodological Recommendations of the FSSP of Russia dated June 19, 2012 No. 01-16).

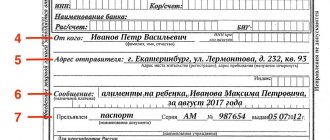

When sending the withheld amount by mail, on the back of the postal transfer coupon in the “For written message” section, indicate the details of the writ of execution, the type of deductions and their amount. For example, the entry may look like this: “According to writ of execution No. 125/1 for March 2015, alimony was collected in the amount of 1/3 of A.S.’s earnings. Kondratieva. The amount of alimony is 2160 rubles.”

If the address of the person in whose favor alimony is being collected is unknown, the FSSP of Russia recommends transferring alimony by payment order to the settlement account of a structural unit of the territorial body of the FSSP of Russia (subclause 9, clause II of Appendix No. 1 to the Methodological Recommendations of the FSSP of Russia dated June 19, 2012 No. 01-16).

From what income can amounts be withheld under a writ of execution?

Deductions under a writ of execution are possible from:

- wages, including those paid in kind, salary advances, average earnings saved for the duration of a business trip;

- bonuses, allowances, incl. for working in hazardous conditions;

- payments for part-time work (both internal and external);

- payment for downtime;

- vacation pay, including compensation for unused vacation;

- temporary disability benefits;

- material assistance;

- other income paid by the employer to the employee.

You can also withhold money under a writ of execution from amounts paid under a civil contract (for example, for renting an employee’s personal property or for performing work under a contract).

Postage

The cost of postal services can be deducted from the employee’s income (Article 109 of the Family Code of the Russian Federation).

Situation: how to calculate the maximum amount of alimony that can be withheld from an employee’s income - with or without postage costs?

Calculate the maximum amount of alimony that can be withheld from an employee’s income without taking into account shipping costs. The size limitation applies only to the amount of withholding specified in the executive document (Article 99 of the Law of October 2, 2007 No. 229-FZ). The costs of sending alimony, provided for in Article 109 of the Family Code of the Russian Federation, are not included in this amount.

They do not represent deduction, but additional costs that must be compensated by the employee (Article 109 of the Family Code of the Russian Federation, Part 3 of Article 98 of the Law of October 2, 2007 No. 229-FZ, Subclause 9 of Clause II of Appendix No. 1 to Methodological recommendations of the FSSP of Russia dated June 19, 2012 No. 01-16, letter of Rostrud dated March 11, 2009 No. 1147-TZ).

An example of deducting postal expenses for the transfer of alimony from an employee’s income

The organization, according to the writ of execution, withholds from specialist A.S. Kondratieva alimony for the maintenance of two minor children. The amount of deductions is 1/3 of the employee’s monthly earnings.

Alimony is transferred to the recipient by mail. The postal fee is 3 percent of the transfer amount.

For the reporting month, the employee received a salary in the amount of 32,000 rubles. Personal income tax was withheld from her - 4160 rubles. (RUB 32,000 × 13%).

Alimony is collected from Kondratyev in the amount of 9,280 rubles. ((RUB 32,000 – RUB 4,160) × 1/3).

The amount to be withheld for alimony obligations (including postal transfer costs) is: RUB 9,280. + 9280 rub. × 3% = 9558 rub.

The total amount of deductions is: 4160 rubles. + 9558 rub. = 13,718 rub.

Kondratyev is paid an income in the amount of: 32,000 rubles. – 13,718 rub. = 18,282 rub.

Reflection in accounting of sanctions under contracts with counterparties

How can accounting entries reflect fines or penalties that arise in relations with counterparties? Expenses or income generated by a legal entity in this case are among others (clause 7 of PBU 9/99 and clause 11 of PBU 10/99, approved by orders of the Ministry of Finance of Russia dated May 6, 1999 No. 32n and No. 33n). The chart of accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) recommends using account 91 to reflect them, the credit of which will show income, and the debit - expenses.

The corresponding account for account 91 in the entry for reflecting a fine or penalty in accounting will be settlement account 76, to which the Chart of Accounts provides for the opening of a sub-account called “Settlements for claims.” Analytics in this sub-account is organized by counterparties and each arising claim.

That is, the entries for the accrual of penalties will look like this:

- Dt 91 Kt 76 from a legal entity reflecting the claim addressed to it (i.e. its expense);

- Dt 76 Kt 91 from a legal entity that has submitted a claim to its counterparty and is counting on the receipt of funds to its address.

The amount accompanying these postings will be determined in the same way for both entries: as corresponding to the volume of accruals, either recognized by the debtor or established by the court (clause 10.2 of PBU 9/99, clause 14.2 of PBU 10/99). Accordingly, the moment of reflection in accounting will coincide with the moment of either recognition or adoption of a court decision.

Payment of sanctions will be expressed by posting Dt 76 Kt 51 (transfer to the counterparty) or Dt 51 76 (receipt from the counterparty).

Return of the writ of execution to the bailiff

After the organization has withheld all the amounts specified in the writ of execution (or at the end of the period during which it was necessary to make deductions), this document must be returned to the bailiff (for example, sent by mail).

The same should be done if the employee from whose income the deductions are made quit.

At the same time, on the back of the writ of execution, write what amount the organization withheld and transferred to the claimant, as well as the balance of the debt. For example, the entry may look like this: “Alimony in the amount of 21,100 rubles. withheld and transferred to the claimant in full. The remaining amount is 10,000 rubles. not withheld due to the dismissal of an employee. The employee’s new place of work is unknown.” In addition, indicate the numbers of payment orders (receipts) and the dates of transfer of funds. The entry made must be certified by the signature of the chief accountant and the seal of the organization. Similar explanations are contained in subparagraph 10 of paragraph II of Appendix No. 1 to the Methodological Recommendations of the FSSP of Russia dated June 19, 2012 No. 01-16, letter of the FSSP of Russia dated June 25, 2012 No. 12/01-15257.

As a rule, the writ of execution is sent to the bailiff within three days after the employee is dismissed. In relation to alimony, such a period is established by Article 111 of the Family Code of the Russian Federation. For other deductions, the law does not establish a specific period. However, Part 4 of Article 98 of Law No. 299-FZ of October 2, 2007 states that the writ of execution must be returned immediately after the debtor changes his place of work.

Situation: how to withhold child support for the month in which an employee’s child turns 18?

Payment of alimony stops when the child reaches the age of majority (Clause 2 of Article 120 of the Family Code of the Russian Federation). Therefore, to calculate alimony, the salary accrued to the employee for the month in which his child turns 18 years old must be divided into two parts.

The first is the one that falls from the beginning of the month until the day the child comes of age. Child support must be withheld from this amount.

The second is that part of the salary that was accrued for the time when the employee’s child turned 18 years old. There is no need to withhold alimony from this amount.

Accounting

To account for mandatory deductions under writs of execution for account 76, open the subaccount “Settlements under writs of writ.”

When deducting amounts under executive documents from an employee’s salary, make an entry in your accounting:

Debit 70 Credit 76 sub-account “Settlements based on executive documents”

– deducted from the employee’s salary according to the executive document.

When paying the withheld funds to the claimant from the cash register, make the following entry:

Debit 76 subaccount “Settlements on executive documents” Credit 50

– the amount withheld under the writ of execution was issued to the recipient.

When transferring the withheld funds to the creditor's bank account, make a note:

Debit 76 subaccount “Settlements on executive documents” Credit 51

– the amount withheld under the writ of execution is transferred to the recipient.

Reflect the transfer fee using the following entries:

Debit 76 subaccount “Settlements on executive documents” Credit 51

– the bank withheld a commission for the transfer of the amount withheld under the writ of execution.

The fee for a bank transfer or postage is paid by the debtor, that is, the employee (Part 3 of Article 98 of the Law of October 2, 2007 No. 229-FZ).

Therefore, deduct the bank transfer fee from the employee’s salary:

Debit 70 Credit 76 sub-account “Settlements based on executive documents”

– the commission for bank transfer of the amount under the writ of execution is repaid from the employee’s salary.

If the withheld amount is transferred by mail, make the following entries:

Debit 71 Credit 50

– the amount of alimony was issued on account, which must be sent by postal order, and money to pay the postage;

Debit 76 subaccount “Settlements on executive documents” Credit 71

– the amount withheld under the writ of execution has been transferred by postal order, and the postage fee has been paid.

Debit 70 Credit 76 sub-account “Settlements based on executive documents”

– the postal fee for transferring the amount under the writ of execution is paid from the employee’s salary.

To what account should payments to bailiffs be attributed?

» » In this article, lawyer Alexey Knyazev answers the popular question: “?”.

Question: The organization pays an enforcement fee to the bailiff service. Where to include this amount in accounting and whether or not this amount reduces the taxable base for income tax. Thank you. Answer: According to Art. 112 of the Federal Law of 02.10.2007 N 229-FZ “On Enforcement Proceedings”, the enforcement fee is a monetary penalty imposed on the debtor in the event of his failure to fulfill the executive document within the time limit established for the voluntary execution of the executive document, as well as in the event of his failure to comply with the executive document, subject to immediate execution, within 24 hours from the receipt of a copy of the bailiff's decision to initiate enforcement proceedings.

The performance fee is credited to the federal budget. The enforcement fee is set at 7% of the amount to be collected or the value of the property being recovered, but not less than five hundred rubles from a debtor-citizen and five thousand rubles from a debtor-organization.

In case of non-execution of an enforcement document of a non-property nature, the enforcement fee from the debtor-citizen is established in the amount of five hundred rubles, from the debtor-organization - five thousand rubles. Clause 3 of the Constitutional Court of the Russian Federation of July 30, 2001 N 13-P explains that the enforcement fee is not included in the list of taxes and fees that are established, amended or canceled by the Tax Code of the Russian Federation (clause

clauses 3 and 5 art. 3 of the Tax Code of the Russian Federation), and, therefore, it does not apply to fees in the sense of Art.

57 of the Constitution of the Russian Federation. It is also not a state duty.

The amount, calculated at 7% of the funds collected under the writ of execution, refers, in fact, to coercive measures in connection with non-compliance with the legal requirements of the state.

This measure is a punitive sanction, that is, imposing on the debtor the obligation to make a certain additional payment as a measure of his public legal liability arising in connection with an offense committed by him in the process of enforcement proceedings.

Debt collection through court (postings)

› › › Often, enterprises providing services for the supply of goods or performance of services cannot work on prepayment with all of their clients. And therefore they are faced with malicious debtors among them. When all attempts to resolve this situation have been exhausted, the company's management has no choice but to go to court to collect the debt.

Let's consider a situation where the court made a decision in favor of the creditor and, in addition to the debt, ordered the debtor to return legal costs and imposed a penalty.

To begin with, the acquired fine or the amount of interest for late payment is included in income. In paragraph 3 of Art. 250 of the Tax Code of the Russian Federation spells out in detail about these funds. Accounting will classify these amounts as other income.

Only the fine specified in the court decision is taken into account, since it has the opportunity to reduce the requested penalty if it considers that the requested penalty is too high. The tax base for income tax will be increased by the state duty, which will be compensated. Because the defendant will return it in full.

When the claim was submitted, this amount was written off as expenses.

Debt collection through the court - a procedure providing for the forced return of debt - is carried out through judicial proceedings and enforcement proceedings. As for the amount of debt, the goods were sent but not paid, therefore, the proceeds have already been reflected.

The accrual method implies that it does not matter at what time the firm receives the cash. The same rules come into force if the company has carried out work or provided services. To accept expenses for accounting, it is necessary to obtain a court order that will confirm the expenses (PBU 10/99 clause.

14.2). The court ruling is considered legal as soon as it enters into force.

The state duty is taken into account on the account. 68, legal costs on the subaccount “Settlements for claims” account.